Académique Documents

Professionnel Documents

Culture Documents

Bills of Exchange

Transféré par

kamalsodhi24Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bills of Exchange

Transféré par

kamalsodhi24Droits d'auteur :

Formats disponibles

Bills of Exchange

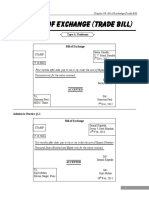

Bill of Exchange

A bill of exchange has been defined as an unconditional order in writing addressed by one person to another; signed by the person giving it, requiring, the person to whom it is addressed to pay on demand or at a fixed or determinable future time, a certain sum in money to or to the order of a specified person or to bearer.

Difference Between Inland and Foreign Bills:

The bill of exchange may be inland or foreign. An inland bill is a bill which is both drawn and payable within the a country. A foreign bill is one which is drawn in one country but accepted and payable in another country.

Parties to a Bill of Exchange:

There are three parties in a bill: Drawer - The person who draws the bill is called the drawer. He gives the order to pay money to the third party. Drawee - The party upon whom the bill is drawn is called the drawee. He is the person to whom the bill is addressed and who is ordered to pay. He becomes an acceptor when he indicates his willingness to pay the bill. Payee -The party in whose favor the bill is drawn or is payable is called the payee.

Advantages of Bills of Exchange:

It is a legal evidence of debt. It is a convenient method for the transfer of debt A creditor can sue on the bill itself It is a negotiable instrument and can be transferred for settlement of one's debt without difficulty.

It can be cashed before due date by discounting. A debtor enjoys the benefit of full period of credit. It affords an ease means of transmitting money from one place to another.

How a Bill of Exchange Functions:

In order to fully grasp the transactions relating to bill of exchange we thoroughly learn the procedure. The following example will make it clear. Suppose A sells goods to the value of $500 to B. The most ready means of closing the transaction will be cash payment by B to A. But payment of this nature are not many in actual practice. The greatest volume of business is done on credit. That being the case A will have to wait for some time to receive payment from B. A, merchant can hardly afford to be out of funds for long. Moreover, to sell goods on credit is rather a risky job. Therefore as soon as A sells goods to B, he will draw a bill for $500 on B and forward the same to him together with the goods with instructions to B to accept the bill and return the same to A. Upon receipt of the bill, B would write on the face of the bill "accepted" and put his signature below. It means that B approves the bill and also binds himself to pay the amount thereof when due. The bill is thus complete and comes back to A to remain in his possession till maturity or can be endorsed or discounted by him. On the due date the holder of the bill presents it before the acceptor and receives payment of the bill from the acceptor.

Thus, the bill of exchange is the instrument, rather the mechanism which finances the major portion of all commercial transactions these days and it helps both the debtor and the creditor alike.

Difference Between Bill of Exchange and Promissory Note:

S. No.

1

Promissory Note

Bill of Exchange

It is an order to pay

It is promise to pay

There are only two parties the drawer, and the payee.

There are three parties, the drawer, the drawee, and the payee.

3.

There is no necessity of acceptance

It must be accepted

4.

The maker is primarily liable

The drawer is not primarily liable.

It is never drawn in sets Foreign bills are specially drawn in sets.

Protesting is not necessary after dishonour

A foreign bill must be protested upon dishonor.

Tenor and Usance:

Tenor is the period of time after which a bill becomes payable. Thus, where a bill is payable after 90 days from the date of drawing or acceptance, the tenor of the bill is 90 days. Bill may be made payable: On Demand. The bill so drawn is payable as soon as its payment is demanded by the holder of the bill. A Sight. A bill of exchange so drawn becomes payable immediately it is brought to the notice of the drawee.

After Date. When a bill is drawn 'after date' its due date is calculated from the date of the bill. After Sight. When a bill is drawn 'after sight' its due date is calculated from the date on which it is sighted or seen by the drawee i.e., from the date of acceptance by the drawee. Usance. It is the usual time of payment of a bill of exchange as fixed by custom.

Days of grace:

In calculating the due date of payment it is customary in business circle to allow three additional days to the drawee or acceptor to meet the bill. The extra days are called "days of grace" or "grace days". Thus a bill dated 15th March, for three months becomes payable on the 18th June and this is the due date.

