Académique Documents

Professionnel Documents

Culture Documents

Prepared By: Fernando Quijano and Yvonn Quijano: - Macroeconomics, 5/e - Olivier Blanchard

Transféré par

Arief KurniawanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Prepared By: Fernando Quijano and Yvonn Quijano: - Macroeconomics, 5/e - Olivier Blanchard

Transféré par

Arief KurniawanDroits d'auteur :

Formats disponibles

CHAPTER 18

Openness in Goods

and Financial

Markets

CHAPTER 18

Prepared by:

Fernando Quijano and Yvonn Quijano

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 2 of 40

Openness in Goods and Financial Markets

Openness has three distinct dimensions:

1. Openness in goods markets. Free trade restrictions

include tariffs and quotas.

2. Openness in financial markets. Capital controls

place restrictions on the ownership of foreign assets.

3. Openness in factor markets. The ability of firms to

choose where to locate production, and workers to

choose where to work. The North American Free

Trade Agreement (NAFTA) is an example of this.

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 3 of 40

18-1 Openness in Goods Markets

Exports and Imports

Since 1960, exports and

imports have more than

doubled in relation to GDP.

U.S. Exports and

Imports as Ratios of

GDP since 1960

Figure 18 - 1

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 4 of 40

The behavior of exports and imports in the United States

is characterized by:

The U.S. economy is becoming more open over

time, and trades more than twice as much (relative

to its GDP) with the rest of the world as it did just 40

years ago.

Although imports and exports have followed broadly

the same upward trend, they have also diverged for

long periods of time, generating sustained trade

surpluses and trade deficits.

18-1 Openness in Goods Markets

Exports and Imports

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 5 of 40

A good index of openness is the proportion of

aggregate output composed of tradable goodsor

goods that compete with foreign goods in either

domestic markets or foreign markets.

Estimates are that tradable goods represent around

60% of aggregate output in the United States today.

18-1 Openness in Goods Markets

Exports and Imports

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 6 of 40

The main factors behind differences in export ratios are

geography and country size:

- Distance from other markets.

- Size also matters: The smaller the country, the more it must

specialize in producing and exporting only a few products and

rely on imports for other products.

Table 18-1

Ratios of Exports to GDP for Selected OECD Countries, 2006

Country Export Ratio (%) Country Export Ratio (%)

United States 11 Switzerland 54

Japan 18 Austria 62

United Kingdom 30 Netherlands 80

Germany 48 Belgium 92

18-1 Openness in Goods Markets

Exports and Imports

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 7 of 40

Can Exports Exceed GDP?

Countries can have export ratios larger

than the value of their GDP because

exports and imports may include exports

and imports of intermediate goods.

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 8 of 40

When goods markets are open, domestic consumers must

decide not only how much to consume and save, but also

whether to buy domestic goods or to buy foreign goods.

Central to the second decision is the price of domestic

goods relative to foreign goods, or the real exchange rate.

18-1 Openness in Goods Markets

The Choice between Domestic Goods and Foreign Goods

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 9 of 40

Nominal exchange rates between two currencies can be

quoted in one of two ways:

As the price of the domestic currency in terms of

the foreign currency.

As the price of the foreign currency in terms of the

domestic currency.

18-1 Openness in Goods Markets

Nominal Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 10 of 40

The nominal exchange rate is the price of the foreign

currency in terms of the domestic currency.

An appreciation of the domestic currency is an

increase in the price of the domestic currency in

terms of the foreign currency, which corresponds

to a increase in the exchange rate.

A depreciation of the domestic currency is a decrease

in the price of the domestic currency in terms of the

foreign currency, or a decrease in the exchange rate.

18-1 Openness in Goods Markets

Nominal Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 11 of 40

When countries operate under fixed exchange rates, that

is, maintain a constant exchange rate between them, two

other terms used are:

Revaluations, rather than appreciations, which are

decreases in the exchange rate, and

Devaluations, rather than depreciations, which are

increases in the exchange rate.

