Académique Documents

Professionnel Documents

Culture Documents

The Chapter Describes in Brief About INTERNETBANKING

Transféré par

sivakulanthay5195Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Chapter Describes in Brief About INTERNETBANKING

Transféré par

sivakulanthay5195Droits d'auteur :

Formats disponibles

The chapter describes in brief about INTERNETBANKING. Internet:-INTRODUCTION :There is a sea change in the media world.

While most consumerssee the news papers, the same magazines and listen to the samer a d i o p r o g r a m s , b e h i n d t h i s b l a n d p u b l i c e x t e r i o r t h e r e i s a seething world of innovation, acquisition, global partnership anddivorces, births and deaths all of it most readily interpreted asthe inevitable result of the technological revolution that is in the p r o c e s s o f m e r g i n g t e l e p h o n e s , c o m p u t e r s , t e l e v i s i o n s i n t o a single all singing, all dancing magic kit that will, very possible,change all of our lives more than we can imagine some dayT h e r e a r e 2 w a y s y o u c a n r e s p o n d t o t h i s 1 i s t o p a n i c , whichm a y m e a n s i m p l y c u r l i n g u p i n a c o r n e r a n d w i s h i n g t h a t i t would all go away. The other is to embrace the new religion withm e s s i a n i c f e r v o r a n d g o o u t t o p r o c l a i m t h e m i l l e n n i u m . I welcome you to the new emerging world of the Info-High-Way,destined to redefine the world of communications: HISTORY :It is said that necessity is the mother of invention. And true, it isseeds of Internet were sown in the ashes of the world war H a v i n g b o m b e d t h e c i t i e s o f H i r o s h i m a a n d N a g a s a k i , U S military was forced to provide the answer to the question Whatif someone bombed the USA? So for many years after the war,m o s t o f t h e U S m i l i t a r y r e s e a r c h c o n c e n t r a t e d o n w a y s a n d means to survive the nuclear h o l o c a u s t . A n d o n e o f t h e m o s t important strategic problems was- How would us authoritiesc o m m u n i c a t e w i t h e a c h o t h e r i n t h e a f t e r m a t h o f a n u c l e a r attack? computers were already there. But, communicatio n networks were connected to each in a private fashion- in sort of c h a i n s : s o m e w h a t l i k e a n e l e c t r i c i t y l i n e t o y o u r h o m e . Th i s means that if even one chain in the middle were blown up, thewhole network would collapse.Then in the 1960s the problem was taken by Americas foremostmilitary think tank, the Rand Corporation. After a lot of ideaswere put up and knocked down, Paul baron- a rand thinker hitupon an idea. What if the network was not built like a chain butlike a fish net? he said. If one strand on the fish net broke then e t w o u l d s t i l l b e f u n c t i o n a l . A f t e r s p en d i n g m a n y a g o n i z i n g hours over it, he came up with 11-volume report f o r t h e pentagon. But, as fate would have it was rejected. B y t h e n , young engineers were impressed by the idea and worked on it.Well before the end of the decade, the first net was created andc a l l e d A R P A N E T , c o n n e c t i n g f o u r A m e r i c a n r e s e a r c h organizations- university of Utah, university of California in LosAngeles and Santa Barbara, and Stanford research institute.I n t e r n e t a s a c o m m u n i c a t i o n m e d i u m a n d a s a r e p o s i t o r y o f information has caught the imagination of computer users. Thish a s f u e l l e d a n u n p a r a l l e l e d g r o w t h i n t h e n u m b e r o f I n t e r n e t users. VARIOUSPARTSOFINTERNET :-

The Internet is made up of terminal computers through whichsubscribers access the net; gateways servers which connect theusers to the rest of the network (of computers); servers whichhost information in them; and, the communication network over which data actually flows.I n t e r n e t o f f e r s i t s u s e r s a variety of services. Th e subscribersm a y h a v e a c c e s s t o a l l o r a n y o f t h e f o l l o w i n g s e r v i c e s depending upon the type of connection that one has subscribedfor: 1 ) E - M a i l 2)World Wide Web (WWW)3)File Transfer Protocol (FTP)4 ) T e l n e t The net banking, thus, now is more of a norm rather than a n exception in many developed countries due to the fact that it isthe cheapest way of providing banking services.Internet banking refers to the use of the Internet as a r e m o t e delivery channel for banking services. Such services includ et r a d i t i o n a l o n e s , s u c h a s o p e n i n g a d e p o s i t a c c o u n t o r transferring funds among different accounts, and new bankings e r v i c e s , s u c h a s e l e c t r o n i c b i l l p r e s e n t m e n t a n d p a y m e n t (allowing customers to receive and pay bills on a banks Website). Banks offer Internet banking in two main ways. An existing b a n k w i t h p h y s i c a l o f f i c e s c a n e s t a b l i s h a W e b s i t e a n d o f f e r Internet banking to its customers as an addition to its traditionaldelivery channels. A second alternative is to establish a virtual,branchless, or Internet-only bank. The computer server thatlies at the heart of a virtual bank may be housed in an office thats e r v e s a s t h e l e g a l a d d r e s s o f s u c h a b a n k , o r a t s o m e o t h e r location. Virtual banks may offer their customers the ability tomake deposits and withdraw funds via ATMs or other remotedelivery channels owned by other institutions.The impact of E-transaction and authentication issues in banking It's hardly great news that there has been tremendous growth int h e u s e o f t h e I n t e r n e t a n d o t h e r e l e c t r o n i c f a c i l i t i e s t o pr ocess financial transactions. According to the FederalDeposit Insurance Corp., transactional Web sites have more thand o u b l e d e a c h y e a r f o r t h e p a s t s i x years, growing from one i n 1995 to nearly 2,500 in 2000.T h i s g r o w t h i s a r e f l e c t i o n o f t h e f a c t t h a t o v e r t h e p a s t f e w years, financial leaders have been considering various ways inw h i c h t o a l l o w t h e i r c u s t o m e r s t o t r a n s a c t b u s i n e s s u s i n g t h e I n t e r n e t . T h i s o b j e c t i v e i s n o w r e a c h i n g b e y o n d t h e f i n a n c i a l services industry into non-electronic business segments, such asthe building supply industry. Furthermore, this growth is likely toc o n t i n u e t o c l i m b a s t h e n u m b e r o f I n t e r n e t u s e r s , I n t e r n e t connection speed, and the number of transactional Web site s continues to increase. The number of adults using PC banking isalso growing. With this growth, there is an increased awarenessof the benefits of using online transaction processing, therebyf u e l i n g t h e t h o u g h t t h a t a l l b u s i n e s s s h o u l d b e e l e c t r o n i c a l l y facilitated Gartner predicts that worldwide business-to-business (B2B) e-c o m m e r c e will total $3.6 trillion by 2003 and $8.5 trillion in2005. Online f i n a n c i a l a c t i v i t y h a d a s l o w e r s t a r t , b u t h a s h a d steady growth, from 6 million users in 1998 to 27.5 million

