Académique Documents

Professionnel Documents

Culture Documents

New Investment and Project Appraisal

Transféré par

Runaway ShujiDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

New Investment and Project Appraisal

Transféré par

Runaway ShujiDroits d'auteur :

Formats disponibles

INVESTMENT

AND PROJECT

APPRAISAL

Prepared by: Kha Pham

1

CHAPTER OBJECTIVES

The methods of project appraisal: accounting rate

of return, payback and discounted cash flow

The concepts of time preference, the opportunity

cost of finance and the cost of capital

Relevant cash flows

Net present value and internal rate of return

methods

The implications of taxation and inflation in

discounted cash flow

2

I. STEPS IN PROJECT APPRAISAL

Decision making and control cycle:

3

GROUP DISCUSSION

Imagine you were Starbucks top managers. The

corporation planned to open the second Starbuck

store in Vietnam, following their successful operation

of the first one in Ho Chi Minh City.

Appraise the potentials of this project in Hanoi and

Danang City and make your conclusion!

4

METHODS OF PROJECT

APPRAISAL

1. The accounting rate of return: calculates the

accounting profit (rather than cash flow) that will

be earned by a project and expresses this as a

percentage of the capital invested in the project

2. Payback period: Calculates the length of time a

project will take to recoup the initial investment,

based on cash flows

3. Discounted cash flow (DCF):

i. Net present value method (NPV)

ii. Internal rate of return (IRR)

5

NON-FINANCIAL FACTORS

Legal

Ethical

Changes to regulations

Political

Quality implication

Personnel

Coherence

6

II. ACCOUNTING RATE OF RETURN

=

100

Estimated average profits = Average annual cash flows

Estimated average investment =

+

2

7

ARR EXAMPLE

ABC Limited is now choosing between two

alternatives of machine for the upcoming project:

8

Machine A Machine B

Cost $15,000 $15,000

Estimated Scrap value $3,000 $4,000

Estimated life 3 years 3 years

Estimated future cash flows

Year 1 $4,000 $5,000

Year 2 $7,000 $7,000

Year 3 $7,000 $3,500

A ($) B ($)

Total Cash flows 18,000 15,500

Total depreciation 12,000 11,000

Total profit after depreciation 6,000 4,500

Average profit (3 years) 2,000 1,500

Value of investment initially 15,000 15,000

Eventual residual value 3,000 4,000

18,000 19,000

Average value of investment (/2) 9,000 9,500

9

ARR for:

A 22%

B 16%

Machine A is preferred!

III. PAYBACK PERIOD

Gives greater weight to cash flows generated in

earlier years

The length of time required before the total cash

inflows are equal to the original cash outlay

10

Machine P Machine Q

Cost $10,000 $10,000

Estimated future cash flows

Year 1 $3,000 $5,000

Year 2 $4,000 $7,000

Year 3 $4,000 $3,500

Year 4 $2,000 $2,000

IV. TIME VALUE OF MONEY

The value of money (purchasing power) today is

different from the value of money in the future!

For example, a $1,000 saving in a bank gives you

$1,100 in one year

The interest rate is 10%

The two amounts have the same purchasing power to

the owner who expects the 10% interest!

In other words, $1,100 is the future value of $1,000 in

one year!

11

V. DISCOUNTING AND COMPOUND

INTEREST

Simple interest: = (1 +)

Compound interest: = (1 +)

Discounting: Compounding in reverse

=

(1 +)

12

VI. DISCOUNTED CASH FLOW

A technique of evaluating capital investment

projects, using discounting arithmetic to determine

whether or not they will provide a satisfactory return

Ignore Depreciation

Only deal with Cash!

Can be used in two ways

Net Present Value (NPV)

Internal Rate of Return (IRR)

13

NET PRESENT VALUE (NPV)

The sum of all present value of cash flows (both

outflow/ initial outlay and inflow) over the period of

the project

If NPV > 0: PV of benefits > PV of cost so the

project earns higher return than the cost of capital

should be accepted!

