Académique Documents

Professionnel Documents

Culture Documents

Asset Misappropriations

Transféré par

Irwan Januar0 évaluation0% ont trouvé ce document utile (0 vote)

83 vues25 pagesAsset Misappropriations

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAsset Misappropriations

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

83 vues25 pagesAsset Misappropriations

Transféré par

Irwan JanuarAsset Misappropriations

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 25

Chapter 2

Introduction to Asset Misappropriations

History of Asset Misappropriations

The Acts of Enclosure England

Prohibited pilfering company assets

The Carriers Case Southampton, England (1473)

Defendant took bales of wool and textile products

Precedent setting embezzlement case

History of Asset Misappropriations

The Norton Warburg Group Ltd.

London, England (late 1970s)

Investment management firm

Primary client/business partner - Pink Floyd

Pink Floyd pulled out assets (860,000)

Deceived clients and embezzled investor funds (4.5

million)

London, Inggris (1970's terlambat; almarhum)

Manajemen investasi dengan teguh

Mitra client/business utama -Floyd Merah Muda

Floyd Merah Muda mencabut aktiva-aktiva (860,000)

Klien-klien ditipu dan jo dana pemodal yang digelapkan (45 juta)

History of Asset Misappropriations

The United Way of America (early 1990s)

President William Aramony

$1.2 million for lavish lifestyle and a girlfriend

Andrew Bellucci New York

Pizza historian

Had embezzled from law firm of Newman Schlau Fitch

and Lane

FBI caught him on a TV commercial

History of Asset Misappropriations

Bank of Tokyo (1996)

Hideki Nishiyama embezzled $9 million by forging loan applications

Willis A. Carto (1994)

Founder of a controversial revisionist group

Embezzled $7.5 million

What is a Misappropriation?

Misuse of a company asset for personal gain

Includes more than theft or embezzlement

Use of company computer to surf the net

Company car for personal trips, etc.

Steal cash

False invoicing, etc.

Defining Assets

Assets = resources owned by the organization

Two categories:

Intangible Assets

Tangible Assets

Intangible Assets

Not physically identifiable

Usually represented by contractual right

Examples:

Patents, trademarks, leaseholds

Goodwill

Trade secrets

Tangible Assets

Five principal types:

Cash

Accounts receivable

Inventory

Plant and equipment

Investments

Most asset misappropriations involve tangible

assets (especially cash)

How Asset Misappropriations Affect

Books of Account

Assets = Liabilities + Owners Equity

Asset Misappropriation causes $ for $ set-off to owners

equity

Affects balance sheet via income statement

Revenue expenses = profit

Asset misappropriation essentially an expense of doing

business

But we dont know how big the expense is or when it occurs

The Accounting Entry for Fraud

Debits Credits

Expense Cash

Asset Cash

OR:

Revenue

Liability Cash

Equity

Concealing Asset Misappropriations

False debits

Omitted credits

Out-of-balance conditions

Forced balances

Concealing Asset Misappropriations

False debits

To expenses (most common)

Expenses are not tangible (cant be inventoried)

Expense accounts closed to zero at end of year

To assets

Commonly debit accounts receivable

Debit to asset easier to detect

Stays on books

Concealing Asset Misappropriations

Omitted credits

Concealment technique for cash skimming

Pocket cash, no credit to sales

Out-of-balance conditions

Asset removed from business (debit)

No corresponding credit

Perp hopes nobody notices

Concealing Asset Misappropriations

Forced balances

Variation of out-of-balance technique

Instead of a false entry to cover loss, perp simply

adds wrong, carry false totals

Used by perps with access to the books

Frequency of Asset Misappropriation

Schemes

Occupational Fraud

Asset

Mis

80%

Fraud Stmt

4%

Other

1%

Corrpt.

14.6%

Asset Misappropriations

are by far the most

common form of

occupational fraud.

1,224 asset

misappropriation cases

were reported in the

Associations study.

*Represents size of misstatement

Median Loss for

Asset Misappropriations

$4,000,000*

$440,000

$65,000

$0 $1,000 $2,000 $3,000 $4,000

Thousands

Fraud Stmt

Corruption

Asset Mis

Asset misappropriation schemes had the lowest

median loss of the three major occupational fraud

categories. However, at $65,000 the cost of these

schemes is still substantial.

