Académique Documents

Professionnel Documents

Culture Documents

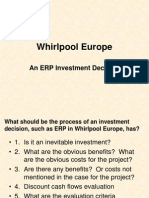

Marketing Mix of Telecom Services

Transféré par

Gopi2230 évaluation0% ont trouvé ce document utile (0 vote)

64 vues32 pagesThis document analyzes the telecom industry in India from 2009-2014. It summarizes key metrics including:

- Wireless subscribers increased from 525 million to 904 million from 2009-2014. Bharti Airtel and Vodafone had the largest market shares.

- Wireline subscribers declined from 37 million to 28 million over this period, with BSNL and MTNL maintaining the largest shares.

- Rural wireless subscribers grew from 165 million to 371 million. Bharti Airtel and Vodafone had the largest rural subscriber bases.

- The major operators segment customers based on factors like geography, income level, and usage patterns. They target both urban and rural areas.

Description originale:

Marketing mix of telecom services

Titre original

Marketing mix of telecom services

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document analyzes the telecom industry in India from 2009-2014. It summarizes key metrics including:

- Wireless subscribers increased from 525 million to 904 million from 2009-2014. Bharti Airtel and Vodafone had the largest market shares.

- Wireline subscribers declined from 37 million to 28 million over this period, with BSNL and MTNL maintaining the largest shares.

- Rural wireless subscribers grew from 165 million to 371 million. Bharti Airtel and Vodafone had the largest rural subscriber bases.

- The major operators segment customers based on factors like geography, income level, and usage patterns. They target both urban and rural areas.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

64 vues32 pagesMarketing Mix of Telecom Services

Transféré par

Gopi223This document analyzes the telecom industry in India from 2009-2014. It summarizes key metrics including:

- Wireless subscribers increased from 525 million to 904 million from 2009-2014. Bharti Airtel and Vodafone had the largest market shares.

- Wireline subscribers declined from 37 million to 28 million over this period, with BSNL and MTNL maintaining the largest shares.

- Rural wireless subscribers grew from 165 million to 371 million. Bharti Airtel and Vodafone had the largest rural subscriber bases.

- The major operators segment customers based on factors like geography, income level, and usage patterns. They target both urban and rural areas.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 32

By-

Abhilasha Seam M003

Mahesh Alapati M009

Deepak Nair M025

Gopinath Vangari M027

Snehal Madne M060

Telecom Industry

Introduction

Market Analysis

Wireless Subscriber Base:

525.09

752.19

893.84

864.72

886.3

904.51

0

100

200

300

400

500

600

700

800

900

1000

2009 2010 2011 2012 2013 2014

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

M

i

l

l

i

o

n

)

Year

Total Wireless Subscribers

Total WireLess Subscribers

0

50

100

150

200

250

2009 2010 2011 2012 2013 2014

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

Trend in Subscriber Share

Bharti Airtel

Vodafone

Reliance

Tata

Idea

BSNL

23%

18%

12% 7%

15%

11%

14%

Current Subscriber Share

Bharti Airtel Vodafone Reliance Tata

Idea BSNL Other

Source:TRAI

Contd

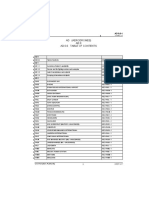

Wire line Subscriber Base:

37.06

35.09

32.69

30.79

28.89 28.89

0

5

10

15

20

25

30

35

40

2009 2010 2011 2012 2013 2014

N

o

.

o

f

s

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

Total Wire line Subscribers

Total Wire line Subscribers

0

5

10

15

20

25

30

2009 2010 2011 2012 2013 2014

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

Trend in Subscriber Share

BSNL

MTNL

Bharti Airtel

Reliance

Tata

64%

12%

12%

4%

5% 3%

Current Subscriber Share

BSNL MTNL Bharti Airtel Reliance Tata Others

Contd

Rural Wire less Subscriber Base:

164.57

250.89

307.59

331.6

359.67

371.38

0

50

100

150

200

250

300

350

400

2009 2010 2011 2012 2013 2014

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

Total Rural Subscribers

Total Rural Subscribers

0

20

40

60

80

100

2009 2010 2011 2012 2013 2014

N

o

.

o

f

r

u

r

a

l

s

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

Trend in Subscriber Share

Bharti Airtel

Reliance

Vodafone

BSNL

Tata

Idea

25%

7%

24%

9%

4%

20%

11%

Current Subscriber Share

Bharti Airtel Reliance Vodafone BSNL

Tata Idea Other

Contd

Rural-Urban Share:

0

20

40

60

80

100

120

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

AIRTEL RURAL-URBAN SHARE

Urban

Rural

0

50

100

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

VODAFONE RURAL-URBAN

SHARE

Urban

Rural

0

20

40

60

80

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

IDEA RURAL-URBAN SHARE

Urban

Rural

0

50

100

150

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

RELIANCE RURAL-URBAN SHARE

Urban

Rural

0

20

40

60

80

N

o

.

o

f

S

u

b

s

c

r

i

b

e

r

s

(

i

n

m

i

l

l

i

o

n

)

Year

TATA RURAL-URBAN SHARE

Urban

Rural

Airtel

Power to

Keep in

touch

Live every

moment

Segmentation

Geographic

Region

wise

Density

Demographic

Age

Income

Gender

Targeting

Premium and

Upper middle

class

Expansion-

Rural

Women &

Seniors

Vodafone

Segmentation

Geographic

Region wise

Density

Demographic

Occupation

Business

Consumer

Income

Age

Behavioural

Post-paid/Prepaid

Service usage(VAS)

Targeting

Wide target market

Urban customers in focus

Vodafone Delights

Made for you offers

Idea, Reliance & Docomo

Idea

Income, Geographic

Students, Workers

Tata Docomo

Demographic

Middle and upper middle

class

Reliance

Income, Geographic

Rural/Sub urban

PRODUCT : SIM CARDS

SERVICES

VOICE

INTERNET USAGE

VALUE ADDED SERVICES

MOBILE BANKING

2G/3G/4G

POSTPAID/PREPAID

CUSTOMER SUPPORT

MNP

Roaming

PROCESS

PROCESS

Business Process Framework eTOM

Enhanced Telecom Operations Map ITU M.3050

https://www.itu.int/rec/TREC-M.3050/en

PROCESS

Advertisement Analysis

45

7

23

12

8

5

Advertisement Channels

TV Channels

Social Media

Print Ads

Billboards/ Hoardings/

Posters

Event Sponsorships

Radio

64%

32%

3%

1.20%

0.80%

Innovative Promotions

Vodafone

TATA Doomo

Idea

Airtel

Reliance

Vodafones Zoo Zoo

Campaign both in media

as well as social

networking sites.

TATA Docomos brand

campaign that urges

customers to pay by

the second, always.

38%

34%

14%

8%

6%

Ads Rural Connect

AIRTEL

Idea

Reliance

Docomo

Vodafone

Airtel and Idea have most rural connect

Vodafone fails to

connect well to rural

areas because of difficulty

in understanding

faced by them.

28%

27%

25%

16%

4%

Brand Endorsers

Ranbir Kapoor

Zoo Zoo

SRK

Abhishek Bachchan

Anushka Sharma

89%

4.50%

3.50%

2.50%

0.50%

AIRTEL

Reliance

Idea

TATA Docomo

Vodafone

Most Popular Ringtone

AIRTELs signature tune by

A.R. Rahman is perhaps the most

downloaded ringtone.

52%

18%

14%

14%

2%

Most Popular Tagline

Idea

AIRTEL

TATA Docomo

Reliance

Vodafone

Idea:Ek Idea J o Badalde

Aapki Duniya

Airtel: Aisi Azadi Aur Kaha

TATA Docomo: Keep it

simple silly.

