Académique Documents

Professionnel Documents

Culture Documents

Ifrs - 1

Transféré par

Asis Koirala0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues17 pageshgc

Titre original

IFRS - 1

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documenthgc

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues17 pagesIfrs - 1

Transféré par

Asis Koiralahgc

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 17

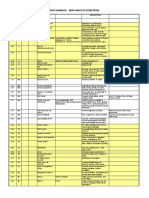

First-time Adoption of International

Financial Reporting Standards

Adoption Nepal

Nepal is a little behind in adoption of IFRS

Announced to be the first IFRS reporting period

is 2012- 2013 (July 16th 2012 July 15th

2013)

Bigger Challenge - convergence rather than

adoption

Biggest challenge - first time adoption

2

2. Which of the following are underlying

assumptions of financial statements?

(a) Relevance and reliability

(b) Financial capital maintenance and physical

capital maintenance

(c) Accrual basis and going concern

(d) Prudence and conservatism

To ensure that an entitys first IFRS financial

statements, and its interim financial reports

contain high quality information that is:

Transparent for users and comparable over

all periods presented

Provides a suitable starting point for

accounting in accordance with IFRSs

Can be generated at a cost that does not

exceed the benefits

An enterprise for the first time making explicit

and unreserved statement that GPFS (general

purpose financial statements) comply with IFRS

If enterprise in its published GPFS asserted

Compliance with some but not all IFRSs

GPFS included only reconciliation of selected

figures from previous GAAP to IFRSs

Not first time adopter if in the preceding year

its published financial statements asserted

Compliance with IFRSs even if auditors report

contained a qualification with respect to

conformity to IFRS

Compliance with both previous GAAP and

IFRSs

Derecognize items as assets or liabilities if

IFRSs do not permit such recognition

Recognise all assets and liabilities whose

recognition is required by IFRSs

Reclassification of items that were recognised

under previous GAAP as one type of asset,

liability or component of equity, which are

different type of asset, liability or component

of equity under IFRSs.

Apply IFRSs in measuring all recognised

assets and liabilities

IAS 28 prohibits recognition of expenditure on intangible

assets like

Research

Start up, pre-operating cost

Training costs

Moving and relocation

Eliminate these

If previous GAAP allowed recognition of reimbursements

and contingent assets not virtually certain, be eliminated

If previous GAAP allowed recognition of future operating

losses or major overhauls as provisions, but do not meet

recognition criteria per IAS -37

New Assets and Liabilities

IAS - 39 - recognition of all derivative financial assets

and liabilities

IAS 19 Employer to recognize liabilities under defined

benefit plans (not only pensions but also obligations

for medical, vacation, deferred compensation etc)

IAS 37 liabilities on onerous contract, restructuring,

decommissioning, site restoration, warranties, guarantees

IAS 10 (Events after Reporting Date) Proposed

Dividend not recognized as liability

Reclassify as part of retained earnings

Previous GAAP allowed Treasury Stock as asset, to

be reclassified as component of equity

IAS 32 ( Financial Instruments Presentation)

Redeemable Preference Shares not part of equity

but liability

Offsetting or Netting of assets/ Liabilities or Income/

Expenses

Subject to certain exception to general

measurement principles

Measurement principles applicable on the

day of adoption. If enterprises in Nepal

adopts IFRS first time for year ended 15th

July 2013, measurement

principles applicable on that date

Adjustments recognized directly in retained

earnings or other apt category of equity on

the date of transition .

Same accounting policies in its opening IFRS

statement of financial position and throughout

all periods presented in its first IFRS financial

statements

Shall comply with each IFRS effective at the

end of its first IFRS reporting period

financial assets and financial liabilities

Not permitted to recognize financial assets or

financial liabilities if these were de-recognized in

erstwhile GAAP

if a first-time adopter derecognised non-derivative

financial assets or non-derivative financial liabilities

in accordance with its previous GAAP as a result of a

transaction that occurred before date of transition, it

shall not recognise those assets and liabilities in

accordance with IFRSs (unless they qualify for

recognition as a result of a later transaction or event)

It is consistent with the transition provision of

IAS 39

Certain IAS 27 requirements not to apply

retrospectively prior to date of transition to IFRSs

Total comprehensive income is attributed to the

owners of the parent and to the non-controlling

interests even if this results in the non-

controlling interests having a deficit balance; The

accounting of changes in the parents ownership

interest in a subsidiary that do not result in a loss

of control

Exception - Howsoever if first-time adopter

elects to apply IFRS 3 retrospectively to past

business combinations 18

Carried under Cost Model Fair Value becomes

Deemed cost (including for intangibles if active

market exists)

Revalued under previous GAAP, revalued amount at

the Revaluation Date becomes deemed cost

Before date of first IFRS balance sheet, any IPO/

privatization done, and the revaluation at Fair

Value done, it becomes deemed cost after initial

adoption of IFRS Adjustment for subsequent

depreciation, amortization and impairment

required.

