Académique Documents

Professionnel Documents

Culture Documents

Rbi

Transféré par

Vanessa DavisCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rbi

Transféré par

Vanessa DavisDroits d'auteur :

Formats disponibles

RBI

Overview

It was established in April 1935 with a share

capital of Rs. 5 crores

The share capital was divided into shares of

Rs. 100 each fully paid which was entirely

owned by private shareholders in the

beginning.

The Government held shares of nominal

value of Rs. 2,20,000.Reserve Bank of India

was nationalized in the year 1949.

Overview

Has 22 regional offices, most of them in state

capitals.

Working is distributed among 24 departments

of organization.

Key Functions :

Monetary Authority

Regulator and supervisor of the financial

system, Manager of Foreign Exchange,

Issuer of currency,

Developmental role,

Related Functions

Overview

RBI is located only in 18 places for currency

operations

Distribution of notes and coins throughout

the country is done through designated bank

branches, called chests

Chest is a receptacle in a commercial bank to

store notes and coins on behalf of the

Reserve Bank

Reason of Formation

To regulate the issue of banknotes

To maintain reserves with a view to securing

monetary stability

To operate the credit and currency system of

the country to its advantage.

Functions Of RBI

Functions

Bankers' Bank

and

Lender of

the Last

Resort

Bank of Issue

Banker To

Government

Controller

of Credit

Custodian Of

Foreign Reserves

Functions Of RBI

Bank of Issue

Under Section 22 of the Reserve Bank of

India Act, the Bank has the sole right to

issue bank notes of all denominations.

The Reserve Bank of India is required to

maintain gold and foreign exchange

reserves of Ra. 200 crores, of which at

least Rs. 115 crores should be in gold.

The system as it exists today is known as

the minimum reserve system.

Functions Of RBI

Banker to Government

The Reserve Bank has the obligation to

transact Government business, via. to

keep the cash balances as deposits free of

interest.

The Reserve Bank of India helps the

Government - both the Union and the

States to float new loans and to manage

public debt.

Functions Of RBI

Bankers' Bank and Lender of the Last

Resort

Banks have been asked to keep cash

reserves equal to 5 per cent of their

aggregate deposit liabilities.

The scheduled banks can borrow from the

Reserve Bank of India on the basis of

eligible securities or get financial

accommodation in times of need.

Functions Of RBI

Controller of Credit

It controls the credit operations of banks

through quantitative and qualitative

controls

It controls the banking system through

the system of licensing, inspection and

calling for information.

It acts as the lender of the last resort by

providing rediscount facilities to scheduled

banks.

Functions Of RBI

Custodian of Foreign Reserves

Besides maintaining the rate of exchange

of the rupee, the Reserve Bank has to act

as the custodian of India's reserve of

international currencies.

To facilitate external trade and payment

and promote orderly development and

maintenance of foreign exchange market

in India.

Functions Of RBI

Supervisory functions

RBI has wide powers of supervision and

control over commercial and co-operative

banks

Relating to licensing and establishments,

branch expansion, liquidity of their assets,

management and methods of working,

amalgamation, reconstruction, and

liquidation.

Functions Of RBI

Promotional functions

The RBI has set up the Agricultural

Refinance and Development Corporation

to provide long-term finance to farmers.

The Bank now performs a variety of

developmental and promotional functions,

which, at one time, were regarded as

outside the normal scope of central

banking.