18-1 Openness in Goods Markets

Nominal Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 12 of 40

18-1 Openness in Goods Markets

Nominal Exchange Rates

Although the dollar has

appreciated relative to the

pound over the past four

decades, this appreciation has

come with large swings in the

nominal exchange rate

between the two currencies,

especially in the 1980s.

The Nominal Exchange

Rate between the Dollar

and the Pound since

1970

Figure 18 - 2

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 13 of 40

Note the two main characteristics of the figure:

The trend increase in the exchange rate. Put another

way, there was an appreciation of the dollar vis--vis

the pound over the period.

The large fluctuations in the exchange rate. Put

another way, there was a very large appreciation of

the dollar in the first half of the 1980s, followed by a

large depreciation later in the decade.

18-1 Openness in Goods Markets

Nominal Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 14 of 40

Lets look at the real exchange rate between the United

States and the UK.

If the price of a Cadillac in the US is $40,000, and

a dollar is worth 0.50 pounds, then the price of a

Cadillac in pounds is $40,000 X 0.50 = 20,000.

If the price of a Jaguar in the UK is 30,000, then

the price of a Cadillac in terms of Jaguars would

be 20,000/ 30,000 = 0.66.

To generalize this example to all of the goods in the

economy, we use a price index for the economy, or the

GDP deflator.

18-1 Openness in Goods Markets

From Nominal to Real Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 15 of 40

1. P = price of U.S. goods in dollars

2. P* = price of British goods in pounds

*

EP

P

c =

18-1 Openness in Goods Markets

From Nominal to Real Exchange Rates

The Construction of the

Real Exchange Rate

Figure 18 - 3

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 16 of 40

Like nominal exchange rates, real exchange rates move

over time:

An increase in the relative price of domestic goods in

terms of foreign goods is called a real appreciation,

which corresponds to a decrease in the real exchange

rate, c.

A decrease in the relative price of domestic goods in

terms of foreign goods is called a real depreciation,

which corresponds to an increase in the real exchange

rate, c.

18-1 Openness in Goods Markets

From Nominal to Real Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 17 of 40

18-1 Openness in Goods Markets

From Nominal to Real Exchange Rates

Except for the difference in

trend reflecting higher average

inflation in the United Kingdom

than in the United States, the

nominal and the real

exchange rates have moved

largely together since 1970.

Real and Nominal

Exchange Rates

between the United

States and the United

Kingdom since 1970

Figure 18 - 4

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 18 of 40

18-1 Openness in Goods Markets

From Nominal to Real Exchange Rates

Note the two main characteristics of Figure 18-4:

While the nominal exchange rate went up during

the period, the real exchange rate went down.

The large fluctuations in the nominal exchange

rate also show up in the real exchange rate.

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 19 of 40

Two things have happened since 1970.

First, E has increased. The dollar has gone

up in terms of pounds.

Second, P/P* has decreased. The price level

has increased less in the United States than

in the UK.

18-1 Openness in Goods Markets

From Nominal to Real Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 20 of 40

Table 18-2 The Country Composition of U.S. Exports

and Imports, 2006

Proportion of Exports to (%) Proportion of Imports from (%)

Canada 14 12

Mexico 8 8

European Union 29 25

China 3 13

Japan 6 9

Rest of Asia* 14 11

Others 26 22

* Asia, excluding Japan and China

18-1 Openness in Goods Markets

From Bilateral to Multilateral Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 21 of 40

Bilateral exchange rates are exchange rates between

two countries. Multilateral exchange rates are

exchange rates between several countries.

For example, to measure the average price of U.S.

goods relative to the average price of goods of U.S.

trading partners, we use the U.S. share of import and

export trade with each country as the weight for that

country, or the multilateral real U.S. exchange rate.

18-1 Openness in Goods Markets

From Bilateral to Multilateral Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 22 of 40

Equivalent names for the relative price of foreign

goods vis--vis U.S. goods are:

The real multilateral U.S. exchange rate.

The U.S. trade-weighted real exchange rate.

