Académique Documents

Professionnel Documents

Culture Documents

CG

Transféré par

ronak183Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CG

Transféré par

ronak183Droits d'auteur :

Formats disponibles

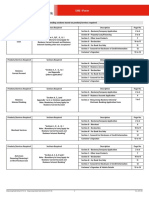

Corporate Governance In India And

SEBI Regulations

Presented By:

Atif Ghayas

Aligarh Muslim University, Aligarh

Here comes your footer

Contents

Introduction

Definition

Key players

Principles of Corporate Governance

Objectives of Corporate Governance

Corporate Governance in India

Securities Exchange Board Of India

Satyam Scandal

Conclusion

Here comes your footer

Introduction

The last few years have seen some major scams and corporate

collapse across the globe.

In India, the major example is Satyam which is one of the largest

IT companies in India.

All these events have caused the pendulum of public faith to shift

away from free market to a more closely regulated one

Here comes your footer

Definition

A system of law and sound

approaches by which corporations are

directed and controlled

Corporate governance are the policies,

procedures and rules governing the

relationships between the

shareholders, directors and managers

in a company, as defined by the

applicable laws, the corporate charter,

the companys bylaws, and formal

policies

Here comes your footer

Key players in CG

Management

Board of Directors

Customers

Shareholders

Employees

Regulators

Suppliers

Here comes your footer

Principles in CG

Rights and equitable treatment of shareholders

Interests of other stakeholders

Role and responsibilities of the board

Integrity and ethical behaviour

Disclosure and transparency

Here comes your footer

Objectives of CG

Enhance the performance of companies

Enhance access to capital

Enhance long term prosperity

Provide barrier to corrupt dealings

Impacts on the society as a whole

Here comes your footer

CG in India

The Indian corporate scenario was more or less stagnant till the

early 90s.

The position and goals of the Indian corporate sector has changed

a lot after the liberalization of 90s.

Indias economic reform programme made a steady progress in

1994.

India with its 20 million shareholders, is one of the largest

emerging markets in terms of the market capitalization.

Here comes your footer

Securities Exchange Board Of India

On April 12, 1988, SEBI was established with objective of

protecting the rights of small investors and regulating and

developing the stock markets in India.

In 1992, the Bombay Stock Exchange (BSE),the leading stock

exchange in India, witnessed the first major scam masterminded

by Harshad Mehta.

Here comes your footer

Securities Exchange Board Of India

Analysts unanimously felt that if more powers had been given to

SEBI, the scam would not have happened.

As a result the Government of India brought in a separate

legislation by the name of SEBI Act 1992and conferred statutory

powers to it.

Since then, SEBI had introduced several stock market reforms.

These reforms significantly transformed the face of Indian Stock

Markets

Here comes your footer

Overstated assets and income

The results announced on October 17, 2009

overstated quarterly Revenues by percent and

profits by 97 percent.

The global head of internal audit also illegally

obtained loans for the company.

Created 13000 fake salary accounts

Created fake customer identities and generated

fake invoices to inflate revenue

Satyam Scandal

Here comes your footer

Satyam Scandal

The CEO was convinced that the gap in the balance sheets reached an

unmanageable heights and could not be filled.

Satyam Computer crashed by Rs 139.15 or 77.69 per cent to close at

Rs 39.95, after the Chairman`s confession

Bombay stock exchange fell 700 points

The Sensex recorded the biggest single-day loss in the past two

months, after Satyam Computers Services, plunged 80 percent.

Here comes your footer

Conclusion

Corporate governance And economic development are

intrinsically linked.

Effective corporate governance systems promote the

development of strong financial systems

Which, in turn, have an unmistakably positive effect on

economic growth and poverty reduction.