Financial Supervision

The Reserve Bank of India performs this

function under the guidance of the Board for

Financial Supervision (BFS)

BFS undertake consolidated supervision of

the financial sector comprising of

Commercial Banks

Financial Institutions

Non-banking Finance Companies

Financial Supervision

The BFS oversees the functioning of :

Department of Banking Supervision

(DBS)

Department of Non-Banking Supervision

(DNBS)

Financial Institutions Division

(FID)

Financial Supervision

The initiatives taken by BFS:

Restructuring of the system of bank

inspections

Introduction of off-site surveillance,

Strengthening of the role of statutory

auditors

Strengthening of the internal defenses of

supervised institutions

Financial Supervision

Current Focus

Supervision of financial institutions

Consolidated accounting

Legal issues in bank frauds

Divergence in assessments of non-

performing assets

Supervisory rating model for banks

Organization Structure

Chief General Managers-in -Charge

Support Staff

Managers

Asstt. Managers

Deputy General Managers

Governor

General Managers

Principal Chief General Manager Executive Directors

Deputy Governors

Asstt. General Managers

Chief General Managers

Facts Of RBI

RBI owns the following:

National Housing Bank(NHB)

National Bank for Agriculture and Rural

Development(NABARD)

Deposit Insurance and Credit Guarantee

Corporation of India(DICGC)

Bharatiya Reserve Bank Note Mudran Private

Limited(BRBNMPL)

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Test Bank Principles of Managerial Finance Brief 8th Edition Chad J. Zutter SamplesDocument33 pagesTest Bank Principles of Managerial Finance Brief 8th Edition Chad J. Zutter Samplessalafite50% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- DFA5058 Tutorial Chapter 3 SolutionDocument9 pagesDFA5058 Tutorial Chapter 3 SolutionArabella Summer100% (1)

- APIs in Banking Four Approaches To Unlocking Business Value - Report PDFDocument60 pagesAPIs in Banking Four Approaches To Unlocking Business Value - Report PDFgargaaankit100% (3)

- Eureka - in Standared - 12 - Biology Content ListDocument13 pagesEureka - in Standared - 12 - Biology Content ListVanessa DavisPas encore d'évaluation

- Pincon Group: 1 0060014836 Saurabh Singh Rawat 6 6,000.00 110.40 441.60 22.08 253.92 0.00Document1 pagePincon Group: 1 0060014836 Saurabh Singh Rawat 6 6,000.00 110.40 441.60 22.08 253.92 0.00Vanessa DavisPas encore d'évaluation

- Fund-BarometerDocument134 pagesFund-BarometerVanessa DavisPas encore d'évaluation

- Pincon Group: Voucher List For DECEMBER 13-2NDDocument1 pagePincon Group: Voucher List For DECEMBER 13-2NDVanessa DavisPas encore d'évaluation

- Business Standard 27.03.2014Document1 pageBusiness Standard 27.03.2014Vanessa DavisPas encore d'évaluation

- UTSAV IntroductionDocument3 pagesUTSAV IntroductionVanessa DavisPas encore d'évaluation

- FCCBDocument14 pagesFCCBVanessa DavisPas encore d'évaluation

- Study Material Commercial BankingDocument171 pagesStudy Material Commercial BankingprateekramchandaniPas encore d'évaluation

- 2 - Copy of Evolution of BankingDocument17 pages2 - Copy of Evolution of BankingVanessa DavisPas encore d'évaluation

- Education Is An Ornament in Prosperity and A Refuge in Adversity AristotleDocument23 pagesEducation Is An Ornament in Prosperity and A Refuge in Adversity AristotleVanessa DavisPas encore d'évaluation

- Dlfi1701130046 I-791134L0008828: Nseit Limited - Dehradun ApDocument1 pageDlfi1701130046 I-791134L0008828: Nseit Limited - Dehradun ApVanessa DavisPas encore d'évaluation

- Financial IntermediationDocument45 pagesFinancial IntermediationVanessa DavisPas encore d'évaluation

- Financial DerivativesDocument140 pagesFinancial DerivativesgeethkeetsPas encore d'évaluation

- Managing Operational RiskDocument14 pagesManaging Operational RiskVanessa DavisPas encore d'évaluation

- Derivatives: Analysis and ValuationDocument34 pagesDerivatives: Analysis and ValuationVanessa DavisPas encore d'évaluation