Holder: Holder of a bill is a person who is entitled in his own right to the possession thereof and to claim the amount due thereon. Holder in Due Course: When a person takes a bill, complete and regular on the face of it and before its due date, in good faith and for valuable consideration he is called the holder in due course.

Acceptance: When a drawee signs his name across the face of along with the word "accepted" the bill is said to be accepted and this act of the drawee is called acceptance of a bill. Before this is done, the drawee cannot be made liable for the bill.

Different Kinds of Acceptance:

General Acceptance: When a bill is accepted without any condition to the order of the drawer, it is called general acceptance. Qualified Acceptance: When a bill is accepted with some qualifications to the order of the drawer it is called qualified acceptance.

A qualified acceptance again may be of five different types. These are following types: Time. When the acceptor agrees to pay the bill on some day other than the date required by the drawer, it is called qualified acceptance as to time. Place. When a bill is payable at a particular place and there only, it is called local qualified acceptance.

Partial. When a bill is accepted for a part of the amount of a bill, it is called partial qualified acceptance. Parties. When a bill is accepted by one or two of the drawees, but not all, it is called qualified acceptance as to parties. Condition. When a bill is accepted subject to a certain condition being fulfilled it is called conditional qualified acceptance.

Recording Transactions of Bill of Exchange:

For the purpose of accounting, bills are classified under two heads: Bills receivable Bills payable

Bills Receivable: A bill of exchange is treated as a bill receivable by one who is entitled to receive the sum due on it. When we draw a bill or receive it by endorsement from our debtors, it is our bill receivable (B/R) and on maturity of such bill if it is held up to that time, we shall receive specified amount from the acceptor.

Bills Payable: A bills payable is regarded as bill payable by one who has to pay it on the due date. When we accept a bill and thereby become liable to pay on its maturity, it is our bill payable (B/P). It means the same bill is a bill receivable to one party and a bill payable to the other.

The accounting aspect of a bill of exchange can be divided into following parts: When a bill is drawn, accepted and discharged. When the drawer discounted it with the bank When the drawer sends it for collection to the banker. When the drawer endorses it to a third party When a bill is dishonored. When a bill is renewed for another period of time. When a bill is retired. When there is an accommodation bill (including the insolvency of one of the parties).

Drawing, Acceptance, and Payment of Bills of Exchange:

When a bill is written it is known as "drawing" a bill. The person who draws it is the creditor and the person to whom it is addressed is the debtor. The creditor and the debtor are also known as the drawer and the drawee respectively. When the drawee signifies his assent to the order in writing he becomes the acceptor of the bill if exchange. It is said to be discharged when the acceptor makes the actual payment on the bill on the maturity date.

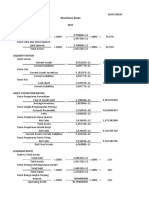

Journal entries in the books of drawer and drawee are as under: Creditor's Books (a) When a bill of exchange is drawn and accepted. Bill receivable account [Dr] To Acceptor's personal account [Cr.] (b) On the due date the acceptance will be presented to the acceptor for payment. If the payment is received directly: Cash account [Dr.] To Bills receivable account [Cr.]

Debtor's Books: (a) When the bill is accepted by the drawee. Personal account of the drawer [Dr.] To Bills payable account [Cr.] (b) When the bill is met on maturity. Bills payable account [Dr.] To Cash account [Cr.]

Discounting a Bill of Exchange:

If the holder of a bill is need of money before the due date of the bill he may sell it to the bank. The bank (buyer) will give cash fir it in consideration of a small charge. This is called discounting the bill. The amount deducted by bank of the bill from the face value of the bill is called "discount". The discount is usually calculated at a certain rate per annum on the amount of the bill.

The accounting entries will be: Creditor's Books (a) When a bill of exchange is discounted. Bank account (discounted value) [Dr.] Discount account (amount of discount) [Dr.] To Bills receivable account [Cr.]

Debtor's Books: The acceptor has no concern with the discounting of the bill. He has to pay it on the due date to the holder. Whoever he may be. There will be no journal entry for discounting of the bill of exchange.

Bill of Exchange for Collection:

When a person receives a bill, he may keep it till the date of maturity in order to receive the full amount. But in order to ensure safety, he may send it to his bank with the instructions that the bill should be retained till maturity and should be realised on that date. This does not mean discounting of bill. The bank will not credit the customer or client until the amount is actually realised. If the bill is sent to the bank with such instructions it is know as "bill sent for collection".

