Académique Documents

Professionnel Documents

Culture Documents

Fiscal Policy Explained

Transféré par

JadedGothTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fiscal Policy Explained

Transféré par

JadedGothDroits d'auteur :

Formats disponibles

FISCAL POLICY

Submitted by:

Huma Khan

Wajiha Khan

Sehrish Shaukat

Ziyad Bin Mehtab

Jawad Mughal

What is Fiscal Policy?

It is the use of government expenditure and

revenue collection to influence the economy.

Fiscal policy refers to the overall effect of the

budget outcome on economic activity.

Fiscal policy can be contrasted with the other main

type of economic policy, monetary policy, which

attempts to stabilize the economy by controlling

interest rates and the supply of money.

Objectives of Fiscal Policy

Economic Growth

Promotion of Employment.

Economic Stability

Economic Justice or Equity

Price Stability

Fiscal Policy And Macroeconomic Goals

Goal Description

Economic Growth

By creating conditions for increase in

savings & investment.

Employment

By encouraging the use of labor-absorbing

technology.

Stabilization

Fight with depressionary trends and booming

(overheating) indications in the economy.

Economic Equality

By reducing the income and wealth gaps

between the rich and poor.

Price stability

Employed to contain inflationary and

deflationary tendencies in the economy.

How Fiscal Policy Works

Fiscal policy is based on the theories of

British economist John Maynard Keynes. Also

known as Keynesian economics, this theory

basically states that governments can

influence macroeconomic productivity levels

by increasing or decreasing tax levels and

public spending.

This influence, in turn, curbs inflation (generally

considered to be healthy when at a level between

2-3%), increases employment and maintains a

healthy value of money.

Use of Fiscal Policy

Adjustment of income tax allowances rather than rates

of income tax

Extending or amending range of goods covered by VAT

Changing the rules under which tax has to be paid

married persons allowances, inheritance taxes, stamp

duties, etc.

Abolishment of certain tax allowances MIRAS (Mortgage

Income Relief At Source)

Accusations of stealth taxes much of it is a tinkering

with the tax system to achieve certain aims mostly non-

economic (governments these days, for example, rarely

increase taxes to dampen down the economy)

Economic Effects of Fiscal Policy

Governments use fiscal policy to

influence the level of aggregate demand

in the economy, in an effort to achieve

economic objectives of price stability,

full employment, and economic growth.

Instruments of Fiscal Policy

Government Expenditure

Taxation

Direct

Indirect

Public Debt

Impact of Instruments

Changes in the level and composition of

taxation and government spending can

impact on the following variables in the

economy:

Aggregate demand and the level of

economic activity;

The pattern of resource allocation;

The distribution of income.

Government Expenditure

It includes :

Government spending on the purchase

of goods & services.

Payment of wages and salaries of

government servants

Public investment

Transfer payments

Taxation

Non quid pro quo transfer of private

income to public coffers by means of

taxes.

Classified into:

Direct Taxes- Corporate Tax, Div. Distribution

Tax, Personal Income Tax, Fringe Benefit Taxes,

Banking Cash Transaction Tax

Indirect Taxes- Central Sales Tax, Customs,

Service Tax, Exercise Duty

Public Debt

Internal Borrowings

1. Borrowings from the public by means of treasury

bills and govt. bonds

2. Borrowings from the central bank (Monetized

Deficit Financing)

External Borrowings

1. Foreign investments

2. International organizations like World Bank & IMF

3. Market borrowings

Fiscal Policy In Inflation

Control over public expenditure

Increase in taxes

Increase in public borrowing

Delay in the payment of old debts

Fiscal Policy In Deflation

Increase in public expenditure.

Decrease in taxes.

Increase in social welfare expenditure.

Prices support policy.

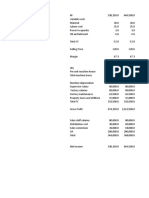

Budget

A budget is a

detailed plan of

operations for some

specific future

period.

It is an estimate

prepared in advance

of the period to

which it applies.

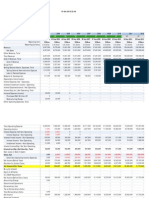

Where The Rupee Comes From

state's share of

taxes & duties

18%

non plan assistance

to states

5%

planned state

assistance

7%

central plan

20%

interest

20%

defence

12%

subsidies

7%

other non plan exp.

11%

Where Does The Rupee Go To

state's share of

taxes & duties

18%

non plan assistance

to states

5%

planned state

assistance

7%

central plan

20%

interest

20%

defence

12%

subsidies

7%

other non plan exp.

