Académique Documents

Professionnel Documents

Culture Documents

LTD

Transféré par

Carol Recilla JampasTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LTD

Transféré par

Carol Recilla JampasDroits d'auteur :

Formats disponibles

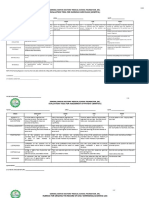

REAL ESTATE

MORTGAGE

MORTGAGE

May a deed of mortgage provide that

future amounts borrowed be included as

part of the mortgage obligation?

The provisions in the first mortgage deed,

including as part of the obligation future

amounts that may be borrowed by the

mortgagor-debtors is not improper

MORTGAGE IN BAD FAITH

A person who deliberately ignores a

significant fact that would create a

suspicion in an otherwise reasonable

person is not an innocent purchaser for

value (DBP vs CA, 331 SCRA 267)

WHO MAY CONSTITUTE

MORTGAGE

It is only the absolute owner of the

property who can constitute a valid

mortgage on it (Art. 2085, NCC)

MORTGAGEE IN GOOD FAITH

A valid mortgage under Art. 2085 of the

Civil Code is that the thing mortgage be

owned by the person who mortgage it.

The innocent mortgagee for value

principle contemplates cases involving

individuals who by their negligence

enabled other persons to cause the

cancellation of the original TCT and the

issuance of a new one.

ASSIGNMENT OF THE RIGHT OF

THE MORTGAGEE

The mortgagee may convey or assign his

mortgage credit to a third person totally

or partially, provided that it is effected by

a public instrument and that a notice

therefore is given to the debtor and that is

recorded in the registry.

COURSES OF ACTIONS LEFT TO

MORTGAGEE UPON DEATH OF

MORTGAGOR

1. He may abandon the security and file his

claim with the clerk of court in the testate or

intestate proceedings against the

deceaseds estate and share in the general

distribution of the assets thereof;

2. He may foreclose the mortgage by ordinary

action in court, making the executor or

administrator of the estate a party

defendant and ask for deficiency judgment

in case the proceeds of the sale are not

sufficient

3. He may rely exclusively upon his

mortgage and foreclose the same at any

time within the period of statute of

limitations and in such event he shall not be

admitted as creditor of the estate nor share

in the general distribution of the assets of the

decedents estate.

MAY A MARRIED WOMAN

MORTGAGE WITHOUT MARITAL

CONSENT?

Article 140 of the Civil Code provides that a

married woman of age may mortgage,

encumber, alienate or otherwise dispose of

her paraphernal property without the

permission of the husband, and appear alone

in court to litigate with regard to the same

In case the woman shall be the administrator

of the property shall have the rights of the

husband when he was the administrator

Art. 214 of the Civil Code provides that the wife may

dispose of or mortgage her own separate estate

without the consent of her husband, including what

she may accumulate from her profession, business or

industry

In an absolute community, neither spouse may

alienate or encumber any common property

without the consent of the other.

When the husband acts as the administrator of the

conjugal partnership, he cannot alienate or

encumber any real property of the conjugal

partnership without the wifes consent.

UNREGISTERED SALE VS.

MORTGAGE

The unregistered sale is superior than the

registered mortgage. (dela Merced vs.

GSIS, et al., GR No. 140398, Sept. 1, 2002)

The owner of registered land may

mortgage it by executing the deed in a

form sufficient in law.

The instrument shall be registered and

shall take effect upon the title only from

the time of registration.

REGISTRATION OF MORTGAGE

No new title shall be entered or issued pursuant to

any instrument which does not divest the

ownership or title from the owner or from the

transferee of the registered owners.

All interest in the registered land less than the

ownership shall be registered by filing with the

Registrar of Deeds the instrument which creates or

transfers or claims such interest and by a brief

memorandum thereof made by the Registrar of

Deeds upon the certificate of title and signed by

him.

Real mortgage need be registered or filed in the

Registry of Deeds of the city or province where the

land lies. (Sec. 124, Act 496)

If the deed of mortgage is not registered, the

mortgage is nevertheless binding between the

parties. (Art. 2125 Civil Code of the Phil.)

The mortgagees knowledge of a prior unregistered

mortgage is equivalent to registration since the

purpose of the law has already been served.

The registration of mortgage binds third parties.

CONVEYANCING: FORMS

Deeds, conveyances , encumbrances,

discharges, powers of attorney and other

voluntary instruments, whether affecting

registered or unregistered land, executed

in accordance with law in the form of

public instrument shall be registrable.

FORGED POWER OF ATTOREY

When a person, under a forged power of

attorney , mortgages a property

belonging to another, the mortgage

thereby executed is void.

