Académique Documents

Professionnel Documents

Culture Documents

Lead Bank Scheme

Transféré par

Charu ModiCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lead Bank Scheme

Transféré par

Charu ModiDroits d'auteur :

Formats disponibles

Under the Scheme, each district had been assigned to different banks (public and private) to act as a consortium

leader to coordinate the efforts of banks in the district particularly in matters like branch expansion and credit planning. The LBS did not envisage a monopoly of banking business to Lead Bank in the District. The Lead Bank was to act as a consortium leader for co-ordinating the efforts of all credit institutions in each of the allotted districts for expansion of branch banking facilities and for meeting the credit needs of the rural economy. Banks were directed to open a large number of branches in unbanked rural and semi-urban areas.

1. Allotment of districts among the lead banks All the districts in the country excepting the metropolitan cities of Mumbai, Kolkata, Chennai and Union Territories of Chandigarh, Delhi and Goa were allotted among public sector banks and a few private sector banks. Later on, the Union Territories of Goa, Daman and Diu as also the rural areas of the Union Territories of Delhi and Chandigarh have been brought within the purview of LBS. 2. Impressionistic surveys and branch expansion The Lead Banks conducted impressionistic surveys during 1969 70 in their districts to identify the potential for branch expansion and invoke the co operation of other banks operating in the district for branch expansion and financing the various union industries. This has resulted in massive branch expansion in the unbanked and under banked areas.

3. Formation of district consultative committees (DCCs) The next important development in the history of LBS was the constitution of DCCs in all the districts, in the early seventies to facilitate co-ordination of activities of all the Banks and the financial institutions on the one hand and Government departments on the other. The DCCs were constituted in the lead districts during 1971 73.

4. District credit plan (DCP) The second and most important phase of the LBS was formulation of DCPs and their implementation. Although certain structural credit gaps were identified earlier, positive measures were introduced only after nationalization of the banks. Certain sectors which were hitherto neglected were given a priority status and banks were asked to provide credit to these sectors in a more concerted way.

5. Standing committee of DCC A task force comprising representatives of DCCBs, CBs having wide network of branches in the district and District Planning Officials was set up to assist the lead bank in the preparation of operationally meaningful DCP and AAP. This task force was converted into a Standing Committee of DCC for associating it in implementation of the plans. Its membership was enlarged to include the LDO of RBI, representative of ARDC (now District Development Managers DDM, NABARD), the Chief Executive of DRDA/ (Zilla Parishads also) and an official from the Co-operative Department, etc.

7. Lead bank officers and lead district officers

The organizational base of the Lead Banks was strengthened for preparation of DCPs and for its monitoring and implementation. RBI advised them in 1979 to appoint Lead Bank Officer (normally called Lead District Manager (LDM) in each district for the purpose. Our Lead Banks are being headed by Lead District Managers. Simultaneously, RBI appointed LDOs who were allotted 4 or 5 districts each and were entrusted with the responsibilities of overseeing the preparation and implementation of DCPs in the allotted districts. Village adoption scheme (vas) Concomitant to LBS, the other form of area approach in operation was VAS,under which bank adopted some villages in their command area for intensive lending.

9. Emergence of regional rural banks.

Nationalisation of banks was not able to bridge the entire credit gap in the rural areas. A vast majority of the small and marginal farmers and rural artisans remained untouched by the banking system. Therefore, the range of institutional alternatives was widened in 1975 by adding Regional Rural Banks (RRBs) to the banking scene which would exclusively cater to the credit demands of the hitherto neglected segment of the rural economy

10. Emergence of service area approach

There was a need to have a close look at the quality of lending. It has been observed that during the five years ended 1985-86, the gross value added in agricultural sector registered a growth rate of 2.70% per annum. The share of agriculture in the total net domestic product at factor cost (at 1970-71 prices) declined from 39.80% to 35.40%.

