Académique Documents

Professionnel Documents

Culture Documents

Tutorial For KUKA

Transféré par

tan_judyanne10Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tutorial For KUKA

Transféré par

tan_judyanne10Droits d'auteur :

Formats disponibles

1. (Corporate income tax) Potts, Inc. had sales of $6 million during the past year.

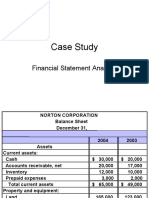

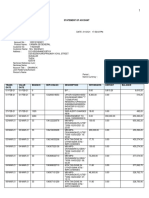

The cost of goods sold amounted to $3 million. Operating expenses totaled $2.6 million and interest expense was $30,000. Determine the firms tax liability. 2. (Measuring cash flows) Calculate the free cash flows for T.P. Jarmon, Inc., for the year ended December 31, 2003, both from an asset and a financing perspective. Interpret your results. T.P. Jarmon, Inc. Balance Sheet at 12/31/02 and 12/31/03 ASSETS 2002 Cash $15,000 Marketable securities 6,000 Accounts receivable 42,000 Inventory 51,000 Prepaid rent 1,200 Total current assets 115,200 Net plant and equipment 286,000 Total assets $401,200 LIABILITIES AND OWNERS EQUITY 2002 Accounts receivable $48,000 Notes payable 15,000 Accruals 6,000 Total current liabilities 69,000 Long-term debt 160,000 Common stockholders equity 172,200 Total liabilities and owners equity 401,200 T.P. Jarmon, Inc. Income Statement for year ending 12/31/03 Sales Less: cost of goods sold Gross profit Less: expenses General and administrative Interest Depreciation Total operating expenses Earnings before taxes Less: taxes Net income Less: cash dividents To retained earnings $600,000 460,000 $140,000 $30,000 10,000 30,000 70,000 70,000 27,100 42,900 31,800 11,100

2003 $14,000 6,200 33,000 84,000 1,600 138,300 270,000 $408,300

2003 $57,000 13,000 5,000 75,000 150,000 183,300 408,300

3. (Measuring cash flows) Calculate the free cash flows for Abrams Manufacturing Company for the year ended December 31, 2003, both from an asset and a financing perspective. Interpret your results. Abrams Manufacturing Company Balance Sheets at 12/31/2002 and 12/31/2003 2002 2003 Cash $ 89,000 $ 100,000

Accounts receivable Inventory Prepaid expenses Plant and equipment Accumulated depreciation Total Accounts Payable Accruals liabilities Mortgage payable Preferred stock Common stock Retained earnings Total liabilities and equity

64,000 112,000 10,000 238,000 (40,000) $ 473,000 $ 85,000 68,000 70,000 0 205,000 45,000 $ 473,000

70,000 100,000 10,000 311,000 (66,000) $ 525,000 $ 90,000 63,000 0 120,000 205,000 47,000 $ 525,000

Abrams Manufacturing Company Income Statement for the Year Ended 12/31/03 Sales Cost of sales Gross profit Selling, general, and administrative expenses Depreciation expense Operating income Interest expense Taxes Preferred stock dividends Net income Additional information: The firm paid $22,000 in common stock dividends during 2003. $ 184,000 60,000 124,000 44,000 26,000 $ 584,000 4,000 16,000 10,000 $ 24,000

Vous aimerez peut-être aussi

- Butler Lumber 1Document6 pagesButler Lumber 1Bhavna Singh33% (3)

- Lone Pine CafeDocument4 pagesLone Pine CafeRahul TiwariPas encore d'évaluation

- Final Upload Buad 280 Practice Exam Midterm 3Document7 pagesFinal Upload Buad 280 Practice Exam Midterm 3Connor JacksonPas encore d'évaluation

- The Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesDocument5 pagesThe Financial Statements and Notes of ZETA Corporation Are Reproduced Over The Next Several PagesJesia DjaduPas encore d'évaluation

- Ch03 P15 Build A ModelDocument2 pagesCh03 P15 Build A Model03020380% (1)

- Chemalite Sol Final 011112Document9 pagesChemalite Sol Final 011112pankyagr75% (4)

- SMCH 12Document101 pagesSMCH 12FratFool33% (3)

- AP PreboardDocument6 pagesAP PreboardMark Kenneth Chan BalicantaPas encore d'évaluation

- Problem 1 Current Liability Entries and Adjustments: InstructionsDocument6 pagesProblem 1 Current Liability Entries and Adjustments: Instructionsbeeeeee100% (1)

- PROBLEM Tugas AKM 2Document33 pagesPROBLEM Tugas AKM 2Dina Dwi Ningrum67% (3)

- Chemilite Case StudyDocument12 pagesChemilite Case StudyRavi Pratap Singh Tomar100% (3)

- CACC 520-781 Accounting For ManagementDocument7 pagesCACC 520-781 Accounting For ManagementEmadPas encore d'évaluation