LENGTH OF MORTGAGE :

Mortgage to Aliens

Any provision of law to the contrary

notwithstanding, private real property may be

mortgaged in favor of ay individual,

corporation, or association, but the

mortgagee or his successor-in-interest, if

disqualified to acquire or hold lands of the

public domain in the Philippines, shall not take

into possession or enjoy the fruits of the

mortgaged property during the existence of

the mortgage and shall not bid or take part in

any sale of such real property in case of

forclosure.

MORTGAGE WITHOUT FIXED

PERIOD

The obligation is not due ad payable until

an action is commenced by the

mortgagee against the mortgagor for the

purpose of having the court fix the date

on and after which the instrument is

payable and the date of maturity is fixed

in pursuance thereto.

HOW MORTGAGE MAY BE

DISCHARGED

A mortgaged may be discharged by the

creditor executing a public instrument

cancelling or releasing the mortgage

substantially in accordance with form

prescribed by Sec. 112 of PD 1529.

The instrument must be presented to the

RD where the land lies together with the

owners duplicate copy for registration.

FORCLOSURE

A remedy available to the mortgagee by

which he subjects the mortgaged

property to the satisfaction of the

obligation, to secure which the mortgage

was given.

Grounds;

Principal obligation was not paid

Condition, stipulation, or warranty is

violated by the mortgagor

JUDICIAL vs.

EXTRAJUDICIAL

JUDICIAL FORCLOSURE

A certified copy of the final order of the

court confirming the sale shall be

registered with the RD.

If there is no right of redemption, the title

of the mortgagor shall be cancelled and

a new title shall be issued to the name of

the purchaser

When there is a right of redemption, the certificate of

title of the mortgagor shall not be cancelled but the

certificate confirming the sale shall be registered by a

brief memorandum thereof made by the Registrar of

Deeds upon the certificate of title

In case of redemption, the certificate of redemption

shall be filed with the registry of deeds and a brief

memorandum shall be annotated on the title of the

mortgagor

If the property is not redeemed, the final deed of sale

shall be executed by the sheriff in favor of the purchaser

at a foreclosure sale shall be registered with the Registrar

of Deeds; whereupon the title of the mortgagor shall be

cancelled, and a new certificate issued in the name of

the purchaser

Public action is always under the direction of sheriff

with the owner of the property being allowed to

participate

A deficiency judgment may be asked to cover any

pat of the obligation still unsatisfied.

NATURE OF ACTION

In personam

Based on personal cause of action and binding

only upon the defendant personally

In rem

One directed exclusively against the property

which is responsible for the satisfaction of the

claim of the party bringing the action

Quasi in rem

An action based on personal claim but is sought

to be enforced against specific property of the

defendant.

VENUE FOR FORECLOSURE

Action for foreclosure must be brought in

the Regional Trial Court of the province

where property lies, unless there is an

agreement between parties.

INSTITUTION OF FORECLOSURE

SUIT

The mortgagee is not compelled to rely

on his security and is under no obligation

to foreclose the mortgage.

An action for foreclosure may be

instituted in accordance with Rule 68 of

the Rules of court.

CONTENTS OF COMPLAINT

The complaint shall set forth date and due

execution of mortgage, its assignments,

names and residence of the mortgagors and

mortgagee, description of the mortgaged

premises, a statement of the date of the note

or other obligation secured by the mortgage,

the amount claimed to be unpaid thereon

and the names and residences of all persons

having or claiming an interest in the premises

subordinate in right to that of the holder of

the mortgagee, all of whom shall be made

defendants in the action

Section 1 of PD 385 makes it mandatory for

government financial institutions to foreclose the

collaterals and/or security for any loan, credit,

accommodation and/or guarantees granted by

them whenever the arrearages on such account,

including accrued interest and other charges,

amount to at least twenty percent (20%) of the total

outstanding obligations including interests and

other charges, as appearing in the books of

account and/or related records of the financial

institution concerned

Sec 2 of the said law provides that no restraining

order, temporary or permanent injunction shall be

issued by the court against any government

financial institution in any action taken by such

institution in compliance with mandatory

foreclosure provided in sec 1 thereof whether such

restraining order is sought by the borrower or any

third party, except after due hearing in which it is

established by the borrower and admitted by the

government institution that 20% of the outstanding

arrearages had been paid after the filing of

foreclosure proceedings

ACTION TO FORECLOSE

MORTGAGE: PRESCRIPTION

The right of action to foreclose a

mortgage affecting registered land

prescribes after ten years according to

article 1142 of the Civil Code

ATTACHMENT OF

UNMORTGAGED PROPERTY

The court has jurisdiction to grant an

attachment against the property of the

debtor to be levied upon property not

covered by the mortgage, upon showing

by affidavit that the value of the

mortgaged property is insufficient to

cover the debt and that the debtor has

disposed, or is to disposed of his other

property with intent to defraud the

creditor.

