Académique Documents

Professionnel Documents

Culture Documents

Manacc-Cost MGT & Activity Based Costing

Transféré par

Daniel John Cañares LegaspiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Manacc-Cost MGT & Activity Based Costing

Transféré par

Daniel John Cañares LegaspiDroits d'auteur :

Formats disponibles

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 1

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 1

Cost Management System

A cost management system (CMS) is

a collection of tools and techniques

that identifies how managements

decisions affect costs.

Learning

Objective 1

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 2

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 2

Cost Management System

The primary purposes of a cost

management system are to provide...

cost information for strategic

management decisions,

cost information for

operational control, and

measure of inventory value and cost

of goods sold for financial reporting.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 3

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 3

Cost Accounting Systems

Cost accounting is that part of the cost

management system that measures

costs for the purposes of management

decision making and financial reporting.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 4

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 4

Cost Accounting System

Cost

accumulation:

Collecting costs by some

natural classification

such as materials or labor

Cost

assignment:

Tracing costs to one or

more cost objectives

Learning

Objective 2

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 5

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 5

Cost Accounting System

Cost

accumulation

Cost assignment

to cost objects

Cabinets

Desks

Tables

Material costs

(metals)

Finishing Department

Activity Activity

Activity Activity

Cabinets

Desks

Tables

Machining Department

Activity Activity

Activity Activity

1. Departments

2. Activities

3. Products

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 6

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 6

Cost

A cost is a sacrifice or giving up of

resources for a particular purpose.

Costs are frequently measured by

the monetary units that must be

paid for goods and services.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 7

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 7

Cost Object

A cost object (objective) is anything for which

A separate measurement of costs is desired.

Customers

Departments

Processing orders

Product

Service

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 8

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 8

Direct, Indirect, and Unallocated Costs

Direct costs can be identified specifically and exclusively

with a given cost objective in an economically feasible way.

Learning

Objective 3

Indirect costs cannot be identified specifically and exclusively

With a given cost objective in an economically feasible way.

Unallocated costs are recorded but

not assigned to any cost object.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 9

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 9

Cost Allocation

Cost allocation is used to assign indirect costs to cost objects, in proportion

to the cost objects use of a particular cost-allocation base.

A cost-allocation base is some measure of input or output that

determines the amount of cost to be allocated to a particular cost object.

An ideal cost-allocation base would measure how much

of the particular cost is caused by the cost objective.

Note the similarity of this definition to that of a cost driveran output

measure that causes costs. Therefore, most allocation bases are cost drivers.

Learning

Objective 4

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 10

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 10

Cost Allocation

Cost allocations support a companys CMSthe system

providing cost measurements for strategic decision making,

operational control, and external reporting.

Four purposes of cost allocation:

Predict the economic effects of strategic and operational control decisions.

Provide desired motivation and to give feedback for performance evaluation.

Compute income and asset valuations for financial reporting.

Justify costs or obtain reimbursement.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 11

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 11

Cost Pool

A cost pool is a group of individual costs that a company

allocates to cost objects using a single cost-allocation base.

1. Accumulate indirect costs for a period of time.

2. Select an allocation base for each cost pool, preferably a cost driver,

that is, a measure that causes the costs in the cost pool.

3. Measure the units of the cost-allocation base used for each cost

object and compute the total units used for all cost objects.

4. Determine the percentage of total cost-allocation base units

used for each cost object.

5. Multiply the percentage by the total costs in the cost pool to

determine the cost allocated to each cost object.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 12

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 12

Cost Allocation

Direct costs are physically traced to a cost object.

Indirect costs are allocated using a cost-allocation base.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 13

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 13

Direct, Indirect, and Unallocated Costs

Li Companys Statement of Operating Income

Statement of Operating Income

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 14

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 14

Direct Material Costs

Direct materials include the acquisition costs

of all materials that a company identifies

as a part of the manufactured goods.

These costs are identified in

an economically feasible way.

