Académique Documents

Professionnel Documents

Culture Documents

Types of Bank Laws Presentation - Unitedworld School of Business

Transféré par

Unitedworld School Of BusinessCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Types of Bank Laws Presentation - Unitedworld School of Business

Transféré par

Unitedworld School Of BusinessDroits d'auteur :

Formats disponibles

CHARACTERS & CLASSIFICATIONS OF COMMERCIAL BANK SCHEDULED BANK COOPERATIVE BANK FOREIGN BANK

The Banking Regulation Act, 1949, defines banking as accepting for the

purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise and withdraw able by cheque, draft, order otherwise. Commercial banks are like other financial institution (e.g. ,money lenders, Indigenous bankers, cooperative societies, agricultural and industrial credit institution). Which are in the business of lending and borrowing of money or credit.

The operations of all these banks are regulated by the Reserve Bank of

India, which is the central bank and supreme financial authority in India. The main source of income of a commercial bank is the difference between these two rates which they charge to borrowers and pay to depositors.

Commercial banks are the primary vehicle through which credit and

monetary policies are transmitted to the economy. Credit and monetary policies are implemented through action on bank reserves (cash and statutory liquidity ratios), margin requirements and the rate at which scheduled banks can borrow from the RBI. These affect the supply, availability and cost of credit at banks.

The nature of lending and investing by commercial banks is multi-

functional.

They deal in a wide variety of assets and accommodate different types of

borrowers.

They facilitate the spread of the impact of monetary policy to non-bank

lenders and to other sections of the economy.

The operations of commercial banks are highly flexible since they provide

facilities for financing different types of borrowers which enables them to channel funds according to specified priorities and purposes

Scheduled banks :- Banks which have been included in the Second

Schedule of RBI Act 1934. Public Sector Banks :- are those banks in which majority of stake is held by the government. E.g.. SBI, PNB, Syndicate Bank, Union Bank of India etc. Private Sector Banks :- are those banks in which majority of stake is held by private individuals. E.g.. ICICI Bank, IDBI Bank, HDFC Bank, AXIS Bank etc. Foreign Banks :- are the banks with Head office outside the country in which they are located. E.g.. Citi Bank, Standard Chartered Bank, Bank of Tokyo Ltd. etc.

Scheduled Banks in India constitute those banks which have been included

in the Second Schedule of Reserve Bank of India(RBI) Act, 1934. RBI in turn includes only those banks in this schedule which satisfy the criteria laid down vide section 42 (6) (a) of the Act. The banks included in this schedule list should fulfil two conditions. 1. The paid capital and collected funds of bank should not be less than Rs. 5 lakh. 2.Any activity of the bank will not adversely affect the interests of depositors.

Every Scheduled bank enjoys the following facilities.

1. Such bank becomes eligible for debts/loans on bank rate from the RBI 2. Such bank automatically acquire the membership of clearing house.

A Co-operative bank, as its name indicates is an institution consisting of a number of individuals who join together to pool their surplus savings for the purpose of eliminating the profits of the bankers or moneylenders with a view to distributing the same amongst the depositors and borrowers.

Co-operative banks in India came into existence with the enactment of the

Agricultural Credit Co-operative Societies Act in 1904. Co-operative bank form an integral part of banking system in India. Under the act of 1904, a number of co-operative credit societies were started. Owing to the increasing demand of co-operative credit, anew act was passed in 1912, which was provided for establishment of co-operative central banks by a union of primary credit societies and individuals.

The Co-operative banking structure in India comprises of: 1. Urban Co-operative Banks 2. Rural Co-operatives

Some co-operative banks are scheduled banks, while others are nonscheduled banks. For instance, State Co-operative banks and some Urban Co-operative banks are scheduled banks but other co-operative banks are non-scheduled banks

The term Urban Co-operative Banks (UCBs), though not formally defined,

refers to primary cooperative banks located in urban and semi-urban areas. These banks, till 1996, were allowed to lend money only for non-agricultural purposes. This distinction does not hold today. These banks were traditionally centred around communities, localities work place groups. They essentially lent to small borrowers and businesses. Today, their scope of operations has widened considerably. The origins of the urban cooperative banking movement in India can be traced to the close of nineteenth century when, inspired by the success of the experiments related to the cooperative movement in Britain and the cooperative credit movement in Germany such societies were set up in India. Cooperative societies are based on the principles of cooperation, - mutual help, democratic decision making and open membership. Cooperatives represented a new and alternative approach to organisaton as against proprietary firms, partnership firms and joint stock companies which represent the dominant form of commercial organisation.

