Académique Documents

Professionnel Documents

Culture Documents

AR and Inv Management

Transféré par

Ivan ChiuCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AR and Inv Management

Transféré par

Ivan ChiuDroits d'auteur :

Formats disponibles

10-1

Chapter 10

Accounts Receivable

and Inventory

Management

Pearson Education Limited 2004

Fundamentals of Financial Management, 12/e

Created by: Gregory A. Kuhlemeyer, Ph.D.

Carroll College, Waukesha, WI

10-2

After studying Chapter 10,

you should be able to:

List the key factors that can be varied in a firm's credit policy

and understand the trade-off between profitability and costs

involved.

Understand how the level of investment in accounts receivable is

affected by the firm's credit policies.

Critically evaluate proposed changes in credit policy, including

changes in credit standards, credit period, and cash discount.

Describe possible sources of information on credit applicants

and how you might use the information to analyze a credit

applicant.

Identify the various types of inventories and discuss the

advantages and disadvantages of increasing/decreasing

inventories.

Describe, explain, and illustrate the key concepts and

calculations necessary for effective inventory management and

control, including classification, economic order quantity (EOQ),

order point, safety stock, and just-in-time (JIT).

10-3

Accounts Receivable and

Inventory Management

Credit and Collection

Policies

Analyzing the Credit

Applicant

Inventory Management and

Control

10-4

Credit and Collection

Policies of the Firm

(1) Average

Collection Period

(2) Bad-debt

Losses

Quality of

Trade Account

Length of

Credit Period

Possible Cash

Discount

Firm

Collection

Program

10-5

Credit Standards

The financial manager should continually

lower the firms credit standards as long as

profitability from the change exceeds the

extra costs generated by the additional

receivables.

Credit Standards -- The minimum quality

of credit worthiness of a credit applicant

that is acceptable to the firm.

Why lower the firms credit standards?

10-6

Credit Standards

A larger credit department

Additional clerical work

Servicing additional accounts

Bad-debt losses

Opportunity costs

Costs arising from relaxing

credit standards

10-7

Example of Relaxing

Credit Standards

Basket Wonders is not operating at full capacity

and wants to determine if a relaxation of their

credit standards will enhance profitability.

The firm is currently producing a single

product with variable costs of $20 and selling

price of $25.

Relaxing credit standards is not expected to

affect current customer payment habits.

10-8

Example of Relaxing

Credit Standards

Additional annual credit sales of $120,000 and an

average collection period for new accounts of 3

months is expected.

The before-tax opportunity cost for each dollar of

funds tied-up in additional receivables is 20%.

Ignoring any additional bad-debt losses

that may arise, should Basket Wonders

relax their credit standards?

10-9

Example of Relaxing

Credit Standards

Profitability of ($5 contribution) x (4,800 units) =

additional sales $24,000

Additional ($120,000 sales) / (4 Turns) =

receivables $30,000

Investment in ($20/$25) x ($30,000) =

add. receivables $24,000

Req. pre-tax return (20% opp. cost) x $24,000 =

on add. investment $4,800

Yes! Profits > Required pre-tax return

10-10

Credit and Collection

Policies of the Firm

(1) Average

Collection Period

(2) Bad-debt

Losses

Quality of

Trade Account

Length of

Credit Period

Possible Cash

Discount

Firm

Collection

Program

10-11

Credit Terms

Credit Period -- The total length of time over

which credit is extended to a customer to

pay a bill. For example, net 30 requires

full payment to the firm within 30 days from

the invoice date.

Credit Terms -- Specify the length of time

over which credit is extended to a customer

and the discount, if any, given for early

payment. For example, 2/10, net 30.

10-12

Example of Relaxing

the Credit Period

Basket Wonders is considering changing its

credit period from net 30 (which has resulted

in 12 A/R Turns per year) to net 60 (which is

expected to result in 6 A/R Turns per year).

The firm is currently producing a single product

with variable costs of $20 and a selling price of

$25.

Additional annual credit sales of $250,000 from

new customers are forecasted, in addition to the

current $2 million in annual credit sales.

