Académique Documents

Professionnel Documents

Culture Documents

3b5a3lecture 3 Time Value of Money

Transféré par

April MartinezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

3b5a3lecture 3 Time Value of Money

Transféré par

April MartinezDroits d'auteur :

Formats disponibles

Amity Business School

1

Amity Business School

MBA Class of 2015, Semester II

Amity Business School

Objective

At the end of this course the students will understand:

Understand what is meant by "the time value of money.

Understand the relationship between present and future value.

Describe how the interest rate can be used to adjust the value of cash

flows both forward and backward to a single point in time.

Calculate both the future and present value of: (a) an amount invested

today; (b) a stream of equal cash flows (an annuity); and (c) a stream of

mixed cash flows.

Distinguish between an ordinary annuity and an annuity due.

.

Use interest factor tables to find an unknown interest rate or growth rate

when the number of time periods and future and present values are

known.

Amity Business School

Money has time value. A rupee earned today is

more valuable than a rupee a year hence.

WHY?

Future uncertainties

Preference for present consumption

Reinvestment opportunities

Amity Business School

Therefore TVM is the Rate of Return which

an investor can earn by reinvesting its

present money.

This Rate of Return can also be expressed as

required rate of return to make equal the worth

of money of two different time period

Amity Business School

TVM results from the concept of

Interest And the Time Gap

Amity Business School

The Interest Rate

Which would you prefer -- $10,000

today or $10,000 in 5 years?

You already recognize that there

is TIME VALUE TO MONEY!!

Amity Business School

Why is TIME such an important

element in our decision?

TIME allows you the opportunity to

postpone consumption and earn

INTEREST

Amity Business School

How amounts in different time periods

can compare?

One can adjust values from different time periods

using an

Remember, one CANNOT compare numbers in different

time periods without first adjusting them using an

interest rate

Amity Business School

The Timeline

A timeline is a linear representation of the

timing of potential cash flows.

Drawing a timeline of the cash flows will

help you visualize the financial problem

Amity Business School

Example

Assume that you loan $20,000 to a friend. You will be

repaid in two payments, one at the end of each year

over the next two years.

Amity Business School

Differentiate between two types of cash flows

I nflows are positive cash flows.

Outflows are negative cash flows, which

are indicated with a (minus) sign.

Amity Business School

Example

Assume that you are lending $10,000 today and that the

loan will be repaid in two annual $6,000 payments.

The first cash flow at date 0 (today) is represented as a

negative sum because it is an outflow.

Timelines can represent cash flows that take place at the

end of any time period.

Amity Business School

Amity Business School

Amity Business School

Comparison of cash flows of different time periods

necessitate the conversion of money to a common point of

time. And techniques used for doing so are:

Compounding Techniques: the process of calculating

future values of present cash flows and

Discounting Techniques: the process of calculating

present values of future cash flows

Amity Business School

Compounding Techniques

Compounding concept

means the interest

earned on the initial

principal sum becomes

a part of the principal

or initial sum at the end

of the compounded

period.

Year 1 2 3

Beginning

Amount 1000 1050 1102.5

Interest rate 5% 5% 5%

Amount of

interest 50 52.5 55.125

Beginning

Principal 1000 1050 1102.5

Ending

Principal 1050 1102.5

1157.6

25

Amity Business School

Future Value

The compounding technique is used to find out the

FUTURE VALUE of a present money.

It can further be explained with reference to:

The future value of a single cash flow (Lump sum

amount)

The Future value of a series of Cash Flows

(Annuity)

Amity Business School

(i) The FV of Single Cash Flow

Formula

FV = PV (1+r)

n

FV

is Future Value

PV is Present Value

r is the interest rate

n is time period

If you deposited Rs 55,650 in a bank, which was

paying a 15 per cent rate of interest on a ten-year time

deposit, how much would the deposit grow at the end

of ten years?

Amity Business School

The general form of equation for calculating the

future value of a lump sum after n periods may,

therefore, be written as follows:

The term (1 + r)

n

is the compound value factor

(CVF) of a lump sum of Re 1, and it always has

a value greater than 1 for positive i, indicating

that CVF increases as r and n increase.

FV

n

= PV x CVF

r,n

Amity Business School

We will first find out the compound value factor

at 15 per cent for 10 years which is 4.046.

