Académique Documents

Professionnel Documents

Culture Documents

Partnership 1

Transféré par

jed_nurDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Partnership 1

Transféré par

jed_nurDroits d'auteur :

Formats disponibles

Law on Partnerships Chapter 1.

- GENERAL PROVISIONS Business Organizations In the Philippines nowadays, the common business organizations are partnerships and private corporations. If one prefers to undertake his own business devoid of associates, then he has to put up a business under sole proprietorship. Historical Background of Partnership Business in the olden times was carried on more popularly either in the form of lone business venture or in partnerships with other adventurous traders. Partnerships in the early times was recognized as Societas ( now known as general partnership) or Societe en Commandite (Limited Partnership. Before the effectivity of the New Civil Code on August 30, 1950, there were two kinds of partnership in the Philippines, namely commercial partnerships which were governed by the Code of Commerce and civil partnerships which were governed by the Old Civil Code of Spain of 1889. With the advent of the New Civil Code, the law on partnerships is now governed by Articles 1767 to 1867 of the said law. Incidentally these provision were taken from the old civil code of Spain, Uniform Partnership Act and Uniform Limited Partnership Act of the USA which were incorporated in the Uniform State Laws of 1907 drafted, enacted and signed by 31 states of the US in 1907 to resolve diversities of interpretation of courts in declaratory common laws observed by these states and apply uniformity as to the interpretation and applicability of these laws Be it noted that the passage of R.A No. 386 repealed the provisions of the Code of Commerce and the Old Civil Code relating to civil and commercial partnerships. Hence, the New Civil Code governs all partnership transactions, whether civil or mercantile. Art. 1767. By the contract of partnership two or more persons bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing the profits among themselves. Two or more persons may also form a partnership for the exercise of a profession. (1665a) Define partnership. Partnership is a contract whereby two or more persons bind themselves to contribute money, property or industry to a common fund, with the intention of dividing the profits among themselves. (Art. 1767.) Two or more persons may also form a partnership for the exercise of a profession. (Ibid.) Characteristic s of Partnership 1. Consensual as a contract, it is perfected by mere consent. Art. 1315, contracts are perfected by mere consent and form that moment parties are bound not only of what has been expressly stipulated but also to all the consequences which according to their nature, may be in keeping with good faith, usage and law. Once perfected, principle of obligatory in force and compliance in good faith applies, Obligation arising from contract have the force of law between the contracting parties and should b complied with good faith (Art. 1159). 2. Nominate - BECAUSE IT HAS A DESIGNATED NAME. The Civil Code identifies the same with a special name, Partnership 3. Bilateral, or multilateral because it is entered into or stipulated upon by two or more persons. 4. Onerous-because it involves consideration in the form of contributions by the parties to the common fund. Each of the parties to procure for himself a benefit through the giving of something. 5. Commutative because the undertaking of each of partner is considered as the equivalent of that of the others. 6. Principal because it does not depend for its existence or validity upon some other contract; and

7. Preparatory because it is entered into as means to an end. i.e., to engage in business for the realization of profits with the view of dividing them among the contracting parites. A partnership contract, in its essence, is a special contract of agency. Essential Features of Partnership Elements 1. There must be a valid contract A partnership can exist only if there is a valid contract entered by two or more persons creating the same. The three essential elements of the contract must be present, namely consent, object and the cause or consideration. There must be an intent to create a partnership. There exists a personal relation in which the element of delectus personae exists. Delectus personae ( in Latin delectus personarum choice of person or persons)) means the person has the right to choose person/persons he wants to become his partner taking consideration the sterling qualities of honesty, integrity and more importantly trust and confidence Affectio societatis desire to formulate an active union with people among whom there exist mutual trust and confidence (delectus personarum) exists. 2. The parties must have legal capacity to enter into a contract. Capacity to become a partner. Since partnership involves making a contract, the persons constituting the same must be capable of entering to a contractual relation. Minors, insane or demented persons and deaf mutes who do not know how to write cannot give intelligent consent. 3. There must be contribution of money, property or industry in the common fund. It is required that partners must have proprietary or financial interest in the business, that is the contribution of money, property or services. a) Money refers to the legal tender of the Phils. Although, parties are free to stipulate that the contribution be made in currency other than the legal tender (R.A. No. 8183 in relation to Art. 1249). Contribution through checks, drafts, promissory notes are not considered money unless they have been converted into cash. b) Property The property contributed may be real or personal, tangible or intangible. Credit such as promissory notes or evidence of indebtedness even goodwill may be contributed even if these are intangible. c) Industry means the work or services of the party associated which may be either personal manual efforts or intellectual and for which he receives a share in the profits ( not salary) of the business. A limited partner in a limited partnership cannot contribute industry or services. Industry contributed may be intellectual or physical 4. The object must be lawful. the object of the partnership must be lawful (Art 1770) and must be established for the common benefit or interest of the partners. It must not be contrary to law, morals, good customs, public order or public policy. OTHERWISE, the contract of partnership shall be void ab initio (Art. 1409). 5. The purpose or primary purpose must be to obtain profits and to divide the same among the parties. This is the element that distinguishes partnership from other social or religious associations or organization. Though silent, it is not only profits that are shared but including losses as this could be an expected consequence or risk of a business undertaking. 6. There must be intent to engage in a lawful business, trade or profession. 7. A new personality created that of the firm- must arise separate and distinct from the separate personality of the partners. Art. 1768. The partnership has a judicial personality separate and distinct from that of each of the partners, even in case of failure to comply with the requirements of Article 1772, first paragraph. (n)