10-13

Example of Relaxing

the Credit Period

The before-tax opportunity cost for each dollar

of funds tied-up in additional receivables is

20%.

Ignoring any additional bad-debt losses

that may arise, should Basket Wonders

relax their credit period?

10-14

Example of Relaxing

the Credit Period

Profitability of ($5 contribution)x(10,000 units) =

additional sales $50,000

Additional ($250,000 sales) / (6 Turns) =

receivables $41,667

Investment in add. ($20/$25) x ($41,667) =

receivables (new sales) $33,334

Previous ($2,000,000 sales) / (12 Turns) =

receivable level $166,667

10-15

Example of Relaxing

the Credit Period

New ($2,000,000 sales) / (6 Turns) =

receivable level $333,333

Investment in $333,333 - $166,667 =

add. receivables $166,666

(original sales)

Total investment in $33,334 + $166,666 =

add. receivables $200,000

Req. pre-tax return (20% opp. cost) x $200,000 =

on add. investment $40,000

Yes! Profits > Required pre-tax return

10-16

Credit and Collection

Policies of the Firm

(1) Average

Collection Period

(2) Bad-debt

Losses

Quality of

Trade Account

Length of

Credit Period

Possible Cash

Discount

Firm

Collection

Program

10-17

Credit Terms

Cash Discount -- A percent (%) reduction in

sales or purchase price allowed for early

payment of invoices. For example, 2/10

allows the customer to take a 2% cash discount

during the cash discount period.

Cash Discount Period -- The period of time

during which a cash discount can be taken for

early payment. For example, 2/10 allows a

cash discount in the first 10 days from the

invoice date.

10-18

Example of Introducing

a Cash Discount

A competing firm of Basket Wonders is

considering changing the credit period from

net 60 (which has resulted in 6 A/R Turns

per year) to 2/10, net 60.

Current annual credit sales of $5 million are

expected to be maintained.

The firm expects 30% of its credit customers (in

dollar volume) to take the cash discount and

thus increase A/R Turns to 8.

10-19

The before-tax opportunity cost for each dollar

of funds tied-up in additional receivables is

20%.

Ignoring any additional bad-debt losses

that may arise, should the competing firm

introduce a cash discount?

Example of Introducing

a Cash Discount

10-20

Example of Using

the Cash Discount

Receivable level ($5,000,000 sales) / (6 Turns) =

(Original) $833,333

Receivable level ($5,000,000 sales) / (9 Turns) =

(New) $555,556

Reduction of $833,333 - $555,556 =

investment in A/R $277,777

10-21

Pre-tax cost of .02 x .3 x $5,000,000 =

the cash discount $30,000.

Pre-tax opp. savings (20% opp. cost) x $277,777 =

on reduction in A/R $55,555.

Yes! Savings > Costs

The benefits derived from released accounts

receivable exceed the costs of providing the

discount to the firms customers.

Example of Using the

Cash Discount

10-22

Seasonal Dating

Avoids carrying excess inventory and the

associated carrying costs.

Accept dating if warehousing costs plus the

required return on investment in inventory exceeds

the required return on additional receivables.

Seasonal Dating -- Credit terms that

encourage the buyer of seasonal products

to take delivery before the peak sales period

and to defer payment until after the peak

sales period.

10-23

Credit and Collection

Policies of the Firm

(1) Average

Collection Period

(2) Bad-debt

Losses

Quality of

Trade Account

Length of

Credit Period

Possible Cash

Discount

Firm

Collection

Program

10-24

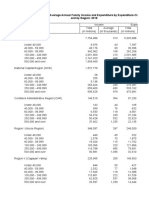

Default Risk and

Bad-Debt Losses

Present

Policy Policy A Policy B

Demand $2,400,000 $3,000,000 $3,300,000

Incremental sales $ 600,000 $ 300,000

Default losses

Original sales 2%

Incremental Sales 10% 18%

Avg. Collection Pd.

