Académique Documents

Professionnel Documents

Culture Documents

Chap 005

Transféré par

ssregens820 évaluation0% ont trouvé ce document utile (0 vote)

9 vues28 pagesfinance

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PPT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentfinance

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

9 vues28 pagesChap 005

Transféré par

ssregens82finance

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 28

McGraw-Hill/I rwin

Copyright 2012 by The McGraw-Hill Companies, I nc. All rights reserved.

5-2

Money has a time value. It can be expressed in

multiple ways:

A dollar today held in savings will grow.

A dollar received in a year is not worth as much as a dollar

received today.

Time Value of Money

5-3

Future Values

Future Value: Amount to which an investment will grow

after earning interest.

Let r = annual interest rate

Let t = # of years

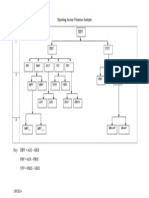

Simple Interest Compound Interest

FV = Initial investment (1 )

t

Compound

r +

FV = Initial investment (1 )

Simple

r t +

5-4

Simple Interest: Example

Interest earned at a rate of 7% for five years on a

principal balance of $100.

Example - Simple Interest

Today Future Years

1 2 3 4 5

Interest Earned

Value 100

Value at the end of Year 5: $135

7

107

7

114

7

121

7

128

7

135

5-5

Interest earned at a rate of 7% for five years on the

previous years balance.

Example - Compound Interest

Today Future Years

1 2 3 4 5

Interest Earned

Value 100

Compound Interest: Example

7

107

7.49

114.49

8.01

122.50

8.58

131.08

9.18

140.26

Value at the end of Year 5 =$140.26

5-6

The Power of Compounding

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

1 6 11 16 21 26 31 36

F

u

t

u

r

e

V

a

l

u

e

Year

Simple Interest

Compound Interest

Interest earned at a rate of 7% for the first forty years on

the $100 invested using simple and compound interest.

5-7

Present Value

What is it?

Why is it useful?

5-8

Present Value

Present Value:

Discount Rate:

Discount Factor:

1

(1 )

t

r

PV FV

+

=

1

(1 )

t

r

DF

+

=

Recall: t = number of years

r

5-9

Present Value: Example

Example

Always ahead of the game, Tommy, at 8 years old, believes

he will need $100,000 to pay for college. If he can invest at a

rate of 7% per year, how much money should he ask his rich

Uncle GQ to give him?

10

1

(1.07)

1

$100, 000 $50,835

(1 )

t

PV FV

r

= = ~

+

Note: Ignore inflation/taxes

$100, 000 10 7% FV t yrs r = = =

5-10

The PV formula has many applications. Given

any variables in the equation, you can solve for

the remaining variable.

1

(1 )

t

r

PV FV

+

=

Time Value of Money

(applications)

5-11

0

20

40

60

80

100

120

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Number of Years

P

V

o

f

$

1

0

0

0%

5%

10%

15%

Present Values: Changing Discount Rates

Discount Rates

The present value of $100 to be received in 1 to 20 years at varying discount rates:

5-12

PV of Multiple Cash Flows

1 2

1 2

(1 ) (1 ) (1 )

....

t

t

C C C

r r r

PV

+ + +

= + + +

The present value of multiple cash flows can be calculated:

1

2

:

The cash flow in year 1

The cash flow in year 2

The cash flow in year t (with any number of cash flows in between)

t

Denote

C

C

C

=

=

=

Recall: r = the discount rate

5-13

Multiple Cash Flows: Example

Example

Your auto dealer gives you the choice to pay $15,500 cash now or

make three payments: $8,000 now and $4,000 at the end of the

following two years. If your cost of money (discount rate) is 8%, which

do you prefer?

1

2

4,000

1

(1 .08)

4,000

2

(1 .08)

Initial Payment* 8,000.00

3, 703.70

3, 429.36

Total PV $15,133.06

PV of C

PV of C

+

+

= =

= =

=

* The initial payment occurs immediately and therefore would not be discounted.

