Académique Documents

Professionnel Documents

Culture Documents

FM Sem - Inventory RSP

Transféré par

NiteshKhadka0 évaluation0% ont trouvé ce document utile (0 vote)

21 vues17 pagesFm Sem - Inventory RSP

Titre original

Fm Sem - Inventory RSP

Copyright

© © All Rights Reserved

Formats disponibles

PPT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentFm Sem - Inventory RSP

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

21 vues17 pagesFM Sem - Inventory RSP

Transféré par

NiteshKhadkaFm Sem - Inventory RSP

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 17

5 - 1

Copyright 2009 by R. S. Pradhan. All rights reserved.

Welcome to the session

on

Estimates of Inventory Demand

by Nepalese Corporations

Research in Nepalese Finance

5 - 2

Copyright 2009 by R. S. Pradhan. All rights reserved.

Estimates of Inventory Demand by Nepalese

Corporations

Regressions one year lagged sales on

inventories produced the following results:

Empirical results:

ln Y

t

= 0.33 + 0.68 ln S

t-1

(9)

(12.62*)

R-bar square = 0.64, F = 159.32

ln Y

t

= 1.85 + 0.65 ln S

t-1

0.68 ln i

t

(10)

(11.97*) (2.37*)

R-bar square = 0.658, F = 86.67

5 - 3

Copyright 2009 by R. S. Pradhan. All rights reserved.

Regressions of current year sales on inventories

produced the following results:

ln Y

t

= 0.33 + 0.69 ln S

t

(11)

(12.57*)

R-bar square = 0.638, F = 157.98

ln Y

t

= 1.99 + 0.65 ln S

t

0.76 ln i

t

(12)

(12.07*) (2.67*)

R-bar square = 0.662, F = 88.07

The partial adjustment model results:

ln Y

t

=0.78+0.08 ln S

t-1

0.43 ln i

t

+0.85 ln Y

t-1

(13)

(2.62*) (2.27*) (15.23*)

R-bar square = 0.889, F = 238.55

xxx

5 - 4

Copyright 2009 by R. S. Pradhan. All rights reserved.

Estimates of Inventory Demand by Nepalese

Corporations

Statement of the problem

There is no controversy as to the fact that

target inventory level is a function of expected

sales as indicated by almost all the earlier

studies on the demand for inventories by firms.

The controversy arises as to the presence of

economies of scale in inventory holdings, the

cost of capital and other effects on inventory

demand, and the adjustment speed of actual

inventory level with target inventory level.

5 - 5

Copyright 2009 by R. S. Pradhan. All rights reserved.

Among others, Irvine (1981 May, 1981

September) and Akhtar (1983) clearly indicated

economies of scale in inventory holding.

However, some of the inventory demand

functions of Lieberman (1980) showed

diseconomies of scale.

Much of the controversies, however, exist with

the cost of capital effect on inventory demand.

Theoretically, the level of inventories of a firm

would depend on the costs associated with

holding inventories.

However, the earlier studies on the demand for

inventories did not present unanimous findings.

5 - 6

Copyright 2009 by R. S. Pradhan. All rights reserved.

Liu (1963, 1969), Kuznets (1964), Lieberman,

Irvin and Akhtar reported statistically significant

effect of capital costs on the demand for

inventories.

However, Robinson (1959), Lovell (1961, 1964),

Burrows (1971), Joyce (1973), and Maccini and

Rossana (1981) did not report the same.

Controversy also exists with respect to

coefficients of adjustment.

Among others, Burrows, Maccini and Rossana

and Irvine observed faster adjustment between

actual inventories and target inventories.

While Lovell and Grossman (1973) observed

slow speed of adjustment.

5 - 7

Copyright 2009 by R. S. Pradhan. All rights reserved.

Thus, there is no unanimous finding with

respect to:

- economies of scale in inventory holdings,

- capital costs effect on inventory demand, &

- adjustment coefficient of actual inventories to

desired inventories.

It has therefore become difficult to support

one view or another as there exists no such

studies in the context of Nepal.

5 - 8

Copyright 2009 by R. S. Pradhan. All rights reserved.

I. The Model

The decision about the aggregate level of

inventories to be held may be regarded as

subject to the constraint of wealth and the cost of

holding inventories.

