Académique Documents

Professionnel Documents

Culture Documents

Bull Spread

Transféré par

MALLIKARJUN0 évaluation0% ont trouvé ce document utile (0 vote)

75 vues25 pagesBull Spread

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBull Spread

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

75 vues25 pagesBull Spread

Transféré par

MALLIKARJUNBull Spread

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 25

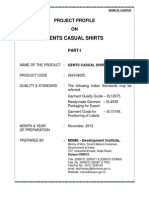

The bull call spread option trading strategy is employed

when the options trader thinks that the price of the

underlying asset will go up moderately in the near

term.

Bull call spreads can be implemented by buying an at-

the-money call option while simultaneously writing a

higher striking out-of-the-money call option of the

same underlying security and the same expiration

month.

Limited Upside profits

Maximum gain is reached for the bull call spread

options strategy when the stock price move above the

higher strike price of the two calls and it is equal to the

difference between the strike price of the two call

options minus the initial debit taken to enter the

position.

The formula for calculating maximum profit is

given below:

Max Profit = Strike Price of Short Call Strike

Price of Long Call Net Premium Paid

Commissions Paid

Max Profit Achieved When Price of Underlying

>= Strike price of Short Call

Limited Downside risk

The bull call spread strategy will result in a loss if

the stock price declines at expiration.

The formula for calculating maximum loss is given

below:

Max Loss = Net Premium Paid + Commissions Paid

Max Loss Occurs When Price of Underlying <=

Strike Price of Long Call

Breakeven point(s)

The underlie price at which break-even is

achieved for the bull call spread position can

be calculated using the following formula.

Breakeven Point = Strike Price of Long Call +

Net Premium Paid

EXAMPLE

Nifty index Current Value

4191.10

Buy ITM Call

Option

Strike Price (Rs.)

4100

Mr. XYZ Pays Premium (Rs.)

170.45

Sell OTM Call

Option

Strike Price (Rs.)

4400

Mr. XYZ

Receives

Premium (Rs.)

35.40

Net Premium Paid

(Rs.)

135.05

Break Even Point

(Rs.)

4235.05

Strategy : Buy a Call with a lower strike (ITM) + Sell a Call with a higher

strike (OTM)

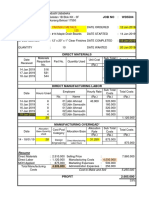

PAYOFF OF BULL CALL SPREAD

On expiry

Nifty Closes

at

Net Payoff from Call

Buy (Rs.)

Net Payoff from

Call Sold (Rs.)

Net Payoff

(Rs.)

3600.00 -170.45 35.40 -135.05

3700.00 -170.45 35.40 -135.05

3800.00 -170.45 35.40 -135.05

3900.00 -170.45 35.40 -135.05

4000.00 -170.45 35.40 -135.05

4100.00 -170.45 35.40 -135.05

4200.00 -70.45 35.40 -35.05

4235.05 -35.40 35.40 0

4300.00 29.55 35.40 64.95

4400.00 129.55 35.40 164.95

4500.00 229.55 -64.60 164.95

4600.00 329.55 -164.60 164.95

4700.00 429.55 -264.60 164.95

4800.00 529.55 -364.60 164.95

4900.00 629.55 -464.60 164.95

5000.00 729.55 -564.60 164.95

Bull Spread Using Calls

X

1

X

2

Profit

S

T

Spread- Bull Spread-Example

An investor buys for Rs.8 a call with a strike price of

Rs.50 and sells a call for Rs.5 with a strike price of

Rs.60.

Bull Spread Long Call EX Price Rs-50 & Premium Rs 8 (X1)

Received, Short Call Ex Price Rs-60 & Premium Rs 5 (X2)

Given.