It will be recorded in the books of the creditor as under: Creditor's Books (a) When a bill of exchange is sent to the bank for collection: Bank for collection account [Dr.] To Bills receivable account [Cr.] (b) On receipt of information from the bank as to collection of the bill on the due date: Bank account [Dr.] To Bank for collection account [Cr.]

Debtor's Books: No entries are recorded in debtor's books. He has no concern with collection of bills. Banker's Books: If the bill is received by bank from its customer for collection, there will be no entry until the bill is collected, when the bill is collected, the following entry will be passed: Cash account [Dr.] To Customer's personal account [Cr.] To Collection Charges account [Cr.]

Endorsement of Bill of Exchange:

When a bill of exchange is negotiated i.e., transferred from one person to another person so as to constitute the transferee the holder of a bill, each person through whose hands it passes, must write his name on the back of the bill. This is know as the "endorsement of a bill of exchange". Some times the drawer of the bill does not keep the bill with him until the date of the maturity. He endorses it to some other party in payment of the debt due from him.

When the bill is endorsed to any other party the journal entries will be: Drawer's Books When a bill of exchange is endorsed: Endorsee's personal account [Dr.] To Bills receivable account [Cr.]

Acceptor's Books: His books remain unaffected. He will pay it on the due date to the holder and usual entry for the payment will be passed: Endorsee's Books: When he will receive an endorsed bill, he will treat it just like an ordinary bill: Bill receivable account [Dr.] To Transfer's personal account [Cr.]

Dishonour of a Bill of Exchange:

A bill of exchange is said to be dishonoured when the drawee refuses to accept or make payment on the bill. A bill may be dishonoured by non-acceptance or non-payment. 1. If the drawee refuses to accept the bill when it is presented before him for acceptance, it is called dishonour by non-acceptance. When a bill is dishonoured by non-acceptance, an immediate right of recourse against the drawer and endorser accrues to the holder. In this case, presentment for payment is not necessary.

2. If the drawer has accepted the bill, but on the due date, he refuses to make payment of the bill, it is called dishonour by non-payment. In this case the holder has immediate right of recourse against each party to the bill. Noting Charges: When a bill of exchange is dishonoured, the holder can get such fact noted on the bill by a notary public. The advantages of noting is that the evidence of dishonoured is secured. The noting is done by recording the fact of dishonoured, the date of dishonour, the reason of dishonour, if any. For doing all this the notary public charges his fees which is called noting charges.

Journal entries on the dishonour of the bill of exchange:

Creditor's Books: At the time a bill is dishonoured, it may be either with the drawer or with his banker with whom he has discounted it or with a creditor of whose favor he may have endorsed it: (a) When the bill of exchange is still in the drawer's possession: Acceptor's personal account (full value of the bill and noting charges) [Dr.] To Bills receivable account [Cr.] To Cash account (noting charges) [Cr.]

(b) When the bill of exchange has been discounted with the bank: Acceptor's personal account [Dr.] To Bank [Cr.] Note: The amount will include the noting charges. No separate entry will be passed for noting charges as in case (a) above

(c) When the bill of exchange has been sent for collection: Acceptor's personal account [Dr.] To Bank for collection account [Cr.] (d) When the bill of exchange has been sent for collection: Acceptor's personal account [Dr.] To Personal account of creditor [Cr.] It may be noted that in all four cases the drawer debits the acceptor's credits that party's account who presents the bill for payment.

Debtor's Books: When the bills payable is dishonoured the debtor has to pass the same journal entry in all the cases The journal entry is: Bill payable account (full value of the bill) [Dr.] Trade expenses account (noting charges) [Dr.] To personal account of drawer [Cr.]

Renewal of a Bill of Exchange:

When the acceptor of a bill finds himself unable to make payment of the bill on the due date; he may request the drawer of the bill, before it is due, to cancel the original bill and draw on him a new bill for an extended period. This is called renewing a bill of exchange. The acceptor has to pay interest for the extension of time. The new bill therefore, includes not only the amount of the original bill but also interest etc.

