Académique Documents

Professionnel Documents

Culture Documents

Bimal Jalan Committee

Transféré par

Manish MahajanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bimal Jalan Committee

Transféré par

Manish MahajanDroits d'auteur :

Formats disponibles

Bimal Jalan Committees Report on New

Bank Licenses

Submitted by: Manish Mahajan (20) and Sahil Sharma (37)

About Bimal Jalan Committee:

Committee Formation: The panel was constituted by RBI

under the chairmanship of Bimal Jalan in October 2013. RBI

had constituted the committee to examine the criteria,

business plans and corporate governance practices of

applicants applying for new bank Licenses. The central bank

issued guidelines for licensing of new banks on 22 February

2013.

About Bimal Jalan Committee:

Report Submission: In the first stage, the applications were

scrutinized by RBI to ensure eligibility of the applicants under

the Guidelines. Thereafter, the applications were referred to

the HLAC. The HLAC submitted its recommendations to RBI on

February 25, 2014 for its consideration. The report contains

names of entities eligible for bank licences.

Applicants Selection : On April 2

nd

2014, RBI grants in-

principle approvals to IDFC and Bandhan Financial Services for

new bank licences based on Jalan Committee Report.

The entities in the race for bank

licences

Initially, 27 entities expressed interest in entering the banking field.

But, Tata Sons Ltd and Value Industries Ltd. withdrew its

applications in November 2013 leaving 25 players, namely;

Public Sector Units: Department of Post and IFCI Ltd

Private Sector units: Aditya Birla Financial Services Ltd, Bajaj

Finance Ltd, Bandhan Financial Services Pvt Ltd (Kolkata),

Edelweiss Financial Services, IDFC Ltd, Indiabulls Housing Finance

Ltd, India Infoline Ltd, INMACS Management Services Ltd (Gurgaon),

Janalakshmi Financial Services Pvt Ltd (Bangalore), JM Financial, LIC

Housing Finance Ltd, L&T Finance Holdings Ltd, Magma Fincorp Ltd

(Kolkata), Muthoot Finance, Reliance Capital Ltd, Religare

Enterprises Ltd, Shriram Capital, Smart Global Ventures Pvt Ltd

(Noida), SREI Infrastructure Finance Ltd (Kolkata), Suryamani

Financing Company Ltd (Kolkata), Tourism Finance Corporation of

India Ltd, UAE Exchange & Financial Services (Kochi).

At the first stage, the applications were screened by the

Reserve Bank. Thereafter, the applications were referred to a

High Level Advisory Committee (HLAC) chaired by Bimal Jalan.

The Committee then submitted its recommendations to the

Reserve Bank.

The Reserve Bank of India (RBI) has decided on 2 April 2014 to

grant in-principle approval to two applicants viz., IDFC Ltd

and Bandhan Financial Services Pvt. Ltd, to set up banks under

the Guidelines on Licensing of New Banks in the Private Sector

issued on February 22, 2013.

Procedure For RBI Decisions:

Contd

The in-principle approval granted will be valid for a period

of 18 months during which the applicants have to comply with

the requirements.

On being satisfied that the applicants have complied with the

requisite conditions laid down by the RBI as part of in-

principle approval, they would be considered for grant of a

licence for commencement of banking business under Section

22(1) of the Banking Regulation Act, 1949.

New bank license granting procedure:

Granting of full

banking licence

after 18 months.

In-Principle

approval by RBI

Recommendation

to RBI after In-

depth investigation

by HLAC

Issuance of

guidelines by RBI

Preliminary

Application

screening by RBI

RBIs Guidelines for New Bank Licences:

(i) Eligible Promoters: Entities / groups in the private sector,

entities in public sector and Non-Banking Financial Companies

(NBFCs) shall be eligible to set up a bank through a wholly-

owned Non-Operative Financial Holding Company (NOFHC).

(ii) Fit and Proper criteria: Entities / groups should have a

past record of sound credentials and integrity, be financially

sound with a successful track record of 10 years. For this

purpose, RBI may seek feedback from other regulators and

enforcement and investigative agencies.

(iii) Corporate structure of the NOFHC: The NOFHC shall be

wholly owned by the Promoter / Promoter Group. The NOFHC

shall hold the bank as well as all the other financial services

entities of the group.

