Académique Documents

Professionnel Documents

Culture Documents

Sebi Order

Transféré par

Ankur ShahDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sebi Order

Transféré par

Ankur ShahDroits d'auteur :

Formats disponibles

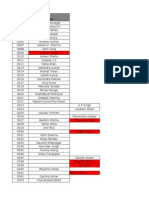

Database Type Trading

Client Id L2087

Client Name SUNIL KUMAR MEHTA HUF

Source

Order Date 1 27/05/2011

Trading

L1468

AJAY ROONGTA

1 27/05/2011

Trading

L1447

SUNIL KUMAR MEHTA

1 27/05/2011

Trading

HOL2087

SUNIL KUMAR MEHTA (HUF)

1 27/05/2011

Trading

HOL1468

AJAY ROONGTA

1 27/05/2011

Trading

HOL1447

SUNIL KUMAR MEHTA

1 27/05/2011

Trading

RMS101

PANDYA HARDIK MAHESHBHAI

1 02/02/2011

Trading

RMS100

WALMIKI AMAR PREMCHAND

1 02/02/2011

Trading

PCG056

SANCHANIYA ANKIT R

1 02/02/2011

Trading

PCG055

JARIWALA CHIRAG

1 02/02/2011

Trading

PCG054

THAKER BIPIN JAYANT

1 02/02/2011

Trading

PCG050

SHAH VIPUL HIRALAL

1 02/02/2011

Trading

L8206

MEHTA KAUSHIK RAJNIKANT

1 02/02/2011

Trading

621RMS101

HARDIK MAHESHBHAI PANDYA

1 02/02/2011

Trading

621RMS100

AMAR PREMCHAND WALMIKI

1 02/02/2011

Trading

1454F79FIN

AVINASH BOTHRA

1 02/02/2011

Trading

1454F79

AVINASH BOTHRA

1 02/02/2011

CDSL

1201330000283931

HARDIK MAHESHBHAI PANDYA

1 02/02/2011

CDSL

1201330000283925

AMAR PREMCHAND WALMIKI

1 02/02/2011

Trading

EASA133

KHESE UMESH SHYAMRAO

1 15/12/2010

Trading

165EASA133

KHESE UMESH SHYAMRAO

1 15/12/2010

CDSL

1201330000115739

UMESH SHYAMRAO KHESE

1 15/12/2010

Trading

L6080

WALLFORT & SHARE STOCK BORKERS

1 12/08/2010

CDSL

1201330000406051

WALLFORT SHARE AND STOCK BROKERS PVT LTD

1 12/08/2010

Trading

EASA118

SHAILESH SOMABHAI PATEL

1 22/01/2010

CDSL

1201330000107506

SHAILESH SOMABHAI PATEL

1 22/01/2010

Trading

EASR520

BHADRESH R SANGHVI

1 21/12/2009

CDSL

1201330000099678

BHADRESH R SANGHVI

1 21/12/2009

CDSL

1201330000498887

ABHISHEK KUMAR JAIN

1 01/09/2009

Trading

RDM05

MUKESH G. KONDE

1 05/06/2009

Trading

RDH02

HETAL RAJESH PATEL

1 05/06/2009

Trading

KLK0594

EVERSIGHT TRADECOMM PVT LTD

1 04/06/2009

Trading

KLK0593

ALOSHA VANIJYA PRIVATE LIMITED

1 04/06/2009

Trading

RSA016

ANCHAL PROPERTIES PRIVATE LIMITED

1 23/04/2009

Trading

RDH02

HETAL RAJESH PATEL

1 23/04/2009

Trading

KEP012

POPATLAL KASTURCHANDJI SHAH

1 23/04/2009

Trading

KEA011

ANAND BHANWARLAL HUNDIA

1 23/04/2009

Trading

KAB292

DOSHI TRADING CO APNESH RANGNATH SANGLE

1 23/04/2009

Trading

KAB291

R K TRADERS JAFARBHAI SITARBHAI DANAVALA

1 23/04/2009

Trading

KAB291

R K TRADERS JAFARBHAI SITARBHAI DANAVALA

1 23/04/2009

Trading

KAB291

R K TRADERS JAFARBHAI SITARBHAI DANAVALA

1 23/04/2009

Trading

KAB18

DULARAJ UTTAMCHAND JAIN

1 23/04/2009

Trading

KAB18

DULARAJ UTTAMCHAND JAIN

1 23/04/2009

Trading

GRM101

MAHENDRA AMRUTLAL JAIN

1 23/04/2009

Trading

96GRM101

MAHENDRA AMRUTLAL JAIN

1 23/04/2009

Order Details

Watch List Name

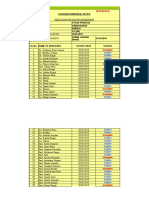

PAN AAQHS1190F

SEBI vide its ad interim ex-parte order no. Mr. Sunil Mehta WTM/KMA/IVD/385/05/2011 (copy attached) dated May 27, 2011 has restrained Mr. Sunil Mehta (Permanent Account Number AAQHS1190F and ACEPM8838L), Ms. Anjana Mehta (Permanent Account Number ACOPM6377N), Mr. Bhavesh Kothari (Permanent Account Number AABPK7614H), Mr. Manish Mathur (Permanent Account Number AIVPM4384J), Mr. Praveen Gate (Permanent Account Number AJOPG3159M), Mr. Rakesh Jain (Permanent Account Number AEMPJ7329B), Mr. Bhavesh Jain (Permanent Account Number AGCPJ7776Q), Mr. Ramesh Gandhi (Permanent Account Number AADPG7990C), Mr. Sitanshu Nanawati (Permanent Account Number AGDPN4597Q), Mr. Devendra Kumar Rai (Permanent Account Number AINPR6798Q), Mr. Meena Rajawat (Permanent Account Number AFEPP9056J), Ms. Usha Mehta (Permanent Account Number ABQPM3248M), Mr. Shaikh Soalli Jainuddin (Permanent Account Number BJCPS6572H), Mr. Bharat Jain (Permanent Account Number AACPJ0602M), Mr. Vinay Kothari (Permanent Account Number AAFHV6824A), Mr. Pradeep Kothari (Permanent Account Number AAJHP7271F), Mr. Ajay Roongta (Permanent Account Number AAVPR5584R), Mr. Seema Mathur (Permanent Account Number APRPM5075M) and Mr. Suresh Hanswal (Permanent Account Number ABPPH6308A) from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, with immediate effect, till further directions.As per the order, the respective trading members are advised to square off the existing open positions of the above persons/entities if any, at the earliest in the Futures and Options segment and ensure that no further positions are created for the said persons and that the said persons are not be allowed to take fresh positions or increase their open positions or execute trades.