usersin 2000. During 2000, only 30 percent of the Internet-capablehouseholds were using some form of Internet banking, indicatingthat there is tremendous room for increased use.The e-Commerce Value ChainConsider that the consumer and the merchant are on either endsof the electronic commerce value chain, with the authenticationnetwork and transaction processor (bank) in the middle. Banksh a v e t r a d i t i o n a l l y b e e n t h e t r u s t e d a g e n t s , h ave the largestcustomer base, and have received the in i t i a l b e n e f i t s f r o m electronic commerce. Value has begun a steady migration to thee n d s o f t h e v a l u e c h a i n . C u s t o m e r s c a n r e c e i v e a n d p a y b i l l s from one point using products from multiple issuers. Merchantscan influence and enhance the consumer experience by providinginnovative and time-saving means of doing business. Merchantscan add value to the payment process, for example, by offeringdiscounted prices for electronic payment M e r c h a n t s c a n a l s o r e d u c e t h e i r c o s t s b y r e c e i v i n g e l e c t r o n i c payme nts, which results in reducing and sometimes eliminatingthe need for data entry, as well as reducing the error rate and thet i m e t o i n v e s t i g a t e a n d c o r r e c t t h e d a t a . B y i n c r e a s i n g a n d effectively managing cash flow, merchants may also be able toreduce costs associated with lines of credit The law defines an electronic signature as "an electronic sound,s y m b o l , o r p r o c e s s a t t a c h e d t o o r l o g i c a l l y a s s o c i a t e d w i t h a contract or other record and executed or adopted by a person withthe intent to sign the record." Fortunately, the legislation does notattempt to define acceptable technologies except to indicate thatthe technologies must be mutually acceptable to the transacting p a r t i e s . S i n c e a v a l i d s i g n a t u r e c a n b e a s s i m p l e a s a d i g i t a l image of a signature (enabled through an electronic pen and pad)o r a s c o m p l e x a s t o d a y ' s p u b l i c k e y i n f r a s t r u c t u r e ( P K I ) a n d associated encryption methods, the technology decision maker m u s t d e f i n e r e l e v a n t b u s i n e s s o b j e c t i v e s a n d u n d e r s t a n d ther i s k s , s u c h a s c o s t a n d u n a u t h o r i z e d u s e a s s o c i a t e d w i t h alternative implementations.T h e r e a r e p o s s i b l e a d d i t i o n a l b e n e f i t s t o t h e i m p l e m e n t i n g organization. These include reduced transacti o n t i m e l i n e s , reduction in paper processing costs, facilitation of c ustomer migration to the Internet as a business channel, and i n c r e a s e d online transaction security. When compared to physical signatures, e-signature technologiesa r e , i n g e n e r a l , a m o r e s e c u r e a u t h e n t i c a t i o n m e t h o d . M a n y financial institutions are studying the possible implementation of a public key infrastructure (PKI) system that will allow them toexchange electronic information securely with unknown parties.P K I i s t h e d e l i v e r y c h a n n e l f o r p u b l i c k e y c r y p t o graphy, am e t h o d t h a t a l l o w s t h e p a r t i e s t o a t r a n s a c t i o n t o k e e p a communication private through the use of a two-part key madeup of public and private components. To encrypt messages, the published public keys of the recipients are used. To decrypt them e s s a g e s , t h e r e c i p i e n t s u s e t h e i r u n p u b l i s h e d p r i v a t e k e y s , known only to them. Quite simply, if the signer's private key isnot compromised, which can happen by releasing the passwordo r a l l o w i n g access to the device containing the private key, adocument cannot be digitally signed history of internet banking T h e t e r m o n l i n e

b a n k i n g w a s f i r s t s t a r t e d i n 8 0 s . T h e t e r m online became popular in the late '80s and referred to the use of aterminal, keyboard and TV (or monitor) to access the bankingsystem using a phone line. Home banking can also refer to theuse of a numeric keypad to send tones down a phone line withinstructions to the bank. Online services started in New York in1 9 8 1 w h e n f o u r o f t h e c i t y s m a j o r b a n k s ( Citibank , Chase Manhattan , Chemical and Manufacturers Hanover ) offered home b a n k i n g s e r v i c e s u s i n g t h e videotext s y s t e m . B e c a u s e o f t h e commercial failure of videotex these ban king services never b e c a m e p o p u l a r e x c e p t i n F r a n c e w h e r e the use of videotex( Minitel ) w a s s u b s i d i z e d b y t h e t e l e c o m p r o v i d e r a n d t h e U K , where the Prestel system was used. The UKs first home online banking services was set up by the Nottingham Building Society (NBS) in 1983 .The system used was based on the UK's Prestel system and used a computer , such asthe BBC Micro , or keyboard (Tandata Td1400) connected to thet e l e p h o n e s y s t e m a n d t e l e v i s i o n s e t . T h e s y s t e m ( k n o w n a s' Home li n k' ) allo wed on - l i n e v i ewin g of s t at emen ts , b a n k transfers and bill payments. In order to make bank transfers and bill payments, a written instruction giving details of the intendedrecipient had to be sent to the NBS who set the details up on theHome link system. Typical recipients were gas, electricity andtelephone companies and accounts with other banks. Details of p a y m e n t s t o b e m a d e w e r e i n p u t i n t o t h e N B S s y s t e m b y t h e account holder via Prestel. A cheque was then sent by NBS to the payee and an advice giving details of the payment was sent tothe account holder. BACS was later used to transfer the paymentdirectly.Stanford Federal Credit Union was the first financial institutionto offer online internet banking services to all of its members inOct, 1994. Later on it was adopted by worldwide banks State Bank of India (SBI) is that country's largest commercial bank. The government-controlled bank--the Indian governmentmaintains a stake of nearly 60 percent in SBI through the centralReserve Bank of India--also operates the world's largest branchnetwork, with more than 13,500 branch offices throughout