Price

Competition Based Pricing - Customized Flexi Pricing (Monthly Unlimited Plans , Special Roaming Packs , Data Packs , Social

Network Packs , Re 1 Entertainment store Vodafone)

VAS and Data services are the Margin Levers

Product Mix Pricing Methods-

1)Product Line Pricing - Class Distinctions

2)Optional Feature Pricing - Optional features and services along with main product- Ex- Entertainment Packs, 3G Packs , GPRS

Packs , Message Packs etc

3)Two Part Pricing - Fixed fee plus a variable usage fee. Telephone users pay a minimum monthly fee plus charges for calls beyond

the minimum . (Fixed fee should be low enough to induce purchase of service)

4)Product Bundling Pricing - Mixed Bundling , Pure Bundling

42.5

47

49.7

35.3

36.8

38.2 38.2

41.1

47.4

FY 2013 FY 2014 FY 20115E

ARPM-Paisa/Min

Vodafone Airtel Idea

190

201.1

205.2 206.3

215.4

223.1

164.2

175.1

179.3

FY 2013 FY 2014 FY 2015E

ARPU-Rs/User

Vodafone Airtel Idea

31.5

32.2

33.1

29.3

32.1

28.5

30.1

30.7

31.2

FY 2013 FY 2014 FY 2015E

Data Realization-Paisa/MB

Vodafone Airtel Idea

Crisil Research June 2014

Place

Vodafone Airtel Tata

3 G Coverage In India

Ref- vodafone.com , Tataindicom.in, Icra.in

,

PEOPLE

Employees at Retail Stores

Customer Care Support

Importance:

Involves high level of communication with the customers

97% of the participants talk about 'after-sales service'. Each one tells approximately 47 people about their bad

experience.

According to a survey done by ET, nearly 7 out of 10 consumers intended to make a purchase decided

against it due to poor service experience.

64% of Indians lose their temper with a customer service executive, far higher in comparison to an average of

48% in other markets

Play an important role in increasing the sales in rural and semi urban areas.

Employee

Wellbeing

Framework

Proper

training and

continuity

education

programmes

Employee

friendly

policies

Fitness and

Health

Promotion

Rewards

and

Recognition

Flexible work

options

Safe

Working

Environment

Employee

Engagement

Contd

IDEA

2013:Best Telecom

Company to work

for

Amity Telecom

Excellence Award

for 'The Best Rural

Services Provider

of the Year 2013

2011:Best Telecom

Company to work

for

VODAFONE

2014:Best Telecom

Company to work

for (only Telecom

Company in top

100)

2013:Second Best

Telecom Company

to work for

2012:Second Best

Telecom Company

to work for

AIRTEL

2011:Third Best

Telecom Company

to work for

'The Most

Impactful HR

Practise Award

for the use of

mobile

technologies for

employee

services(Organized

by the National

HRD Network)

Accolades:

Source: ET and Great Place to Work

PHYSICAL EVIDENCE

Retail Stores

Websites

Mobile Apps

Survey Results

AGE

Income (Monthly)

Services Currently used

Services Used

<21 21-40

>40

Ratings given by the users

Deciding Factors

Satisfaction Levels

Ranking on Advt. Visibility

Frequency of Visits to Customer Care Centre

Preferred Brand Ambassador

Vous aimerez peut-être aussi

- Marketing Mix of Telecom ServicesDocument32 pagesMarketing Mix of Telecom ServicesGopinath VangariPas encore d'évaluation

- Airtel Brand AuditDocument38 pagesAirtel Brand AuditreetamPas encore d'évaluation

- Customer Experiences Towards Telecom Operators On "Airtel, Jio and Voda"Document3 pagesCustomer Experiences Towards Telecom Operators On "Airtel, Jio and Voda"sonu sharmaPas encore d'évaluation

- ConnectDocument33 pagesConnectcatchoutrishiPas encore d'évaluation

- Bharti Airtel: (GSM Mobile Services)Document24 pagesBharti Airtel: (GSM Mobile Services)Deepankar MukherjeePas encore d'évaluation

- About AirtelDocument31 pagesAbout AirtelVignesh GuruPas encore d'évaluation

- Saptrack-Jan ReportDocument3 pagesSaptrack-Jan ReportKumar RameshPas encore d'évaluation