Multiplying 4.046 by Rs.55,650, we get Rs

225,159.90 as the compound value:

FV= 55,650 X CVF 10, .15

= 55,650 X 4.046

= Rs. 225159.90

Amity Business School

Non-Annual Compounding

Compounding is not always annually it may be half- yearly,

quarterly, monthly. So in this case compounding can be done

be using the following formula.

FV = PV(1+r/m)

mn

m is the number of time compounding is done in a year

n is the time period.

Compounding Period No of period (m)

Annually 1

Half- Yearly 2

Quarterly 4

Monthly 12

Note: More frequently the compounding is made, the faster is the growth

in the FV

Amity Business School

Effective Rate of Interest

Effective rate of interest is a rate at which money held at

present actually increases in a year.

Sometimes it often happens that interest is compounded

more than once in a year. In such circumstances

effective rate of interest is different from given rate of

interest.

Formula for Effective Rate of Interest is:

r

e

= (1+r/m)

m

-1

Amity Business School

Example:

A deposit of Rs.15000 is made in a bank for a period of

1year.

The Bank offers two options

(i) To receive interest at 12% p.a. compounded

monthly.

(ii) To receive interest at 12.25% p.a. compounded half

yearly.

Which option should be accepted?

Amity Business School

Solution

option (i) option (ii)

Rate of interest =12% p.a. Rate of interest = 12.25%p.a.

PV is Rs.15000 PV is Rs.15000

Time 1yr (compounded monthly) Time 1yr (compounded

Half- yearly)

r

e

= (1+r/m)

m

-1 r

e

= (1+r/m)

m

-1

r

e

= (1+.12/12)

12

= (1+ .1225/2)

2

-1

= 1.1268-1 = 1.1263 -1

= .1268 = .1263

= 12.68% = 12.63%

Amity Business School

(ii) Future Value of series of cash flow

(Annuity)

An Annuity represents a series of payments (or

receipts) occurring over a specified number of

equidistant periods

Types of Annuities

Ordinary Annuity: Payments or receipts

occur at the end of each period.

Annuity Due: Payments or receipts occur

at the beginning of each period

Amity Business School

Examples of Annuities

Student Loan Payments

Car Loan Payments

Insurance Premiums

Mortgage Payments

Retirement Savings

Amity Business School

0 1 2 3

$100 $100 $100

(Ordinary Annuity)

End of

Period 1

End of

Period 2

Today

Equal Cash Flows

Each 1 Period Apart

End of

Period 3

PARTS OF ANNUITY

Amity Business School

PARTS OF ANNUITY DUE

0 1 2 3

$100 $100 $100

(Annuity Due)

Beginning of

Period 1

Beginning of

Period 2

Today

Equal Cash Flows

Each 1 Period Apart

Beginning of

Period 3

Amity Business School

Note

The future value of an ordinary annuity

can be viewed as occurring at the end

of the last cash flow period,

whereas the future value of an annuity

due can be viewed as occurring at the

beginning of the last cash flow period

Amity Business School

Formula for ordinary Annuity

As it is clear now that Annuity is a fixed payment (or

receipt) each year for a specified number of years. If

you rent a flat and promise to make a series of

payments over an agreed period, you have created an

annuity.

The term within brackets is the compound value factor

for an annuity of Re 1, which we shall refer as CVAF.

F

n

= A x CVAF

n,r

(1 ) 1

n

n

i

F A

i

(

+

=

(

Amity Business School

Example of ordinary Annuity

FVA

3

= $1,000(1.07)

2

+

$1,000(1.07)

1

+ $1,000

= $1,145 + $1,070 + $1,000

= $3,215

$1,000 $1,000 $1,000

0 1 2 3 4

$3,215 = FVA

3

7%

$1,070

$1,145

Cash flows occur at the end of the period

Amity Business School

Formula For Annuity Due

(1 ) 1

n

n

i

F A

i

(

+

=

(

(1+i)

Amity Business School

FVAD

3

= $1,000(1.07)

3

+

$1,000(1.07)

2

+ $1,000(1.07)

1

= $1,225 + $1,145 + $1,070

= $3,440

$1,000 $1,000 $1,000 $1,070

0 1 2 3 4

$3,440 = FVAD

3

7%

$1,225

$1,145

Cash flows occur at the beginning of the period

Amity Business School

Sinking Fund

Sinking fund is a fund, which is created out of fixed

payments each period to accumulate to a future sum

after a specified period. For example, companies

generally create sinking funds to retire bonds

(debentures) on maturity.