India,s t a f f e d b y n e a r l y 2 2 0 , 0 0 0 e m p l o y e e s . S B I i s a l s o p r e s e n t worldwide, with seven international subsidiaries in the UnitedS t a t e s , C a n a d a , N e p a l , B h u t a n , N i g e r i a , M a u r i t i u s , a n d theU n i t e d K i n g d o m , a n d m o r e t h a n 5 0 b r a n c h o f f i c e s i n 3 0 countries. Long an arm of the Indian government's infrastructure,agricultural, and industrial development policies, SBI has beenforced to revamp its operations since competition was introducedinto the country's commercial banking system. As part of thateffort, SBI has been rolling out its own network of automatedt e l l e r m a c h i n e s , a s w e l l a s d e v e l o p i n g a n y t i m e - a n y w h e r e banking services through Internet and other technologies. SBIa l s o h a s t a k e n a d v a n t a g e o f t h e d e r e g u l a t i o n o f t h e I n d i a n banking sector to enter the, assets management, and securities brokering sectors. In addition, SBI has been working on reigningin its branch network, reducing its payroll, and strengthening itsloan portfolio. In 2003, SBI reported revenue of $10.36 billionand total assets of $104.81 billion. The establishment of the British colonial government in India brought with it calls for the formation of a Westernstyle bankings y s t e m , i f o n l y t o s e r v e t h e n e e d s a n d i n t e r e s t s o f t h e B r i t i s h imperial government and of the European trading houses doing business there. The creation of a national banking system beganat the beginning of the 19th century.The first component of what was later to become the State Bank o f India was created in 1806, in Calcutta. Called the Bank of Calcutta, it was also the country's first joint stock c o m p a n y . Originally established to serve the city's interests, the bank wasgranted a charter to serve all of Bengal in 1809, becoming theB a n k o f B e n g a l . Th e i n t r o d u c t i o n o f W e s t e r n - s t y l e bankingi n s t i t u t e d d e p o s i t s a v i n g s a c c o u n t s a n d , i n s o m e c a s e s , investment services. The Bank of Bengal also received the rightto issue its own notes, which became legal currency within theBengali region. This right enabled the bank to establish a solidfinancial foundation, building an interest-free capital base Th e s p r e a d o f c o l o n i a l i n f l u e n c e a l s o extended the scope o f g o v e r n m e n t a n d c o m m e r c i a l f i n a n c i a l i n f l u e n c e . T o w a r d t h e middl e of the century, the imperial government created two moreregional banks. The Bank of Bombay was created in 1840, andwas soon joined by the Bank of Madras in 1843. Together witht h e B a n k o f B e n g a l , t h e y b e c a m e k n o w n a s t h e " p r e s i d e n c y " banks.All three banks were operated as joint stock companies, with theimperial government holding a one-fifth share of each bank. Theremaining shares were sold to private subscribers and, typically,w e r e c l a i m e d b y t h e W e s t e r n E u r o p e a n t r a d i n g f i r m s . T h e s e firms were represented on each bank's board of directors, whichwas presided over by a nominee from the government. While the banks performed typical banking functions, for the Western firmsand population and members of Indian society, their main rolew a s t o a c t a s a l e v e r f o r r a i s i n g l o a n c a p i t a l , a s w e l l a s h e l p stabilize government securities The charters backing the establishment of the presidency banksg r a n t e d t h e m t h e r i g h t t o e s t a b l i s h b r a n c h o f f i c e s . I n t o t h e second half of the century, however, the banks remained singleoffice concerns. It was only after the passage of the Paper Currency Act in 1861 that the banks began their first expansione f f o r t .

T h a t l e g i s l a t i o n h a d t a k e n a w a y t h e p r e s i d e n c y b a n k s ' authority to issue currency, instead placing the issuing of paper currency under direct control of the British government in India,starting in 1862.Y e t t h a t s a m e l e g i s l a t i o n i n c l u d e d t w o k e y f e a t u r e s t h a t stimulated the growth of a national banking network. On the onehand, the presidency banks were given the responsibility for thenew currency's management and circulation. On the other, theg o v e r n m e n t a g r e e d t o t r a n s f e r t r e a s u r y c a p i t a l b a c k i n g t h e c u r r e n c y t o t h e b a n k s - - a n d e s p e c i a l l y t o t h e i r b r a n c h o f f i c e s . This latter feature encouraged the three banks to begin buildingt h e c o u n t r y ' s f i r s t b a n k i n g n e t w o r k . T h e t h r e e b a n k s t h e n launched an expansion effort, establishing a system of brancho f f i c e s , a g e n c i e s , a n d s u b - a g e n c i e s t h r o u g h o u t t h e m o s t populated regions of the Indian coast, and into the inland areasa s w e l l . B y t h e e n d o f t h e 1 8 7 0 s , t h e t h r e e p r e s i d e n c y b a n k s operated nearly 50 branches among them. The rapid growth of the presidency banks came to an abrupt haltin 1876, when a new piece of legislation, the Presidency BanksA c t , p l a c e d a l l t h r e e b a n k s u n d e r a c o m m o n c h a r t e r - a n d a common set of restrictions. As part of the legislation, the Britishimperial government gave up its ownership stakes in the banks,although they continued to provide a number of services to theg o v e r n m e n t , a n d r e t a i n e d s o m e o f t h e g o v e r n m e n t ' s t r e a s u r y c a p i t a l . Th e m a j o r i t y o f t h a t , h o w e v e r , w a s t r a n s f e r r e d t o t h e t h r e e n e w l y c r e a t e d R e s e r v e T r e a s u r i e s , l o c a t e d i n C a l c u t t a , Bom bay, and Madras. The Reserve Treasuries continued to lendcapital to the presidency banks, but on a more restrictive basis.Th e m i n i m u m b a l a n c e n o w g u a r a n t e e d u n d e r t h e P r e s i d e n c y Ba nks Act was applicable only to the banks' central offices. With branch offices no longer guaranteed a minimum balance backed b y g o v e r n m e n t f u n d s , t h e b a n k s e n d e d d e v e l o p m e n t o f t h e i r networks. Only the Bank of Madras continued to grow for somet i m e , s u p p l i e d a s i t w a s b y t h e i n f l u x o f c a p i t a l f r o m development of trade among the region's port cities. The loss of the government-backed balances w a s s o o n compensated by India's rapid economic development at the endof the 19th century. The building of a national railroad network launched the country into a new era, seeing the rise of cashcropf a r m i n g , a m i n i n g i n d u s t r y , a n d w i d e s p r e a d i n d u s t r i a l development. The three presidency banks took active r o l e s i n financing this development. The banks also extended their rangeo f s e r v i c e s a n d o p e r a t i o n s , a l t h o u g h f o r t h e t i m e b e i n g w a s excluded from the foreign exchange market.By the beginning of the 20th century, India's banking industry b o a s t e d a h o s t o f n e w a r r i v a l s , a n d p a r t i c u l a r l y f o r e i g n b a n k s a u t h o r i z e d t o e x c h a n g e c u r r e n c y . Th e g r o w t h o f t h e b a n k i n g sector, and the development of indigenous banks, in turn createda need for a larger "bankers' bank." At the same time, the Indiang o v e r n m e n t h a d o u t g r o w n i t s c o l o n i a l b a c k g r o u n d a n d n o w required a more centralized banking institution. These factors ledto the decision