Share Price Ex Price X1

(Long call)

Profit on

Ex. (X1)

Ex Price X2

(Short call)

Profit on

Ex. (X2)

Net

Profit/Loss

40 50 -8 60 5 -3

45 50 -8 60 5 -3

50 50 -8 60 5 -3

55 50 -3 60 5 2

60 50 2 60 5 7

65 50 7 60 0 7

70 50 12 60 -5 7

80 50 22 60 -15 7

Bull Put Spread

The bull put spread option trading strategy is

employed when the options trader thinks that

the price of the underlying asset will go up

moderately in the near term.

The bull put spread options strategy is also

known as the bull put credit spread as a credit

is received upon entering the trade.

Bull put spreads can be implemented by selling a higher

striking in-the-money put option and buying a lower

striking out-of-the-money put option on the same

underlying stock with the same expiration date.

Limited Upside Profit

If the stock price closes above the higher strike price on

expiration date, both options expire worthless and the bull

put spread option strategy earns the maximum profit which

is equal to the credit taken in when entering the position.

The formula for calculating maximum profit is given below:

Max Profit = Net Premium Received Commissions Paid

Max Profit Achieved When price of Underlying >= Strike

price of Short put

Limited Downside Risk

If the stock price drops below the lower strike

price on expiration date, then the bull put spread

strategy incurs a maximum loss equal to the

difference between the strike prices of the two

puts minus the net credit received when putting

on the trade.

Max Loss = Strike Price of Short Put Strike Price

of Long Put Net Premium Received +

Commissions Paid

Max Loss Occurs When Price of Underlying <=

Strike Price of Long put

Breakeven Point(s)

The underlier price at which break-even is

achieved for the bull put spread position can

be calculated can be calculated using the

following formula.

Breakeven Point = Strike price of Short Put -

Net Premium Received

EXAMPLE

Nifty Index Current Value

4191.10

Sell Put Option Strike Price (Rs.)

4000

Mr. XYZ Receives Premium (Rs.)

21.45

Buy Put Option Strike Price (Rs.)

3800

Mr. XYZ Pays Premium (Rs.)

3.00

Current Value Net Premium

Received (Rs.)

18.45

Break Even Point

(Rs.)

3981.55

Strategy : Sell a Put + Buy a Put

PAYOFF OF BULL PUT SPREAD

On expiry Nifty

Closes at

Net Payoff from

Put Buy (Rs.)

Net Payoff from

Put Sold (Rs.)

Net Payoff

(Rs.)

3500.00 297.00 -478.55 -181.55

3600.00 197.00 -378.55 -181.55

3700.00 97.00 -278.55 -181.55

3800.00 -3.00 -178.55 -181.55

3900.00 -3.00 -78.55 -81.55

3981.55 -3.00 3.00 0.00

4000.00 -3.00 21.45 18.45

4100.00 -3.00 21.45 18.45

4200.00 -3.00 21.45 18.45

4300.00 -3.00 21.45 18.45

v4400.00 -3.00 21.45 18.45

4500.00 -3.00 21.45 18.45

4600.00 -3.00 21.45 18.45

4700.00 -3.00 21.45 18.45

4800.00 -3.00 21.45 18.45

Bull Spread Using Puts

X

1

X

2

Profit

S

T

An investor buys a put option with an exercise

price equal to Rs.40 for Rs.6 and writes an

option identical in all respects except the

exercise price that is equal to Rs.50 for a price

of Rs.9

Bearish Trading Strategies

Bearish strategies in options trading are

employed when the options trader expects

the underlying stock price to move

downwards.

It is necessary to assess how low the stock

price can go and the timeframe in which the

decline will happen in order to select the

optimum trading strategy.

BEAR CALL SPREAD STRATEGY: SELL

ITM CALL, BUY OTM CALL

When to use: When the investor is mildly bearish

on market.

Risk: Limited to the difference between the two

strikes minus the net premium.

Reward: Limited to the net premium received for

the position i.e., premium received for the short

call minus the premium paid for the long call.

Break Even Point: Lower Strike + Net credit

EXAMPLE

Nifty index Current Value

2694

Sell ITM Call

Option

Strike Price (Rs.)

