Académique Documents

Professionnel Documents

Culture Documents

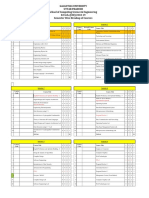

12 2oligopoly

Transféré par

Kishan PatelTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

12 2oligopoly

Transféré par

Kishan PatelDroits d'auteur :

Formats disponibles

Oligopoly

Chapter 16-2

Models of Oligopoly

Behavior

No single general model of

oligopoly behavior exists.

Oligopoly

An oligopoly is a market structure

characterized by:

Few firms

Either standardized or differentiated

products

Difficult entry

Interdependence

A key characteristic of oligopolies is

that each firm can affect the market,

making each firms choices dependent

on the choices of the other firms. They

are interdependent.

Characteristics Oligopoly

Oligopolies are made up of a small

number of mutually interdependent

firms.

Each firm must take into account the

expected reaction of other firms.

Interdependence

The importance of interdependence is that it

leads to strategic behavior.

Strategic behavior is the behavior that occurs

when what is best for A depends upon what B

does, and what is best for B depends upon what

A does.

Oligopolistic behavior includes both ruthless

competition and cooperation.

Game Theory

Strategic behavior has been analyzed

using the mathematical techniques of

game theory.

Game theory provides a description of

oligopolistic behavior as a series of

strategic moves and countermoves.

Characteristics of Oligopoly

Oligopolies are made up of a small number

of firms in an industry

Oligopolistic firms are mutually interdependent

In any decision a firm makes, it must take into account

the expected reaction of other firms

Oligopolies can be collusive or noncollusive

Firms may engage in strategic decision making where

each firm takes explicit account of a rivals expected

response to a decision it is making

16-8

Models of Oligopoly Behavior

There is no single model of oligopoly

behavior

The cartel model is when a combination of firms acts

as if it were a single firm and a monopoly price is set

An oligopoly model can take two extremes:

The contestable market model is a model of

oligopolies where barriers to entry and exit, not market

structure, determine price and output decisions and a

competitive price is set

Other models of oligopolies give price results between the

two extremes

16-9

The Cartel Model

A cartel model of oligopoly is a model

that assumes that oligopolies act as if

they were a monopoly and set a price

to maximize profit

Output quotas are assigned to individual member firms

so that total output is consistent with joint profit

maximization

If oligopolies can limit the entry of other firms, they can

increase profits

16-10

Implicit Price Collusion

Explicit (formal) collusion is illegal in

the U.S. while implicit (informal)

collusion is permitted

Implicit price collusion exists when multiple firms

make the same pricing decisions even though they

have not consulted with one another

Sometimes the largest or most dominant firm takes

the lead in setting prices and the others follow

16-11

Why Are Prices Sticky?

One characteristic of informal

collusive behavior is that prices tend

to be sticky they dont change

frequently

Informal collusion is an important reason why prices are

sticky

Another is the kinked demand curve

If a firm increases price, others wont go along, so

demand is very elastic for price increases

If a firm lowers price, other firms match the

decrease, so demand is inelastic for price

decreases

16-12

The Kinked Demand Curve

Graph

A gap in the MR curve exists

A large shift in marginal cost

is required before firms will

change their price

Q

P

Q

MC

1

D MR

P

If P increases, others wont go

along, so D is elastic

If P decreases, other firms

match the decrease, so D

is inelastic

MC

2

Gap

16-13

The Contestable Market Model

The contestable market model is a

model of oligopolies where barriers to

entry and exit, not market structure,

determine price and output decisions

and a competitive price is set

Even if the industry contains only one firm, it will set a

competitive price if there are no barriers to entry

Much of what happens in oligopoly pricing is

dependent on the specific legal structure within which

firms interact

16-14

Comparing Contestable Market

and Cartel Models

The cartel model is appropriate for

oligopolists that collude, set a monopoly

price, and prevent market entry

The contestable market model describes oligopolies that

set a competitive price and have no barriers to entry

Oligopoly markets lie between these two extremes

Both models use strategic pricing decisions where

firms set their price based on the expected reactions of

other firms

16-15

New Entry as a Limit on the

Cartelization Strategy and Price

Wars

Price wars are the result of strategic pricing decisions

gone wild

A predatory pricing strategy involves temporarily

pushing the price down in order to drive a competitor

out of business

The threat of outside competition limits oligopolies from

acting as a cartel

The threat will be more effective if the outside competitor

is much larger than the firms in the oligopoly

16-16

Why Are Prices Sticky?