JUDGMENT

If the court shall find the fact set to be true, it

shall ascertain the amount to the plaintiff

upon the mortgage debt or obligation,

including interest and cost, and shall render

judgment for the sum so found due and order

the same to be paid unto court within the

period of not less than 90 days from the date

of service of such order, and that in default of

such payment, the property shall be sold to

realize the mortgage debt and cost.

SALE OF PROPERTY

The court shall order the sale of the property if

the judgment debtor shall fail to pay the

amount ascertained by the court.

It shall be sold in the manner and under the

regulations that govern sales of real

properties.

The sale shall operate to divest the rights of all

parties to the action and to vest their rights in

the purchaser, subject to such rights of

redemption as may be allowed by law

There is no right of redemption from a judicial

foreclosure after confirmation of sale except those

granted by banks or banking institutions as provided

by General Banking Act.

DISPOSTION OF PROCEEDS

The money obtained from the sale of

mortgaged property shall be, after deducting

costs of the sale, paid to the person

foreclosing the mortgage, and when there

shall be surplus, after paying off such

mortgage, the shall be paid to junior

encumbrances in the order of priority, to be

ascertained by the court, or if there is no

encumbrances or there be surplus after

payment of such encumbrances, to the

mortgagor or his agent, or to the person

entitled to it.

CONFIRMATION OF SALE

A hearing is held for confirmation of sale.

A notice shall be given to interested

parties, failure to do so is a good cause

for setting aside the confirmation

The mortgaged property should sold to

the highest bidder, any stipulation in the

mortgage contract fixing an upset price is

in violation of the rules of court.

CANCELLATION OF SALE

When the property was sold for an

inadequate price or was made not in

accordance with law, when there was

fraud, collusion, accident, mutual mistake,

breach of trust, or misconduct by the

purchaser, the sale may be set aside.

the sale shall not set aside by inadequacy

alone unless it is so great that it is shocking

to the conscience.

DEFICIENCY JUDGMENT

If there shall be a balance due to the plaintiff

upon applying the proceeds of sale, the

court, upon motion shall render a judgment

against the defendant for any such balance

for which, by the record of the case, may be

personally liable to the plaintiff upon which

execution may issue immediately if the

balance is all due at the time of the rendition

of the judgment

If not, the balance shall be due on the terms

stated on the original contract

MORTGAGEE FILES A

PERSONAL ACTION

If a mortgagee files for a personal action

for the recovery of indebtedness, he shall

lose the right to foreclose the mortgage.

Picking up one of the options shall waive

the right over the other option.

RIGHTS AND OBLIGATIONS OF

SECOND MORTGAGEE IN A

JUDICIAL FORECLOSURE OF

MORTGAGE

The second mortgagee has the right to be joined

as defendants together with the mortgagor

To participate in a public bidding of the

mortgaged property held under the judicial

foreclosure

The second mortgagee is bound to acknowledge

and respect the priority or preferred right of the

first mortgagee.

He must exercise his right to redeem or be

debarred from enforcing any further claim on the

mortgaged property.

FINAL RECORD IN JUDICIAL

FORECLOSURE

Sec 7, Rule 68 of the Rules of Court requires

that the final record of a foreclosure

proceeding shall set forth, in brief, the

proceedings under the order of sale, the

order confirming the sale, the name of the

purchaser, with the description of the

property by him purchased, and the

certificate of redemption, if any, or the final

deed of reconveyance executed in favor of

the purchaser

EXTRAJUDICIAL FORECLOSURE

A certificate of sale executed by the

officer who conducted by the sale shall

be filed with the Registrar of Deeds who

shall make a brief memorandum on the

Transfer Certificate of Title

In case of redemption, the certificate of

redemption shall be filed with the registry

of deeds and a brief memorandum shall

be annotated on the title of the

mortgagor

In case of non-redemption, the purchaser at

foreclosure sale shall file with the Registrar of Deeds,

either a final deed of sale executed by the person

authorized by virtue of the power of attorney

embodied in the deed of mortgage or his sworn

statement attesting to the fact of non-redemption.

The Registrar of Deeds shall issue a new certificate

in favor of the purchaser and cancel the previous

title in favor of the mortgagor

Public auction may be under the direction of either

the sheriff of the province, the justice or auxilliary

justice of peace of the municipality, or a notary

public.

There is no such thing as deficiency judgment

because there is no court action.

