Académique Documents

Professionnel Documents

Culture Documents

LIC Guaranteed HNI Pension Plan

Transféré par

Bhushan ShethCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LIC Guaranteed HNI Pension Plan

Transféré par

Bhushan ShethDroits d'auteur :

Formats disponibles

Bhushan Sheth

Immediate Annuity : Invest One time, Pension from next year

Pros : Fixed Pension Rate (Currently 7.4%) Cons : Taxable Annuity

Deferred Annuity : Invest for 20 Years, Commutation and Pension after 20 Years

Pros : Deferment allows building of corpus Cons : Pension Rate applicable will be market rate applicable 20 years hence; Taxable Annuity

This is Indias one and only Deferred Pension Plan with a Guaranteed Pension rate Pre Tax Pension rate works out to be as high as 9% (depending on age and amount of investment), but it is fixed for lifetime Best suited for HNIs in age group of 35-45 looking to invest for 15-20 years Plans offer commutation, Lifetime Pension, Lifetime Insurance and further variable benefits (Lifetime = Up to age 100)

Age 40, Face value of plan : 5 Crores Premium : 24.11 Lacs payable annually for 20 years Lets understand the following three points:

Maturity and Pension Insurance Benefits Exit Clause

1.

After 20 Years : Commutation of 5 Crores (Variable and Tax Free) PLUS

2.

From 21st Year : Lifetime Pension of 27,50,000 p.a. (Guaranteed and Tax Free) PLUS

From 21st Year : Lifetime Insurance Cover of 5 Crores (Guaranteed and Tax Free) PLUS From 21st Year : Increase in Lifetime Insurance Cover of 10% every 10 years (Variable and Tax Free) Consider the scenario where if you re-invest 5Crores from Point1 and earn additional pension of at least 20Lacs p.a. : will mean your total pension will be about 48Lacs p.a. i.e. 4Lacs per month (Assumed Pension Rate of 4%)

3.

4.

5.

During the premium payment phase:

5 Crores (Guaranteed and Tax Free) PLUS Annualized Portion of Point 1 (i.e. 25Lacs p.a.) (Variable and Tax Free)

During the pension phase : As per point 3 & 4 of previous slide

Exit during Premium payment phase:

1st to 3rd Year : Zero Value 4th to 7th Year : Loss Making Value From 8th Year : Approximate Proportionate Value From 4th Year : Either liquidate OR Reduce Face value

Exit During Pension Phase:

Relinquish benefits under point 2, 3 & 4 of Pension and Insurance Benefits Get a Settlement Value of 4.5 Crores (Guaranteed and Tax Free) Partial Exit possible

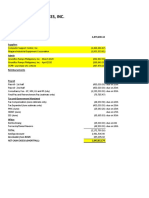

Investment : 24.11 Lacs p.a. for 20 Years = 4.82Cr. Returns (assuming human life as 90):

After 20Yrs : 5 Crores Pension for 30Yrs : 8.25 Crores Insurance at age 90 : 6.5 Crores Total : 19.75 Crores

Yield : Min 6.2% Tax Free Thus a pre tax rate of 9% is achieved

Vous aimerez peut-être aussi

- Sales Enablers CashRich Insurance PlanDocument2 pagesSales Enablers CashRich Insurance PlanhdfcblgoaPas encore d'évaluation

- Product DetailsDocument13 pagesProduct Detailskannakumar1983Pas encore d'évaluation

- Smart Junior Product Brochure NewDocument11 pagesSmart Junior Product Brochure NewSantosh KumarPas encore d'évaluation

- Quarter Ended Sep 2018Document11 pagesQuarter Ended Sep 2018Abhinav VermaPas encore d'évaluation

- ICICI PrudentialDocument68 pagesICICI PrudentialYash DroliaPas encore d'évaluation

- Jeevan AmritDocument11 pagesJeevan Amritapi-3800339100% (1)

- ReportDocument7 pagesReporttanjim_47Pas encore d'évaluation

- Exide Life New Fulfilling Life: 16-Year Money Back Plan with Life Cover till 85Document4 pagesExide Life New Fulfilling Life: 16-Year Money Back Plan with Life Cover till 85arulkumarPas encore d'évaluation

