Académique Documents

Professionnel Documents

Culture Documents

Qualityj

Transféré par

Venn Bacus Rabadon0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues28 pagesi

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documenti

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

35 vues28 pagesQualityj

Transféré par

Venn Bacus Rabadoni

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 28

The use of the term "quality cost" is

confusing to some people. It does not refer to

costs such as using a higher grade leather to

make a wallet or using 14K gold instead of

gold plating in jewelry. Instead the term

quality cost refers to all of the costs that are

incurred to prevent defects or that result

from defects in products.

the policies, procedures, techniques, and

mechanisms that help ensure that

management's response to reduce risks

identified during the risk assessment process

is carried out. In other words, control

activities are actions taken to minimize risk.

Preventive activities are designed to deter the

occurrence of an undesirable event. The

development of these controls involves

predicting potential problems before they

occur and implementing procedures to avoid

them.

Detective activities are designed to identify

undesirable events that do occur and alert

management about what has happened. This

enables management to take corrective action

promptly.

Policies

Procedures

Sequences or combinations of procedures

Assignments of duties, responsibilities, and

authorities

Physical arrangements or processes

Combinations of the above.

of activities performed because contaminants

and waste have been produced but not

discharge into the environment.

To ensure that the contaminants and waste

produced are not released to the environment

To ensure that the level of the contaminants

released to an amount that complies with

environmental standards

the cost of activities performed after

discharging contaminants and waste into

the environment.

Realized external failure cost are those

incurred and paid for by the firm.

Unrealized external failure cost, or societal

costs, are caused by the firm but are

incurred and paid for by parties outside the

firm.

A compliance cost is expenditure of time or

money in conforming with government

requirements such

as legislation or regulation. For example,

people or organizations registered for value

added taxhave the extra burden of having to

keep detailed records of all input tax and

output tax to facilitate the completion of VAT

returns. This may necessitate them having to

employ someone skilled in this field, which

would be regarded a compliance cost.

Meeting Obligations Imposed by Regulation

A Working Definition

Some Costs Are Less tangible

Some Are Non-Quantifiable

Compliance Cost versus Administrative and

Economic Costs

regulations that facilitate the collection of

taxation

regulations that require businesses to record

information

regulations that impose obligations on

business for the benefit of third parties

Because the cascading effects of ongoing

noncompliance can geometrically accelerate

the costs of and number of people affected

by a given case, prevention or, failing that,

early recognition and intervention are vital.

The overall costs of government action have

to be set against the expected benefits. A

fundamental requirement of sound policy

analysis is that the expected benefits to

society as a whole from government action

will exceed the overall costs.

Net Benefit = Benefits less Costs

(administration/compliance/direct/economic)

PREVENTION COST

APPRAISAL COST

INTERNAL FAILURE COST

EXTERNAL FAILURE COST

Prevention costs support activities whose

purpose is to reduce the number of defects.

Companies employ many techniques to

prevent defects for example statistical

process control, quality engineering, training,

and a variety of tools from total quality

management (TQM).

Appraisal costs, which are sometimes

called inspection costs, are incurred to

identify defective products before the

products are shipped to customers.

External failure costs include warranty,

repairs and replacements, product recalls,

liability arising from legal actions against a

company, and lost sales arising from a

reputation for poor quality. Such costs can

decimate profits.

Internal failure costs result from

identification of defects before they are

shipped to customers. These costs include

scrap, rejected products, reworking of

defective units, and downtime caused by

quality problem.

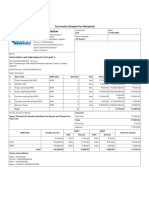

A quality cost report details the prevention

costs, appraisal costs, and internal failure

costand external failure cost that arise from

company's current level of defective products

or services. Companies often construct

a quality cost report that provides an

estimate of the financial consequences of the

company's current level of defects.

Time to correct (in hours) Plus out-of-pocket

cost (including material & services) = Event

cost to fix

Then

Event Cost to fix Times Frequency of

occurrence Equals Cost of Quality

If sales of 100,000 pcs. Of item A requires

production of 110,000 units( an 11% reject

rate), and each replacement piece contains

$10 labor and $5 material, then the cost of

quality equals $150,000. If sales of $10,000

of item B requires 11,000 to be made (also an

11% reject ion), and each replacement

contains $20 labor and $30 material, its cost

of quality equals to $50,000

*Loss of Money

*Loss of Time

Two other types of loss:

*Loss of Control

*Loss of Reputation

To benchmark current operations

To identify opportunities for improvement

To set relative priorities

To monitor progress and validate

improvement actions

Use of Cost of Quality measurement does not

account for variation in process or product

quality in a single capture.

