Académique Documents

Professionnel Documents

Culture Documents

Warm Up (8/27: - List Two Facts You Already Know About Credit Cards

Transféré par

Sandra_ZimmermanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Warm Up (8/27: - List Two Facts You Already Know About Credit Cards

Transféré par

Sandra_ZimmermanDroits d'auteur :

Formats disponibles

2.4.1.

G1

Warm Up (8/27

List two facts you already know about credit cards.

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 1 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Take Charge of Credit Cards

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 2 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

What is a Credit Card?

Pre-approved credit

Credit- When a financial institution lends an individual money and trusts he or she will pay it back

Used to purchase items now and pay for them later The word credit comes from the Latin word Credo meaning I believe.

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 3 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Credit Card Terms

Interest- Fee for borrowed money Credit Line Maximum amount of money that can be charged to a credit card Annual Percentage Rate- Interest rate charged to the cardholder on the amount borrowed Finance Charge Possible charges assessed to an account for credit card use

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 4 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Credit Card Terms Continued

Annual Fees - Fee charged once per year for credit card ownership Minimum Payment Minimum payment of a credit card bill that must be paid Due Date Date payment is due Late Payment Fee - Fee charged when a cardholder does not make the minimum monthly payment by the due date

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 5 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Advantages

Brainstorm 3 advantages of using a credit card

Convenient Useful for emergencies Often required to hold a reservation Purchase expensive items earlier Eliminate the need to carry around large amounts of cash

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 6 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Disadvantages

Brainstorm 3 disadvantages of using a credit card

Paying interest Additional fees are common Tempting to overspend Responsible for lost/stolen cards Identity theft is easier Can cause large amounts of debt

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 7 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Safety Tips

Shred any unwanted credit card offers or credit cards received in the mail Always check your credit card statement to make sure there are no false purchases Sign card with signature and Please See ID Do not leave cards lying around Close unused accounts in writing and by phone, then cut up the card

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 8 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Safety Tips continued

Do not give out account number unless making secure purchases Keep a list of all cards, their account numbers, and phone numbers separate from cards Report lost or stolen cards promptly

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 9 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2.4.1.G1

Remember.

Only use a credit card when there is no doubt about ability to pay off the charges at the end of the month

Family Economics & Financial Education December 2005 Get Ready to Take Charge of Your Finances Take Charge of Credit Cards Slide 10 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Bank of AmericaDocument13 pagesBank of AmericaAnne-marie aubry83% (6)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Wells Fargo Combined Statement of AccountsDocument7 pagesWells Fargo Combined Statement of AccountsbrhanePas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Does Money Grow On TreesDocument23 pagesDoes Money Grow On TreesSandra_ZimmermanPas encore d'évaluation

- Checking Account and Debit Card SimulationDocument62 pagesChecking Account and Debit Card SimulationSandra_Zimmerman100% (1)

- Unit 1: The Nature of TechnologyDocument36 pagesUnit 1: The Nature of TechnologySandra_ZimmermanPas encore d'évaluation

- T-Mobile 947812655 09 03 15Document82 pagesT-Mobile 947812655 09 03 15shreyasgaonkarPas encore d'évaluation

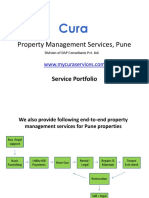

- Property ManagementDocument8 pagesProperty ManagementMyCura ServicesPas encore d'évaluation

- Contract Franciza in LB EnglezaDocument7 pagesContract Franciza in LB EnglezaEliza MartacPas encore d'évaluation

- 186 Palma Development Corp Vs Zambaonga Del SurDocument3 pages186 Palma Development Corp Vs Zambaonga Del SurClarisse ZaplanPas encore d'évaluation

- eTicket Itinerary Receipt for Domestic Lion Air FlightDocument2 pageseTicket Itinerary Receipt for Domestic Lion Air FlightTaufan RennaldyPas encore d'évaluation

- Take Charge of CreditcardsDocument10 pagesTake Charge of CreditcardsSandra_ZimmermanPas encore d'évaluation

- CH 02Document44 pagesCH 02Sandra_ZimmermanPas encore d'évaluation

- Goals GaloreDocument15 pagesGoals GaloreSandra_ZimmermanPas encore d'évaluation

