Académique Documents

Professionnel Documents

Culture Documents

MONOVA

Transféré par

Avishkar JainCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MONOVA

Transféré par

Avishkar JainDroits d'auteur :

Formats disponibles

Multivariate analysis of

variance

Life is Not That Simple

The world is complex and multivariate in nature, and

instances when a single variable completely explains a

phenomenon are rare.

For example, when trying to explore how to grow a

bigger tomato, we would need to consider factors that

have to do with the

plants' genetic makeup,

soil conditions,

lighting,

temperature, etc..

So analyze all those variables Multivariate analysis is

used

Multivariate Analysis

Many statistical techniques focus on just one

or two variables

Multivariate analysis (MVA) techniques allow

more than two variables to be analysed at once

MANOVA

The purpose of MANOVA is to test whether the vectors of

means for the two or more groups are sampled from the same

sampling distribution.

MANOVA tests whether mean differences among groups on a

combination of DVs is likely to occur by chance

An extension of univariate ANOVA procedures to situations in

which there are two or more related dependent variables

(ANOVA analyses only a single DV at a time)

The more important purpose is to explore how independent

Variables influence some patterning of response on the

dependent variables.

Basic Requirements

2 or more DVs (I, R)

1 or more categorical IVs (N, O)

Proper Usage

MANOVA is appropriate when we have several

DVs which all measure different aspects of

some cohesive theme, e.g., several different

types of academic achievement (e.g., Maths,

English, Science).

MANOVA works well in situations where there

are moderate correlations between DVs.

MANOVA vs ANOVA

Because variables are more significant

together than considered separately.

It considers inter correlations between DVs.

It controls the inflation of Type I error*.

ADVANTAGES

It tests the effects of several independent

variables and several outcome (dependent)

variables within a single analysis

It can provide a more powerful test of

significance than available when using

univariate tests

It reduces error rate compared with performing

a series of univariate tests

Assumptions of MANOVA

Multivariate normality:

DV should be normally distributed within groups..

Homogeneity of covariance matrices:

The inter correlations (co variances) of the multiple DV across

the cells of design.

Assumptions of MANOVA

I ndependence of observations:

Subject score on DV are not influenced or related to other subject

scores.

Linearity

Linear relationship against

All pairs of dependent variables,

All pairs of covariates,

All dependent variable covariate pairs in each cell.

THEORY

Mathematical Vector Model

Where overall mean

ith treatment effect with

jth error for the ith group

jth observation of the ith group

Hypothesis

against HA = at least one inequality

Theory

Observational data

No of groups (i)= k

No of observations In each group= n i

Then MANOVA equation is

Theory

Sources of

variations

Degree of

freedom

Treatment effect

(B)

(variability

between the

different groups)

k-1

Residual effect

(W)

(variability within

the group)

n-k

Total SSCP

(W+B)

n-1

Multivariate Test Statistics

Wilks' lambda ()

The smaller the value of Wilks' lambda, the

larger the between-groups dispersion

= IWI

IW+BI

Ho rejects if is small

Hypothesis Testing

Example

In certain district of Punjab hospitals are

classified on the bases of ownership (private,

government, non- profit). The study was made

to investigate effect of ownership on the costs

to hospitals:

X 1: cost of nursing

X 2: maintenance cost

Does the type of ownership effects costs to

hospital?

Data Given

p=2 k=3 n=8

np= 3 ng = 2 nnp = 3

Type of ownership obs.no. Cost of nursing (X1)

(in million)

Maintenance cost (X2)

(in millions)

Private 1 9 3

2 6 2

3 9 7

Government 1 2 2

2 2 2

Non - profit 1 3 8

2 1 9

3 2 7

Computed Means

Type of ownership X1 (mean) X2 (mean)

Private 8 4

Government 2 2

Non - profit 2 8

Grand mean 4 5

Calculations

X

1

Calculations Result

Total SSQ 5

2

+2

2

+5

2

+(-2)

2

+(-2)

2

+(-1)

2

+(-3)

2

+(-2)

2

76

Treatment SSQ 3*4

2

+2*(-2)

2

+3*(-2)

2

68

Residual SSQ 1

2

+(-2)

2

+1

2

+0+0+1

2

+(-1)

2

+0 8

X

2

Total SSQ (-2)

2

+(-3)

2

+2

2

+(-3)

2

+(-3)

2

+3

2

+4

2

+2

2

64

Treatment SSQ 3*(-1)

2

+2*(-3)

2

+3*3

2

48

Residual SSQ (-1)

2

+(-2)

2

+3

2

+0+0+0+1+(-1)