Classifying Asset Misappropriation

Schemes

Larceny

Skimming

Fraudulent Disbursements

Cash

Misuse

Larceny

Inventory

ASSET MISAPPROPRIATION

Asset Misappropriation Cases Cash v.

Non-Cash

Cash

86.8%

Non-

Cash

13.2%

Of 1,224 asset

misappropriation

cases in the

Associations 1993

survey, 1,062 cases

involved the theft of

cash.

Median Losses -

Cash v. Non-Cash

$100,000

$60,000

$0 $20,000 $40,000 $60,000 $80,000 $100,000

Non-Cash

Cash

Median cost of non-cash schemes was higher than

that of cash schemes

Non-cash schemes: thefts of inventory, equipment,

proprietary information, etc.

Classifying Cash Schemes

Cash on Hand

From the Deposit

Other

LARCENY

Billing Schemes

Payroll Schemes

Expense Reimbursements

Check Tampering

Register Disbursements

FRAUDULENT DISBURSEMENTS

Sales

Receivables

Other

SKIMMING

CASH

Cash Schemes

Breakdown of Cases

Fraud

Disb

67%

Larceny

4.1% Skim

28.9%

Two-thirds of cash

schemes involve

fraudulent

disbursements.

Examples: billing

schemes, payroll

schemes, check

tampering

Cash Schemes -

Median Losses

$75,000

$50,000

$22,000

$0 $20,000 $40,000 $60,000 $80,000

Fraud Disb.

Skimming

Cash Larceny

Among cash schemes, fraudulent disbursements have

the highest median loss.

Larceny is both the least common and least costly

method of cash fraud, on average.

Fraudulent Disbursements

Breakdown of Cases

Check

Tamp

24.5%

Payroll

16.5%

Expense

14.9%

Register

2.7%

Billing

33.3%

Other

8.1%

Fraudulent disbursements

are the largest category of

cash frauds.

Billing schemes and check

tampering are the two most

common forms of fraudulent

disbursement.

Kecurangan pada pengeluaran

adalah kategori paling besar

dari penipuan tunai.

Rencana biaya periklanan dan

cek rusak/kosong adalah kedua

wujud paling umum dari

pengeluaran yang curang.

Fraudulent Disbursements -

Median Losses

$140,000

$20,000

$22,500

$50,000

$96,432

$250,000

$0 $50,000 $100,000 $150,000 $200,000 $250,000

Other

Expense

Register

Payroll

Check Tamp

Billing

Vous aimerez peut-être aussi

- Cash Stuffing Secrets: Budgeting for a Better Life and Unlocking Financial FreedomD'EverandCash Stuffing Secrets: Budgeting for a Better Life and Unlocking Financial FreedomPas encore d'évaluation

- Anti-Money Laundering and Terrorist FinancingDocument21 pagesAnti-Money Laundering and Terrorist FinancingfaisalPas encore d'évaluation

- NNJ Chapter Acams Study Guide Review PDFDocument134 pagesNNJ Chapter Acams Study Guide Review PDFSaied Mastan100% (1)

- ACAMS Study guide review ( PDFDrive )Document16 pagesACAMS Study guide review ( PDFDrive )jerry99750Pas encore d'évaluation

- CH 03Document16 pagesCH 03morawalakPas encore d'évaluation

- The Five Letter F Word: Fraud in The Hospitality Industry: Topics For DiscussionDocument21 pagesThe Five Letter F Word: Fraud in The Hospitality Industry: Topics For Discussionmohamed12345Pas encore d'évaluation

- Lecturer 2 (I) - Money LaunderingDocument28 pagesLecturer 2 (I) - Money LaunderingkhooPas encore d'évaluation

- 3 - Cash Larceny 2015Document28 pages3 - Cash Larceny 2015Mel LissaPas encore d'évaluation

- Money Laundering: Ajith S Aviraj Pawan Raina Rajkumar RajnishDocument62 pagesMoney Laundering: Ajith S Aviraj Pawan Raina Rajkumar RajnishRaina_Burbure_6980Pas encore d'évaluation