Art. 1772. Every contract of partnership having a capital of three thousand pesos or more, in money or property, shall appear in a public instrument, which must be recorded in the Office of the Securities and Exchange Commission. Failure to comply with the requirements of the preceding paragraph shall not affect the liability of the partnership and the members thereof to third persons.

A partnership is a juridical person. As an association of persons, a partnership duly formed under the law has a juridical personality separate and district form that of each of the partners. Thus, in the partnership X & Co., in which A and B are the partners, there are three (3) district persons namely: (1) X & Co., (2) A, and (3) B. As a consequence of its distinct legal personality, a partnership may acquire the possess property, incur obligations, and bring civil or criminal actions in its own name. (Art. 46.) Note: There is no prohibition against a partnership being a partner in another partnership. Consequences of Juridical Personality 1. It has separate and distinct juridical personality from that of each partner. 2. The partnership as a juridical personality can a. Acquire and possess properties of all kinds b. Incur obligations c. Bring criminal or civil actions If there is non-compliance with Article 1772, the partnership is still a juridical person as Article 1772 is NOT a requisite for acquisition of juridical personality by the partnership, but merely a condition for the issuance of licenses to engage in business or trade. In this way, the tax liabilities of big partnerships cannot be evaded and the public can also determine more accurately their membership and capital before dealing with them. Distinguish partnership from an ordinary voluntary association. (1) A partnership is a voluntary association with a legal personality, ordinarily created for the purpose of engaging in business for profit, while an ordinary voluntary association has no legal personality and is usually formed for moral, social, or benevolent purposes; and (2) In a partnership, capital is contributed, while in an ordinary voluntary organization, no capital is given although fees are usually collected. (As distinguished from other business organizations, see (VII. - Corporation Law.) May a partnership be a partner in another partnership? Yes. There is no prohibition against a partnership being a partner in another partnership. When two or more partnerships combine with each other (or with a natural person or persons) creating a distinct partnership, say, partnerships will be individually liable to the members of the creditors of partnership X. What is a sole proprietorship? Sole proprietorship or, as it is also called, individual proprietorship, is a form of business organization in which a persons conducts his business alone and entirely for his own profit, being solely responsible for all its activities and liabilities. Give the advantages and disadvantages of the sole proprietorship as a form of business organization. They are:

(1) Advantages: (a) It is easy to organize since no formality is required in its formation; (b) The proprietor or owner exercises exclusive control of the business; (c) He enjoys privacy in the operation of his business; (d) He gets all the profits which fact is a strong incentive to industry; (e) It is entirely flexible as to management: 1) The owner may discontinue one form of activity and take on another at will; and 2) He may even engage in other lines of business totally unconnected with his main business should he so desire; (f) It is subject to less government control; and (g) Its income is subject to less taxes. (2) Disadvantages: (a) The owner is solely responsible for all its activities and liabilities; (b) His liability for debts of the business is unlimited; (c) It is difficult for one man to keep close control of the detailed operations of a large business; (d) The general credit of the business is limited to the principal resources of the proprietor; (e) The inability to obtain large amounts of capital usually prevents the growth or expansion of the business; (f) The business lacks stability or permanence, for it ends with the death, bankruptcy, etc. of the owner and this prevent borrowing for long periods of time on the general credit of the business. Summarize the advantage and disadvantages of a partnership as a business organization. They may be set forth as follows: (1) Advantages: (a) It is easy and inexpensive to organize as it is formed by a simple contract between two or more persons; (b) The unlimited liability of the partners makes it reliable from the point of view of the creditor; (c) The combined personal credit of the partners offers better opportunity for obtaining additional capital than does the sole proprietorship;

(d) The participation in the business by more than one person makes possible a closer supervision of all its activities; (e) The direct gain to the partners is an incentive to close attention to the business;

(f)

