Académique Documents

Professionnel Documents

Culture Documents

Techniques of Budgeting

Transféré par

Pooja RanaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Techniques of Budgeting

Transféré par

Pooja RanaDroits d'auteur :

Formats disponibles

1

Capital-Budgeting

Techniques

Chapter 9

2

Capital Budgeting Concepts

Capital Budgeting involves evaluation of (and

decision about) projects. Which projects should be

accepted? Here, our goal is to accept a project

which maximizes the shareholder wealth. Benefits

are worth more than the cost.

The Capital Budgeting is based on forecasting.

Estimate future expected cash flows.

Evaluate project based on the evaluation method.

Classification of Projects

Mutually Exclusive - accept ONE project only

Independent - accept ALL profitable projects.

3

Capital Budgeting Concepts

Initial Cash Outlay - amount of capital spent to get

project going.

Cash Flows

4

Capital Budgeting Concepts

Initial Cash Outlay - amount of capital spent to get

project going.

If spend $10 million to build new plant then the Initial

Outlay (IO) = $10 million

Cash Flows

CF

0

= Cash Flow time 0 = -10 million

5

Capital Budgeting Concepts

Initial Cash Outlay - amount of capital spent to get

project going.

If spend $10 million to build new plant then the Initial

Outlay (IO) = $10 million

Cash Flows

CF

n

= Sales - Costs

Annual Cash Inflows--after-tax CF

Cash inflows from the project

CF

0

= Cash Flow time 0 = -10 million

We will determine

these in Chapter 10

6

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

7

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

8

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

0 1 2 3 4

3,500 3,500 3,500 3,500 (10,000)

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

9

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

0 1 2 3 4

3,500

-6,500

3,500 3,500 3,500 (10,000)

Cumulative CF

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

10

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

0 1 2 3 4

3,500

-6,500

3,500

-3,000

3,500 3,500 (10,000)

Cumulative CF

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

11

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

0 1 2 3 4

3,500

-6,500

3,500

-3,000

3,500

+500

3,500 (10,000)

Cumulative CF

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

12

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

0 1 2 3 4

3,500

-6,500

3,500

-3,000

3,500

+500

3,500 (10,000)

Payback 2.86 years

Cumulative CF

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

13

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

14

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

0 1 2 3 4

500 500 4,600 10,000 (10,000)

15

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

0 1 2 3 4

500

-9,500

500 4,600 10,000 (10,000)

Cumulative CF

16

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

0 1 2 3 4

500

-9,500

500

-9,000

4,600 10,000 (10,000)

Cumulative CF

17

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

0 1 2 3 4

500

-9,500

500

-9,000

4,600

-4,400

10,000 (10,000)

Cumulative CF

18

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

0 1 2 3 4

500

-9,500

500

-9,000

4,600

-4,400

10,000

+5,600

(10,000)

Cumulative CF

19

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

0 1 2 3 4

500

-9,500

500

-9,000

4,600

-4,400

10,000

+5,600

(10,000)

Payback = 3.44 years

Cumulative CF

20

Capital Budgeting Methods

Number of years needed to recover your initial

outlay.

Payback Period

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

0 1 2 3 4

500

-9,500

500

-9,000

4,600

-4,400

10,000

+5,600

(10,000)

Payback 3.44 years

Cumulative CF

Evaluation:

Company sets maximum

acceptable payback. If

Max PB = 3 years,

accept project A and

reject project C

21

Payback Method

The payback method is not a good method as it does

not consider the time value of money.

Which project should you choose?

CF0 CF1 CF2 CF3

A -100,000 90,000 9,000 1,000

B -100,000 1,000 9,000 90,000

22

Payback Method

The Discounted payback method can correct this

shortcoming of the payback method.

To find the discounted pay back

(1) Find the PV of each cash flow on the time line.

(2) Find the payback using the discounted CF and

NOT the CF.

Example In Table 9-2

23

Payback Method

Also, the payback method is not a good method as it

does not consider the cash flows beyond the payback

period.

24

Payback Method

Also, the payback method is not a good method as

it does not consider the cash flows beyond the

payback period.