Watch List Address

Other Info

SEBI vide its ad interim ex-parte order no. Mr. Ajay Roongta WTM/KMA/IVD/385/05/2011 (copy attached) dated May 27, 2011 has restrained Mr. Sunil Mehta (Permanent Account Number AAQHS1190F and ACEPM8838L), Ms. Anjana Mehta (Permanent Account Number ACOPM6377N), Mr. Bhavesh Kothari (Permanent Account Number AABPK7614H), Mr. Manish Mathur (Permanent Account Number AIVPM4384J), Mr. Praveen Gate (Permanent Account Number AJOPG3159M), Mr. Rakesh Jain (Permanent Account Number AEMPJ7329B), Mr. Bhavesh Jain (Permanent Account Number AGCPJ7776Q), Mr. Ramesh Gandhi (Permanent Account Number AADPG7990C), Mr. Sitanshu Nanawati (Permanent Account Number AGDPN4597Q), Mr. Devendra Kumar Rai (Permanent Account Number AINPR6798Q), Mr. Meena Rajawat (Permanent Account Number AFEPP9056J), Ms. Usha Mehta (Permanent Account Number ABQPM3248M), Mr. Shaikh Soalli Jainuddin (Permanent Account Number BJCPS6572H), Mr. Bharat Jain (Permanent Account Number AACPJ0602M), Mr. Vinay Kothari (Permanent Account Number AAFHV6824A), Mr. Pradeep Kothari (Permanent Account Number AAJHP7271F), Mr. Ajay Roongta (Permanent Account Number AAVPR5584R), Mr. Seema Mathur (Permanent Account Number APRPM5075M) and Mr. Suresh Hanswal (Permanent Account Number ABPPH6308A) from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, with immediate effect, till further directions.As per the order, the respective trading members are advised to square off the existing open positions of the above persons/entities if any, at the earliest in the Futures and Options segment and ensure that no further positions are created for the said persons and that the said persons are not be allowed to take fresh positions or increase their open positions or execute trades.

AAVPR5584R

SEBI vide its ad interim ex-parte order no. Mr. Sunil Mehta WTM/KMA/IVD/385/05/2011 (copy attached) dated May 27, 2011 has restrained Mr. Sunil Mehta (Permanent Account Number AAQHS1190F and ACEPM8838L), Ms. Anjana Mehta (Permanent Account Number ACOPM6377N), Mr. Bhavesh Kothari (Permanent Account Number AABPK7614H), Mr. Manish Mathur (Permanent Account Number AIVPM4384J), Mr. Praveen Gate (Permanent Account Number AJOPG3159M), Mr. Rakesh Jain (Permanent Account Number AEMPJ7329B), Mr. Bhavesh Jain (Permanent Account Number AGCPJ7776Q), Mr. Ramesh Gandhi (Permanent Account Number AADPG7990C), Mr. Sitanshu Nanawati (Permanent Account Number AGDPN4597Q), Mr. Devendra Kumar Rai (Permanent Account Number AINPR6798Q), Mr. Meena Rajawat (Permanent Account Number AFEPP9056J), Ms. Usha Mehta (Permanent Account Number ABQPM3248M), Mr. Shaikh Soalli Jainuddin (Permanent Account Number BJCPS6572H), Mr. Bharat Jain (Permanent Account Number AACPJ0602M), Mr. Vinay Kothari (Permanent Account Number AAFHV6824A), Mr. Pradeep Kothari (Permanent Account Number AAJHP7271F), Mr. Ajay Roongta (Permanent Account Number AAVPR5584R), Mr. Seema Mathur (Permanent Account Number APRPM5075M) and Mr. Suresh Hanswal (Permanent Account Number ABPPH6308A) from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, with immediate effect, till further directions.As per the order, the respective trading members are advised to square off the existing open positions of the above persons/entities if any, at the earliest in the Futures and Options segment and ensure that no further positions are created for the said persons and that the said persons are not be allowed to take fresh positions or increase their open positions or execute trades.

ACEPM8838L

SEBI vide its ad interim ex-parte order no. Mr. Sunil Mehta WTM/KMA/IVD/385/05/2011 (copy attached) dated May 27, 2011 has restrained Mr. Sunil Mehta (Permanent Account Number AAQHS1190F and ACEPM8838L), Ms. Anjana Mehta (Permanent Account Number ACOPM6377N), Mr. Bhavesh Kothari (Permanent Account Number AABPK7614H), Mr. Manish Mathur (Permanent Account Number AIVPM4384J), Mr. Praveen Gate (Permanent Account Number AJOPG3159M), Mr. Rakesh Jain (Permanent Account Number AEMPJ7329B), Mr. Bhavesh Jain (Permanent Account Number AGCPJ7776Q), Mr. Ramesh Gandhi (Permanent Account Number AADPG7990C), Mr. Sitanshu Nanawati (Permanent Account Number AGDPN4597Q), Mr. Devendra Kumar Rai (Permanent Account Number AINPR6798Q), Mr. Meena Rajawat (Permanent Account Number AFEPP9056J), Ms. Usha Mehta (Permanent Account Number ABQPM3248M), Mr. Shaikh Soalli Jainuddin (Permanent Account Number BJCPS6572H), Mr. Bharat Jain (Permanent Account Number AACPJ0602M), Mr. Vinay Kothari (Permanent Account Number AAFHV6824A), Mr. Pradeep Kothari (Permanent Account Number AAJHP7271F), Mr. Ajay Roongta (Permanent Account Number AAVPR5584R), Mr. Seema Mathur (Permanent Account Number APRPM5075M) and Mr. Suresh Hanswal (Permanent Account Number ABPPH6308A) from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, with immediate effect, till further directions.As per the order, the respective trading members are advised to square off the existing open positions of the above persons/entities if any, at the earliest in the Futures and Options segment and ensure that no further positions are created for the said persons and that the said persons are not be allowed to take fresh positions or increase their open positions or execute trades.