to merge the three presidency banks into a new,single and centralized banking institution, the Imperial Bank of India. Created in 1921, the Imperial Bank of India appe a r e d t o inaugurate a new era in India's history-culminating in itsdeclaration of independence from the Brit i s h E m p i r e . T h e Imperial Bank took on the role of central bank for the Indiangovernment, while acting as a bankers' bank for the growingIndian banking sector. At the same time, the Imperial Bank,which, despite its role in the government financial structurer e m a i n e d i n d ep e n d e n t o f t h e g o v e r n m e n t , c a r r i e d o n i t s o w n commercial banking operations.In 1926, a government commission recommended the creation of a t r u e c e n t r a l b a n k . W h i l e s o m e p r o p o s e d c o n v e r t i n g theImperial Bank into a central banking organization f or thec oun t r y , th e co mmi s s i on r ej ec t ed th i s i d ea a n d i n s t e a d recommended that the Imperial Bank be transfo r m e d i n t o a purely commercial banking institution. The government took upthe commission's recommendations, drafting a new bill in 1927.Passage of the new legislation did not occur until 1935, however,with the creation of the Reserve Bank of India. That bank took over all central banking functions. Th e I m p e r i a l B a n k t h e n c o n v e r t e d t o f u l l c o m m e r c i a l s t a t u s , which accordingly allowed it to enter a number of banking areas,such as currency exchange and trustee and estate management,from which it had previously been restricted. Despite the loss of i t s r o l e a s a g o v e r n m e n t b a n k i n g o f f i c e , t h e I m p e r i a l B a n k continued to provide banking services to the Reserve Ban k, p a r t i c u l a r l y i n a r ea s wh er e t h e Re s e r v e Ba n k h ad n o t y e t established offices. At the same time, the Imperial Bank retainedits position as a bankers' bank.By then, India had achieved its independence from Britain. In1 9 5 1 , t h e n e w g o v e r n m e n t l a u n c h e d i t s f i r s t F i v e Y e a r Plan,targeting in particular the development of the country's r u r a l areas. The lack of a banking infrastructure in these regions ledthe government to develop a state-owned banking entity to fillt h e g a p . A s p a r t o f t h a t p r o c e s s , t h e I m p e r i a l B a n k w a s nationalized and then integrated with other existing government-owned banking components. The result was the creation of theState Bank of India, or SBI, in 1955 The new state-owned bank now controlled more than one-fourthof India's total banking industry. That position was expanded att h e e n d o f t h e d e c a d e , w h e n n e w l e g i s l a t i o n w a s p a s s e d providing for the takeover by the State Bank of eight regionally b a s e d , g o v e r n m e n t - c o n t r o l l e d b a n k s . A s s u c h t h e B a n k s o f Bikaner, Jaipur, Indore, Mysore, Patiala, Hyderabad, Saurashtra,a n d T r a v a n c o r e b e c a m e s u b s i d i a r i e s o f t h e S t a t e B a n k . Following the 1963 merger of the Bikaner and J a i p u r b a n k s , their seven remaining subsidiaries were converted into associate banks.In the early 1960s, the State Bank's network already containednearly 500 branches and sub-offices, as well as the three originalhead offices inherited from the presidency bank era. Yet the StateB a n k n o w b e g a n a n e r a o f expansion, acting as a motor for India's industrial and agricultural development that was

t o transform it into one of the world's largest financial networks.Indeed, by the early 1990s, the State Bank counted nearly 15,000 b r a n c h e s a n d o f f i c e s t h r o u g h o u t I n d i a , g i v i n g i t t h e w o r l d ' s si ngle largest branch network. S B I p l a y e d a n e x t r e m e l y i m p o r t a n t r o l e i n d e v e l o p i n g I n d i a ' s rural regions, providing the financing needed to modernize thec o u n t r y ' s a g r i c u l t u r a l i n d u s t r y a n d d e v e l o p n e w i r r i g a t i o n methods and cattle breeding techniques, and backing the creationo f d a i r y f a r m i n g , a s w e l l a s p o r k a n d p o u l t r y i n d u s t r i e s . Th e bank also provided backing for the development of the country'sinfrastructure, particularly on a local level, where it providedc r e d i t c o v e r a g e a n d d e v e l o p m e n t a s s i s t a n c e t o v i l l a g e s . T h en a t i o n a l i z a t i o n o f t h e b a n k i n g s e c t o r i t s e l f , a n e v e n t t h a t occurred in 1969 under the government led by Indira Gandhi,gave SBI new prominence as the country's leading bank E v e n a s i t p l a y e d a p r i m a r y r o l e i n t h e I n d i a n g o v e r n m e n t ' s industrial and agricultural development policies, SBI continuedt o d e v e l o p i t s c o m m e r c i a l b a n k i n g o p e r a t i o n s . I n 1 9 7 2 , f o r example, the bank began offering merchant banking services. Byt h e m i d 1980s, the bank's merchant banking operations hadg r o w n s u f f i c i e n t l y t o s u p p o r t t h e c r e a t i o n o f a d e d i c a t e d subsidiary, SBI Capital Markets, in 1986. The following year, thecompany launched another subsidiary, SBI Home Finance, inc o l l a b o r a t i o n w i t h t h e H o u s i n g D e v e l o p m e n t F i n a n c e Corporation. Then in the early 1990s, SBI added subsidiariesS B I F a c t o r s a n d C o m m e r c i a l S e r v i c e s , a n d t h e n l a u n c h e d institutional investor services. SBI was allowed to dominate the Indian banking sector for moret h a n t w o d e c a d e s . I n t h e e a r l y 1 9 9 0 s , t h e I n d i a n g o v e r n m e n t kicked off a series of reforms aimed at deregulating the bankingand financial industries. SBI was now forced to brace itself for the arrival of a new wave of competitors eager to enter the fastgrowing Indian economy's commercial banking sector. Yet yearsas a governmentrun institution had left SBI bloated--the civil-s e r v a n t s t a t u s o f i t s employees had encouraged its payroll tos w e l l t o m o r e t h a n 2 3 0 , 0 0 0 . T h e b u r e a u c r a t i c n a t u r e o f t h e bank's management left little room for personal initiative, nor incentive for controlling costs.I n 1 9 9 4 , t h e b a n k h i r e d c o n s u l t i n g g r o u p M c K i n s e y & C o . t o help it restructure its operations. McKinsey then led SBI througha m a s s i v e r e s t r u c t u r i n g e f f o r t t h a t l a s t e d t h r o u gh m u c h o f t h e decade and into the beginning of the next, an effort that helpedS B I d e v e l o p a n e w c o r p o r a t e c u l t u r e f o c u s e d m o r e o n profitability than on social and political policy. SBI also steppedup its international trade operations, such as foreign exchanget r a d i n g , a s w e l l a s c o r p o r a t e f i n a n c e , e x p o r t c r e d i t , a n d international banking SBI had long been present overseas, operating some 50 offices in34 countries, including full-fledged subsidiaries in the UnitedKingdom, the United States, and elsewhere. In 1995 the bank setup a new subsidiary, SBI Commercial and International Bank Ltd., to back its corporate and international banking services.T h e b a n k a l s o e x t e n d e d i t s i n t e r n a t i o n a l n e t w o r k i n t o

