Académique Documents

Professionnel Documents

Culture Documents

Legal and Regulatory Environment of Brazil: ANATEL, ANEEL, CVM, MERCOSUR

Transféré par

audityaerosDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Legal and Regulatory Environment of Brazil: ANATEL, ANEEL, CVM, MERCOSUR

Transféré par

audityaerosDroits d'auteur :

Formats disponibles

Legal and Regulatory Environment of

Brazil

Presented by :

Auditya Eros

Kartika Adhitama

Kezia Revina

Levana Setya Violani

Nadira Laksita

A Preview of Brazil

The largest country in both South America and the Latin American region. It is

the world's fifth largest country, both by geographical area and by population.

According to the IMF and WB, Brazil is the largest national economy in Latin

America, the world's seventh largest economy at market exchange rates and

in purchasing power parity (PPP).

The Aspects of Brazils Legal and

Regulatory Environment

Government Control

Taxation Policy

Trade Zone

Free Trade Agreement

Related Goverment Control

There are government agencies thah regulate and supervise every industry

ANATEL for telecommunications industry

ANEEL for electricity industry

CVM for securities markets and listed companies

only securities issued by companies registered with the CVM may traded

on stock exchanges and over-the-counter markets

For some sectors, government will not let foreign company to own it.

For example, in term of aviations industry, foreign ownership of Brazilian airlines

is restricted.

Related to Taxation Policy

High tariffs are imposed on many imports

Incentives tax for the Northeast and Amazon regions

Companies will experience 75% reduction of the income tax and

nonrefundable surcharges due on operating profit, for a maximum

period of ten years, for implementation, expansion, diversification and

improvement projects submitted and approved from August 24, 2000,

to December 31, 2018.

Related to Trade Zones

MANAUS Free Trade Zone (Zona Franca de Manaus ZFM)

- to atrract industry and commerce to the Amazon region

- entitled to certain tax benefits

Export Processing Zones (EPZs)

- industrial districts where companies operate with tax suspension,

currency exchange freedom

- receivable favorable income tax treatment

Related to Free-Trade Agreement

Brazil is a member of the Latin American Integration Association (ALADI), the

World Trade Organization (WTO), and the Common Market of the Southern

Cone (MERCOSUR),

Common Market of the Southern Cone (MERCOSUR)

- Certificate of Origin main requirement

- 60% of inputs must be produced inside the country

- tend to prefer doing trade only between its members countries

Challenges

Developing nation

Local labor forces

Technology and infrastructure

Financial and taxes

Facts of Starting Business in Brazil

Brazil ranked 126

th

out of 183 countries in the WBs latest annual global

report which evaluates the ease of starting a business.

It takes 13 procedures and 119 days of work to start a business in Brazil.

Construction permits has an average of 17 procedures and 49 days to finally

get authorized.

source : www.doingbusiness.org

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

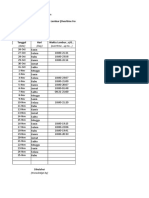

- Deliver GoodsDocument20 pagesDeliver GoodsaudityaerosPas encore d'évaluation

- PT.IMFI Payment Recipients ListDocument2 pagesPT.IMFI Payment Recipients ListaudityaerosPas encore d'évaluation

- No. Waybinama Pengnama PenerimaDocument6 pagesNo. Waybinama Pengnama PenerimaaudityaerosPas encore d'évaluation

- Journal PutriDocument12 pagesJournal PutriaudityaerosPas encore d'évaluation

- Syamsudin (Lost Shipment JNT)Document1 pageSyamsudin (Lost Shipment JNT)audityaerosPas encore d'évaluation

- Annex2 Website1702131007Document144 pagesAnnex2 Website1702131007Farhan Khan NiaZiPas encore d'évaluation

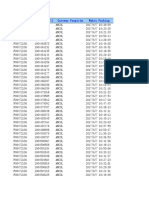

- Overtime records for Indonesia OPPO Electronics HR departmentDocument23 pagesOvertime records for Indonesia OPPO Electronics HR departmentaudityaerosPas encore d'évaluation