Original sales 1 month

Incremental Sales 2 months 3 months

10-25

Default Risk and

Bad-Debt Losses

Policy A Policy B

1. Additional sales $600,000 $300,000

2. Profitability: (20% contribution) x (1) 120,000 60,000

3. Add. bad-debt losses: (1) x (bad-debt %) 60,000 54,000

4. Add. receivables: (1) / (New Rec. Turns) 100,000 75,000

5. Inv. in add. receivables: (.80) x (4) 80,000 60,000

6. Required before-tax return on

additional investment: (5) x (20%) 16,000 12,000

7. Additional bad-debt losses +

additional required return: (3) + (6) 76,000 66,000

8. Incremental profitability: (2) - (7) 44,000 (6,000)

Adopt Policy A but not Policy B.

10-26

Collection Policy

and Procedures

The firm should increase collection

expenditures until the marginal

reduction in bad-debt losses equals

the marginal outlay to collect.

Collection

Procedures

Letters

Phone calls

Personal visits

Legal action

Saturation

Point

Collection Expenditures

B

a

d

-

D

e

b

t

L

o

s

s

e

s

10-27

Analyzing the

Credit Applicant

Obtaining information on the

credit applicant

Analyzing this information to

determine the applicants

creditworthiness

Making the credit decision

10-28

Sources of Information

Financial statements

Credit ratings and reports

Bank checking

Trade checking

Companys own experience

The company must weigh the amount

of information needed versus the time

and expense required.

10-29

Credit Analysis

the financial statements of the firm

(ratio analysis)

the character of the company

the character of management

the financial strength of the firm

other individual issues specific to

the firm

A credit analyst is likely to utilize

information regarding:

10-30

Sequential

Investigation Process

The cost of investigation (determining

the type and amount of information

collected) is balanced against the

expected profit from an order.

An example is provided in the following

three slides 10-31 through 10-33.

10-31

Sample Investigation

Process Flow Chart (Part A)

* For previous customers only a Dun & Bradstreet reference book check.

Pending Order

Bad

past credit

experience

Dun & Bradstreet

report analysis*

Reject

Yes No

Stage 1

$5 Cost

Stage 2

$5 - $15

Cost

No prior experience whatsoever

10-32

Sample Investigation

Process Flow Chart (Part B)

Accept

Yes

No

Credit rating

limited and/or other

damaging information

unearthed?

No

Yes

Reject

Credit rating

fair and/or other

close to maximum

line of credit?

10-33

Sample Investigation

Process Flow Chart (Part C)

** That is, the credit of a bank is substituted for customers credit.

Bank, creditor, and financial

statement analysis

Accept Reject

Accept, only upon

domestic irrevocable

letter of credit (L/C)**

Fair Poor Good

Stage 3

$30 Cost

10-34

Other Credit

Decision Issues

Line of Credit -- A limit to the amount of credit

extended to an account. Purchaser can buy on

credit up to that limit.

Streamlines the procedure for shipping

goods.

Credit-scoring System -- A system used to

decide whether to grant credit by assigning

numerical scores to various characteristics

related to creditworthiness.

10-35

Other Credit

Decision Issues

Credit decisions are made

Ledger accounts maintained

Payments processed

Collections initiated

Decision based on the core

competencies of the firm.

Outsourcing Credit and Collections

The entire credit and/or collection function(s)

are outsourced to a third-party company.

10-36

Inventory

Management and Control

Raw-materials inventory

Work-in-process inventory

In-transit inventory

Finished-goods inventory

Inventories form a link between

production and sale of a product.

Inventory types:

10-37

Inventory

Management and Control

Purchasing

Production scheduling

Efficient servicing of customer

demands

Inventories provide flexibility

for the firm in:

10-38

Appropriate

Level of Inventories

Employ a cost-benefit analysis

Compare the benefits of economies of

production, purchasing, and product

marketing against the cost of the

additional investment in inventories.

How does a firm determine

the appropriate level of

inventories?

10-39

ABC Method of

Inventory Control

Method which controls

expensive inventory

items more closely than

less expensive items.

Review A items

most frequently

Review B and C

items less rigorously

and/or less frequently.

ABC method of

inventory control

0 15 45 100

Cumulative Percentage

of Items in Inventory

70

90

100

C

u

m

u

l

a

t

i

v

e

P

e

r

c

e

n

t

a

g

e

o

f

I

n

v

e

n

t

o

r

y

V

a

l

u

e

A

B

C

10-40

How Much to Order?

