Académique Documents

Professionnel Documents

Culture Documents

Insurance Code of The Philippines (Various Sections)

Transféré par

Dennis VillartaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Insurance Code of The Philippines (Various Sections)

Transféré par

Dennis VillartaDroits d'auteur :

Formats disponibles

Whenever used in this Code, the following terms shall have the respective meanings hereinafter set forth

or indicated, unless the context otherwise requires:

1) A "contract of insurance" is an agreement WHEREBY one undertakes for a consideration to indemnify another AGAINST loss, damage, or liability ARISING from an unknown or contingent event

A contract of suretyship shall be deemed to be an insurance contract, WITHIN THE MEANING OF THIS CODE, ONLY IF made by a surety who or which, as such, is doing an insurance business as hereinafter provided

2) The term "doing an insurance business" or "transacting an insurance business" within the meaning of this code, shall include: a) Making or proposing to make, as insurer, any insurance contract

b) Making or proposing to make, as surety, any contract of suretyship as a vocation and not as merely incidental to any other legitimate business or activity of the surety; c) Doing any kind of business, including a resinsurance business, specifically recognized as constituting the doing of an insurance business within the meaning of this Code;

d) Doing or proposing to do any business in substance equivalent to any of the foregoing in a manner designed to evade the provisions of this Code.

In the application of the provision of this Code the fact that NO PROFIT IS DERIVED FROM THE MAKING OF INSURANCE CONTRACTS, AGREEMENTS OR TRANSACTIONS, OR THAT NO SEPARATE OR DIRECT CONSIDERATION IS RECEIVED THEREFOR, shall not be deemed conclusive to show that the making thereof does not constitute the doing or transacting of an insurance business.

3) as used in this Code, the term "Commissioner" means the "Insurance Commissioner".

Any contingent or unknown event, Whether past or future, Which may damnify a person having an insurable interest Or create a liability against him, May be insured against, Subject to the provisions of this chapter.

The consent of the husband is not necessary for the validity of an insurance policy taken out by a married woman on her life or that of her children.

Any minor of the age of eighteen years or more, may, notwithstanding such minority, contract for life, health and accident insurance, with any insurance company duly authorized to do business in the Philippines, provided the insurance is taken on his own life and the beneficiary appointed is the minor's estate or the minor's father, mother, husband, wife, child, brother or sister.

The married woman or the minor herein allowed to take out an insurance policy may exercise all the rights and privileges of an owner under a policy.

All rights, title, and interest in the policy of insurance taken out by an original owner on the life or health of a minor shall automatically vest in the minor upon the death of the original owner, unless otherwise provided for in the policy.

Every person, partnership, association, or corporation duly authorized to transact insurance business as elsewhere provided in this code, may be an insurer.

Every person has an insurable interest in the life and health: a) of himself, of his spouse and of his children; b) of any person on whom he depends wholly or in part for education or support, or in whom he has a pecuniary interest; c) of any person under a legal obligation to him for the payment of money, or respecting property or services, of which death or illness might delay or prevent the performance; and d) of any person upon whose life any estate or interest vested in him depends.

An insurable interest in property may consist in: An existing interest; An inchoate interest founded on an existing interest; or An expectancy, coupled with an existing interest in that out of which the expectancy arises.

Vous aimerez peut-être aussi

- Negotiable Instruments Law-OverviewDocument35 pagesNegotiable Instruments Law-OverviewChristine joyce MagotePas encore d'évaluation

- The Labor Code of The Philippines Presidential Decree No. 442, As AmendedDocument9 pagesThe Labor Code of The Philippines Presidential Decree No. 442, As AmendedJessemar Solante Jaron WaoPas encore d'évaluation

- Commercial Law Reviewer 2012Document427 pagesCommercial Law Reviewer 2012Eisley Sarzadilla-GarciaPas encore d'évaluation

- Demurrer To Evidence: Rule 33Document53 pagesDemurrer To Evidence: Rule 33MacPas encore d'évaluation

- ALLIED BANKING CORPORATION v. JESUS S. YUJUICO (DECEASED), REPRESENTED BY BRENDON V. YUJUICO.Document2 pagesALLIED BANKING CORPORATION v. JESUS S. YUJUICO (DECEASED), REPRESENTED BY BRENDON V. YUJUICO.Carmel LouisePas encore d'évaluation

- GREAT PACIFIC LIFE Vs JUDICO (Final Digest)Document6 pagesGREAT PACIFIC LIFE Vs JUDICO (Final Digest)Russ TuazonPas encore d'évaluation

- Banking Laws Bank Secrecy Law PurposeDocument9 pagesBanking Laws Bank Secrecy Law PurposeTrevor Del MundoPas encore d'évaluation

