Académique Documents

Professionnel Documents

Culture Documents

Tax Evasion by Raymone Bains and V Michael Jackson

Transféré par

TeamMichaelDescription originale:

Titre original

Copyright

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Tax Evasion by Raymone Bains and V Michael Jackson

Transféré par

TeamMichaelDroits d'auteur :

UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLUMBIA

Raymone K. Bain, et al.,

Plaintiffs,

v.

MICHAEL J. JACKSON, et al.,

Defendants.

:

:

:

:

:

:

:

:

:

Civil Action No. 09-0826 (JR)

MEMORANDUM

Prior to Michael Jacksons death in June 2009,

Raymone K. Bain brought this case against him and his production

company, MJJ Productions, Inc., asserting claims for breach of

contract, quantum meruit, and unjust enrichment. Bain became

Jacksons publicist in December 2003, but the suit arises out of

the expanded role Bain took in Jacksons affairs beginning in the

middle of 2006. On May 30, 2006, Jackson signed a Personal

Services Agreement (PSA), drafted by Bain, that entitled Bain

to a ten percent finders fee for any agreement Jackson entered

that she or her associates generated. [#3-1]. Around this time,

Jackson also hired Bain as his personal General Manager, [#3-2],

and as his agent to review and approve music usage requests, [#3-

3].

Bain alleges that she initiated negotiations for

several projects on Jacksons behalf in early 2007, including:

(1) a project with SONY Music to promote the 25 anniversary of

th

Jacksons Thriller album release (Thriller deal); (2) Jacksons

Bain also attempts to take credit for another deal

1

one involving use of Jacksons music in a Vitamin Water

advertisement aired during the Superbowl [#49] - but I have

denied her motion to amend her complaint. [#50]

- 2 -

participation at the 2008 Grammy Awards ceremony; (3) a project

with the Anschutz Entertainment Group, Inc. for development of

the Neverland Valley Ranch, recording and film projects, and live

performances at the O2 Arena in London (AEG project); and

(4) Jacksons refinancing of his loan against the SONY/ATV music

catalog (SONY/ATV refinancing). Shortly after the

1

refinancing, but before the other projects were finalized,

Jackson abruptly cut ties with Bain, without paying the ten

percent finders fee on any of Bains projects. Because Jackson

ultimately cemented the agreements and earned money on them in

2008, Bain believes she is now entitled to a ten percent finders

fee for each deal pursuant to the PSA. She seeks $44 million in

damages, plus attorneys fees and costs. [#3]

On June 18, 2009, the Jackson parties moved to dismiss

Bains claims, arguing that Bains suit was barred by a release

she signed on December 27, 2007 that discharged the Jackson

parties from any future claims and payments. [#24]. Jackson

died eight days later, on June 26, 2009. I stayed further

proceedings pending the appointment of an executor for Jacksons

estate. I also notified the parties that the motion to dismiss

would be treated as a motion for summary judgment and invited

- 3 -

them to submit all additional material pertinent to the motion.

[#31]. I dissolved the stay on November 20, 2009. The parties

then filed supplemental briefing and affidavit testimony

regarding the release and addressing Bains new allegation that

the release was fraudulently obtained. [#48, #54, #59, #60,

#61].

The Jackson parties replied with their own new

(alternative) argument that the binding arbitration clause in

the Release requires dismissal or a stay in this case. Under New

York law, the contractual right to arbitrate may be waived, when

the requesting party engaged in litigation to such an extent as

to manifest[] a preference clearly inconsistent with [its] later

claim that the parties were obligated to settle their differences

by arbitration and thereby elected to litigate rather than

arbitrate. See, e.g., Les Constructions Beauce-Atlas, Inc. v

Tocci Bldg. Corp. of New York, Inc., 294 A.D.2d 409, 410 (N.Y.

App. Div. 2002) (internal quotations omitted). To avoid waiver,

a party must raise its desire to arbitrate promptly and must

decline to avail itself of pre-trial discovery and other attempts

to litigate on the merits. Id.

