Académique Documents

Professionnel Documents

Culture Documents

Deadweight Loss Presentation by GRP 3

Transféré par

pakshal19Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Deadweight Loss Presentation by GRP 3

Transféré par

pakshal19Droits d'auteur :

Formats disponibles

Deadweight loss of taxation

Presented by Group 3

Definition

A loss of economic well-being imposed by a tax.

Taxes lower the value of transactions to both buyers and

sellers, in that, to some extent, the buyer pays more for the

product and the supplier receives less.

Example of deadweight loss

Example

10% Entertainment duty on movie tickets

tickets priced between Rs.251 and Rs.350

from January 16, 2013.

P

Q

D

S

{

330

315

300

Example

When subsidy is provided by government ,the

total cost of subsidy exceeds the benefits enjoyed

by the consumers and sellers.

3 4

Seller receives

Equilibrium

Buyer pays

Pp

Pc

E

S1

S

D

P

Q

Pp= Price producer receives

Pc=Price consumer pays

What determines whether the deadweight loss from a tax is

large or small?

The magnitude of the deadweight loss depends on how much the

quantity supplied and quantity demanded respond to changes in the

price.

That, in turn, depends on the price elasticity of supply and demand.

The greater the elasticity of demand and supply:

the larger will be the decline in equilibrium quantity and,

the greater the deadweight loss of a tax.

Determinants of deadweight loss

Inelastic supply

Price

0 Quantity

Demand

Supply

Size of tax

When supply is

relatively inelastic,

the deadweight loss

of a tax is small.

Inelastic Supply

Mumbai- Delhi

Flight base fare Rs 5,110

Flight taxes Rs 401

Price + tax ( price paid by fliers) Rs 5511

Supply= inelastic

Price

0 Quantity

Demand

Supply

Size

of

tax

When supply is relatively

elastic, the deadweight

loss of a tax is large.

Elastic supply

Inelastic demand

Demand

Supply

Price

0 Quantity

Size of tax

When demand is

relatively inelastic,

the deadweight loss

of a tax is small.

Inelastic Demand

Examples of inelastic demand

The government may choose to levy an excise tax on tobacco products to deal with the negative externality

of secondhand smoke.

This would raise the price of the tobacco products, driving a wedge between the price that buyers pay and

the revenue that sellers receive.

However, because this particular good is addictive and thus subject to habitual consumption, so demand is

relatively inelastic.

In other words, demand does not decrease much when the price increases.

Elastic demand

Price

0 Quantity

Size

of

tax

Demand

Supply

When demand is relatively

elastic, the deadweight

loss of a tax is large.

Elastic Demand

Elastic demand

Example of Elastic Demand

Greater deadweight in elastic demand

Example:

Suppose Rs1000 tax is levied on used cars and the no. of units

traded falls from 750 to 500. The imposition of the tax reduced the

units traded by 250 units.

The loss of the mutual benefit that would have been derived had the

tax not eliminated 250 units of exchange imposes a cost on the

buyers and sellers.

The cost is deadweight loss of the tax.

EXAMPLE OF ELASTIC DEMAND

Clothing has elastic demand. True, people have to wear clothes, but there are

many choices of what kind of clothing, and how much to spend.

Stores offered sales, and as a result clothing prices dropped to maintain

demand. Small stores that couldn't offer huge discounts went out of business.

During the Great Recession, they were replaced by second-hand stores that

offered quality used clothing at steeply discounted prices

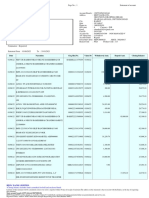

Dead weight loss and tax revenue

Tax revenue is the income that is gained by governments through

taxation.

Tax revenue varies with the proportion of the tax as a percentage of

the product price.