When there is a kink in the demand

curve, there has to be a gap in the

marginal revenue curve.

The kinked demand curve is not a theory

of oligopoly but a theory of sticky prices.

D

2

The Kinked Demand Curve

D

1

MR

2

MR

1

Price

Quantity

0

Q

P

a

b

c

d

MC

0

MC

1

The Kinked Demand Curve

Game Theory and

Strategic Decision Making

The prisoners dilemma is a well-

known game that demonstrates the

difficulty of cooperative behavior in

certain circumstances.

Game Theory and

Strategic Decision Making

In the prisoners dilemma, where

mutual trust gets each one out of the

dilemma, confessing is the rational

choice.

Prisoners Dilemma and a

Duopoly Example

The prisoners dilemma has its simplest

application when the oligopoly consists

of only two firmsa duopoly.

Prisoners Dilemma and a

Duopoly Example

By analyzing the strategies of both

firms under all situations, all

possibilities are placed in a payoff

matrix.

A payoff matrix is a box that contains

the outcomes of a strategic game under

various circumstances.

Firm and Industry Duopoly

Cooperative Equilibrium

P

r

i

c

e

P

r

i

c

e

575

$800

700

600

500

400

300

200

100

0

(a) Firm's cost curves

1 2 3 4 5 6 7 8

Quantity (in thousands)

MC

ATC

$800

700

600

500

400

300

200

100

0

1 2 3 4 5 6 7 8 9 10 11

Monopolist

solution

MR

D

Competitive

solution

MC

(b) Industry: Competitive and monopolist solution

Quantity (in thousands)

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Firm and Industry Duopoly Equilibrium

When One Firm Cheats

P

r

i

c

e

P

r

i

c

e

P

r

i

c

e

$800

700

600

500

400

300

200

100

0

$800

700

600

500

400

300

200

100

0

$900

800

700

600

500

400

300

200

100

0

550 550 550

1 2 3 4 5 6 7 1 2 3 4 5 6 7

A

MC

A TC

Quantity (in thousands)

(a) Noncheating firms loss

A

MC

A TC

Quantity (in thousands)

(b) Cheating firms profit

A

B

C

1 2 3 4 5 6 7 8

Quantity (in thousands)

(c) Cheating solution

Non-

cheating

firms

output

Cheating

firms

output

McGraw-Hill/Irwin

2004 The McGraw-Hill Companies, Inc., All Rights Reserved.

Duopoly and a Payoff

Matrix

The duopoly is a variation of the

prisoner's dilemma game.

The results can be presented in a

payoff matrix that captures the essence

of the prisoner's dilemma.

B Cheats

B Does not

cheat

A Does not cheat A Cheats

B +$200,000

B 0

A 0

A +$200,000

B $75,000

A $75,000

A $75,000

B $75,000

The Payoff Matrix of Strategic

Pricing Duopoly

Dominant Strategy

In an oligopoly, firms try to achieve a

dominant strategya strategy that

produces better results no matter what

strategy other firms follow.

The interdependence of oligopolies

decisions can often lead to the prisoners

dilemma.

Prisoners Dilemma

Implicit Price Collusion

Formal collusion is illegal in the U.S.

while informal collusion is permitted.

Implicit price collusion exists when

multiple firms make the same pricing

decisions even though they have not

consulted with one another.

Implicit Price Collusion

Sometimes the largest or most

dominant firm takes the lead in setting

prices and the others follow.

Cooperation and Cartels

If the firms in an oligopoly cooperate, they may earn

more profits than if they act independently.

Collusion, which leads to secret cooperative

agreements, is illegal in the U.S., although it is legal and

acceptable in many other countries.

Price-Leadership Cartels may form in which firms

simply do whatever a single leading firm in the industry

does. This avoids strategic behavior and requires no

illegal collusion.

Implicit Price Collusion

Why Are Prices Sticky?

Informal collusion is an important

reason why prices are sticky.

Another is the kinked demand curve.

Cartels

A cartel is an organization of

independent firms whose purpose is

to control and limit production and

maintain or increase prices and

profits.

Like collusion, cartels are illegal in the

United States.

Conditions necessary for a cartel

to be stable (maintainable):

There are few firms in the industry.

There are significant barriers to entry.

An identical product is produced.

There are few opportunities to keep

actions secret.

There are no legal barriers to sharing

agreements.

OPEC as an Example of a Cartel

OPEC: Organization of Petroleum Exporting Countries.