Learning

Objective 5

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 15

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 15

Direct Labor Costs

Direct Labor costs include the

wages of all labor that can be

traced specifically and exclusively

to the manufactured goods in an

economically feasible way.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 16

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 16

Indirect Production Costs (Manufacturing Overhead)

Manufacturing overhead includes all costs

associated with the production process

that the company cannot be traced to

the manufactured goods in an

economically feasible way.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 17

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 17

Product Costs

Product costs are costs identified with goods

produced or purchased for resale.

These costs first become part of the inventory

on hand, sometimes called inventoriable costs.

Inventoriable costs become expenses in the form of

cost of goods sold only when the inventory is sold.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 18

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 18

Period Costs

Period costs are deducted as expenses

during the current period without

going through an inventory stage.

1 2 3

4 5 6 7 8 9 10

11 12 13 14 15 16 17

18 19 20 21 22 23 24

25 26 28 29 30 31 27

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 19

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 19

Merchandising Company

(Retailer or Wholesaler)

Merchandise

Purchases

Merchandise

Inventory

Sales

Minus

Cost of

Goods Sold

(Expenses)

Selling Expenses and

Administrative

Expenses

Period

Costs

Equals Gross Margin

Minus

Equals Operating

Income

Product

(Inventoriable)

Costs

Expiration

Financial Statement Presentation

Merchandising Companies

Learning

Objective 6

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 20

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 20

Manufacturing Company

Direct

Material

Purchases

Finished

Goods

Inventory

Sales

Minus

Cost of

Goods Sold

(Expenses)

Selling Expenses and

Administrative

Expenses

Period

Costs

Equals Gross Margin

Minus

Equals Operating

Income

Product

(Inventoriable)

Costs

Expiration

Financial Statement Presentation

Manufacturing Companies

Work-in-

Process

Inventory

Direct

Material

Inventory

Direct Labor

Indirect

Manufacturing

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 21

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 21

Current Asset Sections

of Balance Sheets

Cash $ 4,000

Receivables 25,000

Subtotal $29,000

Finished goods 32,000

Work in process 22,000

Direct material 23,000

Total inventories $77,000

Other current assets 1,000

Total current assets $107,000

Manufacturer

Cash $ 4,000

Receivables 25,000

Merchandise inventories 77,000

Other current assets 1,000

Total current assets $107,000

Retailer or Wholesaler

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 22

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 22

Income Statement Presentation

of Costs for a Manufacturer

Direct labor

Indirect manufacturing

The manufacturers cost of goods produced

and then sold is usually composed of

the three major categories of cost:

Direct materials

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 23

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 23

Income Statement Presentation

of Costs for a Retailer

The merchandisers cost of goods sold

is usually composed of the purchase

cost of items, including freight-in,

that are acquired and then resold.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 24

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 24

Traditional Costing System

Learning

Objective 7

Direct

Materials

For Pen

Casings

$22,500

Direct

Labor

For Pen

Casings

$135,000

Direct

Materials For

Cell

Phone

Casings

$12,000

Direct

Labor For

Cell Phone

Casings

$15,000

Sales $360,000 Sales $80,000 Unallocated $00,000

All

Indirect

Resources

$220,000

All Unallocated

Value Chain

Costs

$100,000

Cost Driver

[Direct Labor

Hours]

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 25

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 25

Traditional Costing System

Statement of Operating Income

Traditional Cost Allocation System

Pen

Casings

Cell Phone

Casings

Sales $440,000 $360,000 $80,000

Direct materials 34,500 22,500 12,000

Direct labor 150,000 135,000 15,000

Indirect manufacturing 220,000 198,000 22,000

Gross profit $ 35,500 $ 4,500 $31,000

Corporate expenses 100,000

Operating loss ($ 64,500)

Gross profit margin 8.07% 1.25% 38.75%

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 26

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 26

ABC System

Direct

Materials

For Pen

Casings

$22,500

Direct

Labor

For Pen

Casings

$135,000

Direct

Materials For

Cell

Phone

Casings

$12,000

Direct

Labor For

Cell Phone

Casings

$15,000

Sales $360,000 Sales $80,000 Unallocated $00,000

Plant and

Machinery

$180,000

All Unallocated

Value Chain Costs

$100,000

Cost Driver

[Direct Labor Hours]