The Jackson parties first filing did not raise the

arbitration issue. Rather, they elected to address the merits of

Bains claim, and did not invoke their right to arbitration -

presumably realizing that the case would not be resolved quickly

The tender back doctrine is not applicable here,

2

where Bain is indisputably entitled to the payment she retained,

and where that amount would be credited to the defendants if Bain

were to succeed in her claim. See Goldfarb v. Wright, 40 N.Y.S.2d

705, 707-709 (N.Y. App. Div. 1943).

- 4 -

on the merits - until filing a reply brief on the motion to

dismiss on July 10, 2009. [#29, at 4-6]. I find that the

Jackson parties initial filings invoked the judicial process to

such an extent that their right to arbitrate has been waived.

Therefore, I must determine whether the Release covers

the fees Bain now demands, and, if it does, whether the Jackson

parties had a duty to disclose the status of those deals at the

time Bain signed the release.

2

The Release, which the parties agree is governed by New

York law, states that Jackson shall render a payment made

payable to you in the amount of [$488,820.05] as full and final

satisfaction of any all [sic] monies, known or unknown, to be

owed to you by the Jackson Parties with respect to any and all

agreements whether verbal or written that you may have entered

into with the Jackson Parties from the beginning of time until

December 27, 2007. [#27-2 at 20].

Bain argues that this language does not preclude her

from seeking a finders fees pursuant to the PSA, because she

intended the Release to cover only specific, past-due cash

disbursements, loans, credit card bills, and consultant fees, in

the amount of $488,820.05. As evidence of her intent, she cites

- 5 -

her hand-written edits to the Release, itemizing the payments she

intended to release, [#27-2 at 20], and she explains that

Jacksons attorney, Frank Salzano, represented, in his 12/03/07

email, that the Release was necessary to clean all past debts

and liabilities of Mr. Jackson, [#60-2].

Under New York law, the rule is that a valid release

which is clear and unambiguous on its face and which is knowingly

and voluntarily entered into will be enforced as a private

agreement between the parties, even if one of the parties claims

he intended a narrower release. See, e.g., Chaudhry v. Garvale,

262 A.D.2d 518, 519 (N.Y.A.D. 2 Dept, 1999). Because I find no

ambiguity in the language of Bains Release, I may apply it

without considering Bains testimony about her

intent. Consolidated Edison, Inc. v. Northeast Utilities, 332

F.Supp.2d 639, 647 (S.D.N.Y. 2004). The Release unambiguously

covers all monies, known or unknown, owed under any and all

agreements whether written or verbal. (emphasis added) That

release language covers Bains claims about the Thriller deal,

the Grammy ceremony, the AEG project, and the SONY/ATV

refinancing, no matter what stage they were in when the release

was signed.

But Bain goes on to argue that, even if the Release

does cover her claims, it is void because she was fraudulently

- 6 -

induced to sign it, or, alternatively, because she was mistaken

as to is effect.

To establish fraud-in-the-inducement under New York

law, Bain must prove that the Jackson parties (1) made a material

representation or omission which was false and known to be false

(2) for the purpose of inducing her to rely on it, and (3) that

Bain reasonably relied upon it in entering the agreement (4) to

her detriment. See, e.g., Lama Holding Co. v. Smith Barney,

Inc., 88 N.Y.2d 413, 421 (N.Y. 1996). Where the claim is that

the defendant fraudulently concealed a material fact to procure

the agreement, the plaintiff must show that the defendant had a

duty to disclose the concealed information. See, Sitar v. Sitar,

61 A.D.3d 739, 741 (N.Y. App. Div. 2009). Absent a fiduciary

relationship between the parties, a duty to disclose arises only

where one party possesses superior knowledge of essential facts

that makes a transaction inherently unfair if those facts are

not disclosed, those facts are not readily available to the other

party, and the first party knows that the second party is acting

on the basis of mistaken knowledge. UniCredito Italiano SPA v.