The factor used to calculate the annuity for a given

future sum is called the sinking fund factor (SFF).

=

(1 ) 1

n

n

i

A F

i

(

(

+

Vous aimerez peut-être aussi

- Lecture 4 Time Value of MoneyDocument16 pagesLecture 4 Time Value of MoneyA.D. Home TutorsPas encore d'évaluation

- Time Value of Money-Part2Document48 pagesTime Value of Money-Part2Ahmed El KhateebPas encore d'évaluation

- FM Unit 4 Lecture Notes - Time Value of MoneyDocument4 pagesFM Unit 4 Lecture Notes - Time Value of MoneyDebbie DebzPas encore d'évaluation

- Intuition Behind The Present Value RuleDocument34 pagesIntuition Behind The Present Value RuleAbhishek MishraPas encore d'évaluation

- Time Value of MoneyDocument17 pagesTime Value of Moneyyolanda monikaPas encore d'évaluation

- Time Value of Money Notes Loan ArmotisationDocument12 pagesTime Value of Money Notes Loan ArmotisationVimbai ChituraPas encore d'évaluation

- Time Value of MoneyDocument60 pagesTime Value of MoneyAtta MohammadPas encore d'évaluation

- Time Value of MoneyDocument7 pagesTime Value of MoneyMary Ann MarianoPas encore d'évaluation

- Time Value of MoneyDocument78 pagesTime Value of Moneyneha_baid_167% (3)

- 01 TVMDocument47 pages01 TVMSaranya GedelaPas encore d'évaluation

- Timevalueofmoney 160502121318Document30 pagesTimevalueofmoney 160502121318S BALAJI VH10788Pas encore d'évaluation

- Time Value of MoneyDocument37 pagesTime Value of Moneyansary75Pas encore d'évaluation

- Time Value of MoneyDocument38 pagesTime Value of MoneyLaiba KhanPas encore d'évaluation

- Engineering Economics CH 2Document81 pagesEngineering Economics CH 2karim kobeissiPas encore d'évaluation

- Lecture 3rd Time Value of MoneyDocument26 pagesLecture 3rd Time Value of MoneyBahrawar saidPas encore d'évaluation

- Engineering Economics Lect 3Document43 pagesEngineering Economics Lect 3Furqan ChaudhryPas encore d'évaluation

- Time Value of MoneyDocument36 pagesTime Value of Moneybisma9681Pas encore d'évaluation

- Unit-3 Time Value of MoneyDocument26 pagesUnit-3 Time Value of MoneySushil KharelPas encore d'évaluation

- BFW2140 Lecture Week 2: Corporate Financial Mathematics IDocument33 pagesBFW2140 Lecture Week 2: Corporate Financial Mathematics Iaa TANPas encore d'évaluation

- CUZ CORP FIN Time Value For Money-1Document16 pagesCUZ CORP FIN Time Value For Money-1KIMBERLY MUKAMBAPas encore d'évaluation

- Parrino 2e PowerPoint Review Ch05Document42 pagesParrino 2e PowerPoint Review Ch05Khadija AlkebsiPas encore d'évaluation

- Unit 3 TVM Live SessionDocument43 pagesUnit 3 TVM Live Sessionkimj22614Pas encore d'évaluation

- Finance: Dr. Suhaib AnagrehDocument113 pagesFinance: Dr. Suhaib AnagrehRabeea AsifPas encore d'évaluation

- Issues in Corporate Finance: ValuationDocument52 pagesIssues in Corporate Finance: ValuationMD Hafizul Islam HafizPas encore d'évaluation

- Chapter 4Document50 pagesChapter 422GayeonPas encore d'évaluation

- The Time Value of Money: Topic 3Document35 pagesThe Time Value of Money: Topic 3lazycat1703Pas encore d'évaluation

- Planning and Evaluationl English 4Document40 pagesPlanning and Evaluationl English 4Absa TraderPas encore d'évaluation

- Chapter 4. Time Value of MoneyDocument49 pagesChapter 4. Time Value of MoneyThu PhươngPas encore d'évaluation