The U.S. effective real exchange rate.

18-1 Openness in Goods Markets

From Bilateral to Multilateral Exchange Rates

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 23 of 40

18-1 Openness in Goods Markets

From Bilateral to Multilateral Exchange Rates

The large real appreciation of

U.S. goods in the first half of

the 1980s was followed by a

large real depreciation in the

second half of the 1980s. This

large swing in the 1980s is

sometimes called the dance

of the dollar.

The U.S. Multilateral

Real Exchange Rate

since 1973

Figure 18 - 5

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 24 of 40

The purchase and sale of foreign assets implies buying or

selling foreign currencysometimes called foreign

exchange.

Openness in financial markets allows:

Financial investors to diversifyto hold both domestic

and foreign assets and speculate on foreign interest rate

movements.

Allows countries to run trade surpluses and deficits. A

country that buys more than it sells must pay for the

difference by borrowing from the rest of the world.

18-2 Openness in Financial Markets

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 25 of 40

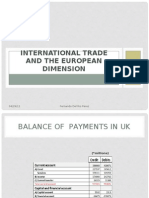

The balance of payments account summarizes a

countrys transactions with the rest of the world.

Transactions above the line are current account

transactions. Transactions below the line are

capital account transactions.

The current account balance and the capital

account balance should be equal, but because of

data gathering errors they dont. For this reason,

the account shows a statistical discrepancy.

The Balance of Payments

18-2 Openness in Financial Markets

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 26 of 40

Table 18-3 The U.S. Balance of Payments, 2006 (in billions of U.S. dollars)

Current Account

Exports 1,436

Imports 2,200

Trade balance (deficit = ) (1) -763

Investment income received 620

Investment income paid 629

Net investment income (2) -9

Net transfers received (3) -84

Current account balance (deficit = -) (1) + (2) + (3) -856

Capital Account

Increase in foreign holdings of U.S. assets (4) 1,764

Increase in U.S. holdings of foreign assets (5) 1,049

Capital account balance (deficit = -) (4) (5) 715

Statistical discrepancy 141

The Balance of Payments

18-2 Openness in Financial Markets

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 27 of 40

The transactions above the line record payments to and

from the rest of the world are called current account

transactions:

The first two lines record the exports and imports of

goods and services.

U.S. residents receive investment income on their

holdings of foreign assets and vice versa.

Countries give and receive foreign aid; the net value

is recorded as net transfers received.

The Balance of Payments

18-2 Openness in Financial Markets

The Current Account

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 28 of 40

The sum of net payments in the current

account balance can be positive, in which

case the country has a current account

surplus, or negativea current account

deficit.

The Balance of Payments

18-2 Openness in Financial Markets

The Current Account

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 29 of 40

Transactions below the line are called capital account

transactions.

The capital account balance, also known as net capital

flows can be positive (negative) if foreign holdings of U.S.

assets are greater (less) than U.S. holdings of foreign assets,

in which case there is a capital account surplus (deficit).

Negative net capital flows are called a capital account

deficit.

The numbers for current and capital account transactions are

constructed using different sources; although they should give

the same answers, they typically do not. The difference

between the two is call the statistical discrepancy.

The Balance of Payments

18-2 Openness in Financial Markets

The Capital Account

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 30 of 40

The decision whether to invest abroad or at home

depends not only on interest rate differences, but

also on your expectation of what will happen to

the nominal exchange rate.

The Choice between Domestic and Foreign Assets

18-2 Openness in Financial Markets

Expected Returns from

Holding One-Year U.S.

Bonds or One-Year U.K.

Bonds

Figure 18 - 6

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 31 of 40

If both U.K. bonds and U.S. bonds are to be held, they

must have the same expected rate of return, so that the

following arbitrage relation must hold:

*

1

( ) ( ) 1 + 1 +

t

e

t t

t

E

i

i

E

+

| |

=

|

\ .

*

1

1

) ( )( ) (1 + 1 +

e

t

t t

t

i E

i

E

+

| |

=

|

\ .