Capture of Cost of quality measures can be

seen as threatening to many workers

Cost of Quality can be skewed by poor

measurement tools, subjective data and bad

reporting. Accurate global data are generally

better than inaccurate tactical data.

THE END

Vous aimerez peut-être aussi

- Just in Time Manufacturing System: A Special Topic in Cost Accounting 2Document12 pagesJust in Time Manufacturing System: A Special Topic in Cost Accounting 2Venn Bacus RabadonPas encore d'évaluation

- Anagerial Ccounting: An OverviewDocument7 pagesAnagerial Ccounting: An OverviewVenn Bacus RabadonPas encore d'évaluation

- Team Quiz 1 PartnershipDocument1 pageTeam Quiz 1 PartnershipVenn Bacus RabadonPas encore d'évaluation

- International Quality Standards: Group 2Document30 pagesInternational Quality Standards: Group 2Venn Bacus RabadonPas encore d'évaluation

- Total Quality Management and BenchmarkingDocument17 pagesTotal Quality Management and BenchmarkingVenn Bacus RabadonPas encore d'évaluation

- University of San Carlos: School of Business and EconomicsDocument3 pagesUniversity of San Carlos: School of Business and EconomicsVenn Bacus RabadonPas encore d'évaluation

- BackFlush Costing2Document12 pagesBackFlush Costing2Venn Bacus RabadonPas encore d'évaluation

- Abrera vs. BarzaDocument11 pagesAbrera vs. BarzaVenn Bacus RabadonPas encore d'évaluation

- Group 5: Cornejo, Sue Cleo Pedroza, Pia Loraine Rodrigo, Karla Angela Therese Yutico, Roxane Mae Imperial, SheenaDocument12 pagesGroup 5: Cornejo, Sue Cleo Pedroza, Pia Loraine Rodrigo, Karla Angela Therese Yutico, Roxane Mae Imperial, SheenaVenn Bacus RabadonPas encore d'évaluation

- Pp. vs. Perfecto G.R. No. L-18463, October 4, 1922: FactsDocument12 pagesPp. vs. Perfecto G.R. No. L-18463, October 4, 1922: FactsVenn Bacus Rabadon100% (1)

- Digested Borjal vs. CADocument3 pagesDigested Borjal vs. CAVenn Bacus RabadonPas encore d'évaluation

- International Financial Reporting StandardsDocument2 pagesInternational Financial Reporting StandardsVenn Bacus RabadonPas encore d'évaluation

- Quality Costs: of Quality. The Use of The Term "Quality Cost" Is Confusing To Some People. It Does Not Refer ToDocument8 pagesQuality Costs: of Quality. The Use of The Term "Quality Cost" Is Confusing To Some People. It Does Not Refer ToVenn Bacus RabadonPas encore d'évaluation

- Arendain vs. BfhomesDocument12 pagesArendain vs. BfhomesVenn Bacus RabadonPas encore d'évaluation

- Chapter 18 Derivatives and Risk Management No CoverDocument85 pagesChapter 18 Derivatives and Risk Management No CoverVenn Bacus RabadonPas encore d'évaluation

- Ravelo Evaristo DigestedDocument1 pageRavelo Evaristo DigestedVenn Bacus RabadonPas encore d'évaluation

- Gaston Vs RepublicDocument6 pagesGaston Vs RepublicVenn Bacus RabadonPas encore d'évaluation

- Case Title: Marcelo Lasoy and Felix Banisa, vs. Hon. Monina A. Zenarosa G.R. No. 129472. April 12, 2005Document2 pagesCase Title: Marcelo Lasoy and Felix Banisa, vs. Hon. Monina A. Zenarosa G.R. No. 129472. April 12, 2005Venn Bacus RabadonPas encore d'évaluation

- Alvin Physics TrickDocument5 pagesAlvin Physics TrickVenn Bacus RabadonPas encore d'évaluation

- Case Title: People v. Escaño 323 SCRA 754 November 10, 2010Document3 pagesCase Title: People v. Escaño 323 SCRA 754 November 10, 2010Venn Bacus RabadonPas encore d'évaluation

- Transfer PricingDocument37 pagesTransfer PricingVenn Bacus RabadonPas encore d'évaluation

- TB Bal - Perf 2Document17 pagesTB Bal - Perf 2Venn Bacus RabadonPas encore d'évaluation

- Commodity MoneyDocument28 pagesCommodity MoneyVenn Bacus RabadonPas encore d'évaluation