Vous aimerez peut-être aussi

- Position PaperDocument6 pagesPosition PaperCarol Recilla JampasPas encore d'évaluation

- Resignation LetterDocument2 pagesResignation LetterCarol Recilla JampasPas encore d'évaluation

- Thesis Title PageDocument19 pagesThesis Title PageCarol Recilla JampasPas encore d'évaluation

- Duties & ResponsibilitiesDocument1 pageDuties & ResponsibilitiesCarol Recilla JampasPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- LECTURE 1.COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICS - Ver 2Document24 pagesLECTURE 1.COMMUNICATION PROCESSES, PRINCIPLES, AND ETHICS - Ver 2Trixia Nicole De LeonPas encore d'évaluation

- Soal Pas Myob Kelas Xii GanjilDocument4 pagesSoal Pas Myob Kelas Xii GanjilLank BpPas encore d'évaluation

- Economic Survey 2023 2Document510 pagesEconomic Survey 2023 2esr47Pas encore d'évaluation

- SPE-199498-MS Reuse of Produced Water in The Oil and Gas IndustryDocument10 pagesSPE-199498-MS Reuse of Produced Water in The Oil and Gas Industry叶芊Pas encore d'évaluation

- DODGER: Book Club GuideDocument2 pagesDODGER: Book Club GuideEpicReadsPas encore d'évaluation

- Adrenal Cortical TumorsDocument8 pagesAdrenal Cortical TumorsSabrina whtPas encore d'évaluation

- أثر البحث والتطوير على النمو الاقتصادي - دراسة قياسية لحالة الجزائر (1990 -2014)Document17 pagesأثر البحث والتطوير على النمو الاقتصادي - دراسة قياسية لحالة الجزائر (1990 -2014)Star FleurPas encore d'évaluation

- PEDIA OPD RubricsDocument11 pagesPEDIA OPD RubricsKylle AlimosaPas encore d'évaluation

- Electric Trains and Japanese Technology: Breakthrough in Japanese Railways 4Document9 pagesElectric Trains and Japanese Technology: Breakthrough in Japanese Railways 4Aee TrDPas encore d'évaluation

- Filipino Chicken Cordon BleuDocument7 pagesFilipino Chicken Cordon BleuHazel Castro Valentin-VillamorPas encore d'évaluation

- Surat Textile MillsDocument3 pagesSurat Textile MillsShyam J VyasPas encore d'évaluation

- Bus Organization of 8085 MicroprocessorDocument6 pagesBus Organization of 8085 MicroprocessorsrikrishnathotaPas encore d'évaluation

- Assignment of Public Speaking Section A2Document2 pagesAssignment of Public Speaking Section A2Hamza KhalidPas encore d'évaluation

- Research On Goat Nutrition and Management in Mediterranean Middle East and Adjacent Arab Countries IDocument20 pagesResearch On Goat Nutrition and Management in Mediterranean Middle East and Adjacent Arab Countries IDebraj DattaPas encore d'évaluation

- Dialogue About Handling ComplaintDocument3 pagesDialogue About Handling ComplaintKarimah Rameli100% (4)

- Baybay - Quiz 1 Code of EthicsDocument2 pagesBaybay - Quiz 1 Code of EthicsBAYBAY, Avin Dave D.Pas encore d'évaluation

- Congestion AvoidanceDocument23 pagesCongestion AvoidanceTheIgor997Pas encore d'évaluation

- Forensic BallisticsDocument23 pagesForensic BallisticsCristiana Jsu DandanPas encore d'évaluation

- 5.4 Marketing Arithmetic For Business AnalysisDocument12 pages5.4 Marketing Arithmetic For Business AnalysisashPas encore d'évaluation

- 12-Zoomlion 70t Crawler Crane Specs - v2.4Document2 pages12-Zoomlion 70t Crawler Crane Specs - v2.4Athul BabuPas encore d'évaluation

- Problem Based LearningDocument23 pagesProblem Based Learningapi-645777752Pas encore d'évaluation

- Trainee'S Record Book: Technical Education and Skills Development Authority (Your Institution)Document17 pagesTrainee'S Record Book: Technical Education and Skills Development Authority (Your Institution)Ronald Dequilla PacolPas encore d'évaluation

- Event Planning Sample Cover Letter and ItineraryDocument6 pagesEvent Planning Sample Cover Letter and ItineraryWhitney Mae HaddardPas encore d'évaluation

- Surefire Hellfighter Power Cord QuestionDocument3 pagesSurefire Hellfighter Power Cord QuestionPedro VianaPas encore d'évaluation

- January Payslip 2023.pdf - 1-2Document1 pageJanuary Payslip 2023.pdf - 1-2Arbaz KhanPas encore d'évaluation

- Manual StereoDocument29 pagesManual StereoPeter Mac RedPas encore d'évaluation

- University of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveDocument4 pagesUniversity of Engineering & Management, Jaipur: (A) Production (B) Quality (C) Product Planning (D) All of The AboveSupriyo BiswasPas encore d'évaluation

- 1 3 Quest-Answer 2014Document8 pages1 3 Quest-Answer 2014api-246595728Pas encore d'évaluation

- WRAP HandbookDocument63 pagesWRAP Handbookzoomerfins220% (1)

- College PrepDocument2 pagesCollege Prepapi-322377992Pas encore d'évaluation