- Capital MarketsDocument17 pagesCapital MarketsYshi KimPas encore d'évaluation

- Session 10: Unit II: Time Value of MoneyDocument49 pagesSession 10: Unit II: Time Value of MoneySamia ElsayedPas encore d'évaluation

- Time Value of MoneyDocument60 pagesTime Value of MoneyZain AbbasPas encore d'évaluation

- Compound Value of Series of Payments & Present Value of Single Payment and Present Value of Series of PaymentsDocument10 pagesCompound Value of Series of Payments & Present Value of Single Payment and Present Value of Series of PaymentstenuneethugmailcomPas encore d'évaluation

- Time Value of Money - TVMDocument21 pagesTime Value of Money - TVMTh'bo Muzorewa ChizyukaPas encore d'évaluation

- Capital Budgeting: Present ValueDocument15 pagesCapital Budgeting: Present ValueNoorunnishaPas encore d'évaluation

- Concept of Value and Return Question and AnswerDocument4 pagesConcept of Value and Return Question and Answervinesh1515Pas encore d'évaluation

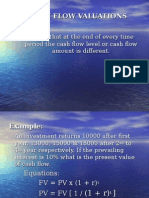

- Cash Flow ValuationsDocument14 pagesCash Flow ValuationsRao Shahid TufailPas encore d'évaluation

- Financial Management FM 1: Introduction & Time Value of MoneyDocument20 pagesFinancial Management FM 1: Introduction & Time Value of MoneyharryworldPas encore d'évaluation

- Finman Modules Chapter 5Document9 pagesFinman Modules Chapter 5Angel ColartePas encore d'évaluation

- Arbaminch Distance Chapter 3Document16 pagesArbaminch Distance Chapter 3Gizaw BelayPas encore d'évaluation

- Financial Management Lecture 4thDocument34 pagesFinancial Management Lecture 4thMansour NiaziPas encore d'évaluation

- PEB4102 Chapter 4Document61 pagesPEB4102 Chapter 4LimPas encore d'évaluation

- Chapter 4. Time Value of MoneyDocument49 pagesChapter 4. Time Value of MoneySơn Đặng TháiPas encore d'évaluation

- Chapter-3 Time Value of MoneyDocument29 pagesChapter-3 Time Value of MoneyInSha RafIqPas encore d'évaluation

- (Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamDocument51 pages(Wiley Resource - Chapter 6 - Customized & Abridged) Dr. Tasadduq ImamMuhammad Ramiz AminPas encore d'évaluation

- Chapter 1 - Time Value of MoneyDocument61 pagesChapter 1 - Time Value of MoneyVishal PathakPas encore d'évaluation

- Time Value of MoneyDocument18 pagesTime Value of MoneyJunaid SubhaniPas encore d'évaluation

- 1349 1Document6 pages1349 1Noaman AkbarPas encore d'évaluation

- Managerial Finance chp5Document13 pagesManagerial Finance chp5Linda Mohammad FarajPas encore d'évaluation

- Time Value of Money MPFDocument6 pagesTime Value of Money MPFSaloni AgrawalPas encore d'évaluation

- Lecture 3 - Time Value of MoneyDocument22 pagesLecture 3 - Time Value of MoneyJason LuximonPas encore d'évaluation

- Presentation 3-Time Value of Money - 29908Document39 pagesPresentation 3-Time Value of Money - 29908Chin Keanna BuizonPas encore d'évaluation

- Time Value of MoneyDocument19 pagesTime Value of Moneyjohnnyboy30003223Pas encore d'évaluation

- Module in Financial Management - 05Document8 pagesModule in Financial Management - 05Angelo DomingoPas encore d'évaluation

- Business Finance Module 5Document10 pagesBusiness Finance Module 5CESTINA, KIM LIANNE, B.Pas encore d'évaluation

- The Time Value of MoneyDocument75 pagesThe Time Value of MoneySanchit AroraPas encore d'évaluation

- The Time Value of Money: Money NOW Is Worth More Than Money LATER!Document37 pagesThe Time Value of Money: Money NOW Is Worth More Than Money LATER!Meghashyam AddepalliPas encore d'évaluation

- 04 Time Value of MoneyDocument39 pages04 Time Value of Moneyselcen sarıkayaPas encore d'évaluation