JPMorgan Chase Bank, 288 F.Supp.2d 485, 497 (S.D.N.Y. 2003).

Bains own complaint demonstrates why the Jackson

parties had no duty of disclosure. It paints a picture of Bain

as a savvy business woman who founded her own public relations

firm, has represented many high profile public figures in the

Bain appears to take credit for saving Jackson from

3

financial and legal ruin. If her recitation of the services she

performed for Jackson is to be believed, she must have been more

knowledgeable about Jacksons business than he was. She claims

that, among other things, she was responsible for hiring a

creative manager for Jackson ( 20); she hired a legal and

accounting team ( 21); she facilitated an audit of Jacksons

finances ( 22); she averted imminent foreclosures of his

properties ( 23); she arranged Jacksons day-to-day housing and

living requirements ( 24); she hired a new personnel company to

pay Jacksons employees ( 25); she approved music usage requests

that generated over ten million dollars in annual income for

Jackson ( 26); she supervised a team of accountants to address

complaints lodged with the California Department of Labor ( 27);

and she was responsible for paying Jacksons creditors and other

bills ( 28).

- 7 -

sports, entertainment and political fields, was responsible for

essentially all of Jacksons affairs for a period of time, and

3

in fact spoke to [him] several times a day during that time.

[#3 at 2,7-11, 18-41]. For the deals at issue here, Bain

alleges more than minor involvement; she claims that she played

an integral and substantial role in negotiating all of them. Id.

Bain clearly knew that various deals were in the works - in fact,

she admits to initiating them and participating in on-going

discussions about them - and she does not explain why, given her

relationships with the parties involved, she could not readily

have discovered the status of the agreements before signing the

Release. Thus, the Jackson parties had no duty to disclose the

status of the projects on which Bain bases her claims, nor, if

there were any omissions, was it reasonable for Bain to rely on

Because I find the Jackson parties had no duty to

4

disclose the status of the deals, Bains request, pursuant to

Rule 56(f), for discovery on this topic and other irrelevant

issues is denied.

- 8 -

them. See Banque Franco-Hellenique de Commerce Intern. et

4

Maritime, S.A. v. Christophides, 106 F.3d 22, 27 (2d Cir. 1997)

(the defrauded person need not exercise due diligence, but

reliance is not justifiable where the defrauded party exercised

minimal diligence despite being placed on guard or practically

faced with the facts).

For the same reasons, Bains argument that the Release

is voidable under the doctrine of mistake must be rejected. It

is illogical to believe that the Jackson parties knew or should

have known that Bain was unaware of the deals - a showing that is

required to prove unilateral mistake. See, e.g., Kraft Foods,

Inc. v. All These Brand Names, Inc., 213 F.Supp.2d 326, 330

(S.D.N.Y. 2002).

Bains equitable theories of recovery - quantum meruit

and unjust enrichment - also fail. As to Jacksons estate, Bain

concedes that the PSA is a valid contract, which precludes relief

under those theories. See, e.g., Bloomgarden v. Coyer, 479 F.2d

201, 210 (D.D.C. 1973). As to MJJ Productions, Bain provides no

support for her contention that her efforts conferred a benefit

on MJJ Productions that it unjustly retained, nor does she

describe circumstances that would have reasonably notified MJJ

- 9 -

Productions of her expectation that she would be paid. In fact,

Bain provides virtually no explanation of what or who MJJ

Productions is; or how it is related to this suit; or whether she

even interacted with it during her negotiations. Such a claim

without any support or reasonable likelihood of finding support

through discovery cannot withstand summary judgment.

An appropriate order accompanies this memorandum.