As a first approximation to the theory, the

function may be written as,

Y* = f (S, i) ... (1)

Where, Y* is real desired level of inventories,

S is the real desired wealth defined in terms of

sales, and i is the holding cost.

In an empirical investigation, expression (1)

takes the form.

Y* = k S b

1

i b

2

e

u

(2)

Where, the error terms e

u

is assumed to be

independently and normally distributed.

5 - 9

Copyright 2009 by R. S. Pradhan. All rights reserved.

Taking the natural logarithm of the expression

(2) gives,

ln Y* = ln k + b

1

ln S + b

2

ln i + U

i

(3)

It is assumed that the desired level of

inventories (Y*) is equal to its actual level (Y).

Thus, the equation to be estimated is,

ln Y = b

0

+ b

1

ln S + b

2

ln i + U

i

(4)

Where, b

0

is constant, b

1

and b

2

are elasticities

of Y with respect to sales and holding costs

respectively.

The above model assumes the following

reasonable a priori hypothesis:

y/s > 0, & y/i < 0 (5)

5 - 10

Copyright 2009 by R. S. Pradhan. All rights reserved.

While estimating the above equations,

inventories and sales have been deflated by using

a deflator.

The empirical analysis also takes into account a

partial adjustment or flexible accelerator model of

inventory behaviour.

This model hypothesizes that each corporation

has a desired target level of inventories, and that

each corporation, finding its actual level of

inventories not equal to its desired level, attempts

only a partial adjustment towards the desired

level within any one period.

The partial adjustment model is used to

indicate the speed with which corporations adjust

their actual level to desired level of inventories.

5 - 11

Copyright 2009 by R. S. Pradhan. All rights reserved.

The partial adjustment model is stated as,

ln Y

t

=c

0

+c

1

ln S

t

+c

2

ln i

t

+(1 ) ln Y

t-1

+U

t

(7)

Where, =rate of adjustment coefficient, c

1

& c

2

are the short run elasticities of inventories with

respect to sales & interest costs respectively.

Long run elasticities with respect to sales &

interest costs are b

1

and b

2

.

Since c

1

= b

1

and c

2

= b

2

,

b

1

= c

1

/ & b

2

= c

2

/ (8)

Short-term interest rate of commercial banks

has been used as a proxy for holding cost of

funds invested in inventories.

5 - 12

Copyright 2009 by R. S. Pradhan. All rights reserved.

Empirical Results

The regression of inventories on sales

produced the following result:

ln Y

t

= 0.33 + 0.68 ln S

t-1

(9)

(12.62*)

R-bar square = 0.64, F = 159.32

The elasticity of sales with respect to

inventories is less than unity showing evidence of

economies of scale

It thus supports the findings of Akhtar and

Irvine and contradicts unitary or more than

unitary sales elasticities noticed in some of the

equations of Lieberman.

Equation (9) ignores the opportunity cost of

funds invested in inventories.

5 - 13

Copyright 2009 by R. S. Pradhan. All rights reserved.

The regression of inventories on sales and

capital cost produced the following:

ln Y

t

= 1.85 + 0.65 ln S

t-1

0.68 ln i

t

(10)

(11.97*) (2.37*)

R-bar square = 0.658, F = 86.67

Interest rate coefficient is statistically

significant with a theoretically correct sign.

Previously, this coefficient used to be either

positive or not significant in many of the studies

on the demand for inventories by firms.

The highly significant coefficient of sales is

consistently less than unity in equation (10).

It shows evidence suggesting economies of

scale in inventory holding.

5 - 14

Copyright 2009 by R. S. Pradhan. All rights reserved.

This finding supports the conclusions of Liu,

Kuznets, Lieberman, Irvine and Akhtar.

And contradicts with the results of Robinson,

Lovell, Jon Joyce, Burrows, and Maccini and

Rossana.

Holding the sales constant, it indicates that a

one percentage point increase in capital cost

leads on an average to about a 0.68 percent

decline in inventory investment.

Similarly, holding the capital cost constant, a

one percentage point increase in sales leads on

an average to about 0.65 percent increase in

inventory investment.

5 - 15

Copyright 2009 by R. S. Pradhan. All rights reserved.