- Ways To Increase The Average Revenue Per Subscriber For Idea Cellular LTDDocument74 pagesWays To Increase The Average Revenue Per Subscriber For Idea Cellular LTDmss_singh_sikarwarPas encore d'évaluation

- Research On BSNLDocument12 pagesResearch On BSNLArjunSahooPas encore d'évaluation

- Manish Vodafone FinalDocument116 pagesManish Vodafone FinalPooja SharmaPas encore d'évaluation

- T I Airtel: Elecom NdustryDocument24 pagesT I Airtel: Elecom NdustrykaaviyaheshamPas encore d'évaluation

- IDEA Project DharmenderDocument62 pagesIDEA Project Dharmendermss_sikarwar3812Pas encore d'évaluation

- By: Sunaina Manhas Roll No. - 31 MBA (1 Sem) : Vodafone & Airtel - A ComparisonDocument15 pagesBy: Sunaina Manhas Roll No. - 31 MBA (1 Sem) : Vodafone & Airtel - A ComparisonSunaina ManhasPas encore d'évaluation

- Mobile Number Portability and Customer Retention: Rohit Kumar Sarang Sarthak Parnami Satya PrakashDocument13 pagesMobile Number Portability and Customer Retention: Rohit Kumar Sarang Sarthak Parnami Satya PrakashRohit SarangPas encore d'évaluation

- Jio Mini ProjectDocument55 pagesJio Mini Projectastrozeno06Pas encore d'évaluation

- New Era of Communication Over Digital Technology andDocument22 pagesNew Era of Communication Over Digital Technology andChaya RajkonwariPas encore d'évaluation

- Comparative Analysis of Idea and AirtelDocument29 pagesComparative Analysis of Idea and AirtelTyson RodriguezPas encore d'évaluation

- Stratigic ManagementDocument15 pagesStratigic ManagementKunal MehraPas encore d'évaluation

- A Study On Customer Perception and Satisfaction of Service Quality On Airtel Service Provider in Coimbatore CityDocument11 pagesA Study On Customer Perception and Satisfaction of Service Quality On Airtel Service Provider in Coimbatore CityAmarkantPas encore d'évaluation

- A Comparative Study On Vodafone & Airtel Marketing Research 2012Document78 pagesA Comparative Study On Vodafone & Airtel Marketing Research 2012Ajit Singh Rathore67% (9)

- Marketing Management Assignment: Marketing Research On The Impact of Mobile Network AdvertisementsDocument10 pagesMarketing Management Assignment: Marketing Research On The Impact of Mobile Network AdvertisementsNat WilliamsPas encore d'évaluation

- Comparative Analysis of Reliance Jio With Airtel, Vodafone Telecom ServiceDocument6 pagesComparative Analysis of Reliance Jio With Airtel, Vodafone Telecom Service405 - 111 Nikitha AnnaramPas encore d'évaluation

- Airtelvodafone 2Document23 pagesAirtelvodafone 2Abdul Rehman KalvaPas encore d'évaluation

- Consumer Behaviour Towards Advertisements and During Buying New Mobile ConnectionsDocument32 pagesConsumer Behaviour Towards Advertisements and During Buying New Mobile ConnectionspreetikangPas encore d'évaluation

- Mobile Service IndustryDocument18 pagesMobile Service IndustryAnkit ChoudharyPas encore d'évaluation

- School OF Management Studies Customer Satisfaction On Telecommunication/ Mobile Service ProviderDocument19 pagesSchool OF Management Studies Customer Satisfaction On Telecommunication/ Mobile Service ProviderAkshat ShrivastavPas encore d'évaluation

- AirtelDocument31 pagesAirtelRajiv KeshriPas encore d'évaluation

- Airtel Project ReportDocument23 pagesAirtel Project ReportKanchan Sanyal100% (2)