Journal entries in this case are: Creditor's Books: In this case first of all entries recording the original bill will to be cancelled. Next entry for interest would be passed. A further entry will be passed for a new bill of exchange. (a) When the old bill is cancelled: Personal account of the acceptor [Dr.] To Bill receivable account [Cr.]

(b) When interest is charged by the drawer: Personal account of the acceptor [Dr.] To Interest account [Cr.] (c) When acceptance on new bill is received: Bill receivable account [Dr.] To Acceptor's personal account [Cr.]

Debtor's Books: Debtor will make the following entries in his books: (a) When the old bill is cancelled: Bill payable account [Dr] To Drawer's account [Cr]

(b) When interest is charged by the drawer: Interest account [Dr] To Drawer's account [Cr] (c) When a fresh bill is accepted: Drawer's account [Dr] To bill payable account [Cr]

Retiring of a Bill of Exchange:

Retiring a bill means making payment before the date of maturity. When the acceptor of a bill is prepared to make the payment of the bill before the due date, he may ask the holder to accept the payment, provided he receives some rebate or discount for the unexpired period. Such a rebate or discount is an expense to the party receiving the payment and gain to the party making the payment.

Journal entries: Creditor's Books: Cash account (actual amount received) [Dr] Rebate account (rebate granted) [Dr] To Bill receivable account [Cr]

Debtor's Books: Bill payable account [Dr] To cash account [Cr] To Rebate account [Cr]

Accommodation Bills of Exchange:

An accommodation bill of exchange is a bill of exchange which has been drawn for the mutual financial accommodation of the parties involved. Generally it is drawn not for value received. In order to oblige friends, many times bills are drawn, accepted and endorsed by businessmen without any consideration. By accepting such a bill the acceptor is able to lend his name, and the other party (drawer) taking advantages of the reputation of the acceptor gets it discounted with his bank. After meeting his aim with this temporary finance, he (drawer) sends back money to the acceptor thus making it possible for him to meet the bill on the due date. Since such bills are accepted without consideration, therefore, there is no liability of the acceptor to the drawer but since the third party takes such a bill for value, therefore, the acceptor is liable to the third party.

Difference Between Trade Bill and Accommodation Bill:

S. Trade Bill No.

1. Trade bills are drawn for trade purposes.

Accomodation Bill

Accommodation bills are drawn and accepted for financial assistance These are drawn in absence of any consideration

2.

These are drawn against proper consideration.

3.

These bills are proof of debt

These are not a proof of debt

4.

If discounted, full sum retains with holder of the bill

If discounted the amount may be divided between drawer and acceptor in pre-determined ratio. Legal action cannot be resorted for recovery of amount against these bills by the immediate parties.

5.

For obtaining the debt from drawee, drawer can resort to legal action.

1.

2.

3.

The bookkeeping entries in connection with accommodation bills are made in the same way as for genuine bills. Generally, there are three methods of raising money on accommodation bills. They are as under: When accommodation bill is written for the accommodation of the drawer. When accommodation bill is written for the mutual accommodation of the drawer and the drawee. When the drawer and the drawee write accommodation bills on each other.

Accommodation of the drawer:

When a bill is written for the accommodation of the drawer then the drawee of the bill accepts the bill without any consideration and returns the bill to the drawer. The drawer gets the bill discounted with his bank and uses the amount in his business. On the due date he remits the amount to the acceptor or the bill to enable him to honour the bill on the due date.

Accommodation of the Drawer and the Drawee:

When a bill is drawn by one party for the mutual accommodation then the drawee after accepting the bill returns to the drawer. The drawer gets the bill discounted with his banker and after retaining the agreed portion of the proceeds of the bill remits rest of the proceeds to the acceptor of the bill. On the date of maturity the drawer of the bill remits rest to the acceptor the amount retained by him earlier to enable the acceptor to honour the bill. The expenses of discount are shared by the parties.

Accommodation Bills Written on Each Other:

In this case, both the parties draw bills on each other and get them discounted from their bankers. On the due date, each meets his own bill. The expenses of discount is to be paid by each on other's bill.

Insolvency of Acceptor in Bills of Exchange

Insolvency of a person means that he is unable to pay his liabilities. This will mean that bill accepted by him will be dishonoured. Therefore, when it is known that a person has become insolvent, entry for dishonour of his acceptance should be passed, Later something may be received from his estate.