Cost Driver

[Distinct Parts]

Engineers and

CAD Equipment

$40,000

Processing

Activity

$135,000

+ 8,000

$143,000

Production Support

Activity

$45,000

+32,000

$77,000

75% 25%

20% 80%

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 27

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 27

Activity-Based Cost Allocation System

Sales $440,000 $360,000 $80,000

Direct materials 34,500 22,500 12,000

Direct labor 150,000 135,000 15,000

Processing activity 143,000 128,700 14,300

Production support activity 77,000 15,400 61,600

Gross profit $ 35,500 $ 58,400 ($22,900)

Corporate expenses 100,000

Operating loss ($ 64,500)

Gross profit margin 8.07% 16.22% (28.63%)

External

Reporting

Internal Purposes

Pen

Casings

Cell

Phone

Casings

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 28

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 28

ABM is using the output of an activity-based

cost accounting system to aid strategic decision

making and to improve operational control.

Activity-Based Management

A value-added cost is the cost of an activity

that cannot be eliminated without affecting

a products value to the customer.

In contrast, nonvalue-added costs are costs

that can be eliminated without affecting

a products value to the customer.

Learning

Objective 8

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 29

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 29

Activity-Based Management

Benchmarking is the continuous process of

comparing products, services, and activities

to the best industry standards.

Benchmarking is a tool to help an organization measure

its competitive posture. Benchmarks can come from

within the organization, from competing organizations,

or from other organizations having similar processes.

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 30

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 30

Benefits of Activity-Based Costing and

Management Systems

set an optimal product mix

to estimate profit margins of new products

determine consumption of companys shared resources

keep pace with new product techniques

and technological changes

decrease the costs associated with bad decisions

take advantage of reduced cost of ABC

systems due to computer technology

Companies adopt ABC systems to:

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 31

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 31

Design of a Traditional Costing System

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 32

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 32

Design of an Activity-Based

Cost Accounting System

Determine the key

components of the

cost accounting

system.

Cost objectives

Key activities

Resources

Related cost drivers

Learning

Objective 9

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 33

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 33

Design of an Activity-Based

Cost Accounting System

Account billing

Bill verification

Account inquiry

Correspondence

Other activities

Number or printed pages

Number of accounts verified

Number of inquiries

Number of letters

Number of printed pages

Key

Activity

Cost

Driver

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 34

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 34

Activity Performed

Resource Account

Used to Inquiry Correspondence Billing Verification All Other

Perform Activity Activity Activity Activity Activity Activities Total

Supervisor 40% 10% 30% 20% 100%

Account inquiry labor 90 10 100%

Billing labor 30 70 100%

Verification labor 100 100%

Paper 100 100%

Computer 45 5 35 10 5 100%

Telecommunications 90 10 100%

Occupancy 65 15 20 100%

Printing machines 5 90 5 100%

All other department resources 100 100%

Determine the relationships among

cost objectives,activities, and resources.

Design of an Activity-Based

Cost Accounting System

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 35

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 35

Design of an Activity-Based

Cost Accounting System

Collect relevant data concerning costs and the physical

flow of the cost-driver units among resources and activities.

Number of Cost Driver Units

Activity Cost Driver Units Residential Commercial Total

Account inquiry Inquiries 20,000 5,000 25,000

Correspondence Letters 1,800 1,000 2,800

Bill printing Printed pages 120,000 40,000 160,000

Verification Accounts verified 20,000 20,000

Other activities Printed pages 120,000 40,000 160,000

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 36

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 36

Design of an Activity-Based

Cost Accounting System

Calculate and interpret the new

activity-based information.

Determine the traceable costs for

each of the activity cost pools.