The personal element in the characters of the partners is retained; and

(g) It is generally free from government control. (2) Disadvantages: (a) The personal liability for firm debts deters many from investing capital in it; (b) A partner may be subject to personal liability for the wrongful acts or omissions of his associates; (c) It also lacks stability due to the ease by which it may be dissolved; (d) There is divided authority; and (e) There is constant likelihood of dissension and disagreement when each of the partners has the same authority in the management of the concern. Art. 1769. In determining whether a partnership exists, these rules shall apply: (1) Except as provided by Article 1825, persons who are not partners as to each other are not partners as to third persons; (2) Co-ownership or co-possession does not of itself establish a partnership, whether such-co-owners or co-possessors do or do not share any profits made by the use of the property; (3) The sharing of gross returns does not of itself establish a partnership, whether or not the persons sharing them have a joint or common right or interest in any property from which the returns are derived; (4) The receipt by a person of a share of the profits of a business is prima facie evidence that he is a partner in the business, but no such inference shall be drawn if such profits were received in payment: (a) As a debt by installments or otherwise; (b) As wages of an employee or rent to a landlord; (c) As an annuity to a widow or representative of a deceased partner; (d) As interest on a loan, though the amount of payment vary with the profits of the business; (e) As the consideration for the sale of a goodwill of a business or other property by installments or otherwise. (n) Discussion: Purpose of Article 1769 provide rules for determining existence of partnership. Requisites for existence of partnership In general to show the existence of a partnership, all of its essential characteristics must be proved; in particular it must be proved that: a. There was an intention to create a partnership b. There was a common fund obtained from contributions c. There was a joint interest in the profits

THEREFORE: a) Mere co-ownership or co-possession ( even with community of interest in profit sharing). Reason: Co-ownership is created by law while partnership is created by contract. b) Mere sharing if gross returns (even with joint ownership of the properties involved do not establish partnership. The legal effect of the receipt by a person of a share of the profits of a business: Such receipt is prima facie evidence that he is a partner in the business. No such inference, however, shall be drawn if such profits were received in payment: (1) As a debt by installments or otherwise; (2) As wages of an employee or rent to a landlord; (3) As annuity to a window or representative of a deceased partner; (4) As interest on a loan though the amount of payment may vary with the profits of the business; and (5) As the consideration for the sale of goodwill of a business or other property by installment or otherwise. (Art. 1769.) In all the above cases, the profits in the business are not shared as profits of a partner but in some other respects. EXAMPLES: In the following cases, Y is not a partner in partnership X: (1) Y, creditor of partnership X, is entrusted by the partners to manage the business and Y shall receive, in addition to his compensation, a share in the net profits of the business in settlement of his credit; (2) Y, an employee of partnership X, shall receive instead of a fixed salary, or being the owner of a building rented by the partnership, Y shall receive as rent, a certain percentage on the monthly net profits of the business. (3) Y, the window of a deceased partner in partner in partnership X, in consideration of the continuation of the business without liquidation and satisfaction of the deceased's interest, shall receive an annuity for a period of five (5) years based on a certain percentage of the net profits; (4) Y, creditor of partnership X, agreed that the payment of interest shall be taken from the net profits to be realized by the partnership; and (5) Y sold property to partnership X, and he agreed that the purchase price shall be paid out of the net profits of the business. In any of the above cases, I shall not be entitled to receive payment where there are no profits; nor shall he be liable to share any losses incurred by the partnership.

Does co-ownership or co-possession wherein the co-owner or co-possessor shares any profits made by the use of the property of itself establish a partnership? No. There is co-ownership whenever the ownership of an undivided thing or right belongs to different persons. (Art. 484.) Although every partnership is founded on a community of interest, every community of interest does not necessarily constitute a partnership (e.g., The heirs who inherited an

apartment which is leased to third persons are not partners but merely co-owners although they share in the profits from the lease of the property).

Does sharing of gross returns by persons who have a joint or common interest in the property from which the returns are derived of itself establish a partnership? No, since in a partnership, the partners share profits after satisfying all of the partnership's liabilities. (Arts. 1769, 1812, 1839.) Art. 1770. A partnership must have a lawful object or purpose, and must be established for the common benefit or interest of the partners. When an unlawful partnership is dissolved by a judicial decree, the profits shall be confiscated in favor of the State, without prejudice to the provisions of the Penal Code governing the confiscation of the instruments and effects of a crime. What are the effects of unlawful partnership? They are: (1) The contract is void ab initio and the partnership never existed in the eyes of the law (Art. 1409.); (2) The profits shall be confiscated in favor of the government; and (3) The instrument of tools and proceeds of the crime shall be forfeited in favor of the government. (Art. 1770.) Art. 1771. A partnership may be constituted in any form, except where immovable property or real rights are contributed thereto, in which case a public instrument shall be necessary. (1667a) Art. 1772. Every contract of partnership having a capital of three thousand pesos or more, in money or property, shall appear in a public instrument, which must be recorded in the Office of the Securities and Exchange Commission. Failure to comply with the requirements of the preceding paragraph shall not affect the liability of the partnership and the members thereof to third persons. (n) Art. 1773. A contract of partnership is void, whenever immovable property is contributed thereto, if an inventory of said property is not made, signed by the parties, and attached to the public instrument. State the formalities required for the creation of a partnership. As a general rule, a partnership may be constituted in any form (Art. 1771.) except in the following cases: (1) Where personal property is contributed and the capital is P 3, 000 or more. (a) The contract must appear in a public instrument; and (b) It must be registered with the Securities and Exchange Commission. (Art. 1772.) Note: However, failure to comply with the above requirements does not prevent the establishment of the partnership as a distinct personality (Art. 1768.) or affect its liability and that of the partners to third persons (Art. 1772.) because they are merely for administrative and licensing purposes.

