Académique Documents

Professionnel Documents

Culture Documents

EC11

Transféré par

Junaid YCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

EC11

Transféré par

Junaid YDroits d'auteur :

Formats disponibles

The discount rate often used in capital budgeting that

makes the net present value of all cash flows of a

particular project equal to zero.

Generally speaking, the higher a project's internal rate of

return, the more desirable it is to undertake the project.

As such, IRR can be used to rank several prospective

projects a firm is considering.

Assuming all other factors are equal among the various

projects, the project with the highest IRR would probably

be considered the best and undertaken first.

IRR is sometimes referred to as "economic rate of return

(ERR)".

Internal Rate of Return (IRR)

EC11

Modified Internal Rate Of Return MIRR

While the internal rate of return (IRR) assumes

the cash flows from a project are reinvested at

the IRR, the modified IRR assumes that all cash

flows are reinvested at the firm's cost of capital.

Therefore, MIRR more accurately reflects the

profitability of a project.

Internal Rate of Return: IRR

0 1 2 3

CF

0

CF

1

CF

2

CF

3

Cost Inflows

IRR is the discount rate that forces

PV inflows = cost. This is the same

as forcing NPV = 0.

( )

.

1

0

NPV

r

CF

t

t

n

t

=

+

=

( ) t

n

t

t

CF

IRR =

+

=

0 1

0.

NPV: Enter r, solve for NPV.

IRR: Enter NPV = 0, solve for IRR.

Calculate IRR

10 80 60

0 1 2 3

IRR = ?

-100.00

PV

3

PV

2

PV

1

0 = NPV

IRR = 18.13%.

40 40 40

0 1 2 3

IRR = ?

Find IRR if CFs are constant:

-100

IRR = 9.70%.

Depreciation

Depreciation may be defined as the decrease in the value

of physical assets with the passage of time as a result of

wear, deterioration and technological obsolescence.

It is used in the books of accounts for preparing a

balance sheet of assets.

Depreciation is viewed as a part of business expenses

that reduce taxable income.

Why Do We Consider Depreciation?

Depreciation Example

You purchased a car worth $15,000 at the beginning of year

2004.

D

e

p

r

e

c

i

a

t

i

o

n

End of

Year

Market

Value

Loss of

Value

0

1

2

3

4

5

$15,000

10,000

8,000

6,000

5,000

4,000

$5,000

2,000

2,000

1,000

1,000

p

Factors to Consider in Asset Depreciation

Depreciable life (how long?)

Salvage value (disposal value)

Cost basis (depreciation basis)

Method of depreciation (how?)

Salvage value is the price of an equipment

that can be obtained after it has been used.

What Can Be Depreciated?

Assets used in business or held for production of income

Assets having a definite useful life and a life longer than

one year

Assets that must wear out, become obsolete or lose value

A qualifying asset for depreciation must satisfy all of the

three conditions above.

Cost Basis

Cost of a new hole-punching

machine (Invoice price)

$62,500

+ Freight 725

+ Installation labor 2,150

+ Site preparation 3,500

Cost basis to use in depreciation

calculation

$68,875

Depreciation Methods

Straight-Line Method

Declining Balance Method

Unit Production Method

Straight Line (SL) Method

This method assumes a uniform decrease in the

value of asset with the passage of time.

Formula

Annual Depreciation

D

n

= (I S) / N, and constant for all n.

Book Value

B

n

= I n (D)

where I = cost basis/value

S = Salvage value

N = depreciable life

Book value is the

worth of an asset as

shown on the

accounting record of a

company.

Example Straight Line Method

D1

D2

D3

D4

D5

B1

B2

B3

B4

B5

$10,000

$8,000

$6,000

$4,000

$2,000

0

1 2 3 4 5

T

o

t

a

l

d

e

p

r

e

c

i

a

t

i

o

n

a

t

e

n

d

o

f

l

i

f

e

n D

n

B

n

1 1,600 8,400

2 1,600 6,800

3 1,600 5,200

4 1,600 3,600

5 1,600 2,000

I = $10,000

N = 5 Years

S = $2,000

D = (I - S)/N

Annual Depreciation

Book Value

n

Declining Balance Method

In this method the depreciation cost is highest in the

first year and reduces year after year.

Formula

Annual Depreciation

Book Value

1

=

n n

B D o

1

) 1 (

=

n

I o o

n

I B ) 1 ( o =

where 0 < o < 2(1/N)

Note: if o is chosen to be the upper bound, o = 2(1/N),

we call it a 200% DB or double declining balance method.

n

n

Example Declining Balance Method

D1

D2

D3

D4

D5

B1

B2

B3

B4

B5

$10,000

$8,000

$6,000

$4,000

$2,000

0

1 2 3 4 5

T

o

t

a

l

d

e

p

r

e

c

i

a

t

i

o

n

a

t

e

n

d

o

f

l

i

f

e

$778

Annual Depreciation

Book Value

n

0

1

2

3

4

5

D

n

$4,000

2,400

1,440

864

518

B

n

$10,000

6,000

3,600

2,160

1,296

778

I

N

S

D B

I

B I

n n

n

n

n

= $10,

= years

= $778

=

= ( -

000

5

1

1

1

1

o

o o

o

)