Moderate tax rate= most tax revenue

Tax rate small= less tax revenue.

tax rate high= less tax revenue

Tax revenue

Demand

Supply

Quantity 0

Price

Q

1

Deadweight

loss

P

B

Q

2

P

S

Size of tax is small

Tax revenue

Quantity 0

Price

P

B

Q

2

P

S

Supply

Demand

Q

1

Deadweight

loss

Size of tax is medium

T

a

x

r

e

v

e

n

u

e

Demand

Supply

Quantity 0

Price

Q

1

P

B

Q

2

P

S

Deadweight

loss

Size of Tax is large

Deadweight vs tax size

Deadweight VS Tax size

Size of tax is small

Tax revenue vs tax size

Vous aimerez peut-être aussi

- Tiki MarketingDocument16 pagesTiki MarketingLộc Nguyễn tàiPas encore d'évaluation

- WORKSHEET 01 1 2 3 EXERCISE - Sections of A Report Exercise PDFDocument5 pagesWORKSHEET 01 1 2 3 EXERCISE - Sections of A Report Exercise PDFWardah Faruk100% (1)

- Global Production and Supply Chain StrategiesDocument19 pagesGlobal Production and Supply Chain Strategiesrain06021992Pas encore d'évaluation

- Socio-Cultural and Political-Legal Barriers For Amazon in ChinaDocument5 pagesSocio-Cultural and Political-Legal Barriers For Amazon in Chinaphuc hauPas encore d'évaluation

- Microeconomics IntroductionDocument76 pagesMicroeconomics IntroductionAgostina DanielPas encore d'évaluation

- Task 1 Theo Thoi GianDocument18 pagesTask 1 Theo Thoi GianLinh100% (1)

- HTTPS://WWW - Coursehero.com/file/9775476/solutions To Mergers Acquisitions ProblemsDocument22 pagesHTTPS://WWW - Coursehero.com/file/9775476/solutions To Mergers Acquisitions ProblemsShiva PPas encore d'évaluation

- Dang - Vu Hoang Hai - 31211023497Document10 pagesDang - Vu Hoang Hai - 31211023497Hải Đăng Vũ HoàngPas encore d'évaluation

- Lecture 5-6 Unit Cost CalculationDocument32 pagesLecture 5-6 Unit Cost CalculationAfzal AhmedPas encore d'évaluation

- Global Manufacturing of VolkswagenDocument3 pagesGlobal Manufacturing of Volkswagennarmin mammadli0% (1)

- Outsourcing of UnileverDocument6 pagesOutsourcing of UnileverFTU-ERPas encore d'évaluation

- Shiseido in China Marketing StrategyDocument48 pagesShiseido in China Marketing StrategyPhương TrangPas encore d'évaluation

- Microeconomics AssignmentDocument7 pagesMicroeconomics AssignmentAkriti SharmaPas encore d'évaluation

- Business Economics Final Exam Study GuideDocument8 pagesBusiness Economics Final Exam Study GuideAnnaPas encore d'évaluation

- Globalization Chapter 1 OverviewDocument66 pagesGlobalization Chapter 1 OverviewThanh ThảoPas encore d'évaluation

- Forecast Demand For Vinamilk Fresh Milk ProductsDocument3 pagesForecast Demand For Vinamilk Fresh Milk ProductsBarbielat0% (1)

- Nghiên Cứu Về Chiến Lược Của MixueDocument8 pagesNghiên Cứu Về Chiến Lược Của MixuePhạm Diệu LinhPas encore d'évaluation

- International Marketing 16th Edition by Cateora Gilly and Graham Solution Manual PDFDocument9 pagesInternational Marketing 16th Edition by Cateora Gilly and Graham Solution Manual PDFmohamed saedPas encore d'évaluation

- Group 6 - Case Study OptimizationDocument17 pagesGroup 6 - Case Study OptimizationLinh ChiPas encore d'évaluation

- Gung Ho (Movie) Worksheet: American Versus Japanese CultureDocument1 pageGung Ho (Movie) Worksheet: American Versus Japanese CultureHugh Fox III100% (1)