Contd

(iv) Regulatory framework: The bank will be governed by the

provisions of the relevant Acts, relevant Statutes and the

Directives, Prudential regulations and other

Guidelines/Instructions issued by RBI and other regulators.

The NOFHC shall be registered as a non-banking finance

company (NBFC) with the RBI and will be governed by a

separate set of directions issued by RBI.

(v) Foreign shareholding in the bank: The initial aggregate

non-resident shareholding has been restricted to 49% for the

first 5 years.

(vi) Corporate governance of NOFHC: At least 50% of the

Directors of the NOFHC should be independent directors. The

corporate structure should not impede effective supervision

of the bank and the NOFHC on a consolidated basis by RBI.

(vii) Prudential norms for the NOFHC: The prudential norms

will be applied to NOFHC both on stand-alone as well as on a

consolidated basis and the norms would be on similar lines as

that of the bank.

(Viii) Exposure norms: The NOFHC and the bank shall not

have any exposure to the Promoter Group. The bank shall not

invest in the equity / debt capital instruments of any financial

entities held by the NOFHC.

Contd

(ix) Business Plan for the bank: The business model of the

applicant should be realistic and viable and should address

how the bank proposes to achieve financial inclusion.

(x) The initial paid-up capital for new banks has been pegged

at INR 500 crores, with the promoter NOFHC holding not less

than 40% of capital, along with a 5 year lock-in period. Then

progressive reduction of shareholding of promoter NOFHC to

15% within 12 years.

(xi) The bank shall get its shares listed on the stock exchanges

within three years of the commencement of business by the

bank.

Contd

(xii) Other conditions for the bank :

The bank shall open at least 25 per cent of its branches in

unbanked rural centres (population upto 9,999 as per the

latest census).

The bank shall comply with the priority sector lending targets

and sub-targets as applicable to the existing domestic banks.

Banks promoted by groups having 40 per cent or more

assets/income from non-financial business will require RBIs

prior approval for raising paid-up voting equity capital beyond

INR 10 billion for every block of INR 5 billion.

Any non-compliance of terms and conditions will attract penal

measures including cancellation of licence of the bank.

Contd

(xiii) Additional conditions for NBFCs promoting / converting

into a bank : Existing NBFCs, if considered eligible, may be

permitted to promote a new bank or convert themselves into

banks.

Contd

Areas of problems for applicants

In view of the new guidelines, many corporate houses will have to

float a new holding company structure to become eligible for a

banking licence.

10-year track record of the promoter group to assess credentials

and integrity for fit and proper criteria.

The bigger challenge will be in reducing the holding to 15 per cent

within 12 years (banking being a long-gestation business it may

result in offloading of stake holding cheaply).

Opening of at least 25 per cent of its branches in unbanked rural

areas.

FDI limit has been kept at 49% for the first 5 yrs.

Now the goodies

There is also a requirement to compulsorily list shares on

stock exchanges within three years of the commencement of

business by the bank. This is good news as small investors

would be able to share in the fruits of capital appreciation in a

banking stock if - they stay invested over the long term.

Banks promoted by groups with 40 per cent or more of their

assets and income in non-financial businesses will be required

to take the RBI's approval to raise equity capital beyond Rs

1,000 crore for every block of Rs 500 crore.

Conclusion:

RBIs granting of two licences out of an applicant pool of 25 is

a cautious - and welcome approach, marking the first such

issuance in a decade and the latest move to heighten

competition in the countrys Rs 81-trillion (US$ 1.31 trillion)

Banking Industry. With more players to join the fray, it has the

potential to become the fifth largest banking industry in the

world by 2020 and the third largest by 2025, according to an

industry report.

Private Sector Banks, particularly New Private Sector Banks

have played an important role in the Indian banking sector by

increasing the efficiency of the domestic banking system and

bringing in more sophisticated financial services and financial

inclusion.