AAQHS1190F

SEBI vide its ad interim ex-parte order no. Mr. Ajay Roongta WTM/KMA/IVD/385/05/2011 (copy attached) dated May 27, 2011 has restrained Mr. Sunil Mehta (Permanent Account Number AAQHS1190F and ACEPM8838L), Ms. Anjana Mehta (Permanent Account Number ACOPM6377N), Mr. Bhavesh Kothari (Permanent Account Number AABPK7614H), Mr. Manish Mathur (Permanent Account Number AIVPM4384J), Mr. Praveen Gate (Permanent Account Number AJOPG3159M), Mr. Rakesh Jain (Permanent Account Number AEMPJ7329B), Mr. Bhavesh Jain (Permanent Account Number AGCPJ7776Q), Mr. Ramesh Gandhi (Permanent Account Number AADPG7990C), Mr. Sitanshu Nanawati (Permanent Account Number AGDPN4597Q), Mr. Devendra Kumar Rai (Permanent Account Number AINPR6798Q), Mr. Meena Rajawat (Permanent Account Number AFEPP9056J), Ms. Usha Mehta (Permanent Account Number ABQPM3248M), Mr. Shaikh Soalli Jainuddin (Permanent Account Number BJCPS6572H), Mr. Bharat Jain (Permanent Account Number AACPJ0602M), Mr. Vinay Kothari (Permanent Account Number AAFHV6824A), Mr. Pradeep Kothari (Permanent Account Number AAJHP7271F), Mr. Ajay Roongta (Permanent Account Number AAVPR5584R), Mr. Seema Mathur (Permanent Account Number APRPM5075M) and Mr. Suresh Hanswal (Permanent Account Number ABPPH6308A) from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, with immediate effect, till further directions.As per the order, the respective trading members are advised to square off the existing open positions of the above persons/entities if any, at the earliest in the Futures and Options segment and ensure that no further positions are created for the said persons and that the said persons are not be allowed to take fresh positions or increase their open positions or execute trades.

AAVPR5584R

SEBI vide its ad interim ex-parte order no. Mr. Sunil Mehta WTM/KMA/IVD/385/05/2011 (copy attached) dated May 27, 2011 has restrained Mr. Sunil Mehta (Permanent Account Number AAQHS1190F and ACEPM8838L), Ms. Anjana Mehta (Permanent Account Number ACOPM6377N), Mr. Bhavesh Kothari (Permanent Account Number AABPK7614H), Mr. Manish Mathur (Permanent Account Number AIVPM4384J), Mr. Praveen Gate (Permanent Account Number AJOPG3159M), Mr. Rakesh Jain (Permanent Account Number AEMPJ7329B), Mr. Bhavesh Jain (Permanent Account Number AGCPJ7776Q), Mr. Ramesh Gandhi (Permanent Account Number AADPG7990C), Mr. Sitanshu Nanawati (Permanent Account Number AGDPN4597Q), Mr. Devendra Kumar Rai (Permanent Account Number AINPR6798Q), Mr. Meena Rajawat (Permanent Account Number AFEPP9056J), Ms. Usha Mehta (Permanent Account Number ABQPM3248M), Mr. Shaikh Soalli Jainuddin (Permanent Account Number BJCPS6572H), Mr. Bharat Jain (Permanent Account Number AACPJ0602M), Mr. Vinay Kothari (Permanent Account Number AAFHV6824A), Mr. Pradeep Kothari (Permanent Account Number AAJHP7271F), Mr. Ajay Roongta (Permanent Account Number AAVPR5584R), Mr. Seema Mathur (Permanent Account Number APRPM5075M) and Mr. Suresh Hanswal (Permanent Account Number ABPPH6308A) from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, with immediate effect, till further directions.As per the order, the respective trading members are advised to square off the existing open positions of the above persons/entities if any, at the earliest in the Futures and Options segment and ensure that no further positions are created for the said persons and that the said persons are not be allowed to take fresh positions or increase their open positions or execute trades.