=

( )

n

o =.40

Example Declining Balance Method (if B<salvage value)

D1

D2

D3

D4

B1

B2

B3

B4

B5

$10,000

$8,000

$6,000

$4,000

$2,000

0

1 2 3 4 5

T

o

t

a

l

d

e

p

r

e

c

i

a

t

i

o

n

a

t

e

n

d

o

f

l

i

f

e

$778

Annual Depreciation

Book Value

n

0

1

2

3

4

5

D

n

$4,000

2,400

1,440

160

0

B

n

$10,000

6,000

3,600

2,160

2000

2000

I

N

S

D B

I

B I

n n

n

n

n

= $10,

= years

= $778

=

= ( -

000

5

1

1

1

1

o

o o

o

)

=

( )

n

2000

When S = $2,000

End of

Year

Depreciation Book Value

1 0.4($10,000) = $4,000 $10,000 - $4,000 = $6,000

2 0.4(6,000) = 2,400 6,000 2,400 = 3,600

3 0.4(3,600) = 1,440 3,600 1,440 = 2,160

4 0.4(2,160) = 864 > 160 2,60 160 = 2,000

5 0 2,000 0 = 2,000

Note: Tax law does not permit us to depreciate assets below

their salvage values.

Units-of-Production Method

Principle

Service units will be consumed in a non

time-phased fashion

Formula

Annual Depreciation

D

n

= Service units consumed for year

total service units

(I - S)

Example

Given: I = $55,000, S = $5,000, Total service

units = 250,000 miles, usage for this year =

30,000 miles

Solution:

30, 000

($55, 000 $5, 000)

250, 000

3

($50, 000)

25

$6, 000

Dep =

| |

=

|

\ .

=

Break-Even is the output level where total costs

equal total revenue.

Break-even analysis is a technique

used to estimate the number of units

which must be produced and sold for

a project to break-even.

Break Even Analysis

In business, revenue or revenues is income that a

company receives from its normal business

activities.

Profits or net income generally imply total

revenue minus total expenses in a given period.

Break-even analysis provides a simple

means of measuring profits and losses at

different levels of output

With this simple technique, a manager can

calculate the effect of different marketing

strategies and different pricing strategies on

the business.

The break-even point gives a business an

initial target at which to aim.

Drawing a Break-Even Chart

Quantity

Fixed costs

Total costs

Sales revenue

Break-even

output

Break-even

sales

break-

even

point

At the break-even point, total sales = total cost

(i.e. no profit or loss is made)

Margin of Safety

x units

Break-even

output

margin of

safety

The difference between actual output and the break-

even output is known as the margin of safety.

Break-Even Point

The point at which total costs are covered

and no profit or loss is made is called the

break-even point

the break-even point is where the total

revenue and total cost lines intersect on the

chart

this can also be calculated using the formula:

BEP = fixed costs

contribution per unit

To work out break-even we need to know various bits of information:

The price you are charging

The variable costs (direct costs) of each unit - these are the

costs of raw materials, labour and so on that can be directly

attributed to each unit.

The fixed costs (or indirect costs/overheads) - these are the

costs that stay the same whatever the level of output and will

be things like rent, marketing costs, admin costs and so on.

Once we have this information, we can work out the break-even

level of output. Let's look at an example:

Break-Even Calculation

Assuming that a product has a selling price of

6. Variable costs are 1 per unit and fixed

costs are 50,000 per year

Calculate the number of units that a firm must

sell in order to break-even

Answer - 50,000 = 1000 units

5

Uses of Break-Even Analysis

To calculate the minimum amount of sales required

in order to be able to break even

To see how changes in output, selling price or costs

will affect profit levels

To calculate the level of output required to reach a

certain level of profit

To allow various scenarios (what-if) to be tested out

To aid forecasting and planning

Limitations of break-even analysis

Its accuracy depends upon the accuracy of the data

used

Forecasting the future is difficult, especially long

term

It assumes there is a simple relationship between

variable costs and sales

Sales income does not necessarily rise in a constant

relationship to sales volume

Break-even does not specify a time that it will take

to reach this level. This will depend on how quickly

sales are generated.

Vous aimerez peut-être aussi

- RTS DC Servo DriveDocument4 pagesRTS DC Servo DriveJunaid YPas encore d'évaluation

- FluidsDesignProjectReport DesDocument9 pagesFluidsDesignProjectReport DesJunaid YPas encore d'évaluation

- Asme JMDDocument6 pagesAsme JMDJunaid YPas encore d'évaluation

- SolidWorks MotionDocument1 pageSolidWorks MotionJunaid YPas encore d'évaluation

- Field Representation:: Kinematics of The MotionDocument7 pagesField Representation:: Kinematics of The MotionJunaid YPas encore d'évaluation

- New Microsoft Office Word DocumentDocument11 pagesNew Microsoft Office Word DocumentJunaid YPas encore d'évaluation