Rural Cooperative Banking and Credit Institutions play an important role in meeting the growing credit needs of rural India. The volume of credit flowing through these institutions has increased. The performance of these institutions, however (apparent in the share of total institutional credit and the indicators of their financial health), has been less than satisfactory and is deteriorating rapidly. Of late, a number of Committees have gone into the reasons for this situation and suggested remedial measures, but there has been little progress in implementing their recommendations.

Foreign Banks in India always brought an explanation about the prompt

services to customers. After the set up foreign banks in India, the banking sector in India also become competitive and accurative. New rules announced by the Reserve Bank of India for the foreign banks in India in this budget has put up great hopes among foreign banks which allows them to grow unfettered. Now foreign banks in India are permitted to set up local subsidiaries. The policy conveys that forign banks in India may not acquire Indian ones (except for weak banks identified by the RBI, on its terms) and their Indian subsidiaries will not be able to open branches freely. Please see the list of Foreign banks in India till date.

Commercial banks engage in the following activities: Processing of payments by way of telegraphic transfer, EFTPOS(electronic

fund transfer point of sale), internet banking, or other means. Issuing bank drafts and bank cheques. Accepting money on term deposit. Lending money by overdraft, installment loan, or other means. Providing documentary and standby letter of credit, guarantees, performance bonds, securities underwriting commitments and other forms of off balance sheet exposures.

Safekeeping of documents and other items in safe deposit boxes. Sales, distribution or brokerage, with or without advice, of: insurance, unit

trusts and similar financial products as a financial supermarket. Cash management and treasury. Merchant banking and private equity financing. Traditionally, large commercial banks also underwrite bonds, and make markets in currency, interest rates, and credit-related securities, but today large commercial banks usually have an investment bank arm that is involved in the mentioned activities.

A bill of exchange is an instrument in writing containing an unconditional

order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of , a certain person or to the bearer of the instrument. ESSENTAIL ELEMENTS OF A BILL OF EXCHANGE Writing: It must be in writing and may be in any language, and in any form. Parties: The must be three parties to the bill of exchange, for example, Drawer, Drawee and Payee. The person who draws a bill is called a Drawer or Maker. The person on whom the bill is drawn is called a Drawee and the person to whom the money is paid is called Payee.

Payee: section 7 defines Payee as the person named in the instrument, to

whom or to whose order the money is, by the instrument directed to be paid. It is not necessary that the three parties should be three distinct persons. One person can play the role of two, for example, one person can be the drawer and payee or drawee and payee acting in two different capacities. However, drawer and drawee cannot be the same person as the person cannot order himself the payment. There should, therefore, be at least two distinct persons. In any case, three parties must be pointed out in the bill with reasonable certainty. There may be joint drawers or joint payees, but bill cannot be addressed to two or more drawees in the alternative.

Order to pay: The bill of exchange must contain an order by the drawer to

drawee to pay under any circumstances. Only excessive politeness will not construe an order to pay and the instrument would not be a bill of exchange. Unconditional: The order in the bill must be unconditional, for example, payable under all events and circumstances. A promise or order to pay is not conditional simply because the time for payment of the amount or any instalment thereof being expressed to be payable on the lapse of a certain period after the happening of a specified event which, according to the ordinary expectation of mankind, is certain to happen although the time of its happening may be uncertain. Conditional bill is invalid. Signed: The bill must be signed by the drawer.

Person directed, for example, the drawee must be certain: The order to

pay must be directed to a certain person. Certainty of the drawee helps the payee to present the bill for acceptance or payment to a certain person and also helps the drawee to know whether it is addressed to him or not. Drawee must be designated with reasonable ceetainty. Money: The order must be to pay money only. Payee must be certain: It must be payable to a definite person or his order. The payee must be certain. Bill may be made payable to two or more payees jointly or in the alternative. Certain sum: The sum payable must be certain. The sum payable must be certain although it includes future interest or is payable at an indicated rate of exchange, or is according to the course of exchange. What the section indicates is that the principal sum payable must be certain. Stamping: Bill of exchange is chargeable

Order to pay: The bill of exchange must contain an order by the drawer to

drawee to pay under any circumstances. Only excessive politeness will not construe an order to pay and the instrument would not be a bill of exchange. Unconditional: The order in the bill must be unconditional, for example, payable under all events and circumstances. A promise or order to pay is not conditional simply because the time for payment of the amount or any instalment thereof being expressed to be payable on the lapse of a certain period after the happening of a specified event which, according to the ordinary expectation of mankind, is certain to happen although the time of its happening may be uncertain. Conditional bill is invalid. Signed: The bill must be signed by the drawer.