(2) Where immovable property or real rights thereto are contributed, regardless of valve. (a) The contract must appear in a public instrument (Art. 1771.); and (b) An inventory of the property, signed by the partners, must be attached to the public instrument (Art. 1773.) Note: If the above requirements are not observed the contract of partnership is void. (Ibid.) They do not apply where the immovable property is acquired (not contributed by the partners) by the partnership. (Agad vs. Mabato. L-24173, June 28, 1968.) (3) In case of limited partnership. (a) The partners must sign and swear to a certificate or articles of limited partnership which states the matters prescribed by law; and (b) They must file such certificate with the Securities and Exchange Commission. (Art. 1844.) Note: If there is no substantial compliance with the above legal requirements, the partnership becomes a general partnership. Art. 1775. Associations and societies, whose articles are kept secret among the members, and wherein any one of the members may contract in his own name with third persons, shall have no juridical personality, and shall be governed by the provisions relating to co-ownership. Effects if Articles are kept: a) The association here is certainly not a partnership and therefore not a legal person, because anyone of the members may contract in his name wit third persons and not with the name of the firm. b) Although not a juridical entity, it may be sued by third persons under the common name it uses otherwise innocent third parties may be prejudiced. c) However, it cannot sue as such because it has no legal personality, and therefore, cannot ordinarily be a party to a civil action. Moreover the fact that it has no legal personality as a partnership cannot be invoked by the partners for the purpose of evading compliance with obligations contracted by them, because they who caused the nullity of the contract are prohibited from availing of its benefits. d) Therefore, insofar as innocent third parties are concerned, the partners can be considered as members of a partnership; but between themselves, or insofar as 3rd persons are prejudiced, only the rules on co-ownership must apply. THE SAME rules applies in partnership estoppels Art. 1776. As to its object, a partnership is either universal or particular. As regards the liability of the partners, a partnership may be general or limited. What are the classes of partnerships? They are: (1) As to its object: (a) Universal partnership. - There are two Kinds. 1) Universal partnership of all present property. - one in which the partners contribute all the properties which actually belong to each of them at the time of the constitution of the partnership to a common fund, with the intention of dividing the same among themselves as well as the profits which they may acquire therewith (Art. 1778.); and

2) Universal partnership of all profits. - one which comprises all that the partners may acquire by their industry or work during the existence of the partnership and the usufruct of movable or immovable property which each of the partners may possess at the time of the celebration of the contract. (Art. 1780.) Articles of universal partnership entered into without specification of its nature only constitute a universal partnership of profits (Art. 1781.) Note: Persons who are prohibited from giving each other any donation or advantage cannot enter into universal partnership of profits. (Art. 1782.) (b) Particular partnership. - one which has for its object determinate things, their use or fruits, or a specific undertaking, e.g., acquisition of a real property for the purpose of reselling it at a profit, or practice of a profession or vocation. (Art. 1783.) So, the carrying on a business of a continuing nature is not essential to constitute a partnership. (2) As to liability of the partners: (a) General partnership. - one consisting of general partners who are liable pro rata and subsidiarily (Art. 1816.) and sometimes solidarily (Arts. 1822-1824.) with their separate property for partnership debts; or (b) Limited partnership. - one formed by two or more persons having as members one or more general partners and one or more limited partners, who as such are not bound by the obligation of the partnership. (Art. 1843.) (3) As to duration: (a)Partnership at will. - one which no time is specified and is not formed for a particular undertaking or venture and which may be terminated any time by mutual agreement of the partners or by the will of one alone (40 Am. Jur. 139.); or (b) Partnership with a fixed term. - one in which the term of period for which the partner is to exist is agreed upon or one formed for a particular undertaking, and upon the expiration of that term or completion of the particular enterprise, the partnership is dissolved, unless continued by the partners. (Art. 1785.) (4) As to representation to others: (a) Ordinary partnership. - one which actually exists among the partners and also as to third persons; or (b) Partnership by estoppel. - one which in reality is not a partnership, but is considered a partnership only in relation to those who, by their conduct or admission, are precluded to deny or disprove its existence. (Art. 1825.) (5) As to legality of its existence: (a) De jure partnership. - one which has complied with all the requirements for its establishment (see Arts. 1772, par. 2; 1773.); or (b) De facto partnership. - one which has failed to comply with all the legal requirements for its establishment. (Ibid.) (6) As to publicity: (a) Secret partnerships. - one wherein the existence of certain persons as partners are not made known to the public by any of the partners; or (b) Open or notorious. - one whose existence is made known to the public by the members of the firm.