ACEPM8838L

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Pandya Hardik M

ARJPP6330Q

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Amar Premchand Walmiki

AAUPW9971A

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Ankit R Sanchaniya

BLNPS3316L

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Chirag RajnikantJariwala

AFMPJ7543L

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Bipin Jayant Thaker

ABYPT4984H

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Vipul Hiralal Shah

AZCPS9537P

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Kaushik Rajnikant Mehta

ANNPM6298A

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Pandya Hardik M

ARJPP6330Q

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Amar Premchand Walmiki

AAUPW9971A

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Avinash Bothra

AKFPB9350B

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Avinash Bothra

AKFPB9350B

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Pandya Hardik M

ARJPP6330Q

SEBI vide its ad interim ex-parte order no. WTM/KMA/ISD/353/02/2011 (copy attached) dated February 02, 2011 has restrained the following entities/persons from accessing the securities market and further prohibited them from buying, selling or dealing in securities in any manner whatsoever, till further directions. 1. Narendra Prabodh Ganatra ( AEMPG4315C ) 2. Bhavesh Prakash Pabari ( AKGPP8679N ) 3. Prem Mohanlal Parikh ( ALHPP3489N ) 4. Ankit R Sanchaniya ( BLNPS3316L ) 5. Bharat Shantilal Thakkar ( AAZPT9542R ) 6. Hemant Madhusudan Sheth ( ANOPS8607E ) 7. Bipinkumar Gandhi ( AJHPG6989J ) 8. Bipin Jayant Thaker ( ABYPT4984H ) 9. Chirag RajnikantJariwala ( AFMPJ7543L ) 10. Gemstone Investments Limited ( AAACG1483A ) 11. Kishore Balubhai Chauhan ( AFPPC9703G ) 12. Mala Hemant Sheth ( AZXPS0694J ) 13. Samant Vivek Kishanpal ( BRSPS0294N ) 14. Manoj Bhandari ( AGQPB7879L ) 15. Vipul Hiralal Shah ( AZCPS9537P ) 16. Rajnandi Yarns Private Limited ( AADCR0099J ) 17. H Bhavesh Securities and Commodities Private Limited ( AAACB1655R ) 18. Amar Premchand Walmiki ( AAUPW9971A ) 19. Samir Sureshbhai Shah ( AGEPS0157L ) 20. Samir Sureshbhai Shah (HUF) ( AAHHS5122G ) 21. Pandya Hardik M ( ARJPP6330Q ) 22. Pandya Yaminiben M ( APGPP6166F ) 23. Santosh Vishram Ghadshi ( AHNPG0002C ) 24. Rameshbhai V Parmar ( ASQPP5072M ) 25. Bharatkumar Baldevbhai Parmar ( ARTPP9101B ) 26. Shobhnaben R Parmar ( ASNPP5381N ) 27. Ashokkumar Bhikhalal Parmar ( AOJPP8746B ) 28. Laxman Dhirubhai Parmar ( ASNPP5380P ) 29. Aditi M Gandhi ( AKCPG0247R ) 30. Mayank Navnitbhai Gandhi ( AKCPG0246Q )

Amar Premchand Walmiki

AAUPW9971A

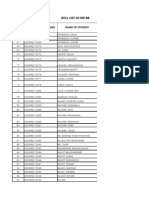

SEBI vide its 5 orders dated December 15, 2010 (copies Mr. Khese S. Umesh attached) has restrained the following entities from accessing the securities market and further prohibited them from buying, selling or otherwise dealing in securities, directly or indirectly, till all the pending investor grievances against the Company are resolved and the same is reported to and confirmed by the Securities and Exchange Board of India. SEBI order no. WTM/KMA/OIAE/337/12/2010 Indo American Credit Corporation Ltd (Registered office at IOL House, Nr. Swati Apartment, Opp. C.B.I. Lane, UR Ahmedabad, Ambawadi Bazar, Ambawadi, Ahmedabad, Gujarat) SEBI order no. WTM/KMA/OIAE/339/12/2010 Kanel Oil & Export Industries Limited. (registered office at 203 Abhijeet-1, Nr. Mithakhali Six Roads, Ellisbridge, Ahmedabad 380006) SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Thakkar K. Dhiren SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Khese S. Umesh SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Thakkar K. Hitesh Bhai SEBI order no. WTM/KMA/OIAE/340/12/2010 Kolar Biotech Limited, formerly know as Kolar Information Technologies Limited, (registered office at 23 Narayan Building, Lakhamshi Napoo Road, Dadar [Central Railway], Mumbai-400014) SEBI order no. WTM/KMA/OIAE/340/12/2010 Mr. Basantani Chinrai Rajkumar (address at 701,Pinky Panorama, 6th Road, Khar (West), Mumbai-400052) SEBI order no. WTM/KMA/OIAE/340/12/2010 Mr. Jain Mohanlal Vijay (address at B/12, Nandhhan Estate, Bankur Nagar, Goregaon (West), Mumbai- 400090) SEBI order no. WTM/KMA/OIAE/338/12/2010 Motorol Enterprises Limited (Motorol House, R C Dutt Road, Vadodara, Gujarat-390007)

AARPK1059J

SEBI vide its 5 orders dated December 15, 2010 (copies Mr. Khese S. Umesh attached) has restrained the following entities from accessing the securities market and further prohibited them from buying, selling or otherwise dealing in securities, directly or indirectly, till all the pending investor grievances against the Company are resolved and the same is reported to and confirmed by the Securities and Exchange Board of India. SEBI order no. WTM/KMA/OIAE/337/12/2010 Indo American Credit Corporation Ltd (Registered office at IOL House, Nr. Swati Apartment, Opp. C.B.I. Lane, UR Ahmedabad, Ambawadi Bazar, Ambawadi, Ahmedabad, Gujarat) SEBI order no. WTM/KMA/OIAE/339/12/2010 Kanel Oil & Export Industries Limited. (registered office at 203 Abhijeet-1, Nr. Mithakhali Six Roads, Ellisbridge, Ahmedabad 380006) SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Thakkar K. Dhiren SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Khese S. Umesh SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Thakkar K. Hitesh Bhai SEBI order no. WTM/KMA/OIAE/340/12/2010 Kolar Biotech Limited, formerly know as Kolar Information Technologies Limited, (registered office at 23 Narayan Building, Lakhamshi Napoo Road, Dadar [Central Railway], Mumbai-400014) SEBI order no. WTM/KMA/OIAE/340/12/2010 Mr. Basantani Chinrai Rajkumar (address at 701,Pinky Panorama, 6th Road, Khar (West), Mumbai-400052) SEBI order no. WTM/KMA/OIAE/340/12/2010 Mr. Jain Mohanlal Vijay (address at B/12, Nandhhan Estate, Bankur Nagar, Goregaon (West), Mumbai- 400090) SEBI order no. WTM/KMA/OIAE/338/12/2010 Motorol Enterprises Limited (Motorol House, R C Dutt Road, Vadodara, Gujarat-390007)