Determine the activity-based cost per

account for each customer class

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 37

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 37

Activity Cost Pool

Cost (from Account

Resource slide 4-33) Inquiry Correspondence Billing Verification Other

Supervisors $ 33,600 $ 13,440* $ 3,360** $ 10,080*** $ 6,720****

Account inquiry

labor 173,460 156,114 17,346

Billing labor 56,250 16,875 $39,375

Verification labor 11,250 11,250

Paper 7,320 7,320

Computer 178,000 80,100 8,900 62,300 17,800 8,900

Telecommunication 58,520 52,668 5,852

Occupancy 47,000 30,550 7,050 9,400

Printers 55,000 2,750 49,500 2,750

Other resources 67,100 67,100

Total traceable

cost $687,500 $332,872 $32,356 $153,125 $68,425 $100,722

*From slides 33 and 36, account inquiry activity uses 40% of the supervisor resource. So the allocation is 40% $33,600 = $13,440.

**10% $33,600

***30% $33,600

****20% $33,600

Total traceable costs for the 5 activity cost pools.

Design of an Activity-Based

Cost Accounting System

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 38

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 38

Driver Costs

Total Number of

Traceable Costs Driver Units Cost per

(from Exhibit 4-12) (From Exhibit 4-11) Driver Unit

Activity (Driver Units) (1) (2) (1) (2)

Account inquiry (inquiries) $332,872 25,000 Inquiries $13,314880

Correspondence (letters) 32,356 2,800 Letters $11.555714

Account billing (printed pages) 153,125 160,000 Printed pages $ 0.957031

Bill verification (accounts verified) 68,425 20,000 Accounts verified $ 3.421250

Other activities (printed pages) 100,722 160,000 Printed pages $ 0.629513

Cost per Customer Class

Residential Commercial

Cost per Number of Number of

Driver Unit Driver Units Cost Driver Units Cost

Account inquiry $13.314880 20,000 Inquiries $266,298 5,000 Inquiries $ 66,574

Correspondence $11.555714 1,800 Letters 20,800 1,000 Letters 11,556

Account billing $ 0.957031 120,000 Pages 114,844 40,000 Pages 38,281

Bill verification $ 3.421250 20,000 Accts. 68,425

Other activities $ 0.629513 120,000 Pages 75,541 40,000 pages 25,181

Total cost $477,483 $210,017

Number of accounts 120,000 20,000

Cost per account $ 3.98 $ 10.50

Cost per account, traditional

system from slide 33 $ 4.58 $ 6.88

Design of an Activity-Based

Cost Accounting System

Activity-based cost per account for each customer class

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 39

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 39

Strategic Decisions, Operational Cost

Control, and ABM

Outsourcing

Reducing operating costs

Identifying nonvalue-added activities

Improving both strategic

and operational decisions

2005 Prentice Hall Business Publishing, Introduction to Management Accounting 13/e, Horngren/Sundem/Stratton 4 - 40

2008 Prentice Hall Business Publishing, Introduction to Management Accounting 14/e, Horngren/Sundem/Stratton/Schatzberg/Burgstahler 4 - 40

End of Chapter 4

The End

Vous aimerez peut-être aussi

- Gen Banking LawDocument11 pagesGen Banking LawDaniel John Cañares LegaspiPas encore d'évaluation

- Bank Secrecy LawDocument2 pagesBank Secrecy LawDaniel John Cañares LegaspiPas encore d'évaluation

- City University of PasayDocument2 pagesCity University of PasayDaniel John Cañares LegaspiPas encore d'évaluation

- Santa Rosa Science and Technology High School Values Education ExamDocument1 pageSanta Rosa Science and Technology High School Values Education ExamPrinces Paula Mendoza BalanayPas encore d'évaluation

- BEHASCIDocument2 pagesBEHASCIDaniel John Cañares LegaspiPas encore d'évaluation

- Data DictionaryDocument4 pagesData DictionaryDaniel John Cañares LegaspiPas encore d'évaluation

- Certificate of Recognition: Charrevie M. TingsonDocument2 pagesCertificate of Recognition: Charrevie M. TingsonDaniel John Cañares LegaspiPas encore d'évaluation

- The Trans-Pacific Partnership (Trade of Goods)Document6 pagesThe Trans-Pacific Partnership (Trade of Goods)Daniel John Cañares LegaspiPas encore d'évaluation