Lead Bank Scheme (LBS) was evolved as a framework to be more responsive to the needs of the rural economy. The objectives of the scheme cannot be achieved unless rural lending is properly tied to well designed programmers of development. This calls for effective co-operation and coordination not only between credit institutions but also between the credit institutions but also between the credit institutions on the one hand and the concerned Government and other development agencies on the other. Appropriate forums had to be created where these two agencies can meet periodically to discuss operational issues arising from the implementation of scheme evolved by both Government and the Banks. Initially forums were set up at the District and State Level.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- It Is in The Agricultural Sector That The Battle For Long Term Economic Development Will Be Won or LostDocument1 pageIt Is in The Agricultural Sector That The Battle For Long Term Economic Development Will Be Won or LostPranjal Gupta50% (2)

- Teaching Me Softly: A Syllabus For A Subject On Soft Skills: March 2015Document8 pagesTeaching Me Softly: A Syllabus For A Subject On Soft Skills: March 2015Charu ModiPas encore d'évaluation

- Marketing Management MCQDocument42 pagesMarketing Management MCQAbdul Rehman Chahal75% (4)

- Soft Skills For Business Success Deloitte Access Economics FINALDocument41 pagesSoft Skills For Business Success Deloitte Access Economics FINALWah Khaing100% (1)

- Time Value of MoneyDocument24 pagesTime Value of MoneyCharu Modi100% (1)

- Public Private PartnershipsDocument14 pagesPublic Private PartnershipsCharu ModiPas encore d'évaluation

- MCQ On Marketing ManagementDocument2 pagesMCQ On Marketing ManagementCharu Modi67% (3)

- E MarketingDocument13 pagesE MarketingCharu ModiPas encore d'évaluation

- Sales of Goods ActDocument56 pagesSales of Goods ActCharu ModiPas encore d'évaluation

- Faculty Development Program ScheduleDocument1 pageFaculty Development Program ScheduleCharu ModiPas encore d'évaluation

- Data Analysis and InterpretationDocument12 pagesData Analysis and InterpretationCharu ModiPas encore d'évaluation

- Derivatives As Risk Management Tool For CorporatesDocument86 pagesDerivatives As Risk Management Tool For CorporatesCharu ModiPas encore d'évaluation

- MAMDocument13 pagesMAMCharu ModiPas encore d'évaluation

- Subjects: Entrepreneurship Development Business EnvironmentDocument11 pagesSubjects: Entrepreneurship Development Business EnvironmentCharu ModiPas encore d'évaluation

- Mock Test Marketing Officer 29 Feb, 2012 Explanations Quantitative Aptitude (51-55) : Posts Post Post Post Post Com. I II III IVDocument9 pagesMock Test Marketing Officer 29 Feb, 2012 Explanations Quantitative Aptitude (51-55) : Posts Post Post Post Post Com. I II III IVCharu ModiPas encore d'évaluation

- Model Curriculum PGDM 060912Document154 pagesModel Curriculum PGDM 060912Charu ModiPas encore d'évaluation

- Syllabus@PGDM 1st YearDocument84 pagesSyllabus@PGDM 1st Yearmail_garaiPas encore d'évaluation

- Risk ManagementDocument27 pagesRisk ManagementCharu Modi100% (1)

- 5 IIM Graduates Who Quit Job To Become EntrepreneursDocument19 pages5 IIM Graduates Who Quit Job To Become EntrepreneursCharu ModiPas encore d'évaluation

- Fodder ScamDocument3 pagesFodder ScamCharu ModiPas encore d'évaluation

- Daftar PustakaDocument4 pagesDaftar PustakaIvana HalingkarPas encore d'évaluation

- Organic Forest Coffee in ThailandDocument7 pagesOrganic Forest Coffee in ThailandTheerasitPas encore d'évaluation

- Hairy Small-Leaf Ticktrefoil: Desmodium Ciliare (Muhl. Ex Willd.) DC. - Plant Fact Sheet - Plant Materials Center, Beltsville, MDDocument2 pagesHairy Small-Leaf Ticktrefoil: Desmodium Ciliare (Muhl. Ex Willd.) DC. - Plant Fact Sheet - Plant Materials Center, Beltsville, MDMaryland Native Plant ResourcesPas encore d'évaluation

- Project Report On Ngo in Koraput District in OdishaDocument39 pagesProject Report On Ngo in Koraput District in OdishaSambeet ParidaPas encore d'évaluation