2

16

Cross Products

Total SCP 5*(-2)+2*(-3)+5*2+(-3)*(-2)+(-2)*(-3)+(-1)*3+(-3)*4+(-2)*2 -13

Treatment SCP 3*4*(-1)+2*(-2)*(-2)+3*(-2)*3 -18

Residual SCP 1*(-1)+(-2)*(-2)+1*3+0+0+0+(-1)*1+0 5

Calculations

Variance co-variance matrix

X1 X2

X1 a c

X2 c b

Sources of variation degree of freedom Matrix Determinant

Treatment effect (B) 2 68 -18 2940

-18 48

Residual effect (w) 5 8 5 103

5 16

Total effect 7 76 -13 4695

-13 64

Calculations

= IWI

IW+BI

= 103/(4695) = .0219

As p=2 k=3

Test statistics =

= 11.514

Result

Significance level = .01

Tabulated F4,8 (.01) =7.01

As Test statistics (11.514) > tabulated F4,8 (.01) =7.01

Hypothesis H0 =

is rejected.

That is to say that average costs (D.V.) differ with

different type of ownership (I.V.).

Vous aimerez peut-être aussi

- Learn Statistics Fast: A Simplified Detailed Version for StudentsD'EverandLearn Statistics Fast: A Simplified Detailed Version for StudentsPas encore d'évaluation

- Applied Longitudinal Analysis Lecture NotesDocument475 pagesApplied Longitudinal Analysis Lecture NotesyeoserenePas encore d'évaluation

- Chapter 6 - SDocument93 pagesChapter 6 - SMy KiềuPas encore d'évaluation

- 13 - AnovaDocument33 pages13 - AnovaMuhammad AbdullahPas encore d'évaluation

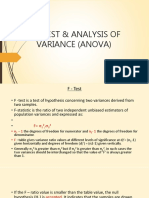

- F Test and ANNOVADocument23 pagesF Test and ANNOVADiksha SinghPas encore d'évaluation

- ANo VADocument56 pagesANo VATeja Prakash chowdary100% (4)

- 5 MANOVA Presentation StatsDocument32 pages5 MANOVA Presentation StatsVaibhav BaluniPas encore d'évaluation

- An OvaDocument82 pagesAn OvaGargi RajvanshiPas encore d'évaluation

- AnovaDocument40 pagesAnovaarafat karimPas encore d'évaluation

- Chapter No. 03 Experiments With A Single Factor - The Analysis of Variance (Presentation)Document81 pagesChapter No. 03 Experiments With A Single Factor - The Analysis of Variance (Presentation)Sahib Ullah MukhlisPas encore d'évaluation

- IMP Video ConceptDocument56 pagesIMP Video ConceptParthJainPas encore d'évaluation

- Chapter Sixteen: Analysis of Variance and CovarianceDocument64 pagesChapter Sixteen: Analysis of Variance and CovarianceSurbhi KambojPas encore d'évaluation

- Chi-Square, F-Tests & Analysis of Variance (Anova)Document37 pagesChi-Square, F-Tests & Analysis of Variance (Anova)MohamedKijazyPas encore d'évaluation

- Statistics For Decision Making: ANOVA: Analysis of VarianceDocument32 pagesStatistics For Decision Making: ANOVA: Analysis of VarianceAmit AdmunePas encore d'évaluation

- T-And F-Tests: Testing HypothesesDocument26 pagesT-And F-Tests: Testing HypothesesparneetkaurbediPas encore d'évaluation

- Applied Biostatistics 2020 - 05 ANOVADocument44 pagesApplied Biostatistics 2020 - 05 ANOVAYuki NoShinkuPas encore d'évaluation

- Lecture Notes 13: ANOVA (A.k.a. Analysis of Variance)Document34 pagesLecture Notes 13: ANOVA (A.k.a. Analysis of Variance)zhilmil guptaPas encore d'évaluation

- Analysis of Variance (Anova) : Advanced StatisticsDocument18 pagesAnalysis of Variance (Anova) : Advanced StatisticsGregorio Gamboa Maniti IIPas encore d'évaluation

- Chapter1 - An Overview of Regression AnalysisDocument35 pagesChapter1 - An Overview of Regression AnalysisZiaNaPiramLiPas encore d'évaluation

- Regression Analysis: Statistics For PsychologyDocument40 pagesRegression Analysis: Statistics For PsychologyiamquasiPas encore d'évaluation

- ANOVA and Simple Comparative ExperimentDocument44 pagesANOVA and Simple Comparative ExperimentsohorabatscribdPas encore d'évaluation

- Analysis of Variance PPT at BEC DOMSDocument56 pagesAnalysis of Variance PPT at BEC DOMSBabasab Patil (Karrisatte)100% (1)

- 10measures of AssociationDocument249 pages10measures of AssociationAbel GebratPas encore d'évaluation

- LECTURE 02-Probability IE 3373 - ALDocument44 pagesLECTURE 02-Probability IE 3373 - ALMahmoud AbdelazizPas encore d'évaluation