JAMES ROBERTSON

United States District Judge

Vous aimerez peut-être aussi

- Cascio Tracks - New Theoretical Evidence'Document11 pagesCascio Tracks - New Theoretical Evidence'TeamMichaelPas encore d'évaluation

- John Branca, V IRS Opening Statements.Document24 pagesJohn Branca, V IRS Opening Statements.TeamMichaelPas encore d'évaluation

- Witness Statement of Karen LangfordDocument8 pagesWitness Statement of Karen LangfordTeamMichaelPas encore d'évaluation

- Tohme Tohme Transcripts Michael Jackson Exe. Branca V IRSDocument161 pagesTohme Tohme Transcripts Michael Jackson Exe. Branca V IRSTeamMichaelPas encore d'évaluation

- Kiki Fournier Examination 17.03.05Document27 pagesKiki Fournier Examination 17.03.05MJ BrookinsPas encore d'évaluation

- Jackson V AEG Live May 8th 2013 Transcripts Alif Sankey - (Associate Producer This Is It)Document22 pagesJackson V AEG Live May 8th 2013 Transcripts Alif Sankey - (Associate Producer This Is It)TeamMichael100% (1)

- JACKSON V AEGLive April 30th RICHARD SENEFF/ Martinez DetectiveDocument208 pagesJACKSON V AEGLive April 30th RICHARD SENEFF/ Martinez DetectiveTeamMichael100% (1)

- Tohme TohmeDocument64 pagesTohme TohmeTeamMichaelPas encore d'évaluation

- Levine Hearne Goforth Deposition Excerpts at Robson CaseDocument28 pagesLevine Hearne Goforth Deposition Excerpts at Robson CaseIvy100% (3)

- Robson Second Amended ComplaintDocument22 pagesRobson Second Amended ComplaintIvy100% (2)

- Order On MJ Estate Motion To Compel RobsonDocument2 pagesOrder On MJ Estate Motion To Compel RobsonIvy100% (1)

- Living With Michael Jackson Part 4 of 9Document23 pagesLiving With Michael Jackson Part 4 of 9Karen O'HalloranPas encore d'évaluation

- JACKSON V AEGLive June 4th Brandon "Randy" Phillips-CEO OF AEGLIVEDocument27 pagesJACKSON V AEGLive June 4th Brandon "Randy" Phillips-CEO OF AEGLIVETeamMichaelPas encore d'évaluation

- Jackson V AEG Live July - 26th Transcripts of ERIC C BRIGGSDocument54 pagesJackson V AEG Live July - 26th Transcripts of ERIC C BRIGGSTeamMichaelPas encore d'évaluation

- How Was MJ Abused by His FatherDocument5 pagesHow Was MJ Abused by His FatherMithra Rulezz100% (1)

- Adrian Marie Mcmanus Examination 7-8.04.05Document60 pagesAdrian Marie Mcmanus Examination 7-8.04.05MJ BrookinsPas encore d'évaluation

- John Branca TRANSCRIPTS-IMPEACHED! IMPEACHED! IRS TrialDocument211 pagesJohn Branca TRANSCRIPTS-IMPEACHED! IMPEACHED! IRS TrialTeamMichaelPas encore d'évaluation

- Brandon Phillips Transcripts Michael Jackson EXe. John Branca V IRSDocument74 pagesBrandon Phillips Transcripts Michael Jackson EXe. John Branca V IRSTeamMichaelPas encore d'évaluation

- MJ Estate Third AccountingDocument98 pagesMJ Estate Third AccountingIvy100% (2)

- JACKSON V AEGLive June 5th Brandon "Randy" Phillips-CEO OF AEGLIVE SLAPPED MICHAEL JACKSON!Document153 pagesJACKSON V AEGLive June 5th Brandon "Randy" Phillips-CEO OF AEGLIVE SLAPPED MICHAEL JACKSON!TeamMichaelPas encore d'évaluation

- MJ Companies Answer To Robson 4th Amended ComplaintDocument8 pagesMJ Companies Answer To Robson 4th Amended ComplaintIvy100% (1)

- Letter To HBO Re: Michael Jackson DocumentaryDocument10 pagesLetter To HBO Re: Michael Jackson DocumentaryNG19250100% (1)

- JACKSON V AEGLive June 10th Brandon "Randy" Phillips-CEO OF AEGLIVEDocument139 pagesJACKSON V AEGLive June 10th Brandon "Randy" Phillips-CEO OF AEGLIVETeamMichael100% (1)