Selected financial data for periods before first

IFRS Balance Sheet

IAS 1 requires one year of full comparative

financial statements

If enterprise desires to disclose selected data,

conformity to earlier data under IFRS optional

Prominently disclose non conformity to IFRS

for such select data

Disclose nature of main adjustment that

would make IFRS compliant

Narrative disclosure - not necessarily

quantified 23

In the GPFS of first time adopter

To explain how the transition from previous GAAP to IFRS

affected enterprises reported financial position, performance

and cash flows

Reconciliations of equity on the date of transition to IFRSs,

and end of latest period presented in the entitys most recent

annual financial statements under previous GAAP

Reconciliations of IFRSs based profit or loss with that

reported under previous GAAP recognition and reversal of any

impairment loss explaining that such would have been

required under IAS 36 even other wise Reconciliations should

provide sufficient details to enable users to understand the

material adjustments

Subsidiary adopts in Enterprise Only (stand

alone)

GPFS, before the Group for Consolidated FS

the date on which it adopted (date - not for the

group)

> If group adopts before subsidiary, Subsidiary

has two options elect group date as its

transition date or first time adopt in its

enterprise only statement

> If group adopts before the Parent

Parents adoption date is date of Group adoption

Thank you!

Vous aimerez peut-être aussi

- IFRS 1 - First Time AdopterDocument9 pagesIFRS 1 - First Time AdopterAkinwumi AyodejiPas encore d'évaluation

- Ifrs 1Document6 pagesIfrs 1Marc Eric RedondoPas encore d'évaluation

- IFRS 1 First-Time Adoption SummaryDocument2 pagesIFRS 1 First-Time Adoption SummaryJydel FamenteraPas encore d'évaluation

- 1st Tym AdoptionDocument15 pages1st Tym Adoptionmishra2210Pas encore d'évaluation

- Ifrs 1Document10 pagesIfrs 1kadermaho456Pas encore d'évaluation

- First AdoptDocument25 pagesFirst AdoptSetianingsih SEPas encore d'évaluation

- Chapter 23Document40 pagesChapter 23rameelamirPas encore d'évaluation

- Summary of Ifrs 1Document9 pagesSummary of Ifrs 1Divine Epie Ngol'esuehPas encore d'évaluation

- First Time Adoption of Ind As 101Document3 pagesFirst Time Adoption of Ind As 101vignesh_vikiPas encore d'évaluation

- MBC Audited FS 2017 PARENTDocument57 pagesMBC Audited FS 2017 PARENTMikx LeePas encore d'évaluation

- Note 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSDocument6 pagesNote 4 - 1FRS 1 - FIRST TIME ADOPTION OF IFRSdemolaojaomoPas encore d'évaluation

- International Accounting StandardsDocument49 pagesInternational Accounting StandardsShin Hye ParkPas encore d'évaluation

- Interim Standard Comprehensive Project 25 April 2013: Accounts Published Accounts IssuedDocument4 pagesInterim Standard Comprehensive Project 25 April 2013: Accounts Published Accounts IssuedJuan TañamorPas encore d'évaluation

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithPas encore d'évaluation

- IFRS 14 - Regulatory Deferral AccountsDocument3 pagesIFRS 14 - Regulatory Deferral AccountsMarc Eric Redondo100% (1)

- Disclosure Template - FullDocument15 pagesDisclosure Template - FullMarvin CeledioPas encore d'évaluation

- MODULE 2 - NotesDocument5 pagesMODULE 2 - NotesAravind YogeshPas encore d'évaluation

- Ifrs 1 First Time AdoptionDocument27 pagesIfrs 1 First Time AdoptionHagere EthiopiaPas encore d'évaluation

- Table 3: Optional Exemptions From Retrospective ApplicationDocument3 pagesTable 3: Optional Exemptions From Retrospective ApplicationnatiPas encore d'évaluation

- IFRS 1 First-Time AdoptionDocument27 pagesIFRS 1 First-Time Adoptionesulawyer2001Pas encore d'évaluation

- IFRS 1 - For PresDocument27 pagesIFRS 1 - For Presnati67% (3)

- PERFAST Corporation 2016 Financial StatementsDocument9 pagesPERFAST Corporation 2016 Financial StatementsMCDABCPas encore d'évaluation

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadPas encore d'évaluation

- Assignment ON Ifrs1-First Time Adoption of IfrsDocument46 pagesAssignment ON Ifrs1-First Time Adoption of IfrsMohit BansalPas encore d'évaluation