- Ch. 4 - The Time Value of MoneyDocument46 pagesCh. 4 - The Time Value of MoneyNeha BhayaniPas encore d'évaluation

- LIC New Jeevan Anand Plan DetailsDocument3 pagesLIC New Jeevan Anand Plan DetailsVandana SharmaPas encore d'évaluation

- A Target Savings Plan With The Advantage of Liquidity and Life CoverDocument11 pagesA Target Savings Plan With The Advantage of Liquidity and Life CoverRishipal ChauhanPas encore d'évaluation

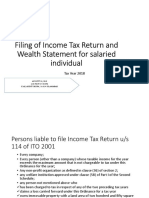

- Income Tax ReturnDocument57 pagesIncome Tax ReturnMalik WasimPas encore d'évaluation

- Lic of India LTDDocument4 pagesLic of India LTDAnish PenmahalePas encore d'évaluation

- AnitaDocument11 pagesAnitaapi-248282977Pas encore d'évaluation

- Whole Life Schemes: Sum Assured Min MaxDocument48 pagesWhole Life Schemes: Sum Assured Min MaxrajeevbachraPas encore d'évaluation

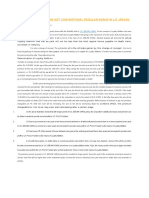

- Income Tax Calculations On Salaries and Other Income For The Assessment Year 2024Document20 pagesIncome Tax Calculations On Salaries and Other Income For The Assessment Year 2024ManoharanR Rajamanikam0% (1)

- ITR-1, ITR-2, ITR-3: Key points for filing Income Tax returnsDocument4 pagesITR-1, ITR-2, ITR-3: Key points for filing Income Tax returnsSANDEEP SAHUPas encore d'évaluation

- O Sec 56 (2) I.E. IOS Clause V, Vi, VII (A & B), Ix, X, XiDocument7 pagesO Sec 56 (2) I.E. IOS Clause V, Vi, VII (A & B), Ix, X, XiRadhika SarawagiPas encore d'évaluation

- Ulip BrochureDocument20 pagesUlip BrochureTelus InternationalPas encore d'évaluation

- March 20 Lecture Slides TVMDocument12 pagesMarch 20 Lecture Slides TVMareejPas encore d'évaluation

- SBI Life - Saral Pension (UIN: 111N088V01) (Product Code: 1E)Document11 pagesSBI Life - Saral Pension (UIN: 111N088V01) (Product Code: 1E)Abhijeet DuttaPas encore d'évaluation

- Premier: Income PlanDocument11 pagesPremier: Income PlansrinathpsgPas encore d'évaluation

- Tax Planning Tips for RetireesDocument34 pagesTax Planning Tips for Retireesmail2ncPas encore d'évaluation

- Aadhaar StambhDocument16 pagesAadhaar StambhAbhijeetPas encore d'évaluation

- Invest Builder - Product SummaryDocument30 pagesInvest Builder - Product SummaryJun Rui ChngPas encore d'évaluation

- GMB Brochure NewDocument12 pagesGMB Brochure NewSubhash NaikPas encore d'évaluation

- Jeevan Bharti A Women Plan - 9811896425Document2 pagesJeevan Bharti A Women Plan - 9811896425Harish ChandPas encore d'évaluation

- TUTORIALDocument10 pagesTUTORIALViễn QuyênPas encore d'évaluation

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanDriptendu MaitiPas encore d'évaluation

- 1 3+part+1Document26 pages1 3+part+1jaspreet kaurPas encore d'évaluation

- Jeevan Surabhi - 106 - 107 - 108Document3 pagesJeevan Surabhi - 106 - 107 - 108Vinay KumarPas encore d'évaluation

- Comparison Between I.T. and DTCDocument23 pagesComparison Between I.T. and DTCsharma.shalinee1626Pas encore d'évaluation

- Portal Investment Proof Verification Guidelines 2022 23Document11 pagesPortal Investment Proof Verification Guidelines 2022 23yfiamataimPas encore d'évaluation

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaPas encore d'évaluation

- CH 04 EOC Solutions 4e StudentDocument15 pagesCH 04 EOC Solutions 4e StudentMary Shannon DeeringPas encore d'évaluation