Rearranging the equation, we obtain the uncovered

interest parity relation, or interest parity condition:

The Choice between Domestic and Foreign Assets

18-2 Openness in Financial Markets

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 32 of 40

The assumption that financial investors will hold

only the bonds with the highest expected rate of

return is obviously too strong, for two reasons:

It ignores transaction costs.

It ignores risk.

The Choice between Domestic and Foreign Assets

18-2 Openness in Financial Markets

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 33 of 40

GDP versus GNP: The Example of Kuwait

Table 1 GDP, GNP, and Net Factor

Payments in Kuwait, 1989-1994

Year GDP GNP Net Factor Payments

1989 7,143 9,616 2,473

1990 5,328 7,560 2,232

1991 3,131 4,669 1,538

1992 5,826 7,364 1,538

1993 7,231 8,386 1,151

1994 7,380 8,321 941

Note: All numbers are in millions of Kuwaiti dinars. 1 dinar =

$3.67 (2007).

Source: IMF International Financial Statistics.

Gross domestic product (GDP) is the measure that corresponds

to value added domestically.

Gross national product (GNP) corresponds to the value added by

domestically owned factors of production.

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 34 of 40

The relation between the domestic nominal interest rate,

the foreign nominal interest rate, and the expected rate of

depreciation of the domestic currency is stated as:

*

1

( )

(

[ ( ) / )]

1 +

1 + ) =

1 +

t

t

e

t t t

i

i

E E E

+

A good approximation of the equation above is given by:

Interest Rates and Exchange Rates

18-2 Openness in Financial Markets

*

1

e

t t

t

t

t

E

i i

E

E

+

~

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 35 of 40

This is the relation you must remember: Arbitrage implies that the

domestic interest rate must be (approximately ) equal to the foreign

interest rate plus the expected depreciation rate of the domestic

currency.

If , then

1

e

t t

E

E

+

=

*

t t

i

i

=

Interest Rates and Exchange Rates

18-2 Openness in Financial Markets

*

1

e

t t

t

t

t

E

i i

E

E

+

~

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 36 of 40

Should you hold U.K. bonds or U.S. bonds?

It depends whether you expect the pound to depreciate

vis--vis the dollar over the coming year.

If you expect the pound to depreciate by more then

3.0%, then investing in U.K. bonds is less attractive than

investing in U.S. bonds.

If you expect the pound to depreciate by less than 3.0%

or even to appreciate, then the reverse holds, and U.K.

bonds are more attractive than U.K. bonds.

Interest Rates and Exchange Rates

18-2 Openness in Financial Markets

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 37 of 40

Interest Rates and Exchange Rates

18-2 Openness in Financial Markets

U.S. and U.K. nominal interest

rates have largely moved

together over the past 38

years.

Three-Month Nominal

Interest Rates in the

United States and in the

United Kingdom since

1970

Figure 18 - 7

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 38 of 40

Buying Brazilian Bonds

Shouldnt you be buying Brazilian bonds at a monthly interest

rate of 36.9%?

What rate of depreciation of the cruzeiro should you expect

over the coming month? A reasonable assumption is to expect

the rate of depreciation during the coming month to be equal

to the rate of depreciation during last month.

The expected rate of return in dollars from holding Brazilian

bonds is only (1.017 1) = 1.6% per month.

Think of the risk and the transaction costsall the elements

we ignored when we wrote the arbitrage condition. When

these are taken into account, you may well decide to keep

your funds out of Brazil.

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 39 of 40

We have set the stage for the study of an open economy:

The choice between domestic goods and foreign

goods depends primarily on the real exchange rate.

The choice between domestic assets and foreign

assets depends primarily on their relative rates of

return, which depend on domestic interest rates and

foreign interest rates, and on the expected

depreciation of the domestic currency.