- Interfor Report John Branca.Document2 pagesInterfor Report John Branca.TeamMichael100% (3)

- Safechuck V MJJ 2nd District OpinionDocument9 pagesSafechuck V MJJ 2nd District OpinionTHROnlinePas encore d'évaluation

- MJ Estate Second AccountingDocument96 pagesMJ Estate Second AccountingIvy100% (2)

- Declaration of John Branca at Robson CaseDocument7 pagesDeclaration of John Branca at Robson CaseIvy100% (2)

- Documento Policial Investigacion Muerte Michael JacksonDocument18 pagesDocumento Policial Investigacion Muerte Michael JacksonlacortedelreyPas encore d'évaluation

- JACKSON V AEG May 23rd 2013 - Shawn Trell-Trial TranscriptsDocument117 pagesJACKSON V AEG May 23rd 2013 - Shawn Trell-Trial TranscriptsTeamMichaelPas encore d'évaluation

- Diane Dimond On CNN Breaking The Chandler StoryDocument7 pagesDiane Dimond On CNN Breaking The Chandler StoryLynette Marie AndersonPas encore d'évaluation

- John Branca Direct ExaminationDocument111 pagesJohn Branca Direct ExaminationTeamMichael100% (1)

- People V Michael Jackson-CourtTranscript-2!28!2005.Document182 pagesPeople V Michael Jackson-CourtTranscript-2!28!2005.TeamMichaelPas encore d'évaluation

- Michael Jackson Estate Vs Dr. Tohme TohmeDocument19 pagesMichael Jackson Estate Vs Dr. Tohme TohmeJacky J. Jasper100% (1)

- Jackson V AEG Live Transcripts of DR Scott David Saunders (Doctor)Document69 pagesJackson V AEG Live Transcripts of DR Scott David Saunders (Doctor)TeamMichaelPas encore d'évaluation

- Michael Jackson Bill GatesDocument1 pageMichael Jackson Bill GatesThe WrapPas encore d'évaluation

- John Branca You Are FIRED!Document1 pageJohn Branca You Are FIRED!TeamMichael100% (1)

- Transcripts - Katherine Jackson V AEG Live - May 1st 2013 - Detective ORLANDO MARTINEZDocument76 pagesTranscripts - Katherine Jackson V AEG Live - May 1st 2013 - Detective ORLANDO MARTINEZTeamMichaelPas encore d'évaluation

- JACKSON V AEGLive June 11th Brandon "Randy" Phillips-CEO OF AEGLIVEDocument158 pagesJACKSON V AEGLive June 11th Brandon "Randy" Phillips-CEO OF AEGLIVETeamMichaelPas encore d'évaluation

- People V Conrad Murray - Transcripts - June 16th 2011Document54 pagesPeople V Conrad Murray - Transcripts - June 16th 2011TeamMichael50% (2)

- Safechuck Ruling Demurrer DismissalDocument19 pagesSafechuck Ruling Demurrer DismissalIvy100% (1)

- Katherine Jackson V AEG Live Transcripts of August 15th 2013 DR David SlavitDocument66 pagesKatherine Jackson V AEG Live Transcripts of August 15th 2013 DR David SlavitTeamMichaelPas encore d'évaluation

- Michael Jackson Siblings Letter To John Branca, McClain, Randy Phillips, Perry Sanders, Trent Jackson, Lowell Henry-SONY-AEG ET ALLDocument4 pagesMichael Jackson Siblings Letter To John Branca, McClain, Randy Phillips, Perry Sanders, Trent Jackson, Lowell Henry-SONY-AEG ET ALLbullocks450100% (1)

- Robson Respondents BriefDocument80 pagesRobson Respondents BriefSebastian Mille100% (3)

- Joseph Jackson's Ofjection To Appointment of John Branca and John Mcclain As Executors of The Estate of Michael JacksonDocument71 pagesJoseph Jackson's Ofjection To Appointment of John Branca and John Mcclain As Executors of The Estate of Michael JacksonTeamMichael100% (2)