5-14

Perpetuities

Let C = Yearly Cash Payment

PV of Perpetuity:

C

r

PV =

What are they?

Recall: r = the discount rate

5-15

Perpetuities: Example

Example :

In order to create an endowment, which pays $185,000 per year

forever, how much money must be set aside today if the rate of

interest is 8%?

What if the first payment wont be received until 3 years from

today?

185,000

.08

$2, 312, 500 PV = =

2

2,312,500

(1 .08)

$1, 982, 596 PV

+

= =

5-16

Annuities

What are they?

Annuities are equally-spaced, level streams of cash flows

lasting for a limited period of time.

Why are they useful?

5-17

Present Value of an Annuity

Let:

C = yearly cash payment

r = interest rate

t = number of years cash payment is received

1 1

(1 )

t

r

r r

PV C

+

(

=

The terms within the brackets are

collectively called the annuity factor.

5-18

Annuities: Example

Example:

You are purchasing a home and are scheduled to make 30

annual installments of $10,000 per year. Given an interest

rate of 5%, what is the price you are paying for the house

(i.e. what is the present value)?

30

1 1

.05

.05(1 .05)

$10, 000

$153, 724.51

PV

PV

+

(

=

=

5-19

Future Value of Annuities

Example - Future Value of annual payments

You plan to save $4,000 every year for 20 years and then retire.

Given a 10% rate of interest, how much will you have saved

by the time you retire?

20

20

1 1

.10

.10(1 .10)

$4, 000 (1 .10)

$229,100

FV

FV

+

(

= +

=

5-20

Annuity Due

How does it differ from an ordinary annuity?

What is it?

Recall: r = the discount rate

(1 )

Annuity Due Annuity

FV FV r = +

How does the future value differ from an ordinary annuity?

(1 )

Annuity Due Annuity

PV PV r = +

5-21

Annuities Due: Example

) 1 ( r FV FV

Annuity AD

+ =

Example: Suppose you invest $429.59 annually at the

beginning of each year at 10% interest. After 50 years,

how much would your investment be worth?

000 , 550 $

) 10 . 1 ( ) 000 , 500 ($

) 1 (

=

=

+ =

AD

AD

Annuity AD

FV

FV

r FV FV

5-22

Interest Rates: EAR & APR

What is EAR?

What is APR?

How do they differ?

5-23

*where MR = monthly interest rate

EAR & APR Calculations

1 ) 1 (

12

+ = MR EAR

Effective Annual Interest Rate (EAR):

Annual Percentage Rate (APR):

12 = MR APR

5-24

EAR and APR: Example

Example:

Given a monthly rate of 1%, what is the Effective Annual

Rate(EAR)? What is the Annual Percentage Rate (APR)?

% 00 . 12 ) 12 ( ) 01 . 0 (

% 68 . 12 1 ) 01 . 1 (

12

= =

= =

APR

EAR

5-25

Inflation

What is it?

What determines inflation rates?

What is deflation?

5-26

Inflation and Real Interest

1+nominal interest rate

1+inflation rate

1 real interest rate= +

Exact calculation:

Approximation:

rate inflation - rate interest nominal rate interest Real ~

5-27

Inflation: Example

Example

If the nominal interest rate on your interest-bearing savings account is

2.0% and the inflation rate is 3.0%, what is the real interest rate?