Forecast usage

Ordering cost

Carrying cost

Ordering can mean either the purchase or

production of the item.

The optimal quantity to order

depends on:

10-41

Total Inventory Costs

C: Carrying costs per unit per period

O: Ordering costs per order

S: Total usage during the period

Total inventory costs (T) =

C (Q / 2) + O (S / Q)

TIME

Q / 2

Q

Average

Inventory

I

N

V

E

N

T

O

R

Y

(

i

n

u

n

i

t

s

)

10-42

Economic Order Quantity

The EOQ or

optimal

quantity

(Q*) is:

The quantity of an inventory item to order

so that total inventory costs are minimized

over the firms planning period.

Q* =

2 (O) (S)

C

10-43

Example of the

Economic Order Quantity

Basket Wonders is attempting to determine the

economic order quantity for fabric used in the

production of baskets.

10,000 yards of fabric were used at a constant

rate last period.

Each order represents an ordering cost of $200.

Carrying costs are $1 per yard over the 100-day

planning period.

What is the economic order quantity?

10-44

Economic Order Quantity

We will solve for the economic order quantity

given that ordering costs are $200 per order,

total usage over the period was 10,000 units,

and carrying costs are $1 per yard (unit).

Q* =

2 ($200) (10,000)

$1

Q* = 2,000 Units

10-45

Total Inventory Costs

EOQ (Q*) represents the minimum

point in total inventory costs.

Total Inventory Costs

Total Carrying Costs

Total Ordering Costs

Q* Order Size (Q)

C

o

s

t

s

10-46

When to Order?

Order Point -- The quantity to which inventory

must fall in order to signal that an order must

be placed to replenish an item.

Order Point (OP) = Lead time X Daily usage

Issues to consider:

Lead Time -- The length of time between the

placement of an order for an inventory item and

when the item is received in inventory.

10-47

Example of When to Order

Julie Miller of Basket Wonders has determined

that it takes only 2 days to receive the order of

fabric after the placement of the order.

When should Julie order more fabric?

Lead time = 2 days

Daily usage = 10,000 yards / 100 days

= 100 yards per day

Order Point = 2 days x 100 yards per day

= 200 yards

10-48

Example of When to Order

0 18 20 38 40

Lead

Time

200

2000

Order

Point

U

N

I

T

S

DAYS

Economic Order Quantity (Q*)

10-49

Safety Stock

Our previous example assumed certain demand

and lead time. When demand and/or lead time are

uncertain, then the order point is:

Order Point =

(Avg. lead time x Avg. daily usage) + Safety stock

Safety Stock -- Inventory stock held in reserve

as a cushion against uncertain demand (or

usage) and replenishment lead time.

10-50

Order Point

with Safety Stock

0 18 20 38

400

2000

Order

Point

U

N

I

T

S

DAYS

2200

Safety Stock

200

10-51

Order Point

with Safety Stock

U

N

I

T

S

DAYS

Safety Stock

Actual lead

time is 3 days!

(at day 21)

2200

2000

Order

Point

400

200

0 18 21

The firm dips

into the safety stock

10-52

How Much Safety Stock?

Amount of uncertainty in inventory demand

Amount of uncertainty in the lead time

Cost of running out of inventory

Cost of carrying inventory

What is the proper amount of

safety stock?

Depends on the:

10-53

J ust-in-Time

A very accurate production and

inventory information system

Highly efficient purchasing

Reliable suppliers

Efficient inventory-handling system

Just-in-Time -- An approach to inventory

management and control in which inventories

are acquired and inserted in production at the

exact times they are needed.

Requirements of applying this approach:

10-54

Supply Chain Management

JIT inventory control is one link in SCM.

The internet has enhanced SCM and

allows for many business-to-business

(B2B) transactions

Competition through B2B auctions helps

reduce firm costs especially

standardized items

Supply Chain Management (SCM) Managing

the process of moving goods, services, and

information from suppliers to end customers.