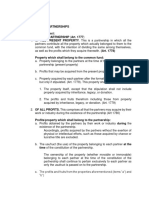

What are the classes of partners? They are: (1) As to contributions: (a) Capital partner. - one who contributes capital. I.e., money or property, to the common fund (Art. 1767.); or (b) Industrial partner. - one who contributes industry or labor. (Art. 1789, 1767.) (2) As to liability: General partner. - one whose liability to third (a) Liquidation partner. - one who takes charge of the winding up of partnership affairs upon dissolution (Art. 1836.) (b) Nominal partner or partner by estoppel. - one who is not really a partner, not being a party to the partnership agreement, but is made liable as a partner for the protection of innocent third persons (Art. 1825.); (c) Real partner. - one who is actually connected with the business as a partner (Art. 1767.) (e) Ostensible partner. - one who is actually connected with the business as a partner in the business (Art. 1834, par. 2.); (f) Dormant partner. - one who does not take active part in the business and is not known to the public as a partner; he is both a silent and secret partner (Ibid.); and (e) Subpartner. - one who contracts with a partner with reference to the latter's share in the partnership. (Art. 1804) He is not really a partner. Art. 1778. A partnership of all present property is that in which the partners contribute all the property which actually belongs to them to a common fund, with the intention of dividing the same among themselves, as well as all the profits which they may acquire therewith. (1673) Art. 1779. In a universal partnership of all present property, the property which belongs to each of the partners at the time of the constitution of the partnership, becomes the common property of all the partners, as well as all the profits which they may acquire therewith. A stipulation for the common enjoyment of any other profits may also be made; but the property which the partners may acquire subsequently by inheritance, legacy, or donation cannot be included in such stipulation, except the fruits thereof. (1674a) Art. 1780. A universal partnership of profits comprises all that the partners may acquire by their industry or work during the existence of the partnership. Movable or immovable property which each of the partners may possess at the time of the celebration of the contract shall continue to pertain exclusively to each, only the usufruct passing to the partnership. (1675) Art. 1781. Articles of universal partnership, entered into without specification of its nature, only constitute a universal partnership of profits. (1676) Art. 1782. Persons who are prohibited from giving each other any donation or advantage cannot enter into universal partnership. (1677)

Art. 1783. A particular partnership has for its object determinate things, their use or fruits, or specific undertaking, or the exercise of a profession or vocation. (1678) Universal Partnership a) with all present property b) with all profits ( the individual properties here continued to be owned by the partners, but the usufruct thereof passes to the firm). Particular here the object is determinate things, their use or fruits; a specific undertaking, or the exercise of a profession or occupation (Art. 1783) ALL PROFITS a) Only the usufruct of the properties of the partners becomes COMMON PROPERTY (owned by them and the partnership); NAKED OWNERSHIP is retained by each of the partners. b) All PROFITS acquired by the INDUSTRY or WORK of the partners become COMMON PROPERTY (regardless of whether or not said profits were obtained through the usufruct contributed. ALL PRESENT PROPERTY a) All the property actually belonging to the partners are contributed and said properties become common property (owned by all partners and by the partnership). b) As a rule, aside from the contributed properties only the PROFITS of said contributed COMMON PROPERTY (not other profits) NOTE: Profits from other sources may become COMMON, but only if there is a stipulation to such effect. Properties subsequently acquired by inheritance, legacy or donation, cannot be included in the stipulation BUT the fruits thereof can be included in the stipulation.) Future Property Reason why future ( by inheritance, legacy, donation) property cannot be included in the stipulation regarding universal partnership of all present property: a) First, as a rule contract regarding successional rights cannot be made. b) Secondly, a partnership demands the contributed things be determinate, known and certain. c) Thirdly, a universal partnership of all present properties really implies donation and it is well known that generally future property cannot be donated. PROBLEMS ON ALL PRESENT PROPERTY a. A and B entered into a universal partnership of all present property. No stipulation was made regarding other properties. Subsequently, A received a parcel of land by inheritance from his father; and another parcel of land from the Ateneo College as remuneration for As work as professor therein. Question: Are the two parcels of land and their fruits to be enjoyed by the partnership?

