Académique Documents

Professionnel Documents

Culture Documents

Chapter 06final Cost Accouting

Transféré par

Umar FarooqTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 06final Cost Accouting

Transféré par

Umar FarooqDroits d'auteur :

Formats disponibles

2009 Pearson Prentice Hall. All rights reserved.

Master Budgeting

and

Responsibility Accounting

2009 Pearson Prentice Hall. All rights reserved.

Budget defined

The quantitative expression of a proposed plan of

action by management for a specified period, and

An aid to coordinating what needs to be done to

implement that plan

May include both financial and non-financial data

2009 Pearson Prentice Hall. All rights reserved.

The Ongoing Budget Process:

1. Managers and accountants plan the performance of

the company, taking into account past performance

and anticipated future changes

2. Senior managers distribute a set of goals against

which actual results will be compared

2009 Pearson Prentice Hall. All rights reserved.

The Ongoing Budget Process:

3. Accountants help managers investigate deviations

from budget. Corrective action occurs at this point

4. Managers and accountants assess market feedback,

changed conditions, and their own experiences as

plans are laid for the next budget period

2009 Pearson Prentice Hall. All rights reserved.

Strategy, Planning and Budgets,

Illustrated

2009 Pearson Prentice Hall. All rights reserved.

Advantages of Budgets

Provides a framework for judging performance

Motivates managers and other employees

Promotes coordination and communication among

subunits within the company

2009 Pearson Prentice Hall. All rights reserved.

Components of Master Budgets

Operating Budget building blocks leading to the

creation of the Budgeted Income Statement

Financial Budget building blocks based on the

Operating Budget that lead to the creation of the

Budgeted Balance Sheet and the Budgeted Statement

of Cash Flows

2009 Pearson Prentice Hall. All rights reserved.

Basic Operating Budget Steps

1. Prepare the Revenues Budget

2. Prepare the Production Budget (in Units)

3. Prepare the Direct Materials Usage Budget and

Direct Materials Purchases Budget

4. Prepare the Direct Manufacturing Labor Budget

2009 Pearson Prentice Hall. All rights reserved.

Basic Operating Budget Steps

5. Prepare the Manufacturing Overhead Costs Budget

6. Prepare the Ending Inventories Budget

7. Prepare the Cost of Goods Sold Budget

8. Prepare the Operating Expense (Period Cost)

Budget

9. Prepare the Budgeted Income Statement

2009 Pearson Prentice Hall. All rights reserved.

Basic Financial Budget Steps

Based on the Operating Budgets:

1. Prepare the Capital Expenditures Budget

2. Prepare the Cash Budget

3. Prepare the Budgeted Balance Sheet

4. Prepare the Budgeted Statement of Cash Flows

2009 Pearson Prentice Hall. All rights reserved.

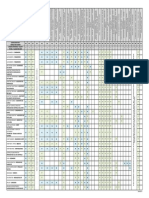

Sample

Master

Budget,

Illustrated

2009 Pearson Prentice Hall. All rights reserved.

Other Budgeting Issues

Financial-planning software may be employed to

conduct sensitivity (what-if) analysis to assist

in the budgetary process

Kaizen Budgeting incorporating continuous

improvement factors in the budgeting process

Activity-Based Budgeting incorporating

Activity-Based Costing in the budgetary process

2009 Pearson Prentice Hall. All rights reserved.

Kaizen Budgeting, Illustrated

2009 Pearson Prentice Hall. All rights reserved.

Budgeting and the Organization:

Responsibility Accounting

Responsibility Center a part, segment, or subunit of a

organization whose manager is accountable for a

specified set of activities

Responsibility Accounting a system that measures

the plans, budgets, actions and actual results of each

Responsibility Center

2009 Pearson Prentice Hall. All rights reserved.

Types of Responsibility Centers

1. Cost accountable for costs only

2. Revenue accountable for revenues only

3. Profit accountable for revenues & costs

4. Investment accountable for investments, revenues,

and costs

2009 Pearson Prentice Hall. All rights reserved.

Budgets and Feedback

Budgets offer feedback in the form of variances: actual

results deviate from budgeted targets

Variances provide managers with

Early warning of problems

A basis for performance evaluation

A basis for strategy evaluation

2009 Pearson Prentice Hall. All rights reserved.

Controllability

Controllability is the degree of influence that a

manager has over costs, revenues, or related items for

which he is being held responsible

Responsibility Accounting focuses on information

sharing, not in laying blame on a particular manager

2009 Pearson Prentice Hall. All rights reserved.

Budgeting and Human Behavior

The budgeting process may be abused both by

superiors and subordinates, leading to negative

outcomes

Superiors may dominate the budget process or hold

subordinates accountable for events they have no

control over

Subordinates may build budgetary slack into their

budgets

2009 Pearson Prentice Hall. All rights reserved.

Budgetary Slack

The practice of underestimating budgeted revenues, or

overestimating budgeted expenses, in an effort to

make the resulting budgeted goals (profits) more

easily attainable

2009 Pearson Prentice Hall. All rights reserved.

Vous aimerez peut-être aussi

- Hca14 - PPT - CH06 Master Budgeting and Responsibility AccountingDocument20 pagesHca14 - PPT - CH06 Master Budgeting and Responsibility AccountingNiizamUddinBhuiyan100% (1)

- CH 6 PowerpointDocument15 pagesCH 6 Powerpointjaysuhn94Pas encore d'évaluation

- Chapter 01finalcha 1Document16 pagesChapter 01finalcha 1Abhi SinghPas encore d'évaluation

- Performance Measurement, Compensation, and Multinational ConsiderationsDocument32 pagesPerformance Measurement, Compensation, and Multinational ConsiderationsKapil MendaparaPas encore d'évaluation

- RevisedDocument15 pagesRevisedSibtain AbbasPas encore d'évaluation

- Master BudgetDocument1 pageMaster BudgetDevank MaliPas encore d'évaluation

- Developing Operating & Capital BudgetingDocument48 pagesDeveloping Operating & Capital Budgetingapi-3742302100% (2)

- Master Budget and Responsibility AccountingDocument27 pagesMaster Budget and Responsibility AccountingAnis WidiasiwiPas encore d'évaluation

- Chapter 5Document7 pagesChapter 5intelragadio100% (1)

- CHAPTER 23 Performance Measurement, Compensation, and Multinational ConsiderationsDocument32 pagesCHAPTER 23 Performance Measurement, Compensation, and Multinational ConsiderationsSierra.Pas encore d'évaluation

- The Accountant's Role in The Organization: © 2009 Pearson Prentice Hall. All Rights ReservedDocument16 pagesThe Accountant's Role in The Organization: © 2009 Pearson Prentice Hall. All Rights ReservedWisnu WidodoPas encore d'évaluation

- Chapter 01finalDocument16 pagesChapter 01finalmohamedPas encore d'évaluation

- M4 Budgeting For Profit and ControlDocument8 pagesM4 Budgeting For Profit and Controlwingsenigma 00Pas encore d'évaluation

- Budgeting CycleDocument4 pagesBudgeting CycleAhsaan KhanPas encore d'évaluation

- Bases de CostosDocument13 pagesBases de CostosNohemi LopezPas encore d'évaluation

- Chapter 5 SummaryDocument6 pagesChapter 5 SummaryDiana Mark AndrewPas encore d'évaluation

- BSBFIM501 Manage Budgets and Financial Plans AssignmentDocument11 pagesBSBFIM501 Manage Budgets and Financial Plans AssignmentAryan SinglaPas encore d'évaluation

- BUDGETINGDocument7 pagesBUDGETINGMarjorie ManuelPas encore d'évaluation

- Budget: A Condensed Business Plan For The Forthcoming Year (Or Less)Document7 pagesBudget: A Condensed Business Plan For The Forthcoming Year (Or Less)Mega Pop LockerPas encore d'évaluation

- BudgetingDocument3 pagesBudgetingmaryjoypesodasPas encore d'évaluation

- BudgetingDocument9 pagesBudgetingCaelah Jamie TublePas encore d'évaluation

- CHAPTER 3 5 Contents ONLYDocument18 pagesCHAPTER 3 5 Contents ONLYKimberly Quin CañasPas encore d'évaluation

- Budget ManualsDocument3 pagesBudget ManualsJun Emmanuel Gapol MacalisangPas encore d'évaluation

- Motivation, Budgets and Responsibility AccountingDocument5 pagesMotivation, Budgets and Responsibility AccountingDesak Putu Kenanga PutriPas encore d'évaluation