- PCAOB Auditing Standards Chapter 5Document35 pagesPCAOB Auditing Standards Chapter 5Daniel John Cañares Legaspi100% (1)

- Scatter Plot: 10000 F (X) 7.6826983136x 2 - 10550.0630855715x + 10546.0342910681 R 0.9999999728Document6 pagesScatter Plot: 10000 F (X) 7.6826983136x 2 - 10550.0630855715x + 10546.0342910681 R 0.9999999728Daniel John Cañares LegaspiPas encore d'évaluation

- Table of Contents - Tech DraftDocument2 pagesTable of Contents - Tech DraftDaniel John Cañares LegaspiPas encore d'évaluation

- Stra ManDocument137 pagesStra ManDaniel John Cañares LegaspiPas encore d'évaluation

- Phoenix Wright Ace Attorney Trials and TribulationDocument54 pagesPhoenix Wright Ace Attorney Trials and TribulationjinzoningenPas encore d'évaluation

- Introduction of The CompanyDocument7 pagesIntroduction of The CompanyDaniel John Cañares LegaspiPas encore d'évaluation

- SOE Week Sportsfest 2014 Schedule November 24-28Document2 pagesSOE Week Sportsfest 2014 Schedule November 24-28Daniel John Cañares LegaspiPas encore d'évaluation

- IntelDocument11 pagesIntelDaniel John Cañares LegaspiPas encore d'évaluation

- Prinmar SurveyDocument1 pagePrinmar SurveyDaniel John Cañares LegaspiPas encore d'évaluation

- Candidates For Internship Program For 1st Term AY 2015-2016Document1 pageCandidates For Internship Program For 1st Term AY 2015-2016Daniel John Cañares LegaspiPas encore d'évaluation

- October 2014 CPALE TopnotchersDocument2 pagesOctober 2014 CPALE TopnotchersRockacerPas encore d'évaluation

- Resume FormatDocument2 pagesResume FormatJessicaGonzalesPas encore d'évaluation

- Chapter 3. Decision Analysis Section 3.1. Decision Trees With Conditional ProbabilitiesDocument12 pagesChapter 3. Decision Analysis Section 3.1. Decision Trees With Conditional ProbabilitiesDaniel John Cañares LegaspiPas encore d'évaluation

- 23 Marcon, Louise Margarette 24 Millar, AllyssaDocument2 pages23 Marcon, Louise Margarette 24 Millar, AllyssaDaniel John Cañares LegaspiPas encore d'évaluation

- Partnership ReviewerDocument21 pagesPartnership ReviewerDaniel John Cañares Legaspi100% (1)

- Del Mundo Q and ADocument2 pagesDel Mundo Q and ADaniel John Cañares LegaspiPas encore d'évaluation

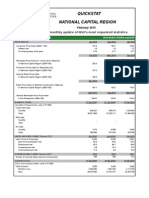

- Quickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDocument3 pagesQuickstat National Capital Region: A Monthly Update of NSO's Most Requested StatisticsDaniel John Cañares LegaspiPas encore d'évaluation

- CentralizeDocument2 pagesCentralizeDaniel John Cañares LegaspiPas encore d'évaluation

- PhotoshootDocument1 pagePhotoshootDaniel John Cañares LegaspiPas encore d'évaluation

- Chapter 6Document2 pagesChapter 6Daniel John Cañares LegaspiPas encore d'évaluation

- Rgf-Glossary of Terms-Chapter 14-Withholding TaxesDocument1 pageRgf-Glossary of Terms-Chapter 14-Withholding TaxesanggandakonohPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Austral Coke ScamDocument3 pagesAustral Coke ScamMohit GiriPas encore d'évaluation

- Wealth Management in Asia 2016 PDFDocument240 pagesWealth Management in Asia 2016 PDFChristamam Herry WijayaPas encore d'évaluation

- New Microsoft Word DocumentDocument10 pagesNew Microsoft Word DocumentMukit-Ul Hasan PromitPas encore d'évaluation

