Académique Documents

Professionnel Documents

Culture Documents

Partnership Act 1932 New Slides

Transféré par

Arsalan Ali KhowajaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Partnership Act 1932 New Slides

Transféré par

Arsalan Ali KhowajaDroits d'auteur :

Formats disponibles

1932

Content

INTRODUCTION SALIENT FEATURES

PG no.

4

5 HOW PARTNERSHIP REGISTERED 6 PROCEDURE HOW PARTNERSHIP FORMED 9 AGGREEMENT 10 ESSENTIALS RIGHTS AND DUTIES OF PARTNERS 13 RIGHTS AND DUTIES

Section-4 of a partnership as the relation between persons who agreed to share profit of a business carried on by all, or by any of them acting for all. According to sir F.POLLOCK,A partnership is the relation which subsist between the persons who have agreed to share the profits of a business carried on by all, or any of them on behalf of all of them.

SALIENT FEATURES:To constitute a partnership. There must be a

contract at least two persons are required. The partnership act does not lay down any maximum number of partners. According to section-11 of the company act ,a partnership for a banking business must not have more than ten partners. For other business ,partners must not have more than twenty partners. There must be an agreement between the partners to share the profit(including negative

HOW PARTNERSHIP REGISTERED:A registered partnership firm is one which is duly

registered with the registrar of firms, in ac procedure laid section-58. accordance with the down under

PROCEDURE:The following are the procedure for registration of partnership firm:It must be registered, any time, with the registrar

of firm of the area where the business of the firm is situated, or is proposed to be situated.

A detail statement must be sent to the registrar of

firms of the respective area on a form, prescribed for the purpose along with the amount of the fee, prescribed for registration.

The prescribe forms contains all details

PROCEDURE:The statement must be sign by all the

partners personally, or by there agent on there behalf, specially authorized for the purpose. All such signature (i.e. of their agents),must be verified as well. Such statement may be sent by post or may be delivered personally to the registrar of firms concerned.

HOW PARTNERSHIP FORMED:ORAL OR WRITTEN AGREEMENT- As per normal

provision of contract, a partnership can be formed by written or oral agreement SHARING OF PROFIT NECESSARYThe partners must come together to Share profit NUMBER OF PARTNERS- There must be minimum two partners. MUTUAL AGENCY IS THE REAL TEST - The real test of partnership firm is mutual agency, i.e. whether a partner can bind the firm by his act, i.e. whether he can act as agent of all other partners.

AGREEMENT:NAME OF THE BUSINESS:-Name of the

business should be specified with the partners. TERM:-Business date should be specified and shall start the business either it will terminated.

CAPITAL:-The capital of the partnership

shall be contributed in cash by the partners. PROFIT AND LOSS:- The net profits of the

partnership shall be divided equally between

AGREEMENT:SALARIES AND WITHDRAWLS:-Neither partner

shall receive any salary for services rendered to the partnership. Each partner may, from time to time, withdraw the credit balance in their income account. DUTIES AND RESTRICTION:-The partners shall have equal rights in the management of the partnership business, and each partner shall devote their entire time to the conduct of the business. BANKING:-All funds of the partnership shall be deposited in its name in such checking account or accounts as shall be

AGREEMENT:BOOKS:-The partnership books shall be maintained at

the principal office of the partnership, and each partner shall at all times have access thereto. VOLUNTARY TERMINATION:-The partnership may be dissolved at any time by agreement of the partners, in which event the partners shall proceed with reasonable promptness to liquidate the business of the partnership. DEATH:-Upon the death of either partner, the surviving partner shall have the right either to purchase the interest of the decedent in the partnership or to terminate and liquidate the partnership business.