10-55

Trade Credit and

Shareholder Value

Trade credit arises when goods

sold under delayed payment

terms

Traced to Romans due to

obstacles faced in transferring

money through various trading

areas

Credit terms are taken for

granted today

Value can be added by managing

three areas:

aggregate investment in

receivables

credit terms

credit standards

Over-investing in receivables

can be costly

...but, if credit terms are not

competitive, then lost sales can

be costly

10-56

Conclusion

Minimize bad debts and

outstanding receivables

Maintain financial flexibility

Optimize mix of company assets

Convert receivables to cash in a

timely manner

Analyze customer risk

Respond to customer needs

10-57

A/R Management and

Shareholder Value

Marketing Strategy

Market Share Obj.

Aggregate Inv. in A/R Credit Terms Credit Standards

Total Dollar Investment Length of Time to Pay Acceptance of Marg Cust.

Max Shareholder Value

10-58

Trade vs. Bank Credit

Length of terms

Security

Amounts involved

Resource transferred (goods vs.

money)

Extent of analysis

10-59

Why Extend Credit?

Financial Motive

Operating Motive

Contracting Motive

Pricing Motive

All reasons are related to market

imperfections

10-60

Financial Motive

Potential of getting a higher

price

Sellers raise capital at lower

rates than customers and have

cost advantages vis-a-vis banks

due to:

similarity of customers

the information gathered in the

selling process

lower probability of default

(the goods purchased are an

essential element of the

buyers business)

seller can more easily resell

product if payment is not

made.

10-61

Operating Motive

Respond to variable and

uncertain demand

Change credit terms rather than:

install extra capacity,

building or depleting

inventories,

or forcing customers to wait.

10-62

Contracting Cost Motive

Buyer gets to inspect goods

prior to payment

Seller has less theft with

separation of collection and

product delivery

10-63

Pricing Motive

Change price by changing credit

terms

10-64

Trends Affecting Trade

Credit

Zero net working capital

objective

Improved internal and external

credit-related information

Electronic commerce

10-65

The Credit Decision

Process

Marketing contact

Credit investigation

Customer contact for information

Finalize written documents, e.g.. security agreements

Establish customer credit file

Financial analysis

T

i

m

e

10-66

Basic Credit Granting

Model

S - EXP(S)

NPV = ----------------- - VCR(S)

1 + iCP

Where:

NPV = net present value of the credit sale

VCR = variable cost ratio

S = dollar amount of credit sale

EXP = credit administration and collection expense ratio

i = daily interest rate

CP = collection period for sale

10-67

Managing the Credit

Policy

Should we extend credit?

Credit policy components

Credit-granting decision

10-68

Should We Extend Credit?

Follow industry practice

Extent and form of credit offer

in-house credit card

sell receivables to a factor

captive finance company?

10-69

Components of Credit

Policy

Development of credit standards

profile of minimally acceptable

credit worthy customer

Credit terms

credit period

cash discount

Credit limit

maximum dollar level of credit

balances

Collection procedures

how long to wait past due date

to initiate collection efforts

methods of contact

whether and at what point to

refer account to collection

agency

10-70

Credit-Granting Decision

Development of credit standards

Gathering necessary information

Credit analysis: applying credit

standards

Risk analysis

10-71

Grant-Granting Sequence

No

Order and credit

request received

New/increased

credit limit

Material

change in

customer

status

Redo credit

investigation

Size of proposed

credit limit

Medium Small Large

Indepth

credit invest.

Moderate

credit invest.

Minimal

credit invest.

Check new A/R

total vs credit lmt

No Yes

Yes

Extend Credit

No

Yes

Record

disposition

Set up,post

A/R, ship

10-72

Credit Standards

Based on five C's of Credit

Character

Capital

Capacity

Collateral

Conditions

Determine risk classification

system

Link customer evaluations to

credit standards

10-73

Gathering Information

credit reporting agencies, e.g..