- AirtelDocument22 pagesAirtelAbhinav DaharwalPas encore d'évaluation

- Global MKTDocument28 pagesGlobal MKTArun KumarPas encore d'évaluation

- Consumer BehaviourDocument57 pagesConsumer BehaviourrahsatputePas encore d'évaluation

- A Study On Customers Satisfaction Towards Reliance Jio 4G Service With Special Reference To Coimbatore CityDocument5 pagesA Study On Customers Satisfaction Towards Reliance Jio 4G Service With Special Reference To Coimbatore CityRanjith SiddhuPas encore d'évaluation

- Presentation By:: A Seminar On Vodafone MarketingDocument17 pagesPresentation By:: A Seminar On Vodafone MarketingAnkit SachdevaPas encore d'évaluation

- Consumer Satisfaction Regarding Telecom Service ProvidersDocument43 pagesConsumer Satisfaction Regarding Telecom Service ProvidersKritikka BatraaPas encore d'évaluation

- Recharge and Sim Card Penetration in Female Segment: Presented By: Jasbeer Kaur 09CBSPGDM43Document21 pagesRecharge and Sim Card Penetration in Female Segment: Presented By: Jasbeer Kaur 09CBSPGDM43Jasveer KaurPas encore d'évaluation

- Telecom IndustryDocument22 pagesTelecom IndustryShiji Mol N100% (2)

- Research Proposal On AirtelDocument22 pagesResearch Proposal On AirtelRupesh Lakra0% (1)

- Grievance Redressal Mechanism in Telecom Services Sector Vodafone ResponsivenessDocument5 pagesGrievance Redressal Mechanism in Telecom Services Sector Vodafone ResponsivenesssjdsjPas encore d'évaluation

- PC 1Document4 pagesPC 12046 Karthick RajaPas encore d'évaluation

- Airtel PPT (Chandan)Document29 pagesAirtel PPT (Chandan)Chandan SharmaPas encore d'évaluation

- A Presentation On Organization Study: Bharat Sanchar Nigam Limited (BSNL), SirsaDocument17 pagesA Presentation On Organization Study: Bharat Sanchar Nigam Limited (BSNL), SirsaKapil SethiPas encore d'évaluation

- Isme MM - Airtel Data AmbitionsDocument6 pagesIsme MM - Airtel Data AmbitionsAkhilesh desaiPas encore d'évaluation

- On Telenor Management FunctionsDocument32 pagesOn Telenor Management FunctionsShahid SoomroPas encore d'évaluation

- Wateen: Communication Lahore Pakistan WimaxDocument15 pagesWateen: Communication Lahore Pakistan WimaxYasmeenPas encore d'évaluation

- TTSLDocument44 pagesTTSLkapie_aro9Pas encore d'évaluation

- Example For SWOT 1 387960045Document49 pagesExample For SWOT 1 387960045Manish TiwariPas encore d'évaluation

- Direct Marketing SamsungDocument58 pagesDirect Marketing SamsungSaurav Kumar33% (3)

- 7 Ps of Telecom Industry 120106093739 Phpapp02Document22 pages7 Ps of Telecom Industry 120106093739 Phpapp02Pranati JaiswalPas encore d'évaluation

- Project Report VodafoneDocument48 pagesProject Report VodafoneRahul RamchandaniPas encore d'évaluation

- Project AIRTELDocument58 pagesProject AIRTELSonal LuthraPas encore d'évaluation

- Telecommunication Industry: by Kalpana Dwivedi Taduri Srilatha Arnab Dawn Tushar ShuklaDocument27 pagesTelecommunication Industry: by Kalpana Dwivedi Taduri Srilatha Arnab Dawn Tushar ShuklaArnab DawnPas encore d'évaluation

- AIRTEL Presentation in Product ManagementDocument45 pagesAIRTEL Presentation in Product Managementmermaid11Pas encore d'évaluation

- BSNLDocument17 pagesBSNLNagaveni Gl100% (4)

- Afs Mobile Banking Final 2Document29 pagesAfs Mobile Banking Final 2Alok SinghPas encore d'évaluation