- Costing in HotelDocument35 pagesCosting in HotelsamismithPas encore d'évaluation

- CH 1 PowerpointDocument13 pagesCH 1 Powerpointjaysuhn94Pas encore d'évaluation

- Cost Accounting - MidhunDocument19 pagesCost Accounting - MidhunmidhunPas encore d'évaluation

- Cost Accounting: Sixteenth Edition, Global EditionDocument32 pagesCost Accounting: Sixteenth Edition, Global EditionAhmed El KhateebPas encore d'évaluation

- Overhead BudgetDocument16 pagesOverhead BudgetRonak Singh67% (3)

- Engineers Education Association I. Background of The StudyDocument6 pagesEngineers Education Association I. Background of The StudyAnifahchannie PacalnaPas encore d'évaluation

- Budgets and Managing MoneyDocument51 pagesBudgets and Managing MoneyIrtiza Shahriar ChowdhuryPas encore d'évaluation

- Managerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaDocument3 pagesManagerial Accounting Asiacareer College/Cparcenter Operational and Financial Budgeting DWM - Reyno, Cpa, DbaCertified Public AccountantPas encore d'évaluation

- Managerial Accounting: Summary: Chapter 10 - Master BudgetingDocument6 pagesManagerial Accounting: Summary: Chapter 10 - Master BudgetingIra PutriPas encore d'évaluation

- Profit ForecastingDocument7 pagesProfit ForecastingKomal Shujaat100% (3)

- Financial Planning and BudgetingDocument45 pagesFinancial Planning and BudgetingRafael BensigPas encore d'évaluation

- MANAGEMENT CONTROL SYSTEMS-Report Stell Plant & HPCLDocument17 pagesMANAGEMENT CONTROL SYSTEMS-Report Stell Plant & HPCLPrasad GantiPas encore d'évaluation

- Lesson 14 TextbookDocument36 pagesLesson 14 Textbookluo jamesPas encore d'évaluation

- Financial Planning and Control ProcessDocument3 pagesFinancial Planning and Control ProcessPRINCESS HONEYLET SIGESMUNDOPas encore d'évaluation

- Budgeting MAF 280Document6 pagesBudgeting MAF 280HazwaniSagimanPas encore d'évaluation

- Section C. Budgetary System & Variance - TuttorsDocument61 pagesSection C. Budgetary System & Variance - TuttorsNirmal Shrestha100% (1)

- Chapter 3Document3 pagesChapter 3Mixx MinePas encore d'évaluation

- Chapter 6 Solutions Horngren Cost AccountingDocument51 pagesChapter 6 Solutions Horngren Cost AccountingAnik Kumar Mallick100% (3)

- Budget PreparationDocument4 pagesBudget PreparationPawan Biswa100% (1)

- Managemnt Accountant Theroy (Year QuestionDocument3 pagesManagemnt Accountant Theroy (Year QuestionJack SonPas encore d'évaluation

- Budeget PreparationDocument22 pagesBudeget PreparationSuresh RainaPas encore d'évaluation

- Tugas Ak Manajemen 8Document2 pagesTugas Ak Manajemen 8Stefano WIllyPas encore d'évaluation

- Chapter 3Document14 pagesChapter 3Tariku KolchaPas encore d'évaluation

- Budgetary Control of IndiaDocument30 pagesBudgetary Control of IndiaNiks DujaniyaPas encore d'évaluation

- Profit Planning: Reporter: Maria Magdalena Dg. FranciscoDocument51 pagesProfit Planning: Reporter: Maria Magdalena Dg. FranciscoElmin ValdezPas encore d'évaluation

- Class Notes CH21Document17 pagesClass Notes CH21KamauWafulaWanyamaPas encore d'évaluation

- Budgeting in DetailDocument94 pagesBudgeting in DetailNyimaSherpaPas encore d'évaluation

- Budget Stages - Kyle - GolindangDocument17 pagesBudget Stages - Kyle - GolindangKylie GolindangPas encore d'évaluation

- Chapter 5: Financial Forecasting, Corporate Planning, and Budgeting Corporate PlanningDocument6 pagesChapter 5: Financial Forecasting, Corporate Planning, and Budgeting Corporate PlanningAdoree RamosPas encore d'évaluation