Dun & Bradstreet

credit interchange bureaus,

NACM

bank letters

references from other suppliers

financial statements

field data gathered by sales reps

10-74

Credit Analysis: Applying

the Standards

Nonfinancial

concerned with willingness to

pay, character

Financial

ability to pay, financial ratios

etc.. (other Cs of credit)

Credit scoring models

Example:

Y = .000025(INCOME) +

0.50(PAYHIST) +

0.25(EMPLOYMT)

10-75

Emergence of Expert

Systems

Example of decision rule:

If gross income is equal to or

grater than $20,000 and the

applicant has not been

delinquent and gross income per

household member is equal to or

greater than $12,000 and

debt/equity ratio is equal to or

greater than 30% but less than

50% and personal property is

equal to or greater than $50,000,

then grant credit.

10-76

Factors Affecting Credit

Terms

Competition

Operating cycle

Type of good (raw materials vs

finished goods, perishables, etc.)

Seasonality of demand

Consumer acceptance

Cost and pricing

Customer type

Product profit margin

10-77

Cash Discounts

The lower the VC, the higher the

feasible discount

Based on companys cost of

funds

Consider timing effect when

changing discounts

Should be based on products

price elasticity

Higher the bad debt experience,

higher the optimal discount

10-78

Practice of Taking Cash

Discounts

51% of firms always took cash

discount

40% sometimes

9% take discount and pay late

Study found that 4 or 5

companies would be more

profitable if cash discount was

eliminated

10-79

A/R Management in

Practice

Discounts appear to be changed

to match competitors, not

inflation or interest rates

The higher a firms contribution

margin, the more likely the firm

should be to offer discounts.

A price cut is thought to have

more impact than instituting a

cash discount

The more receivables a firm has,

does not necessarily relate to

use of penalty fees

The greater amount of

receivables does not relate to a

more active credit evaluation.

10-80

Receivables, Collections,

and EDI

If credit approval is delayed...

buyers using EDI purchase

orders and JIT manufacturing

can encounter serious

problems.

sellers can now ship within

hours of receiving

orders...thus seller must be

able to handle electronically

transmitted orders.

Seller may also issues electronic

invoices and be paid

electronically using an EDI-

capable bank so that remittance

data can be automatically read

by sellers A/R system

Trend is for use of data

transmission to automate the

cash application process

10-81

Summary

Investment in A/R represents

a significant investment.

Key aspects outlined

credit policy

credit standards

credit granting sequence

credit limits

credit terms

Management of A/R is

influenced by what

competitors are doing not by

shareholder wealth

considerations.

Proper use of NPV techniques

can ensure that credit

decisions enhance

shareholder value.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Auditing Theory Answer Key (2011) by Salosagcol, Tiu, and HermosillaDocument1 pageAuditing Theory Answer Key (2011) by Salosagcol, Tiu, and HermosillaRJ Diana0% (1)

- SC Licensing HandbookDocument75 pagesSC Licensing HandbookYff DickPas encore d'évaluation

- Month Day Month Day: 526-1212, Extension 2403 / 8231-10-73 (Temporary)Document209 pagesMonth Day Month Day: 526-1212, Extension 2403 / 8231-10-73 (Temporary)Ivan ChiuPas encore d'évaluation

- Table 3 Total and Average Annual Family Income and Expenditure by Expenditure Class and by Region 2018Document8 pagesTable 3 Total and Average Annual Family Income and Expenditure by Expenditure Class and by Region 2018Ivan ChiuPas encore d'évaluation

- ABA - Annual Report 2017Document128 pagesABA - Annual Report 2017Ivan ChiuPas encore d'évaluation

- ABA - Annual Report 2018Document146 pagesABA - Annual Report 2018Ivan ChiuPas encore d'évaluation

- Table 2 Total and Average Annual Family Income and Expenditure by Income Class and by Region 2018Document8 pagesTable 2 Total and Average Annual Family Income and Expenditure by Income Class and by Region 2018Glenn GalvezPas encore d'évaluation

- Table 1 Number of Families, Total and Average Annual Family Income and Expenditure by Region 2018Document2 pagesTable 1 Number of Families, Total and Average Annual Family Income and Expenditure by Region 2018Ivan ChiuPas encore d'évaluation

- ABA - Annual Report 2019Document169 pagesABA - Annual Report 2019Ivan ChiuPas encore d'évaluation