ESSENTIALS:ASSOCIATION OF TWO OR MORE PERSON

MUST EMERGE OUT OF AN AGREEMENT. MINOR CANNOT BE MEMBER OFA

PARTNERSHIP PARTICULAR PARTNERSHIP MUST BE TO CARRY ON SOME BUSINESS MUST BE TO SHARE THE PROFIT OF THE BUSINESS ACTIVE PARTNERS AND SLEEPING PARTNERS PARTNERS AS AGENT OR PRINCIPAL OF OTHER PARTNERS

RIGHTS of a partner:Right to take part in the conduct of the business of

the firm. Right to share equally the profit of the firm. Right to express his opinion on any matter. Right to be the joint owner of the property of the firm. Right to take in an emergency all such action as are reasonably necessary to protect the firm from any loss. Right not to be expelled. Right to retire. Right to carry on an competing business, but only after retirement. Right as an retiring partner to share subsequent

DUTIES of a partner: It is the duty of each partner to indemnify the firm

for the losses caused to it due to the fraud committed by him during the conduct of the firms business. Partner is duty-bound not to carry on any business other than the firms own business, so long as he continues to be a partner of that firm, if he is restrained by an agreement to this effect with the other partners. It is the partners duty to indemnify the firm for any losses suffered by it, due to his willful negligence in the conduct of the firms business.

DUTIES of a partner: A partner is duty-bound to account for all the

profits that he makes, even secretly, from any transaction of the firm, or from the use of any of the properties of the firm, or the business connections of the firm, or even by using the name of the firm. In case a partner happens to carry on some business that competes with the firms own business, he will have to account for and pay to the firm all the profits made by him in that competing business. A partner is duty-bound not to assign his own share to some outside party, the partnership itself

COMPANY VS PARTNERSHIP: Formation: A company is created by

registration under the Companies Act. A partnership is created by agreement

COMPANY VS PARTNERSHIP:NUMBER OF MEMBERS: A private company must

have at least two members and maximum 50 members. A partnership cannot consist of more than 20 persons (10 persons in case of banking business). MANAGEMENT: Members of a company are not entitled to take part in the management of the company unless they become directors. Partners are entitled to share in the management of the firm unless the articles provide otherwise. AGENCY:A member of a company is not an agent of the company or that of other members . Each

COMPANY VS PARTNERSHIP:LIABILITY OF MEMBERS: The liability of a member

of a company may be limited by shares or by guarantee. The liability of a partner is unlimited. POWER: The company can only operate within the objects laid down in the memorandum of association, though these can be altered to some extent by special resolution. Partners may carry on any business as they please so long as it is not illegal and make whatever arrangements they wish with regard to the running of the firm from time to time. TERMINATION: No one member of a company can

SHARING OF PROFIT:The partners must come together to share profits. Thus, if one member gets only fixed remuneration (irrespective of profits) or one who gets only interest and no profit share at all, is not a partner. - Similarly, sharing of receipts or collections (without any relation to profits earned) is not sharing of profit and the association is not partnership. For example, agreement to share rents collected or percentage of tickets sold is not partnership, as sharing of profits is not involved. - - The share need not be in proportion to funds contributed by each partner. - Interestingly, though sharing of profit is essential,

ACCOUNTING TREATMENT: No salary or commission is payable to the partner for

participating in the business.

Sharing profits and losses equally, unless mention

in the deed. No interest is payable on capital, unless mention in the deed. It is only payable on profit. Interest on loan given by partners at 6%p.a. unless mention in the deed. It is payable even if there is no profits. No interest is payable on drawings unless mention in the deed.

DISSOLUTION OF PARTNERSHIP FIRM: By mutual agreement;

By notice of dissolution; By operation of law; By the happening of certain contingencies; By a decree of the court

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- AGREEMENT TO SELL HUDA BlankDocument4 pagesAGREEMENT TO SELL HUDA BlankSachin goel100% (2)

- Sale Deed for Flat TransferDocument4 pagesSale Deed for Flat Transfermailmahendar90% (20)

- POA (Power of Attorney)Document5 pagesPOA (Power of Attorney)Siva PrasadPas encore d'évaluation

- MotivationDocument43 pagesMotivationArsalan Ali KhowajaPas encore d'évaluation

- Heirs of Gregorio Lopez VsDocument7 pagesHeirs of Gregorio Lopez VsdaryllPas encore d'évaluation

- Law On Agency NotesDocument6 pagesLaw On Agency NotesRolly Pagtolon-anPas encore d'évaluation

- A Short History of Human RightsDocument4 pagesA Short History of Human RightsHelplife HerbPas encore d'évaluation

- Merger AgreementDocument4 pagesMerger AgreementRocketLawyerPas encore d'évaluation

