Académique Documents

Professionnel Documents

Culture Documents

Ayyurlab Financial Analysis

Transféré par

Jitesh KandoriyaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ayyurlab Financial Analysis

Transféré par

Jitesh KandoriyaDroits d'auteur :

Formats disponibles

1

FINANCIAL ANALYSIS OF AYURLAB HERBALS PVT LTD

Under The Guidance Of:Prof. (Dr.) Rajkumari Soni

Prepared By:Sampada purohit

Parul Instituite Of Eng &Technology (Mba Dept) Limda dist, vadodara

TABLE OF CONTENT

Sr No 1 2 3 4 5 6 7

Particulars Acknowledgement Introduction Short Term Finance Interpretation Conclusion Bibliography Appendixes

Page No 3 4-6 7 8-9 10 11 12-

ACKNOWLEDGEMENT

I owe our special thanks to our lecturer Prof Rajkumari Soni who gave me the opportunity to work on this project FINANCIAL ANALYSIS OF AYURLAB HERBALS PVT LTD. My Deepest Thanks to her for guiding me in this . I express my thanks to our Director Dr Bijal Zaveri for extending her support .

INTRODUCTION

AYURLAB HERBALS PVT LTD is one of the most trusted, research based pharma company. Ayurlab has developed a reputation for its strength in sales and marketing through strong brand building. Ayurlab has successfully emerged as a Pharma major in India and is currently in the process of globalization. They have world class manufacturing facilities, approved by several regulatory authorities. Since its inception in the year 1981, AYURLAB HERBALS PVT. LTD. has grown from strength to strength and has experienced progress at an accelerated pace. Under the vigilant mentorship of the Director, Dr. Milind Purohit, the company has developed into a business giant and is reputed by peers and competitors for the safe array of medicines offered by us. This has been ensured by our dedicated work towards developing our expertise in understanding and meeting the specific demands regarding Herbal Medicines in the market. INFRASTRUCTURE:- AHPL is situated in pollution free environment at Halol Pavagadh Road, 45 kms from Baroda. It is easily accessible and is situated on the highway connecting to the states of Rajasthan and Madhya Pradesh. The company boasts of a well equipped research facility together with sophisticated technology for production. World class facility devoted to the formulation of highly effective Herbal Medicines with state-of-the-art equipment is also in place at the companys research and manufacturing unit. In addition to this, we also possess our own in-house QA/QC Laboratory equipped with HPTLC, UV- Spectrophotometer, GC, AAS- ICP, etc. besides, we also avail the CAD (Computer-Aided Design)/CAM (Computer-Aided Manufacturing)Facility for developing the array of Herbal Medicines. We have the expert Team and R&D Setup for New Product Design & Development.

BENCHMARK:- Company has acquired ISO 9001- 2000 certification from BVQI & accreditation by UKAS (UK). Company has also been acquired with GMP (Good Manufacturing Practices) Certification from FDA Gujarat & Factory Plan fulfill, the requirement of Schedule T Prescribed by drug authority. MANUFACTURING CONCEPT:- Our products are manufactured under the concept of HOLISTIC (TOTALISTIC), a formulation that treats patient in totality. In short, the formulation treats somatopscychic and psychosomatic disorders. We have introduced this concept in 1985, therefore, we our known in the market as Pioneers In Holistic Ayurvedic Medicines All formulations, which we manufacture, are Holistic (Totalistic) and are manufactured by blending modern science with ancient wisdom which is reflected from our concept Where Research Blends Modern Science With Ancient Wisdom.

Vision of company:- EXCELLENCE THROUGH INNOVATION

PRODUCTS Zymodyne syrub Vasaoci cough syrub Rhemacin syrub Livplus syrub Samhita hair oil Skin caire Rhemalint Evorin capsules Vigorin capsules Smrutigold Smruti rich Hemecaire syrub Argicard syrub Entrocin Normacid Nefralka Satgol Shatoja and many more.

SHORT TERM FINANCE There are numerous occasions where businesses and corporations need financial assistance. When the need arises they have multiple avenues from which to draw funds and one of the most common ones is through short term finance solutions.In short term financing there are three types of temporary finance solutions; short term loans, trade credit, and commercial paper. Loans and trade credit can be utilized by any corporation or business but, out of the three, commercial paper is the most unique and complex type of temporary finance solutions.Short term financing is one of the most common ways for corporations and businesses to receive funding since it is a smaller amount of money, generally, that can be used on a wide variety of needs. A lot of companies use temporary financing solutions to replenish stock when the demand is high, that way they can capitalize on the current demand rather than wait for their revenue to build up so they can purchase the inventory at a later date. Long term financing can be used to pay off a substantial amount of debt, expand the company, increase facilities, or do large construction projects.Some of the examples are given as follows: Bank loans necessity of paying interest on the payment, repayment periods from 1 year upwards but generally no longer than 5 or 10 years at most Overdraft facilities the right to be able to withdraw funds you do not currently have Provides flexibility for a firm Interest only paid on the amount overdrawn Overdraft limit the maximum amount allowed to be drawn - the firm does not have to use all of this limit Trade credit Careful management of trade credit can help ease cash flow usually between 28 and 90 days to pay Factoring the sale of debt to a specialist firm who secures payment and charges a commission for the service. Leasing provides the opportunity to secure the use of capital without ownership effectively a hire agreement