AARPK1059J

SEBI vide its 5 orders dated December 15, 2010 (copies Mr. Khese S. Umesh attached) has restrained the following entities from accessing the securities market and further prohibited them from buying, selling or otherwise dealing in securities, directly or indirectly, till all the pending investor grievances against the Company are resolved and the same is reported to and confirmed by the Securities and Exchange Board of India. SEBI order no. WTM/KMA/OIAE/337/12/2010 Indo American Credit Corporation Ltd (Registered office at IOL House, Nr. Swati Apartment, Opp. C.B.I. Lane, UR Ahmedabad, Ambawadi Bazar, Ambawadi, Ahmedabad, Gujarat) SEBI order no. WTM/KMA/OIAE/339/12/2010 Kanel Oil & Export Industries Limited. (registered office at 203 Abhijeet-1, Nr. Mithakhali Six Roads, Ellisbridge, Ahmedabad 380006) SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Thakkar K. Dhiren SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Khese S. Umesh SEBI order no. WTM/KMA/OIAE/339/12/2010 Mr. Thakkar K. Hitesh Bhai SEBI order no. WTM/KMA/OIAE/340/12/2010 Kolar Biotech Limited, formerly know as Kolar Information Technologies Limited, (registered office at 23 Narayan Building, Lakhamshi Napoo Road, Dadar [Central Railway], Mumbai-400014) SEBI order no. WTM/KMA/OIAE/340/12/2010 Mr. Basantani Chinrai Rajkumar (address at 701,Pinky Panorama, 6th Road, Khar (West), Mumbai-400052) SEBI order no. WTM/KMA/OIAE/340/12/2010 Mr. Jain Mohanlal Vijay (address at B/12, Nandhhan Estate, Bankur Nagar, Goregaon (West), Mumbai- 400090) SEBI order no. WTM/KMA/OIAE/338/12/2010 Motorol Enterprises Limited (Motorol House, R C Dutt Road, Vadodara, Gujarat-390007) SEBI vide its consent order no. CO/IVD-/204/391/2010 M/s. Wallfort Share & Stock (copy attached) dated August 12, 2010 received on Brokers Pvt. Ltd. August 16, 2010 has directed the applicant M/s. Wallfort Share & Stock Brokers Pvt. Ltd. (PAN No : AAACW0750G) not to buy, sell or deal in securities in any manner, directly or indirectly, in its proprietary capacity, for a period of one year from August 12, 2010. This order shall come into force with immediate effect. SEBI vide its consent order no. CO/IVD-/204/391/2010 M/s. Wallfort Share & Stock (copy attached) dated August 12, 2010 received on Brokers Pvt. Ltd. August 16, 2010 has directed the applicant M/s. Wallfort Share & Stock Brokers Pvt. Ltd. (PAN No : AAACW0750G) not to buy, sell or deal in securities in any manner, directly or indirectly, in its proprietary capacity, for a period of one year from August 12, 2010. This order shall come into force with immediate effect.

AARPK1059J

AAACW0750G

AAACW0750G

SEBI vide its order no. WTM/MSS/IVD/ID-2/34/10 dated Mr. Shailesh Patel January 22, 2010, has restrained the following entities from buying, selling or dealing in the securities market in any manner whatsoever or accessing the securities market, directly or indirectly, for the periods mentioned against their names in the following table, from the date of the order. This order shall come into force with immediate effect. Sr No. Name of the entity PAN/CIN Period of ban 1.M/s. Shree Yaax Pharma & Cosmetics Ltd. ( CIN: L24231GJ1995PLC024937 ) 5 years 2.Mr. Shailesh Patel PAN ( ABCPP2114M) 5 years 3.Mr. Dharamraj Valla PAN ( AAPPW2589P) 2 years 4.Mr. Kirit S Pandya PAN ( AGLPP3492J) 2 years 5.Ms. Bharati J. Shah PAN ( AQNPS7667L) 2 years 6.Mr. Jitendra Shah PAN ( ACIPS7085F) 2 years 7.M/s. Kajol Impex Limited PAN ( AAACJ9577E) 2 years 8.Mr. Umit V. Patel PAN ( AGOPP1340E) 2 years 9.Mr. Gaurang Patel PAN ( AGOPP1347D) 2 years 10.Mr. Haresh D Vora PAN ( AADPV1458Q) 6 months 11.Mr. Pradeep Babel PAN ( ACXPB9917G) 6 months 12.Mr. Pankaj V Maru PAN ( AHRPM2225P) 6 months 13.Mr. Shivprasad Yadav (Sainagar, 90 ft Road, Behind Bldg No. 5, Ghatkopar (East), Mumbai-400077) 6 months 14. Ms. Varsha Atul Bhayani PAN ( ABJPB8614K) 6 months 15.Ms. Parul Shah PAN ( AEQPS5801P) 6 months 16.Mr. Rajesh J. Panchal PAN ( AHQPP3844E) 6 months 17.Mr. Samir M. Shah PAN ( ASEPS2684Q) 6 months 18. Mr. Harish Amritlal Mehta PAN ( AFAPM9012R) 6 months

ABCPP2114M

Further to SEBI order no. WTM/MSS/IVD/ID-2/34/10 dated January 22, 2010, SEBI now vide its order no. WTM/MSS/IVD/ID-2/35/10 dated January 22, 2010 has permitted the respective members dealing for the said