- MAS202 Chapter 11Document31 pagesMAS202 Chapter 11xuantoan501Pas encore d'évaluation

- Chapter 13 One Way ANOVADocument19 pagesChapter 13 One Way ANOVAKPas encore d'évaluation

- Anova 1: Eric Jacobs Hubert KorziliusDocument39 pagesAnova 1: Eric Jacobs Hubert KorziliusPolinaPas encore d'évaluation

- AnovaDocument40 pagesAnovaBeenish MujahidPas encore d'évaluation

- AnovaDocument40 pagesAnovaMary Loise SantosPas encore d'évaluation

- AnovaDocument40 pagesAnovaNeil VillasPas encore d'évaluation

- Analysis of Variance (Anova) : Madam Siti Aisyah Zakaria EQT 271 SEM 2 2014/2015Document29 pagesAnalysis of Variance (Anova) : Madam Siti Aisyah Zakaria EQT 271 SEM 2 2014/2015Farrukh JamilPas encore d'évaluation

- ANOVADocument82 pagesANOVAPradeepPas encore d'évaluation

- Analysis of Variance: Testing Equality of Means Across GroupsDocument7 pagesAnalysis of Variance: Testing Equality of Means Across GroupsMuraliManoharPas encore d'évaluation

- Analysis of VarianceDocument82 pagesAnalysis of VarianceshilpeekumariPas encore d'évaluation

- Unit 5 DefinitionsDocument8 pagesUnit 5 DefinitionslokeshnathPas encore d'évaluation

- Balanced ANOVADocument40 pagesBalanced ANOVAGagana U KumarPas encore d'évaluation

- BivariateDocument28 pagesBivariateVikas SainiPas encore d'évaluation

- ANOVA (Medtech Lecture)Document57 pagesANOVA (Medtech Lecture)Liza Lorena C. JalaPas encore d'évaluation

- Biostatistics Lectr - Basic Concepts ANOVA (2020)Document22 pagesBiostatistics Lectr - Basic Concepts ANOVA (2020)Chileshe SimonPas encore d'évaluation

- Analysis of Variance AnovaDocument38 pagesAnalysis of Variance AnovahidaPas encore d'évaluation

- T-Test and F-Test HypothesesDocument25 pagesT-Test and F-Test HypothesesKabirPas encore d'évaluation

- One-Way Analysis of Variance (ANOVA)Document31 pagesOne-Way Analysis of Variance (ANOVA)Nina ForliniPas encore d'évaluation

- Final NotesDocument184 pagesFinal Notesak.khalil20Pas encore d'évaluation

- 2011 L1 FinalDocument89 pages2011 L1 FinalAnca AfloroaeiPas encore d'évaluation

- Design of ExperimentsDocument12 pagesDesign of ExperimentsSreehari ViswanathanPas encore d'évaluation

- A Nova Sumner 2016Document23 pagesA Nova Sumner 2016Supun RandeniPas encore d'évaluation

- An OvaDocument82 pagesAn OvaShweta SinghPas encore d'évaluation

- Anova: Module 3 - Advanced StatisticsDocument17 pagesAnova: Module 3 - Advanced StatisticsVarun BhayanaPas encore d'évaluation

- Unit 5 - STUDENTS - ANOVADocument32 pagesUnit 5 - STUDENTS - ANOVAEdward MochekoPas encore d'évaluation

- Unit 5 Mba 1STDocument197 pagesUnit 5 Mba 1STsaritalodhi636Pas encore d'évaluation

- Discrete Random Variables and Probability DistributionDocument27 pagesDiscrete Random Variables and Probability DistributionMohd Nazri OthmanPas encore d'évaluation

- Methods Seminar Chon 2004-04-14 LKDocument19 pagesMethods Seminar Chon 2004-04-14 LKdullah_t2kg88Pas encore d'évaluation

- A5 - One-Way ANOVADocument32 pagesA5 - One-Way ANOVAChristian Daniel100% (1)

- Anova BiometryDocument33 pagesAnova Biometryadityanarang147Pas encore d'évaluation

- Module 11Document52 pagesModule 11Tanvi DeshmukhPas encore d'évaluation

- Analysis of VarianceDocument45 pagesAnalysis of Varianceaman.ace0701Pas encore d'évaluation

- Chapter 14, Multiple Regression Using Dummy VariablesDocument19 pagesChapter 14, Multiple Regression Using Dummy VariablesAmin HaleebPas encore d'évaluation

- Lecture 5 - Student Slides (Large)Document40 pagesLecture 5 - Student Slides (Large)ctriolairePas encore d'évaluation