If NPV < 0: PV of benefits < PV of cost so the

project earns lower return than the cost of capital

should be rejected!

14

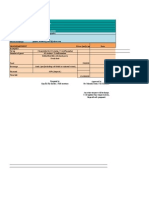

NPV EXAMPLE

15

Project A

Outlay cost $15,000

Estimated future cash flows

Year 1 $4,000

Year 2 $7,000

Year 3 $7,000

Discount rate/ Cost of capital/

Required rate of return

10%

Evaluate the following project

Year Cash

flow

Present value

factor

Present value

$ 10% $

0 (15,000) 1.000 (15,000)

1 4,000 0.909 3,636

2

7000 0.826 5782

3

7000 0.751 5257

NPV

(325)

16

NPV < 0: Reject the project!

DISCOUNTED PAYBACK PERIOD

Reflect the time value of money!

17

Year Cash flow Present

value

Cumulative

PV

$ $ $

0 (15,000) (15,000) (15,000)

1 4,000 3,636 (11,364)

2

7,000 5,782 (5,582)

3

7,000 5,257 (325)

4

6,000 4,098 3,773

DISCOUNTED PAYBACK PERIOD

Discounted payback period = 3 yrs + 325/4,098

= 3.079 years

This compares with a non-discounted payback period,

instead of occurring near the end of year 3, the

discounted payback period suggests that the initial

outlay can only be recouped at the beginning of year 4

If the project stops at year 3, it will not add value to the

company!

18

COST OF CAPITAL

The appropriate discount rate to use in investment

appraisal is the companys cost of capital difficult

to determine

Both shareholders and debt holders expect some

sort of returns cost of financing to the company

Cost of capital = Weighted average cost of all the

sources of capital that a company uses

19

ANNUITIES

In DCF, annuities are an annual cash payment/

receipt that is the same amount every year for a

number of year

Instead of using the normal DCF calculation, there

is a short-cut formula for annuities

20

INTERNAL RATE OF RETURN (IRR)

IRR is the rate of return at which NPV = 0 (or the

total cash inflows are equal to the total cash

outflow)

There are two steps involved in IRR calculation

Calculating IRR expected from a project

Comparing IRR with cost of capital

21

VII. ALLOWING FOR INFLATION

The inflation will influence the level of expected

returns of investors

Which rate to use? Money rate (Nominal rate) or

Real rate?

22

VIII. TAXATION AND PROJECT

APPRAISAL

The incremental tax cash flows should be included

in the cash flows of the project for discounting to

arrive at the projects NPV

When taxation is ignored in the DCF calculation,

the discount rate is pre-tax rate of return

When taxation is included in the cash flows, a post-

tax rate is required!

23

Vous aimerez peut-être aussi

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDocument17 pagesCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_Pas encore d'évaluation

- Project Management: The Financial Perspective: Muhammad UmerDocument37 pagesProject Management: The Financial Perspective: Muhammad Umermumer1Pas encore d'évaluation

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunPas encore d'évaluation

- Present ValueDocument8 pagesPresent ValueFarrukhsgPas encore d'évaluation

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82Pas encore d'évaluation

- 4-Capital Budgeting TechniquesDocument20 pages4-Capital Budgeting TechniquesnoortiaPas encore d'évaluation

- Principles of Capital InvestmentDocument35 pagesPrinciples of Capital InvestmentAnam Jawaid100% (1)

- Capital BudgetingDocument42 pagesCapital BudgetingPiyush ChitlangiaPas encore d'évaluation

- Capital BudgetingDocument52 pagesCapital Budgetingrabitha07541Pas encore d'évaluation

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84Pas encore d'évaluation

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004Pas encore d'évaluation

- Industrial Management and Process Economics Assignment: University of The PunjabDocument14 pagesIndustrial Management and Process Economics Assignment: University of The PunjabAbubakr KhanPas encore d'évaluation