n e w markets such as Russia, China, and South Africa.B a c k h o m e , i n t h e m e a n t i m e , S B I b e g a n a d d r e s s i n g t h e technology gap that existed between it and its foreignbackedc o m p e t i t o r s . I n t o t h e 1 9 9 0 s , S B I h a d y e t t o e s t a b l i s h a n automated teller network; indeed, it had not even automated itsinformation systems. SBI responded by launching an ambitioustechnology drive, rolling out its own ATM network, then teamingu p w i t h G E C a p i t a l t o i s s u e i t s o w n c r e d i t c a r d . I n t h e e a r l y 2000s, the bank began cross-linking its banking network with itsA T M n e t w o r k a n d I n t e r n e t a n d telephone access, rolling out"anytime, anywhere" banking access. B y 2 0 0 2 , t h e b a n k h a d succeeded in networking its 3,000 most profitable branches RETAIL BANKING:The Retail banking application is an integration of severalf unctional areas, and enables customers to: Issue Demand Drafts online Transfer funds to own and third party account C r e d i t b e n e f i c i a r y a c c o u n t s u s i n g t h e V I S A M o n e y Transf er, RTGS/NEFT feature Generate account statements Setup Standing Instructions Configure profile settings Use eTax for online tax payment Use ePay for automatic bill payments Interface with merchants for railway and airl i n e reservations AvailDEMATandIPOservices CORPORATE BANKING:The OnlineSBI corporate banking application provides featurest o a d m i n i s t e r a n d m a n a g e c o r p o r a t e a c c o u n t s o n l i n e . T h e corporate module provides roles such as Regulator, Admi n , Uploader, Transaction Maker, Authorizer, and Auditor. Theseroles have access to the following functions Access accounts in several branches with a single sign-onmechanism U p l o a d f i l e s t o m a k e b u l k t r a n s a c t i o n s t o t h i r d p a r t i e s , supplier, vendor and tax collection authorities. Use online transactional features such as fund transfer toown accounts, third party payments, and draft issues Make bill payments over the Internet.

A u t h o r i z e , m o d i f y , r e s c h e d u l e a n d c a n c e l t r a n s a c t i o n s , based on rights assigned to the user Generate account statement Enquire on transaction details or current balance Value added services : Tax payments to central and state governments through siteto site integration. Supply Chain Finance( e-VFS- Electronic Vendor FinanceScheme) Direct Debit Facility E Collection Facilities for: Core Banking Transactions e- ticketing E-TICKETING :You can book your railway, air and bus tickets online throughOnlineSBI.To book your train ticket, just log on to irctc.co.in and create anID there at if you do not have one. Submit your travel plan and book the ticket(s)-either i-ticket (where the delivery of tickets will be made at your address) or E-tickets (wherein after successful payment transactions,a n e - t i c k e t i s g e n e r a t e d which can be printed any time.For an e-ticket, the details of photo i d e n t i t y c a r d w i l l required to be filled in)And select State Bank of India in the payment options. You will b e r e d i r e c t e d t o I n t e r n e t B a n k i n g s i t e o f S B I ( www.onlinesbi.com ).After submitting the respective ID and password, you can selectyour account. After a successful debit, Railways will generatet h e t i c k e t . E - t i c k e t c a n b e printed by you whereas the iticketw i l l b e d i s p a t c h e d b y I R C T C a t t h e g i v e n a d d r e s s . S e r vice charges @ Rs.10/- per transaction shall be levied in addition tot h e c o s t o f t h e t i c k e t . C a n c e l l a t i o n o f E - t i c k e t c a n b e d o n e b y logging on to IRCTC's site; refund amount will be credited toy o u r a c c o u n t d i r e c t l y within 2-3 days. For cancellation of iticket, you shall be required to submit your t i c k e t a t a computerized counter of Railways and on cance llation; thea m o u n t s h a l l b e c r e d i t e d b a c k t o y o u r a c c o u n t . You can also book your Air ticket through the e-ticketing feature.Logon to Indian Airlines website to make a payment for an e-ticket through State Bank of India, you need to select SBI as the p a y m e n t o p t i o n . T h e p a y m e n t r e q u e s t w i l l b e r e d i r e c t e d t o Internet Banking site. The request may be processed based onv a l u e s s e n t f r o m t h e a i r l i n e s w e b s i t e . O n c e a t r a n s a c t i o n i

s processed, an appropriate response will be sent to airlines site toupdate the status of the transaction. You can print the E-ticketimmediately.To book bus tickets to destinations in Karnataka, log on to theKSRTC website. Provide details about the start and end points of y o u r j o u r n e y , d a t e o f j o u r n e y a n d n u m b e r o f t i c k e t s . V e r i f y availability of seats on the selected date and confirm the t r a n s a c t i o n . S e l e c t O n l i n e S B I t o m a k e t h e p a y m e n t . P r o v i d e your credentials and select the SBI account that will be debitedfor the payment. You are provided a KSRTC reference number for your e-Ticket. 2) SBI E-TAX:You can pay your taxes online through SBI E-Tax. This facilityenables you to pay TDS, Income tax, Indirect tax, Corporationtax, Wealth tax, Estate Duty and Fringe Benefits tax. Click the e-Tax link in the home page. You are displayed a page with twolinks Direct Tax and Indirect Tax.Click the Direct Tax link. You will be redirected to the NSDLsite where you can select an online challan based on the tax youwish to pay. Provide the PAN, name and address, assessmentyear, nature of payment and bank name. On selecting the bank name as SBI and submitting the form, you will be redirected tothe Internet Banking site. After submitting the respective ID and password, you can select your account for making payment of taxes. After payment is successful you can print the E-Receip for the payment. The E-receipt can be printed at a later date alsoand the same can be retrieved from: Enquiries > FindTransactions > Status Enquiries > Click on the respectivetransaction to print the tax receipt.The Indirect Tax link is used to make Central Excise and ServiceTax payments to Central Board of Excise and Customs. Theonline payment feature facilitates anytime, anywhere paymentand an instant E-Receipt is generated once the transaction iscomplete. The Indirect Tax payment facility is available toRegistered Central Excise/Service Tax Assessee who possessesthe 15 digit PAN based Assessee Code. You can make CBEC payments using the Indirect Taxes link available in thePayments/Transfers tab. You need to provide your assessee codeas registered with CBEC and select the minor heads towardswhich you intend to pay tax. Select the appropriate tax type andenter the tax amount. Select an account for debiting the total taxamount. You can use any of your transaction accounts to makethe payment. If a payment is successful, CBEC provides a link togenerate an E-Receipt for the payment.Internet banking customers can pay tax through site to site integration. For government agencies, which are not Internet-enabled, OnlineSBI offers the Government Tax Payment facility.This facility is available as a post login feature in the retail andcorporate banking sites of the Online SBI portal.Please note that the cut-off time for OLTAS and CBEC paymentis 8 P.M. IST. Any transactions created after the cut off time will be processed after 7 A.M. on the following day. 3) Bill Payment :A simple and convenient service for viewing and paying your bills online. No more late payments No more queues