- Republic Act 9208 or The Anti-Trafficking in PersonsDocument23 pagesRepublic Act 9208 or The Anti-Trafficking in PersonsAmy Lou Cabayao0% (1)

- Sales of Good (Answer SC (1) (1ii) )Document4 pagesSales of Good (Answer SC (1) (1ii) )zizul86100% (4)

- 12 Heirs of Dela Rosa V Batongbacal GR No 179205Document1 page12 Heirs of Dela Rosa V Batongbacal GR No 179205mark anthony mansueto100% (1)

- Chapter 9 Profit Planning SolutionDocument8 pagesChapter 9 Profit Planning SolutionArsalan Ali Khowaja67% (3)

- Financial Ratio AnalysisDocument47 pagesFinancial Ratio AnalysisArsalan Ali KhowajaPas encore d'évaluation

- Parts of Speech ActivityDocument1 pageParts of Speech ActivityArsalan Ali KhowajaPas encore d'évaluation

- Parts of Speech ActivityDocument1 pageParts of Speech ActivityArsalan Ali KhowajaPas encore d'évaluation

- G.R. No. 158891 June 27, 2012 PABLO P. GARCIA, Petitioner, Yolanda Valdez Villar, RespondentDocument9 pagesG.R. No. 158891 June 27, 2012 PABLO P. GARCIA, Petitioner, Yolanda Valdez Villar, RespondentKatherine OlidanPas encore d'évaluation

- Sales - 2nd WeekDocument10 pagesSales - 2nd WeekCharlene Joy Bumarlong QuintosPas encore d'évaluation

- Seventh Day AdventistDocument2 pagesSeventh Day AdventistrozePas encore d'évaluation

- Ugovor o PovjerljivostiDocument1 pageUgovor o PovjerljivostiDalibor KunicPas encore d'évaluation

- History of Land Tenure in EnglandDocument3 pagesHistory of Land Tenure in EnglandissaPas encore d'évaluation

- Partnership & AgencyDocument10 pagesPartnership & AgencyJhazreel BiasuraPas encore d'évaluation

- Chennai Apartment 1302Document7 pagesChennai Apartment 1302sijo jacobPas encore d'évaluation

- African Human Rights System - Docx Assignment For Human Rights LawDocument3 pagesAfrican Human Rights System - Docx Assignment For Human Rights LawMERCY LAW100% (1)

- October NewsletterDocument2 pagesOctober NewsletterRayWhite TownsvilleCityPas encore d'évaluation

- Agreement For Hire-Purchase of MachineryDocument4 pagesAgreement For Hire-Purchase of MachineryDivine LitigationPas encore d'évaluation

- Justa Guido vs. Rural Progress AdministrationDocument2 pagesJusta Guido vs. Rural Progress AdministrationBea CapePas encore d'évaluation

- PNB Liable for Failing to Verify Property StatusDocument2 pagesPNB Liable for Failing to Verify Property StatusVon Lee De LunaPas encore d'évaluation

- Guidelines for Determining Capital vs Ordinary Real Estate AssetsDocument6 pagesGuidelines for Determining Capital vs Ordinary Real Estate AssetsJames Estrada CastroPas encore d'évaluation

- GVJ Board ResolutionDocument2 pagesGVJ Board ResolutionAlbert RainierPas encore d'évaluation

- Property Art 440-465Document7 pagesProperty Art 440-465nbalanaPas encore d'évaluation

- Settlement of EstateDocument20 pagesSettlement of EstateBianca SapugayPas encore d'évaluation

- Guerrero v. Yñigo (1954)Document2 pagesGuerrero v. Yñigo (1954)Gain DeePas encore d'évaluation

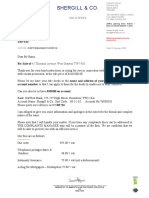

- S00101 Shergill and Co. Client Care Letter 19jul2021 12 38Document4 pagesS00101 Shergill and Co. Client Care Letter 19jul2021 12 38Sanveer BainsPas encore d'évaluation

- Funda NewDocument8 pagesFunda NewSourav SutradharPas encore d'évaluation

- Joint Circular No. 1Document1 pageJoint Circular No. 1Jasper Dela PenaPas encore d'évaluation