- 9 ICMS Instructions For AuthorsDocument3 pages9 ICMS Instructions For AuthorsJunaid YPas encore d'évaluation

- Ce Lec06Document28 pagesCe Lec06Junaid YPas encore d'évaluation

- Ce Lec05 (Ocms)Document7 pagesCe Lec05 (Ocms)Junaid YPas encore d'évaluation

- Project Report 31Document21 pagesProject Report 31Junaid YPas encore d'évaluation

- Die Casting 1Document11 pagesDie Casting 1Junaid YPas encore d'évaluation

- FEEDCON - Lesson 08 - Closed-Loop Control Systems Part 2Document36 pagesFEEDCON - Lesson 08 - Closed-Loop Control Systems Part 2Junaid YPas encore d'évaluation

- Control Engineering: Assistant Professor, UET TaxilaDocument18 pagesControl Engineering: Assistant Professor, UET TaxilaJunaid YPas encore d'évaluation

- Ce Lec04Document11 pagesCe Lec04Junaid YPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaPas encore d'évaluation

- LICDocument82 pagesLICTinu Burmi Anand100% (2)

- Defeating An Old Adversary Cement Kiln BallsDocument5 pagesDefeating An Old Adversary Cement Kiln BallsManish KumarPas encore d'évaluation

- U.S. Pat. 9,514,727, Pickup With Integrated Contols, John Liptac, (Dialtone) Issued 2016.Document39 pagesU.S. Pat. 9,514,727, Pickup With Integrated Contols, John Liptac, (Dialtone) Issued 2016.Duane BlakePas encore d'évaluation

- STM Series Solar ControllerDocument2 pagesSTM Series Solar ControllerFaris KedirPas encore d'évaluation

- Legal Ethics HW 5Document7 pagesLegal Ethics HW 5Julius Robert JuicoPas encore d'évaluation

- Communication On The Telephone InfoDocument30 pagesCommunication On The Telephone Infomelese100% (1)

- Milestone 9 For WebsiteDocument17 pagesMilestone 9 For Websiteapi-238992918Pas encore d'évaluation

- Intro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Document5 pagesIntro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Thăng Nguyễn BáPas encore d'évaluation

- Bill Swad's Wealth Building Strategies - SwadDocument87 pagesBill Swad's Wealth Building Strategies - Swadjovetzky50% (2)

- Sealant Solutions: Nitoseal Thioflex FlamexDocument16 pagesSealant Solutions: Nitoseal Thioflex FlamexBhagwat PatilPas encore d'évaluation

- 9.admin Rosal Vs ComelecDocument4 pages9.admin Rosal Vs Comelecmichelle zatarainPas encore d'évaluation

- Insurance Smart Sampoorna RakshaDocument10 pagesInsurance Smart Sampoorna RakshaRISHAB CHETRIPas encore d'évaluation

- Elliot WaveDocument11 pagesElliot WavevikramPas encore d'évaluation

- Lenskart SheetDocument1 pageLenskart SheetThink School libraryPas encore d'évaluation

- Writing Task The Strategy of Regional Economic DevelopementDocument4 pagesWriting Task The Strategy of Regional Economic DevelopementyosiPas encore d'évaluation

- 1980WB58Document167 pages1980WB58AKSPas encore d'évaluation

- Heat TreatmentsDocument14 pagesHeat Treatmentsravishankar100% (1)

- SQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFDocument13 pagesSQL Datetime Conversion - String Date Convert Formats - SQLUSA PDFRaul E CardozoPas encore d'évaluation

- MWG Installation 7.6.2 IG INSTALLATION 0516 en - PDDocument64 pagesMWG Installation 7.6.2 IG INSTALLATION 0516 en - PDjbondsrPas encore d'évaluation

- 87 - Case Study On Multicomponent Distillation and Distillation Column SequencingDocument15 pages87 - Case Study On Multicomponent Distillation and Distillation Column SequencingFranklin Santiago Suclla Podesta50% (2)

- White Button Mushroom Cultivation ManualDocument8 pagesWhite Button Mushroom Cultivation ManualKhurram Ismail100% (4)

- TT Class XII PDFDocument96 pagesTT Class XII PDFUday Beer100% (2)

- The Finley ReportDocument46 pagesThe Finley ReportToronto StarPas encore d'évaluation

- V Series: Three Wheel, Counterbalanced Lift TruckDocument126 pagesV Series: Three Wheel, Counterbalanced Lift TruckВиктор МушкинPas encore d'évaluation

- TQM BisleriDocument27 pagesTQM BisleriDishank ShahPas encore d'évaluation

- QuizDocument11 pagesQuizDanica RamosPas encore d'évaluation

- Quality in CRDocument10 pagesQuality in CRkaushikcrPas encore d'évaluation

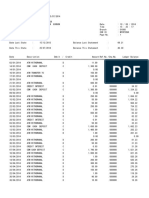

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDocument1 pageItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranPas encore d'évaluation

- Portfolio Report Zarin Tasnim Tazin 1920143 8Document6 pagesPortfolio Report Zarin Tasnim Tazin 1920143 8Fahad AlfiPas encore d'évaluation