- CFASDocument5 pagesCFASLurissa CabigPas encore d'évaluation

- IFRS TransitionDocument4 pagesIFRS Transitiondarshanshah86Pas encore d'évaluation

- Aspe Vs IfrsDocument49 pagesAspe Vs IfrsafaiziPas encore d'évaluation

- Pfrs 1 First-Time Adoptation of Philippine Financial Reporting StandardsDocument3 pagesPfrs 1 First-Time Adoptation of Philippine Financial Reporting StandardsR.A.Pas encore d'évaluation

- Acctg 112 Reviewer Pas 1 8Document26 pagesAcctg 112 Reviewer Pas 1 8surbanshanrilPas encore d'évaluation

- PFRS SummaryDocument20 pagesPFRS Summaryrena chavezPas encore d'évaluation

- Pas 1 To Pas 7 (Cfas Notes)Document3 pagesPas 1 To Pas 7 (Cfas Notes)Gio BurburanPas encore d'évaluation

- PFRS 11-17Document8 pagesPFRS 11-17Merie Flor BasinilloPas encore d'évaluation

- PFRS 11 Joint ArrangementDocument8 pagesPFRS 11 Joint ArrangementMerie Flor BasinilloPas encore d'évaluation

- Acctg 112 Pas 7 and 8 ReviewerDocument7 pagesAcctg 112 Pas 7 and 8 ReviewersurbanshanrilPas encore d'évaluation

- Ias 1 Presentation of Financial Statements-2Document7 pagesIas 1 Presentation of Financial Statements-2Pia ChanPas encore d'évaluation

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document9 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatPas encore d'évaluation

- "Full" Pfrss Refer To The Standards That We Had DiscussedDocument7 pages"Full" Pfrss Refer To The Standards That We Had DiscussedJustine VeralloPas encore d'évaluation

- PFRS 14: Regulatory Deferral AccountsDocument23 pagesPFRS 14: Regulatory Deferral AccountsMeiPas encore d'évaluation

- Group 47 Assignment Acc306Document18 pagesGroup 47 Assignment Acc306Nathanael MudohPas encore d'évaluation

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document8 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatPas encore d'évaluation

- IFRS StandardsDocument13 pagesIFRS StandardsmulualemPas encore d'évaluation

- IFRS 1: Understanding First-Time Adoption RequirementsDocument27 pagesIFRS 1: Understanding First-Time Adoption RequirementsSabaa ifPas encore d'évaluation

- Philippians 4:13 - Financial Statements (39Document23 pagesPhilippians 4:13 - Financial Statements (39Marcus Monocay100% (1)

- Adoption of New StandardsDocument6 pagesAdoption of New StandardsRievaPas encore d'évaluation

- IAS 1 - Financial StatementsDocument7 pagesIAS 1 - Financial StatementsJOEL VARGHESE CHACKO 2011216Pas encore d'évaluation

- Pas 1Document5 pagesPas 1Christy CanetePas encore d'évaluation

- Presentation of Financial Statements (Copy) (Copy) - TaskadeDocument5 pagesPresentation of Financial Statements (Copy) (Copy) - Taskadebebanco.maryzarianna.olavePas encore d'évaluation

- Acctg 112 Reviewer Chap 34Document15 pagesAcctg 112 Reviewer Chap 34surbanshanrilPas encore d'évaluation

- #3 Pas 1Document6 pages#3 Pas 1Shara Joy B. ParaynoPas encore d'évaluation

- Accounting Standards Update: Lyceum of The Philippines UniversityDocument48 pagesAccounting Standards Update: Lyceum of The Philippines Universitymamasita25Pas encore d'évaluation

- ABA - Annual Report 2018Document146 pagesABA - Annual Report 2018Ivan ChiuPas encore d'évaluation

- Accounting Policy Options in IFRSDocument11 pagesAccounting Policy Options in IFRSSaiful Iksan PratamaPas encore d'évaluation

- Third SessionDocument32 pagesThird SessionroshandimanthaofficialPas encore d'évaluation

- Ias 8Document47 pagesIas 8অরূপ মিস্ত্রী বলেছেনPas encore d'évaluation

- International Financial Reporting Standards (IFRS-1,2,3,4,5)Document13 pagesInternational Financial Reporting Standards (IFRS-1,2,3,4,5)hina4Pas encore d'évaluation

- Accounting StandardsDocument40 pagesAccounting StandardsBhupendraRathorePas encore d'évaluation

- Adamay International Co., Inc.: Note 1 - General InformationDocument36 pagesAdamay International Co., Inc.: Note 1 - General Informationgrecelyn bianesPas encore d'évaluation