- A 9-Step Guide To Strategic Sourcing Implementation A 9-Step Guide To Strategic Sourcing ImplementationDocument9 pagesA 9-Step Guide To Strategic Sourcing Implementation A 9-Step Guide To Strategic Sourcing Implementationjuan david trochezPas encore d'évaluation

- MKT205 Assignment 2Document12 pagesMKT205 Assignment 2Phuc DinhPas encore d'évaluation

- Case 10 (1) AsanteDocument13 pagesCase 10 (1) AsanteradislamyPas encore d'évaluation

- The Coca-Cola Ritual Mixing Consumers' Creativity and InnovationDocument10 pagesThe Coca-Cola Ritual Mixing Consumers' Creativity and InnovationAdina PascuPas encore d'évaluation

- Ebay: An Examination of A Business Model Without Boundaries: Christopher Chavez and Daniel Lindquist The HistoryDocument6 pagesEbay: An Examination of A Business Model Without Boundaries: Christopher Chavez and Daniel Lindquist The HistoryNishtha GargPas encore d'évaluation

- Managerial Economics Lecture on Deadweight Loss of TaxationDocument6 pagesManagerial Economics Lecture on Deadweight Loss of Taxationfakename4bugmenotPas encore d'évaluation

- Topic 8 Taxation (1) - Positive Principles of TaxationDocument47 pagesTopic 8 Taxation (1) - Positive Principles of TaxationJandzz Del ZhondalePas encore d'évaluation

- SESSION 11 and 12 Edited (2)Document15 pagesSESSION 11 and 12 Edited (2)moyaseenali13Pas encore d'évaluation

- Consumer and Producer Surplus: Effects of TaxationDocument28 pagesConsumer and Producer Surplus: Effects of TaxationRajeev SinghPas encore d'évaluation

- Supply, Demand, and Government Policies: Dr. Rama Pal H&SS, IIT Bombay Email: Ramapal@iitb - Ac.inDocument33 pagesSupply, Demand, and Government Policies: Dr. Rama Pal H&SS, IIT Bombay Email: Ramapal@iitb - Ac.inHarsh ChandakPas encore d'évaluation

- Understanding the Economic Effects of TaxesDocument41 pagesUnderstanding the Economic Effects of TaxesAhmed MahmoudPas encore d'évaluation

- Impact of Specific and Ad Valorem Tax On Market OutcomesDocument6 pagesImpact of Specific and Ad Valorem Tax On Market OutcomesMandeep KaurPas encore d'évaluation

- Figure 1 The Effects of A Tax: PriceDocument29 pagesFigure 1 The Effects of A Tax: PricecaportPas encore d'évaluation

- Page 162 TaxationDocument3 pagesPage 162 TaxationYamin Kyaw (Lin Lin)Pas encore d'évaluation

- How Tax Affects The MarketDocument20 pagesHow Tax Affects The MarketRoland EmersonPas encore d'évaluation

- Application: The Costs of TaxationDocument33 pagesApplication: The Costs of TaxationrsabyrbekovPas encore d'évaluation

- Tax Incidence AnalysisDocument50 pagesTax Incidence AnalysisAsadtabiPas encore d'évaluation

- Chapter 8: The Costs of Taxation Learning Objectives:: Principles of Microeconomics (Hss1021)Document9 pagesChapter 8: The Costs of Taxation Learning Objectives:: Principles of Microeconomics (Hss1021)Guru DeepPas encore d'évaluation

- Topic 4 - Supply & Demand & Government Policies PDFDocument32 pagesTopic 4 - Supply & Demand & Government Policies PDF郑伟权100% (1)

- Price Cielings and Price FloorDocument54 pagesPrice Cielings and Price FloorKrish KumarPas encore d'évaluation

- ECO2011 Basic Microeconomics - Lecture 12Document11 pagesECO2011 Basic Microeconomics - Lecture 121194390705Pas encore d'évaluation

- Microeconomics: Lecture 11: The Analysis of Competitive MarketsDocument36 pagesMicroeconomics: Lecture 11: The Analysis of Competitive Marketsblackhawk31Pas encore d'évaluation