- Michael Jackson's Hetero Adult Magazines Presented in Court On March 25 2005Document2 pagesMichael Jackson's Hetero Adult Magazines Presented in Court On March 25 2005Arven MajorPas encore d'évaluation

- Jackson V AEG Live August 8th 2013 Transcripts of Kenneth Ortega (This Is It Director/Creator)Document115 pagesJackson V AEG Live August 8th 2013 Transcripts of Kenneth Ortega (This Is It Director/Creator)TeamMichaelPas encore d'évaluation

- The Case Against Michael JacksonDocument318 pagesThe Case Against Michael Jacksonvenus1111100% (1)

- Katherine Jackson V AEG Live. Transcripts of Michael LaPerruque (MJs Security) August 5th 2013Document24 pagesKatherine Jackson V AEG Live. Transcripts of Michael LaPerruque (MJs Security) August 5th 2013TeamMichael100% (1)

- KATHERINE JACKSON V AEG Live Transcripts of William Ackerman - Forensic Accountant) August 13th 2013Document92 pagesKATHERINE JACKSON V AEG Live Transcripts of William Ackerman - Forensic Accountant) August 13th 2013TeamMichaelPas encore d'évaluation

- Melissa Johnson DeclarationDocument62 pagesMelissa Johnson DeclarationTeamMichaelPas encore d'évaluation

- Michael Jackson Lies Run Spirits But The Truth Runs MarathonsDocument187 pagesMichael Jackson Lies Run Spirits But The Truth Runs MarathonsAga Tok100% (1)

- JACKSON V AEGLive-Travis Payne May 13th (Associate Director/Choreographer, This Is It)Document18 pagesJACKSON V AEGLive-Travis Payne May 13th (Associate Director/Choreographer, This Is It)TeamMichaelPas encore d'évaluation

- MJ Estate Motion To Compel RobsonDocument17 pagesMJ Estate Motion To Compel RobsonIvy100% (4)

- JACKSON V AEG May 28th 2013 - Paul Gongaware Trial TranscriptsDocument164 pagesJACKSON V AEG May 28th 2013 - Paul Gongaware Trial TranscriptsTeamMichaelPas encore d'évaluation

- Tohme MjEstate ComplaintDocument41 pagesTohme MjEstate ComplaintIvyPas encore d'évaluation

- Jackson's Goldman LoanDocument1 pageJackson's Goldman LoanThe WrapPas encore d'évaluation

- Valerie Parker vs. Bank of America, Na and Bac Home Loans Servicing, IncDocument28 pagesValerie Parker vs. Bank of America, Na and Bac Home Loans Servicing, Incakisselo8398Pas encore d'évaluation

- James Nederlander Transcripts. Michael Jackson Exe. Branca V IRSDocument20 pagesJames Nederlander Transcripts. Michael Jackson Exe. Branca V IRSTeamMichaelPas encore d'évaluation

- John Branca TRANSCRIPTS-IMPEACHED! IMPEACHED! IRS TrialDocument211 pagesJohn Branca TRANSCRIPTS-IMPEACHED! IMPEACHED! IRS TrialTeamMichaelPas encore d'évaluation

- Andrew Wallet Transcripts. Michael Jackson Exe. Branca V IRSDocument5 pagesAndrew Wallet Transcripts. Michael Jackson Exe. Branca V IRSTeamMichaelPas encore d'évaluation

- Weston Anson - Transcripts. Michael Jackson Exe. Branca V IRSDocument336 pagesWeston Anson - Transcripts. Michael Jackson Exe. Branca V IRSTeamMichael100% (2)

- Jay Fishman Transcripts. Michael Jackson Exe. Branca V IRSDocument84 pagesJay Fishman Transcripts. Michael Jackson Exe. Branca V IRSTeamMichaelPas encore d'évaluation