2600

Mr. XYZ

Receives

Premium (Rs.) 154

Buy OTM Call

Option

Strike Price (Rs.) 2800

Mr. XYZ pays Premium (Rs.)

49

Net premium received

(Rs.)

105

Break Even Point (Rs.)

2705

Strategy : Sell a Call with a lower strike (ITM)+ Buy a Call with a higher

strike (OTM)

PAYOFF OF BEAR CALL SPREAD

On expiry

Nifty Closes

At

Net Payoff from Call

Sold (Rs.)

Net Payoff from Call

bought (Rs.)

Net Payoff

(Rs.)

2100 154 -49 105

2200 154 -49 105

2300 154 -49 105

2400 154 -49 105

2500 154 -49 105

2600 154 -49 105

2700 54 -49 5

2705 49 -49 0

2800 -46 51 -95

2900 -146 151 -95

3000 -246 251 -95

3100 -346 351 -95

3200 -446 451 -95

3300 -546 551 -95

When to use: When you are moderately bearish on

market direction

Risk: Limited to the net amount paid for the spread. i.e.

the premium paid for long position less premium

received for short position.

Reward: Limited to the difference between the two

strike prices minus the net premium paid for the

position.

Break Even Point: Strike Price of Long Put Net

Premium Paid

BEAR PUT SPREAD STRATEGY:BUY PUT,

SELL PUT

EXAMPLE

Nifty index Current Value

2694

Buy ITM Put Option Strike Price (Rs.)

2800

Mr. XYZ pays Premium (Rs.)

132

Sell OTM Put Option Strike Price (Rs.)

2600

Mr. XYZ receives Premium (Rs.)

52

Net Premium Paid

(Rs.)

80

Break Even Point

(Rs.)

2720

Strategy : BUY A PUT with a higher strike (ITM) + SELL A PUT with a

lower strike (OTM)

PAYOFF OF BEAR PUT SPREAD

On expiry Nifty

closes at

On expiry Nifty

closes at

Net Payoff from

Put Sold (Rs.)

Net payoff

(Rs.)

2200 468 -348 120

2300 368 -248 120

2400 268 -148 120

2500 168 -48 120

2600 68 52 120

2720 -52 52 0

2700 -32 52 20

2800 -132 52 -80

2900 -132 52 -80

3000 -132 52 -80

3100 -132 52 -80

Vous aimerez peut-être aussi

- Chapter 1 TQM Evolution Ppt2Document33 pagesChapter 1 TQM Evolution Ppt2MALLIKARJUNPas encore d'évaluation

- Module 2 - Location StrategyDocument70 pagesModule 2 - Location StrategyMALLIKARJUNPas encore d'évaluation

- C As E 1-GW PergaultDocument4 pagesC As E 1-GW PergaultMALLIKARJUN0% (1)

- MKVIB, A Goverment of Mizoram Undertaking, India - PMEGP Trade ListDocument11 pagesMKVIB, A Goverment of Mizoram Undertaking, India - PMEGP Trade ListMALLIKARJUNPas encore d'évaluation

- Mba Draft Matrix FinDocument156 pagesMba Draft Matrix FinMALLIKARJUNPas encore d'évaluation

- Cmdatahien Projprof Gents Casual ShirtsDocument10 pagesCmdatahien Projprof Gents Casual ShirtsMALLIKARJUNPas encore d'évaluation

- Cross HedgingDocument1 pageCross HedgingMALLIKARJUNPas encore d'évaluation

- Payment Banks in IndiaDocument9 pagesPayment Banks in IndiaMALLIKARJUNPas encore d'évaluation

- Self Help Groups in BGKDocument25 pagesSelf Help Groups in BGKMALLIKARJUNPas encore d'évaluation

- Capital BudgetingDocument69 pagesCapital BudgetingMALLIKARJUNPas encore d'évaluation

- A Swot Analysis of Fdi in Indian Retail SectorDocument7 pagesA Swot Analysis of Fdi in Indian Retail SectorMALLIKARJUNPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- HSEDocument308 pagesHSEAnonymous 2JNPJ2aXPas encore d'évaluation