- Fraud Tree Focus InventorycompressedDocument64 pagesFraud Tree Focus InventorycompressedJonathan Navallo100% (1)

- Fraudulent ReportingDocument39 pagesFraudulent ReportingBulelwa HarrisPas encore d'évaluation

- PPT3-Recoqnizing The Symptoms of FraudDocument21 pagesPPT3-Recoqnizing The Symptoms of FraudSintia LiePas encore d'évaluation

- Money Laundering : A Global ProblemDocument29 pagesMoney Laundering : A Global ProblemsaadrehPas encore d'évaluation

- Chapter 12 - Money and The Banking SystemDocument52 pagesChapter 12 - Money and The Banking Systemavneet kaur100% (2)

- Anti-Money Laundering Seminar Friday 25Document135 pagesAnti-Money Laundering Seminar Friday 25Nearchos A. IoannouPas encore d'évaluation

- Week - 11 AML BasicsDocument26 pagesWeek - 11 AML BasicsEmiraslan MhrrovPas encore d'évaluation

- White Collar CrimeDocument18 pagesWhite Collar CrimeArjun NaiduPas encore d'évaluation

- Let Me Begin On A TangentDocument59 pagesLet Me Begin On A Tangentgaurkud75% (4)

- Corporate Frauds: Prevention, Detection and Deterrents: Narendra P. Sarda 13 December, 2007Document38 pagesCorporate Frauds: Prevention, Detection and Deterrents: Narendra P. Sarda 13 December, 2007MohitDhingra24100% (1)

- AMLClient AwarenessDocument12 pagesAMLClient AwarenessVijay Singh GavariaPas encore d'évaluation

- Fundamentals of Anti-Money LaunderingDocument38 pagesFundamentals of Anti-Money LaunderingAxmed MacalinPas encore d'évaluation

- Chapter 2 - SkimmingDocument8 pagesChapter 2 - SkimmingYenttirb NeyugnPas encore d'évaluation

- Basics of Anti-Money Laundering & Know Your CustomerDocument37 pagesBasics of Anti-Money Laundering & Know Your CustomerChitra ChituPas encore d'évaluation

- Epp Outline Team 6Document5 pagesEpp Outline Team 6Kim HanaPas encore d'évaluation

- Decoding Fraud and Profiling the FraudsterDocument23 pagesDecoding Fraud and Profiling the FraudsterAnn Margarette SambilayPas encore d'évaluation

- Forensic Accounting: Dr. Lynn H. Clements Cpa Cfe CR - Fa Cma CFMDocument14 pagesForensic Accounting: Dr. Lynn H. Clements Cpa Cfe CR - Fa Cma CFMRalph Santos0% (1)

- Prevention of Money LaunderingDocument51 pagesPrevention of Money LaunderingRamprasad AkshantulaPas encore d'évaluation

- Fraud Detection & Control: Money LaunderingDocument19 pagesFraud Detection & Control: Money LaunderingHenry HardoonPas encore d'évaluation

- Anti-Money Laundering The BasicsDocument12 pagesAnti-Money Laundering The BasicsMangesh BansodePas encore d'évaluation

- Types of Financial FraudDocument25 pagesTypes of Financial FraudAZMI ABDUL MANAFPas encore d'évaluation

- Audit PresentationDocument8 pagesAudit PresentationRafi TagalaPas encore d'évaluation

- Money LaunderingDocument31 pagesMoney LaunderingjammuuuPas encore d'évaluation

- 1 Cash and Cash EquivalentsDocument16 pages1 Cash and Cash EquivalentsAYEZZA SAMSONPas encore d'évaluation

- FinancialcrimesDocument32 pagesFinancialcrimestyrwerPas encore d'évaluation

- Picpa Davao - Coso Internal Control SlidesDocument86 pagesPicpa Davao - Coso Internal Control SlidesMariell Ann AbalosPas encore d'évaluation

- Managing Cash & Marketable SecuritiesDocument14 pagesManaging Cash & Marketable SecuritiesRuhani KimpaPas encore d'évaluation

- Acfe NotesDocument12 pagesAcfe NotesIshmael OneyaPas encore d'évaluation

- Accounting Recording Process - Debit, Credit RulesDocument10 pagesAccounting Recording Process - Debit, Credit RulesShashikant ZarekarPas encore d'évaluation