- FASB-IASB standards comparisonDocument2 pagesFASB-IASB standards comparisonKomal RehmanPas encore d'évaluation

- CPA Review Notes 2019 - Audit (AUD)D'EverandCPA Review Notes 2019 - Audit (AUD)Évaluation : 3.5 sur 5 étoiles3.5/5 (10)

- Retail Luxury Brands Club SY Cabinet: Co-President: Co-PresidentDocument1 pageRetail Luxury Brands Club SY Cabinet: Co-President: Co-PresidentAsis KoiralaPas encore d'évaluation

- Financial Statements ChecklistDocument1 pageFinancial Statements ChecklistAsis KoiralaPas encore d'évaluation

- MBAA DI Cabinet and RolesDocument1 pageMBAA DI Cabinet and RolesAsis KoiralaPas encore d'évaluation

- Co-Presidents:: Audrey Dotson Jordan Daniel LantzDocument1 pageCo-Presidents:: Audrey Dotson Jordan Daniel LantzAsis KoiralaPas encore d'évaluation

- Title Earnings and Hours Worked, Age Group by Occupation by Two-Digit SOC: ASHE Table 20Document3 334 pagesTitle Earnings and Hours Worked, Age Group by Occupation by Two-Digit SOC: ASHE Table 20Asis KoiralaPas encore d'évaluation

- Operating Leases-Incentives: SIC Interpretation 15Document4 pagesOperating Leases-Incentives: SIC Interpretation 15Anna AntonioPas encore d'évaluation

- Audit Universe and Risk Assessment ToolDocument10 pagesAudit Universe and Risk Assessment ToolAsis KoiralaPas encore d'évaluation

- Monthly Marketing Reporting TemplateDocument20 pagesMonthly Marketing Reporting TemplateIonuț BenaPas encore d'évaluation

- Leading From Day One: Brand ManagementDocument2 pagesLeading From Day One: Brand ManagementAsis KoiralaPas encore d'évaluation

- Duke MMS - Sample - ResumesDocument2 pagesDuke MMS - Sample - ResumesAsis KoiralaPas encore d'évaluation

- Guide To The Occupation MatrixDocument11 pagesGuide To The Occupation MatrixAsis KoiralaPas encore d'évaluation

- Monthly Marketing Reporting TemplateDocument20 pagesMonthly Marketing Reporting TemplateIonuț BenaPas encore d'évaluation

- Solomons-Proverbs - Very Clear SummaryDocument168 pagesSolomons-Proverbs - Very Clear SummaryAsis KoiralaPas encore d'évaluation

- Income Taxes-Changes in The Tax Status of An Entity or Its ShareholdersDocument4 pagesIncome Taxes-Changes in The Tax Status of An Entity or Its ShareholdersAnna AntonioPas encore d'évaluation

- Johnson Workbook 2015Document54 pagesJohnson Workbook 2015Asis Koirala100% (1)

- Quickbooks Setup New Company FileDocument16 pagesQuickbooks Setup New Company FileAsis KoiralaPas encore d'évaluation

- Service Concession Arrangements: Disclosures: SIC Interpretation 29Document6 pagesService Concession Arrangements: Disclosures: SIC Interpretation 29Anna AntonioPas encore d'évaluation

- Examples of Control DeficienciesDocument4 pagesExamples of Control DeficienciesAsis KoiralaPas encore d'évaluation

- Math and Test StrategiesDocument2 pagesMath and Test StrategiesArturo Vergara83% (6)

- CPD Waiver Application and Guidance FormDocument2 pagesCPD Waiver Application and Guidance FormAsis KoiralaPas encore d'évaluation

- IAS-7 Statement of Cash FlowsDocument23 pagesIAS-7 Statement of Cash FlowsAsis KoiralaPas encore d'évaluation

- Ifrs - 1Document17 pagesIfrs - 1Asis KoiralaPas encore d'évaluation

- 9287 Load SheddingDocument3 pages9287 Load SheddingAsis KoiralaPas encore d'évaluation

- Sa June11 Dipabv2faDocument4 pagesSa June11 Dipabv2faAsis KoiralaPas encore d'évaluation

- RoutineDocument2 pagesRoutineAsis KoiralaPas encore d'évaluation

- Internal Audit Roles IDocument20 pagesInternal Audit Roles IJuris Renier MendozaPas encore d'évaluation

- Representation Letter 2012Document3 pagesRepresentation Letter 2012Asis KoiralaPas encore d'évaluation

- Internal Audit Roles IIDocument20 pagesInternal Audit Roles IIJuris Renier MendozaPas encore d'évaluation

- Acca p1 NotesDocument67 pagesAcca p1 NotesAsis KoiralaPas encore d'évaluation