18-3 Conclusions and a Look Ahead

C

h

a

p

t

e

r

1

8

:

O

p

e

n

n

e

s

s

i

n

G

o

o

d

s

a

n

d

F

i

n

a

n

c

i

a

l

M

a

r

k

e

t

s

Copyright 2009 Pearson Education, Inc. Publishing as Prentice Hall Macroeconomics, 5/e Olivier Blanchard 40 of 40

Key Terms

openness in goods markets,

tariffs

quotas

openness in financial markets

capital controls

openness in factor markets

North American Free Trade Agreement

(NAFTA)

tradable goods

real exchange rate

nominal exchange rate

appreciation (nominal)

depreciation (nominal)

fixed exchange rates

revaluation

devaluation

real appreciation

real depreciation

bilateral exchange rate

multilateral exchange rate

multilateral real U.S. exchange rate

trade-weighted real exchange rate

effective real exchange rate

foreign exchange

balance of payments

above the line, below the line

current account

investment income

net transfers received

current account balance

current account surplus, current

account deficit

capital account

net capital flows

capital account balance

capital account surplus, capital account

deficit

statistical discrepancy

gross domestic product (GDP)

gross national product (GNP)

uncovered interest parity relation, or

interest parity condition

Vous aimerez peut-être aussi

- Handbook of International TradeDocument411 pagesHandbook of International Traderamkrishna0071100% (14)

- Australia in The Global Economy 2013 - 6th Edition PDFDocument418 pagesAustralia in The Global Economy 2013 - 6th Edition PDFBlatant YocedPas encore d'évaluation

- 4 Osmena V Orbos DGSTDocument2 pages4 Osmena V Orbos DGSTMiguelPas encore d'évaluation

- MCQs With Solution For ECONS (Macro)Document38 pagesMCQs With Solution For ECONS (Macro)DzifahManteau100% (1)

- International Business Chapter 10Document24 pagesInternational Business Chapter 10Rabiatul AndawiyahPas encore d'évaluation

- I-Procurement 12.2.7 (2297706.1)Document8 pagesI-Procurement 12.2.7 (2297706.1)Vaibhav KulkarniPas encore d'évaluation

- editedQUIZ CHAPTER-15 MISCELLANEOUS-TOPICSDocument2 pageseditedQUIZ CHAPTER-15 MISCELLANEOUS-TOPICSanna maria50% (2)

- International Economics 3rd Edition Feenstra Test BankDocument26 pagesInternational Economics 3rd Edition Feenstra Test BankNicholasSolisdiwex100% (13)

- CH 01Document14 pagesCH 01Madalina RaceaPas encore d'évaluation

- Lecture 10Document40 pagesLecture 10Tiffany Tsang100% (1)

- Chapter 1 IE NewDocument49 pagesChapter 1 IE NewTrâm NgọcPas encore d'évaluation

- Armstrong Testimony To Congress - 1996Document8 pagesArmstrong Testimony To Congress - 1996KrisPas encore d'évaluation

- Eleventh Edition, Global EditionDocument21 pagesEleventh Edition, Global EditionBilge SavaşPas encore d'évaluation

- ch18 4eDocument40 pagesch18 4eKumarGauravPas encore d'évaluation

- The Open Economy: © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier BlanchardDocument31 pagesThe Open Economy: © 2003 Prentice Hall Business Publishing Macroeconomics, 3/e Olivier BlanchardAleriz ChangPas encore d'évaluation

- Int Business Chap4. DuDocument20 pagesInt Business Chap4. DusoheltushPas encore d'évaluation

- Mit Ch18 NoteDocument42 pagesMit Ch18 NoteoakashlerPas encore d'évaluation

- Understanding The Global Context of BusinessDocument20 pagesUnderstanding The Global Context of BusinessNoel MosesPas encore d'évaluation

- International EconomicsDocument32 pagesInternational EconomicsknahmedPas encore d'évaluation

- Macroeconomics: Welcome To HKUSTDocument38 pagesMacroeconomics: Welcome To HKUSTyaoamber9628Pas encore d'évaluation