- Money LaunderingDocument6 pagesMoney LaunderingMohammad MonirujjamanPas encore d'évaluation

- Accounting Fraud and Forensic Investigation: An IntroductionDocument19 pagesAccounting Fraud and Forensic Investigation: An IntroductionLO WANYEEPas encore d'évaluation

- Cash ManagementDocument27 pagesCash ManagementAnonymous jGew8BPas encore d'évaluation

- Chapter - 20 Cash and Liquidity ManagementDocument17 pagesChapter - 20 Cash and Liquidity ManagementBayem BusukPas encore d'évaluation

- KYC AML Policy GuideDocument32 pagesKYC AML Policy GuideMuralidharprasad AyaluruPas encore d'évaluation

- PBL Money LaunderingDocument29 pagesPBL Money LaunderingTokeiPas encore d'évaluation

- Murrays Guide To Being Smarter Than He WasDocument72 pagesMurrays Guide To Being Smarter Than He WasKen MurrayPas encore d'évaluation

- How Criminals Launder MoneyDocument9 pagesHow Criminals Launder MoneyNICAEL ARVIN VALMONTE100% (1)

- Cash and Liquidity Management: Mcgraw-Hill/IrwinDocument19 pagesCash and Liquidity Management: Mcgraw-Hill/Irwinjoshua soebrotoPas encore d'évaluation

- Money Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaDocument15 pagesMoney Laundering: By-Chintan Gutka Himanshu Kapadia Harshael Sawant Olivia D'Mello Ritesh Sapre Ashwin SharmaHarshael SawantPas encore d'évaluation

- Money Functions Forms and MeasurementDocument33 pagesMoney Functions Forms and MeasurementKawtar SalhiPas encore d'évaluation

- January 2013 - Anti-Fraud and The IA FunctionDocument88 pagesJanuary 2013 - Anti-Fraud and The IA FunctionTARIQPas encore d'évaluation

- Fraud Detection: No Name Matric NumberDocument51 pagesFraud Detection: No Name Matric NumberRiri MorganaPas encore d'évaluation

- Chapter 3 - Cash LarcenyDocument22 pagesChapter 3 - Cash LarcenyNur AthirahPas encore d'évaluation

- Money Laundering Process & PreventionDocument26 pagesMoney Laundering Process & PreventionJ M100% (3)

- The Accountant and The Fight Against Money LaunderingDocument39 pagesThe Accountant and The Fight Against Money LaunderingnominhkPas encore d'évaluation

- Information TechnologyDocument43 pagesInformation TechnologyAlexis TradioPas encore d'évaluation

- FIN2004Document79 pagesFIN2004morry123Pas encore d'évaluation

- Chapter 3 SkimmingDocument27 pagesChapter 3 SkimmingIrwan JanuarPas encore d'évaluation

- KYC & Anti Money Laundering: CA. Ramesh ShettyDocument56 pagesKYC & Anti Money Laundering: CA. Ramesh ShettyMahapatra MilonPas encore d'évaluation

- FIN - Cash ManagementDocument24 pagesFIN - Cash Management29_ramesh170Pas encore d'évaluation

- FinancialStatement 2019Document298 pagesFinancialStatement 2019Tonga ProjectPas encore d'évaluation

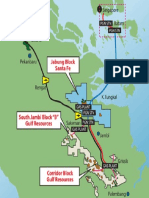

- IATMI Conference Day 1: Strategies for Achieving Indonesia's 1 Million BOPD Target by 2030Document16 pagesIATMI Conference Day 1: Strategies for Achieving Indonesia's 1 Million BOPD Target by 2030Irwan JanuarPas encore d'évaluation

- MapillusDocument1 pageMapillusIrwan JanuarPas encore d'évaluation

- Country Analysis Brief: Australia: Last Updated: March 7, 2017Document24 pagesCountry Analysis Brief: Australia: Last Updated: March 7, 2017Lizeth CampoPas encore d'évaluation

- Pages From 251912087-Talisman-Energy-KinabaluDocument1 pagePages From 251912087-Talisman-Energy-KinabaluIrwan JanuarPas encore d'évaluation

