Académique Documents

Professionnel Documents

Culture Documents

Presentation

Transféré par

jifinjames99Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Presentation

Transféré par

jifinjames99Droits d'auteur :

Formats disponibles

- JIFIN JAMES

REGULATORS IN INDIA

Reserve Bank of India

Ministry of Finance

Securities and Exchange Board of India(SEBI)

FRDA)

National Housing Bank (NHB)

National Bank for Agriculture and Rural

Development (NABARD)

Ministry of Corporate Affairs (MCA)

Pension Funds Regulatory and Development

Authority (PFRDA)

Insurance Regulatory and Development

Authority of India (IRDAI)

Company Affairs (DCA)

Reserve Bank of India

RBI is the Central Bank of India.

It was established on 1st April 1935.

By RBI act - 1934.

RBI is the apex institution to regulate monitory

and financial system of the country.

Securities and Exchange Board of India (SEBI)

SEBI was established with statutory powers on 12

th

April 1992.

The objective of SEBI is to protect the interests of

investors in securities and to promote the

development of, and to regulate the securities

market.

Ministry of Finance

Ministry of Finance is the ministry of the

Government of India

deals with the taxation, capital market, capital

market, financial legislation, centre and state

finances, and union budget.

It studies the overall trend of economy and

formulate and legislate rules and regulations

accordingly.

It is a Indian Government ministry charged with

monitoring the Companies Act 1956 and other acts

related to private sector.

I t is responsible for regulation of Indian

enterprises in service and industrial sector.

The ministry administers various acts such as

Companies Act 1956, The Competition Act 2002

and The MRTP Act 1969, Company secretaries Act

etc.

Ministry of Corporate Affairs (MCA)

Insurance Regulatory and Development

Authority of India (IRDAI)

The IRDAI was formed on 1999.

IRDAI is introduced to end the monopoly of

state owned companies and to give Insurance

Regulatory Authority power to control the

insurance sector.

The authority is a body corporate named

insurance regulatory and development authority

having perpetual succession and common seal.

Objectives of Financial Regulation

The following are the major objectives of

financial regulation:-

Financial stability- to ensure protection and

enhance stability of the financial system and

the economy.

Prevention of malpractices- aims at the frauds

and crimes relating to financial system.

Consumer protection-ensure protection to the

consumers and the various players in the

economy.

to bring confidence in the financial system

and the economy.

--------------------------------------------------------

-JIFIN JAMES

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Whole Life InsuranceDocument4 pagesWhole Life Insuranceprasanthgeni22Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- StatementDocument2 pagesStatementZomi MessengerPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Welcome To RBI - Application Form Print PDFDocument1 pageWelcome To RBI - Application Form Print PDFRevathikalpanaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- NAFA Money Market FundsDocument2 pagesNAFA Money Market FundschqaiserPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Document Custody Services: Leadership in The IndustryDocument1 pageDocument Custody Services: Leadership in The IndustryNye LavallePas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- TT18 - Credit Card Repayment SpreadsheetDocument6 pagesTT18 - Credit Card Repayment SpreadsheetlugoskyPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Chapter 04 PQDocument3 pagesChapter 04 PQTayyeb AhmadPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Camels RatingDocument14 pagesCamels RatingsmgajraniPas encore d'évaluation

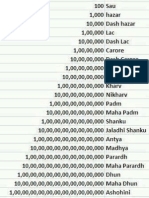

- Count On ZerosDocument3 pagesCount On Zerosmahendrasing2Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Insurance & Risk Management SyllabusDocument1 pageInsurance & Risk Management SyllabuskunkumabalaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Application For Cash Surrender/ Termination Value: The President & General ManagerDocument1 pageApplication For Cash Surrender/ Termination Value: The President & General ManagerRodnieGubatonPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Balance Sheet GodrejDocument4 pagesBalance Sheet Godrejjohn11051990100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- AAIB Money Market Fund (Juman) : Fact Sheet MayDocument1 pageAAIB Money Market Fund (Juman) : Fact Sheet Mayapi-237717884Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- BOD Vs PPDocument9 pagesBOD Vs PPPratik SharmaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- CUBihar Dec12 ChallanDocument1 pageCUBihar Dec12 Challannareshjangra397Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Proof of Your No Claims Bonus: Call Customer Services OnDocument2 pagesProof of Your No Claims Bonus: Call Customer Services OnstephjazzercisePas encore d'évaluation

- Credit Creation Economics For MbaDocument12 pagesCredit Creation Economics For Mbavinodgupta1960Pas encore d'évaluation

- Application Letter 17741Document1 pageApplication Letter 17741Ganga DharaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Lownds CFPB 3 of 3Document1 704 pagesLownds CFPB 3 of 3Judicial Watch, Inc.Pas encore d'évaluation

- Gap Analysis For ICICIDocument3 pagesGap Analysis For ICICISandeep JannuPas encore d'évaluation

- Welcome To IBPS - (CWE - Clerks-IV) - Application Form PrintDocument1 pageWelcome To IBPS - (CWE - Clerks-IV) - Application Form Printrickyali_rocksPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Jesus TambuntingDocument5 pagesJesus TambuntingheinzteinPas encore d'évaluation

- Ecs FormDocument2 pagesEcs FormNanette CarvalhoPas encore d'évaluation

- Meaning of Cash Reserve Ratio and Statutory Liquidity....Document7 pagesMeaning of Cash Reserve Ratio and Statutory Liquidity....Radhey JangidPas encore d'évaluation

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra50% (2)

- Loan AgreementDocument2 pagesLoan AgreementKago KhachanaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Alternative InvestmentDocument3 pagesAlternative InvestmentdhwaniPas encore d'évaluation

- A4V Canada - To Make A4V Work in Canada Without Any HassleDocument2 pagesA4V Canada - To Make A4V Work in Canada Without Any HassleCristian Cambiazo100% (2)

- Banking Industry: Structure and CompetitionDocument34 pagesBanking Industry: Structure and CompetitionA_StudentsPas encore d'évaluation

- Questionnaire On Investment Pattern of IndividualsDocument3 pagesQuestionnaire On Investment Pattern of IndividualsJoyal Anthony PintoPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)