- Capital Budgeting - I: Gourav Vallabh Xlri JamshedpurDocument64 pagesCapital Budgeting - I: Gourav Vallabh Xlri JamshedpurSimran JainPas encore d'évaluation

- Investment Decisions in Hotels: Topic 6Document20 pagesInvestment Decisions in Hotels: Topic 6sv03Pas encore d'évaluation

- Dani IFM AssignmentDocument9 pagesDani IFM AssignmentdanielPas encore d'évaluation

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngPas encore d'évaluation

- Evaluation of Financial Feasibility of CP OptionsDocument35 pagesEvaluation of Financial Feasibility of CP OptionsInamulla KhanPas encore d'évaluation

- CB and Cash Flow (FM Keown10e Chap10Document70 pagesCB and Cash Flow (FM Keown10e Chap10Hasrul HashomPas encore d'évaluation

- Financial Management: A Project On Capital BudgetingDocument20 pagesFinancial Management: A Project On Capital BudgetingHimanshi SethPas encore d'évaluation

- Capital Investment AppraisalDocument41 pagesCapital Investment Appraisalbookabdi1Pas encore d'évaluation

- Chapter-Five: Capital Budgeting DecisionDocument50 pagesChapter-Five: Capital Budgeting DecisionGizaw BelayPas encore d'évaluation

- Capital BudgetingDocument7 pagesCapital BudgetingKazi Abdullah Susam0% (1)

- Investment Decision CriteriaDocument71 pagesInvestment Decision CriteriaBitu GuptaPas encore d'évaluation

- Chapter 7 The Analysis of Investment ProjectsDocument41 pagesChapter 7 The Analysis of Investment ProjectsHùng PhanPas encore d'évaluation

- Presentation CB DIBADocument18 pagesPresentation CB DIBAFarhana Abedin DibaPas encore d'évaluation

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaPas encore d'évaluation

- Choosing Innovation ProjectDocument25 pagesChoosing Innovation ProjectChrisha Jane LanutanPas encore d'évaluation

- Capital Budgeting TechniquesDocument57 pagesCapital Budgeting TechniquesAlethea DsPas encore d'évaluation

- Capital BudgetingDocument37 pagesCapital Budgetingyashd99Pas encore d'évaluation

- Capital Budgeting and Cost AnalysisDocument75 pagesCapital Budgeting and Cost AnalysisAkhil BatraPas encore d'évaluation

- Chapter 7: NPV and Capital Budgeting: Assigned Problems Are 3, 7, 34, 36, and 41. Read Appendix ADocument8 pagesChapter 7: NPV and Capital Budgeting: Assigned Problems Are 3, 7, 34, 36, and 41. Read Appendix AmajorkonigPas encore d'évaluation

- ACCT 2200 - Chapter 11 P1 - FullDocument39 pagesACCT 2200 - Chapter 11 P1 - Fullafsdasdf3qf4341f4asDPas encore d'évaluation

- ACCA F9 Lecture 2Document37 pagesACCA F9 Lecture 2Fathimath Azmath AliPas encore d'évaluation

- Unit 2 Capital Budgeting Technique ProblemsDocument39 pagesUnit 2 Capital Budgeting Technique ProblemsAshok KumarPas encore d'évaluation

- Cost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Document27 pagesCost-Volume-Profit & Capital Budgeting Techniques: Lecture-9Nirjon BhowmicPas encore d'évaluation

- Capital Budgeting Technique: Md. Nehal AhmedDocument25 pagesCapital Budgeting Technique: Md. Nehal AhmedZ Anderson Rajin0% (1)

- Irr, NPV, PB, ArrDocument54 pagesIrr, NPV, PB, ArrSushma Jeswani Talreja100% (3)

- Ins3007 S4 SVDocument32 pagesIns3007 S4 SVnguyễnthùy dươngPas encore d'évaluation

