Académique Documents

Professionnel Documents

Culture Documents

BF2201 L9 Chapter 10 Student

Transféré par

Wong XianlingCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BF2201 L9 Chapter 10 Student

Transféré par

Wong XianlingDroits d'auteur :

Formats disponibles

Chapters 10

Copyright 2010 by The McGraw-Hill Companies, I nc. All rights reserved. McGraw-Hill/I rwin

10.1 Bond Characteristics (revise FM)

Revise 2.1 and 2.2 of chapter 2 on your own.

Fixed income/debt securities = a claim on a

specified periodic stream of income

Face or par value or principal value

Maturity date

Coupon rate

Variable or fixed

Zero

Review with a video:

http://www.youtube.com/watch?v=ftsNgtx2haY

10.2 Bond Pricing & Yields

a) Bond Price for a corporate bond:

C = Coupon = 10%, interest rate r = YTM = 12%, Maturity = N

or T = 10 years, P = price, Par = $1,000

What is the bonds price using semiannual compounding?

2N

2N

1 T

T

r) (1

Par

r) (1

$C

P

+

+

)

`

+

=

=

{ } $885.30 $311.80 $573.50 P = + =

64.8%

35.2%

20

20

1 T

T

) 06 . (1

$1,000

) 06 . (1

$50

P

+

+

)

`

=

=

10-3

Bond Pricing Between Coupon Dates

The flat price or quoted price assumes the

bond is purchased on a coupon payment

date.

If the bond buyer purchases a bond

between payment dates the buyers

invoice price = flat price + accrued interest.

10-4

Bond Pricing Between Coupon

Dates

A bond has a flat price of $925.30 and an annual coupon of

$42.50. 160 days have passed since the last coupon

payment and there are 182 days separating the coupon

payments. What is the bonds invoice price?

Annual Coupon$ Days since last coupon payment

Accrued Interest *

2 Days between coupon payments

=

$42.50 160

Accrued Interest * $18.68

2 182

= =

Interest Accrued Price Flat price Invoice + =

$943.98 $18.68 $925.30 price Invoice = + =

10-5

1. Yield to Maturity (YTM): The discount rate

that makes the present value of a bonds

payments equal to its price

e.g. Find the YTM for a 8% coupon, 30-year

bond selling at $1,276.76

What are the assumptions of this calculation?

10.3 Bond Yields

2N

2N

1 T

T

r) (1

Par

r) (1

$C

P

+

+

)

`

+

=

=

60

60

1 T

T

r) (1

$1,000

r) (1

$40

76 . 276 , 1 $

+

+

)

`

+

=

=

% 2 3x r =

10-6

Q1. A coupon bond which pays interest of 4%

annually, has a par value of $1,000, matures in 5

years, and is selling today at $785. The actual

yield to maturity on this bond is _________.

1. 7.2%

2. 8.8%

3. 9.1%

4. 9.6%

0 of 40

Q2. You purchased a 5-year annual interest coupon bond

one year ago. Its coupon interest rate was 6% and its par

value was $1,000. At the time you purchased the bond, the

yield to maturity was 4%. If you sold the bond after

receiving the first interest payment and the bond's yield to

maturity had changed to 3%, your annual total rate of

return on holding the bond for that year would have been

approximately _________.

1. 5%

2. 5.5%

3. 7.6%

4. 8.9%

0 of 40

Alternative Measures of Yield

2. Current Yield

Annual dollar coupon divided by the price; excludes

capital gain or loss

3. Yield to Call

Call price replaces par

Call date replaces maturity

4. Holding Period Yield (HPY)

use actual reinvestment rate on coupons; instead of

YTM

Considers any change in price if the bond is sold prior

to maturity

10-9

Bond Prices and Yields

Prices and Yields (required rates of return)

have an inverse relationship (see fig. 10.3).

When yields get very high, the value of the bond

will be very low.

When yields approach zero, the value of the

bond approaches the sum of the cash flows.

Note the curvilinear relationship between bond

prices and yields.

10-10

Figure 10.3 The Inverse Relationship Between Bond Prices

and Yields:

10-11

Fig 10.4 Yield to Call Illustrated

10-12

Figure 10.5 . The future value of the coupons depends on the rate of

return when the coupons are reinvested. An investor will not earn the

promised yield unless they reinvest the coupons at the promised YTM.

10-13

Reinvestment Risk

10.4 Bond Prices Over Time

Premium Bond

Coupon rate exceeds yield to maturity

Bond price will decline to par over its maturity

Discount Bond

Yield to maturity exceeds coupon rate

Bond price will increase to par over its maturity

Can you explain why these price change will

occur?

Refer to figure 10.6

10-14

Figure 10.6 Premium and Discount

Bonds over Time

10-15

Q3.Consider a 5-year bond with a 10% coupon

rate selling at a YTM of 8%. If interest rates

remain constant, the price of the bond at maturity

will be __________.