- Insurance Code of The Philippines PD No. 1460, As Amended: July 26, 2012Document48 pagesInsurance Code of The Philippines PD No. 1460, As Amended: July 26, 2012Melissa M. Abansi-BautistaPas encore d'évaluation

- Obligations of The VendeeDocument3 pagesObligations of The VendeeMichelle0Pas encore d'évaluation

- Republic Act No 10607Document7 pagesRepublic Act No 10607Romel TorresPas encore d'évaluation

- Confidence and Trust.: Law On PartnershipsDocument8 pagesConfidence and Trust.: Law On PartnershipsDwight BlezaPas encore d'évaluation

- Different Kinds of DamagesDocument4 pagesDifferent Kinds of DamagesMary Ann Kristine FerrerPas encore d'évaluation

- Anti-Money Laundering Act As AMENDED BY RA 9194,10167,10365Document12 pagesAnti-Money Laundering Act As AMENDED BY RA 9194,10167,10365mtabcao100% (2)

- Article 315 of RPC Estafa by False Pretense: Chanrobles VirDocument3 pagesArticle 315 of RPC Estafa by False Pretense: Chanrobles VirPatrick Marz AvelinPas encore d'évaluation

- Intro To Law (Support) - 1Document6 pagesIntro To Law (Support) - 1fangalanoPas encore d'évaluation

- R.A. 8791 GENERAL BANKING LAW of 2000 - Law, Politics, and Philosophy (Recovered)Document23 pagesR.A. 8791 GENERAL BANKING LAW of 2000 - Law, Politics, and Philosophy (Recovered)Michael VillalonPas encore d'évaluation

- Manila Banking V TeodoroDocument2 pagesManila Banking V Teodoroluiz ManieboPas encore d'évaluation

- Republic Act No. 10667 Philippine Competition ActDocument9 pagesRepublic Act No. 10667 Philippine Competition Actbelbel08Pas encore d'évaluation

- BP22Document62 pagesBP22PhilipBrentMorales-MartirezCariagaPas encore d'évaluation

- The Warehouse Receipts LawDocument62 pagesThe Warehouse Receipts LawPingotMagangaPas encore d'évaluation

- B e F U L L y P A I: Basis of The Intellectual Property Law (R.A. 8293, As Amended)Document4 pagesB e F U L L y P A I: Basis of The Intellectual Property Law (R.A. 8293, As Amended)Dred OplePas encore d'évaluation

- Sample Security Services Contract For Security GuardsDocument5 pagesSample Security Services Contract For Security GuardsJacob GiffenPas encore d'évaluation

- LOC ReviewerDocument12 pagesLOC ReviewerIvan LuzuriagaPas encore d'évaluation

- Mercantile Law ReviewerDocument226 pagesMercantile Law ReviewerMelody BangsaludPas encore d'évaluation

- Effects of PossessionDocument22 pagesEffects of PossessionHNicdaoPas encore d'évaluation

- Extraordinary Diligence of Common Carriers in The Transport of PassengersDocument17 pagesExtraordinary Diligence of Common Carriers in The Transport of Passengersautumn moon50% (2)

- Tax Differentiated From Other TermsDocument2 pagesTax Differentiated From Other TermsMiguel Satuito100% (1)

- RA No. 8556Document20 pagesRA No. 8556TianettePas encore d'évaluation

- Filipinas Marble v. IACDocument4 pagesFilipinas Marble v. IACGennard Michael Angelo AngelesPas encore d'évaluation

- Insurance Code PDFDocument32 pagesInsurance Code PDFaivi santosPas encore d'évaluation

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument26 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress Assembledeinel dcPas encore d'évaluation

- Types of Employment in The PhilippinesDocument2 pagesTypes of Employment in The Philippinesschating2Pas encore d'évaluation

- Womens MonthDocument23 pagesWomens MonthShelene Cathlyn Borja Daga-asPas encore d'évaluation

- WarrantiesDocument2 pagesWarrantiesBiboy GSPas encore d'évaluation

- City Government of Quezon City vs. ErictaDocument2 pagesCity Government of Quezon City vs. Erictasahara lockwoodPas encore d'évaluation

- Condominium Act of The Philippines ExplainedDocument1 pageCondominium Act of The Philippines ExplainedtimothymaderazoPas encore d'évaluation

- LAW-ON-SALES-Lecture SummaryDocument10 pagesLAW-ON-SALES-Lecture SummaryErwin LimpangogPas encore d'évaluation

- 39 Bank of The Philippine Islands vs. Court of AppealsDocument2 pages39 Bank of The Philippine Islands vs. Court of AppealsJemPas encore d'évaluation