- Ipcc Wg3 Ar5 FullDocument1 454 pagesIpcc Wg3 Ar5 Fullchoonkiat.leePas encore d'évaluation

- Pages From Apr-Investor-PresDocument1 pagePages From Apr-Investor-PresIrwan JanuarPas encore d'évaluation

- Catalog - SS UOMODocument64 pagesCatalog - SS UOMOIrwan JanuarPas encore d'évaluation

- Product Brochure DynaSlot XL Online ViewDocument6 pagesProduct Brochure DynaSlot XL Online ViewIrwan JanuarPas encore d'évaluation

- Vdocuments - MX - Session 10 Technical Paul Davies Conocophillips PDFDocument38 pagesVdocuments - MX - Session 10 Technical Paul Davies Conocophillips PDFIrwan JanuarPas encore d'évaluation

- Energy Dependency and Energy Security - Role of NREDocument23 pagesEnergy Dependency and Energy Security - Role of NREIrwan JanuarPas encore d'évaluation

- Content Handbook of Energy Economic Statistics of Indonesia 2016 08989 PDFDocument70 pagesContent Handbook of Energy Economic Statistics of Indonesia 2016 08989 PDFshandyPas encore d'évaluation

- EnergyPoliciesofIEACountriesDenmark2017Review PDFDocument213 pagesEnergyPoliciesofIEACountriesDenmark2017Review PDFIrwan JanuarPas encore d'évaluation

- Key World 2017Document97 pagesKey World 2017Kien NguyenPas encore d'évaluation

- INAGA Ins For Geothermal Dev Proj 201306 PaperDocument7 pagesINAGA Ins For Geothermal Dev Proj 201306 PaperIrwan JanuarPas encore d'évaluation

- INAGA Ins For Geothermal Expl 201306 SlidesDocument14 pagesINAGA Ins For Geothermal Expl 201306 SlidesIrwan JanuarPas encore d'évaluation

- PT SMI's Role in Geothermal Energy Development - For Public - v2Document8 pagesPT SMI's Role in Geothermal Energy Development - For Public - v2Irwan JanuarPas encore d'évaluation

- NRE ContributionDocument74 pagesNRE ContributionIrwan JanuarPas encore d'évaluation

- 2010 Esp Geothermal ApplicationsDocument7 pages2010 Esp Geothermal ApplicationsIrwan JanuarPas encore d'évaluation

- 07 Mar 2017 111739167GF5FKTEUFeasibilityStudyReportbyIITChennai PDFDocument26 pages07 Mar 2017 111739167GF5FKTEUFeasibilityStudyReportbyIITChennai PDFYbud0% (1)

- Titik Karang AsemDocument9 pagesTitik Karang AsemIrwan JanuarPas encore d'évaluation

- LeRoux Wavecalc (2010)Document28 pagesLeRoux Wavecalc (2010)Irwan JanuarPas encore d'évaluation

- Force Field AnalysisDocument4 pagesForce Field AnalysisIrwan JanuarPas encore d'évaluation

- UKC CalculationDocument2 pagesUKC CalculationIrwan Januar0% (1)

- Kerjasama PT Pelindo I Indonesia Dengan Port of RotterdamDocument12 pagesKerjasama PT Pelindo I Indonesia Dengan Port of RotterdamIrwan JanuarPas encore d'évaluation

- Sustainable Geothermal Power - The Life Cycle of A Geothermal PlantDocument5 pagesSustainable Geothermal Power - The Life Cycle of A Geothermal PlantIrwan JanuarPas encore d'évaluation

- UKC CalculationDocument2 pagesUKC CalculationIrwan JanuarPas encore d'évaluation

- Thermo IsopentaneDocument51 pagesThermo IsopentaneIrwan JanuarPas encore d'évaluation

- Two Phase FlowDocument3 pagesTwo Phase FlowIrwan JanuarPas encore d'évaluation

- META Model For Electricity Technology AssessmentDocument6 pagesMETA Model For Electricity Technology AssessmentIrwan JanuarPas encore d'évaluation

- Eagle Capital Management PresentationDocument23 pagesEagle Capital Management Presentationturnbj75Pas encore d'évaluation