0 of 40

1. Higher

2. The same

3. Lower

4. Face value

Zero-coupon bonds and Treasury Strips

Zero-coupon Bond

Sell at discount (Interest type = discount).

One cash-flow payment (= principal value) at maturity.

e.g. U.S. Treasury bills.

Treasury STRIPS are longer-term zero-coupon

bonds.

eg. A 20-year bond with face value of $20,000 and 10%

coupon rate is stripped into its principal and 40-semi-

annual coupon payments.

Each of the 41 securities have its own maturity date and trades

separately with distinct ID until its maturity date at prices determined

by the market.

10-17

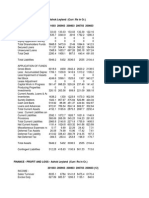

10.5 Default Risk and Bond Pricing

Default risk

Credit rating: Investment grade versus

speculative grade

Determinants of bond credit rating

Coverage ratio: times-interest-earned ratio

Leverage ratio : Debt to equity ratio

Liquidity ratios: current ratio and quick ratio

Profitability ratios: ROA, ROE

Cash flow-to-debt ratio

10-18

Credit Default Swap

Skip bond indentures and yield-to-maturity and

default risk

Credit Default Swap (CDS)

Insurance policy on the default risk of a corporate

bond.

Suppose a BB-rated bond bundled with CDS is

effectively equivalent to a AAA-rated bond.

Price of CDS approximates the yield differences

between the BB-rated bond and the AAA-rated bond.

10-19

Q4. Which of the following changes will increase

the YTM on a bond?

0 of 40

1. Increase in times-interest-

earned ratio.

2. Decrease in debt-equity

ratio.

3. Decrease in quick ratio.

4. Increase in current ratio.

Q5. Which of the following will NOT improve the

credit rating of a bond?

0 of 40

1. Add a CDS to the bond.

2. Increase in equity value

relative to debt value.

3. Decrease in current ratio.

4. Increase in ROA.

10.6 Term structure of interest rates

asianbondsonline.adb.org/singapore.php

Singapore Treasury Bills and Bonds

10.6 Theories of the Term Structure

Expectations

Long term rates are a function of expected future short

term rates

Upward slope means that the market is expecting higher

future short term rates

Downward slope means that the market is expecting

lower future short term rates

Liquidity Preference

Upward bias over expectations

The observed long-term rate includes a risk premium

10-23

Figure 10.13 Returns to Two 2-

year Investment Strategies

10-24

Forward Rates Implied

in the Yield Curve

) 1301 . 1 ( ) 11 . 1 ( ) 12 . 1 (

) 1 ( ) 1 ( ) 1 (

1 2

1

1

=

= + + +

f y y

n n n

n n

For example, using 1-yr and 2-yr rates

Longer term rate, y

n

= 12%

Shorter term rate, y

n-1

= 11%

Forward rate, a one-year rate in one year

from now = 13.01%

10-25

Figure 10.14 Illustrative Yield Curves

10-26

Figure 10.15 Term Spread

10-27

Q6. The yield curve is upward-sloping. Which of

the following statements could be valid?

I. Investors expect short-term interest rates to be flat

according to the expectations hypothesis.

II. Investors expect a larger liquidity premium for longer-

term investments.

0 of 40

1. I only

2. II only.

3. I and II only.

4. None of the above

Q7. One, two and three year maturity, default-free,

zero-coupon bonds have yields-to-maturity of 7%,

8% and 9% respectively. What is the implied one-

year forward rate for the second year?

1. 2%

2. 8%

3. 9%

4. 11%

0 of 40

Q8. One, two and three year maturity, default-free,

zero-coupon bonds have yields-to-maturity of 7%,

8% and 9% respectively. What is the implied one-

year forward rate for the third year?

0 of 40

1. 9%

2. 10%

3. 11%

4. 12%

Q9. One, two and three year maturity, default-free,

zero-coupon bonds have yields-to-maturity of 7%,

8% and 9% respectively. What is the implied two-

year forward rate for year 2?

0 of 40

1. 8%

2. 9%

3. 10%

4. 11%

Q10. Based on your answers to Q7- Q9. Which of the

following statements are true?

I. The yield curve is rising due to falling future short-term rates.

II. The yield curve is rising due to constant future short-term

rates.