Person directed, for example, the drawee must be certain: The order to

pay must be directed to a certain person. Certainty of the drawee helps the payee to present the bill for acceptance or payment to a certain person and also helps the drawee to know whether it is addressed to him or not. Drawee must be designated with reasonable ceetainty. Money: The order must be to pay money only. Payee must be certain: It must be payable to a definite person or his order. The payee must be certain. Bill may be made payable to two or more payees jointly or in the alternative. Certain sum: The sum payable must be certain. The sum payable must be certain although it includes future interest or is payable at an indicated rate of exchange, or is according to the course of exchange. What the section indicates is that the principal sum payable must be certain. Stamping: Bill of exchange is chargeable with stamp duty.

A promissory note is a negotiable instrument, wherein the one party (the issuer or maker) make an unconditional promise to pay a determined sum of money to the other (the payee), either at a fixed or determined future time, or on the demand of the payee under specific terms.

Writing: The promissory note must be in writing. Oral engagements or

promise is excluded. Undertaking to pay: It is not necessary to use the word promise but the intention must clearly show an unconditional undertaking to pay the amount. Eg: I owe you Rs. 3500. This is not a promissory note. UNCONDITIONAL: Promise to pay should be unconditional. A conditional instrument is invalid. It must be certain of payment. Eg: - I promise to pay you Rs.2500 when you will score 85% in your exams. (conditional promissory note) -I will pay you Rs.2500 on 28 october,2012 (unconditional promissory note)

SIGNED: The instrument must be signed by the maker thereof. Person must

sign with his free consent. It should not only be a physical act but also a mental act with an intention to sign. CERTAIN PERSON: Two different persons should fill in the role of maker and payee. A note cannot be made payable to the maker himself. Eg: A promissory note payable to my own son living in london is a valid promissory note. SPECIFIC SUM: The sum promised to be paid must be certain and specific. Eg: I promise to pay you Rs. 1 lakh and all other sum due to you. Stamping: Promissory notes are chargeable with stamp duty.it is advisable to cancel the stamps with makers signature or initials.

A cheque is a bill of exchange drawn on a specified banker

and not expressed to be payable otherwise than on demand. It includes the electronic image of a truncated cheque and a cheque in the electronic form.

A cheque is drawn on a banker only, while bill of exchange can be drawn on

any one.

Cheque has three parties:

drawer, drawee, payee

A bill of exchange is wider than cheque. Therefore, all cheques are bills of

exchange but all bills of exchange are not cheques.

A cheque does not require acceptance.

There is no privity of contract between the payee and the banker.

The banker is liable only to the drawer. Drawing of a cheque is simplya direction to pay. A cheque is not invalid because it is post-dated or anti-dated.

A cheque is payable only on demand and on presentation.

Vaild for period of six months. It may be drawn on Sunday or holiday.

1. Bearer or open cheques: These cheques are payable at the counter of drawee banker on presentment. As the bearer cheques carry risk of being lost or stolen and the finder may be able to get it encashed, crossing of cheques avoids such a contigency and secure payments.

2. Crossed cheques: crossing of cheques is of different types

cheques crossed generally: (SEC 123) when It has two transverse parallel lines marked across its face; or It bears an abbreviation & Co. between the two parallel lines; or It bears the word not negotiable between the two parallel lines.

CHEQUE CROSSED SPECIALLY: (SEC 124 & 126) Where a cheque is crossed by two parallel transverse lines and the name of the banker is written between the two parallel lines,with or without the words, not negotiable it is called Special crossing (Sec. 124) It may be noted that two transverse parallel lines are not necessary in special crossing. The banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed, or his agents for collection. (Sec.126)

Cheque bearing not negotiable: (Sec.130) A cheque bearing not negotiable is deprived of the main feature of negotiability. it, however, does not render the instrument non-transferable. Such cheques can be transferred but the Transferee dose not acquire the right of a holder in due course. The object of not negotiable crossing is to afford protection to the drawer against dishonesty, loss or theft in the course of transit.

Hundis are negotiable instruments written in an original language. They are sometimes bills of exchange and sometimes promissory notes, and are not covered under the Negotiable Instruments Act,1881. Generally, they are governed by the customs and usages in the locality but if custom is silent on the point of dispute before the court, this Act applies to the Hundis. The term Hundi was formerly applicable to native bills of exchange. The promissory notes were then called teep. The hundis were in circulation in India even before the present Negotiable Instrument Act,1881 came into operations. Its usage varies with the locality in which they were in circulation.