SEBI vide its order no. WTM/MSS/IVD/ID-2/34/10 dated Mr. Shailesh Patel January 22, 2010, has restrained the following entities from buying, selling or dealing in the securities market in any manner whatsoever or accessing the securities market, directly or indirectly, for the periods mentioned against their names in the following table, from the date of the order. This order shall come into force with immediate effect. Sr No. Name of the entity PAN/CIN Period of ban 1.M/s. Shree Yaax Pharma & Cosmetics Ltd. ( CIN: L24231GJ1995PLC024937 ) 5 years 2.Mr. Shailesh Patel PAN ( ABCPP2114M) 5 years 3.Mr. Dharamraj Valla PAN ( AAPPW2589P) 2 years 4.Mr. Kirit S Pandya PAN ( AGLPP3492J) 2 years 5.Ms. Bharati J. Shah PAN ( AQNPS7667L) 2 years 6.Mr. Jitendra Shah PAN ( ACIPS7085F) 2 years 7.M/s. Kajol Impex Limited PAN ( AAACJ9577E) 2 years 8.Mr. Umit V. Patel PAN ( AGOPP1340E) 2 years 9.Mr. Gaurang Patel PAN ( AGOPP1347D) 2 years 10.Mr. Haresh D Vora PAN ( AADPV1458Q) 6 months 11.Mr. Pradeep Babel PAN ( ACXPB9917G) 6 months 12.Mr. Pankaj V Maru PAN ( AHRPM2225P) 6 months 13.Mr. Shivprasad Yadav (Sainagar, 90 ft Road, Behind Bldg No. 5, Ghatkopar (East), Mumbai-400077) 6 months 14. Ms. Varsha Atul Bhayani PAN ( ABJPB8614K) 6 months 15.Ms. Parul Shah PAN ( AEQPS5801P) 6 months 16.Mr. Rajesh J. Panchal PAN ( AHQPP3844E) 6 months 17.Mr. Samir M. Shah PAN ( ASEPS2684Q) 6 months 18. Mr. Harish Amritlal Mehta PAN ( AFAPM9012R) 6 months

ABCPP2114M

Further to SEBI order no. WTM/MSS/IVD/ID-2/34/10 dated January 22, 2010, SEBI now vide its order no. WTM/MSS/IVD/ID-2/35/10 dated January 22, 2010 has permitted the respective members dealing for the said

SEBI vide its ad interim ex-parte order no Shri Bhadresh Sanghvi WTM/MSS/MIRSD-2/30/09 dated December 21, 2009 has restrained sub-broker, Shri Bhadresh Sanghvi (Trade Name: Arihant Investment), (PAN No.: AXDPS8704K), SEBI Registration No. INS235801011 from buying, selling or dealing in the securities market in any manner whatsoever or accessing the securities market, directly or indirectly, either for himself or for his clients. The directions of the order shall come into force with immediate effect and shall remain in force until further orders. Further to SEBI ad interim ex-parte order no WTM/MSS/MIRSD-2/30/09 dated December 21, 2009, SEBI now vide its order no. WTM/MSS/MIRSD-2/64/10 (copy attached) dated August 30, 2010 received on August 31, 2010 has confirmed the ad-interim ex-parte order dated December 21, 2009, which had restrained sub-broker, Shri Bhadresh Sanghvi (Trade Name: Arihant Investment), (PAN No.: AXDPS8704K), SEBI Registration No. INS235801011 from buying, selling or dealing in the securities market in any manner whatsoever or accessing the securities market, directly or indirectly, either for himself or for his clients.

AXDPS8704K

SEBI vide its ad interim ex-parte order no Shri Bhadresh Sanghvi WTM/MSS/MIRSD-2/30/09 dated December 21, 2009 has restrained sub-broker, Shri Bhadresh Sanghvi (Trade Name: Arihant Investment), (PAN No.: AXDPS8704K), SEBI Registration No. INS235801011 from buying, selling or dealing in the securities market in any manner whatsoever or accessing the securities market, directly or indirectly, either for himself or for his clients. The directions of the order shall come into force with immediate effect and shall remain in force until further orders. Further to SEBI ad interim ex-parte order no WTM/MSS/MIRSD-2/30/09 dated December 21, 2009, SEBI now vide its order no. WTM/MSS/MIRSD-2/64/10 (copy attached) dated August 30, 2010 received on August 31, 2010 has confirmed the ad-interim ex-parte order dated December 21, 2009, which had restrained sub-broker, Shri Bhadresh Sanghvi (Trade Name: Arihant Investment), (PAN No.: AXDPS8704K), SEBI Registration No. INS235801011 from buying, selling or dealing in the securities market in any manner whatsoever or accessing the securities market, directly or indirectly, either for himself or for his clients.

AXDPS8704K

SEBI vide its following consent orders dated September 01, 2009 has ordered that the applicants mentioned shall not buy, sell or deal in securities market in any manner whatsoever, whether directly or indirectly, for a period of two months from September 07, 2009. SEBI Consent Order no. Order Date Applicant Name Applicant PAN Debarrment CO/ERO/758/273/2009 1-Sep-09 Shri Abhishek Kumar Jain ADDPJ4501D period of two months from September 07, 2009 CO/ERO/765/268/2009 1-Sep-09 M/s. Adinath BioLabs Limited AAECA5539M period of two months from September 07, 2009. CO/ERO/756/269/2009 1-Sep-09 Shri Fateh Chand Jain Not Provided period of two months from September 7, 2009 CO/ERO/757/272/2009 1-Sep-09 Shri Manoj Kumar Bothra AKCPB7393K period of two months from September 07, 2009 CO/ERO/760/271/2009 1-Sep-09 Shri Sanjay Kumar Jain Not Provided period of two months from September 07, 2009 CO/ERO/785/270/2009 1-Sep-09 Smt. Bhanwari Devi Jain Not Provided period of two months from September 07, 2009. CO/ERO/784/274/2009 1-Sep-09 Shree Tulsi Online.com Limited AAHCS8167L period of two months from September 07, 2009