- 5, 6 & 7 Capital BudgetingDocument42 pages5, 6 & 7 Capital BudgetingNaman AgarwalPas encore d'évaluation

- Capital Budgeting - Part 1Document6 pagesCapital Budgeting - Part 1Aurelia RijiPas encore d'évaluation

- Capital BudgetingDocument45 pagesCapital BudgetingdawncpainPas encore d'évaluation

- Appraisal Criteria - Capital BudgetingDocument50 pagesAppraisal Criteria - Capital BudgetingNitesh NagdevPas encore d'évaluation

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDPas encore d'évaluation

- Recall The Flows of Funds and Decisions Important To The Financial ManagerDocument27 pagesRecall The Flows of Funds and Decisions Important To The Financial ManagerAyaz MahmoodPas encore d'évaluation

- Capital Budgeting Decision - SBSDocument43 pagesCapital Budgeting Decision - SBSSahil SherasiyaPas encore d'évaluation

- Screening Capital Investment ProposalsDocument13 pagesScreening Capital Investment ProposalsSandia EspejoPas encore d'évaluation

- Investment DecDocument29 pagesInvestment DecSajal BasuPas encore d'évaluation

- MBA7001 Week 5 Investment Appraisal Methods 1Document39 pagesMBA7001 Week 5 Investment Appraisal Methods 1Pranjal JaiswalPas encore d'évaluation

- Investment Appraisal TechniquesDocument14 pagesInvestment Appraisal TechniquesIan MutukuPas encore d'évaluation

- cc78b4a013a1ea0106599cd465d99893Document8 pagescc78b4a013a1ea0106599cd465d99893Liyana AzizulPas encore d'évaluation

- Chapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsDocument11 pagesChapter 8: Planning Investments - Discounted Cash Flows End of Chapter QuestionsRavinesh Amit PrasadPas encore d'évaluation

- Capital BudgetingDocument26 pagesCapital BudgetingAshenafi AbdurkadirPas encore d'évaluation

- Capital Investment AppraisalDocument30 pagesCapital Investment Appraisalzahiraqasrina100% (1)

- Investment Criteria ExDocument14 pagesInvestment Criteria ExMon ThuPas encore d'évaluation

- 6 Capital Budgeting TechniquesDocument49 pages6 Capital Budgeting TechniquesAkwasi BoatengPas encore d'évaluation

- PM Introduction PDFDocument39 pagesPM Introduction PDFbhaskkarPas encore d'évaluation

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- Investment Appraisal: A Simple IntroductionD'EverandInvestment Appraisal: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (6)

- Decoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisD'EverandDecoding DCF: A Beginner's Guide to Discounted Cash Flow AnalysisPas encore d'évaluation

- High-Q Financial Basics. Skills & Knowlwdge for Today's manD'EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manPas encore d'évaluation

- Business Game ScheduleDocument2 pagesBusiness Game ScheduleRunaway ShujiPas encore d'évaluation

- Assignment MAAR 1Document28 pagesAssignment MAAR 1Runaway ShujiPas encore d'évaluation

- APC 309 ABC Mock Exam Solution A and BDocument3 pagesAPC 309 ABC Mock Exam Solution A and BRunaway ShujiPas encore d'évaluation

- NX0472 / LD0472: Developing Global Management Competencies I (BI Strand)Document5 pagesNX0472 / LD0472: Developing Global Management Competencies I (BI Strand)Runaway ShujiPas encore d'évaluation

- Assignment PPD 1Document33 pagesAssignment PPD 1Runaway Shuji33% (3)

- Financial Analysis For Boa CoffeeDocument2 pagesFinancial Analysis For Boa CoffeeRunaway ShujiPas encore d'évaluation

- Company Profile of PumaDocument1 pageCompany Profile of PumaRunaway ShujiPas encore d'évaluation