- No. Bagging No. Waybill Gateway Pengirim Waktu PackingDocument27 pagesNo. Bagging No. Waybill Gateway Pengirim Waktu PackingaudityaerosPas encore d'évaluation

- No. Bagging No. Waybill Gateway Pengirim Waktu PackingDocument36 pagesNo. Bagging No. Waybill Gateway Pengirim Waktu PackingaudityaerosPas encore d'évaluation

- Export 20170130091421Document2 pagesExport 20170130091421audityaerosPas encore d'évaluation

- Please Fill in The Form in English: MT Function Preference: (Commercial/Supply Chain/Finance/Procurement/Technical)Document2 pagesPlease Fill in The Form in English: MT Function Preference: (Commercial/Supply Chain/Finance/Procurement/Technical)Friska Martha NapitupuluPas encore d'évaluation

- No. Waybill Tempat Tujuan Tanggal Pengiriman Hitung Berat Total Biaya Yang Harus Diterima Nama PengirimDocument16 pagesNo. Waybill Tempat Tujuan Tanggal Pengiriman Hitung Berat Total Biaya Yang Harus Diterima Nama PengirimaudityaerosPas encore d'évaluation

- ReturDocument1 pageReturaudityaerosPas encore d'évaluation

- Study Programmes 2017-2018 Study Level Indonesia: X X X XDocument8 pagesStudy Programmes 2017-2018 Study Level Indonesia: X X X XaudityaerosPas encore d'évaluation

- Waybill Receiver ListDocument4 pagesWaybill Receiver ListaudityaerosPas encore d'évaluation

- Annex2 Website1702131007Document144 pagesAnnex2 Website1702131007Farhan Khan NiaZiPas encore d'évaluation

- President University Student Enrollment: Name: Academic Year: ID Number: Semester: Advisor: Study ProgramDocument1 pagePresident University Student Enrollment: Name: Academic Year: ID Number: Semester: Advisor: Study ProgramaudityaerosPas encore d'évaluation

- Annex2 Website1702131007Document144 pagesAnnex2 Website1702131007Farhan Khan NiaZiPas encore d'évaluation

- International TradeDocument3 pagesInternational TradeaudityaerosPas encore d'évaluation

- Chart SizeDocument1 pageChart SizeaudityaerosPas encore d'évaluation

- International Marketing Environment (Cultural, Economic, and Technological)Document46 pagesInternational Marketing Environment (Cultural, Economic, and Technological)audityaerosPas encore d'évaluation

- Intl MKTG Chap 4Document32 pagesIntl MKTG Chap 4audityaerosPas encore d'évaluation

- Theories of Leadership Models ExplainedDocument63 pagesTheories of Leadership Models ExplainedaudityaerosPas encore d'évaluation

- Export Selling vs. Export MarketingDocument22 pagesExport Selling vs. Export MarketingaudityaerosPas encore d'évaluation

- PhilippinesDocument10 pagesPhilippinesaudityaerosPas encore d'évaluation

- Overview of The Program: Herman J. Suhendra, MADocument12 pagesOverview of The Program: Herman J. Suhendra, MAaudityaerosPas encore d'évaluation

- Philippines Market Analysis Reveals Opportunities in Basketball and Sport Shoes IndustryDocument29 pagesPhilippines Market Analysis Reveals Opportunities in Basketball and Sport Shoes IndustryaudityaerosPas encore d'évaluation

- Theories of Leadership Models ExplainedDocument63 pagesTheories of Leadership Models ExplainedaudityaerosPas encore d'évaluation

- FMCH 06Document137 pagesFMCH 06audityaerosPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Information GovernanceDocument14 pagesInformation GovernanceAvinash PonugupatiPas encore d'évaluation

- Bs en 764 7 Pressure Equipment Part 7 Safety Systems for Unfired Pressure Equipment 1Document8 pagesBs en 764 7 Pressure Equipment Part 7 Safety Systems for Unfired Pressure Equipment 1Mohamed IrfanPas encore d'évaluation

- 1661-Article Text-3069-1-10-20201125Document29 pages1661-Article Text-3069-1-10-20201125Seble KinfePas encore d'évaluation

