Académique Documents

Professionnel Documents

Culture Documents

Source of Short Term Finance, Source of Short Term Finance

Transféré par

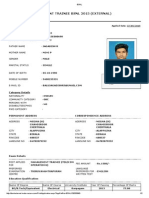

BalujagadishTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Source of Short Term Finance, Source of Short Term Finance

Transféré par

BalujagadishDroits d'auteur :

Formats disponibles

Source of Short Term

Finance

BALU.J

Short Term Finance

Borrowing or lending of funds for a short period of time.

Usually one year or less in duration.

Short term finance is secured for financing the current assets.

Bank Overdraft

Treasury bill(T-Bill)

Trade Creditors

Customers Advances

Finance Companies

Commercial Paper

Certificate of Deposit

Bank Overdraft

Overdraft is a temporary facility that bank provides to its customers in

which the customer is permitted to draw money from banks in excess of

the balance in their bank accounts.

You are charged interest based on the amount overdrawn and the

length of time overdrawn.

Advantages Flexible,Quick

Disadvantage Cost,Recall

Customers Advances

Customers often finance the seller through advance payment for

the goods.

The prices of the goods to be purchased are paid in advance, i.e.

before the receipt of the goods.

Trade Creditors

Trade creditors are probably the most important single source of

short term credit. Trade creditors are those business establishments

which sell good to others on credit. That is, they do not require

payment on the spot; rather they are to be paid after some days

from the date of sale.

Credit granted to manufactures and traders by the suppliers of raw

materials.

Usually for 30-90 days.

Treasury bill(T-Bill)

Short Term Government Security

They are promissory Notes issued at discount and for a fixed period

Central\State Govt. (RBI)

First issued in India in 1917

Usually sold at auction on discount basis.

Maturity 91- 364 days

Sold to Public & Banks

Risk is Low.

Yield is lower than on other securities.

Treasury Notes Long term 1- 10 yrs.

Commercial Paper

It is an Unsecured money market instrument issued in the form of a

promissory note.

Introduced in India in 1990

It was introduced in India with a view to enabling highly rated

corporate borrowers to diversify their sources of short term borrowing

and to provide an additional instrument to investors.

Who can issue

Corporates

Primary Dealers(PDs)

All India Financial Institutions

Commercial papers are a form of short-term borrowing facility with

maturities from seven to 364 days.

Companies can thus obtain unsecured finance directly from investors.

Bypassing banks and bond markets, although banks are often used as

agents to place the paper.

Who can Invest

Indiviuals,banking companies, other corporate bodies

Requirements

Credit Rating Serviice (CRISIL) minimum credit A-2

Period of Maturity

7-1yr

There is no collateral on the debt,Commerical paper is only an

option for large companies having high level credit rating from

recognised credit rating agency (S&P).

Commercial Banks

The commercial banks of a country generally supply funds to the

business concerns on a short-term basis.

Either with security or without security if the customer is financially

established.

The banks, collecting scattered savings of the people, invest a

portion of the deposits in the business for a short period of time.

Certificate of deposit (CD)

Similar to savings account

CDs are a form of time deposit

A certificate of Deposit is a relatively low risk debt instrument

purchased directly through a commercial bank of savings and loan

institution.

CD indicates that the investors has deposited a sum of money for

specified rate of interest.

CDs are not publicly traded securities.you can purchase CDs

through a stockbroker. Issued by Bank.

Interest on CDs not exempt from States and local taxes.

You can look but cant touch before maturity.

Higher rates of return

Money removed subject to penalty.

3 Months 7yrs

Banks have to maintain appropriate reserve requirement (CRR)

Types of CDs

Traditional CD - receive fixed interest rate over a specific period of

time.(Half penalty)

Bump-Up CD Allows you to swap your CDs interest rate for a

higher one if rates on new CDs of similar duration rise during your

investment period.

Liquid CD Allows to withdraw part of your deposit without paying a

penalty.

Callable CD Bank that issues this type can recall it after asset

period.

Factors or Brokers

In one basic respect, factoring is different from other forms of

financing. In other forms funds are granted to one individual largely

on the basis of his property. Factoring is based on a different

philosophy.