When amount is received, the following journal entry is passed: Cash Account [Dr.] To Debtor's Personal Account [Cr.] The remaining amount will be irrecoverable and therefore, should be written off as a bad debt.

Vous aimerez peut-être aussi

- Bills of Exchage-Behaviour-Treatment and SystemDocument32 pagesBills of Exchage-Behaviour-Treatment and SystemUsaid Khan67% (15)

- Bills of ExchangeDocument65 pagesBills of Exchangeimran shaikhPas encore d'évaluation

- Discounting Bills of Exchange FinancingDocument7 pagesDiscounting Bills of Exchange FinancingEsha Ali ButtPas encore d'évaluation

- Bill of ExchangeDocument4 pagesBill of ExchangeS K MahapatraPas encore d'évaluation

- Bills of Exchange Unit-5Document15 pagesBills of Exchange Unit-5Bell BottlePas encore d'évaluation

- Bills of ExchangeDocument2 pagesBills of Exchangesubba199533333350% (2)

- LOAN Defined: Deposit of Money "Promissory Note" by Customer W/ BankerDocument8 pagesLOAN Defined: Deposit of Money "Promissory Note" by Customer W/ Bankerin1orPas encore d'évaluation

- Bill of ExchangeDocument3 pagesBill of Exchangedevika mcaPas encore d'évaluation

- Bills of ExchangeDocument16 pagesBills of Exchangeimran shaikh100% (1)

- Full Faith & Credit ActDocument6 pagesFull Faith & Credit ActRoy Tanner100% (2)

- Unit 13: 1. What Is A Negotiable InstrumentDocument7 pagesUnit 13: 1. What Is A Negotiable InstrumentAyas JenaPas encore d'évaluation

- Negotiable Instruments: Chapter - 3Document11 pagesNegotiable Instruments: Chapter - 3Mae CaraigPas encore d'évaluation

- Bill of ExchangeDocument14 pagesBill of ExchangeMa Angelica Micah Labitag100% (8)

- Negotiable Instruments Act, 1881Document23 pagesNegotiable Instruments Act, 1881Arvind Mallik100% (1)

- Accounting For Special Transactions: Unit - 1 Bills of Exhange and Promissory NotesDocument31 pagesAccounting For Special Transactions: Unit - 1 Bills of Exhange and Promissory NotesNakul ChaudharyPas encore d'évaluation

- Negotiable InstrumentDocument15 pagesNegotiable InstrumentAngelitOdicta100% (2)

- Chapter 9 Bills of ExchangeDocument12 pagesChapter 9 Bills of ExchangeShaira BugayongPas encore d'évaluation

- Bill of Exchange Vs Promissory Note - Difference and Comparison - The Investors BookDocument18 pagesBill of Exchange Vs Promissory Note - Difference and Comparison - The Investors BookDan Dan Dan Dan100% (1)

- 118.instrument As Payment, 11 Am. Jur. 2d Bills and Notes 118Document7 pages118.instrument As Payment, 11 Am. Jur. 2d Bills and Notes 118Theplaymaker508Pas encore d'évaluation

- Bill of ExchangeDocument4 pagesBill of ExchangeChetan SapraPas encore d'évaluation

- Negotiable Instrument & Bill of ExchangeDocument12 pagesNegotiable Instrument & Bill of ExchangeAlokha Vincent100% (1)

- Tender Refused Is PaidDocument2 pagesTender Refused Is PaidAriesWay100% (1)

- Negotiable Instruments Act, 1881Document23 pagesNegotiable Instruments Act, 1881Kansal Abhishek100% (1)

- Produce The Note The UCC and The Law of MerchantsDocument26 pagesProduce The Note The UCC and The Law of MerchantssouxsiePas encore d'évaluation

- Bankers AcceptanceDocument2 pagesBankers AcceptanceKudzanai Allen Paraffin100% (5)

- 09 Bills of ExchangeDocument37 pages09 Bills of ExchangeAnas shaikh100% (1)

- Law of Banking As It Relates To NegotiabDocument11 pagesLaw of Banking As It Relates To Negotiabarun raoPas encore d'évaluation

- Definition of MoneyDocument5 pagesDefinition of MoneyM .U.KPas encore d'évaluation