No more hassles of depositing chequesUsing the bill payment you can 'view and Pay various billsonline, directly from your SBI account. You can pay telephone,electricity, insurance, credit cards and other bills from thecomfort of your house or office, 24 hours a day, 365 days a year RTGS system facilitates transfer of funds from accounts in one bank to another on a "real time" and on "gross settlement" basis.This system is the fastest possible interbank money transfer facility available through secure banking channels in India.RTGS transaction requests will be sent to RBI immediatelyduring working hours post working hours requests are registeredand sent to RBI on next working day. You can also schedule atransaction for a future date. You can transfer an amount of Rs.1lac and above using RTGS system. National Electronic Funds Transfer (NEFT) facilitates transfer of funds to the credit account with the other participating bank. RBIacts as the service provider and transfers the credit to the other bank's account. NEFT transactions are settled in batches based on the followingtimings1.6 settlements on weekdays - at 09:00, 11:00, 12:00, 13:00,15:00 and 17:00 hrs.2.3 settlements on Saturdays - at 09:00, 11:00 and 12:00hrs. Conclusion:Studying the project we came to know that Internet banking isclearly the way forward for the State Bank of India. It providescomfort to customers at the same time it provides cost cutting toSBI by eliminating physical documentation. Internet bankingsaves time of bank as well as those of customers.Study states that internet banking provides greater reach tocustomers. Feedback can be obtained easily as internet is virtualin nature. Customer loyalty can be gain. Personal attention can be given by bank to customer also quality service can be served.Bank should know that No system is perfect, however a systemo f s u c h a t y p e w i l l n e e d t o b e v e r y s e c u r e . T h i s i s a s y s t e m which holds account details and customers wealth. If such asystem was not trusted and not reliable, then SBI w o u l d f a c e serious laws and would lose business.After studying the SWOC analysis, we came to know variousstrengths of SBI such as quality customer service, greater reach,customer loyalty, easy access to information, 24 hours access easy online applications etc. SBI should put efforts to multiplythe number of strengths. In terms of weakness I come to knows o m e o f t h e m a j o r w e a k n e s s e s t h e y a r e l a c k o f a w a r e n e s s o f internet banking among the customers, obsolesce of technologyrelated to security, complicated procedures of availing internet banking facilities, lack of knowledge among the employees of SBI. SBI should concentrate on the weaknesses and reduce themto zero.In the third segment of SWOC analysis of internet banking wedealt with opportunities like 95 % market of internet market isuntapped, SBIs path to become first virtual bank. By encashingsuch opportunities bank can become the leader in banking sector o f I n d i a . I n t h e l a s t s e g m e n t I c o m e t o know about variousc h a l l e n g e s w h i c h a r e i n f r o n t o f S B I , l i k e s a m e n e s s i n I T infrastructure within various banks, need of vari ous vendor supports for complex technology, maintaining se c u r e d I T infrastructure, alternative mechanism in case of failure of presentsecurity system.T h e c o m p a n y c a n t a k e t h e a d v a n t a g e o f t h e r e p u t a t i o n i t h a s created in the market for itself and become more competitiveTh e r e c o m m e n d a t i o n s a n d s u g g e s t i o n s g i v e n , i f a d o p t e d w i l l improve the position of the company substantially and optimal

Vous aimerez peut-être aussi

- Digital Crimes and Its Impact To The SocietyDocument13 pagesDigital Crimes and Its Impact To The SocietyPunk Addicted0% (1)

- A Brief History and Overview of Internet BankingDocument18 pagesA Brief History and Overview of Internet BankingVIPIN SAM RAVIPas encore d'évaluation

- IJ Paper Jurisdiction On The InternetDocument28 pagesIJ Paper Jurisdiction On The InternetasmirgetsPas encore d'évaluation

- Crypto Uncovered: The Evolution of Bitcoin and the Crypto Currency MarketplaceD'EverandCrypto Uncovered: The Evolution of Bitcoin and the Crypto Currency MarketplacePas encore d'évaluation

- DocDocument42 pagesDocAmmaji KundrapuPas encore d'évaluation

- Acknowledgement: "Cyber Crime in Banking Sector"Document20 pagesAcknowledgement: "Cyber Crime in Banking Sector"akhilshetty93Pas encore d'évaluation

- Investor DeckDocument43 pagesInvestor DeckMa'ruf SubekhiPas encore d'évaluation

- The Internet Will Shake Bankings Medieval FoundationsDocument2 pagesThe Internet Will Shake Bankings Medieval FoundationsanushanPas encore d'évaluation

- Acknowledgement: "Cyber Crime in Banking Sector"Document29 pagesAcknowledgement: "Cyber Crime in Banking Sector"shwetaakhilPas encore d'évaluation

- Acknowledgement: "Cyber Crime in Banking Sector"Document29 pagesAcknowledgement: "Cyber Crime in Banking Sector"shwetaakhilPas encore d'évaluation

- Act. No. DDocument1 pageAct. No. DSamuel Cueva SegismundoPas encore d'évaluation

- Case 2 New Competition Everywhere - 2Document14 pagesCase 2 New Competition Everywhere - 2Le HarryPas encore d'évaluation

- Role of Information TechnologyDocument31 pagesRole of Information TechnologyPrasa PrasanderPas encore d'évaluation

- A Study About Digital AssetsDocument9 pagesA Study About Digital Assetsbrainygamer101Pas encore d'évaluation

- 262 Privacy Part2 TermsDocument11 pages262 Privacy Part2 TermsMar MainPas encore d'évaluation

- Consumer Online Privacy Issues ExploredDocument14 pagesConsumer Online Privacy Issues Exploredmabelle901Pas encore d'évaluation

- 2600 The Hacker Quarterly - Volume 27, #1 (Spring 2010)Document68 pages2600 The Hacker Quarterly - Volume 27, #1 (Spring 2010)kuponecroPas encore d'évaluation

- Leaks From Chantilly - Quotes From Bilderberg 2017Document11 pagesLeaks From Chantilly - Quotes From Bilderberg 2017ArizonaMilitiaPas encore d'évaluation

- Ankita CPP FinalDocument30 pagesAnkita CPP FinalAnonymous eDtcEhdPas encore d'évaluation

- Virtual Diplomacy Homepage Virtual Diplomacy PublicationsDocument6 pagesVirtual Diplomacy Homepage Virtual Diplomacy PublicationsisaPas encore d'évaluation

- Roger W Ferguson JR: Electronic Commerce, Banking and PaymentsDocument5 pagesRoger W Ferguson JR: Electronic Commerce, Banking and PaymentsFlaviub23Pas encore d'évaluation

- Cryptocurrency, Deregulation, and Network Society-1Document6 pagesCryptocurrency, Deregulation, and Network Society-1Aaryan SharmaPas encore d'évaluation

- Introduction of Mobile BankingDocument3 pagesIntroduction of Mobile BankingRupesh BhagwanePas encore d'évaluation

- Allaire Testimony 7-30-19Document13 pagesAllaire Testimony 7-30-19Anonymous 8RR1A8ClpPas encore d'évaluation

- Allaire Testimony 7-30-19 PDFDocument13 pagesAllaire Testimony 7-30-19 PDFBrass BoyPas encore d'évaluation

- Digital Disruption: Implications and opportunities for Economies, Society, Policy Makers and Business LeadersD'EverandDigital Disruption: Implications and opportunities for Economies, Society, Policy Makers and Business LeadersPas encore d'évaluation