In considering a companys request for funds we are more

interested in the men behind the company their ability, their hopes

and aspirations for the future.

Miscellaneous Sources

There are many more sources from which can secure funds for short

period. They arefriend and relatives, public deposits, loan from

officer and the company directors and foreign exchange banks

THANK YOU

Vous aimerez peut-être aussi

- Operations Management 1Document30 pagesOperations Management 1BalujagadishPas encore d'évaluation

- Bus 2C 12 Operations Management: Dr.A.Abirami / OmDocument17 pagesBus 2C 12 Operations Management: Dr.A.Abirami / OmBalujagadishPas encore d'évaluation

- Operations Management 2Document39 pagesOperations Management 2BalujagadishPas encore d'évaluation

- Final Project (Midhun)Document91 pagesFinal Project (Midhun)BalujagadishPas encore d'évaluation

- International Finance - Module IIIDocument19 pagesInternational Finance - Module IIIBalujagadishPas encore d'évaluation

- Module V - Operations Management: Dr.A.Abirami / OmDocument10 pagesModule V - Operations Management: Dr.A.Abirami / OmBalujagadishPas encore d'évaluation

- Module Iv - Operations Management: Dr.A.Abirami / OmDocument20 pagesModule Iv - Operations Management: Dr.A.Abirami / OmBalujagadishPas encore d'évaluation

- Case Study E BatchDocument2 pagesCase Study E BatchBalujagadishPas encore d'évaluation

- TQM Case StudyDocument31 pagesTQM Case StudyBalujagadishPas encore d'évaluation

- Case Study D BatchDocument2 pagesCase Study D BatchBalujagadishPas encore d'évaluation

- Case Study F BatchDocument2 pagesCase Study F BatchBalujagadishPas encore d'évaluation

- Na - 07 11 2019Document26 pagesNa - 07 11 2019BalujagadishPas encore d'évaluation

- Stress MBA IDocument13 pagesStress MBA IBalujagadishPas encore d'évaluation

- POM - AnswersDocument3 pagesPOM - AnswersBalujagadishPas encore d'évaluation

- Resume Anju PDFDocument3 pagesResume Anju PDFBalujagadishPas encore d'évaluation

- Strategic Management (Aug 2010) QPDocument1 pageStrategic Management (Aug 2010) QPBalujagadishPas encore d'évaluation

- Mtbe Module 5 QPDocument1 pageMtbe Module 5 QPBalujagadishPas encore d'évaluation

- Important TopicsDocument2 pagesImportant TopicsBalujagadishPas encore d'évaluation

- BTW 6 1-0-1506 SDK Release NotesDocument9 pagesBTW 6 1-0-1506 SDK Release NotesZul HaFizPas encore d'évaluation

- Managerial Economics - AnswersDocument43 pagesManagerial Economics - AnswersBalujagadishPas encore d'évaluation

- Responsibility CentersDocument12 pagesResponsibility CentersBalujagadishPas encore d'évaluation

- ME ImportantDocument1 pageME ImportantBalujagadishPas encore d'évaluation

- Training EvaluationDocument23 pagesTraining EvaluationBalujagadishPas encore d'évaluation

- Prenuptial AgreementsDocument2 pagesPrenuptial AgreementsBalujagadishPas encore d'évaluation

- Questions and Answers RatiosDocument14 pagesQuestions and Answers RatiosBalujagadishPas encore d'évaluation

- Front Pages - EurekaDocument9 pagesFront Pages - EurekaBalujagadishPas encore d'évaluation

- Rupesh - KS: P.O, Cherthala, Alappuzha Rupeshkaimal @Document3 pagesRupesh - KS: P.O, Cherthala, Alappuzha Rupeshkaimal @BalujagadishPas encore d'évaluation

- Insurance 101 July 10 2013 PresentationDocument202 pagesInsurance 101 July 10 2013 PresentationBalujagadishPas encore d'évaluation