- Elasticity And Tax Incidence AnalysisDocument10 pagesElasticity And Tax Incidence AnalysisSaeed Ahmed SolangiPas encore d'évaluation

- Elasticity and TaxDocument4 pagesElasticity and TaxNgọc Minh Đỗ ChâuPas encore d'évaluation

- Session 5Document44 pagesSession 5Sanket DubeyPas encore d'évaluation

- Taxation and Government Intervention: Mark Jayson C. Agarin Dyrick Marl M. Mata Sherwin N. BeltranqtyDocument45 pagesTaxation and Government Intervention: Mark Jayson C. Agarin Dyrick Marl M. Mata Sherwin N. BeltranqtySherwIn BeltRanPas encore d'évaluation

- Sher QTYhistoryDocument45 pagesSher QTYhistorySherwIn BeltRanPas encore d'évaluation

- Chapter 6 - Problem and Application - MicroeconomicDocument8 pagesChapter 6 - Problem and Application - MicroeconomicVu Duc ThinhPas encore d'évaluation

- Econ Assignment AnswersDocument4 pagesEcon Assignment AnswersKazımPas encore d'évaluation

- Chapter 8 Economics Notes: The Cost of TaxationDocument3 pagesChapter 8 Economics Notes: The Cost of TaxationemilyphiliPas encore d'évaluation

- Taxation and Government Intervention On The BusinessDocument33 pagesTaxation and Government Intervention On The Businessjosh mukwendaPas encore d'évaluation

- Jawahar Babu S ME Assignment2Document3 pagesJawahar Babu S ME Assignment2jawahar babuPas encore d'évaluation

- Solutions To Text Problems: Chapter 6: Quick QuizzesDocument60 pagesSolutions To Text Problems: Chapter 6: Quick QuizzesHassan RouhaniPas encore d'évaluation

- Solutions To Text Problems: Chapter 6: Quick QuizzesDocument60 pagesSolutions To Text Problems: Chapter 6: Quick QuizzesThư PhạmPas encore d'évaluation

- Economic Principles I: Government Intervention in Markets and Its Welfare ImpactDocument25 pagesEconomic Principles I: Government Intervention in Markets and Its Welfare ImpactdpsmafiaPas encore d'évaluation

- 5.4 All Major Internvetions Key NotesDocument34 pages5.4 All Major Internvetions Key Notespaulwilson420Pas encore d'évaluation

- Principles of Microeconomics Canadian 6th Edition Mankiw Solutions ManualDocument12 pagesPrinciples of Microeconomics Canadian 6th Edition Mankiw Solutions Manualbosomdegerml971yf100% (22)

- BBEK1103Document8 pagesBBEK1103Faiqah AzmirPas encore d'évaluation

- 08 Application: The Costs of TaxationDocument33 pages08 Application: The Costs of TaxationwindyuriPas encore d'évaluation

- Basic Microeconomics Day 4 LectureDocument4 pagesBasic Microeconomics Day 4 LectureRoentgen Djon Kaiser IgnacioPas encore d'évaluation

- To ReadDocument1 pageTo Readpakshal19Pas encore d'évaluation

- Nestle India DistributionDocument28 pagesNestle India DistributionSantanu KararPas encore d'évaluation

- Ethical Issues in Human Resource Management in Multinational CorporationsDocument2 pagesEthical Issues in Human Resource Management in Multinational CorporationshaniausmaniPas encore d'évaluation

- Final Psa Ta EoiDocument22 pagesFinal Psa Ta Eoipakshal19Pas encore d'évaluation

- 4Document1 page4pakshal19Pas encore d'évaluation

- CadDocument1 pageCadpakshal19Pas encore d'évaluation

- The Question of Land For SEZsDocument3 pagesThe Question of Land For SEZspakshal19Pas encore d'évaluation