Answer: No, because there was no stipulation regarding future properties or their fruits. b. Same as (a) except that in the contract, it was stipulated that all properties subsequently acquired would belong to the partnership. Answer: The land acquired as salary as well as its fruits will belong to the firm; but the land acquired later by inheritance will not to the firm; but the land acquired later by inheritance will not belong to the partnership since this cannot be stipulated upon (Art. 1780). The fruits of the

inherited land will go to the firm because said fruits may be considered as properties subsequently acquired, and there is no prohibition to stipulate on fruits, even if the fruits be those of properties acquired later on by inheritance, legacy or donation. PROBLEMS ON ALL PROFITS a. In a universal partnership of all profits, A contributed the use of his car. At the end of the partnership, should the car be returned to him? ANS: Yes, because the naked ownership had always been with him and upon the end of the usufruct, full ownership reverts to him. Remember that only its use had been previously contributed. b. A and B entered into a universal partnership of profits. Subsequently, A won 1st prize in the sweepstakes. Will the money belong to the partnership? ANS: No, because it was not acquired by industry or work. c. A and B entered into a universal partnership of all profits. Subsequently A became a professor at the Ateneo. Will As salary belong to the partnership? ANS: Yes, even though no stipulation was made on this point because after all the salary was acquired by As industry or work during the existence of the partnership (Art. 1780, par. 1). Such profit belongs therefore to the firm as a matter of RIGHT. Of course had there been a stipulation that such salary would be excluded, the stipulation would be valid. d. A and B entered into a universal partners of all profits. Later A purchased a parcel of land, Will the fruits of the said land belong to the partnership?

ANS: As a rule, NO, because the usufruct (use and fruits) granted to the firm under Art. 1780, par. 2 refers only to that of the property possessed by the partners at the time of the celebration of the contract. It follows that fruits of after acquired property do not belong to the firm as a matter of right. However, it would be valid to stipulate that the usufruct of after-acquired properties would belong to the partnership.

Vous aimerez peut-être aussi

- Law On Partnership NOTES PDFDocument16 pagesLaw On Partnership NOTES PDFJinky Jorgio100% (4)

- Law On Partnership and Corporation Study GuideDocument109 pagesLaw On Partnership and Corporation Study GuideMaria Angelina Zapanta Jose85% (98)

- WWDocument7 pagesWWNico evansPas encore d'évaluation

- Article 1767 - 1867 SummaryDocument34 pagesArticle 1767 - 1867 SummaryJanaisa Bugayong Espanto67% (3)

- Distinction Between Partnership and CorporationDocument2 pagesDistinction Between Partnership and Corporationdyajee198682% (11)

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Law On Partnership and Corporation NotesDocument26 pagesLaw On Partnership and Corporation NotesJahzeel Y. Nolasco83% (6)

- Law On Partnerships and Private CorporationsDocument17 pagesLaw On Partnerships and Private CorporationsJape Precia86% (7)

- Partnership Law (Chapter 1 and 2) - ReviewerDocument9 pagesPartnership Law (Chapter 1 and 2) - ReviewerJeanne Marie0% (1)

- Law On Partnership and Corporation by Hector de LeonDocument41 pagesLaw On Partnership and Corporation by Hector de LeonMary Claudette Unabia100% (3)

- Art 1777 1780Document9 pagesArt 1777 1780Марк Артём Лимот АпаллаPas encore d'évaluation

- Law On PartnershipDocument27 pagesLaw On Partnershiphotjurist93% (81)

- Notes - Law On Partnerships and Private CorporationsDocument20 pagesNotes - Law On Partnerships and Private CorporationsJeremyDream Lim100% (3)

- Law SummaryDocument60 pagesLaw SummaryRiriPas encore d'évaluation

- Delectus PersonaeDocument59 pagesDelectus Personaeleahtabs100% (3)

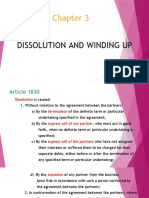

- Chapter 3 Dissolution and Winding UpDocument5 pagesChapter 3 Dissolution and Winding UpCheriferDahangCoPas encore d'évaluation

- PartnershipDocument7 pagesPartnershipami50% (2)

- Cash Flow - Alpa Beta GammaDocument26 pagesCash Flow - Alpa Beta GammaAnuj Rakheja67% (3)

- Revised Corporation CodeDocument172 pagesRevised Corporation CodeRic John Naquila Cabilan70% (10)

- 2010-2012 Bar Questions in Partnership: Question No. 1Document3 pages2010-2012 Bar Questions in Partnership: Question No. 1Jernel Janz0% (1)

- Essential Features of PartnershipsDocument2 pagesEssential Features of PartnershipsYenelyn Apistar Cambarijan100% (1)