- Lic Jeevan Ankur Never InvestedDocument5 pagesLic Jeevan Ankur Never Investedkirang gandhiPas encore d'évaluation

- INCOME TAX U1-MergedDocument38 pagesINCOME TAX U1-Mergedcommercewaale1Pas encore d'évaluation

- LIC's Endowment Plus: (Plan No. 802)Document16 pagesLIC's Endowment Plus: (Plan No. 802)Abhinav VermaPas encore d'évaluation

- Edelweiss Tokio Life - Cashflow ProtectionDocument10 pagesEdelweiss Tokio Life - Cashflow ProtectionRohan R TamhanePas encore d'évaluation

- Unit 4 - AnnuityDocument5 pagesUnit 4 - AnnuityShashank HundiaPas encore d'évaluation

- Test - Chapter 2 Time Value of MoneyDocument18 pagesTest - Chapter 2 Time Value of Moneyk60.2112150055Pas encore d'évaluation

- CALCULATE STOCK INDEXES, INTEREST RATES AND PRESENT VALUESDocument4 pagesCALCULATE STOCK INDEXES, INTEREST RATES AND PRESENT VALUESMithun SagarPas encore d'évaluation

- SM RT: DHFL Pramerica Smart Income, A Non-Participating Endowment Insurance PlanDocument4 pagesSM RT: DHFL Pramerica Smart Income, A Non-Participating Endowment Insurance PlankulaseraPas encore d'évaluation

- Why Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?Document1 pageWhy Loyalty Additions Not Conventional Regular Bonus in Lic Jeevan Saral Policy?uketechPas encore d'évaluation

- Kotak Guaranteed Savings Plan Brochure1Document12 pagesKotak Guaranteed Savings Plan Brochure1balaPas encore d'évaluation

- Traditional Investing Options for Senior CitizensDocument3 pagesTraditional Investing Options for Senior CitizensIndranilGhoshPas encore d'évaluation

- An Analysis On Tax Free BondsDocument5 pagesAn Analysis On Tax Free BondscrvishnuramPas encore d'évaluation

- Rnl-Fixed-Savings 121n101v03 BrochureDocument8 pagesRnl-Fixed-Savings 121n101v03 BrochureRahul SharmaPas encore d'évaluation

- How LIC SIIP Plan WorksDocument4 pagesHow LIC SIIP Plan WorksHarshalPas encore d'évaluation

- Plan 802Document16 pagesPlan 802kandaswamyprakashPas encore d'évaluation

- 財務管理 課本Document3 pages財務管理 課本王彥婷Pas encore d'évaluation

- SBI - Life - Smart Privilege BrochureDocument16 pagesSBI - Life - Smart Privilege BrochureAvinash SinghPas encore d'évaluation

- Question Bank - Topic 2 - Time Value of MoneyDocument9 pagesQuestion Bank - Topic 2 - Time Value of MoneyPaolo JovePas encore d'évaluation

- Jeevan Umang G PlanDocument2 pagesJeevan Umang G PlanKv kPas encore d'évaluation

- 5-YrRenewable ConvertiblePlanDocument1 page5-YrRenewable ConvertiblePlanYuvaraja KingPas encore d'évaluation

- Al Rajhi BankDocument4 pagesAl Rajhi BankSimon LeePas encore d'évaluation

- Kotak Guaranteed Fortune Builder Sales LiteratureDocument41 pagesKotak Guaranteed Fortune Builder Sales Literaturerohitis_me2169Pas encore d'évaluation

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvPas encore d'évaluation

- J.K. Lasser's Your Income Tax 2024, Professional EditionD'EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionPas encore d'évaluation

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnD'EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnPas encore d'évaluation

- Nestle SMDocument44 pagesNestle SMMelissa ArnoldPas encore d'évaluation

- Ey Reinventing PharmaDocument36 pagesEy Reinventing PharmaraviPas encore d'évaluation

- Contact Details: BSP DirectoryDocument4 pagesContact Details: BSP DirectoryPondo AsensoPas encore d'évaluation

- Rate of Return Analysis (Online Version)Document35 pagesRate of Return Analysis (Online Version)samiyaPas encore d'évaluation