1+.02

1+.03

1 real interest rate=

1 real interest rate= 0.9903

real interest rate = -.0097 or -.97%

Approximation = .02-.03 = .01 1%

+

+

=

5-28

Appendix A: Inflation

Annual U.S. Inflation Rates from 1900 - 2010

Vous aimerez peut-être aussi

- Risk and Rates of Return: Learning ObjectivesDocument36 pagesRisk and Rates of Return: Learning Objectivesssregens82Pas encore d'évaluation

- Static Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing InstructionsDocument17 pagesStatic Picture Effects For Powerpoint Slides: Reproductio N Instructions Printing Instructions Removing Instructionsssregens82Pas encore d'évaluation

- Building Multi-Tier Web Applications in Virtual EnvironmentsDocument30 pagesBuilding Multi-Tier Web Applications in Virtual Environmentsssregens82Pas encore d'évaluation

- Orchestro State Inventory Management 2015Document8 pagesOrchestro State Inventory Management 2015ssregens82Pas encore d'évaluation

- Lussier 3 Ech 05Document50 pagesLussier 3 Ech 05ssregens82Pas encore d'évaluation

- CHP 3Document2 pagesCHP 3ssregens82Pas encore d'évaluation

- Supplier General QualificationsDocument3 pagesSupplier General Qualificationsssregens82Pas encore d'évaluation

- Judicial Power of Supreme CourtDocument2 pagesJudicial Power of Supreme Courtssregens82Pas encore d'évaluation

- Week 8 AssignmentDocument5 pagesWeek 8 Assignmentssregens82100% (2)

- Transportation and Logistics OptimizationDocument18 pagesTransportation and Logistics Optimizationssregens82Pas encore d'évaluation

- AMIS 525 Pop Quiz - Chapters 22 and 23Document5 pagesAMIS 525 Pop Quiz - Chapters 22 and 23ssregens82Pas encore d'évaluation

- Regular Flow Irregular Flow Irregular Flow DepreciationDocument1 pageRegular Flow Irregular Flow Irregular Flow Depreciationssregens82Pas encore d'évaluation

- Problems, Problem Spaces and Search: Dr. Suthikshn KumarDocument47 pagesProblems, Problem Spaces and Search: Dr. Suthikshn Kumarssregens82Pas encore d'évaluation

- V Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )Document1 pageV Ac - SC V (Aa Ar) - (Sa SR) V (Aa Ar) - (Aa SR) + (Aa SR) - (Sa SR) V ( (Aa Ar) - (Aa SR) ) + ( (Aa SR) - (Sa SR) )ssregens82Pas encore d'évaluation

- TPRICEDocument1 pageTPRICEssregens82Pas encore d'évaluation

- Chapter 1 BowersoxDocument38 pagesChapter 1 Bowersoxssregens82100% (1)

- Vcost DemoDocument2 pagesVcost Demossregens82Pas encore d'évaluation

- Signs For Income VarianceDocument1 pageSigns For Income Variancessregens82Pas encore d'évaluation

- Time Value PracticeDocument1 pageTime Value Practicessregens82Pas encore d'évaluation

- Process StepsDocument1 pageProcess Stepsssregens82Pas encore d'évaluation

- I (P Q) - (V Q) - F: The Fundamental EquationDocument1 pageI (P Q) - (V Q) - F: The Fundamental Equationssregens82Pas encore d'évaluation

- Ri RoiDocument1 pageRi Roissregens82Pas encore d'évaluation

- Percent DoneDocument1 pagePercent Donessregens82Pas encore d'évaluation

- Operating Income Variances DiagramDocument1 pageOperating Income Variances Diagramssregens82Pas encore d'évaluation

- Total For 5 Years Each YearDocument1 pageTotal For 5 Years Each Yearssregens82Pas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- John Carlo A. Rogon BSA 3-1 Prof. Ulysses ValladolidDocument88 pagesJohn Carlo A. Rogon BSA 3-1 Prof. Ulysses ValladolidmerryPas encore d'évaluation

- PEB4102 Chapter 4 - UpdatedDocument79 pagesPEB4102 Chapter 4 - UpdatedLimPas encore d'évaluation

- Accounting and Finance For Managers - MS CourseDocument5 pagesAccounting and Finance For Managers - MS CourseUmer IqbalPas encore d'évaluation