SHAH JOG HUNDI SHAH means a respectable and responsible person or a man of worth in the bazar. Shah Jog Hundi means a hundi which is payable only to a respectable holder, as opposed to a hundi payable to bearer. JOKHMI HUNDI A JOKHMI hundi is always drawn on or against goods shipped on the vessel mentioned in the hundi. It implies a condition that money will be paid only in the event of arrival of the goods against which the hundi is drawn. It is in the nature of policy of insurance. The difference, however, is that money is paid before hand and is to be recovered if the ship arrives safely.

NAM JOG HUNDI It is a hundi payable to the party named in the bill or his order. The name of the payee is specifically inserted in the hundi. It can also be negotiated like a bill of exchange. Its alteration into a Shah Jog hundi is a material alteration and renders it void. DARSHANI HUNDI this is a hundi payable at sight. It is freely negotiable and the price is regulated by demand and supply. They are payable on demand and must be presented for payment within a resonable time after they are received by the holder.

MIADI HUNDI This is otherwise called MUDDATI hundi, that is payable after a specified period of time. Usually money is advanced against these hundis by shroffs after deducting the advance for the period in advance. There are other forms of hundis also like: DHANI HUNDI- A hundi that is payable to the dhani (owner) FIRMAN HUNDI- which is payable to order if can be negotiated by endrosment and delivery.

Ahmedabad

Kolkata

Mumbai

907/A Uvarshad, Gandhinagar Highway, Ahmedabad 382422.

Infinity Benchmark, 10th Floor, Plot G1, Block EP & GP, Sector V, Salt-Lake, Kolkata 700091.

Goldline Business Centre Linkway Estate, Next to Chincholi Fire Brigade, Malad (West), Mumbai 400 064.

Vous aimerez peut-être aussi

- Mba, Bba Admission in Colleges in AhmedabadDocument3 pagesMba, Bba Admission in Colleges in AhmedabadUnitedworld School Of BusinessPas encore d'évaluation

- Analysis of Job Portal IndustryDocument43 pagesAnalysis of Job Portal IndustryUnitedworld School Of Business96% (25)

- Analysis of Job Portal IndustryDocument43 pagesAnalysis of Job Portal IndustryUnitedworld School Of Business96% (25)

- Bba College Ahmedabad, GujaratDocument6 pagesBba College Ahmedabad, GujaratUnitedworld School Of BusinessPas encore d'évaluation

- Marketing Channel Presentation - Unitedworld School of BusinessDocument47 pagesMarketing Channel Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Bba College Ahmedabad, GujaratDocument6 pagesBba College Ahmedabad, GujaratUnitedworld School Of BusinessPas encore d'évaluation

- Negotiable Instruments Act Presentation - Unitedworld School of BusinessDocument52 pagesNegotiable Instruments Act Presentation - Unitedworld School of BusinessUnitedworld School Of Business100% (1)

- The IT-Is and Its Influence Presentation - Unitedworld School of BusinessDocument20 pagesThe IT-Is and Its Influence Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Sales of Goods Act Presentation - Unitedworld School of BusinessDocument32 pagesSales of Goods Act Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Set Theory Presentation - Unitedworld School of BusinessDocument39 pagesSet Theory Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Unnati Presentation - Unitedworld School of BusinessDocument30 pagesUnnati Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Training and Development Presentation - Unitedworld School of BusinessDocument11 pagesTraining and Development Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Working of Barcode Reader Presentation - Unitedworld School of BusinessDocument20 pagesWorking of Barcode Reader Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Valuation of Shares Presentation - Unitedworld School of BusinessDocument146 pagesValuation of Shares Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- The Organization Structure, Managers and Activities Presentation - Unitedworld School of BusinessDocument20 pagesThe Organization Structure, Managers and Activities Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Tean Color Presentation - Unitedworld School of BusinessDocument25 pagesTean Color Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- The Environment Protection Act, 1986 Presentation - Unitedworld School of BusinessDocument22 pagesThe Environment Protection Act, 1986 Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Selection Presentation - Unitedworld School of BusinessDocument28 pagesSelection Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Target Market Presentation - Unitedworld School of BusinessDocument32 pagesTarget Market Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Sage Advance Case Presentation - Unitedworld School of BusinessDocument13 pagesSage Advance Case Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Sampling Methods in Social Research Presentation - Unitedworld School of BusinessDocument12 pagesSampling Methods in Social Research Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Service Marketing Presentation - Unitedworld School of BusinessDocument15 pagesService Marketing Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Sales Force Automation Presentation - Unitedworld School of BusinessDocument13 pagesSales Force Automation Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Personal Values Presentation - Unitedworld School of BusinessDocument11 pagesPersonal Values Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Patent Right Presentation - Unitedworld School of BusinessDocument27 pagesPatent Right Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Research Methodology Presentation - Unitedworld School of BusinessDocument9 pagesResearch Methodology Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Recruitment Presentation - Unitedworld School of BusinessDocument14 pagesRecruitment Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- R.M Case Study Presentation - Unitedworld School of BusinessDocument7 pagesR.M Case Study Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- Personal Selling & Sales Management Presentation - Unitedworld School of BusinessDocument20 pagesPersonal Selling & Sales Management Presentation - Unitedworld School of BusinessUnitedworld School Of BusinessPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- SWIFT Credit Dnepr Bank ListDocument2 pagesSWIFT Credit Dnepr Bank Listtarungupta1986_66389Pas encore d'évaluation