III. The yield curve is rising due to rising future short-term rates.

0 of 40

1. I only

2. II only

3. III only

4. None of the above

Vous aimerez peut-être aussi

- New Tunes For Strings PDFDocument5 pagesNew Tunes For Strings PDFWong Xianling0% (2)

- Briefing For Volunteers: Pauline Chua Volunteers Coordinator, Corporate CommunicationsDocument24 pagesBriefing For Volunteers: Pauline Chua Volunteers Coordinator, Corporate CommunicationsWong XianlingPas encore d'évaluation

- The Classical Piano MethodDocument2 pagesThe Classical Piano MethodWong Xianling20% (5)

- Appointed Post Offices For Steps Tracker Collection NSC4 1537091450Document3 pagesAppointed Post Offices For Steps Tracker Collection NSC4 1537091450Wong XianlingPas encore d'évaluation

- Community Musicworks: Providence String QuartetDocument2 pagesCommunity Musicworks: Providence String QuartetWong XianlingPas encore d'évaluation

- Jane Street Capital InterviewDocument6 pagesJane Street Capital Interviewhc87100% (10)

- Company Organisation Chart: K. AvraamidesDocument1 pageCompany Organisation Chart: K. AvraamidesMuhammad SageerPas encore d'évaluation

- Form of Acceptance: Ntc-Uiuc IipDocument1 pageForm of Acceptance: Ntc-Uiuc IipWong XianlingPas encore d'évaluation

- Trade LiberalizationDocument21 pagesTrade LiberalizationWong XianlingPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Fischer 2017Document28 pagesFischer 2017YPas encore d'évaluation

- Paint IndustryDocument28 pagesPaint IndustryRAJNI SHRIVASTAVAPas encore d'évaluation

- Revise CMSL in 50 Pages PDFDocument50 pagesRevise CMSL in 50 Pages PDFjesurajajoseph100% (1)

- 4 Step Formula Ebook Kathlyn Toh v4Document26 pages4 Step Formula Ebook Kathlyn Toh v4James Warren100% (2)

- Valuation of Bonds and SharesDocument9 pagesValuation of Bonds and Sharessangee_it100% (1)

- BNWMDocument1 pageBNWMHussain AliPas encore d'évaluation

- Capital Structure 1Document12 pagesCapital Structure 1Bhanu PrakashPas encore d'évaluation

- Cash FlowDocument12 pagesCash FlowRozaimie Anzuar0% (1)

- Essay On Market EfficiencyDocument2 pagesEssay On Market EfficiencyKimkhorn LongPas encore d'évaluation

- Frank Dodd SummaryDocument10 pagesFrank Dodd SummaryDonnaAntonucciPas encore d'évaluation

- Using Stock Checkup 9 - 12 Peter ZweigDocument7 pagesUsing Stock Checkup 9 - 12 Peter ZweigngocleasingPas encore d'évaluation

- Ibd 2019 02 11 PDFDocument55 pagesIbd 2019 02 11 PDFyhaseebPas encore d'évaluation

- Case StudyDocument5 pagesCase StudyPhoebiie BeeBiePas encore d'évaluation

- Literature ReviewDocument8 pagesLiterature ReviewAshi GargPas encore d'évaluation

- Week 2: Solutions To Homework Problems: BKM Chapter 3Document4 pagesWeek 2: Solutions To Homework Problems: BKM Chapter 3Dean PhamPas encore d'évaluation

- Pfa0064 - Topic 9Document18 pagesPfa0064 - Topic 9Jeyaletchumy Nava RatinamPas encore d'évaluation

- Cost of Capital QDocument2 pagesCost of Capital QPrinkeshPas encore d'évaluation

- FM14e PPT Ch06Document77 pagesFM14e PPT Ch06Aayat R. AL KhlafPas encore d'évaluation

- Hedging QuestionsDocument6 pagesHedging QuestionsAmeya LonkarPas encore d'évaluation

- Nomura Global Phoenix Autocallable FactsheetDocument4 pagesNomura Global Phoenix Autocallable FactsheetbearsqPas encore d'évaluation

- Practical Trend Analysis by Michael C. ThomsettDocument504 pagesPractical Trend Analysis by Michael C. ThomsettGiri Gajjela100% (7)

- Viking Offshore and Marine LTD Annual Report 2013Document201 pagesViking Offshore and Marine LTD Annual Report 2013WeR1 Consultants Pte LtdPas encore d'évaluation

- Certificates of Deposit Linked To The J.P. Morgan Efficiente Plus DS 5 Index (Net ER) Due June 28, 2024Document21 pagesCertificates of Deposit Linked To The J.P. Morgan Efficiente Plus DS 5 Index (Net ER) Due June 28, 2024David BriggsPas encore d'évaluation

- Vsa Basics From MTMDocument32 pagesVsa Basics From MTMabanso100% (1)

- Introduction To Financial MarketsDocument109 pagesIntroduction To Financial Marketssadhana100% (1)

- Ashok LeylandDocument6 pagesAshok Leylandkaaviya6Pas encore d'évaluation

- M & A As A Growth StrategyDocument36 pagesM & A As A Growth StrategyVedantam GuptaPas encore d'évaluation

- MCQ On FDDocument25 pagesMCQ On FDArun MaxwellPas encore d'évaluation

- Ratio Analysis Is An Instrument - For Decision Making - A StudyDocument6 pagesRatio Analysis Is An Instrument - For Decision Making - A Studys.muthuPas encore d'évaluation