- Mahatma Gandhi University Capital Market Chapter 1 QuestionsDocument42 pagesMahatma Gandhi University Capital Market Chapter 1 QuestionscpriyacpPas encore d'évaluation

- Business Plan For Establishment of Liquid Detergent PlantDocument22 pagesBusiness Plan For Establishment of Liquid Detergent PlantYoseph Melesse89% (38)

- 33868053Document72 pages33868053Douglas LimPas encore d'évaluation

- Price Discovery and Causality in The Indian Derivatives MarketDocument4 pagesPrice Discovery and Causality in The Indian Derivatives MarketmeetwithsanjayPas encore d'évaluation

- Government Expenditure On Education in NigeriaDocument3 pagesGovernment Expenditure On Education in NigeriaScottPas encore d'évaluation

- Parcor Chapter 1Document6 pagesParcor Chapter 1Taylor SwiftPas encore d'évaluation

- 2 Partnership Dissolution 0 Liquidation 2022Document16 pages2 Partnership Dissolution 0 Liquidation 2022Kimberly IgnacioPas encore d'évaluation

- Iif 8 Epcm Contracts Feb16 3Document22 pagesIif 8 Epcm Contracts Feb16 3Jorge RammPas encore d'évaluation

- Portfolio Management PDFDocument47 pagesPortfolio Management PDFbhaumiksawant25Pas encore d'évaluation

- Ratio Analysis of Rastriya Banijya BankDocument51 pagesRatio Analysis of Rastriya Banijya BankMadhusudhan PokhrelPas encore d'évaluation

- Scenario AnalysisDocument2 pagesScenario AnalysisDickson WongPas encore d'évaluation

- Pakistan Operations Meezan Bank Agrees To AcquireDocument9 pagesPakistan Operations Meezan Bank Agrees To AcquireNuwan Tharanga LiyanagePas encore d'évaluation

- TVM AssignmentDocument2 pagesTVM Assignmentapi-271665570Pas encore d'évaluation

- Aswath Damodaran - Valuation of SynergyDocument60 pagesAswath Damodaran - Valuation of SynergyIvaPas encore d'évaluation

- Brookdale Public White Paper February 2015Document18 pagesBrookdale Public White Paper February 2015CanadianValuePas encore d'évaluation

- 12 She Accessibility Based Business Models For Peer To Peer Markets - en PDFDocument20 pages12 She Accessibility Based Business Models For Peer To Peer Markets - en PDFAlexis Gonzalez PerezPas encore d'évaluation

- Managerial Economics:: According To Spencer and SiegelmanDocument10 pagesManagerial Economics:: According To Spencer and SiegelmankwynclePas encore d'évaluation

- Indian EconomyDocument16 pagesIndian EconomyShashank TiwariPas encore d'évaluation

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanPas encore d'évaluation

- Building The is-LM ModelDocument46 pagesBuilding The is-LM ModelMicky BozaPas encore d'évaluation

- Introduction to Syndicated LoansDocument35 pagesIntroduction to Syndicated Loansdivyapillai0201_Pas encore d'évaluation

- Financial Statement Analysis TechniquesDocument16 pagesFinancial Statement Analysis Techniqueskarim abitagoPas encore d'évaluation

- Chap 016Document25 pagesChap 016Utkarsh GoelPas encore d'évaluation

- Long Term Investment Decision at Kesoram CementDocument10 pagesLong Term Investment Decision at Kesoram CementMOHAMMED KHAYYUMPas encore d'évaluation

- A Summer Training Project Report: A Study On Behavioral Finance in Investment Decisions of Investors in Delhi NCRDocument75 pagesA Summer Training Project Report: A Study On Behavioral Finance in Investment Decisions of Investors in Delhi NCRsandeepPas encore d'évaluation

- BEC 2015 AICPA Released QuestionDocument46 pagesBEC 2015 AICPA Released QuestionCA Akshay Garg100% (3)

- India's Hotel Industry Booming Growth Despite ChallengesDocument12 pagesIndia's Hotel Industry Booming Growth Despite ChallengesJitendra GuptaPas encore d'évaluation

- Tanla Solutions (TANSOL) : Rebound in Core Business SegmentsDocument5 pagesTanla Solutions (TANSOL) : Rebound in Core Business SegmentsashishkrishPas encore d'évaluation