- Annuity Due 1Document27 pagesAnnuity Due 1nurulPas encore d'évaluation

- CH 1 Quantitative - Methods RVF45YESAU PDFDocument308 pagesCH 1 Quantitative - Methods RVF45YESAU PDFSiravit AriiazPas encore d'évaluation

- 09 Capital Budgeting KEY PDFDocument24 pages09 Capital Budgeting KEY PDFRianna MangabatPas encore d'évaluation

- InvestmentDocument31 pagesInvestmentCarlo Emmanuel Balane100% (1)

- Lecture 4Document89 pagesLecture 4Lee Li HengPas encore d'évaluation

- Report Financial ManagementDocument30 pagesReport Financial ManagementRishelle Mae C. AcademíaPas encore d'évaluation

- Chap 005Document90 pagesChap 005조서현50% (2)

- Math 11 Gen Math Q2-Week 2Document26 pagesMath 11 Gen Math Q2-Week 2Sherri BonquinPas encore d'évaluation

- Chapter 10 Lease AccountingDocument6 pagesChapter 10 Lease AccountingCasinas Kyana LouissePas encore d'évaluation

- Accounts and Finance For BankersDocument5 pagesAccounts and Finance For BankersneevcoachingPas encore d'évaluation

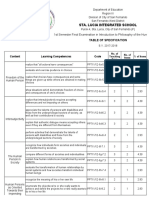

- Sta. Lucia Integrated School: 1st Semester Final Examination in Introduction To Philosophy of The Human PersonDocument21 pagesSta. Lucia Integrated School: 1st Semester Final Examination in Introduction To Philosophy of The Human PersonAngelica Velaque Babsa-ay AsiongPas encore d'évaluation

- AnnuityDocument34 pagesAnnuityDanielle EvangelistaPas encore d'évaluation

- Full Civil Engineering Short Notes by Shubham Sir TestbookDocument452 pagesFull Civil Engineering Short Notes by Shubham Sir Testbook2030331191010.jamPas encore d'évaluation

- CH 06Document80 pagesCH 06ชัยยศ โชติ100% (1)

- Theory of FirmsDocument17 pagesTheory of FirmsWasif AzizPas encore d'évaluation

- Budget of Work (BOW) - GenMathDocument2 pagesBudget of Work (BOW) - GenMathJENETTE SABURAO100% (1)

- Au Mod - 1Document8 pagesAu Mod - 1Keyur PopatPas encore d'évaluation

- Corporate Finance 10th Edition Ross Test Bank DownloadDocument47 pagesCorporate Finance 10th Edition Ross Test Bank DownloadJames Netzer100% (22)

- Ok Na 2 Booklet 1Document36 pagesOk Na 2 Booklet 1mjbicaldoPas encore d'évaluation

- Tvom One Shot Notes Capranav Caf Dec 23Document20 pagesTvom One Shot Notes Capranav Caf Dec 23ayannawaz961253Pas encore d'évaluation

- Mathematics of FinanceDocument116 pagesMathematics of FinanceFerrolinoLouiePas encore d'évaluation

- Plate ElectiveDocument46 pagesPlate ElectiveKatherine Shayne YeePas encore d'évaluation

- CHP 6 - Time Value of MoneyDocument11 pagesCHP 6 - Time Value of MoneyShahnawaz KhanPas encore d'évaluation

- Lecture Notes PDFDocument17 pagesLecture Notes PDFversPas encore d'évaluation

- Chapter 5 Time Value of MoneyDocument39 pagesChapter 5 Time Value of MoneyAU Sharma100% (2)

- Finance 440 Review Time Value of Money PDocument5 pagesFinance 440 Review Time Value of Money PNeighvestPas encore d'évaluation

- This Study Resource Was: Case Study 2: Finding Jill Moran's Retirement AnnuityDocument3 pagesThis Study Resource Was: Case Study 2: Finding Jill Moran's Retirement AnnuityAl Afsana100% (2)