Which project should you choose?

CF0 CF1 CF2 Cf3 CF4

A -100000 90000 10000 0 0

B -100000 90000 9000 80000 1000000

25

Payback Method

Also, the payback method is not a good method as it does

not consider the cash flows beyond the payback period.

Which project should you choose?

CF0 CF1 CF2 Cf3 CF4

A -100,000 90,000 10,000 0 0

B -100,000 90,000 9,000 80,000 100,0000

These two shortcomings often result in an incorrect decisions.

26

Capital Budgeting Methods

Methods that consider time value of money and all

cash flows

Net Present Value:

Present Value of all costs and benefits of a project.

27

Capital Budgeting Methods

Present Value of all costs and benefits of a project.

Concept is similar to Intrinsic Value of a security but

subtracts cost of the project.

Net Present Value

NPV = PV of Inflows - Initial Outlay

28

Capital Budgeting Methods

Present Value of all costs and benefits of a project.

Concept is similar to Intrinsic Value of a security but

subtracts of cost of project.

Net Present Value

NPV = PV of Inflows - Initial Outlay

NPV

= + + ++ IO

CF

1

(1+ k

)

CF

2

(1+ k

)

2

CF

3

(1+ k

)

3

CF

n

(1+ k

)

n

29

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

k=10%

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

30

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

455

k=10%

$500

(1.10)

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

31

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

455

413

k=10%

$500

(1.10)

2

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

32

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

455

413

3,456

k=10%

$4,600

(1.10)

3

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

33

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

455

6,830

413

3,456

k=10%

$10,000

(1.10)

4

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

34

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

455

$11,154

6,830

413

3,456

k=10%

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

35

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

455

6,830

413

3,456

k=10%

PV Benefits > PV Costs

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

$11,154 > $ 10,000

$11,154

36

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

500 500 4,600 10,000 (10,000)

455

6,830

413

3,456

k=10%

PV Benefits > PV Costs

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

$11,154 > $ 10,000

NPV > $0

$1,154 > $0

$11,154

$1,154 = NPV

37

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

3,500 (10,000)

k=10%

3,500 3,500 3,500

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

38

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

3,500 (10,000)

k=10%

3,500 3,500 3,500

NPV

= + + + 10,000

3,500

(1+ .1

)

3,500

(1+ .1)

2

3,500

(1+ .1

)

3

3,500

(1+ .1

)

4

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

39

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

3,500 (10,000)

k=10%

3,500 3,500 3,500

NPV

= + + + 10,000

3,500

(1+ .1

)

3,500

(1+ .1)

2

3,500

(1+ .1

)

3

3,500

(1+ .1

)

4

PV of 3,500 Annuity for 4 years at 10%

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

40

Capital Budgeting Methods

Net Present Value

0 1 2 3 4

3,500 (10,000)

k=10%

3,500 3,500 3,500

NPV

= + + + 10,000

3,500

(1+ .1

)

3,500

(1+ .1)

2

3,500

(1+ .1

)

3

3,500

(1+ .1

)

4

= 3,500 x PVIFA

4,.10

- 10,000

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

= 11,095 10,000 = $1,095

41

Capital Budgeting Methods

If projects are independent then

accept all projects with NPV 0.

NPV Decision Rules

ACCEPT A & B

42

Capital Budgeting Methods

If projects are independent then

accept all projects with NPV 0.

If projects are mutually exclusive,

accept projects with higher NPV.

NPV Decision Rules

ACCEPT A & B

ACCEPT B only

43

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

NPV(0%)

= + + + 10,000

3,500

(1+ 0

)

3,500

(1+ 0)

2

3,500

(1+ 0

)

3

3,500

(1+ 0)

4

= $4,000

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

44

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

NPV(5%)

= + + + 10,000

3,500

(1+ .05

)

3,500

(1+ .05)

2

3,500

(1+ .05

)

3

3,500

(1+ .05)

4

= $2,411

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

45

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

NPV(10%)

= + + + 10,000

3,500

(1+ .10

)

3,500

(1+ .10)

2

3,500

(1+ .10

)

3

3,500

(1+ .10)