- On "A Study On Customer Satisfaction in Indian Telecommunication Industry With Special Reference of Vodafone"Document112 pagesOn "A Study On Customer Satisfaction in Indian Telecommunication Industry With Special Reference of Vodafone"hussainPas encore d'évaluation

- Kinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghDocument39 pagesKinny Jain Nikhil Saraf Dionysiamichalopoulou Rajinder Pal SinghPrashant KumarPas encore d'évaluation

- VoIP Telephony and You: A Guide to Design and Build a Resilient Infrastructure for Enterprise Communications Using the VoIP Technology (English Edition)D'EverandVoIP Telephony and You: A Guide to Design and Build a Resilient Infrastructure for Enterprise Communications Using the VoIP Technology (English Edition)Pas encore d'évaluation

- The IT Value Network: From IT Investment to Stakeholder ValueD'EverandThe IT Value Network: From IT Investment to Stakeholder ValuePas encore d'évaluation

- Technical and Vocational Education and Training in the Philippines in the Age of Industry 4.0D'EverandTechnical and Vocational Education and Training in the Philippines in the Age of Industry 4.0Pas encore d'évaluation

- Public ICT Center for Rural Development: Inclusiveness, Sustainability, and ImpactD'EverandPublic ICT Center for Rural Development: Inclusiveness, Sustainability, and ImpactPas encore d'évaluation

- Star Special Care PolicyclauseDocument6 pagesStar Special Care PolicyclauseGopi223Pas encore d'évaluation

- Investor PresentationDocument28 pagesInvestor Presentationagral BrothersPas encore d'évaluation

- Investor PresentationDocument28 pagesInvestor Presentationagral BrothersPas encore d'évaluation

- Prospectus - Star Special Care: Star Health and Allied Insurance Company LimitedDocument4 pagesProspectus - Star Special Care: Star Health and Allied Insurance Company LimitedGopi223Pas encore d'évaluation

- Data Mining Techniques - Arun K. PujariDocument303 pagesData Mining Techniques - Arun K. Pujarivintosh_p67% (6)

- 06 - DataminingDocument72 pages06 - DataminingKaiztPas encore d'évaluation

- Poland A2Document5 pagesPoland A2KhanZsuriPas encore d'évaluation

- Whirlpool Case Final SolutionDocument22 pagesWhirlpool Case Final SolutionGopi223100% (3)

- Plutus'15 Case StudyDocument12 pagesPlutus'15 Case StudyGopi223Pas encore d'évaluation

- HRM Interim Report - Group 8Document8 pagesHRM Interim Report - Group 8Gopi223Pas encore d'évaluation

- Whirlpool Case Final SolutionDocument22 pagesWhirlpool Case Final SolutionGopi223100% (3)

- Assignment 9: CaseDocument1 pageAssignment 9: CaseGopi223Pas encore d'évaluation

- Riddhi Biswas 236 E Section HUL ShaktiDocument11 pagesRiddhi Biswas 236 E Section HUL ShaktiRiddhi BiswasPas encore d'évaluation

- Whirlpool SolDocument14 pagesWhirlpool SolGopi223Pas encore d'évaluation

- Whirlpool SpreadsheetsDocument8 pagesWhirlpool SpreadsheetsGopi223Pas encore d'évaluation

- Ameritrade Case SolutionDocument42 pagesAmeritrade Case SolutionVinoth_iimr0% (1)

- Whirlpool EuropeDocument19 pagesWhirlpool Europejoelgzm0% (1)

- ABC Classic PenDocument11 pagesABC Classic PenBiswarup Roy ChowdhuryPas encore d'évaluation

- Ameritrade Case SolutionDocument42 pagesAmeritrade Case SolutionVinoth_iimr0% (1)

- Pantaloons FinalDocument30 pagesPantaloons FinalAnkit SharmaPas encore d'évaluation

- 5 Star SynopsisDocument22 pages5 Star Synopsisabdul wahidPas encore d'évaluation

- M180: Data Structure and Algorithms in Java Arab Open UniversityDocument18 pagesM180: Data Structure and Algorithms in Java Arab Open Universityamr201020Pas encore d'évaluation