- E in HRMDocument5 pagesE in HRMwanikogiPas encore d'évaluation

- Maharashtra Private Security Guards Regulation of Employ Welfare Act.112153608Document25 pagesMaharashtra Private Security Guards Regulation of Employ Welfare Act.112153608pakshal19Pas encore d'évaluation

- Kur KureDocument6 pagesKur Kurepakshal19Pas encore d'évaluation

- Strategies To Overcome Organisational ResistanceDocument14 pagesStrategies To Overcome Organisational Resistancepakshal19Pas encore d'évaluation

- Cas 1Document4 pagesCas 1pakshal19Pas encore d'évaluation

- Cas 1Document4 pagesCas 1pakshal19Pas encore d'évaluation

- Mariginal Propencity To ConsumeDocument4 pagesMariginal Propencity To Consumepakshal19Pas encore d'évaluation

- In The Wind Power IndustryDocument2 pagesIn The Wind Power Industrypakshal19Pas encore d'évaluation

- Perception FinalDocument17 pagesPerception Finalpakshal19Pas encore d'évaluation

- Costing ProjectsDocument2 pagesCosting Projectspakshal19Pas encore d'évaluation

- Ranbaxy DuPont Analysis Reveals Profitability, Efficiency and Leverage RatiosDocument3 pagesRanbaxy DuPont Analysis Reveals Profitability, Efficiency and Leverage Ratiospakshal19Pas encore d'évaluation

- Executive Summary 1Document1 pageExecutive Summary 1pakshal19Pas encore d'évaluation

- M.Com. SYLLABUS Business Administration, Management and Cost Accounting, Advanced Financial Accounting, Financial Management, Advanced Business StatisticsDocument12 pagesM.Com. SYLLABUS Business Administration, Management and Cost Accounting, Advanced Financial Accounting, Financial Management, Advanced Business Statisticspakshal19Pas encore d'évaluation

- M.Com. SYLLABUS Business Administration, Management and Cost Accounting, Advanced Financial Accounting, Financial Management, Advanced Business StatisticsDocument12 pagesM.Com. SYLLABUS Business Administration, Management and Cost Accounting, Advanced Financial Accounting, Financial Management, Advanced Business Statisticspakshal19Pas encore d'évaluation

- M.Com. SYLLABUS Business Administration, Management and Cost Accounting, Advanced Financial Accounting, Financial Management, Advanced Business StatisticsDocument12 pagesM.Com. SYLLABUS Business Administration, Management and Cost Accounting, Advanced Financial Accounting, Financial Management, Advanced Business Statisticspakshal19Pas encore d'évaluation

- IT Final AssignmntDocument7 pagesIT Final Assignmntpakshal19Pas encore d'évaluation

- Payment or Compensation Received For Services or Employment. This Includes The Base Salary and Any Bonuses or Other Economic Benefits That An Employee or Executive Receives During EmploymentDocument1 pagePayment or Compensation Received For Services or Employment. This Includes The Base Salary and Any Bonuses or Other Economic Benefits That An Employee or Executive Receives During Employmentpakshal19Pas encore d'évaluation

- Ranbaxy DuPont Analysis Reveals Profitability, Efficiency and Leverage RatiosDocument3 pagesRanbaxy DuPont Analysis Reveals Profitability, Efficiency and Leverage Ratiospakshal19Pas encore d'évaluation

- ANs 1Document3 pagesANs 1pakshal19Pas encore d'évaluation

- Case On SBI CardsDocument5 pagesCase On SBI CardsBabu MertiaPas encore d'évaluation

- Data Storage Device IBM Secondary Storage Performance Inch FerromagneticDocument1 pageData Storage Device IBM Secondary Storage Performance Inch Ferromagneticpakshal19Pas encore d'évaluation

- Inventory ManagementDocument24 pagesInventory ManagementBhanushekhar YadavPas encore d'évaluation

- 2 Control Sheet - IFPDocument1 page2 Control Sheet - IFPArman KhanPas encore d'évaluation