4

= $1,095

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

46

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

NPV(15%)

= + + + 10,000

3,500

(1+ .15

)

3,500

(1+ .15)

2

3,500

(1+ .15

)

3

3,500

(1+ .15)

4

= $7.58

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

47

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

NPV(20%)

= + + + 10,000

3,500

(1+ .20

)

3,500

(1+ .20)

2

3,500

(1+ .20

)

3

3,500

(1+ .20)

4

= $939

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

48

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

Connect the Points

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

49

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

NPV(0%)

= + + + 10,000

500

(1+ 0

)

500

(1+ 0)

2

4,600

(1+ 0

)

3

10,000

(1+ 0)

4

= $5,600

50

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

NPV(5%)

= + + + 10,000

500

(1+.05)

500

(1+.05)

2

4,600

(1+ .05)

3

10,000

(1+ .05)

4

= $3,130

51

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

NPV(10%)

= + + + 10,000

500

(1+.10)

500

(1+.10)

2

4,600

(1+ .10)

3

10,000

(1+ .10)

4

= $1.154

52

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

NPV(15%)

= + + + 10,000

500

(1+.15)

500

(1+.15)

2

4,600

(1+ .15)

3

10,000

(1+ .15)

4

= $445

53

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

Connect the Points

54

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

Net Present Value Profile

Graphs the Net Present Value of the project with

different required rates

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

55

Net Present Value Profile

Compare NPV of the two projects for different

required rates

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

Crossover point

Project A

56

Net Present Value Profile

Compare NPV of the two projects for different

required rates

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

Crossover point

Project A

For any discount rate <

crossover point choose B

57

Net Present Value Profile

Compare NPV of the two projects for different

required rates

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

Crossover point

For any discount rate >

crossover point choose A

Project A

For any discount rate <

crossover point choose B

58

Capital Budgeting Methods

Internal Rate of Return

Measures the rate of return that will make the PV of

future CF equal to the initial outlay.

Definition:

The IRR is that discount rate at which

NPV = 0

IRR is like the YTM. It is the same cocept but

the term YTM is used only for bonds.

59

Capital Budgeting Methods

Internal Rate of Return

Measures the rate of return that will make the PV of

future CF equal to the initial outlay.

The IRR is the discount rate at which NPV = 0

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

NPV = $0

60

Capital Budgeting Methods

Internal Rate of Return

Measures the rate of return that will make the PV of

future CF equal to the initial outlay.

Or, the IRR is the discount rate at which NPV = 0

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

NPV = $0

IRR

A

15%

IRR

B

14%

61

Capital Budgeting Methods

Internal Rate of Return

Determine the mathematical solution for IRR

62

Capital Budgeting Methods

Internal Rate of Return

Determine the mathematical solution for IRR

0 = NPV

= + ++ IO

CF

1

(1+ IRR

)

CF

2

(1+ IRR

)

2

CF

n

(1+ IRR

)

n

63

Capital Budgeting Methods

Internal Rate of Return

Determine the mathematical solution for IRR

0 = NPV

= + ++ IO

CF

1

(1+ IRR

)

CF

2

(1+ IRR

)

2

CF

n

(1+ IRR

)

n

IO

= + ++

CF

1

(1+ IRR

)

CF

2

(1+ IRR

)

2

CF

n

(1+ IRR

)

n

Outflow = PV of Inflows

64

Capital Budgeting Methods

Internal Rate of Return

Determine the mathematical solution for IRR

0 = NPV

= + ++ IO

CF

1

(1+ IRR

)

CF

2

(1+ IRR

)

2

CF

n

(1+ IRR

)

n

IO

= + ++

CF

1

(1+ IRR

)

CF

2

(1+ IRR

)

2

CF

n

(1+ IRR

)

n

Outflow = PV of Inflows

Solve for Discount Rates

65

Capital Budgeting Methods

Internal Rate of Return

For Project B

Cannot solve for IRR

directly, must use Trial &

Error

10,000 = + + +

500

(1+ IRR

)

500

(1+ IRR

)

2

10,000

(1+ IRR

)

4

4,600

(1+ IRR

)

3

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

IRR

B

14%

66

Capital Budgeting Methods

Internal Rate of Return

For Project B

Cannot solve for IRR

directly, must use Trial &

Error

10,000 = + + +

500

(1+ IRR

)

500

(1+ IRR

)

2

10,000

(1+ IRR

)

4

4,600

(1+ IRR

)

3

TRY 14%

10,000 = + + +

500

(1+ .14

)

500

(1+ .14)

2

10,000

(1+ .14

)

4

4,600

(1+ .14

)

3

?