- The Relationship Between Educational Attainment and Professional Attainment in DanangDocument3 pagesThe Relationship Between Educational Attainment and Professional Attainment in DanangRunaway ShujiPas encore d'évaluation

- The Main Barrier of Marketing Plan For Cie: Name: Tran Anh Dung (Jay) Lecturer: Mr. Frederick IgnacioDocument23 pagesThe Main Barrier of Marketing Plan For Cie: Name: Tran Anh Dung (Jay) Lecturer: Mr. Frederick IgnacioRunaway ShujiPas encore d'évaluation

- Assignment Guiide OBDocument5 pagesAssignment Guiide OBRunaway ShujiPas encore d'évaluation

- Modern Approaches To ManagementDocument22 pagesModern Approaches To ManagementRunaway Shuji100% (1)

- Assignment PPD 1Document33 pagesAssignment PPD 1Runaway Shuji33% (3)

- 1.1 Discuss Definitions of Quality in Terms of Business and Services ProvisionDocument10 pages1.1 Discuss Definitions of Quality in Terms of Business and Services ProvisionRunaway ShujiPas encore d'évaluation

- Tran Anh Dung: ObjectivesDocument2 pagesTran Anh Dung: ObjectivesRunaway ShujiPas encore d'évaluation

- Event Date Lunch Set Menu 11 December 2014: Time Venue Number of Guest 10:00 Lemongrass Rest 43 Studen + 5 Staff MemberDocument3 pagesEvent Date Lunch Set Menu 11 December 2014: Time Venue Number of Guest 10:00 Lemongrass Rest 43 Studen + 5 Staff MemberRunaway ShujiPas encore d'évaluation

- Time-Table: Class: SUD12 Semester: Summer (From 1 Sep - 7 Nov 2014) Academic Year: 2014/2015 Room: E301Document1 pageTime-Table: Class: SUD12 Semester: Summer (From 1 Sep - 7 Nov 2014) Academic Year: 2014/2015 Room: E301Runaway ShujiPas encore d'évaluation

- Define QualityDocument14 pagesDefine QualityRunaway ShujiPas encore d'évaluation

- Assignment TQM 1Document13 pagesAssignment TQM 1Runaway ShujiPas encore d'évaluation

- Similarities N Different Deming Juran N CrosbyDocument4 pagesSimilarities N Different Deming Juran N CrosbyRunaway ShujiPas encore d'évaluation

- Place of DistributionDocument38 pagesPlace of DistributionRunaway ShujiPas encore d'évaluation

- Danang University of Economics Btec HND in Business (Management)Document8 pagesDanang University of Economics Btec HND in Business (Management)Runaway ShujiPas encore d'évaluation

- Individual Behavior at WorkDocument22 pagesIndividual Behavior at WorkRunaway ShujiPas encore d'évaluation

- Arvo Li Incident ReportsDocument10 pagesArvo Li Incident ReportsRunaway ShujiPas encore d'évaluation

- Danang University of Economics Btec HND in Business (Management)Document7 pagesDanang University of Economics Btec HND in Business (Management)Runaway ShujiPas encore d'évaluation

- Changes in The Indian Financial System Since 1991Document8 pagesChanges in The Indian Financial System Since 1991Samyra RathorePas encore d'évaluation

- Ben & JerryDocument6 pagesBen & JerrySachin SuryavanshiPas encore d'évaluation

- Presentation About Financial Crisis 2008Document16 pagesPresentation About Financial Crisis 2008Schanzae ShabbirPas encore d'évaluation

- ABM ReviewerDocument5 pagesABM ReviewerKRISTELLE ROSARIOPas encore d'évaluation

- Home Depot Strategic Audit SampleDocument18 pagesHome Depot Strategic Audit SamplekhtphotographyPas encore d'évaluation

- Authority For Expenditures (AFE)Document4 pagesAuthority For Expenditures (AFE)Hacene Lamraoui100% (1)