Shri Abhishek Kumar Jain

ADDPJ4501D

SEBI vide its ad interim, ex-parte order no. Mr. Mukesh G Konde WTM/KMA/81/ISD/06/2009 dated June 05, 2009 in the matter of RTS Power Corporation Limited has restrained Mr. Mukesh G Konde (Permanent Account Number: AOHPK0210P), Mr. Ashok Narayan Waje (Permanent Account Number: AARPW8396C), Mr. Nitesh Ashok Jadhav (Permanent Account Number: AHIPJ8358D), Ms. Hetal Patel (Permanent Account Number: AQUPP6130E), Mr. Rajesh Patel (Permanent Account Number: AQUPP6874F), Mr. Chetan Shah (Permanent Account Number: AAFPS7527M), Om Associates and Bhavani Trading Company from accessing the securities market and further prohibited them from buying, selling or dealing in securities market, directly or indirectly, till further orders. Further to SEBI ad interim, ex-parte order no. WTM/KMA/81/ISD/06/2009 dated June 05, 2009, SEBI now vide its order no. WTM/KMA/IVD/154/10/2009 and WTM/KMA/IVD/155/10/2009 dated October 26, 2009 has confirmed the directions issued vide the ad-interim ex-parte order dated June 5, 2009 in the matter of RTS Power Corporation Limited against Mr. Chetan Shah, Mrs. Hetal Patel and Mr. Rajesh Patel. Further to SEBI ad interim, ex-parte order no. WTM/KMA/81/ISD/06/2009 dated June 05, 2009, SEBI now vide its order no. WTM/KMA/IVD/165/11/2009 dated November 18, 2009 has confirmed the directions issued vide the ad-interim ex-parte order dated June 5, 2009 in the matter of RTS Power Corporation Limited against Mr. Mukesh G. Konde, Mr. Ashok Narayan Waje and Mr. Nitesh Ashok Jadhav. Further to SEBI ad interim, ex-parte order no. WTM/KMA/81/ISD/06/2009 dated June 05, 2009, SEBI now vide its order no WTM/KMA/IVD/172/11/2009 dated November 27, 2009 has confirmed the directions issued

AOHPK0210P

SEBI vide its ad interim, ex-parte order no. Ms. Hetal Patel WTM/KMA/81/ISD/06/2009 dated June 05, 2009 in the matter of RTS Power Corporation Limited has restrained Mr. Mukesh G Konde (Permanent Account Number: AOHPK0210P), Mr. Ashok Narayan Waje (Permanent Account Number: AARPW8396C), Mr. Nitesh Ashok Jadhav (Permanent Account Number: AHIPJ8358D), Ms. Hetal Patel (Permanent Account Number: AQUPP6130E), Mr. Rajesh Patel (Permanent Account Number: AQUPP6874F), Mr. Chetan Shah (Permanent Account Number: AAFPS7527M), Om Associates and Bhavani Trading Company from accessing the securities market and further prohibited them from buying, selling or dealing in securities market, directly or indirectly, till further orders. Further to SEBI ad interim, ex-parte order no. WTM/KMA/81/ISD/06/2009 dated June 05, 2009, SEBI now vide its order no. WTM/KMA/IVD/154/10/2009 and WTM/KMA/IVD/155/10/2009 dated October 26, 2009 has confirmed the directions issued vide the ad-interim ex-parte order dated June 5, 2009 in the matter of RTS Power Corporation Limited against Mr. Chetan Shah, Mrs. Hetal Patel and Mr. Rajesh Patel. Further to SEBI ad interim, ex-parte order no. WTM/KMA/81/ISD/06/2009 dated June 05, 2009, SEBI now vide its order no. WTM/KMA/IVD/165/11/2009 dated November 18, 2009 has confirmed the directions issued vide the ad-interim ex-parte order dated June 5, 2009 in the matter of RTS Power Corporation Limited against Mr. Mukesh G. Konde, Mr. Ashok Narayan Waje and Mr. Nitesh Ashok Jadhav. Further to SEBI ad interim, ex-parte order no. WTM/KMA/81/ISD/06/2009 dated June 05, 2009, SEBI now vide its order no WTM/KMA/IVD/172/11/2009 dated November 27, 2009 has confirmed the directions issued

AQUPP6130E

SEBI vide its ad interim ex-parte order no. Eversight Tradecom Private WTM/KMA/78/ISD/06/2009 dated June 04, 2009 has Limited restrained the following persons/entities from accessing the securities market and further prohibit them from buying, selling or dealing in securities market, directly or indirectly, till further orders.

AAACE7667E

Sr No Name PAN 1 Maruti Securities Limited AABCM3651M 2 Chandra Financial Services Private Limited AABCC5331Q or AABCL5331Q 3 HSM Financial Services Private Limited AAACH9218G 4 Kundan Leasing and Finance Private Limited AAACK7448R 5 Jay Investrade Private Limited AAACJ5150H 6 Shanti Financial Services Private Limited AAFCS2399G 7 Acme Craft Private Limited AAECA8833C 8 Eversight Tradecom Private Limited AAACE7667E 9 Beejay Investment & Financial Consultants Private Limited AABCB0832B 10 Alosha Vanijya Private Limited AACCA5623N 11 Stupendors Traders Private Limited AADCS7524F 12 Ms. Samata Jain ACOPJ3258P 13 Ms. Surabhi Jain AINPJ9654Q 14 Mr. Sudhir Jain AEUPJ6167K 15 Venture Business Advisors Private Limited AAACV7487P 16 Mr. Ravikant Chowdhary AAEPR7102C 17 Mr. Shyam Sundar Shah BGCPS4475G 18 Peanence Commercial Private Limited AAACP3605P 19 VSB Investment Private Limited AABCV7492B 20 Rakhi Trading Private Limited AACCR6372B 21 Chimming Trading Company Limited AADCC1382M 22 Mr. Ashok Kumar Jain AAUPJ7016M 23 Amar Packagings Private Limited AAACA5760G 24 Mr. Jay Shirish Maniar AMKPM0946R 25 Mr. Harsh Shirish Maniar AABPM3940R or

SEBI vide its ad interim ex-parte order no. Alosha Vanijya Private Limited WTM/KMA/78/ISD/06/2009 dated June 04, 2009 has restrained the following persons/entities from accessing the securities market and further prohibit them from buying, selling or dealing in securities market, directly or indirectly, till further orders.