- High-Q Financial Basics. Skills & Knowlwdge for Today's manD'EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manPas encore d'évaluation

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!D'EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!Pas encore d'évaluation

- Chapter 6 - Supply Chain Technology, Managing Information FlowsDocument26 pagesChapter 6 - Supply Chain Technology, Managing Information FlowsArman100% (1)

- US Court Rejects Criticism of AmazonDocument5 pagesUS Court Rejects Criticism of AmazonApril MartinezPas encore d'évaluation

- DominosDocument11 pagesDominosApril MartinezPas encore d'évaluation

- Presentation ObDocument14 pagesPresentation ObApril MartinezPas encore d'évaluation

- US Court Rejects Criticism of AmazonDocument5 pagesUS Court Rejects Criticism of AmazonApril MartinezPas encore d'évaluation

- b83c0LECTURE 3Document21 pagesb83c0LECTURE 3Shubhanshu DubeyPas encore d'évaluation

- Introductio, KJN ParleDocument10 pagesIntroductio, KJN ParleApril MartinezPas encore d'évaluation

- Designation: Achieve Sales & Collection TargetsDocument2 pagesDesignation: Achieve Sales & Collection TargetsApril MartinezPas encore d'évaluation

- 1a6bdlecture 5 Risk ReturnDocument18 pages1a6bdlecture 5 Risk ReturnApril MartinezPas encore d'évaluation

- 1a6bdlecture 5 Risk ReturnDocument18 pages1a6bdlecture 5 Risk ReturnApril MartinezPas encore d'évaluation

- 679 F 9 NoticeDocument2 pages679 F 9 NoticeApril MartinezPas encore d'évaluation

- 1a6bdlecture 5 Risk ReturnDocument18 pages1a6bdlecture 5 Risk ReturnApril MartinezPas encore d'évaluation

- Presentation ObDocument14 pagesPresentation ObApril MartinezPas encore d'évaluation

- CCTV in Town CentresDocument86 pagesCCTV in Town CentresJens OdsvallPas encore d'évaluation

- TetraDocument64 pagesTetraApril MartinezPas encore d'évaluation

- NEW DELHI Safe City ProjectDocument8 pagesNEW DELHI Safe City ProjectApril MartinezPas encore d'évaluation

- Through DTDC CourierDocument1 pageThrough DTDC CourierApril MartinezPas encore d'évaluation

- Book Shipped Through DTDC Courier Reff No, l.z06690,,,l676, and Recieved by Company Seal.Document1 pageBook Shipped Through DTDC Courier Reff No, l.z06690,,,l676, and Recieved by Company Seal.April MartinezPas encore d'évaluation

- Kashish Mehrotra (A-33) Abhishek Arora (A-50)Document14 pagesKashish Mehrotra (A-33) Abhishek Arora (A-50)April MartinezPas encore d'évaluation

- Through DTDCDocument1 pageThrough DTDCApril MartinezPas encore d'évaluation

- US Court Rejects Criticism of AmazonDocument5 pagesUS Court Rejects Criticism of AmazonApril MartinezPas encore d'évaluation

- MBA Full ProjectDocument123 pagesMBA Full Projectdinesh877783% (18)

- Rupee ValueDocument6 pagesRupee ValueApril MartinezPas encore d'évaluation

- US Court Rejects Criticism of AmazonDocument5 pagesUS Court Rejects Criticism of AmazonApril MartinezPas encore d'évaluation

- Beam GlobalDocument1 pageBeam GlobalApril MartinezPas encore d'évaluation

- 8a982GlaxoSmithKline Consumer Healthcare LTD, Su PL Notice 2014Document2 pages8a982GlaxoSmithKline Consumer Healthcare LTD, Su PL Notice 2014April MartinezPas encore d'évaluation

- 8a982GlaxoSmithKline Consumer Healthcare LTD, Su PL Notice 2014Document2 pages8a982GlaxoSmithKline Consumer Healthcare LTD, Su PL Notice 2014April MartinezPas encore d'évaluation

- 84a982GlaxoSmithKline Consumer Healthcare LTD, Su PL Notice 2014Document1 page84a982GlaxoSmithKline Consumer Healthcare LTD, Su PL Notice 2014April MartinezPas encore d'évaluation