- Proc No. 307-2002 Excise TaxDocument15 pagesProc No. 307-2002 Excise Taxcsyena28225Pas encore d'évaluation

- Tax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Document2 pagesTax Invoice: Risi Spice Industries PVT LTD 16 13-Jun-2020Risi Spice industriesPas encore d'évaluation

- Negotiable Instruments Types & PartiesDocument4 pagesNegotiable Instruments Types & PartiesPraveen KumarPas encore d'évaluation

- New Poland Intracountry Fallback Interchange FeesDocument8 pagesNew Poland Intracountry Fallback Interchange FeesMarcin ZgiernickiPas encore d'évaluation

- Easypaisa-All Pricing and CommissioningDocument17 pagesEasypaisa-All Pricing and Commissioningqaisar_murtaza50% (4)

- Taxation System in BangladeshDocument4 pagesTaxation System in BangladeshRony RahmanPas encore d'évaluation

- C7 TaxDocument4 pagesC7 TaxaskermanPas encore d'évaluation

- Auto-Estradas / Motorways: Portagens / Toll SDocument9 pagesAuto-Estradas / Motorways: Portagens / Toll Scry19912617Pas encore d'évaluation

- P Jbytt ZP3 FDBMPMDocument16 pagesP Jbytt ZP3 FDBMPMKeshava MurthyPas encore d'évaluation

- Deferral: Accrual AccountingDocument13 pagesDeferral: Accrual AccountingocalmaviliPas encore d'évaluation

- 0ol 001 A 00144216651712 PDFDocument6 pages0ol 001 A 00144216651712 PDFMark MenezesPas encore d'évaluation

- SavingsAccount History 13092023113303Document3 pagesSavingsAccount History 13092023113303Nadiah IsmaPas encore d'évaluation

- Tax 1 Competency MappingDocument1 pageTax 1 Competency MappingIan Kit LovetePas encore d'évaluation

- SmartOwner Capital Growth Fund I - FAQ - US InvestorsDocument2 pagesSmartOwner Capital Growth Fund I - FAQ - US InvestorssenrrPas encore d'évaluation

- ANSYS Explicit STR (Autodyn Part 1) PDFDocument3 pagesANSYS Explicit STR (Autodyn Part 1) PDFnguyenhPas encore d'évaluation

- TL11ADocument1 pageTL11Aqazwsx213Pas encore d'évaluation

- Sbi StatementDocument2 pagesSbi StatementNagarjuna NagiPas encore d'évaluation

- National Internal Revenue CodeDocument201 pagesNational Internal Revenue Code'Naif Sampaco PimpingPas encore d'évaluation

- VAT Registration CertificateDocument1 pageVAT Registration Certificatelucas.saleixo88Pas encore d'évaluation

- Summer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Document60 pagesSummer Internship Project Report ON "Itr E-Filing": Subject Code:KMBN308Sumit Ranjan100% (6)

- Payroll Summary For The Month of AugustDocument46 pagesPayroll Summary For The Month of AugustAida MohammedPas encore d'évaluation

- ExtracionDocument84 pagesExtracionTatiana Lozada RodriguezPas encore d'évaluation

- Accounting for Income Taxes Multiple Choice QuestionsDocument42 pagesAccounting for Income Taxes Multiple Choice QuestionsMarcus MonocayPas encore d'évaluation

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunPas encore d'évaluation

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument26 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBEPF 32 Sharma RohitPas encore d'évaluation

- How to use BIN for credit cardsDocument3 pagesHow to use BIN for credit cardsShashank GuptaPas encore d'évaluation

- IDBI Royale Plus Account Sep 01 2018Document2 pagesIDBI Royale Plus Account Sep 01 2018Sumit KumarPas encore d'évaluation

- Tax - Sababan's NotesDocument120 pagesTax - Sababan's NotesfranceheartPas encore d'évaluation

- Budget Analysis 2017-18 HighlightsDocument10 pagesBudget Analysis 2017-18 HighlightsShatrughna SamalPas encore d'évaluation