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

IRR

B

14%

67

Capital Budgeting Methods

Internal Rate of Return

For Project B

Cannot solve for IRR

directly, must use Trial &

Error

10,000 = + + +

500

(1+ IRR

)

500

(1+ IRR

)

2

10,000

(1+ IRR

)

4

4,600

(1+ IRR

)

3

TRY 14%

10,000 = + + +

500

(1+ .14

)

500

(1+ .14)

2

10,000

(1+ .14

)

4

4,600

(1+ .14

)

3

?

10,000 = 9,849

?

PV of Inflows too low, try lower rate

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

IRR

B

14%

68

Capital Budgeting Methods

Internal Rate of Return

For Project B

Cannot solve for IRR

directly, must use Trial &

Error

10,000 = + + +

500

(1+ IRR

)

500

(1+ IRR

)

2

10,000

(1+ IRR

)

4

4,600

(1+ IRR

)

3

TRY 13%

10,000 = + + +

500

(1+ .13

)

500

(1+ .13)

2

10,000

(1+ .13

)

4

4,600

(1+ .13

)

3

?

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

IRR

B

14%

69

Capital Budgeting Methods

Internal Rate of Return

For Project B

Cannot solve for IRR

directly, must use Trial &

Error

10,000 = + + +

500

(1+ IRR

)

500

(1+ IRR

)

2

10,000

(1+ IRR

)

4

4,600

(1+ IRR

)

3

TRY 13%

10,000 = + + +

500

(1+ .13

)

500

(1+ .13)

2

10,000

(1+ .13

)

4

4,600

(1+ .13

)

3

?

10,000 = 10,155

?

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

IRR

B

14%

70

Capital Budgeting Methods

Internal Rate of Return

For Project B

Cannot solve for IRR

directly, must use Trial &

Error

10,000 = + + +

500

(1+ IRR

)

500

(1+ IRR

)

2

10,000

(1+ IRR

)

4

4,600

(1+ IRR

)

3

TRY 13%

10,000 = + + +

500

(1+ .13

)

500

(1+ .13)

2

10,000

(1+ .13

)

4

4,600

(1+ .13

)

3

?

10,000 = 10,155

?

13% < IRR < 14%

10% 5%

0

Cost of Capital

N

P

V

6,000

3,000

20% 15%

Project B

IRR

B

14%

71

Capital Budgeting Methods

Decision Rule for Internal Rate of Return

Independent Projects

Accept Projects with

IRR required rate

Mutually Exclusive Projects

Accept project with highest

IRR required rate

72

Capital Budgeting Methods

Profitability Index

PI =

PV of Inflows

Initial Outlay

Very Similar to Net Present Value

73

Capital Budgeting Methods

Profitability Index

PI =

PV of Inflows

Initial Outlay

Very Similar to Net Present Value

Instead of Subtracting the Initial Outlay from the PV

of Inflows, the Profitability Index is the ratio of Initial

Outlay to the PV of Inflows.

74

Capital Budgeting Methods

Profitability Index

PI =

PV of Inflows

Initial Outlay

Very Similar to Net Present Value

Instead of Subtracting the Initial Outlay from the PV

of Inflows, the Profitability Index is the ratio of Initial

Outlay to the PV of Inflows.