- UBI Summer RepotDocument58 pagesUBI Summer RepotAkanksha Pamnani100% (1)

- COST SHEET Atau JOB COSTDocument1 pageCOST SHEET Atau JOB COSTWiraswasta MandiriPas encore d'évaluation

- Interest Rate RiskDocument18 pagesInterest Rate RiskDonny RamantoPas encore d'évaluation

- The Lean CRMDocument8 pagesThe Lean CRMSidak KatyalPas encore d'évaluation

- 4 HR 5 EMA SystemDocument10 pages4 HR 5 EMA SystemBaljeet Singh100% (1)

- Uk Politics Dissertation TopicsDocument8 pagesUk Politics Dissertation TopicsPaperWritingServiceUK100% (1)

- The Dar Es Salaam Stock ExchangeDocument12 pagesThe Dar Es Salaam Stock ExchangeMsuyaPas encore d'évaluation

- Entrep - BrandingDocument13 pagesEntrep - BrandingDorie MinaPas encore d'évaluation

- TRANSCRIPT - How To Write A Business Plan Transcript 1Document22 pagesTRANSCRIPT - How To Write A Business Plan Transcript 1Frank ValenzuelaPas encore d'évaluation

- Flores - Week 1 - BUSI-612 - D01 - Spring2023Document11 pagesFlores - Week 1 - BUSI-612 - D01 - Spring2023Charlene de GuzmanPas encore d'évaluation

- Course OutlineDocument217 pagesCourse OutlineAðnan YasinPas encore d'évaluation

- CPV by WeygandtDocument50 pagesCPV by WeygandtJen NettePas encore d'évaluation

- H.Edris - Quiz 3Document4 pagesH.Edris - Quiz 3Najmah RigaroPas encore d'évaluation

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticPas encore d'évaluation

- Finance ReviewerDocument3 pagesFinance ReviewerRocelyn ManatadPas encore d'évaluation

- Global Strategic PlanningDocument36 pagesGlobal Strategic PlanningSimona Stancioiu100% (1)

- Model Etf Portfolios: IsharesDocument3 pagesModel Etf Portfolios: IsharesmusicbrahPas encore d'évaluation

- JSPL Preliminary Placement DocumentDocument523 pagesJSPL Preliminary Placement Documentseeram varmaPas encore d'évaluation

- Gordons ModelDocument2 pagesGordons ModelOmkar Harmalkar0% (1)

- STP & 4 P's of Axe DeodorantDocument12 pagesSTP & 4 P's of Axe DeodorantGaurav Rai100% (4)

- DelaPena ProjMgtExer10Document2 pagesDelaPena ProjMgtExer10Kressel LedwynePas encore d'évaluation

- @assignment ElasticityDocument2 pages@assignment ElasticityAbhishekPas encore d'évaluation

- Whitepaper: Trade Race ManagerDocument36 pagesWhitepaper: Trade Race ManagerGaëtan DEGUIGNEPas encore d'évaluation

- On The Optimization of Water-Energy Nexus in Shale Gas Networkunder Price UncertaintiesDocument17 pagesOn The Optimization of Water-Energy Nexus in Shale Gas Networkunder Price UncertaintiesOpera AndersonPas encore d'évaluation

- Self EmployementDocument9 pagesSelf EmployementChikanma OkoisorPas encore d'évaluation

- Chapter 3 Sun TzuDocument85 pagesChapter 3 Sun TzuNirhd Jeff100% (1)

- Enterprenuership AssignmentDocument10 pagesEnterprenuership AssignmenthamzahPas encore d'évaluation

- Innovation in Services: A Literature Review " ": Rabeh MorrarDocument9 pagesInnovation in Services: A Literature Review " ": Rabeh Morrarayenarah lopezPas encore d'évaluation

- Paper15 PDFDocument76 pagesPaper15 PDFsrinivasPas encore d'évaluation