- ACCT 701 Chapter 10 AtkinsonDocument54 pagesACCT 701 Chapter 10 AtkinsonAnonymous I03Wesk92Pas encore d'évaluation

- CAPE Unit 2 - Costing Principles CMA & FADocument5 pagesCAPE Unit 2 - Costing Principles CMA & FAPrecious CodringtonPas encore d'évaluation

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1D'EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1Pas encore d'évaluation

- Managerial Accounting IBPDocument58 pagesManagerial Accounting IBPSaadat Ali100% (1)

- Budgetary ControlDocument38 pagesBudgetary ControlraajnanjaiPas encore d'évaluation

- Budgetary ControlDocument31 pagesBudgetary Controlraghavmore5_11660812Pas encore d'évaluation

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"D'Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Pas encore d'évaluation

- Negotiating On Thin Ice: The 2004-2005 NHL DisputeDocument10 pagesNegotiating On Thin Ice: The 2004-2005 NHL DisputeUmar Farooq0% (1)

- NHL Case Study - SolutionDocument23 pagesNHL Case Study - SolutionUmar Farooq75% (4)

- Inventory Costing and Capacity Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedDocument22 pagesInventory Costing and Capacity Analysis: © 2009 Pearson Prentice Hall. All Rights ReservedUmar FarooqPas encore d'évaluation

- Chapter 11final Managerial AccountingDocument32 pagesChapter 11final Managerial AccountingUmar FarooqPas encore d'évaluation

- NHL Case Study - SolutionDocument23 pagesNHL Case Study - SolutionUmar Farooq75% (4)

- Chapter 05final Cost AccoutingDocument20 pagesChapter 05final Cost AccoutingUmar FarooqPas encore d'évaluation

- Flexible Budgets, Direct-Cost Variances, and Management ControlDocument21 pagesFlexible Budgets, Direct-Cost Variances, and Management ControlUmar FarooqPas encore d'évaluation

- Chapter 04 Job Costing.Document28 pagesChapter 04 Job Costing.Sehon RichardsPas encore d'évaluation

- Garnier Men PakistanDocument67 pagesGarnier Men PakistanUmar Farooq100% (1)

- Globalization Issues Faced by Multinational Companies, While Operating in Different CoutriesDocument2 pagesGlobalization Issues Faced by Multinational Companies, While Operating in Different CoutriesUmar FarooqPas encore d'évaluation

- Engro Foods Quarterly Report 2013Document22 pagesEngro Foods Quarterly Report 2013Umar FarooqPas encore d'évaluation

- Monotheism An Economic Sociopolitical TheoryDocument65 pagesMonotheism An Economic Sociopolitical TheoryAdam RicePas encore d'évaluation

- NTS Book For GAT General Free Download PDFDocument142 pagesNTS Book For GAT General Free Download PDFMuhammad Ramzan100% (3)

- Servent Line Mrketing Project, Innovative IdeaDocument46 pagesServent Line Mrketing Project, Innovative IdeaUmar FarooqPas encore d'évaluation

- PakistanDocument3 pagesPakistanUmar FarooqPas encore d'évaluation

- Functions For Maths (Real Functions)Document32 pagesFunctions For Maths (Real Functions)Umar FarooqPas encore d'évaluation

- Sitara ChemicalsDocument50 pagesSitara ChemicalsUmar Farooq91% (11)

- Random HRM DataDocument12 pagesRandom HRM DatasfarhanmehmoodPas encore d'évaluation

- Random HRM DataDocument12 pagesRandom HRM DatasfarhanmehmoodPas encore d'évaluation

- Department of Education: Republic of The PhilippinesDocument1 pageDepartment of Education: Republic of The PhilippinesKlaribelle VillaceranPas encore d'évaluation

- Review and Basic Principles of PreservationDocument43 pagesReview and Basic Principles of PreservationKarl Marlou Bantaculo100% (1)

- HC+ Shoring System ScaffoldDocument31 pagesHC+ Shoring System ScaffoldShafiqPas encore d'évaluation

- Team 6 - Journal Article - FinalDocument8 pagesTeam 6 - Journal Article - FinalAngela Christine DensingPas encore d'évaluation