- Characteristics of A Contract of Partnership: I. Effect If The Above Requirements Are Not Complied WithDocument10 pagesCharacteristics of A Contract of Partnership: I. Effect If The Above Requirements Are Not Complied WithJay jacinto100% (2)

- Chapter 1 - General ProvisionsDocument53 pagesChapter 1 - General ProvisionsJanelle Joyce Maranan DipasupilPas encore d'évaluation

- Partnership de Leon - Reviewer 1 PDFDocument54 pagesPartnership de Leon - Reviewer 1 PDFJuls Nocomora100% (14)

- Highlights of The Revised Corporation CodeDocument22 pagesHighlights of The Revised Corporation CodeLuigi JaroPas encore d'évaluation

- PartnershipDocument8 pagesPartnershipFrancis Ray Arbon FilipinasPas encore d'évaluation

- Chapter 6-Forever Young Case Solution-UpdateDocument5 pagesChapter 6-Forever Young Case Solution-UpdateYUSHIHUI75% (8)

- Partnership ReviewerDocument53 pagesPartnership ReviewerYerdXX100% (1)

- PartnershipDocument24 pagesPartnershipPhebegail ImmotnaPas encore d'évaluation

- Partnership de Leon PDFDocument54 pagesPartnership de Leon PDFClaribelle Dianne Rosales Manrique82% (17)

- Art 1772-1774Document3 pagesArt 1772-1774CML100% (1)

- Partnership CorpoDocument67 pagesPartnership CorpoJennifer Panganiban Dela CruzPas encore d'évaluation

- ARTICLE 1857 One of The Characteristics of Limited PartnershipsDocument6 pagesARTICLE 1857 One of The Characteristics of Limited PartnershipsJovelyn OrdoniaPas encore d'évaluation

- Partnership 1847 1856Document32 pagesPartnership 1847 1856Sunhine50% (2)

- Article 1830Document13 pagesArticle 1830Rustom IbanezPas encore d'évaluation

- Law On Partnerships (General Provisions)Document3 pagesLaw On Partnerships (General Provisions)Citoy LabadanPas encore d'évaluation

- Partnership and Co OwnershipDocument6 pagesPartnership and Co Ownershippnim100% (1)

- CHAPTER 4 Limited PartnershipDocument5 pagesCHAPTER 4 Limited PartnershipWuwu Wuswewu100% (1)

- Law2 Parcor de Leon Full Study GuideDocument89 pagesLaw2 Parcor de Leon Full Study GuideCindy Evangelista100% (4)

- Article 1767-1768Document13 pagesArticle 1767-1768janePas encore d'évaluation

- Report On Partnership Art. 1784-1789Document7 pagesReport On Partnership Art. 1784-1789Winona Marie Borla100% (3)

- Article 1830-1835Document32 pagesArticle 1830-1835Nathaniel SkiesPas encore d'évaluation

- Article 1771Document1 pageArticle 1771karl doceoPas encore d'évaluation

- Property Rights of A PartnerDocument17 pagesProperty Rights of A Partnererikha_araneta100% (5)

- PartnershipDocument269 pagesPartnershipMaruelQueennethJeanMiel100% (4)

- Article 1822-1824Document15 pagesArticle 1822-1824jalilah gunti50% (2)

- Cases - Shares and ShareholdersDocument5 pagesCases - Shares and ShareholdersAling KinaiPas encore d'évaluation

- Modes of Extinguishment of AgencyDocument6 pagesModes of Extinguishment of AgencyDan Abania100% (2)

- Essential Elements of The Contract ofDocument12 pagesEssential Elements of The Contract ofjanicetorredaPas encore d'évaluation

- Art 1838-1839 (Partnership)Document2 pagesArt 1838-1839 (Partnership)Mosarah AltPas encore d'évaluation

- Art. 1776. Kinds of PartnershipsDocument4 pagesArt. 1776. Kinds of PartnershipsJoe P PokaranPas encore d'évaluation

- Article 1801Document2 pagesArticle 1801XaxxyPas encore d'évaluation

- Article 1811Document6 pagesArticle 1811venus mae b caulinPas encore d'évaluation

- Article 1792 To 1997Document12 pagesArticle 1792 To 1997Sukh Gill100% (1)

- Article 1825Document11 pagesArticle 1825Alex Buzarang SubradoPas encore d'évaluation

- Article 1793Document2 pagesArticle 1793JudyPas encore d'évaluation

- Classifications of PartnershipDocument2 pagesClassifications of PartnershipHonnely Palen-Garzon Aponar-Mahilum100% (4)

- Obligations of The Partners With Regard To Third PersonsDocument61 pagesObligations of The Partners With Regard To Third PersonsNathaniel Skies100% (4)