Vous aimerez peut-être aussi

- Draft Guidelines For Licensing of New Banks in The Private SectorDocument5 pagesDraft Guidelines For Licensing of New Banks in The Private SectorManmit KrishnaPas encore d'évaluation

- Banking and Financial Institutions AssignmentDocument5 pagesBanking and Financial Institutions AssignmentCraig WilliamsPas encore d'évaluation

- Banking and InsuranceDocument12 pagesBanking and InsuranceAditya VoraPas encore d'évaluation

- Smfgu271114 PDFDocument10 pagesSmfgu271114 PDFHarsh JainPas encore d'évaluation

- FSI Alert1315463511Document12 pagesFSI Alert1315463511Suhas PatilPas encore d'évaluation

- Asso PDFDocument54 pagesAsso PDFneeta chandPas encore d'évaluation

- Payment Bank LicenseDocument5 pagesPayment Bank LicenseDr. Prafulla RanjanPas encore d'évaluation

- Banking Regulation ActDocument3 pagesBanking Regulation Actsrivenraman4754Pas encore d'évaluation

- Non Banking Financial Companies (NBFCS) in IndiaDocument26 pagesNon Banking Financial Companies (NBFCS) in Indiakusharani601Pas encore d'évaluation

- GK-Capcule 2015 in EnglishDocument54 pagesGK-Capcule 2015 in EnglishJyothi SmilyPas encore d'évaluation

- NBFC CompliancesDocument41 pagesNBFC CompliancesmuskanPas encore d'évaluation

- Synopsis On Differentiated Banking: Name: Pragti Bhargava Roll No: 2 Branch: PGDM-RuralDocument3 pagesSynopsis On Differentiated Banking: Name: Pragti Bhargava Roll No: 2 Branch: PGDM-RuralPardeep Singh SainiPas encore d'évaluation

- Final Guidelines For Payment BanksDocument3 pagesFinal Guidelines For Payment BanksAnkaj MohindrooPas encore d'évaluation

- Module-III Banking Regulation: Course OutlineDocument36 pagesModule-III Banking Regulation: Course OutlineSanjay ParidaPas encore d'évaluation

- GK Power Capsule For SBI Associate Assistant 2015Document56 pagesGK Power Capsule For SBI Associate Assistant 2015Nilay VatsPas encore d'évaluation

- Reserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreambleDocument6 pagesReserve Bank of India Draft Guidelines For Licensing of "Small Banks" in The Private Sector July 17, 2014 I. PreamblejagadeeshPas encore d'évaluation

- PIB 2-14 MarchDocument122 pagesPIB 2-14 MarchgaganPas encore d'évaluation

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocument13 pagesNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way Forwardshubham moonPas encore d'évaluation

- Banking Regulations: Presented by Suresha, Uedesh, Unni, Ujjwal, Vjay, Vinoth, VirankumarDocument27 pagesBanking Regulations: Presented by Suresha, Uedesh, Unni, Ujjwal, Vjay, Vinoth, VirankumarVinoth KumaravadivelPas encore d'évaluation

- B BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateDocument20 pagesB BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateGuruswami PrakashPas encore d'évaluation

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocument13 pagesNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardUbaid DarPas encore d'évaluation

- Roll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemDocument4 pagesRoll No.-103 SAP ID - 500071323: Open Book - Through Blackboard Learning Management SystemAryan DevPas encore d'évaluation

- Non-Banking Financial Companies (NBFC)Document25 pagesNon-Banking Financial Companies (NBFC)nikita kothari18Pas encore d'évaluation

- GK Tornado Final - pdf-87Document54 pagesGK Tornado Final - pdf-87Sourav SenPas encore d'évaluation

- Principles and Practices of BankingDocument24 pagesPrinciples and Practices of BankingVasu DevanPas encore d'évaluation

- Non Banking Financial CompanyDocument3 pagesNon Banking Financial Companyanoop250116Pas encore d'évaluation

- Banking System in India: Chapter TwoDocument24 pagesBanking System in India: Chapter Twokaushik168Pas encore d'évaluation

- Non-Banking Finance Companies: Prof. Anil KalraDocument13 pagesNon-Banking Finance Companies: Prof. Anil KalraSaurabh SinghPas encore d'évaluation

- Banking Today Nov 15Document22 pagesBanking Today Nov 15Apurva JhaPas encore d'évaluation

- Licensing of Financial Banks in IndiaDocument3 pagesLicensing of Financial Banks in IndiaANOUSHKAPas encore d'évaluation

- Banking Sector End IIIIIDocument40 pagesBanking Sector End IIIIIManmohan Prasad RauniyarPas encore d'évaluation