- Greenspan Discusses Changes in US Retail PaymentsDocument3 pagesGreenspan Discusses Changes in US Retail PaymentsFlaviub23Pas encore d'évaluation

- The New Civilization Upon Data - How Big Data Reshapes Human Civilization, Business and The Personal WorldDocument241 pagesThe New Civilization Upon Data - How Big Data Reshapes Human Civilization, Business and The Personal WorldDani KouassiPas encore d'évaluation

- Introduc Tion To I Nformat Ion and Com Munica Tion Technol OgiesDocument80 pagesIntroduc Tion To I Nformat Ion and Com Munica Tion Technol OgiesAgnes Sambat DanielsPas encore d'évaluation

- Mr. Ferguson Discusses Electronic Banking and Its Implications for the Federal ReserveDocument5 pagesMr. Ferguson Discusses Electronic Banking and Its Implications for the Federal ReserveFlaviub23Pas encore d'évaluation

- Soft Ethics and The Governance of The Digital: Philos. TechnolDocument8 pagesSoft Ethics and The Governance of The Digital: Philos. TechnolRaúl VillarroelPas encore d'évaluation

- Mil Lesson 6 - 103551Document21 pagesMil Lesson 6 - 103551Codilan, Cyril Jane- 26 MAXWELL-STEMPas encore d'évaluation

- Cryptocurrency - Are We Ready To Demonetize The World?: AcknowledgementDocument15 pagesCryptocurrency - Are We Ready To Demonetize The World?: AcknowledgementPrarthana SahaPas encore d'évaluation

- Thesis Money LaunderingDocument7 pagesThesis Money Launderinggbwy79ja100% (2)

- Digital Currency Research PaperDocument6 pagesDigital Currency Research Paperefjr9yx3100% (1)

- Crime Report Management SystemDocument49 pagesCrime Report Management Systemsaranbalaji22Pas encore d'évaluation

- Internet MuetDocument15 pagesInternet MuetEzah AtyrahPas encore d'évaluation

- New Regulatory Approach To Ecuador's Electronic Money From A Comparative International ScopeDocument23 pagesNew Regulatory Approach To Ecuador's Electronic Money From A Comparative International ScopeHasfi YakobPas encore d'évaluation

- Biography, Ed. C. C. Gillispie, New York, 1975, XI, Pp. 31-33Document75 pagesBiography, Ed. C. C. Gillispie, New York, 1975, XI, Pp. 31-33wangxulunPas encore d'évaluation

- The Rising Tide of US Electronic Payments: White PaperDocument11 pagesThe Rising Tide of US Electronic Payments: White Papervatimetro2012Pas encore d'évaluation

- Final Draft For Chapter 1 5Document8 pagesFinal Draft For Chapter 1 5Tifanny MallariPas encore d'évaluation

- Xiwei Xu, Ingo Weber, Mark Staples - Architecture For Blockchain Applications (2019, Springer)Document312 pagesXiwei Xu, Ingo Weber, Mark Staples - Architecture For Blockchain Applications (2019, Springer)FRANKLIN GONZALEZ DORADO100% (1)

- Final Changes That Internet IntroducedDocument5 pagesFinal Changes That Internet IntroducedMafer MnzPas encore d'évaluation

- Fintech 1Document10 pagesFintech 123mco058Pas encore d'évaluation

- Hacking - Money LaunderingDocument44 pagesHacking - Money LaunderingCalum YuillPas encore d'évaluation

- Tapscott 2016 How The Tech Behind Bitcoin Will Change Your Life TimeDocument3 pagesTapscott 2016 How The Tech Behind Bitcoin Will Change Your Life TimeFirman HabibPas encore d'évaluation

- Cryptocurrency: A Primer For Policy-Makers: August 2019Document63 pagesCryptocurrency: A Primer For Policy-Makers: August 2019DiegoPas encore d'évaluation

- MR Latter Looks at The Implications of E-Commerce For The Banking and Monetary System in Hong KongDocument4 pagesMR Latter Looks at The Implications of E-Commerce For The Banking and Monetary System in Hong KongFlaviub23Pas encore d'évaluation

- Online BankingDocument68 pagesOnline BankingArvind Sanu MisraPas encore d'évaluation

- Uses Abuses of InternetDocument8 pagesUses Abuses of InternetMuzammil HassanPas encore d'évaluation

- Research Paper On Internet PiracyDocument7 pagesResearch Paper On Internet Piracyvvgnzdbkf100% (1)

- Important of InternetDocument2 pagesImportant of InternetAtiera 사랑Pas encore d'évaluation

- Term Paper Cyber CrimeDocument7 pagesTerm Paper Cyber Crimeafdtrtrwe100% (1)

- Discuss How Such FactorsDocument4 pagesDiscuss How Such FactorsRaizeL RosePas encore d'évaluation

- Consumer Perception Toward Online ShoppingDocument11 pagesConsumer Perception Toward Online ShoppingJIGNESH125Pas encore d'évaluation

- Digital Currencies - Bank For International SettlementsDocument17 pagesDigital Currencies - Bank For International SettlementsAtish KissoonPas encore d'évaluation

- MBA Exam on Business Law and TaxationDocument2 pagesMBA Exam on Business Law and Taxationsivakulanthay5195Pas encore d'évaluation

- InvitationDocument3 pagesInvitationsivakulanthay5195Pas encore d'évaluation

- A) Need of Preservation and Conservation: When An Important, Often UsedDocument1 pageA) Need of Preservation and Conservation: When An Important, Often Usedsivakulanthay5195Pas encore d'évaluation

- CCDocument5 pagesCCsivakulanthay5195Pas encore d'évaluation

- SSRN Id1203322Document75 pagesSSRN Id1203322Sherihan MujeebPas encore d'évaluation

- Factors Influencing Consumer Preferences for Milk BrandsDocument1 pageFactors Influencing Consumer Preferences for Milk Brandssivakulanthay5195Pas encore d'évaluation

- Concept Paper WP 336Document40 pagesConcept Paper WP 336sivakulanthay5195Pas encore d'évaluation

- BismiDocument5 pagesBismisivakulanthay5195Pas encore d'évaluation

- 74230Document156 pages74230sivakulanthay5195Pas encore d'évaluation

- NII-Electronic Library ServiceDocument6 pagesNII-Electronic Library Servicesivakulanthay5195Pas encore d'évaluation

- 2010 02 01ramaniDocument73 pages2010 02 01ramanisivakulanthay5195Pas encore d'évaluation

- PHD Scholars File G.Venkatesan N. Saranya V. Ramachandran R. Murugesan University Circular Dr. P. Thirumoorthy Yrc FileDocument2 pagesPHD Scholars File G.Venkatesan N. Saranya V. Ramachandran R. Murugesan University Circular Dr. P. Thirumoorthy Yrc Filesivakulanthay5195Pas encore d'évaluation