- Auditing Financial StatementsDocument3 pagesAuditing Financial StatementsMega Pop LockerPas encore d'évaluation

- Common Carriers RegulationsDocument3 pagesCommon Carriers RegulationsErgo WingsPas encore d'évaluation

- Natural Bodybuilding Federation of Ireland MembershipDocument1 pageNatural Bodybuilding Federation of Ireland MembershippatsyahernePas encore d'évaluation

- CIAP Document 102: General Conditions of ContractsDocument3 pagesCIAP Document 102: General Conditions of ContractsSheila Mary Delojero CamuloPas encore d'évaluation

- Risk Based Auditing Ebook PDFDocument11 pagesRisk Based Auditing Ebook PDFAsepWahyuPrabowoPas encore d'évaluation

- UN Regulation No. 3 amendments on retro-reflecting devicesDocument2 pagesUN Regulation No. 3 amendments on retro-reflecting devicesMPas encore d'évaluation

- SEC CODE OF CORPORATE GOVERNANCEDocument7 pagesSEC CODE OF CORPORATE GOVERNANCERohanne Garcia AbrigoPas encore d'évaluation

- 02 Manila Electric Co. Vs El Auditor GeneralDocument1 page02 Manila Electric Co. Vs El Auditor GeneralJustine GalandinesPas encore d'évaluation

- Parking Study......Document28 pagesParking Study......Niraj BoharaPas encore d'évaluation

- Waste Recover and Disposal RecordsDocument28 pagesWaste Recover and Disposal RecordsRofel CagasPas encore d'évaluation

- General InformationDocument56 pagesGeneral InformationLeelaram KhatriPas encore d'évaluation

- HW4Monopoly, Game TheoryDocument3 pagesHW4Monopoly, Game TheoryShivani GuptaPas encore d'évaluation

- CPM Efe PDFDocument3 pagesCPM Efe PDFAzenith Margarette CayetanoPas encore d'évaluation

- Notice: Commission Decision To Review, Etc.: Certain Endoscopic Probes For Use in Argon Plasma Coagulation SystemsDocument1 pageNotice: Commission Decision To Review, Etc.: Certain Endoscopic Probes For Use in Argon Plasma Coagulation SystemsJustia.comPas encore d'évaluation

- Lease Extension Agreement (India) : This Packet IncludesDocument6 pagesLease Extension Agreement (India) : This Packet IncludesAnonymous mmSRAn7mPas encore d'évaluation

- Stock Subscription AgreementDocument9 pagesStock Subscription AgreementJerry Marc Carbonell100% (1)

- BS en 1289-1998 PDFDocument8 pagesBS en 1289-1998 PDFromvos8469Pas encore d'évaluation

- The Kerala Account Code Vol IDocument145 pagesThe Kerala Account Code Vol IHIVETECHPas encore d'évaluation

- Regulation of Small SatellitesDocument46 pagesRegulation of Small SatellitesJohn TziourasPas encore d'évaluation

- Maximizing The Value of A Risk-Based Audit Plan.Document4 pagesMaximizing The Value of A Risk-Based Audit Plan.Arco Priyo DirgantoroPas encore d'évaluation

- nzcp2 v2 FarmdairyassessmentDocument56 pagesnzcp2 v2 FarmdairyassessmentAslamPas encore d'évaluation

- Payments 101Document37 pagesPayments 101David Leeman100% (1)

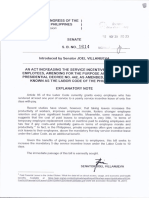

- SB No. 1614Document3 pagesSB No. 1614Simoun Montelibano SalinasPas encore d'évaluation

- Alternative InvestmentsDocument20 pagesAlternative InvestmentsPedro Ale100% (1)

- PPTDocument15 pagesPPTarunPas encore d'évaluation

- VZPM PMLC MC PRmA M1 2011 EN MultChoiceQuesAnsDocument22 pagesVZPM PMLC MC PRmA M1 2011 EN MultChoiceQuesAnsVivek ArumugaPas encore d'évaluation

- ABP vs. ERCDocument38 pagesABP vs. ERCSky SongcalPas encore d'évaluation