- DanielZoharyMariaHopf 2012 DomesticationOfPlantsDocument263 pagesDanielZoharyMariaHopf 2012 DomesticationOfPlantsFrancisco Gil MuñozPas encore d'évaluation

- Za Ss 32 Farming in South Africa Map Work Caps Geography Ver 6Document5 pagesZa Ss 32 Farming in South Africa Map Work Caps Geography Ver 6OnkgopotsePas encore d'évaluation

- POTS Philippines Palm Oil Industry Road MapDocument38 pagesPOTS Philippines Palm Oil Industry Road MapfaridsidikPas encore d'évaluation

- HB 374 - Genuine Agrarian Reform BillDocument25 pagesHB 374 - Genuine Agrarian Reform BillanakpawispartylistPas encore d'évaluation

- Sustainable Agriculture - The Israeli Experience: Raanan KatzirDocument9 pagesSustainable Agriculture - The Israeli Experience: Raanan KatzirDarvvin NediaPas encore d'évaluation

- Lesson 4Document6 pagesLesson 4simmona2101Pas encore d'évaluation

- Dictionary of Agricultural Engineering 2006 EditionDocument361 pagesDictionary of Agricultural Engineering 2006 Editionvhon100% (5)

- NJ Pesticide License Training Courses For Pesticide Applicator RecertificationDocument2 pagesNJ Pesticide License Training Courses For Pesticide Applicator RecertificationRutgersCPEPas encore d'évaluation

- Chaturvedi 2015Document7 pagesChaturvedi 2015Abhishek KhobragadePas encore d'évaluation

- Chapter 101Document20 pagesChapter 101Harsha VardhanPas encore d'évaluation

- Khazana Bawali Historical Wisdom Needing Protection: Narendra ChapalgaonkarDocument5 pagesKhazana Bawali Historical Wisdom Needing Protection: Narendra ChapalgaonkarAbdul KaziPas encore d'évaluation

- Exotic PlantsDocument164 pagesExotic PlantsKenneth100% (9)

- 100% Chemical-Free Solution For Organic Farming: Where Health Is A HabitDocument2 pages100% Chemical-Free Solution For Organic Farming: Where Health Is A Habitamit4118Pas encore d'évaluation

- Conference Proceedings N Fs 1Document404 pagesConference Proceedings N Fs 1erekhajicahsheibesayonPas encore d'évaluation

- LEHNER SuperVario Brochure Engl 3 2023Document4 pagesLEHNER SuperVario Brochure Engl 3 2023Jefferson MagalhaesPas encore d'évaluation

- Vechur CowDocument3 pagesVechur CowAditya KumarPas encore d'évaluation

- Overview of Drip Irrigation: Potential, Issues and ConstraintsDocument24 pagesOverview of Drip Irrigation: Potential, Issues and ConstraintsEngr Muhammad Asif JavaidPas encore d'évaluation

- JH Ankron Vs Government of The Phil Islands CASE DIGESTsDocument2 pagesJH Ankron Vs Government of The Phil Islands CASE DIGESTsVertine Paul Fernandez Beler0% (1)

- FOREST ECOLOGY-presentationDocument13 pagesFOREST ECOLOGY-presentationAndjela Nastic100% (1)

- Lecture 6Document6 pagesLecture 6Esther Suan-LancitaPas encore d'évaluation

- FertilizerDocument220 pagesFertilizerManish Kumar ChoudharyPas encore d'évaluation

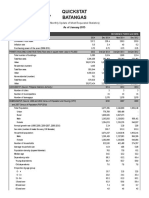

- Quickstat Batangas: (Monthly Update of Most Requested Statistics)Document5 pagesQuickstat Batangas: (Monthly Update of Most Requested Statistics)Martin Owen CallejaPas encore d'évaluation

- Spring 2022 MagazineDocument20 pagesSpring 2022 MagazineOrganicAlberta100% (1)

- GMOs Good and Bad-1Document9 pagesGMOs Good and Bad-1Jordan GriffinPas encore d'évaluation

- Botany of DMTDocument4 pagesBotany of DMTKeirra-lee Clark100% (1)