Attempts to set prices high enough to earn member

countries significant profits, but not so high as to

encourage dramatic increases in oil exploration or the

pursuit of alternative energy sources.

Controls prices by setting production quotas for

member countries.

Such cartels are difficult to sustain because members

have large incentives to cheat, exceeding their quotas.

The Diamond Cartel

In 1870 huge diamond mines in South Africa flooded the gem

market with diamonds.

Investors at the time wanted to control production and created

De Beers Consolidated Mines, Ltd., which quickly took control

of all aspects of the world diamond trade.

The Diamond Cartel, headed by DeBeers, has been

extremely successful. While other commodities prices, such

as gold and silver respond to economic conditions, diamonds

prices have increased every year since the Depression.

This success has been achieved by DeBeers influence on the

supply of diamonds, but also via the cartels influence on

demand.

In the 1940s DeBeers instigated an advertising campaign

making the diamond a symbol of status and romance.

Behavior of a Cartel:

Firms Agree to Act as a Monopolist

Cartel: Firms Act Alone

Cartels and Technological

Change

Cartels can be destroyed by an outsider

with technological superiority.

Thus, cartels with high profits will

provide incentives for significant

technological change.

Facilitating Practices

Facilitating practices are actions by oligopolistic firms

that can contribute to cooperation and collusion even

thought the firms do not formally agree to cooperate.

Cost-plus or mark-up pricing is a pricing policy

whereby a firm computes its average costs of producing

a product and then sets the price at some percentage

above this cost.

Vous aimerez peut-être aussi

- Political and Econimical Analysis of BangladeshDocument6 pagesPolitical and Econimical Analysis of BangladeshKishan PatelPas encore d'évaluation

- Q 1 (B)Document4 pagesQ 1 (B)Kishan PatelPas encore d'évaluation

- Nirmal Jain Stay....Document3 pagesNirmal Jain Stay....Kishan PatelPas encore d'évaluation

- Angel Broking LTD (1) - FinalDocument82 pagesAngel Broking LTD (1) - FinalKishan PatelPas encore d'évaluation

- Puja and TrushnaDocument83 pagesPuja and TrushnaKishan PatelPas encore d'évaluation

- Jit and Lean ProductionDocument13 pagesJit and Lean ProductionKishan PatelPas encore d'évaluation

- 03 LasherIM Ch03Document47 pages03 LasherIM Ch03Maryam Bano100% (5)

- An Analysis of Retailer's Perception Towards Nirma Beauty Soap With Reference To Ahmedabad CityDocument9 pagesAn Analysis of Retailer's Perception Towards Nirma Beauty Soap With Reference To Ahmedabad CityKishan PatelPas encore d'évaluation

- Top Stories Reuters Ians Originals: MoreDocument6 pagesTop Stories Reuters Ians Originals: MoreKishan PatelPas encore d'évaluation

- Is in Global BusinessDocument11 pagesIs in Global BusinessKishan PatelPas encore d'évaluation

- Summer Internship Projects MBA BATCH (2011-13) : Updated On May 29, 2012Document9 pagesSummer Internship Projects MBA BATCH (2011-13) : Updated On May 29, 2012Kishan PatelPas encore d'évaluation

- Answer: Cannot Open DOCX. Files in Microsoft Office 2010 StarterDocument8 pagesAnswer: Cannot Open DOCX. Files in Microsoft Office 2010 StarterKishan PatelPas encore d'évaluation

- Grievance Step LadderDocument23 pagesGrievance Step LadderKishan PatelPas encore d'évaluation

- Nirma 130316080200 Phpapp02Document26 pagesNirma 130316080200 Phpapp02Kishan PatelPas encore d'évaluation

- Nirma Limited: Board of DirectorsDocument80 pagesNirma Limited: Board of DirectorsKishan PatelPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 220245-MSBTE-22412-Java (Unit 1)Document40 pages220245-MSBTE-22412-Java (Unit 1)Nomaan ShaikhPas encore d'évaluation

- 4th Sept - Marathon Series Lecture 8 - General AwarenessDocument208 pages4th Sept - Marathon Series Lecture 8 - General AwarenessManbir ArinPas encore d'évaluation

- Introduction To EthicsDocument18 pagesIntroduction To EthicsMarielle Guerra04Pas encore d'évaluation

- CURRICULUM PharmasubDocument10 pagesCURRICULUM PharmasubZE Mart DanmarkPas encore d'évaluation