+ + ++

CF

1

(1+ k

)

CF

2

(1+ k

)

2

CF

3

(1+ k

)

3

CF

n

(1+ k

)

n

PI =

IO

75

Capital Budgeting Methods

Profitability Index for Project B

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

+ + +

500

(1+ .1

)

500

(1+ .1)

2

4,600

(1+ .1

)

3

10,000

(1+ .1

)

4

10,000

PI =

76

Capital Budgeting Methods

Profitability Index for Project B

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

+ + +

500

(1+ .1

)

500

(1+ .1)

2

4,600

(1+ .1

)

3

10,000

(1+ .1

)

4

10,000

PI =

PI =

11,154

10,000

= 1.1154

77

Capital Budgeting Methods

Profitability Index for Project B

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

+ + +

500

(1+ .1

)

500

(1+ .1)

2

4,600

(1+ .1

)

3

10,000

(1+ .1

)

4

10,000

PI =

PI =

11,154

10,000

= 1.1154

Profitability Index for Project A

10,000

PI =

3,500 x PVIFA

4, .10

78

Capital Budgeting Methods

Profitability Index for Project B

P R O J E C T

Time A B

0 (10,000.) (10,000.)

1 3,500 500

2 3,500 500

3 3,500 4,600

4 3,500 10,000

+ + +

500

(1+ .1

)

500

(1+ .1)

2

4,600

(1+ .1

)

3

10,000

(1+ .1

)

4

10,000

PI =

PI =

11,154

10,000

= 1.1154

Profitability Index for Project A

10,000

PI =

PI =

11,095

10,000

= 1.1095

3,500( )

1

.10(1+.10)

4

1

.10

79

Capital Budgeting Methods

Profitability Index Decision Rules

Independent Projects

Accept Project if PI 1

Mutually Exclusive Projects

Accept Highest PI 1 Project

80

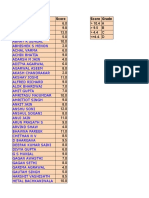

Comparison of Methods

Project A Project B Choose

Payback < 3 years < 4 years A

NPV $1,095 $1,154 B

IRR 14.96% 13.50% A

PI 1.1095 1.1154 B

81

Comparison of Methods

Time Value of Money

Payback - Does not adjust for timing differences

(ignore Discounted Payback)

NPV, IRR and PI take into account the time value of

money

82

Comparison of Methods

Time Value of Money

Payback - Does not adjust for timing differences

NPV, IRR and PI take into account the time value of

money

Relevant Cash Flows?

NPV, IRR and PI use all Cash Flows

Payback method ignores Cash Flows that occur

after the Payback Period.

83

Comparison of Methods

Time Value of Money

Payback - Does not adjust for timing differences

NPV, IRR and PI take into account the time value of

money

Relevant Cash Flows?

NPV, IRR and PI use all Cash Flows

Payback method ignores Cash Flows that occur

after the Payback Period.

0 1 2

5,000 5,000 (10,000)

Project 1

84

Comparison of Methods

Time Value of Money

Payback - Does not adjust for timing differences

NPV, IRR and PI take into account the time value of

money

Relevant Cash Flows?

NPV, IRR and PI use all Cash Flows

Payback method ignores Cash Flows that occur

after the Payback Period.

0 1 2

5,000 5,000 (10,000)

Project 1

0 1 2 3

5,000 5,000 (10,000)

Project 2

10,000

Both Projects have

Identical Payback

85

Comparison of Methods

NPV & PI indicated accept Project B while IRR indicated that

Project A should be accepted. Why?

Sometimes there is a conflict between the decisions based on

NPV and IRR methods.

The conflict arises if there is difference in the timing of CFs or

sizes of the projects (or both).

The cause of the conflict is the underlying reinvestment rate

assumption.

Reinvestment Rate Assumptions

NPV assumes cash flows are reinvested at the required

rate, k.

IRR assumes cash flows are reinvested at IRR.

Reinvestment Rate of k more realistic as most projects earn

approximately k (due to competition)

NPV is the Better Method for project evaluation

86

IRR

Because of its unreasonable reinvestment rate assumption, IRR

method can result in bad decisions.

Another problem with IRR is that if the sign of the cash flow

changes more than once, there is a possibility of multiple IRR.

See p 340.

The problem of unreasonable assumption can be addressed by

using Modified IRR

87

MIRR

To find MIRR

1.Find the FV of all intermediate CFs using the cost of

capital (the hurdle rate) as the interest rate.