So far the estimated results are based on

previous year sales (S

t-1

).

These results may not be directly comparable

to results of some of the earlier studies which

used current year sales (S

t

) as an explanatory

variable so long as the results are similar.

Hence, it is felt necessary to use S

t

instead of

S

t-1

.

The regressions of Y

t

on S

t,

and on S

t

and i

t

produced the following results:

ln Y

t

= 0.33 + 0.69 ln S

t

(11)

(12.57*)

R-bar square = 0.638, F = 157.98

ln Y

t

= 1.99 + 0.65 ln S

t

0.76 ln i

t

(12)

(12.07*) (2.67*)

R-bar square = 0.662, F = 88.07

5 - 16

Copyright 2009 by R. S. Pradhan. All rights reserved.

The use of S

t-1

or S

t

produced similar results.

After assessing the scale effect and cost of

capital effect on inventory demand, we now

estimate the partial adjustment model of

inventory demand.

The pooled estimate of the partial adjustment

model is as follows:

ln Y

t

= 0.78 + 0.08 ln S

t-1

0.43 ln i

t

+ 0.85 ln Y

t-1

(13)

(2.62*) (2.27*) (15.23*)

R-bar square = 0.889, F = 238.55

In equation (13), the coefficient of the lagged

dependent variable has been observed to be 0.85.

Since the coefficient of lag ln Y

t

is equal to 1

minus the adjustment coefficient (1-), the

adjustment coefficient is equal to 0.15.

5 - 17

Copyright 2009 by R. S. Pradhan. All rights reserved.

The speed of adjustment between desired and

actual inventories as implied by this value is

much slower, about 15 percent.

The result therefore contradicts the high speed

of adjustment observed by Burrows, Maccini and

Rossana, and Irvine.

In the partial adjustment model, the estimated

coefficients of the independent variables are

equal to the elasticities of these variable times the

adjustment coefficient, e.g., c

1

= b

1

& c

2

= b

2

,

b

1

=c

1

/ & b

2

=c

2

/. These coefficients are thus

.08/.15=0.53 for sales & .43/.15=2.87 for interest

rate which again support the conclusions drawn

earlier.

The capacity utilization as a significant variable

affecting the demand for inventories is doubtful.

THANKING YOU

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- National Interest Waiver Software EngineerDocument15 pagesNational Interest Waiver Software EngineerFaha JavedPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Passage To Abstract Mathematics 1st Edition Watkins Solutions ManualDocument25 pagesPassage To Abstract Mathematics 1st Edition Watkins Solutions ManualMichaelWilliamscnot100% (50)

- CG SeminarDocument10 pagesCG SeminarNiteshKhadkaPas encore d'évaluation

- Sample DataDocument18 pagesSample DataNiteshKhadkaPas encore d'évaluation

- 6851 Load SheddingDocument1 page6851 Load SheddingShishir MaharjanPas encore d'évaluation

- Corporate GovernanceDocument26 pagesCorporate GovernanceNiteshKhadkaPas encore d'évaluation

- Welcome To: Chapter 1: IntroductionDocument14 pagesWelcome To: Chapter 1: IntroductionNiteshKhadkaPas encore d'évaluation

- Capital BudgetingDocument33 pagesCapital BudgetingNiteshKhadkaPas encore d'évaluation

- Seminar On DividendsDocument14 pagesSeminar On DividendsNiteshKhadkaPas encore d'évaluation

- Seminar On DividendsDocument14 pagesSeminar On DividendsNiteshKhadkaPas encore d'évaluation

- Cost of CapitalDocument19 pagesCost of CapitalNiteshKhadkaPas encore d'évaluation

- Leverage SolutionsDocument19 pagesLeverage SolutionsNiteshKhadkaPas encore d'évaluation

- Silver River2014Document16 pagesSilver River2014NiteshKhadkaPas encore d'évaluation

- Chapter 6 Bond ValuationDocument50 pagesChapter 6 Bond ValuationAnanth Krishnan100% (1)

- Leverage SolutionsDocument19 pagesLeverage SolutionsNiteshKhadkaPas encore d'évaluation

- Raiders of SuluDocument1 pageRaiders of SuluBlexx LagrimasPas encore d'évaluation

- Halloween EssayDocument2 pagesHalloween EssayJonathan LamPas encore d'évaluation