AACCA5623N

Sr No Name PAN 1 Maruti Securities Limited AABCM3651M 2 Chandra Financial Services Private Limited AABCC5331Q or AABCL5331Q 3 HSM Financial Services Private Limited AAACH9218G 4 Kundan Leasing and Finance Private Limited AAACK7448R 5 Jay Investrade Private Limited AAACJ5150H 6 Shanti Financial Services Private Limited AAFCS2399G 7 Acme Craft Private Limited AAECA8833C 8 Eversight Tradecom Private Limited AAACE7667E 9 Beejay Investment & Financial Consultants Private Limited AABCB0832B 10 Alosha Vanijya Private Limited AACCA5623N 11 Stupendors Traders Private Limited AADCS7524F 12 Ms. Samata Jain ACOPJ3258P 13 Ms. Surabhi Jain AINPJ9654Q 14 Mr. Sudhir Jain AEUPJ6167K 15 Venture Business Advisors Private Limited AAACV7487P 16 Mr. Ravikant Chowdhary AAEPR7102C 17 Mr. Shyam Sundar Shah BGCPS4475G 18 Peanence Commercial Private Limited AAACP3605P 19 VSB Investment Private Limited AABCV7492B 20 Rakhi Trading Private Limited AACCR6372B 21 Chimming Trading Company Limited AADCC1382M 22 Mr. Ashok Kumar Jain AAUPJ7016M 23 Amar Packagings Private Limited AAACA5760G 24 Mr. Jay Shirish Maniar AMKPM0946R 25 Mr. Harsh Shirish Maniar AABPM3940R or

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Anchal Properties Pvt Ltd

AAGCA0681A

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Hetal Rajesh Patel

AQUPP6130E

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Advance Finstock Pvt Ltd. (Popatlal Shah)

ADIPS2909K

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Advance Finstock Pvt Ltd (Anand Hunia)

AASPH2909M

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Hari Om Trading Co.( Apnesh Rangnath Sangle)

BESPS6459A

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Siddham Exports (Jafarbhai Danaval A)

AJGPD9220L

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

R K Traders (Jafarbhai Danavala)

AJGPD9220L

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Indian Corpn.(Jafarbhai Danavala)

AJGPD9220L

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Uma Export

ABTPJ4754E

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Roop Impex (Dulraj U Jain)

ABTPJ4754E

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Maya Jewels Pvt Ltd (Mahendra ADNPJ7399B Amritlal Jain)

SEBI vide its ad interim, ex-parte order dated April 23, 2009, in the matter of Investigation in Pyramid Saimira Theatre Limited, has directed 254 entities not to buy , sell or deal in the securities market including Intial Public Offerings , in any manner, either directly or indirectly, till further directions : SEBI vide its order no WTM/KMA/IVD/98/07/2009 dated July 15, 2009 and order no WTM/KMA/IVD/97/07/2009 dated July 15, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Kotecha Capital Services Private Limited and Mrs. Veena Kotecha. Further to SEBI order no: WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/103/07/2009 dated July 28, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Mr. Manilal Kotecha. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order no ; WTM/KMA/IVD/110/07/2009 dated July 31, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Ms.Viral Doshi. Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now vide its order dated August 21, 2009 has confirmed the ex-parte interim order dated April 23, 2009 in the matter of Pyramid Saimira Theatre Limited, against Nirman Management Services Private Limited (PAN AACCN3493P). Further to SEBI ad interim ex-parte order no. WTM/KMA/60/04/2009 dated April 23, 2009, SEBI now

Maya Jewels Pvt Ltd (Mahendra ADNPJ7399B Amritlal Jain)

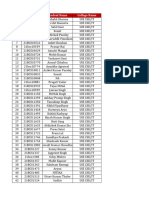

Alias1

Alias2

Passport Number

Demat Account No

Period Till further directions

Nse Circular No NSE/INVG/17902

Till further directions

NSE/INVG/17902

Till further directions

NSE/INVG/17902

Till further directions

NSE/INVG/17902

Till further directions

NSE/INVG/17902

Till further directions

NSE/INVG/17902

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

Till further directions

NSE/INVG/16912

restrained from accessing the securities market and further prohibited them from buying, selling or otherwise dealing in securities, directly or indirectly, till all the pending investor grievances against the Company are resolved and the same is reported

NSE/INVG/16545

restrained from accessing the securities market and further prohibited them from buying, selling or otherwise dealing in securities, directly or indirectly, till all the pending investor grievances against the Company are resolved and the same is reported

NSE/INVG/16545

restrained from accessing the securities market and further prohibited them from buying, selling or otherwise dealing in securities, directly or indirectly, till all the pending investor grievances against the Company are resolved and the same is reported

NSE/INVG/16545

1 year from August 12, 2010

NSE/INVG/15470

1 year from August 12, 2010

NSE/INVG/15470

2 years

NSE/INVG/13959

2 years

NSE/INVG/13959

Till further orders

NSE/INVG/13738

Till further orders

NSE/INVG/13738

2 months wef Sep 07, 2009

NSE/INVG/13005

Till further orders

NSE/INVG/12538

Till further orders

NSE/INVG/12538

Till further directions

NSE/INVG/12520

Till further directions

NSE/INVG/12520

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Till further directions

NSE/INVG/12313

Circular Date 27/05/2011

Nse Circular Link

Notes

27/05/2011

27/05/2011

27/05/2011

27/05/2011

27/05/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

03/02/2011

16/12/2010

16/12/2010

16/12/2010

16/08/2010

http://www.nseindia.com/content/circulars/invg15470.zip

16/08/2010

http://www.nseindia.com/content/circulars/invg15470.zip

22/01/2010

22/01/2010

21/12/2009

http://www.nseindia.com/content/circulars/invg13738.htm

21/12/2009

http://www.nseindia.com/content/circulars/invg13738.htm

02/09/2009

http://www.nseindia.com/content/circulars/invg13005.htm

08/06/2009

http://www.nseindia.com/content/circulars/invg12538.htm

08/06/2009

05/06/2009

05/06/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

23/04/2009

Vous aimerez peut-être aussi

- CSC Svcet 180610Document98 pagesCSC Svcet 180610dharmareddyrPas encore d'évaluation