- Modern Money MechanicsDocument40 pagesModern Money MechanicsEdgar Ricardo Ortega Pineda100% (4)

- Worldpay PayFac Dynamic Payout FAQ V2.3Document22 pagesWorldpay PayFac Dynamic Payout FAQ V2.3Louiz MarianoPas encore d'évaluation

- Reserve Bank of IndiaDocument84 pagesReserve Bank of IndiaSunil ColacoPas encore d'évaluation

- Additional Legal Opinion of Nafeesa PDFDocument6 pagesAdditional Legal Opinion of Nafeesa PDFRaghavendra Prabhu100% (1)

- ICICIDocument33 pagesICICIBansalrenukaPas encore d'évaluation

- Untitled PDFDocument27 pagesUntitled PDFBabuHalderPas encore d'évaluation

- Nudge Nudge Think Think Britain The Economist PDFDocument3 pagesNudge Nudge Think Think Britain The Economist PDFPlatoon Nicart BejerPas encore d'évaluation

- Overseas Direct Investments by Indian Party - Rationalization / LiberalizationDocument6 pagesOverseas Direct Investments by Indian Party - Rationalization / Liberalizationa VenkatachariPas encore d'évaluation

- Factoring, Forfaiting & Bills DiscountingDocument3 pagesFactoring, Forfaiting & Bills DiscountingkrishnadaskotaPas encore d'évaluation

- Asset Liability Management IN Abhuydaya Bank: Amol PatilDocument14 pagesAsset Liability Management IN Abhuydaya Bank: Amol Patilpari0000Pas encore d'évaluation

- PART-B Question No 7Document3 pagesPART-B Question No 73acsgrp 3acsgrpPas encore d'évaluation

- Pu Workers Bank DetailsDocument2 pagesPu Workers Bank DetailsJagadish JagsPas encore d'évaluation

- Funding Your COL Account PDFDocument11 pagesFunding Your COL Account PDFNAi IAnPas encore d'évaluation

- Time Value - Future ValueDocument4 pagesTime Value - Future ValueSCRBDusernmPas encore d'évaluation

- Personal Loan AgreementDocument19 pagesPersonal Loan AgreementRajPas encore d'évaluation

- Nominal & Effective Interest RatesDocument18 pagesNominal & Effective Interest RatesMUHAMMAD QASIMPas encore d'évaluation

- Cryptocurrency PresentationDocument20 pagesCryptocurrency PresentationKhandkar Sahil RidwanPas encore d'évaluation

- Business Application 2018Document2 pagesBusiness Application 2018Janet SimovicPas encore d'évaluation

- Backup Whatzap 26/09/19Document2 pagesBackup Whatzap 26/09/19RIO DE JANEIROPas encore d'évaluation

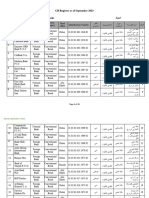

- CB Register September 2023Document25 pagesCB Register September 2023Shiva KathiresanPas encore d'évaluation

- Federal Reserve What Everyone Needs To Know (Axilrod)Document156 pagesFederal Reserve What Everyone Needs To Know (Axilrod)bassfreakstirsPas encore d'évaluation

- NAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsDocument2 pagesNAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsRoss John JimenezPas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRithvik MallikarjunaPas encore d'évaluation

- April 2018 PDFDocument16 pagesApril 2018 PDFPallaviPas encore d'évaluation

- Funds Requisition FormDocument9 pagesFunds Requisition FormFarooq MaqboolPas encore d'évaluation

- Home Loan AssistanceDocument2 pagesHome Loan AssistancedashPas encore d'évaluation

- Negotiable Instrument Hand OutsDocument51 pagesNegotiable Instrument Hand OutsHenry Jones UrsalesPas encore d'évaluation

- Holyoke Property Receivership ListDocument2 pagesHolyoke Property Receivership ListMike PlaisancePas encore d'évaluation

- Wells Fargo: Transaction History (Continued)Document1 pageWells Fargo: Transaction History (Continued)Meyonka WestPas encore d'évaluation