- Michael Kane. Transcripts. Michael Jackson Exe. Branca V IRSDocument80 pagesMichael Kane. Transcripts. Michael Jackson Exe. Branca V IRSTeamMichael100% (1)

- Brandon Phillips Transcripts Michael Jackson EXe. John Branca V IRSDocument74 pagesBrandon Phillips Transcripts Michael Jackson EXe. John Branca V IRSTeamMichaelPas encore d'évaluation

- Felix Sebacious Transcripts. Michael Jackson Exe. Branca V IRSDocument30 pagesFelix Sebacious Transcripts. Michael Jackson Exe. Branca V IRSTeamMichaelPas encore d'évaluation

- Nancy Fannon. Transcripts. Michael Jackson Exe. Branca V IRSDocument28 pagesNancy Fannon. Transcripts. Michael Jackson Exe. Branca V IRSTeamMichael100% (1)

- Andrew Hayward. Transcripts. Perjury? Michael Jackson Ex. Branca V IRSDocument34 pagesAndrew Hayward. Transcripts. Perjury? Michael Jackson Ex. Branca V IRSTeamMichaelPas encore d'évaluation

- OWEN DHAL .Transcripts. IMPEACHED. Michael Jackson EX, Branca V IRSDocument149 pagesOWEN DHAL .Transcripts. IMPEACHED. Michael Jackson EX, Branca V IRSTeamMichaelPas encore d'évaluation

- Matthew Forger Transcripts. Mchael Jackson Ex. Branca V IRSDocument21 pagesMatthew Forger Transcripts. Mchael Jackson Ex. Branca V IRSTeamMichaelPas encore d'évaluation

- David Dunn-Transcripts. Michael Jackson EX. Branca V IRSDocument139 pagesDavid Dunn-Transcripts. Michael Jackson EX. Branca V IRSTeamMichaelPas encore d'évaluation

- John Doelp Transcripts. Michael Jackson EXE Branca V IRSDocument40 pagesJohn Doelp Transcripts. Michael Jackson EXE Branca V IRSTeamMichaelPas encore d'évaluation

- Vincent Chieffo. Transcripts-IMPEACHED. Michael Jackson Ex. Branca V IRSDocument47 pagesVincent Chieffo. Transcripts-IMPEACHED. Michael Jackson Ex. Branca V IRSTeamMichaelPas encore d'évaluation

- James Nederlander.Document13 pagesJames Nederlander.TeamMichaelPas encore d'évaluation

- John Branca Direct ExaminationDocument111 pagesJohn Branca Direct ExaminationTeamMichael100% (1)

- People V Conrad Murray - Transcripts - June 16th 2011Document54 pagesPeople V Conrad Murray - Transcripts - June 16th 2011TeamMichael50% (2)

- Irs V Branca - Order June 24th. Court Retains JurisdictionDocument1 pageIrs V Branca - Order June 24th. Court Retains JurisdictionTeamMichaelPas encore d'évaluation

- Tohme TohmeDocument64 pagesTohme TohmeTeamMichaelPas encore d'évaluation

- Conrad Murray Appeal DeniedDocument68 pagesConrad Murray Appeal DeniedTeamMichaelPas encore d'évaluation

- Quincy Jones Vs Michael Jackson Estate and Sony MusicDocument32 pagesQuincy Jones Vs Michael Jackson Estate and Sony MusicTeamMichael100% (2)

- Transcripts - Katherine Jackson V AEG Live - May 1st 2013 - Detective ORLANDO MARTINEZDocument76 pagesTranscripts - Katherine Jackson V AEG Live - May 1st 2013 - Detective ORLANDO MARTINEZTeamMichaelPas encore d'évaluation

- Sui JurisDocument5 pagesSui JurisArche Udtohan GaudelPas encore d'évaluation

- Illustration: Lady Found A Stone and Sold It As A Topaz For $1 ($25 Today) - It Was A Raw UncutDocument3 pagesIllustration: Lady Found A Stone and Sold It As A Topaz For $1 ($25 Today) - It Was A Raw UncutDavidRiyazMithraPas encore d'évaluation