2.Add all FV.

3. Find that discount rate which makes the PV of the

FV equal to the PV of outflows.

Drop MIRR computations.

88

Vous aimerez peut-être aussi

- Capital Structure TheoriesDocument31 pagesCapital Structure TheoriesShashank100% (1)

- Presentation On Capital GainsDocument12 pagesPresentation On Capital GainsSheemaShaheenPas encore d'évaluation

- Capital Structure TheoriesDocument31 pagesCapital Structure TheoriesShashank100% (1)

- Project Risk MGMTDocument22 pagesProject Risk MGMTPooja RanaPas encore d'évaluation

- Project Risk MGMTDocument22 pagesProject Risk MGMTPooja RanaPas encore d'évaluation

- Chapter 5 - Cost of Capital SML 401 BtechDocument52 pagesChapter 5 - Cost of Capital SML 401 BtechfikePas encore d'évaluation

- Income From House Property KarthikDocument45 pagesIncome From House Property KarthikPooja RanaPas encore d'évaluation

- Managing Performance with Balanced ScorecardDocument25 pagesManaging Performance with Balanced ScorecardPooja RanaPas encore d'évaluation

- Imt CDLDocument56 pagesImt CDLPooja Rana50% (4)

- Political Environment of Business: Presented by Aun AhmedDocument18 pagesPolitical Environment of Business: Presented by Aun AhmedMdheer09Pas encore d'évaluation

- ITSM software implementation improves YUBC Internet serviceDocument32 pagesITSM software implementation improves YUBC Internet servicePooja RanaPas encore d'évaluation

- ITSM software implementation improves YUBC Internet serviceDocument32 pagesITSM software implementation improves YUBC Internet servicePooja RanaPas encore d'évaluation

- BR 3Document39 pagesBR 3Akhil VashishthaPas encore d'évaluation

- Event MGTDocument20 pagesEvent MGTPooja RanaPas encore d'évaluation

- ITSM software implementation improves YUBC Internet serviceDocument32 pagesITSM software implementation improves YUBC Internet servicePooja RanaPas encore d'évaluation

- PDFDocument3 pagesPDFPooja RanaPas encore d'évaluation

- Bo RDocument15 pagesBo RPooja RanaPas encore d'évaluation

- Global SCM OverviewDocument8 pagesGlobal SCM OverviewPooja RanaPas encore d'évaluation

- Talent ManagementDocument33 pagesTalent ManagementPooja Rana100% (3)

- Imt LawDocument42 pagesImt LawPooja RanaPas encore d'évaluation

- LawDocument19 pagesLawPooja RanaPas encore d'évaluation

- Application For The Post of - at Media Lab Asia, Delhi Position CodeDocument3 pagesApplication For The Post of - at Media Lab Asia, Delhi Position CodePooja RanaPas encore d'évaluation

- Oltp VS OlapDocument9 pagesOltp VS OlapSikkandar Sha100% (1)

- Contemporary Theories of MotivationDocument17 pagesContemporary Theories of MotivationArsalan SattiPas encore d'évaluation

- StatsDocument5 pagesStatsPooja RanaPas encore d'évaluation

- HRM Cross-Border M&A GuideDocument14 pagesHRM Cross-Border M&A GuidePooja RanaPas encore d'évaluation

- Groupware Technology (Sameer)Document15 pagesGroupware Technology (Sameer)DIPAK VINAYAK SHIRBHATEPas encore d'évaluation

- ReserchDocument14 pagesReserchPooja RanaPas encore d'évaluation

- Architecture of DSS, GDSS & ESSDocument28 pagesArchitecture of DSS, GDSS & ESSPooja Rana50% (2)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Kelayakan Usaha Pembuatan Rak Telur DI KABUPATEN SIDRAP (Studi Kasus UD Manuntung Raya)Document8 pagesKelayakan Usaha Pembuatan Rak Telur DI KABUPATEN SIDRAP (Studi Kasus UD Manuntung Raya)Clarissa RestuPas encore d'évaluation

- Capital Budgeting - IIDocument16 pagesCapital Budgeting - IIVaibhav Pratap Singh BhadouriaPas encore d'évaluation