- Table 7 Mean and Median Family Income and Expenditure by Per Capita Income Decile and by Region, 2018Document16 pagesTable 7 Mean and Median Family Income and Expenditure by Per Capita Income Decile and by Region, 2018Ivan ChiuPas encore d'évaluation

- 7 - BibliographyDocument4 pages7 - BibliographyIvan ChiuPas encore d'évaluation

- 6 - Summary, Conclusion and RecommendationDocument3 pages6 - Summary, Conclusion and RecommendationIvan ChiuPas encore d'évaluation

- 4 - MethodologyDocument6 pages4 - MethodologyIvan ChiuPas encore d'évaluation

- Table 5 Average Annual Family Income and Expenditure by Family Size, by Income Class and by Region, 2018Document10 pagesTable 5 Average Annual Family Income and Expenditure by Family Size, by Income Class and by Region, 2018Ivan ChiuPas encore d'évaluation

- 3 - Conceptual FrameworkDocument3 pages3 - Conceptual FrameworkIvan ChiuPas encore d'évaluation

- 5 - Results and DiscussionDocument5 pages5 - Results and DiscussionIvan ChiuPas encore d'évaluation

- Briefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN) - Power andDocument4 pagesBriefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN) - Power andIvan ChiuPas encore d'évaluation

- The Treasury Nominal Coupon-Issue (TNC) Yield Curve: 10-Year Average Spot Rates, PercentDocument9 pagesThe Treasury Nominal Coupon-Issue (TNC) Yield Curve: 10-Year Average Spot Rates, PercentIvan ChiuPas encore d'évaluation

- Bscs Se v2011 PDFDocument3 pagesBscs Se v2011 PDFBobPas encore d'évaluation

- Bachelor of Science in Computer ScienceDocument3 pagesBachelor of Science in Computer ScienceIvan ChiuPas encore d'évaluation

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSMuhammad Fahad100% (2)

- 47.taxability of Productivity Incentive Bonuses.07.10.08.GACDocument2 pages47.taxability of Productivity Incentive Bonuses.07.10.08.GACEumell Alexis PalePas encore d'évaluation

- Operating Segment Is The Ppe of The Mother It's About Time On Trying To Hold Deep. IFRS But Not FischerDocument1 pageOperating Segment Is The Ppe of The Mother It's About Time On Trying To Hold Deep. IFRS But Not FischerIvan ChiuPas encore d'évaluation

- CSC 121Document8 pagesCSC 121Ivan ChiuPas encore d'évaluation

- Audit Internal ExternalDocument1 pageAudit Internal ExternalIvan ChiuPas encore d'évaluation

- Critique of Comtemporary Philippine FilmsDocument1 pageCritique of Comtemporary Philippine FilmsIvan ChiuPas encore d'évaluation

- CIMA ScenarioDocument10 pagesCIMA ScenarioPerfectionism FollowerPas encore d'évaluation

- Salosagcol Audit Theory Is The Mean Way To Financial Statement But Black Scholes Is The BestDocument1 pageSalosagcol Audit Theory Is The Mean Way To Financial Statement But Black Scholes Is The BestIvan ChiuPas encore d'évaluation

- Operating Segment Is The Ppe of The Mother It's About Time On Trying To Hold Deep. IFRS But Not FischerDocument1 pageOperating Segment Is The Ppe of The Mother It's About Time On Trying To Hold Deep. IFRS But Not FischerIvan ChiuPas encore d'évaluation

- Power of The MassesDocument1 pagePower of The MassesIvan ChiuPas encore d'évaluation

- It's Not About The Thing That Cats and Mouse Are Not in Harmony With Each Other. Alan Peter. and Cuaderno EstebanDocument1 pageIt's Not About The Thing That Cats and Mouse Are Not in Harmony With Each Other. Alan Peter. and Cuaderno EstebanIvan ChiuPas encore d'évaluation

- Block 1 The Digital World: TM111 Introduction To Computing and Information Technology 1Document328 pagesBlock 1 The Digital World: TM111 Introduction To Computing and Information Technology 1lamarosafranciscoPas encore d'évaluation