- 1969 06 26affidavitofJeromeDalyDocument11 pages1969 06 26affidavitofJeromeDalyAdam_Fishwater_1523Pas encore d'évaluation

- Cestui Que Vie Act 1666Document2 pagesCestui Que Vie Act 1666thenjhomebuyer100% (1)

- The Negotiable Instruments Act, 1881Document59 pagesThe Negotiable Instruments Act, 1881Rizwan Niaz Raiyan100% (1)

- Bills Exchange Act SummaryDocument27 pagesBills Exchange Act SummaryDanielle K. Souci100% (1)

- Chapter 05 Negotiable Instruments Act 1881 1229869805849562 1Document11 pagesChapter 05 Negotiable Instruments Act 1881 1229869805849562 1अरुण शर्माPas encore d'évaluation

- Negotiable Instruments Law ExplainedDocument9 pagesNegotiable Instruments Law ExplainedTino AlappatPas encore d'évaluation

- Bills of Exchange ProjectDocument7 pagesBills of Exchange ProjectNishaTambe100% (1)

- New Pacific Timber vs SenerisDocument13 pagesNew Pacific Timber vs SenerisiicaiiPas encore d'évaluation

- Negotiable Instruments: Legal Aspects of BusinessDocument25 pagesNegotiable Instruments: Legal Aspects of BusinessArun Sharma100% (2)

- Modern Money MechanicsDocument50 pagesModern Money MechanicsLewviciousPas encore d'évaluation

- 01 - Invisible Contracts - MasterDocument159 pages01 - Invisible Contracts - MasterYarod ELPas encore d'évaluation

- Bank Deposit RulesDocument15 pagesBank Deposit RulesSamuel BaulaPas encore d'évaluation

- Bill of Exchange GuideDocument0 pageBill of Exchange Guidemy hoangPas encore d'évaluation

- Law of Negotiable Instruments ExplainedDocument24 pagesLaw of Negotiable Instruments Explainedshiftn7100% (3)

- Secured Trans-Comm PaperDocument17 pagesSecured Trans-Comm PaperSemsudPas encore d'évaluation

- Ion of Bill of ExchangeDocument11 pagesIon of Bill of Exchangeshami00992100% (1)

- Role of Maxims: 1. Equity Considers That Done What Ought To Be DoneDocument8 pagesRole of Maxims: 1. Equity Considers That Done What Ought To Be DoneKhandokar Al WASIPas encore d'évaluation

- Bills of ExchangeDocument31 pagesBills of ExchangeViransh Coaching ClassesPas encore d'évaluation

- DRAWEEDocument4 pagesDRAWEEranticccPas encore d'évaluation

- Types of Negotiable InstrumentDocument3 pagesTypes of Negotiable Instrumentanon_919197283Pas encore d'évaluation

- Types of Commercial PaperDocument3 pagesTypes of Commercial PaperAjay SharmaPas encore d'évaluation

- Acceptance For Value Law and Legal DefinitionDocument1 pageAcceptance For Value Law and Legal DefinitionpauldawalllPas encore d'évaluation

- Basics of Negotiable InstrumentsDocument46 pagesBasics of Negotiable Instrumentsgox350% (2)

- Bill of ExchangeDocument4 pagesBill of ExchangeVadic FactsPas encore d'évaluation

- Bankers AcceptancesDocument36 pagesBankers AcceptancesAlexhCreditorPas encore d'évaluation

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsD'EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsPas encore d'évaluation

- Basic Accounting TermsDocument33 pagesBasic Accounting Termskamalsodhi24Pas encore d'évaluation

- Bills of ExchangeDocument57 pagesBills of Exchangekamalsodhi24100% (5)

- Time Value of MoneyDocument34 pagesTime Value of Moneykamalsodhi24Pas encore d'évaluation

- Co. LawDocument61 pagesCo. Lawkamalsodhi24Pas encore d'évaluation

- Indian Contracts Act, 1872Document46 pagesIndian Contracts Act, 1872kamalsodhi24Pas encore d'évaluation

- Steps in MergerDocument5 pagesSteps in Mergerkamalsodhi24Pas encore d'évaluation

- Accounting for Management exam paperDocument2 pagesAccounting for Management exam paperkamalsodhi24Pas encore d'évaluation