- Low Latency White PaperDocument3 pagesLow Latency White PapersmallakePas encore d'évaluation

- Tutorial 6 SolDocument14 pagesTutorial 6 SolAlex C. Guerrero100% (1)

- Questions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyDocument22 pagesQuestions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyNoura ShamseddinePas encore d'évaluation

- 5-Step Investing Formula Online Course Manual: Introduction To OptionsDocument21 pages5-Step Investing Formula Online Course Manual: Introduction To OptionsjanePas encore d'évaluation

- Research Proposal ForDocument14 pagesResearch Proposal ForMaitri PandyaPas encore d'évaluation

- Csri Summary Edition Credit Suisse Global Investment Returns Yearbook 2019 PDFDocument43 pagesCsri Summary Edition Credit Suisse Global Investment Returns Yearbook 2019 PDFSPPas encore d'évaluation

- Global Securities Operations - An IntroductionDocument2 pagesGlobal Securities Operations - An IntroductionMd Zahid HussainPas encore d'évaluation

- 04-Exchange Rate DeterminationDocument24 pages04-Exchange Rate DeterminationRoopa ShreePas encore d'évaluation

- A Study On Life InsuranceDocument76 pagesA Study On Life Insurancepooja negiPas encore d'évaluation

- ACIS 5194 Financial Statement AnalysisDocument2 pagesACIS 5194 Financial Statement AnalysisstevePas encore d'évaluation

- Neo-Liberal Globalization in The Philippines: Its Impact On Filipino Women and Their Forms of ResistanceDocument27 pagesNeo-Liberal Globalization in The Philippines: Its Impact On Filipino Women and Their Forms of Resistancekyel.munozPas encore d'évaluation

- L&T Fi PDFDocument127 pagesL&T Fi PDFkaran pawarPas encore d'évaluation

- Acconting History (Definition and Relevance by Ama Ogbonnaya KaluDocument13 pagesAcconting History (Definition and Relevance by Ama Ogbonnaya KaluNewman Enyioko100% (1)

- Calculate investment earnings and loan payments over timeDocument1 pageCalculate investment earnings and loan payments over timeYss CastañedaPas encore d'évaluation

- Swift 2002 Annual ReportDocument53 pagesSwift 2002 Annual ReportFlaviub23Pas encore d'évaluation

- Dse 05Document3 pagesDse 05SharifMahmudPas encore d'évaluation

- SweStep GFF FundingDocument4 pagesSweStep GFF FundingkasperPas encore d'évaluation

- Nickel Pig Iron in China: CommoditiesDocument8 pagesNickel Pig Iron in China: CommoditiesDavid Budi SaputraPas encore d'évaluation

- Philippine Financial SystemDocument2 pagesPhilippine Financial SystemKurt Lubim Alaiza-Anggoto Meltrelez-LibertadPas encore d'évaluation

- 2010 Economic Report On Indonesia: ISSN 0522-2572Document26 pages2010 Economic Report On Indonesia: ISSN 0522-2572tanjq87Pas encore d'évaluation

- Biscuit Factory Set up Costing and Process GuideDocument3 pagesBiscuit Factory Set up Costing and Process GuideNipun ShahPas encore d'évaluation

- AntelopeDocument2 pagesAntelopeVivek ShankarPas encore d'évaluation

- Executive SummaryDocument3 pagesExecutive SummaryyogeshramachandraPas encore d'évaluation

- Lesson 4. Tax Administration.Document44 pagesLesson 4. Tax Administration.Si OneilPas encore d'évaluation

- Will Sudhir Kumar BhoseDocument8 pagesWill Sudhir Kumar BhoseBanerjee SuvranilPas encore d'évaluation

- MGM 3101 Case StudyDocument8 pagesMGM 3101 Case StudyNurul Ashikin ZulkefliPas encore d'évaluation

- c6ed5d20992744b5ba6a4d88b6021679Document243 pagesc6ed5d20992744b5ba6a4d88b6021679Reinaldo P. FugaPas encore d'évaluation