- Vodafone Idea LTD.: Detailed QuotesDocument21 pagesVodafone Idea LTD.: Detailed QuotesVachi VidyarthiPas encore d'évaluation

- Lilac Flour Mills - FinalDocument9 pagesLilac Flour Mills - Finalrahulchohan2108Pas encore d'évaluation

- Banks Credit and Agricultural Sector Output in NigeriaDocument12 pagesBanks Credit and Agricultural Sector Output in NigeriaPORI ENTERPRISESPas encore d'évaluation

- Bloomberg Top Hedge Funds 2010Document14 pagesBloomberg Top Hedge Funds 2010jackefeller100% (1)

- 80G CertificateTax ExemptionDocument56 pages80G CertificateTax ExemptionskunwerPas encore d'évaluation

- Patels Airtemp (India) LimitedDocument5 pagesPatels Airtemp (India) LimitedAnkit LohiyaPas encore d'évaluation

- (B) They Share A Majority of Their Common Assets and (C) They Have CommonDocument5 pages(B) They Share A Majority of Their Common Assets and (C) They Have CommonSab0% (1)

- Latsol Abc Ujian 2 InterDocument9 pagesLatsol Abc Ujian 2 InterABIMANTRANAPas encore d'évaluation

- Authorization For Salary ChangeDocument2 pagesAuthorization For Salary ChangeKhan Mohammad Mahmud HasanPas encore d'évaluation

- MAC2601-OCT NOV 2013eDocument11 pagesMAC2601-OCT NOV 2013eDINEO PRUDENCE NONGPas encore d'évaluation

- Tax - Dealings in PropertyDocument18 pagesTax - Dealings in PropertyErik Paul PoncePas encore d'évaluation

- Summary SheetDocument7 pagesSummary SheetAbdullah AbualkhairPas encore d'évaluation

- Module 4Document3 pagesModule 4Robin Mar AcobPas encore d'évaluation

- Mba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDocument4 pagesMba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDeepakPas encore d'évaluation

- Evidence of FundsDocument3 pagesEvidence of FundsMIrfanFananiPas encore d'évaluation

- HPPWD FORM No 7Document2 pagesHPPWD FORM No 7Ankur SheelPas encore d'évaluation

- Draft Develop Bankable Transport Infrastructure Project 24sep1 0Document158 pagesDraft Develop Bankable Transport Infrastructure Project 24sep1 0lilikwbs9334Pas encore d'évaluation

- Retail Banking An Over View of HDFC BankDocument69 pagesRetail Banking An Over View of HDFC BankPrashant Patil0% (1)

- Horngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Document111 pagesHorngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Sally MillerPas encore d'évaluation

- McKinsey Profile Up1 1201Document94 pagesMcKinsey Profile Up1 1201007003sPas encore d'évaluation

- El Paso County 2016 Code of EthicsDocument16 pagesEl Paso County 2016 Code of EthicsColorado Ethics WatchPas encore d'évaluation

- Brigham & Ehrhardt: Financial Management: Theory and Practice 14eDocument46 pagesBrigham & Ehrhardt: Financial Management: Theory and Practice 14eAmirah AliPas encore d'évaluation

- How To Become A Certified Finance Planner (CFP) in India - QuoraDocument11 pagesHow To Become A Certified Finance Planner (CFP) in India - QuorarkPas encore d'évaluation

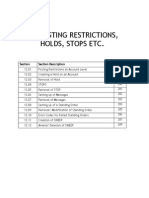

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyPas encore d'évaluation

- Universiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1: Confidential 1 AC/JAN 2017/FAR320NURAISHA AIDA ATANPas encore d'évaluation

- Case Doctrines Credit Transactions PDFDocument24 pagesCase Doctrines Credit Transactions PDFJ Castillo MejicaPas encore d'évaluation

- Consumption, Saving, and InvestmentDocument50 pagesConsumption, Saving, and InvestmentMinerva EducationPas encore d'évaluation