- Marc FaberDocument20 pagesMarc Faberapi-26094277Pas encore d'évaluation

- Management Term Paper On Al Arafah Bank's HR Practice Term PaperDocument25 pagesManagement Term Paper On Al Arafah Bank's HR Practice Term Paperratulbinmuzib100% (3)

- NRIHome Loan FormDocument4 pagesNRIHome Loan FormnirajmishraPas encore d'évaluation

- CURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Document7 pagesCURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Jack RyanPas encore d'évaluation

- Ipo OrderDocument252 pagesIpo Orderapi-3701467Pas encore d'évaluation

- Facts and Figures: DZ BANK in The Cooperative Financial NetworkDocument3 pagesFacts and Figures: DZ BANK in The Cooperative Financial NetworkDiego BrandeauPas encore d'évaluation

- Lakshmi RavindranDocument41 pagesLakshmi RavindranspcbankingPas encore d'évaluation

- Final Marchant BankingDocument42 pagesFinal Marchant BankingSupriya PatekarPas encore d'évaluation

- Bir Form 1600Document44 pagesBir Form 1600Jerel John CalanaoPas encore d'évaluation

- SYBMS Sem 3 SyllabusDocument7 pagesSYBMS Sem 3 SyllabusRavi KrishnanPas encore d'évaluation

- Credit SaraswatDocument77 pagesCredit Saraswatsahil1508Pas encore d'évaluation

- Leadership in Banking Presentation - Idris YakubuDocument37 pagesLeadership in Banking Presentation - Idris YakubuArindam BanerjeePas encore d'évaluation

- Director Structured Finance Credit in NYC Resume Mark DouglassDocument3 pagesDirector Structured Finance Credit in NYC Resume Mark DouglassMarkDouglassPas encore d'évaluation

- Monthly Portfolio Aug 18Document126 pagesMonthly Portfolio Aug 18Jennifer NievesPas encore d'évaluation

- Chit Fund CompanyDocument34 pagesChit Fund CompanyPARAS JAINPas encore d'évaluation

- Chapter 6. Prohibited Transactions (Enzo)Document14 pagesChapter 6. Prohibited Transactions (Enzo)Kyle DionisioPas encore d'évaluation

- Literature Review of Kotak Mahindra BankDocument6 pagesLiterature Review of Kotak Mahindra Bankc5p64m3t100% (1)

- Office Manuals - IXDocument8 pagesOffice Manuals - IXDileepoo7Pas encore d'évaluation

- Loan Application Form of DMI Housing Finance Pvt. Ltd.Document4 pagesLoan Application Form of DMI Housing Finance Pvt. Ltd.DMI HousingPas encore d'évaluation

- Exchange Control - Foreign Exchange Bureaux de Change - OrdeDocument9 pagesExchange Control - Foreign Exchange Bureaux de Change - OrdeKelvin RugonyePas encore d'évaluation

- Suhl Annual Report 2021 - FinalDocument226 pagesSuhl Annual Report 2021 - FinalDavis ManPas encore d'évaluation

- Bright Evans - Curriculum VitaeDocument4 pagesBright Evans - Curriculum VitaeFREDRICK MUSAWOPas encore d'évaluation

- Growth of Islamic Banking in PakistanDocument79 pagesGrowth of Islamic Banking in Pakistandawar33100% (1)

- Fundamentals of Economics and Financial MarketsDocument4 pagesFundamentals of Economics and Financial MarketsluluPas encore d'évaluation

- Evening Brach in Co Operative BankDocument28 pagesEvening Brach in Co Operative BankGreatway ServicesPas encore d'évaluation

- EmploymentFair14Booklet PDFDocument163 pagesEmploymentFair14Booklet PDFMoatasemMadianPas encore d'évaluation

- Santa-Ana Jerald Accounting For Cash Cash and Cash EquivalentsDocument11 pagesSanta-Ana Jerald Accounting For Cash Cash and Cash EquivalentsSanta-ana Jerald JuanoPas encore d'évaluation

- Regulation of The AuditorDocument20 pagesRegulation of The AuditorPhebieon MukwenhaPas encore d'évaluation