- Non Banking Finacial Companies (NBFC)Document20 pagesNon Banking Finacial Companies (NBFC)UtkarshPas encore d'évaluation

- NBFCs and Their Regulation - ClassDocument8 pagesNBFCs and Their Regulation - ClassdebojyotiPas encore d'évaluation

- GK Tornado Rbi Assistant 2020 Mains Exam Eng 40Document180 pagesGK Tornado Rbi Assistant 2020 Mains Exam Eng 40AKHIL RAJ SPas encore d'évaluation

- Bnmit College ProjectDocument21 pagesBnmit College ProjectIMAM JAVOORPas encore d'évaluation

- GK Tornado Ibps RRB and Sbi Main Exams 2020 Eng 2 57Document227 pagesGK Tornado Ibps RRB and Sbi Main Exams 2020 Eng 2 57payal gargPas encore d'évaluation

- Mahindra Finance Project PDFDocument60 pagesMahindra Finance Project PDFIMAM JAVOORPas encore d'évaluation

- Management of Banking Institutions: Financial Services and SystemDocument45 pagesManagement of Banking Institutions: Financial Services and SystemAmit PandeyPas encore d'évaluation

- A Comparative Study of NBFC in IndiaDocument28 pagesA Comparative Study of NBFC in IndiaGuru Prasad0% (1)

- Project On Indian Banking Sector ReformsDocument30 pagesProject On Indian Banking Sector Reformshaneen77% (43)

- RBI Directions On Foreign Banks and Acquisition and Amalgamation of BanksDocument8 pagesRBI Directions On Foreign Banks and Acquisition and Amalgamation of Banksvijayadarshini vPas encore d'évaluation

- Last Six Months Current Affairs For NTPC ExamDocument190 pagesLast Six Months Current Affairs For NTPC ExamMujassamNazarKhanPas encore d'évaluation

- (English) Last 6 Months Current Affairs 2020 PDF (WWW - Examstocks.com)Document188 pages(English) Last 6 Months Current Affairs 2020 PDF (WWW - Examstocks.com)1ECE B 089 THARUN K SPas encore d'évaluation

- Narasimhan CommitteeDocument10 pagesNarasimhan CommitteeAshwini VPas encore d'évaluation

- Dispute Resolution Mechanism Under Banking Ombudsman SchemeDocument15 pagesDispute Resolution Mechanism Under Banking Ombudsman SchemeANAND GEO 1850508Pas encore d'évaluation

- Sample Phase I Ga NotesDocument8 pagesSample Phase I Ga NotesSAI CHARAN VPas encore d'évaluation

- Nbfis and NbfcsDocument11 pagesNbfis and Nbfcs679shrishti SinghPas encore d'évaluation

- Para-Banking and ActivitiesDocument13 pagesPara-Banking and ActivitiesKiran Kapoor100% (1)

- GK Powercapsule For Ibps Po - Iv 2014 ExamDocument45 pagesGK Powercapsule For Ibps Po - Iv 2014 ExamJayapalPas encore d'évaluation

- Assignment FinancialSectorReforms1991Document4 pagesAssignment FinancialSectorReforms1991Swathi SriPas encore d'évaluation

- Marathe CommitteeDocument2 pagesMarathe CommitteeOngwang KonyakPas encore d'évaluation

- GK Tornado For IBPS PO Mains 2016 Exam 1Document56 pagesGK Tornado For IBPS PO Mains 2016 Exam 1Swapna JulakantiPas encore d'évaluation

- Overview of Indian Financial System:Non Banking Finance Companies (NBFCS)Document12 pagesOverview of Indian Financial System:Non Banking Finance Companies (NBFCS)Neena TomyPas encore d'évaluation

- GK Tornado Lic Assistant Main Exams 2019 Eng 18Document203 pagesGK Tornado Lic Assistant Main Exams 2019 Eng 18Sakshi GuptaPas encore d'évaluation

- Bhavesh Jhala 1 PDFDocument42 pagesBhavesh Jhala 1 PDFAniket AutkarPas encore d'évaluation

- Inspection of UCB-BR Act 1949Document46 pagesInspection of UCB-BR Act 1949sandeepprincePas encore d'évaluation

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsD'EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsPas encore d'évaluation

- Regional Rural Banks of India: Evolution, Performance and ManagementD'EverandRegional Rural Banks of India: Evolution, Performance and ManagementPas encore d'évaluation

- Emerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaD'EverandEmerging Issues in Finance Sector Inclusion, Deepening, and Development in the People's Republic of ChinaPas encore d'évaluation

- Chapte R No. Title NODocument3 pagesChapte R No. Title NOManish MahajanPas encore d'évaluation

- 2012-Distribution and Sales MNGTDocument3 pages2012-Distribution and Sales MNGTManish MahajanPas encore d'évaluation

- The Land of RockDocument5 pagesThe Land of RockManish MahajanPas encore d'évaluation

- WWW - Jammuuniversity.in PDF Job-06!06!2014Document4 pagesWWW - Jammuuniversity.in PDF Job-06!06!2014Manish MahajanPas encore d'évaluation

- Advertisement Notice 1 2014Document4 pagesAdvertisement Notice 1 2014ihateu1Pas encore d'évaluation

- Ur!.lviiil@: & If & & Lor andDocument4 pagesUr!.lviiil@: & If & & Lor andManish MahajanPas encore d'évaluation

- 2010-Human Resource ManagementDocument2 pages2010-Human Resource ManagementManish MahajanPas encore d'évaluation

- Fiscal DeficitDocument32 pagesFiscal DeficitManish MahajanPas encore d'évaluation

- CST Regitration FormDocument3 pagesCST Regitration FormAvanindra BhushanPas encore d'évaluation

- CST Regitration FormDocument3 pagesCST Regitration FormAvanindra BhushanPas encore d'évaluation

- Form Vat-01Document6 pagesForm Vat-01Manish MahajanPas encore d'évaluation

- Financing of Foreign TradeDocument29 pagesFinancing of Foreign TradeManish MahajanPas encore d'évaluation

- JKPDD: Government of Jammu & KashmirDocument3 pagesJKPDD: Government of Jammu & KashmirManish MahajanPas encore d'évaluation

- Form B Certificate of RegistrationDocument1 pageForm B Certificate of RegistrationManish MahajanPas encore d'évaluation

- Questionnaire: Demographic InformationDocument3 pagesQuestionnaire: Demographic InformationManish MahajanPas encore d'évaluation

- 28112014Document2 pages28112014Manish MahajanPas encore d'évaluation

- Capital Budgeting For The Multinational CorporationDocument18 pagesCapital Budgeting For The Multinational CorporationManish MahajanPas encore d'évaluation

- Fiscal Policy: by Kumar Devrat Rohita Mohit Shukla Nasreen Prashant SharmaDocument19 pagesFiscal Policy: by Kumar Devrat Rohita Mohit Shukla Nasreen Prashant SharmaMohit ShuklaPas encore d'évaluation

- 11032015Document3 pages11032015Manish MahajanPas encore d'évaluation

- Questionnaire A ADocument3 pagesQuestionnaire A AManish MahajanPas encore d'évaluation

- Case StudyDocument3 pagesCase StudyManish MahajanPas encore d'évaluation

- ImplementationDocument32 pagesImplementationManish MahajanPas encore d'évaluation

- Notification UIIC Assistant PostsDocument17 pagesNotification UIIC Assistant Postsprabhakar_elexPas encore d'évaluation

- Name:-Divya Gupta ROLL NO. 13-MBA-2013 Subject-Management of Financial ServicesDocument2 pagesName:-Divya Gupta ROLL NO. 13-MBA-2013 Subject-Management of Financial ServicesManish MahajanPas encore d'évaluation

- 18102014Document24 pages18102014Wasim ParrayPas encore d'évaluation

- The Secrets To Successful Strategy ExecutionDocument1 pageThe Secrets To Successful Strategy ExecutionManish MahajanPas encore d'évaluation

- Topic S DescriptionDocument66 pagesTopic S DescriptionManish MahajanPas encore d'évaluation

- NoticeDocument1 pageNoticeManish MahajanPas encore d'évaluation

- Venture CapitalDocument6 pagesVenture CapitalManish MahajanPas encore d'évaluation

- WWW Indiabix ComDocument4 pagesWWW Indiabix Combunty13buntyPas encore d'évaluation

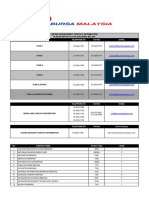

- Bursa Data - ContactList-14January2020Document19 pagesBursa Data - ContactList-14January2020AdamZain788Pas encore d'évaluation