- CPARDocument2 pagesCPARHarryrich MarbellaPas encore d'évaluation

- CivilCAD2014 English Rev1Document443 pagesCivilCAD2014 English Rev1Nathan BisPas encore d'évaluation

- Business Maths Chapter 5Document9 pagesBusiness Maths Chapter 5鄭仲抗Pas encore d'évaluation

- Course Specifications: Fire Investigation and Failure Analysis (E901313)Document2 pagesCourse Specifications: Fire Investigation and Failure Analysis (E901313)danateoPas encore d'évaluation

- Miso Soup Miso Soup Miso Soup: Ingredients Ingredients IngredientsDocument8 pagesMiso Soup Miso Soup Miso Soup: Ingredients Ingredients IngredientsEllie M.Pas encore d'évaluation

- Upend RA Kumar: Master List of Approved Vendors For Manufacture and Supply of Electrical ItemsDocument42 pagesUpend RA Kumar: Master List of Approved Vendors For Manufacture and Supply of Electrical Itemssantosh iyerPas encore d'évaluation

- Homework 1 Tarea 1Document11 pagesHomework 1 Tarea 1Anette Wendy Quipo Kancha100% (1)

- Put Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsDocument2 pagesPut Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsNithya SweetiePas encore d'évaluation

- Festival Implementation PlanDocument5 pagesFestival Implementation Planapi-318058589Pas encore d'évaluation

- Almutairy / Musa MR: Boarding PassDocument1 pageAlmutairy / Musa MR: Boarding PassMusaPas encore d'évaluation

- Asin URL Index URL/keyword DomainDocument30 pagesAsin URL Index URL/keyword DomainStart AmazonPas encore d'évaluation

- Bajaj Allianz General Insurance CompanyDocument4 pagesBajaj Allianz General Insurance Companysarath potnuriPas encore d'évaluation

- Araldite 2020 + XW 396 - XW 397Document6 pagesAraldite 2020 + XW 396 - XW 397Paul Dan OctavianPas encore d'évaluation

- FoodhallDocument3 pagesFoodhallswopnilrohatgiPas encore d'évaluation

- Nationalisation of Insurance BusinessDocument12 pagesNationalisation of Insurance BusinessSanjay Ram Diwakar50% (2)

- UN Layout Key For Trade DocumentsDocument92 pagesUN Layout Key For Trade DocumentsСтоян ТитевPas encore d'évaluation

- Law MCQ 25Document3 pagesLaw MCQ 25nonoPas encore d'évaluation

- Group 9Document1 pageGroup 9Kyla Jane GabicaPas encore d'évaluation

- Tours and Travel MNGTDocument16 pagesTours and Travel MNGTArpita Jaiswal100% (5)

- Belimo ARB24-SR Datasheet En-UsDocument2 pagesBelimo ARB24-SR Datasheet En-Usian_gushepiPas encore d'évaluation

- Lesson Plan Outline - Rebounding - Perez - JoseDocument7 pagesLesson Plan Outline - Rebounding - Perez - JoseJose PerezPas encore d'évaluation

- Tutorial 4 QuestionsDocument3 pagesTutorial 4 QuestionshrfjbjrfrfPas encore d'évaluation

- Standards Guide 1021 1407Document8 pagesStandards Guide 1021 1407Anjur SiPas encore d'évaluation

- Urban LifestyleDocument27 pagesUrban LifestyleNindy AslindaPas encore d'évaluation

- Control Flow, Arrays - DocDocument34 pagesControl Flow, Arrays - DocHARIBABU N SEC 2020Pas encore d'évaluation

- Data Base Format For Company DetailsDocument12 pagesData Base Format For Company DetailsDexterJacksonPas encore d'évaluation

- Dimitris Achlioptas Ucsc Bsoe Baskin School of EngineeringDocument22 pagesDimitris Achlioptas Ucsc Bsoe Baskin School of EngineeringUCSC Students100% (1)

- Taewoo Kim Et Al. v. Jump TradingDocument44 pagesTaewoo Kim Et Al. v. Jump TradingCrainsChicagoBusiness100% (1)

- Material List Summary-WaptechDocument5 pagesMaterial List Summary-WaptechMarko AnticPas encore d'évaluation

- Ingredients EnsaymadaDocument3 pagesIngredients Ensaymadajessie OcsPas encore d'évaluation