- Accounting For Disbursements and Related TransactionsDocument12 pagesAccounting For Disbursements and Related TransactionsVenn Bacus Rabadon100% (9)

- Human EvolutionDocument10 pagesHuman EvolutionVenn Bacus Rabadon0% (1)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Assignment 3 ECON 401Document4 pagesAssignment 3 ECON 401aleena asifPas encore d'évaluation

- 3rd BOCE MinutesDocument8 pages3rd BOCE MinutesKrishna Kanth KPas encore d'évaluation

- Nigeria Property Tax in Federal Capital TerritoryDocument3 pagesNigeria Property Tax in Federal Capital TerritoryMark allenPas encore d'évaluation

- Researchspu, 13 Thanaporn KariyapolDocument13 pagesResearchspu, 13 Thanaporn KariyapolSu MonsanPas encore d'évaluation

- Up Taxation Law Reviewer 2017 PDFDocument267 pagesUp Taxation Law Reviewer 2017 PDFManny Aragones100% (3)

- PGBP New SlidesDocument40 pagesPGBP New SlidesSachin Jain100% (2)

- Veerco SLQT PI - 2537 121617Document2 pagesVeerco SLQT PI - 2537 121617designPas encore d'évaluation

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance Policypinakin medhatPas encore d'évaluation

- Txndetails 101878000509244982Document1 pageTxndetails 101878000509244982s5t5wffcnfPas encore d'évaluation

- Faculty of Accountancy Bachelor of Accountancy (Hons.)Document8 pagesFaculty of Accountancy Bachelor of Accountancy (Hons.)Syafahani SafiePas encore d'évaluation

- SyllabusDocument76 pagesSyllabusamattirkeyPas encore d'évaluation

- A Study On Self-Assessment Tax System Awareness in MalaysiaDocument11 pagesA Study On Self-Assessment Tax System Awareness in MalaysiaEfriani SipahutarPas encore d'évaluation

- Detailed Unit Price Analysis (Dupa)Document1 pageDetailed Unit Price Analysis (Dupa)Nathaniel Gutierez MangubatPas encore d'évaluation

- API MidtermDocument4 pagesAPI MidtermsimranPas encore d'évaluation

- Ra 7171Document3 pagesRa 7171John Paul GarciaPas encore d'évaluation

- 130333-1991-Basco v. Philippine Amusements and Gaming20160212-374-144b11a PDFDocument16 pages130333-1991-Basco v. Philippine Amusements and Gaming20160212-374-144b11a PDFlovekimsohyun89Pas encore d'évaluation

- Description From Currency To Currency Recipient Receive Exchange Rate Amount DueDocument1 pageDescription From Currency To Currency Recipient Receive Exchange Rate Amount DueJOMBANG TIMOERPas encore d'évaluation

- Batch 3 - Taxation 1 / Atty. Dante MarananDocument9 pagesBatch 3 - Taxation 1 / Atty. Dante MarananJPas encore d'évaluation

- Tax Reviewer VitugDocument6 pagesTax Reviewer VitugMis DeePas encore d'évaluation

- Income Statement - Kieso 4Document34 pagesIncome Statement - Kieso 4Muhammad RezaPas encore d'évaluation

- Implementing Value Capture in Latin America Full 1Document72 pagesImplementing Value Capture in Latin America Full 1Kinshuk SaurabhPas encore d'évaluation

- Jawad Hussain: SkillsDocument2 pagesJawad Hussain: SkillsghaziaPas encore d'évaluation

- Impact of GST On Beverage IndustryDocument9 pagesImpact of GST On Beverage Industry1245Simran SahaPas encore d'évaluation

- Lease DeedDocument12 pagesLease DeedjainsachindelhiPas encore d'évaluation

- PA2 X ESP HW9 G1 Revanza TrivianDocument9 pagesPA2 X ESP HW9 G1 Revanza TrivianRevan KonglomeratPas encore d'évaluation

- The Role and Environment of Managerial Finance: True/FalseDocument23 pagesThe Role and Environment of Managerial Finance: True/FalseKenjiPas encore d'évaluation

- Operations Management: Location StrategiesDocument18 pagesOperations Management: Location StrategiesRavi JakharPas encore d'évaluation

- Pestle and Swot Analysis of Adidas and StarbucksDocument9 pagesPestle and Swot Analysis of Adidas and StarbucksAlyn Princess Lopez AseoPas encore d'évaluation

- Fa Notes 2Document17 pagesFa Notes 2Pooja NPas encore d'évaluation

- Heavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022Document1 pageHeavy Metal and Tube India PVT LTD Unit 1 - 272 - 17-06-2022pragnesh prajapatiPas encore d'évaluation