- ACCT 1005 Worksheet 5 Suggested Solutions 2012Document10 pagesACCT 1005 Worksheet 5 Suggested Solutions 2012ChakShaniquePas encore d'évaluation

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- Unit 1 - Essay QuestionsDocument7 pagesUnit 1 - Essay QuestionsJaijuPas encore d'évaluation

- Homeworks 1 and 2Document4 pagesHomeworks 1 and 2danterozaPas encore d'évaluation

- Solutions Exercises Pre-Course Fin Acc Session 3a - MIMDocument36 pagesSolutions Exercises Pre-Course Fin Acc Session 3a - MIMAdrian TajmaniPas encore d'évaluation

- Nalysis ND Nterpretation F Inancial Tatements: Himanshu Puri Assistant Professor IilmDocument88 pagesNalysis ND Nterpretation F Inancial Tatements: Himanshu Puri Assistant Professor IilmRajan GuptaPas encore d'évaluation

- Module 3Document53 pagesModule 3prabhakarnandyPas encore d'évaluation

- Accounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeDocument55 pagesAccounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeMohit AgarwalPas encore d'évaluation

- Financial Accounting ProjectDocument9 pagesFinancial Accounting ProjectL.a. LadoresPas encore d'évaluation

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonPas encore d'évaluation

- Act05 MultinationalDocument7 pagesAct05 MultinationalIgnacioPas encore d'évaluation

- Chapter 7 Financial Statments AnalysisDocument44 pagesChapter 7 Financial Statments AnalysisAddisalem MesfinPas encore d'évaluation

- Accrual AccountingDocument7 pagesAccrual AccountingMUHAMMAD ARIF BASHIRPas encore d'évaluation

- Transaction Analysis and Preparation of Statements Practice Problem SolutionDocument6 pagesTransaction Analysis and Preparation of Statements Practice Problem SolutionAshish BhallaPas encore d'évaluation

- Chapt 03Document17 pagesChapt 03Wahab JavaidPas encore d'évaluation

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument11 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaPas encore d'évaluation

- ENMG602 Week5 HW3Document3 pagesENMG602 Week5 HW3Issam TamerPas encore d'évaluation

- BUS 251 - Homework SolutionsDocument46 pagesBUS 251 - Homework SolutionsJerry He0% (2)

- Advance Financial Accounting (Assignment)Document3 pagesAdvance Financial Accounting (Assignment)Meseret HailemichaelPas encore d'évaluation

- Chapter 7 Financial Statements AnalysisDocument46 pagesChapter 7 Financial Statements Analysismilky makiPas encore d'évaluation

- 9706 w10 QP 41Document8 pages9706 w10 QP 41Diksha KoossoolPas encore d'évaluation

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Document5 pagesTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraPas encore d'évaluation

- Seminar 4 Set Work SolutionsDocument5 pagesSeminar 4 Set Work SolutionsStephanie XiePas encore d'évaluation

- Revision Questions 1Document13 pagesRevision Questions 1Vivian WongPas encore d'évaluation

- ch08 - Functional and Activity-Based BudgetingDocument50 pagesch08 - Functional and Activity-Based BudgetingpujiardaritaPas encore d'évaluation

- Intro To Accounting - One Credit Assignment ContdDocument8 pagesIntro To Accounting - One Credit Assignment Contdapi-342895963Pas encore d'évaluation

- RECEIVABLES QuizDocument4 pagesRECEIVABLES QuizPrinx CarvsPas encore d'évaluation

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroPas encore d'évaluation

- Toth Company Had The Following Assets and Liabilities On TheDocument1 pageToth Company Had The Following Assets and Liabilities On Thetrilocksp SinghPas encore d'évaluation

- Introduction To Business 16 BUS101: Chapter 21: Accounting FundamentalsDocument11 pagesIntroduction To Business 16 BUS101: Chapter 21: Accounting Fundamentalsnahidul202Pas encore d'évaluation

- Book-Keeping and Accounts/Series-2-2004 (Code2006)Document16 pagesBook-Keeping and Accounts/Series-2-2004 (Code2006)Hein Linn Kyaw100% (4)

- Case Study: Financial Statement AnalysisDocument4 pagesCase Study: Financial Statement AnalysisJagath PrasadPas encore d'évaluation

- CH1&2 Homework AnswersDocument5 pagesCH1&2 Homework AnswersGabriel Aaron DionnePas encore d'évaluation

- ACTBAS1 - Lecture 9 (Adjusting Entries) RevisedDocument44 pagesACTBAS1 - Lecture 9 (Adjusting Entries) RevisedAlejandra MigallosPas encore d'évaluation

- Homework # 3 FSADocument5 pagesHomework # 3 FSAOsayd BzootPas encore d'évaluation

- Practice Exam - QuestionsDocument5 pagesPractice Exam - QuestionsHoàng Võ Như QuỳnhPas encore d'évaluation

- Statement of Cash FlowsDocument4 pagesStatement of Cash FlowsLara Lewis AchillesPas encore d'évaluation