- Registration ListDocument5 pagesRegistration ListGnanesh Shetty BharathipuraPas encore d'évaluation

- Borges, The SouthDocument4 pagesBorges, The Southdanielg233100% (1)

- DirectionDocument1 pageDirectionJessica BacaniPas encore d'évaluation

- Nutridiet-Enteral and Parenteral FeedingDocument3 pagesNutridiet-Enteral and Parenteral FeedingBSN 1-N CASTRO, RicciPas encore d'évaluation

- Ultracold Atoms SlidesDocument49 pagesUltracold Atoms SlideslaubbaumPas encore d'évaluation

- Pubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water TunnelsDocument10 pagesPubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water Tunnelsinge ocPas encore d'évaluation

- Galgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesDocument2 pagesGalgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesRohit Singh BhatiPas encore d'évaluation

- Alfa Week 1Document13 pagesAlfa Week 1Cikgu kannaPas encore d'évaluation

- G2 Rust Grades USA PDFDocument2 pagesG2 Rust Grades USA PDFSt3fandragos4306Pas encore d'évaluation

- Wealth and Poverty in The Book of Proverbs PDFDocument133 pagesWealth and Poverty in The Book of Proverbs PDFMaahes Cultural Library100% (1)

- Universal Ultrasonic Generator For Welding: W. Kardy, A. Milewski, P. Kogut and P. KlukDocument3 pagesUniversal Ultrasonic Generator For Welding: W. Kardy, A. Milewski, P. Kogut and P. KlukPhilip EgyPas encore d'évaluation

- 2 Design of DOSAGE DESIGNDocument16 pages2 Design of DOSAGE DESIGNMarjo100% (1)

- Crypto Wall Crypto Snipershot OB Strategy - Day Trade SwingDocument29 pagesCrypto Wall Crypto Snipershot OB Strategy - Day Trade SwingArete JinseiPas encore d'évaluation

- Biotech NewsDocument116 pagesBiotech NewsRahul KapoorPas encore d'évaluation

- Generation III Sonic Feeder Control System Manual 20576Document32 pagesGeneration III Sonic Feeder Control System Manual 20576julianmataPas encore d'évaluation

- The Effect of Co-Op Approach in Improving Visual Motor Integration Skills in Children With Learning DisabilityDocument7 pagesThe Effect of Co-Op Approach in Improving Visual Motor Integration Skills in Children With Learning DisabilityIJAR JOURNALPas encore d'évaluation

- Universitas Tidar: Fakultas Keguruan Dan Ilmu PendidikanDocument7 pagesUniversitas Tidar: Fakultas Keguruan Dan Ilmu PendidikanTheresia Calcutaa WilPas encore d'évaluation

- DIR-819 A1 Manual v1.02WW PDFDocument172 pagesDIR-819 A1 Manual v1.02WW PDFSerginho Jaafa ReggaePas encore d'évaluation

- Based On PSA 700 Revised - The Independent Auditor's Report On A Complete Set of General Purpose Financial StatementsDocument12 pagesBased On PSA 700 Revised - The Independent Auditor's Report On A Complete Set of General Purpose Financial Statementsbobo kaPas encore d'évaluation

- CH-5 Further Percentages AnswersDocument5 pagesCH-5 Further Percentages AnswersMaram MohanPas encore d'évaluation

- IM1 Calculus 2 Revised 2024 PUPSMBDocument14 pagesIM1 Calculus 2 Revised 2024 PUPSMBEunice AlonzoPas encore d'évaluation

- Tuma Research ManualDocument57 pagesTuma Research ManualKashinde Learner Centered Mandari100% (1)

- Test Physics Chapter# 12,13,14 (2 Year) NameDocument1 pageTest Physics Chapter# 12,13,14 (2 Year) NameStay FocusedPas encore d'évaluation

- Department of Education: Template No. 1 Teacher'S Report On The Results of The Regional Mid-Year AssessmentDocument3 pagesDepartment of Education: Template No. 1 Teacher'S Report On The Results of The Regional Mid-Year Assessmentkathrine cadalsoPas encore d'évaluation

- De Thi Hoc Ki 1 Lop 11 Mon Tieng Anh Co File Nghe Nam 2020Document11 pagesDe Thi Hoc Ki 1 Lop 11 Mon Tieng Anh Co File Nghe Nam 2020HiềnPas encore d'évaluation

- Maya Deren PaperDocument9 pagesMaya Deren PaperquietinstrumentalsPas encore d'évaluation