- CHAPTER 3 Dissolution and Winding Up CODALDocument5 pagesCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosPas encore d'évaluation

- Article 1827. The Creditors of The Partnership Shall Be Preferred To Those of Each Partner AsDocument2 pagesArticle 1827. The Creditors of The Partnership Shall Be Preferred To Those of Each Partner AsJanice100% (1)

- Article 1787-1796Document23 pagesArticle 1787-1796Baylon RachelPas encore d'évaluation

- Acompre DatedDocument1 pageAcompre DatedAnonymous t1lbUug0A50% (4)

- Bl212 Prelim To Final ModuleDocument66 pagesBl212 Prelim To Final ModuleloriemiepPas encore d'évaluation

- Maldives - Country Assistance Program EvaluationDocument123 pagesMaldives - Country Assistance Program EvaluationIndependent Evaluation at Asian Development BankPas encore d'évaluation

- BSC 402 Quiz Ch. 2-3 Name: - José Antonio Céspedes PeregrinaDocument2 pagesBSC 402 Quiz Ch. 2-3 Name: - José Antonio Céspedes PeregrinaPepe Céspedes PeregrinaPas encore d'évaluation

- ch02 SM FA7e-1 (Doc - Wendoc.com)Document68 pagesch02 SM FA7e-1 (Doc - Wendoc.com)letuan8vnPas encore d'évaluation

- Krispy Kreme Case Study Solution FinanceDocument32 pagesKrispy Kreme Case Study Solution FinanceMd Sakawat HossainPas encore d'évaluation

- Accountancy Service Requirements of Micro, Small, and Medium Enterprises in The PhilippinesDocument10 pagesAccountancy Service Requirements of Micro, Small, and Medium Enterprises in The PhilippinesJEROME ORILLOSAPas encore d'évaluation

- Vonovia 9M2021 Presentation 20211118Document76 pagesVonovia 9M2021 Presentation 20211118LorenzoPas encore d'évaluation

- Ch03 ExercisesDocument19 pagesCh03 Exercisesfunke michaelsPas encore d'évaluation

- Financial Reporting and Analysis: - Sessions 7 and 8-Professor Raluca Ratiu, PHDDocument53 pagesFinancial Reporting and Analysis: - Sessions 7 and 8-Professor Raluca Ratiu, PHDDaniel YebraPas encore d'évaluation

- Economic Instruments For Environmental ProtectionDocument61 pagesEconomic Instruments For Environmental ProtectionalinaholtPas encore d'évaluation

- TDS Knowledge Base PDFDocument77 pagesTDS Knowledge Base PDFManish DebPas encore d'évaluation

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanPas encore d'évaluation

- Calculate Taxes, Fees and ChargesDocument81 pagesCalculate Taxes, Fees and ChargesramePas encore d'évaluation

- TheUpticks Round1 ExcelDocument66 pagesTheUpticks Round1 ExcelDewashish RaiPas encore d'évaluation

- Mang Inasal 4 Ps OCT0216Document12 pagesMang Inasal 4 Ps OCT0216Nicole67% (3)

- National Tobacco Administration v. CommissionDocument12 pagesNational Tobacco Administration v. CommissionChristian Edward CoronadoPas encore d'évaluation

- MergerDocument41 pagesMergerarulselvi_a9100% (1)

- Unit 18 Pricing of Bank Products and Services: ObjectivesDocument17 pagesUnit 18 Pricing of Bank Products and Services: Objectivesrishabh_arora@live.comPas encore d'évaluation

- House Bill 667Document10 pagesHouse Bill 667daggerpressPas encore d'évaluation

- Net Present Value (NPV) Definition - Calculation - ExamplesDocument3 pagesNet Present Value (NPV) Definition - Calculation - ExamplesKadiri OlanrewajuPas encore d'évaluation

- MBA Finance Job Interview Questions and AnswersDocument9 pagesMBA Finance Job Interview Questions and AnswersNiravPas encore d'évaluation

- FM Summary NotesDocument57 pagesFM Summary NotesVaradPas encore d'évaluation

- VatDocument13 pagesVatJohn Derek GarreroPas encore d'évaluation

- TGP Q3 18 Earnings Presentation vFINALDocument22 pagesTGP Q3 18 Earnings Presentation vFINALDonne BrooksPas encore d'évaluation

- CHAPTER 5 Corporate Income Taxation Regular Corporations ModuleDocument10 pagesCHAPTER 5 Corporate Income Taxation Regular Corporations ModuleShane Mark CabiasaPas encore d'évaluation

- Revised CPALE Syllabus - EditableDocument19 pagesRevised CPALE Syllabus - EditableBromaninePas encore d'évaluation

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- EABDDocument64 pagesEABDsachinPas encore d'évaluation