- 1 s2.0 0008621595001116 MainDocument8 pages1 s2.0 0008621595001116 Mainsivakulanthay5195Pas encore d'évaluation

- SSRN Id1203322Document75 pagesSSRN Id1203322Sherihan MujeebPas encore d'évaluation

- SSRN Id1203322Document75 pagesSSRN Id1203322Sherihan MujeebPas encore d'évaluation

- 08 Chapter 2Document11 pages08 Chapter 2Ridhosh VkPas encore d'évaluation

- Departmental Stores: Fazil AbbasDocument26 pagesDepartmental Stores: Fazil Abbassivakulanthay5195Pas encore d'évaluation

- 12 04Document18 pages12 04sivakulanthay5195Pas encore d'évaluation

- 12 04Document18 pages12 04sivakulanthay5195Pas encore d'évaluation

- National Policy On TribalsDocument8 pagesNational Policy On TribalsBiswajit Aleser BasakPas encore d'évaluation

- Investor Awareness Programme - 2013: Bombay Stock Exchange LimitedDocument2 pagesInvestor Awareness Programme - 2013: Bombay Stock Exchange Limitedsivakulanthay5195Pas encore d'évaluation

- WalMartReport21010 01 11 PDFDocument67 pagesWalMartReport21010 01 11 PDFsivakulanthay5195Pas encore d'évaluation

- FDocument3 pagesFsivakulanthay5195Pas encore d'évaluation

- Java 1 FDocument8 pagesJava 1 Fsivakulanthay5195Pas encore d'évaluation

- Qualitative Research Methods BroughDocument43 pagesQualitative Research Methods BroughRajPihu100% (1)

- EdfvDocument25 pagesEdfvsivakulanthay5195Pas encore d'évaluation

- VGDFDocument13 pagesVGDFsivakulanthay5195Pas encore d'évaluation

- CdSe/Polythiophene Nanocomposite CharacterizationDocument8 pagesCdSe/Polythiophene Nanocomposite CharacterizationShridhar MathadPas encore d'évaluation

- A Study of Old Age Homes in The Care O1Document48 pagesA Study of Old Age Homes in The Care O1sivakulanthay5195100% (2)

- UPI Study: Analysis of India's Unified Payment InterfaceDocument72 pagesUPI Study: Analysis of India's Unified Payment InterfaceSourabh SoniPas encore d'évaluation

- Ch02 DSS BIDocument91 pagesCh02 DSS BIMinh Bùi Vũ NguyệtPas encore d'évaluation

- Faq Change of Cimb Bank Account Number Format 20150316 PDFDocument1 pageFaq Change of Cimb Bank Account Number Format 20150316 PDFOthman A. MughniPas encore d'évaluation

- Customer Registration of Arbro Pharmaceuticals Pvt. Ltd.Document2 pagesCustomer Registration of Arbro Pharmaceuticals Pvt. Ltd.sahil satputePas encore d'évaluation

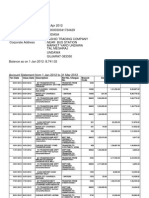

- Bank transaction history report under 40 charsDocument2 pagesBank transaction history report under 40 charsMánøjPas encore d'évaluation

- MT940 Bank Format ExplainedDocument23 pagesMT940 Bank Format Explainedvickygupta12381% (16)

- 3 Months Statement. SAUDA 18Document2 pages3 Months Statement. SAUDA 18Fikile Eem100% (1)

- Bank 4.0 Revolution in VNDocument8 pagesBank 4.0 Revolution in VNDang HaiPas encore d'évaluation

- 0902Document15 pages0902hemrajkPas encore d'évaluation

- MBBcurrent 511074534516 2019-07-31Document9 pagesMBBcurrent 511074534516 2019-07-31Jannah TajudinPas encore d'évaluation

- Account Statement From 1 May 2021 To 21 Dec 2021Document3 pagesAccount Statement From 1 May 2021 To 21 Dec 2021Rikhil NairPas encore d'évaluation

- Account Statement From 2 Oct 2020 To 26 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument12 pagesAccount Statement From 2 Oct 2020 To 26 Apr 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSammy ZalaPas encore d'évaluation

- PCI DSS v3-1 Summary of Changes PDFDocument5 pagesPCI DSS v3-1 Summary of Changes PDFquangchinhPas encore d'évaluation

- StatementDocument3 pagesStatementMarcus GreenPas encore d'évaluation

- Presentation On Back OfficeDocument56 pagesPresentation On Back OfficeARIF PATEL100% (1)

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument3 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceNishi GuptaPas encore d'évaluation

- Transaction AcknowledgmentDocument9 pagesTransaction Acknowledgmentgirish geethuPas encore d'évaluation

- Bank Accounts: What You Should KnowDocument36 pagesBank Accounts: What You Should Knowrohit7853Pas encore d'évaluation

- E-Banking Monthly Incoming Calls ReportDocument85 pagesE-Banking Monthly Incoming Calls ReportDhexter VillaPas encore d'évaluation

- 2024 04 1 04 34 43 Statement - 1704323083904Document22 pages2024 04 1 04 34 43 Statement - 1704323083904karthickPas encore d'évaluation

- FSR 20180101 20181231Document2 pagesFSR 20180101 20181231Michael PhelpsPas encore d'évaluation

- Digital Currency ExplainedDocument12 pagesDigital Currency ExplainedRoichuddin RanaPas encore d'évaluation

- Ebay2017 PDFDocument10 pagesEbay2017 PDFAnonymous XUFH0I2wXz83% (6)

- EMV Master Class Covers Chip Card StandardsDocument2 pagesEMV Master Class Covers Chip Card StandardsSurendranPas encore d'évaluation

- Account Statement SummaryRTGS INB:CR02646079TRANSFER TO99827044308 /RTGS INB:CR02653891TRANSFER TO99827044308 /99922999224,99,976.004,99,976.00Document4 pagesAccount Statement SummaryRTGS INB:CR02646079TRANSFER TO99827044308 /RTGS INB:CR02653891TRANSFER TO99827044308 /99922999224,99,976.004,99,976.00Mufaddal RashidPas encore d'évaluation

- For Any Further Ticket Details Contact or Call 3989 5050: Treat Your Smarticket Like CashDocument2 pagesFor Any Further Ticket Details Contact or Call 3989 5050: Treat Your Smarticket Like CashNirbhay GuptaPas encore d'évaluation

- IRCTC Booking Confirmation for Train 01019 on 09-May-2021 from KYN to BAMDocument1 pageIRCTC Booking Confirmation for Train 01019 on 09-May-2021 from KYN to BAMSarat BeheraPas encore d'évaluation

- Ashish ParmarDocument35 pagesAshish Parmarvaibhav shuklaPas encore d'évaluation

- E - Challan Government of Haryana E - Challan Government of HaryanaDocument1 pageE - Challan Government of Haryana E - Challan Government of HaryanaAmit KumarPas encore d'évaluation

- IU045849Document1 pageIU045849Luka UrushadzePas encore d'évaluation