- PNB vs. Sps. RocamoraDocument11 pagesPNB vs. Sps. Rocamorayan_saavedra_1Pas encore d'évaluation

- Batas Pambansa Blg.22Document10 pagesBatas Pambansa Blg.22Mavz PelonesPas encore d'évaluation

- Digests S0720Document12 pagesDigests S0720Gianina AndesPas encore d'évaluation

- RA 9829 Pre Need CodeDocument23 pagesRA 9829 Pre Need CodeAicing Namingit-VelascoPas encore d'évaluation

- Insurance Lecture Notes 1Document5 pagesInsurance Lecture Notes 1Anthony Tamayosa Del AyrePas encore d'évaluation

- Intengan Vs CADocument1 pageIntengan Vs CAsabrina gayoPas encore d'évaluation

- Saura v. DEVELOPMENT BANK OF THE PHILIPPINESDocument2 pagesSaura v. DEVELOPMENT BANK OF THE PHILIPPINESCamille DomingoPas encore d'évaluation

- Credit DigestsDocument55 pagesCredit DigestsJerome MoradaPas encore d'évaluation

- Javier vs. Lucero, Et Al., 94 Phil. 634, March 29, 1954Document2 pagesJavier vs. Lucero, Et Al., 94 Phil. 634, March 29, 1954Edgar Joshua TimbangPas encore d'évaluation

- Insurance Law in PhilippinesDocument67 pagesInsurance Law in PhilippinesAileen Vasquez-MendozaPas encore d'évaluation

- Insurance Notes RondezDocument75 pagesInsurance Notes RondezCire GeePas encore d'évaluation

- A. Labor Code, Art 82 - 90Document2 pagesA. Labor Code, Art 82 - 90Dom Robinson Baggayan100% (1)

- Intellectual PropertyDocument3 pagesIntellectual PropertyJanelle TabuzoPas encore d'évaluation

- Chapter 2 Simple Loan or MutuumDocument2 pagesChapter 2 Simple Loan or MutuumMarvin CeledioPas encore d'évaluation

- CA 146 and RA 8370Document14 pagesCA 146 and RA 8370Mark JamesPas encore d'évaluation

- Prohibition Against Pactum CommissoriumDocument1 pageProhibition Against Pactum CommissoriumMikko RamiraPas encore d'évaluation

- Rule 131 Rules of Court PhilippinesDocument3 pagesRule 131 Rules of Court PhilippinesArlando G. ArlandoPas encore d'évaluation

- Brotherhood Labor Unity Movement v. NLRC, GR - 48645, Jan. 7, 1987Document2 pagesBrotherhood Labor Unity Movement v. NLRC, GR - 48645, Jan. 7, 1987mae ann rodolfoPas encore d'évaluation

- Literal Meaning of Immediate and Remote PartiesDocument2 pagesLiteral Meaning of Immediate and Remote PartiesAxle InsignePas encore d'évaluation

- Compania Agricola V NepomucenoDocument6 pagesCompania Agricola V NepomucenoStella LynPas encore d'évaluation

- Insurance Impt Provisions 1Document2 pagesInsurance Impt Provisions 1MaryStefaniePas encore d'évaluation

- The Insurance Code of The PhilippinesDocument3 pagesThe Insurance Code of The PhilippinesSon Gabriel UyPas encore d'évaluation

- Special Proceedings Powerpoint Reviewer Presentation Rule 75 To 80Document66 pagesSpecial Proceedings Powerpoint Reviewer Presentation Rule 75 To 80Dennis Villarta100% (1)

- Credit TransactionsDocument26 pagesCredit TransactionsDennis VillartaPas encore d'évaluation

- Credit TransactionsDocument26 pagesCredit TransactionsDennis VillartaPas encore d'évaluation

- Life Insurance PowerpointDocument34 pagesLife Insurance PowerpointDennis Villarta0% (1)

- Megaworld Vs DSMDocument27 pagesMegaworld Vs DSMDennis VillartaPas encore d'évaluation

- Orozco Vs AranetaDocument2 pagesOrozco Vs AranetaDennis VillartaPas encore d'évaluation

- Civil Procedure 44 - Dare Adventure Farm Corp. v. CA GR No. 161122 24 Sept 2012 SC Full TextDocument7 pagesCivil Procedure 44 - Dare Adventure Farm Corp. v. CA GR No. 161122 24 Sept 2012 SC Full TextJOHAYNIEPas encore d'évaluation

- SLLRDC AppDocument2 pagesSLLRDC AppChathuranga PriyasamanPas encore d'évaluation

- Estrada Vs Sandiganbayan DigestDocument4 pagesEstrada Vs Sandiganbayan DigestJoseph Denila LagunaPas encore d'évaluation