- Quantitative Method-Breviary - SPSS: A problem-oriented reference for market researchersD'EverandQuantitative Method-Breviary - SPSS: A problem-oriented reference for market researchersPas encore d'évaluation

- QlikEducationServices CourseDiagramDocument46 pagesQlikEducationServices CourseDiagramcarlos.h.ruedaPas encore d'évaluation

- Business Analytics - The Science of Data Driven Decision Making PDFDocument3 pagesBusiness Analytics - The Science of Data Driven Decision Making PDFGowtham Prapullakumar25% (8)

- Thesis FormatPCUlesson1to3Document5 pagesThesis FormatPCUlesson1to3Vida Tagle DonesPas encore d'évaluation

- MANOVA - AnalysisDocument33 pagesMANOVA - Analysiskenshin1313Pas encore d'évaluation

- Welcome To Forecasting Using R: Rob J. HyndmanDocument33 pagesWelcome To Forecasting Using R: Rob J. HyndmanNathan GurgelPas encore d'évaluation

- Research MethodologyDocument2 pagesResearch MethodologyDeepak0% (1)

- Job DescriptionDocument3 pagesJob DescriptionHarsha sairamPas encore d'évaluation

- Lowest Value of Variance Can BeDocument22 pagesLowest Value of Variance Can BeRameez Abbasi50% (2)

- CO1-L3 - Measures of VariabilityDocument39 pagesCO1-L3 - Measures of VariabilityRAINIER DE JESUSPas encore d'évaluation

- Strategicplanningtoolkit Overviewandapproach 211012054413Document31 pagesStrategicplanningtoolkit Overviewandapproach 211012054413M. Abdullah Koha.100% (1)

- 10.1007@978 3 030 15628 2Document552 pages10.1007@978 3 030 15628 2hubner janampaPas encore d'évaluation

- Computation of Tourist ArrivalDocument1 pageComputation of Tourist ArrivalElbert O BaetaPas encore d'évaluation

- Primary Data and Secondary Data: Reliability Test?Document15 pagesPrimary Data and Secondary Data: Reliability Test?saeed meo100% (3)

- Unit-Iii 3.1 Regression ModellingDocument7 pagesUnit-Iii 3.1 Regression ModellingSankar Jaikissan100% (1)

- ORCIO - Stat - 07 - Lab - 01 1Document4 pagesORCIO - Stat - 07 - Lab - 01 1anna mae orcioPas encore d'évaluation

- River Coursework HypothesisDocument8 pagesRiver Coursework Hypothesisafiwierot100% (2)

- It's A Tentative Explanation of Some Process, Wether That Process Is Natural or ArtificialDocument10 pagesIt's A Tentative Explanation of Some Process, Wether That Process Is Natural or Artificialgenelyn ingatPas encore d'évaluation

- NBA Data Analysis, Player Height Weight, International StatsDocument23 pagesNBA Data Analysis, Player Height Weight, International StatsZee MaqsoodPas encore d'évaluation

- Ghemawats - Apollo HospitalDocument5 pagesGhemawats - Apollo HospitalNilesh GaidhanePas encore d'évaluation

- Criminological ResearchDocument12 pagesCriminological ResearchMagnaye WilvenPas encore d'évaluation

- Non Doctrinal ResearchDocument52 pagesNon Doctrinal Researchsanthiyakarnan16Pas encore d'évaluation

- Final Dissertation Project On Ratio AnalysisDocument61 pagesFinal Dissertation Project On Ratio Analysisangel100% (1)

- Muhammad's ResumeDocument2 pagesMuhammad's Resumemyekini1Pas encore d'évaluation

- Conference - schedule-IAC in Vienna November 2019Document45 pagesConference - schedule-IAC in Vienna November 2019Mariyudi SofyanPas encore d'évaluation

- Project Scope ManagementDocument112 pagesProject Scope ManagementKelvin TingPas encore d'évaluation

- Learning Module Unit 1Document29 pagesLearning Module Unit 1Jessa Rodulfo100% (2)

- Hasil Uji Validitas DoraDocument4 pagesHasil Uji Validitas DoraGitha RahmadhaniPas encore d'évaluation

- CLUSTERING GRID-BASED METHODS Elsayed Hemayed Data Mining CourseDocument14 pagesCLUSTERING GRID-BASED METHODS Elsayed Hemayed Data Mining CourseamjadPas encore d'évaluation

- Panel Data Models: Dynamic Panels and Unit RootsDocument20 pagesPanel Data Models: Dynamic Panels and Unit RootsJeremiahOmwoyoPas encore d'évaluation

- Anova: Single Factor: A. Decision: Since FC 4.25649472909375 F 9.63537592351152, Reject HoDocument4 pagesAnova: Single Factor: A. Decision: Since FC 4.25649472909375 F 9.63537592351152, Reject HoracmaPas encore d'évaluation