- Department of Education: Consolidated Data On Learners' Grade Per QuarterDocument4 pagesDepartment of Education: Consolidated Data On Learners' Grade Per QuarterUsagi HamadaPas encore d'évaluation

- 5620 SAM Rel 14 License Point Configuration ToolDocument416 pages5620 SAM Rel 14 License Point Configuration Toolluis100% (1)

- Bridge Over BrahmaputraDocument38 pagesBridge Over BrahmaputraRahul DevPas encore d'évaluation

- I. Choose The Best Option (From A, B, C or D) To Complete Each Sentence: (3.0pts)Document5 pagesI. Choose The Best Option (From A, B, C or D) To Complete Each Sentence: (3.0pts)thmeiz.17sPas encore d'évaluation

- RH-A Catalog PDFDocument1 pageRH-A Catalog PDFAchmad KPas encore d'évaluation

- Does Adding Salt To Water Makes It Boil FasterDocument1 pageDoes Adding Salt To Water Makes It Boil Fasterfelixcouture2007Pas encore d'évaluation

- Load Chart Crane LiftingDocument25 pagesLoad Chart Crane LiftingLauren'sclub EnglishBimbel Sd-sma100% (1)

- Hitachi Vehicle CardDocument44 pagesHitachi Vehicle CardKieran RyanPas encore d'évaluation

- Data SheetDocument56 pagesData SheetfaycelPas encore d'évaluation

- Ficha Técnica Panel Solar 590W LuxenDocument2 pagesFicha Técnica Panel Solar 590W LuxenyolmarcfPas encore d'évaluation

- Stress Management HandoutsDocument3 pagesStress Management HandoutsUsha SharmaPas encore d'évaluation

- Supply List & Resource Sheet: Granulation Techniques DemystifiedDocument6 pagesSupply List & Resource Sheet: Granulation Techniques DemystifiedknhartPas encore d'évaluation

- Đề Tuyển Sinh Lớp 10 Môn Tiếng AnhDocument11 pagesĐề Tuyển Sinh Lớp 10 Môn Tiếng AnhTrangPas encore d'évaluation

- Poster-Shading PaperDocument1 pagePoster-Shading PaperOsama AljenabiPas encore d'évaluation

- Aristotle - OCR - AS Revision NotesDocument3 pagesAristotle - OCR - AS Revision NotesAmelia Dovelle0% (1)

- A202 KBK3043 - Assignment Individual (20%) Review LiteratureDocument5 pagesA202 KBK3043 - Assignment Individual (20%) Review LiteratureAlfie AliPas encore d'évaluation

- TM Mic Opmaint EngDocument186 pagesTM Mic Opmaint Engkisedi2001100% (2)

- Rankine-Froude Model: Blade Element Momentum Theory Is A Theory That Combines BothDocument111 pagesRankine-Froude Model: Blade Element Momentum Theory Is A Theory That Combines BothphysicsPas encore d'évaluation

- 123Document3 pages123Phoebe AradoPas encore d'évaluation

- Governance Operating Model: Structure Oversight Responsibilities Talent and Culture Infrastructu REDocument6 pagesGovernance Operating Model: Structure Oversight Responsibilities Talent and Culture Infrastructu REBob SolísPas encore d'évaluation

- JUnit 5 User GuideDocument90 pagesJUnit 5 User GuideaawaakPas encore d'évaluation

- Manhole Head LossesDocument11 pagesManhole Head Lossesjoseph_mscPas encore d'évaluation

- MLX90614Document44 pagesMLX90614ehsan1985Pas encore d'évaluation

- Ilovepdf MergedDocument503 pagesIlovepdf MergedHemantPas encore d'évaluation

- Exploring-Engineering-And-Technology-Grade-6 1Document5 pagesExploring-Engineering-And-Technology-Grade-6 1api-349870595Pas encore d'évaluation

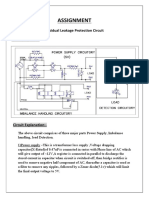

- Assignment: Residual Leakage Protection Circuit Circuit DiagramDocument2 pagesAssignment: Residual Leakage Protection Circuit Circuit DiagramShivam ShrivastavaPas encore d'évaluation