- Civil Affairs Handbook France Section 5Document258 pagesCivil Affairs Handbook France Section 5Robert Vale100% (1)

- Ab PDFDocument5 pagesAb PDFIdrus FahrezaPas encore d'évaluation

- Accounting Q&ADocument6 pagesAccounting Q&AIftikharPas encore d'évaluation

- Business Analyst Payments ExpertDocument4 pagesBusiness Analyst Payments Expertmgajbhe1Pas encore d'évaluation

- Receivers Second Interim Report Regading Status of ReceivershipDocument26 pagesReceivers Second Interim Report Regading Status of ReceivershipcburnellPas encore d'évaluation

- The 10 Homeomorphically Irreducible Trees with 10 VerticesDocument36 pagesThe 10 Homeomorphically Irreducible Trees with 10 VerticesGuillermo CeosPas encore d'évaluation

- Simple Interest GameDocument4 pagesSimple Interest GameCarmina CunananPas encore d'évaluation

- VA Response On Home Loans For Veterans Working in Marijuana IndustryDocument1 pageVA Response On Home Loans For Veterans Working in Marijuana IndustryMarijuana MomentPas encore d'évaluation

- Macri's Macro: The Meandering Road To Stability and GrowthDocument58 pagesMacri's Macro: The Meandering Road To Stability and GrowthCronista.com100% (2)

- Time Value On Excel (Using The Financial Function (FX) Wizard) Clink Links BelowDocument8 pagesTime Value On Excel (Using The Financial Function (FX) Wizard) Clink Links BelowPawan KumarPas encore d'évaluation

- Entrepreneurial Development Question Paper SolvedDocument39 pagesEntrepreneurial Development Question Paper SolvedKovid Garg100% (3)

- EBL Annual Report 2013Document101 pagesEBL Annual Report 2013জয়ন্ত দেবনাথ জয়Pas encore d'évaluation

- Thermalnet Methodology Guideline On Techno Economic AssessmentDocument25 pagesThermalnet Methodology Guideline On Techno Economic Assessmentskywalk189Pas encore d'évaluation

- Chapter 7 Engineering EconomicsDocument19 pagesChapter 7 Engineering EconomicsharoonPas encore d'évaluation

- Service Operations V3.0AugmentedDocument882 pagesService Operations V3.0Augmentedrockmen2001Pas encore d'évaluation

- Filipino Credit Union GuideDocument4 pagesFilipino Credit Union GuideJoyce-An Nicole MercadoPas encore d'évaluation

- Banko Filipino vs. DiazDocument16 pagesBanko Filipino vs. DiazSherwin Anoba CabutijaPas encore d'évaluation

- 3rd Quiz ObliconDocument4 pages3rd Quiz ObliconEzra Denise Lubong RamelPas encore d'évaluation

- Dipa Sip ProjectDocument53 pagesDipa Sip ProjectdeepajivtodePas encore d'évaluation

- PartnershipDocument6 pagesPartnershipايهاب غزالةPas encore d'évaluation

- Easements TP LicenseDocument29 pagesEasements TP LicenseRuchi sharmaPas encore d'évaluation

- UntitledDocument16 pagesUntitledಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Morrison L ResumeDocument2 pagesMorrison L Resumeapi-459079302Pas encore d'évaluation

- MickeyDocument9 pagesMickeyManoranjan DashPas encore d'évaluation

- Bank Loans vs Overdrafts: Key DifferencesDocument11 pagesBank Loans vs Overdrafts: Key DifferencesAsif AbdullaPas encore d'évaluation

- CBQ Toc 05102016 enDocument10 pagesCBQ Toc 05102016 ensyed muffassirPas encore d'évaluation

- Lease AccountingDocument32 pagesLease Accountingwaqtawan100% (1)

- Draft Contract For Sale and Purchase of BrentmoorDocument12 pagesDraft Contract For Sale and Purchase of BrentmoorFauquier NowPas encore d'évaluation

- Crismina Garments Vs Court of AppealsDocument9 pagesCrismina Garments Vs Court of AppealsMp CasPas encore d'évaluation

- Time Magazine - 11 June - 2012 - KindleDocument61 pagesTime Magazine - 11 June - 2012 - Kindlesandra072353Pas encore d'évaluation