11%

Vous aimerez peut-être aussi

- Currency BasicsDocument18 pagesCurrency BasicsChandan AgarwalPas encore d'évaluation

- Bank Statement Template 19Document4 pagesBank Statement Template 19Thai Chu DinhPas encore d'évaluation

- Apple - Income StatementDocument5 pagesApple - Income StatementhappycolourPas encore d'évaluation

- Fiscal PolicyDocument14 pagesFiscal Policykzakiya17Pas encore d'évaluation

- Understanding Macro Economics PerformanceDocument118 pagesUnderstanding Macro Economics PerformanceViral SavlaPas encore d'évaluation

- Econometrics 1 Topic 1Document38 pagesEconometrics 1 Topic 1Iskandar ZulkarnaenPas encore d'évaluation

- Exchange Rate Determination and PolicyDocument33 pagesExchange Rate Determination and PolicyJunius Markov OlivierPas encore d'évaluation

- Fixed Rates Macro PolicyDocument10 pagesFixed Rates Macro PolicyJelenaJovanovicPas encore d'évaluation

- Money and Banking 2009 SpringDocument117 pagesMoney and Banking 2009 SpringborchaliPas encore d'évaluation

- EMEA Group2 EgyptDocument11 pagesEMEA Group2 EgyptRAJARSHI ROY CHOUDHURYPas encore d'évaluation

- By: Domodar N. Gujarati: Prof. M. El-SakkaDocument19 pagesBy: Domodar N. Gujarati: Prof. M. El-SakkarohanpjadhavPas encore d'évaluation

- Econometric Methods: Theory Mathematics StatisticsDocument22 pagesEconometric Methods: Theory Mathematics StatisticsGiri PrasadPas encore d'évaluation

- Introduction To Financial EconometricsDocument38 pagesIntroduction To Financial EconometricsMohd ZahidPas encore d'évaluation

- Fiscal Policy and Monetary Policy.Document19 pagesFiscal Policy and Monetary Policy.wayandragon247100% (1)

- IMF Promotes Global Economic StabilityDocument19 pagesIMF Promotes Global Economic StabilitySunni ZaraPas encore d'évaluation

- Understanding InflationDocument70 pagesUnderstanding Inflationkiler2424Pas encore d'évaluation

- 1.4 Market FailureDocument42 pages1.4 Market FailureRuban PaulPas encore d'évaluation

- International Parity ConditionsDocument62 pagesInternational Parity ConditionsHaimanot tessemaPas encore d'évaluation

- MBA 3 Sem Finance Notes (Bangalore University)Document331 pagesMBA 3 Sem Finance Notes (Bangalore University)Pramod AiyappaPas encore d'évaluation

- ME Cycle 8 Session 7Document96 pagesME Cycle 8 Session 7OttiliePas encore d'évaluation

- Chapter 12Document38 pagesChapter 12Shiela MaeaPas encore d'évaluation

- L2 Exchange Rate DeterminationDocument25 pagesL2 Exchange Rate DeterminationKent ChinPas encore d'évaluation

- Unit - Iii: Foreign Exchange Determination Systems &international InstitutionsDocument97 pagesUnit - Iii: Foreign Exchange Determination Systems &international InstitutionsShaziyaPas encore d'évaluation

- Chapter 1Document26 pagesChapter 1Hamid UllahPas encore d'évaluation

- Lecture03 Parity StudentDocument23 pagesLecture03 Parity StudentMit DavePas encore d'évaluation

- Exchange Rates and Balance of Payments LectureDocument18 pagesExchange Rates and Balance of Payments LectureReza AfrisalPas encore d'évaluation

- G Lecture01Document21 pagesG Lecture01Pramudya Arwana HermawanPas encore d'évaluation

- Exchange RatesDocument34 pagesExchange RatesthebfilesPas encore d'évaluation

- Financial Markets: Lectures 3 - 4Document48 pagesFinancial Markets: Lectures 3 - 4Lê Mai Huyền LinhPas encore d'évaluation

- INTERNATIONAL FINANCIAL SYLLABUSDocument90 pagesINTERNATIONAL FINANCIAL SYLLABUSTarini MohantyPas encore d'évaluation

- 12 FinancialInstrumentsandTheirRelevanceDocument39 pages12 FinancialInstrumentsandTheirRelevanceRizki Fazlur RachmanPas encore d'évaluation