- Open-Economy Macroeconomics: The Balance of Payments and Exchange RatesDocument53 pagesOpen-Economy Macroeconomics: The Balance of Payments and Exchange RatesNikita KhandelwalPas encore d'évaluation

- Nontariff Trade BarriersDocument31 pagesNontariff Trade BarriersThành NgọcPas encore d'évaluation

- Economic Policies Home AssignmentDocument7 pagesEconomic Policies Home AssignmentpalackmosokefePas encore d'évaluation

- Macroeconomics: Case Fair OsterDocument24 pagesMacroeconomics: Case Fair Ostercamo1157Pas encore d'évaluation

- Enquiry Into Marginalization: International Trade TheoryDocument30 pagesEnquiry Into Marginalization: International Trade Theoryনাহিদ উকিল জুয়েলPas encore d'évaluation

- The Balance of PaymentsDocument39 pagesThe Balance of PaymentsKiran AishaPas encore d'évaluation

- ECO364 - International Trade: Chapter 9 - Efficient Tariffs vs. "Protection For Sale"Document64 pagesECO364 - International Trade: Chapter 9 - Efficient Tariffs vs. "Protection For Sale"jooo93Pas encore d'évaluation

- Logistica Primera Entrega FINAL1Document14 pagesLogistica Primera Entrega FINAL1Elian Enrrique Mosquera PereaPas encore d'évaluation

- 01-International Business-1Document98 pages01-International Business-1anwer_quadriPas encore d'évaluation

- The Balance of Payments Provides Us With Important Information About Whether or Not A Country Is "Paying Its Way" in The International EconomyDocument6 pagesThe Balance of Payments Provides Us With Important Information About Whether or Not A Country Is "Paying Its Way" in The International EconomyankitaiimPas encore d'évaluation

- TE 2009 FinaltextDocument144 pagesTE 2009 Finaltextforestlee436629Pas encore d'évaluation

- Week 7 Openness in Goods and Financial MarketsDocument49 pagesWeek 7 Openness in Goods and Financial MarketsGreg AubinPas encore d'évaluation

- Ibiv FTP 2Document382 pagesIbiv FTP 2Srinivasa KirankumarPas encore d'évaluation

- Principles of Economics Chapter 6Document38 pagesPrinciples of Economics Chapter 6Louie Guese MangunePas encore d'évaluation

- International Production TheoryDocument49 pagesInternational Production Theorykoodhorah0% (1)

- Chapter 8Document72 pagesChapter 8AnonymousPas encore d'évaluation

- Fundamentals of TradeDocument15 pagesFundamentals of TradeVishal GayakwadPas encore d'évaluation

- Trade in The Global Economy Trade in The Global Economy: Questions To ConsiderDocument39 pagesTrade in The Global Economy Trade in The Global Economy: Questions To ConsiderKaren GyulzadyanPas encore d'évaluation

- Regional and Global StrategyDocument32 pagesRegional and Global Strategycooljani01Pas encore d'évaluation

- Week 14 Application International TradeDocument29 pagesWeek 14 Application International TradeTri Imam WicaksonoPas encore d'évaluation

- Fernando Del Rio 8 FebDocument19 pagesFernando Del Rio 8 FebFernando Del Rio PerezPas encore d'évaluation

- Exchange Rates: © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray FairDocument35 pagesExchange Rates: © 2002 Prentice Hall Business Publishing Principles of Economics, 6/e Karl Case, Ray FairVikas SharmaPas encore d'évaluation

- Absolute Advantage TheoryDocument4 pagesAbsolute Advantage TheoryNiña Kaye San JosePas encore d'évaluation

- Solution Manual For International Finance Theory and Policy 10Th Edition Krugman Obstfeld and Melitz 0133423638 978013342363 Full Chapter PDFDocument26 pagesSolution Manual For International Finance Theory and Policy 10Th Edition Krugman Obstfeld and Melitz 0133423638 978013342363 Full Chapter PDFdeborah.stapleton117100% (10)