- Scribd Free - Google SearchDocument2 pagesScribd Free - Google Searchnaxaji4234Pas encore d'évaluation

- LERAC M AND E Cash Forecast and Accounts Payable AgingDocument15 pagesLERAC M AND E Cash Forecast and Accounts Payable AgingLERAC AccountingPas encore d'évaluation

- ITC Litigation Section 337 Chapter 14 June 2011Document56 pagesITC Litigation Section 337 Chapter 14 June 2011michaelkaingPas encore d'évaluation

- Signavio - BPMN Modeling ConventionsDocument3 pagesSignavio - BPMN Modeling ConventionsleoaugPas encore d'évaluation

- In Re: Dennis D. Windscheffel, 9th Cir. BAP (2017)Document14 pagesIn Re: Dennis D. Windscheffel, 9th Cir. BAP (2017)Scribd Government DocsPas encore d'évaluation

- Final Order Case 30 Sanjay Dhande Vs ICICI Bank & Ors - SignDocument24 pagesFinal Order Case 30 Sanjay Dhande Vs ICICI Bank & Ors - SignLive Law100% (1)

- Basics of EntrepreneurshipDocument51 pagesBasics of EntrepreneurshipGanesh Kumar100% (1)

- Senior Exploration Management Course: SEG Course Center Littleton, CO, USADocument2 pagesSenior Exploration Management Course: SEG Course Center Littleton, CO, USAwaseemPas encore d'évaluation

- Taxation Comprehensive Exam TosDocument2 pagesTaxation Comprehensive Exam Tosaccounting probPas encore d'évaluation

- Fit Four v. Raww - ComplaintDocument19 pagesFit Four v. Raww - ComplaintSarah BursteinPas encore d'évaluation

- Bertelsmann 2017 05 EngDocument68 pagesBertelsmann 2017 05 EngChess PadawanPas encore d'évaluation

- AMEREX Stainless Steel ShapesDocument9 pagesAMEREX Stainless Steel ShapesCharlie HPas encore d'évaluation

- Anbu Employee Welfare Measure Project PPT PresentationDocument12 pagesAnbu Employee Welfare Measure Project PPT PresentationVasanth KumarPas encore d'évaluation

- Network Planning and Design: Originally by Richard Van Slyke, Polytechnic University AdaptedDocument6 pagesNetwork Planning and Design: Originally by Richard Van Slyke, Polytechnic University AdaptedLe ProfessionistPas encore d'évaluation

- Calf Fattening FeasibilityDocument19 pagesCalf Fattening FeasibilityMuammad Sanwal100% (2)

- Catalogo de Tuberías TenarisDocument134 pagesCatalogo de Tuberías TenarisErwin Jeronimo GarciaPas encore d'évaluation

- HW 7Document13 pagesHW 7Sheldon_CoutinhoPas encore d'évaluation

- Project Procurement Management: Shwetang Panchal Sigma Institute of Management StudiesDocument30 pagesProject Procurement Management: Shwetang Panchal Sigma Institute of Management StudiesShwetang Panchal100% (3)

- 05 ERP Scope of WorkDocument14 pages05 ERP Scope of WorkDr. Syed Masrur67% (3)

- Organizational Behavior Through Contingency ApproachDocument21 pagesOrganizational Behavior Through Contingency Approachjaydee_atc581460% (5)

- Sem-1 Syllabus Distribution 2021Document2 pagesSem-1 Syllabus Distribution 2021Kishan JhaPas encore d'évaluation

- Vouching ControlDocument42 pagesVouching ControlSundayPas encore d'évaluation

- TMForum - EtomDocument61 pagesTMForum - EtomJosé EvangelistaPas encore d'évaluation

- Accounting Is NiceDocument36 pagesAccounting Is NiceYuvika BishnoiPas encore d'évaluation

- Learning Culture: Implications and ProcessDocument18 pagesLearning Culture: Implications and ProcessSohailuddin AlaviPas encore d'évaluation

- Maintenance Cost Implications On ResidenDocument17 pagesMaintenance Cost Implications On ResidenBarnabas UdehPas encore d'évaluation