THANK YOU

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- IC38 Janamghutti v1 10052019 PDFDocument67 pagesIC38 Janamghutti v1 10052019 PDFMahesh S Gour75% (4)

- The Rothschilds Stage Revolutions in Tunisia and EgyptDocument10 pagesThe Rothschilds Stage Revolutions in Tunisia and EgyptZeka Sumerian OutlawPas encore d'évaluation

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- Intellectualpropertyright 140223072438 Phpapp02Document29 pagesIntellectualpropertyright 140223072438 Phpapp02ronak183Pas encore d'évaluation

- Welcome in Semester-II: Business EnvironmentDocument18 pagesWelcome in Semester-II: Business Environmentronak183Pas encore d'évaluation

- NOKIADocument1 pageNOKIAronak183Pas encore d'évaluation

- MittalDocument1 pageMittalronak183Pas encore d'évaluation

- GR 11 Accounting P2 (English) November 2022 Question PaperDocument14 pagesGR 11 Accounting P2 (English) November 2022 Question Paperphafane2020Pas encore d'évaluation

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelPas encore d'évaluation

- Kuwait Finance House AustDocument2 pagesKuwait Finance House AustchairunnisanovPas encore d'évaluation

- 2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationDocument35 pages2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationTsz Ngong KoPas encore d'évaluation

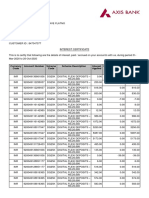

- Interest CertificateDocument2 pagesInterest CertificatesumitPas encore d'évaluation

- Forex - DerivativesDocument5 pagesForex - DerivativesAllyse CarandangPas encore d'évaluation

- SP PaperDocument11 pagesSP Paper9137373282abcdPas encore d'évaluation

- Notes On MicrofinanceDocument8 pagesNotes On MicrofinanceMapuia Lal Pachuau100% (2)

- Credit Report ExplanationDocument3 pagesCredit Report ExplanationthalhaPas encore d'évaluation

- Fundamentals Dec 2014Document40 pagesFundamentals Dec 2014Yew Toh TatPas encore d'évaluation

- PGBPDocument189 pagesPGBPumakantPas encore d'évaluation

- AFAR 1.0 Partnership-Accounting ASSESSMENTDocument5 pagesAFAR 1.0 Partnership-Accounting ASSESSMENTMakisa YuPas encore d'évaluation

- Carried Lumber Co. vs. ACCFADocument6 pagesCarried Lumber Co. vs. ACCFAJENNY BUTACANPas encore d'évaluation

- STD 11 Business Studies ModelDocument2 pagesSTD 11 Business Studies ModelArs BokaroPas encore d'évaluation

- Money: Money Is Any Item or Verifiable Record That Is Generally AcceptedDocument2 pagesMoney: Money Is Any Item or Verifiable Record That Is Generally AcceptedMokshi shahPas encore d'évaluation

- In The Partial Fulfillment of The Requirement For The Award of Degree inDocument17 pagesIn The Partial Fulfillment of The Requirement For The Award of Degree inMohmmedKhayyumPas encore d'évaluation

- Q2 W1 General MathematicsDocument39 pagesQ2 W1 General MathematicsSamantha ManibogPas encore d'évaluation

- My Cash: Balance TotalDocument9 pagesMy Cash: Balance TotalDahlan MuksinPas encore d'évaluation

- Accounting Intern Cover Letter ExamplesDocument7 pagesAccounting Intern Cover Letter Examplesiyldyzadf100% (2)

- HLB SME 1form (Original)Document14 pagesHLB SME 1form (Original)Mandy ChanPas encore d'évaluation

- Iskal ArnoDocument37 pagesIskal ArnoRuan0% (1)

- Revenue: MaicsaDocument13 pagesRevenue: MaicsaJamilah EdwardPas encore d'évaluation

- Brownstone Asset Management - 5 Years, $500 Million AUMDocument1 pageBrownstone Asset Management - 5 Years, $500 Million AUMAbsolute ReturnPas encore d'évaluation

- BSP M-2020-016 PDFDocument9 pagesBSP M-2020-016 PDFRaine Buenaventura-EleazarPas encore d'évaluation

- B40 Confirmation FormDocument3 pagesB40 Confirmation FormJoanne Renu AlexanderPas encore d'évaluation

- Warm Fuzz Cards CaseDocument2 pagesWarm Fuzz Cards CaseVeeranjaneyulu KacherlaPas encore d'évaluation

- Introduction AdvertisingDocument82 pagesIntroduction AdvertisingselbalPas encore d'évaluation