- RR 10-76Document4 pagesRR 10-76matinikkiPas encore d'évaluation

- Evercore ISI's Best "Core" IdeasDocument21 pagesEvercore ISI's Best "Core" IdeasJoyce Dick Lam PoonPas encore d'évaluation

- VE Banking Tests Unit06Document2 pagesVE Banking Tests Unit06Andrea CosciaPas encore d'évaluation

- Feinstein C.H. (Ed.) Banking, Currency, and Finance in Europe Between The Wars (OUP, 1995) (ISBN 0198288034) (O) (555s) - GH - PDFDocument555 pagesFeinstein C.H. (Ed.) Banking, Currency, and Finance in Europe Between The Wars (OUP, 1995) (ISBN 0198288034) (O) (555s) - GH - PDFIsmith PokhrelPas encore d'évaluation

- Final ITC Vs HULDocument15 pagesFinal ITC Vs HULpurvish13Pas encore d'évaluation

- AON Kelompok 5Document39 pagesAON Kelompok 5Berze VessaliusPas encore d'évaluation

- Bank of BarodaDocument24 pagesBank of Barodachris_win30460850% (6)

- 03 Literature ReviewDocument15 pages03 Literature ReviewPraveen PuliPas encore d'évaluation

- Czech Business and Trade 2/2010Document60 pagesCzech Business and Trade 2/2010zamorskaPas encore d'évaluation

- 1&2 PDFDocument24 pages1&2 PDFNoorullah Patwary ZubaerPas encore d'évaluation

- Prulink Withdrawal Form: Individual PolicyownerDocument3 pagesPrulink Withdrawal Form: Individual PolicyownerMunicipal Accounting Office Los BañosPas encore d'évaluation

- 1) in Tally There Are - Predefined Ledger Ans: 2: 2) - Key Is Used To Print A ReportDocument6 pages1) in Tally There Are - Predefined Ledger Ans: 2: 2) - Key Is Used To Print A ReportjeeadvancePas encore d'évaluation

- Diary of A FraudDocument22 pagesDiary of A FraudAndreas AbrahamPas encore d'évaluation

- Pta Financial StatementDocument2 pagesPta Financial StatementDecember Cool100% (1)

- Preeti Singh PDF Final ProjectDocument113 pagesPreeti Singh PDF Final Project0911Preeti SinghPas encore d'évaluation

- 5 02-09-2022 Sale On Approval FTDocument4 pages5 02-09-2022 Sale On Approval FTShweta BhadauriaPas encore d'évaluation

- Trust Deed - Poverty Eradication Movement Foundation TrustDocument15 pagesTrust Deed - Poverty Eradication Movement Foundation TrustANSY100% (2)

- TLC Investment PrintedDocument6 pagesTLC Investment PrintedDewi RenitasariPas encore d'évaluation

- Remic Guide As Explained To Investors - Easy To UnderstandDocument7 pagesRemic Guide As Explained To Investors - Easy To Understand83jjmackPas encore d'évaluation

- Capital BudgetingDocument22 pagesCapital BudgetingBradPas encore d'évaluation

- Consolidated Statements of Changes in Equity: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument4 pagesConsolidated Statements of Changes in Equity: Samsung Electronics Co., Ltd. and Its SubsidiarieschirahotoPas encore d'évaluation

- South Africa - Mid-Term Review of The Country Strategy Paper 2018-2022 and Country Portfolio Performance Review 2021Document100 pagesSouth Africa - Mid-Term Review of The Country Strategy Paper 2018-2022 and Country Portfolio Performance Review 2021Weddie MakomichiPas encore d'évaluation

- Score Booster For All Bank Prelims Exams - Day 29Document28 pagesScore Booster For All Bank Prelims Exams - Day 29bofeniPas encore d'évaluation

- QB of BODocument3 pagesQB of BOAyush KushwahaPas encore d'évaluation