- Internationaltrade Group7 130702031215 Phpapp01 2Document51 pagesInternationaltrade Group7 130702031215 Phpapp01 2Nagarjuna ReddyPas encore d'évaluation

- The Open Economy and Balance of PaymenytsDocument33 pagesThe Open Economy and Balance of PaymenytsSarthak GuptaPas encore d'évaluation

- Fabozzi FoFMI4 CH01Document22 pagesFabozzi FoFMI4 CH01Burcu KaraözPas encore d'évaluation

- Macroeconomics INFLATION 1610Document15 pagesMacroeconomics INFLATION 1610Eddy EdPas encore d'évaluation

- Chapter 15 Lecture PresentationDocument47 pagesChapter 15 Lecture PresentationSumayya AlmdniPas encore d'évaluation

- IBCh 04Document20 pagesIBCh 04Piyush RaiPas encore d'évaluation

- Financial MarketsDocument32 pagesFinancial MarketsArief Kurniawan100% (1)

- International Business Environments and Operations, 13/e Global EditionDocument24 pagesInternational Business Environments and Operations, 13/e Global EditionKHADIZA123123Pas encore d'évaluation

- Presentation On International TradeDocument12 pagesPresentation On International TradeJuhi AgrawalPas encore d'évaluation

- Chapter 1Document29 pagesChapter 1DaisyPas encore d'évaluation

- KTEE308 International Economics: Assoc. Prof. Tu Thuy Anh Faculty of International EconomicsDocument25 pagesKTEE308 International Economics: Assoc. Prof. Tu Thuy Anh Faculty of International EconomicsNgọc MinhPas encore d'évaluation

- Microeconomics Canada in The Global Environment 10th Edition Parkin Solutions ManualDocument12 pagesMicroeconomics Canada in The Global Environment 10th Edition Parkin Solutions Manualclubhandbranwq8100% (17)

- Microeconomics Canada in The Global Environment 10Th Edition Parkin Solutions Manual Full Chapter PDFDocument33 pagesMicroeconomics Canada in The Global Environment 10Th Edition Parkin Solutions Manual Full Chapter PDFSherryElliottpgys100% (9)

- The Instruments of Trade Policy: Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldDocument55 pagesThe Instruments of Trade Policy: Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldJuan TelloPas encore d'évaluation

- Global Trade in The United StatesDocument12 pagesGlobal Trade in The United StatesGlaziel Anne GerapatPas encore d'évaluation

- Measure of Openness:: Export Ratio of Industrialized CountriesDocument43 pagesMeasure of Openness:: Export Ratio of Industrialized CountriesJosh BurkePas encore d'évaluation

- Trade PolicyDocument34 pagesTrade PolicyReida DelmasPas encore d'évaluation

- Full International Trade Theory and Policy 10Th Edition Krugman Solutions Manual PDF Docx Full Chapter ChapterDocument36 pagesFull International Trade Theory and Policy 10Th Edition Krugman Solutions Manual PDF Docx Full Chapter Chaptermanuelmorrisonggan37100% (20)

- 1.1 IE OverviewDocument40 pages1.1 IE Overview22070899Pas encore d'évaluation

- Current Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16D'EverandCurrent Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16Pas encore d'évaluation

- Professional Skills and Capabilities of Accounting Graduates: The New Zealand Expectation Gap?Document31 pagesProfessional Skills and Capabilities of Accounting Graduates: The New Zealand Expectation Gap?Arief KurniawanPas encore d'évaluation

- Accountant (GS-510) Competency Model: (Note: This Competency Model Framework Allows For The Development of ADocument21 pagesAccountant (GS-510) Competency Model: (Note: This Competency Model Framework Allows For The Development of AArief KurniawanPas encore d'évaluation

- The Impact of Tax Holidays On Earnings Management: An Empirical Study of Corporate Reporting Behavior in A Developing-Economy FrameworkDocument13 pagesThe Impact of Tax Holidays On Earnings Management: An Empirical Study of Corporate Reporting Behavior in A Developing-Economy FrameworkArief KurniawanPas encore d'évaluation