- Prospek Pengelolaan Hutan Berbasis Masyarakat Pada Taman Nasional Sebangau Melalui Usaha Pengembangan Tanaman Jelutung (Dyera Lowii)Document14 pagesProspek Pengelolaan Hutan Berbasis Masyarakat Pada Taman Nasional Sebangau Melalui Usaha Pengembangan Tanaman Jelutung (Dyera Lowii)abul_haitsam9764Pas encore d'évaluation

- Capital Budgeting Techniques PDFDocument57 pagesCapital Budgeting Techniques PDFraj100% (1)

- Question 1Document6 pagesQuestion 1Ibrahim SameerPas encore d'évaluation

- 09 Capital Budgeting KEY PDFDocument24 pages09 Capital Budgeting KEY PDFRianna MangabatPas encore d'évaluation

- Nep 2015 Volume 1Document320 pagesNep 2015 Volume 1Stacy Lyn LiongPas encore d'évaluation

- FM12 CH 11 Test Bank Capital BudgetDocument14 pagesFM12 CH 11 Test Bank Capital BudgetOssama FatehyPas encore d'évaluation

- Topic 2 Capital Budgeting PDFDocument65 pagesTopic 2 Capital Budgeting PDFKobe TannerPas encore d'évaluation

- Richa Food Case EditedDocument3 pagesRicha Food Case Editedvishal nigamPas encore d'évaluation

- Handout - Investment Decision RulesDocument64 pagesHandout - Investment Decision RulesKaDi VadiPas encore d'évaluation

- CorelDRAW Graphics Suite X7Document24 pagesCorelDRAW Graphics Suite X7Bitan GhoshPas encore d'évaluation

- 3Document4 pages3Deysy ReyesPas encore d'évaluation

- Capital RationingDocument24 pagesCapital RationingNeelesh GaneshPas encore d'évaluation

- GR 12 - Rbcpb-CoDocument8 pagesGR 12 - Rbcpb-CoDan MarkPas encore d'évaluation

- Analisis Kelayakan Investasi Pit 2 Nambalau Tambang BatukapurDocument7 pagesAnalisis Kelayakan Investasi Pit 2 Nambalau Tambang BatukapurSitiHasnaFathimahPas encore d'évaluation

- Build A Model Chapter 12Document9 pagesBuild A Model Chapter 12PaolaPas encore d'évaluation

- 4 Capital Budgeting PDFDocument45 pages4 Capital Budgeting PDFmichael christianPas encore d'évaluation

- Some Practice Question in Capital BudgetingDocument3 pagesSome Practice Question in Capital BudgetingSHanimPas encore d'évaluation

- Gardial Fisheries investment analysisDocument6 pagesGardial Fisheries investment analysisLydia Perez100% (2)

- LEMBAR JAWABAN CH.10 (Capital Budgeting Techniques)Document4 pagesLEMBAR JAWABAN CH.10 (Capital Budgeting Techniques)Cindy PPas encore d'évaluation

- BFDP Monitoring FormsDocument7 pagesBFDP Monitoring FormsBarangay TaguiticPas encore d'évaluation

- 1 - Capital BudgetigDocument27 pages1 - Capital BudgetigSaYeD SeeDooPas encore d'évaluation

- Ch10 Tool KitDocument30 pagesCh10 Tool KitRimpy Sondh100% (1)

- NPV and IrrDocument7 pagesNPV and IrrSakshi SharmaPas encore d'évaluation

- Capital Budgeting Problem NPV Vs IRR Easy Case PDFDocument4 pagesCapital Budgeting Problem NPV Vs IRR Easy Case PDFHassanSheikh50% (4)

- Capital BudgetingDocument8 pagesCapital Budgetingneesha0% (1)

- Calculate payback period and acceptability of investment projectsDocument58 pagesCalculate payback period and acceptability of investment projectsVibhuti AnandPas encore d'évaluation

- pp13Document65 pagespp13Tejashree NirgudePas encore d'évaluation

- A) Project ADocument9 pagesA) Project AАнастасия ОсипкинаPas encore d'évaluation