- Partnership Deed For 2 PersonDocument2 pagesPartnership Deed For 2 PersonJawad AhmadPas encore d'évaluation

- Constitutional Law Lecture Notes 10Document41 pagesConstitutional Law Lecture Notes 10Honey PandeyPas encore d'évaluation

- Concept of Joint VentureDocument12 pagesConcept of Joint VentureKrishma AfgPas encore d'évaluation

- Perbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraDocument9 pagesPerbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraRendy SuryaPas encore d'évaluation

- Toronto Power Company V PaskwanDocument3 pagesToronto Power Company V PaskwanMichael RhimesPas encore d'évaluation

- Contract & ArbitrationDocument18 pagesContract & ArbitrationAnirudh BabbarPas encore d'évaluation

- CIR Vs Metro Star SupremaDocument9 pagesCIR Vs Metro Star SupremaJepoy Nisperos ReyesPas encore d'évaluation

- FUL V NDPP (Gen Mdluli) - Founding Affidavit (DR Ramphele)Document83 pagesFUL V NDPP (Gen Mdluli) - Founding Affidavit (DR Ramphele)ThepatternsPas encore d'évaluation

- Labor JurisprudenceDocument24 pagesLabor JurisprudenceEarl ConcepcionPas encore d'évaluation

- Human Rights Law Final Course Outline Outline 2017 Second SemDocument5 pagesHuman Rights Law Final Course Outline Outline 2017 Second SemMary Kaye ValerioPas encore d'évaluation

- Child Care (File Ami)Document11 pagesChild Care (File Ami)WulanPas encore d'évaluation

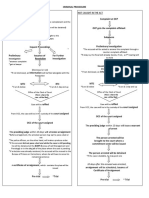

- CrimPro 1 - Diagram For Prosecution of OffensesDocument1 pageCrimPro 1 - Diagram For Prosecution of OffensesCelestino LawPas encore d'évaluation

- Al-Qu'ran, The Guidance For Mankind-English by Muhammad Farooq-i-Azam Malik. (Chapter No. 5)Document17 pagesAl-Qu'ran, The Guidance For Mankind-English by Muhammad Farooq-i-Azam Malik. (Chapter No. 5)manjuPas encore d'évaluation

- #9 Delgado Vda. de La Rosa v. Heirs of Mariciana Rustia Vda. de Damian G.R. No. 155733, January 27, 2006Document3 pages#9 Delgado Vda. de La Rosa v. Heirs of Mariciana Rustia Vda. de Damian G.R. No. 155733, January 27, 2006ZereshPas encore d'évaluation

- Phil. Rabbit Bus Lines vs. IAC. G.R. Nos. L-66102-04 August 30, 1990.Document2 pagesPhil. Rabbit Bus Lines vs. IAC. G.R. Nos. L-66102-04 August 30, 1990.Lara Yulo100% (1)

- 2.good GovernanceDocument10 pages2.good Governancedawoodabdullah56Pas encore d'évaluation

- Hidalgo Vs RepublicDocument2 pagesHidalgo Vs RepublicAnonymous 5MiN6I78I0Pas encore d'évaluation

- Gilbert Complaint 10Document3 pagesGilbert Complaint 10Rickey StokesPas encore d'évaluation

- Pakistan: Status of Women & The Women's MovementDocument4 pagesPakistan: Status of Women & The Women's MovementmainbroPas encore d'évaluation

- 00 Name Declaration Correction and Publication YAH BEY PDFDocument2 pages00 Name Declaration Correction and Publication YAH BEY PDFyahPas encore d'évaluation

- Act 76 Akta Hidupan Liar 1972Document151 pagesAct 76 Akta Hidupan Liar 1972razat85Pas encore d'évaluation

- Adoption and Maintenance CasesDocument5 pagesAdoption and Maintenance CasesNandini TarwayPas encore d'évaluation

- Legal Status of Health CanadaDocument11 pagesLegal Status of Health CanadaMarc Boyer100% (2)

- Sales Case DigestDocument7 pagesSales Case Digestrian5852Pas encore d'évaluation

- Elections and Voting, Pressure GroupsDocument7 pagesElections and Voting, Pressure GroupsAnonymousPas encore d'évaluation

- Paterno Domondon Jr. (Compliance)Document2 pagesPaterno Domondon Jr. (Compliance)Patrick GarciaPas encore d'évaluation

- Webb v. People (276 SCRA 243) 004. Mirasol v. DPWH (490 SCRA 318)Document6 pagesWebb v. People (276 SCRA 243) 004. Mirasol v. DPWH (490 SCRA 318)Jomarc MalicdemPas encore d'évaluation