- Quick Overview of The FX MarketDocument24 pagesQuick Overview of The FX MarketpatrocompsPas encore d'évaluation

- Lecture 6 Currency Derivatives (1) : - The End of This Session Students Should Be Able ToDocument24 pagesLecture 6 Currency Derivatives (1) : - The End of This Session Students Should Be Able ToSaurabh MalikPas encore d'évaluation

- Inflation Persistence and The Taylor Rule: Christian Murray, David Papell, and Oleksandr RzhevskyyDocument18 pagesInflation Persistence and The Taylor Rule: Christian Murray, David Papell, and Oleksandr RzhevskyybilalalishahPas encore d'évaluation

- Risk Management and Basel II: Bank Alfalah LimitedDocument72 pagesRisk Management and Basel II: Bank Alfalah LimitedMuhammad ArslanPas encore d'évaluation

- Financial Markets ExplainedDocument232 pagesFinancial Markets ExplainedThảo Nhi LêPas encore d'évaluation

- "Introduction To International Financial System": "International Finance and Payments"Document425 pages"Introduction To International Financial System": "International Finance and Payments"Ioan 23Pas encore d'évaluation

- Treasury Overview Sesssion 1Document30 pagesTreasury Overview Sesssion 1ravitmadanPas encore d'évaluation

- Determining Exchange RatesDocument35 pagesDetermining Exchange Ratesayush_singhal27Pas encore d'évaluation

- Financial Crisis in Emerging Economies: Case of China 2015Document26 pagesFinancial Crisis in Emerging Economies: Case of China 2015amritaPas encore d'évaluation

- Egypt's Free Floating Exchange RegimeDocument13 pagesEgypt's Free Floating Exchange RegimeWalaa MahrousPas encore d'évaluation

- Management of Transaction ExposureDocument53 pagesManagement of Transaction ExposureParminder SalujaPas encore d'évaluation

- MATHEMATICAL ECONOMICSDocument54 pagesMATHEMATICAL ECONOMICSCities Normah0% (1)

- Financial Risk ManagementDocument31 pagesFinancial Risk ManagementDaanPas encore d'évaluation

- chp1 EconometricDocument52 pageschp1 EconometricCabdilaahi CabdiPas encore d'évaluation

- Topic 4: Macroeconomic Objectives: EconomicsDocument19 pagesTopic 4: Macroeconomic Objectives: EconomicsAlvin Chai Win LockPas encore d'évaluation

- DerivativesDocument21 pagesDerivativesMandar Priya PhatakPas encore d'évaluation

- DBA 5035 - Financial Derivatives ManagementDocument277 pagesDBA 5035 - Financial Derivatives ManagementShrividhyaPas encore d'évaluation

- Forward and Futures PricingDocument13 pagesForward and Futures PricingMandar Priya PhatakPas encore d'évaluation

- Feenstra Taylor Chapter 1Document10 pagesFeenstra Taylor Chapter 1sankalpakashPas encore d'évaluation

- EconomicsDocument32 pagesEconomicsSahil BansalPas encore d'évaluation

- International Parity Relationships & Forecasting Exchange RatesDocument33 pagesInternational Parity Relationships & Forecasting Exchange RatesKARISHMAATA2Pas encore d'évaluation

- MMS Derivatives Lec 4Document64 pagesMMS Derivatives Lec 4AzharPas encore d'évaluation

- LCH Clearnet SwapClear OTC derivatives clearingDocument9 pagesLCH Clearnet SwapClear OTC derivatives clearingAleis RiquelmePas encore d'évaluation

- FRM Lecture 4 2020 2021 HandoutDocument41 pagesFRM Lecture 4 2020 2021 HandoutDaanPas encore d'évaluation

- ch03 ptg01Document9 pagesch03 ptg01Tran Kim NganPas encore d'évaluation

- Exchange RateDocument32 pagesExchange RateCharlene Ann EbitePas encore d'évaluation

- Financial Risk Management with Binomial Option TreesDocument39 pagesFinancial Risk Management with Binomial Option TreesDaanPas encore d'évaluation

- From Convergence to Crisis: Labor Markets and the Instability of the EuroD'EverandFrom Convergence to Crisis: Labor Markets and the Instability of the EuroPas encore d'évaluation

- Fiscal PolicyDocument16 pagesFiscal Policyvivek.birla100% (2)

- INDIAN FISCAL POLICY CURRENT SCENARIODocument7 pagesINDIAN FISCAL POLICY CURRENT SCENARIOChaiyaChaithanyaPas encore d'évaluation