- The Chassis OC 500 LE: Technical InformationDocument12 pagesThe Chassis OC 500 LE: Technical InformationAbdelhak Ezzahrioui100% (1)

- Chapter 10 Translation ExposureDocument14 pagesChapter 10 Translation ExposurehazelPas encore d'évaluation

- Course: Introduction To Geomatics (GLS411) Group Practical (2-3 Persons in A Group) Practical #3: Principle and Operation of A LevelDocument3 pagesCourse: Introduction To Geomatics (GLS411) Group Practical (2-3 Persons in A Group) Practical #3: Principle and Operation of A LevelalyafarzanaPas encore d'évaluation

- Resa Auditing Theorydocx - CompressDocument64 pagesResa Auditing Theorydocx - CompressMaePas encore d'évaluation

- RseDocument60 pagesRseH S Vishwanath ShastryPas encore d'évaluation

- Hatayoga 1Document11 pagesHatayoga 1SACHIDANANDA SPas encore d'évaluation

- Offshore Training Matriz Matriz de Treinamentos OffshoreDocument2 pagesOffshore Training Matriz Matriz de Treinamentos OffshorecamiladiasmanoelPas encore d'évaluation

- Combining Wavelet and Kalman Filters For Financial Time Series PredictionDocument17 pagesCombining Wavelet and Kalman Filters For Financial Time Series PredictionLuis OliveiraPas encore d'évaluation

- Approved College List: Select University Select College Type Select MediumDocument3 pagesApproved College List: Select University Select College Type Select MediumDinesh GadkariPas encore d'évaluation

- Preliminary Examination The Contemporary WorldDocument2 pagesPreliminary Examination The Contemporary WorldJane M100% (1)

- L5T-112 Manual - 2007 - Issue 1.1 PDFDocument16 pagesL5T-112 Manual - 2007 - Issue 1.1 PDFfluidaimaginacionPas encore d'évaluation

- Service Letter Service Letter Service Letter Service Letter: Commercial Aviation ServicesDocument3 pagesService Letter Service Letter Service Letter Service Letter: Commercial Aviation ServicesSamarPas encore d'évaluation

- China's Military UAV Industry - 14 June 2013Document21 pagesChina's Military UAV Industry - 14 June 2013Deep Kanakia100% (1)

- Ocr A Level History Russia CourseworkDocument7 pagesOcr A Level History Russia Courseworkbcrqhr1n100% (1)

- Most Probable Number (MPN) Test: Principle, Procedure, ResultsDocument4 pagesMost Probable Number (MPN) Test: Principle, Procedure, ResultsHammad KingPas encore d'évaluation

- Beng (Hons) Telecommunications: Cohort: Btel/10B/Ft & Btel/09/FtDocument9 pagesBeng (Hons) Telecommunications: Cohort: Btel/10B/Ft & Btel/09/FtMarcelo BaptistaPas encore d'évaluation

- Adding and Subtracting FractionsDocument4 pagesAdding and Subtracting Fractionsapi-508898016Pas encore d'évaluation

- Schermer 1984Document25 pagesSchermer 1984Pedro VeraPas encore d'évaluation

- 3 AcmeCorporation Fullstrategicplan 06052015 PDFDocument11 pages3 AcmeCorporation Fullstrategicplan 06052015 PDFDina DawoodPas encore d'évaluation

- Verilog GATE AND DATA FLOWDocument64 pagesVerilog GATE AND DATA FLOWPRIYA MISHRAPas encore d'évaluation

- Evolution of Campus Switching: Marketing Presentation Marketing PresentationDocument35 pagesEvolution of Campus Switching: Marketing Presentation Marketing PresentationRosal Mark JovenPas encore d'évaluation

- ACTIX Basic (Sample CDMA)Document73 pagesACTIX Basic (Sample CDMA)radhiwibowoPas encore d'évaluation

- Under Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisDocument13 pagesUnder Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisMahmud RahmanPas encore d'évaluation

- OnTime Courier Software System Requirements PDFDocument1 pageOnTime Courier Software System Requirements PDFbilalPas encore d'évaluation

- Iroquois Clothes and WampumDocument3 pagesIroquois Clothes and Wampumapi-254323856Pas encore d'évaluation

- FM Testbank-Ch18Document9 pagesFM Testbank-Ch18David LarryPas encore d'évaluation