Short-term sources of finance include overdrafts, short-term bank loans and trade credit. An overdraft is an agreement by a bank to allow a company to borrow up to a certain limit without the need for further discussion. The company will borrow as muchor as little as it needs up to the overdraft limit and the bank will charge daily interest at a variable rate on the debt outstanding. The bank may also require security or collateral as protection against the risk of non-payment by the company. An overdraft is a flexible source of finance in that a company only uses it when the need arises. However, an overdraft is technically repayable on demand, even though a bank is likely in practice to give warning of its intention to withdraw agreed overdraft facilities A shortterm loan is a fixed amount of debt finance borrowed by a company from a bank, with repayment to be made in the near future Trade credit is an agreement to take payment for goods and services at a later date than that on which the goods and services are supplied to the consuming company Cash Credit is also known as Working Capital .Cash Credit is a facility to withdraw the amount from the business account even though the account may not have enough credit balance.

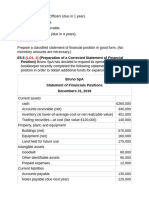

INTERPRETATIONS FOR SHORT TERM FINANCE

Sr no 1 2 Secured loans Sr no 1 2 Total

particulars Secured loan Unsecured loan

2009 3581307 2476644

2010 5801184 578592

2011 8388054 1068068

particulars Term loan Cash credit

2009 1506249 2075058 3581307

2010 3217655 2583529 5801184

2011 5078787 3309267 8388054

Unsecured loans Sr no 1 2 3 total Particulars From directors From relatives From trade deposits/banks/others 2009 1750236 288419 437989 2476644 2010 123173 288419 167000 578592 2011 158411 288419 621238 1068068

In these case term loan and credit facility from united bank of india are secured against hyp of stock in trade , plant and machinery , mortgage of factory ,land and machinery and personal guarantee of directors

EXPLANATION AND INTERPRETATION In the year 2009 the company has taken a term loan of 1506249 and cash credit of 2075058 from United Bank of India .it has paid an interest of 518217 .it has made lot of investment in the form of purchasing fixed asset ie machinery , inventories etc. its sales during this year is 20047023 and its profit is 617202. As its shown in balance sheet that company is making payment of loan in the form of interest rs 518217 which is affordable by the firm to pay so in this year company is able pay all the debts . Here directors of the company has also made investment of rs 2476644(from the last year incomes and profits) in the form of investment ie purchase of machinery or r & d expenses as its pharma company In the year 2010 the company has taken a term loan of 3217655 and cash credit of 2583529 from united bank of india .it has paid an intrest of 798854 .it has made lot of investment in the form of purchasing fixed asset in the form of machinery , inventories. it has made lot of expenditure in this year like administrative exp manufacturing exp etc. Its sales is increasing by 29315828 as compared to last year and profit is also increasing by 1756218 rs as compared to last year here as profit is more as per the balance sheet,company is able to pay all the debts which are in the form of loan interest ie rs 798854 .After reducing interest amount from the profit firm still has 957364 which they keep as savings for future as in reserves.here directors of the company are also making investment to develop something new ie to innovate something new In the year 2011 the company has taken a term loan of 5078787 and cash credit of 3309267 from united bank of india .it has paid an intrest of 1007087 .it has made lot of investment in the form of purchasing fixed asset in the form of machinery , inventories. it has made lot of expenditure in this year like administrative exp manufacturing exp and also selling and promotional exp like introduced new product ,expenses related to r & d are more in this year etc. its sales is increasing by 35825972 as compared to last year and profit is also increasing by 5183841 rs as compared to last year here as profit is more . thus as per the balance sheet company is able to pay all the debts which are in the form of loans ie rs 1007087 .after reducing that amount from the profit firm still has 4176754 which they keep as savings for future as in reserves thus we can say that company is profitable