- SoftwareDocument20 pagesSoftwareJadedGothPas encore d'évaluation

- Computer Networks: Presented byDocument34 pagesComputer Networks: Presented byJadedGoth100% (2)

- InternetDocument46 pagesInternetJadedGothPas encore d'évaluation

- Adidas Report - FinalDocument81 pagesAdidas Report - FinalJadedGoth100% (1)

- HardwareDocument29 pagesHardwareJadedGothPas encore d'évaluation

- Meaning Scope of Tax ManagementDocument5 pagesMeaning Scope of Tax ManagementAnish yadavPas encore d'évaluation

- Amir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentDocument6 pagesAmir Hamza Sikandar. 01-112171-002. Advanced Taxation AssignmentMehreen KhanPas encore d'évaluation

- Theoritical Framework &literature ReviewDocument27 pagesTheoritical Framework &literature ReviewGelani PradipPas encore d'évaluation

- Abhibus Ticket Sri Tulasi Travels: Ticket For Chennai-GunturDocument2 pagesAbhibus Ticket Sri Tulasi Travels: Ticket For Chennai-GunturBhavan Sai VakaPas encore d'évaluation

- Philippine VAT and Percentage Tax RatesDocument41 pagesPhilippine VAT and Percentage Tax RatesKim AranasPas encore d'évaluation

- Alumni Fee Voucher UpdatedDocument1 pageAlumni Fee Voucher UpdatedHassan KhalidPas encore d'évaluation

- Genal ListDocument4 pagesGenal ListErik FarrPas encore d'évaluation

- What is Letter of Credit? Bank Payment Tool for ExportersDocument2 pagesWhat is Letter of Credit? Bank Payment Tool for ExportersCarlos KarmunPas encore d'évaluation

- 1 MondayDocument6 pages1 MondayCeline Marie Libatique AntonioPas encore d'évaluation

- Form - 1040 - Schedule BDocument2 pagesForm - 1040 - Schedule BEl-Sayed FarhanPas encore d'évaluation

- Mbeya University of Science and Technology: Students Who Are Not Eligible To Sit For Semester I Examinations in 2021/2022Document12 pagesMbeya University of Science and Technology: Students Who Are Not Eligible To Sit For Semester I Examinations in 2021/2022william siyamePas encore d'évaluation

- SRPL 2300255Document2 pagesSRPL 2300255radhe panelPas encore d'évaluation

- Official Receipt: Global Indian International SchoolDocument1 pageOfficial Receipt: Global Indian International SchoolBadal BhattacharyaPas encore d'évaluation

- Composition Scheme Under GST 1.0Document28 pagesComposition Scheme Under GST 1.0Saqib AnsariPas encore d'évaluation

- Tax, Budget, InterstDocument10 pagesTax, Budget, InterstNegese MinaluPas encore d'évaluation

- BQs Tax 2011 2012Document44 pagesBQs Tax 2011 2012Dem SalazarPas encore d'évaluation

- EBTax UAT Test Script ARDocument2 pagesEBTax UAT Test Script ARchirag0% (1)

- (Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormDocument1 page(Please Write The Name That Appears On Your Card) : PNB Credit Card Rewards Redemption FormSsa ZabalaPas encore d'évaluation

- Fees and Commissions Guide For IndividualsDocument29 pagesFees and Commissions Guide For IndividualsDPas encore d'évaluation

- GST Implementation and Its Impact On Indian EconomyDocument4 pagesGST Implementation and Its Impact On Indian EconomyarcherselevatorsPas encore d'évaluation

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846Pas encore d'évaluation

- Biologicla Assets PDFDocument2 pagesBiologicla Assets PDFMjhayePas encore d'évaluation

- Crypto Payments Industry Research ReportDocument55 pagesCrypto Payments Industry Research ReportRodrix DigitalPas encore d'évaluation

- Proposed Adjusting Journal EntriesDocument8 pagesProposed Adjusting Journal EntriesEli Mae Rose Densing100% (1)

- Form App Clearance OutwardDocument1 pageForm App Clearance OutwardNuwani PreethikaPas encore d'évaluation

- Challan Form For Written Test Fee Payment (POLICE CONSTABLE)Document1 pageChallan Form For Written Test Fee Payment (POLICE CONSTABLE)Rashid Abbas0% (1)

- 64309445932019499Document76 pages64309445932019499Prabhat SharmaPas encore d'évaluation

- Phelps IndustriesDocument3 pagesPhelps IndustriesDilip ReddyPas encore d'évaluation