- On Buy Back of ShareDocument30 pagesOn Buy Back of Shareranjay260Pas encore d'évaluation

- ManagementDocument8 pagesManagementskgrover5524Pas encore d'évaluation

- Advacc 2 Chapter 1 ProblemsDocument5 pagesAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- Attorney Navpreet Panjrath: DefinitionsDocument16 pagesAttorney Navpreet Panjrath: DefinitionsswetavitaPas encore d'évaluation

- Annual Shareholders' Meeting - 03.24.2014 - MinutesDocument6 pagesAnnual Shareholders' Meeting - 03.24.2014 - MinutesBVMF_RI0% (1)

- Company Career Page Links PDF 1670692311Document3 pagesCompany Career Page Links PDF 1670692311Mayank PandeyPas encore d'évaluation

- Capital Structure Analysis OF: Maruti & InfosysDocument35 pagesCapital Structure Analysis OF: Maruti & Infosys42040Pas encore d'évaluation

- Fosun International - WikipediaDocument17 pagesFosun International - WikipediaZayini Capital InvestamaPas encore d'évaluation

- Wesco Charlie Munger Letters 1983 - 2009 CollectionDocument286 pagesWesco Charlie Munger Letters 1983 - 2009 Collectionbomby0100% (2)

- Sheet 1Document63 pagesSheet 1gerome canlasPas encore d'évaluation

- Darden RestaurantsDocument2 pagesDarden RestaurantsBrianna MimsPas encore d'évaluation

- McKinsey HistoryDocument6 pagesMcKinsey HistoryNishant ChandraPas encore d'évaluation

- Company Pepsico Emmar Misr Chevorlea Unilever Samsung Cocacola B Tea EricssonDocument12 pagesCompany Pepsico Emmar Misr Chevorlea Unilever Samsung Cocacola B Tea Ericssonabdelrahman essamPas encore d'évaluation

- Brad Background Maxim Photo Splash Intro 2009 MySpace FounderDocument30 pagesBrad Background Maxim Photo Splash Intro 2009 MySpace FounderNLGWestCoastLibraryPas encore d'évaluation

- The City's Most Influential Financial PRsDocument4 pagesThe City's Most Influential Financial PRsvinothj86Pas encore d'évaluation

- Fi Account Statement 01 Jun 2023 - 30 Jun 2023 - UnlockedDocument26 pagesFi Account Statement 01 Jun 2023 - 30 Jun 2023 - UnlockedRK MohantyPas encore d'évaluation

- Managment 12Document8 pagesManagment 12Mae FrancesPas encore d'évaluation

- Corporate Laws and PracticesDocument16 pagesCorporate Laws and PracticesMahmudul HasanPas encore d'évaluation

- Mengupas Persoalan Standar Akuntansi Keuangan - Goodwil Di Berbagai Negara: Suatu Pendekatan Studi LiteraturDocument17 pagesMengupas Persoalan Standar Akuntansi Keuangan - Goodwil Di Berbagai Negara: Suatu Pendekatan Studi LiteraturNina HernawatiPas encore d'évaluation

- Sol. Man. - Chapter 15 EpsDocument12 pagesSol. Man. - Chapter 15 Epsfinn mertensPas encore d'évaluation

- Adidas Reebok Merger Case StudyDocument12 pagesAdidas Reebok Merger Case StudynehaPas encore d'évaluation

- Corporate SponsorsDocument30 pagesCorporate SponsorsvivektonapiPas encore d'évaluation

- Midcap FundDocument1 pageMidcap FundAnurag NahataPas encore d'évaluation

- 69th AGM MinutesDocument6 pages69th AGM MinutesAhmad SheikhPas encore d'évaluation

- Annotatted Companies Act 2013 Updated Till Aug 2019Document1 797 pagesAnnotatted Companies Act 2013 Updated Till Aug 2019cspritiPas encore d'évaluation

- Pentamaster 4QCY21Document5 pagesPentamaster 4QCY21nishio fdPas encore d'évaluation

- CH 3 - Lap Konsolidasi PengantarDocument45 pagesCH 3 - Lap Konsolidasi PengantarJulia Pratiwi ParhusipPas encore d'évaluation