- Practice-Exam Question S22019Document4 pagesPractice-Exam Question S22019Trâm MờPas encore d'évaluation

- BudgetingDocument48 pagesBudgetingAnji GoyPas encore d'évaluation

- Fma 04Document38 pagesFma 04Zemenaye TsegayePas encore d'évaluation

- Drycleaning Plant Revenues World Summary: Market Values & Financials by CountryD'EverandDrycleaning Plant Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Sporting Goods & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryD'EverandSporting Goods & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Pressed & Blown Glass & Glassware World Summary: Market Values & Financials by CountryD'EverandPressed & Blown Glass & Glassware World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Air & Gas Compressors World Summary: Market Values & Financials by CountryD'EverandAir & Gas Compressors World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Sporting & Athletic Goods World Summary: Market Values & Financials by CountryD'EverandSporting & Athletic Goods World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Measuring & Controlling Devices World Summary: Market Values & Financials by CountryD'EverandMeasuring & Controlling Devices World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Scales & Balances World Summary: Market Values & Financials by CountryD'EverandScales & Balances World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Chapter 9 Project Cash FlowsDocument28 pagesChapter 9 Project Cash FlowsGovinda AgrawalPas encore d'évaluation

- NAS For MEs ChecklistDocument4 pagesNAS For MEs Checklistsumankandel015Pas encore d'évaluation

- Sti CollegeDocument8 pagesSti CollegeAlyssa DennesePas encore d'évaluation

- Statement of AccountDocument5 pagesStatement of Accountmutaia pandian100% (1)

- Varian9e LecturePPTs Ch10Document69 pagesVarian9e LecturePPTs Ch10王琦Pas encore d'évaluation

- Basic Concept of Macro Economics: Unit 1Document31 pagesBasic Concept of Macro Economics: Unit 1Roxanne OsalboPas encore d'évaluation

- Nike's Cost of CapitalDocument2 pagesNike's Cost of CapitalAdina BusteaPas encore d'évaluation

- Tf27jan17 IbuaeDocument12 pagesTf27jan17 IbuaeMohammed AlsheriefPas encore d'évaluation

- Unit 1Document10 pagesUnit 1AlfatihahPas encore d'évaluation

- CH 03Document61 pagesCH 03Muhammad RamzanPas encore d'évaluation

- Citibank: Launching The Credit Card in Asia Pacific: Erica Baumann Paul Davis Nathan Hahn Rebecca Leeds Lauren LettieriDocument30 pagesCitibank: Launching The Credit Card in Asia Pacific: Erica Baumann Paul Davis Nathan Hahn Rebecca Leeds Lauren Lettierisiddus1Pas encore d'évaluation

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaPas encore d'évaluation

- MCQs - 01 - L&B - AIVA RVODocument5 pagesMCQs - 01 - L&B - AIVA RVOShivamPas encore d'évaluation

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuPas encore d'évaluation

- SecuritizationDocument15 pagesSecuritizationAnkit LakhotiaPas encore d'évaluation

- Describing A DollarDocument2 pagesDescribing A Dollarsharmarachika07Pas encore d'évaluation

- Law Officer Professional Knowledge Question PaperDocument11 pagesLaw Officer Professional Knowledge Question Papernikunj joshiPas encore d'évaluation

- (Honours) III YearDocument21 pages(Honours) III YearShubhamPas encore d'évaluation

- App Form Personal Account Application Form 103 v4Document11 pagesApp Form Personal Account Application Form 103 v4Shaliena LeePas encore d'évaluation

- LR & CDRDocument2 pagesLR & CDRDohly BucarilePas encore d'évaluation

- Chapter 08 Aggregate Demand and Supply HW Attempt 4Document5 pagesChapter 08 Aggregate Demand and Supply HW Attempt 4PatPas encore d'évaluation

- Icungamutungo N'ibaruramari Mumakoperative HarmonizedDocument26 pagesIcungamutungo N'ibaruramari Mumakoperative HarmonizedSamuel UWIDUTIJEPas encore d'évaluation

- Cash Flow StatementDocument11 pagesCash Flow StatementVaibhavPas encore d'évaluation

- Global Rates Trader - A Taper Trade PreviewDocument19 pagesGlobal Rates Trader - A Taper Trade PreviewRafael Lizana ZúñigaPas encore d'évaluation

- WCM Week 5 Financial Securities OverviewDocument20 pagesWCM Week 5 Financial Securities OverviewsanjayPas encore d'évaluation

- Credit Report Legend EquifaxDocument4 pagesCredit Report Legend Equifaxtake.a.chance123456Pas encore d'évaluation

- Combine Client Wise Summary ReportDocument1 pageCombine Client Wise Summary Reportakshat tvPas encore d'évaluation

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaPas encore d'évaluation

- Sugar MillDocument23 pagesSugar Millzahid khanPas encore d'évaluation

- Swaps - Interest Rate and Currency PDFDocument64 pagesSwaps - Interest Rate and Currency PDFKarishma MittalPas encore d'évaluation