- Law of Contract (Lec 2)Document44 pagesLaw of Contract (Lec 2)RaymondMillsPas encore d'évaluation

- Contracts Full OutlineDocument587 pagesContracts Full OutlinePat CrawleyPas encore d'évaluation

- 5 Topic 3 Contract LawDocument35 pages5 Topic 3 Contract LawNordin Yusof71% (7)

- Facts:: Case Digest #1Document2 pagesFacts:: Case Digest #1Sopongco ColeenPas encore d'évaluation

- Void MarriagesDocument8 pagesVoid MarriagesOlek Dela CruzPas encore d'évaluation

- Saint Paul School of Business and Law - RFBT - LAW OUTPUTDocument93 pagesSaint Paul School of Business and Law - RFBT - LAW OUTPUTPam G.Pas encore d'évaluation

- B.law Book Bhushan GoyalDocument515 pagesB.law Book Bhushan GoyalRohit Kumar100% (2)

- The Indian Contract ActDocument41 pagesThe Indian Contract ActChweet CheeniPas encore d'évaluation

- Oblicon Reviewer (Final Exam)Document4 pagesOblicon Reviewer (Final Exam)von vidorPas encore d'évaluation

- Exam in ObliconDocument17 pagesExam in ObliconAiziel OrensePas encore d'évaluation

- Vitiating Factors of A Contrac1Document9 pagesVitiating Factors of A Contrac1Eric TwagsPas encore d'évaluation

- Review For BLDocument722 pagesReview For BLNguyet Sao Bien NguyenPas encore d'évaluation

- Mistake Law: Couturier V Hastie (1856) 5 HL Cas 673Document6 pagesMistake Law: Couturier V Hastie (1856) 5 HL Cas 673Abdul sami bhuttoPas encore d'évaluation

- ObliDocument101 pagesOblihobi stanPas encore d'évaluation

- Mejia v. MapaDocument2 pagesMejia v. MapaTherese AmorPas encore d'évaluation

- Business LawDocument312 pagesBusiness LawKevin Raphael IsaacPas encore d'évaluation

- Offer and Acceptance & Free ConsentDocument36 pagesOffer and Acceptance & Free ConsentAshwinDanielVarghesePas encore d'évaluation

- Bu231 Midterm ReviewDocument8 pagesBu231 Midterm ReviewNatalie BazouziPas encore d'évaluation

- CONTRACTS - Chapter 2, Section 1Document16 pagesCONTRACTS - Chapter 2, Section 1Anne Marieline BuenaventuraPas encore d'évaluation

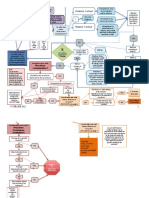

- Contracts FLOW Chart PDFDocument6 pagesContracts FLOW Chart PDFSara ZamaniPas encore d'évaluation

- Study GuideDocument8 pagesStudy GuideAllen BrutasPas encore d'évaluation

- Obligations and Contracts PDFDocument38 pagesObligations and Contracts PDFJoery Bryan BuenconsejoPas encore d'évaluation

- Mistake 1Document10 pagesMistake 1niyiPas encore d'évaluation

- Contract 1Document27 pagesContract 1ShreyaPas encore d'évaluation

- Chapter 2: Essential Requisites of Contracts: Section 1: ConsentDocument13 pagesChapter 2: Essential Requisites of Contracts: Section 1: Consentbrian duelaPas encore d'évaluation

- Business Law Assignment 2Document7 pagesBusiness Law Assignment 2Ali PuriPas encore d'évaluation

- Wharf Properties LTD and Another v. Eric Cumine Associates, Architects Engineers & Surveyors (A Firm) and Others CACV0000521988Document61 pagesWharf Properties LTD and Another v. Eric Cumine Associates, Architects Engineers & Surveyors (A Firm) and Others CACV0000521988Yuet Tung YamPas encore d'évaluation

- LL ProjectDocument8 pagesLL Projectashish buridiPas encore d'évaluation