- Checking Account and Debit Card SimulationDocument61 pagesChecking Account and Debit Card SimulationSandra_ZimmermanPas encore d'évaluation

- Comparison ShoppingDocument18 pagesComparison ShoppingSandra_ZimmermanPas encore d'évaluation

- Comparison ShoppingDocument18 pagesComparison ShoppingSandra_ZimmermanPas encore d'évaluation

- Exploring Values, Needs & WantsDocument9 pagesExploring Values, Needs & WantsSandra_ZimmermanPas encore d'évaluation

- Exploring Values, Needs & WantsDocument9 pagesExploring Values, Needs & WantsSandra_ZimmermanPas encore d'évaluation

- Goals GaloreDocument13 pagesGoals GaloreSandra_ZimmermanPas encore d'évaluation

- Exploring Values, Needs & WantsDocument9 pagesExploring Values, Needs & WantsSandra_ZimmermanPas encore d'évaluation

- NASA student architecture association bylawsDocument26 pagesNASA student architecture association bylawsAnkush BhartiPas encore d'évaluation

- SA Wadiah R&R EngBMDocument12 pagesSA Wadiah R&R EngBMsyamsudin75Pas encore d'évaluation

- Application FormDocument1 pageApplication FormHarish SharmaPas encore d'évaluation

- GSRTCDocument1 pageGSRTCRaju PatelPas encore d'évaluation

- R 1611607001951160716000132 NiitDocument2 pagesR 1611607001951160716000132 Niitsr_rao99100% (1)

- 2020 - 2021 Fccla Parent LetterDocument3 pages2020 - 2021 Fccla Parent Letterapi-517946986Pas encore d'évaluation

- Book Vehicle Rental TermsDocument11 pagesBook Vehicle Rental TermsChris WebbPas encore d'évaluation

- Bill History - Real Estate Account at 524 S DIXIE HWY - TaxSys - Broward County Records, Taxes & Treasury Div.Document2 pagesBill History - Real Estate Account at 524 S DIXIE HWY - TaxSys - Broward County Records, Taxes & Treasury Div.My-Acts Of-SeditionPas encore d'évaluation

- Consulting Service AgreementDocument4 pagesConsulting Service Agreementanandrai2Pas encore d'évaluation

- Fee Structure Btech CseDocument1 pageFee Structure Btech CsechitranshpandeyPas encore d'évaluation

- Affiliated To University of MumbaiDocument98 pagesAffiliated To University of MumbaiAnand YadavPas encore d'évaluation

- Tariffs & Pricing in Liner ShippingDocument25 pagesTariffs & Pricing in Liner ShippingDeepesh Shenoy100% (1)

- 2003 Revised NGAS Chart of AccountsDocument56 pages2003 Revised NGAS Chart of AccountsJaniña Natividad100% (1)

- eBay's Diverse Product Portfolio and ServicesDocument37 pageseBay's Diverse Product Portfolio and ServicesYogendra ShuklaPas encore d'évaluation

- Document 4Document4 pagesDocument 4Ana Sofía Cruz AcostaPas encore d'évaluation

- Accrual and Redemption Process OverviewDocument14 pagesAccrual and Redemption Process OverviewVibha ReddyPas encore d'évaluation

- Ontrack Service AgreementDocument5 pagesOntrack Service AgreementMichael OyiboPas encore d'évaluation

- Aeren LPO PPT PresentationDocument45 pagesAeren LPO PPT PresentationaerenlpoPas encore d'évaluation

- Audit workpapers of Tanglaw ng Panunulyan CenterDocument95 pagesAudit workpapers of Tanglaw ng Panunulyan CenterIsaac Dominic MacaranasPas encore d'évaluation

- Create Late Payment Reminder EmailsDocument5 pagesCreate Late Payment Reminder EmailsJenn TorrentePas encore d'évaluation

- Lmra FeesDocument5 pagesLmra FeesAbdulaziz KhattakPas encore d'évaluation

- SRReport 1621473715093Document4 pagesSRReport 1621473715093wasiqa242Pas encore d'évaluation

- Fees Structure NewDocument1 pageFees Structure NewWAFULA STEPHENPas encore d'évaluation