10

CONCLUSION

After studying the balance sheet and profit and loss statement its observes that profit is increasing in the present year than the last years. Company has also brought new machineries for formulating medicines . it has also contributed in developing some new products.the firm has implemented their vision of innovation through excellence .it has also increased its imports and export activities .whatever expenses are incurred are recovered through profits that are being earned .the company is engaged in the business of manufacturing of drugs and pharmaceuticals .there are no debts of the company and all loans are recovered at prescribed timeie time to time payment of loans is made by paying the interest. so lastly Its concluded that condition of the organization is good and it is moving on the path of developments . the company is profitable.its a proven fact that they are called as pioneers in holistic ayurvedic . they have proved that fact as recently they got 2 awards as best quality product n best enterprener award

11

BIBLOGRAPHY www.google.com www.ayurlabherbals.pvtltd.com

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Burton ExcelDocument128 pagesBurton ExcelJaydeep ShetePas encore d'évaluation

- Translation of Foreign Financial StatementsDocument34 pagesTranslation of Foreign Financial Statementsandrearys100% (2)

- PpeDocument5 pagesPpeSheila Mae AramanPas encore d'évaluation

- Pilinut Business PlanDocument16 pagesPilinut Business PlanJessa BallonPas encore d'évaluation

- HO Branch Accounting MC ProblemsDocument4 pagesHO Branch Accounting MC ProblemsDivine CuasayPas encore d'évaluation

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MarePas encore d'évaluation

- Project One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowDocument6 pagesProject One: Hana PLC. Is Unable To Reconcile The Bank Balance at September 30, 2018 Bank Reconciliation As FollowYesakPas encore d'évaluation

- ACF5950 - Assignment # 109 Semester 2 2014: The Business Has The Following Opening Balances: Additional InformationDocument2 pagesACF5950 - Assignment # 109 Semester 2 2014: The Business Has The Following Opening Balances: Additional InformationkietPas encore d'évaluation

- Executive Summary of Business ConceptDocument3 pagesExecutive Summary of Business ConceptRita RanveerPas encore d'évaluation

- Tunas KaryaDocument14 pagesTunas KaryaAisyah IsnaniPas encore d'évaluation

- Published Accounts (Format) Sem Oct 2022 For Students PDFDocument8 pagesPublished Accounts (Format) Sem Oct 2022 For Students PDFNur SyafiqahPas encore d'évaluation

- Journal Entry To Post Closing Trial BalanceDocument5 pagesJournal Entry To Post Closing Trial BalanceRaez Rodillado100% (1)

- Local Budget Memorandum No. 75 PDFDocument21 pagesLocal Budget Memorandum No. 75 PDFArnold ImbisanPas encore d'évaluation

- FMGT 3510 Midterm Exam Review Questions MC Summer 2019Document38 pagesFMGT 3510 Midterm Exam Review Questions MC Summer 2019Jennifer AdvientoPas encore d'évaluation

- AC1 Reviewer Sample QuestionsDocument3 pagesAC1 Reviewer Sample QuestionsVia EmbienPas encore d'évaluation

- Tax 2022Document6 pagesTax 2022katePas encore d'évaluation

- Chapter 1 - Introduction To AccountingDocument17 pagesChapter 1 - Introduction To AccountingPatrick John AvilaPas encore d'évaluation

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocument10 pagesForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuPas encore d'évaluation

- Chapter-1: Principles of LendingDocument11 pagesChapter-1: Principles of Lendingrabin neupane100% (1)

- DRAFT ASSIGNMENT BRIEF 05 02 Kabigting SHSDocument3 pagesDRAFT ASSIGNMENT BRIEF 05 02 Kabigting SHSTakahiro DaikiPas encore d'évaluation

- 158 635731706753700140 The QuestionsDocument232 pages158 635731706753700140 The QuestionsJonabelle LisingPas encore d'évaluation

- Module - 1 Basic Concepts.Document11 pagesModule - 1 Basic Concepts.Dimple JainPas encore d'évaluation

- P2Document7 pagesP2chowchow123Pas encore d'évaluation

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaPas encore d'évaluation

- Ankit Working Capital Project ReportDocument86 pagesAnkit Working Capital Project ReportSwati SaxenaPas encore d'évaluation

- JL-TRIAL BALANCE LectrureDocument11 pagesJL-TRIAL BALANCE LectrureCrisceldette ApostolPas encore d'évaluation

- Exercise Chap 5Document9 pagesExercise Chap 5JF FPas encore d'évaluation

- Resale Cert PackageDocument476 pagesResale Cert PackageSimmi Kher100% (1)

- ACC2001 Aug 2011 Practice Exam QuestionsDocument4 pagesACC2001 Aug 2011 Practice Exam QuestionsShin TanPas encore d'évaluation

- Chapter 5 (1) - Accruals and PrepaymentsDocument39 pagesChapter 5 (1) - Accruals and PrepaymentsIrsamPas encore d'évaluation