- Financial MarketsDocument32 pagesFinancial MarketsArief Kurniawan100% (1)

- New Microsoft Word DocumentDocument22 pagesNew Microsoft Word DocumentAjay PandayPas encore d'évaluation

- SEM-BCS Versus BPC - Focus On ConsolidationDocument12 pagesSEM-BCS Versus BPC - Focus On ConsolidationPushpa Raj100% (2)

- The IMF Bailout - Will The Anchor Hold? - Dr. Mahamudu BawumiaDocument70 pagesThe IMF Bailout - Will The Anchor Hold? - Dr. Mahamudu BawumiaMahamudu Bawumia100% (5)

- Transportation Cost and Benefit Analysis II - Literature ReviewDocument26 pagesTransportation Cost and Benefit Analysis II - Literature ReviewjarameliPas encore d'évaluation

- CEFA Examination Syllabus 2021Document30 pagesCEFA Examination Syllabus 2021Erico Cortez Fioravante AgnelloPas encore d'évaluation

- 9708 s06 QP 3Document12 pages9708 s06 QP 3icicle_skyPas encore d'évaluation

- Task 2 Revision Foreign ExchangeDocument2 pagesTask 2 Revision Foreign Exchangeshalini sehgalPas encore d'évaluation

- Gold StandardDocument24 pagesGold StandardmetlougamarPas encore d'évaluation

- Handle Foreign Currency Transactions: Establishing A Foreign Branch, o in A Foreign CompanyDocument21 pagesHandle Foreign Currency Transactions: Establishing A Foreign Branch, o in A Foreign Companyabelu habite neriPas encore d'évaluation

- Business SL - EOY - Exam MaterialDocument54 pagesBusiness SL - EOY - Exam MaterialVikram SagarPas encore d'évaluation

- Multinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFDocument33 pagesMultinational Financial Management 9Th Edition Shapiro Solutions Manual Full Chapter PDFheadmostzooenule.s8hta6100% (8)

- Nit 1Document24 pagesNit 1Santanu BiswasPas encore d'évaluation

- SBD 6 2 Local Content FormDocument5 pagesSBD 6 2 Local Content FormVictorPas encore d'évaluation

- R10 Currency Exchange Rates SlidesDocument59 pagesR10 Currency Exchange Rates SlidesKalpesh PatilPas encore d'évaluation

- International Marketing 250 Feasibility Study: Tutor Name: Sean LeeDocument42 pagesInternational Marketing 250 Feasibility Study: Tutor Name: Sean LeeAshwine KumarPas encore d'évaluation

- WTO Report of Indonesia TradeDocument249 pagesWTO Report of Indonesia TradeDewi Harddiana100% (1)

- What Does International Fisher EffectDocument3 pagesWhat Does International Fisher EffectGauri JainPas encore d'évaluation

- Currency Converter Using C#Document6 pagesCurrency Converter Using C#Mohammad SalmanPas encore d'évaluation

- International Finance Global 6Th Edition Eun Test Bank Full Chapter PDFDocument67 pagesInternational Finance Global 6Th Edition Eun Test Bank Full Chapter PDFPamelaHillqans100% (10)

- BCG Global Wealth 2020 PDFDocument36 pagesBCG Global Wealth 2020 PDFArpit CooldudePas encore d'évaluation

- Kingdom Annual Audited Results Dec 2009Document11 pagesKingdom Annual Audited Results Dec 2009Kristi DuranPas encore d'évaluation

- IB HL Global Economics Chapter 16 - Exchange Rates NotesDocument12 pagesIB HL Global Economics Chapter 16 - Exchange Rates NotescharryPas encore d'évaluation

- USDA Poland ReportDocument13 pagesUSDA Poland ReportCrueLargoPas encore d'évaluation

- Exchange Rate: USD, EUR and Romanian LeuDocument11 pagesExchange Rate: USD, EUR and Romanian LeupofokanPas encore d'évaluation