- BSNLDocument2 pagesBSNLBalujagadishPas encore d'évaluation

- Help (Rubbist Documents)Document9 pagesHelp (Rubbist Documents)BalujagadishPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Llpa MatrixDocument7 pagesLlpa MatrixAMIT RAIPas encore d'évaluation

- Bond Price and YieldDocument13 pagesBond Price and YieldHarsh RajPas encore d'évaluation

- Lecture 5 - Advantages of LeasingDocument1 pageLecture 5 - Advantages of LeasingCalvin MaPas encore d'évaluation

- Business Debt & Finance NotesDocument190 pagesBusiness Debt & Finance NotesZohair SadiPas encore d'évaluation

- Wa0010.Document15 pagesWa0010.Krishnan 18Pas encore d'évaluation

- T3TLD-Loans and Deposits R15Document123 pagesT3TLD-Loans and Deposits R15PRAVIN JOSHUA75% (4)

- Limba EnglezaDocument61 pagesLimba Englezapluci09Pas encore d'évaluation

- Partnership Firm Trading and Profit Loss AccountsDocument23 pagesPartnership Firm Trading and Profit Loss Accountskunjap0% (1)

- Financial Statement Analysis PT 2Document43 pagesFinancial Statement Analysis PT 2Kim Patrick VictoriaPas encore d'évaluation

- Personal LoansDocument49 pagesPersonal Loansrohitservi50% (2)

- Partnership (Questions Only)Document23 pagesPartnership (Questions Only)JeromePas encore d'évaluation

- Securing Obligations Through Pledge and MortgageDocument4 pagesSecuring Obligations Through Pledge and MortgagePrincessAngelaDeLeon100% (1)

- Tesla 1.8 Billion OfferingDocument136 pagesTesla 1.8 Billion OfferingBenjamin SpillmanPas encore d'évaluation

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelPas encore d'évaluation

- CFO in Denver Colorado Resume Bruce PeeleDocument2 pagesCFO in Denver Colorado Resume Bruce PeeleBruce PeelePas encore d'évaluation

- Bubble and Bee Organic - Historical Financial InformationDocument14 pagesBubble and Bee Organic - Historical Financial Informationapi-28404220080% (5)

- Beta Markets PrimerDocument86 pagesBeta Markets PrimerHala MadridPas encore d'évaluation

- Cap.15 MFIDocument44 pagesCap.15 MFIAndreea VladPas encore d'évaluation

- Vivriti Capital Webinar - ABS Performance and OpportunitiesDocument22 pagesVivriti Capital Webinar - ABS Performance and OpportunitiesRavi BabuPas encore d'évaluation

- Docket Annotation (Superseding Indictment)Document32 pagesDocket Annotation (Superseding Indictment)MouldieParvatiPas encore d'évaluation

- Cambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtDocument4 pagesCambridge, 2nd Ed. Irrecoverable Debt and Provision For Doubtful DebtShannen LyePas encore d'évaluation

- TVM Problem SetDocument4 pagesTVM Problem SetManya GuptaPas encore d'évaluation

- 1 The Investment Industry A Top Down ViewDocument21 pages1 The Investment Industry A Top Down ViewhimanshuPas encore d'évaluation

- Spouses Villaluz V Land Bank, G.R. No. 192602, January 18, 2017Document3 pagesSpouses Villaluz V Land Bank, G.R. No. 192602, January 18, 2017Lyle BucolPas encore d'évaluation

- Walmart Case 150Document38 pagesWalmart Case 150Phakpoom Naji100% (2)

- Ilovepdf Merged 1Document14 pagesIlovepdf Merged 1BATISATIC, EDCADIO JOSE E.Pas encore d'évaluation

- Guide On Buying Foreclosure PropertiesDocument45 pagesGuide On Buying Foreclosure PropertiesSani Panhwar100% (2)

- Cityam 2011-09-30Document48 pagesCityam 2011-09-30City A.M.Pas encore d'évaluation

- UnderwritingDocument16 pagesUnderwritingChienny HocosolPas encore d'évaluation

- Chicago Park District 2021 Bond Issuance Statement (Preliminary)Document290 pagesChicago Park District 2021 Bond Issuance Statement (Preliminary)jrPas encore d'évaluation