- Hazardous Area Heater Crex 020 Old Version 2721512-544292Document2 pagesHazardous Area Heater Crex 020 Old Version 2721512-544292Achintya KarmakarPas encore d'évaluation

- Hardware Compatibility List (HCL) For Veritas Storage Foundation (TM) and High Availability Solutions 4.1 MP2 For SolarisDocument5 pagesHardware Compatibility List (HCL) For Veritas Storage Foundation (TM) and High Availability Solutions 4.1 MP2 For SolarisbennialPas encore d'évaluation

- New Horizons and Opportunities of Modular Constructions and Their TechnologyDocument9 pagesNew Horizons and Opportunities of Modular Constructions and Their TechnologyPhD. Arch. Klodjan XhexhiPas encore d'évaluation

- DIAGRAMA - 2007 - NEW YarisDocument1 pageDIAGRAMA - 2007 - NEW YarisLuis M. Valenzuela Arias50% (2)

- 4213 TPS Industrial Thermal BookDocument76 pages4213 TPS Industrial Thermal BookDinesh VaghelaPas encore d'évaluation

- Deepak ResumeDocument3 pagesDeepak ResumethiyaguyPas encore d'évaluation

- Final Report FEQ PDFDocument69 pagesFinal Report FEQ PDFNabeel A K JadoonPas encore d'évaluation

- 1.1 About The Protocol:: 1.0 Stop-And-Wait ARQDocument23 pages1.1 About The Protocol:: 1.0 Stop-And-Wait ARQSyed HazimPas encore d'évaluation

- Nob - Data Center - DammamDocument1 pageNob - Data Center - DammamImthiyazAliAhamedHPas encore d'évaluation

- Zipf's Law and Heaps LawDocument10 pagesZipf's Law and Heaps Lawadvita sharmaPas encore d'évaluation

- Indian CyberSecurity Product Landscape PDFDocument56 pagesIndian CyberSecurity Product Landscape PDFShaik InayathPas encore d'évaluation

- !warning!: ME225 Powertorq Series Actuator Instruction ManualDocument2 pages!warning!: ME225 Powertorq Series Actuator Instruction ManualCarlos RondonPas encore d'évaluation

- A Framework For Reliability and Risk Centered MaintenanceDocument8 pagesA Framework For Reliability and Risk Centered MaintenanceIlham M Taufik100% (1)

- Doris Graber, 1996, Say It With PicturesDocument13 pagesDoris Graber, 1996, Say It With PicturesFlorinaCretuPas encore d'évaluation

- Terms Def en It IonDocument29 pagesTerms Def en It IonVichu Kumar KumarPas encore d'évaluation

- Interface Verilog CodeDocument21 pagesInterface Verilog CodeVishwanath B RajashekarPas encore d'évaluation

- Guidance On Shipboard Towing and Mooring EquipmentDocument11 pagesGuidance On Shipboard Towing and Mooring EquipmentNuman Kooliyat IsmethPas encore d'évaluation

- Mamuli N22Document28 pagesMamuli N22doubePas encore d'évaluation

- ADP ObservationDocument15 pagesADP ObservationSanjay SPas encore d'évaluation

- Mazda rx7Document3 pagesMazda rx7Jon WestPas encore d'évaluation

- Yamaha A-S2000 PDFDocument90 pagesYamaha A-S2000 PDFpeti5_1Pas encore d'évaluation

- h51 Manual 3ex5030 50 English PDFDocument4 pagesh51 Manual 3ex5030 50 English PDFCao Thanh Tuan100% (1)

- Aerodromes PDFDocument522 pagesAerodromes PDFaditya100% (1)

- 12T0070 Atr Fit12Document16 pages12T0070 Atr Fit12expairtisePas encore d'évaluation

- Harry BerryDocument2 pagesHarry BerryLuisPas encore d'évaluation

- Gen2 ComfortDocument10 pagesGen2 ComfortRethish KochukavilakathPas encore d'évaluation