Académique Documents

Professionnel Documents

Culture Documents

C Aiib - Fmmodb Class

Transféré par

mevrick_guyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

C Aiib - Fmmodb Class

Transféré par

mevrick_guyDroits d'auteur :

Formats disponibles

CAIIB-Financial Management-MOD-B

The Analysis of Financial Statements

The

Use Of Financial Ratios

Analyzing Liquidity

Analyzing Activity

Analyzing Debt

Analyzing Profitability

A Complete Ratio Analysis

The Analysis of Financial

Statements

THE

USE OF FINANCIAL RATIOS

Financial Ratio are used as a relative measure

that facilitates the evaluation of efficiency or

condition of a particular aspect of a firm's

operations and status

Ratio Analysis involves methods of

calculating and interpreting financial ratios in

order to assess a firm's performance and status

Example

(1)

(2)

(1)/(2)

Year End Current Assets/Current Liab. Current Ratio

1994

$550,000 /$500,000

1.10

1995

$550,000 /$600,000

.92

Interested Parties

Three sets of parties are interested

in ratio analysis:

Shareholders

Creditors

Management

Types of Ratio Comparisons

There are two types of ratio comparisons

that can be made:

Cross-Sectional

Analysis

Time-Series Analysis

Combined Analysis uses both types of analysis

to assess a firm's trends versus its competitors

or the industry

Words of Caution Regarding

Ratio Analysis

single ratio rarely tells enough to make a sound

judgment.

Financial statements used in ratio analysis must be

from similar points in time.

Audited financial statements are more reliable than

unaudited statements.

The financial data used to compute ratios must be

developed in the same manner.

Inflation can distort comparisons.

Groups of Financial Ratios

Liquidity

Activity

Debt

Profitability

Analyzing Liquidity

Liquidity

refers to the solvency of the

firm's overall financial position, i.e. a

"liquid firm" is one that can easily meet

its short-term obligations as they come

due.

A second meaning includes the concept

of converting an asset into cash with little

or no loss in value.

t

Three Important Liquidity Measures

9

Net Working Capital (NWC)

NWC = Current Assets - Current Liabilities

Current Ratio (CR)

Current Assets

CR =

Current Liabilities

Quick (Acid-Test) Ratio (QR)

Current Assets - Inventory

QR =

Current Liabilities

10

Analyzing Activity

Activity

is a more sophisticated

analysis of a firm's liquidity,

evaluating the speed with which

certain accounts are converted into

sales or cash; also measures a firm's

efficiency

Five Important Activity Measures

11

Inventory Turnover (IT)

Average Collection Period (ACP)

Average Payment Period (APP)

Fixed Asset Turnover (FAT)

Total Asset Turnover (TAT)

IT =

ACP =

APP=

FAT =

TAT =

Cost of Goods Sold

Inventory

Accounts Receivable

Annual Sales/360

Accounts Payable

Annual Purchases/360

Sales

Net Fixed Assets

Sales

Total Assets

12

Debt

Analyzing Debt

is a true "double-edged" sword as it allows

for the generation of profits with the use of other

people's (creditors) money, but creates claims on

earnings with a higher priority than those of the

firm's owners.

Financial Leverage is a term used to describe the

magnification of risk and return resulting from

the use of fixed-cost financing such as debt and

preferred stock.

Measures of Debt

13

There

are Two General Types

of Debt Measures

Degree of Indebtedness

Ability to Service Debts

14

Four Important Debt Measures

Debt Ratio

(DR)

Debt-Equity Ratio

(DER)

Times Interest Earned

Ratio (TIE)

DR=

DER=

Total Assets

Long-Term Debt

Stockholders Equity

Earnings Before Interest

& Taxes (EBIT)

TIE=

Interest

FPC=

Fixed Payment Coverage Ratio

(FPC)

Total Liabilities

Earnings Before Interest &

Taxes + Lease Payments

Interest + Lease Payments

+{(Principal Payments +

Preferred Stock Dividends)

X [1 / (1 -T)]}

15

Analyzing Profitability

Profitability Measures assess the firm's ability

to operate efficiently and are of concern to

owners, creditors, and management

A Common-Size Income Statement, which

expresses each income statement item as a

percentage of sales, allows for easy evaluation

of the firms profitability relative to sales.

16

Seven Basic Profitability Measures

Gross Profit Margin

(GPM)

Operating Profit Margin

(OPM)

Net Profit Margin (NPM)

Return on Total Assets

(ROA)

Return On Equity (ROE)

Earnings Per Share (EPS)

Price/Earnings (P/E) Ratio

GPM=

OPM =

NPM=

ROA=

ROE=

EPS =

P/E =

Gross Profits

Sales

Operating Profits (EBIT)

Sales

Net Profit After Taxes

Sales

Net Profit After Taxes

Total Assets

Net Profit After Taxes

Stockholders Equity

Earnings Available for

Common Stockholders

Number of Shares of Common

Stock Outstanding

Market Price Per Share of

Common Stock

Earnings Per Share

17

A Complete Ratio Analysis

DuPont

System of Analysis

DuPont System of Analysis is an integrative

approach used to dissect a firm's financial

statements and assess its financial condition

It ties together the income statement and

balance sheet to determine two summary

measures of profitability, namely ROA and

ROE

DuPont System of Analysis

18

The

firm's return is broken into three

components:

A profitability measure (net profit margin)

An efficiency measure(total asset turnover)

A leverage measure (financial leverage

multiplier)

Summarizing All Ratios

19

An

approach that views all aspects of the

firm's activities to isolate key areas of

concern

Comparisons are made to industry

standards (cross-sectional analysis)

Comparisons to the firm itself over time

are also made (time-series analysis)

Vous aimerez peut-être aussi

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesD'EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesPas encore d'évaluation

- Summary of Joshua Rosenbaum & Joshua Pearl's Investment BankingD'EverandSummary of Joshua Rosenbaum & Joshua Pearl's Investment BankingPas encore d'évaluation

- The Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio AnalysisDocument19 pagesThe Use of Financial Ratios Analyzing Liquidity Analyzing Activity Analyzing Debt Analyzing Profitability A Complete Ratio AnalysisdongaquoctrungPas encore d'évaluation

- Analisis Ratio KeuanganDocument19 pagesAnalisis Ratio KeuanganDoni FerdianPas encore d'évaluation

- Financial AnalysisDocument26 pagesFinancial AnalysisEsther GalpoPas encore d'évaluation

- The Analysis of Financial StatementsDocument5 pagesThe Analysis of Financial StatementsAman GuptaPas encore d'évaluation

- Financial Ratio AnalysisDocument41 pagesFinancial Ratio Analysismbapriti100% (2)

- Financial Statement Analysis and Ratio CalculationsDocument33 pagesFinancial Statement Analysis and Ratio CalculationsKamrul HasanPas encore d'évaluation

- FS Services PDFDocument38 pagesFS Services PDFwajihu9618Pas encore d'évaluation

- Fs AnalysisDocument34 pagesFs Analysisbawangb21Pas encore d'évaluation

- Guide to key financial ratio analysis in 6 areasDocument5 pagesGuide to key financial ratio analysis in 6 areasmichelle dizonPas encore d'évaluation

- Essentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt: Chapter 5Document16 pagesEssentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt: Chapter 51220helen2000Pas encore d'évaluation

- Financial Statements AnalysisDocument42 pagesFinancial Statements AnalysisSulle DadyPas encore d'évaluation

- Finman ReviewerDocument17 pagesFinman ReviewerSheila Mae Guerta LaceronaPas encore d'évaluation

- FS Ratio AnalysisDocument14 pagesFS Ratio AnalysisNoniPas encore d'évaluation

- CH 014Document26 pagesCH 014thenikkitrPas encore d'évaluation

- AccountingDocument8 pagesAccountingaku sexcPas encore d'évaluation

- Chapter 4 Analysis of Financial StatementsDocument2 pagesChapter 4 Analysis of Financial StatementsSamantha Siau100% (1)

- Chapter 14 - Financial Statement AnalysisDocument58 pagesChapter 14 - Financial Statement AnalysisPradipta Gitaya0% (1)

- Chapter 08, Financial Statment AnalysisDocument35 pagesChapter 08, Financial Statment AnalysisPra Yo GoPas encore d'évaluation

- Classification of Financial Ratios On The Basis of FunctionDocument8 pagesClassification of Financial Ratios On The Basis of FunctionRagav AnPas encore d'évaluation

- Financial Analysis GuideDocument6 pagesFinancial Analysis GuideRomelyn Joy JangaoPas encore d'évaluation

- More On ValuatingDocument21 pagesMore On ValuatingmilkenPas encore d'évaluation

- Finance Chapter 4 Online PDFDocument43 pagesFinance Chapter 4 Online PDFJoseph TanPas encore d'évaluation

- Financials RatiosDocument25 pagesFinancials RatiosSayan DattaPas encore d'évaluation

- Accounting for Managers Final Exam RatiosDocument7 pagesAccounting for Managers Final Exam RatiosGramoday FruitsPas encore d'évaluation

- Foundation of Ratio and Financial AnalysisDocument60 pagesFoundation of Ratio and Financial AnalysisMega_ImranPas encore d'évaluation

- Timbol, Kathlyn Mae V - Financial Analysis TechniquesDocument4 pagesTimbol, Kathlyn Mae V - Financial Analysis TechniquesMae TimbolPas encore d'évaluation

- Financial Statement AnalysisDocument42 pagesFinancial Statement AnalysisSwarna RoyPas encore d'évaluation

- Financial Statement Analysis Word FileDocument25 pagesFinancial Statement Analysis Word FileolmezestPas encore d'évaluation

- Financial AnalysisDocument40 pagesFinancial AnalysisCarl Maneclang AbarabarPas encore d'évaluation

- Financial Statement Analysis Lecture v2Document8 pagesFinancial Statement Analysis Lecture v2Yaj CruzadaPas encore d'évaluation

- Trend AnalysisDocument4 pagesTrend AnalysisKha DijaPas encore d'évaluation

- Financial Statements and Ratio Analysis: ChapterDocument25 pagesFinancial Statements and Ratio Analysis: Chapterkarim67% (3)

- Comparative Analysis Evaluating The Performance and Financial PositionDocument38 pagesComparative Analysis Evaluating The Performance and Financial PositionOoiChinPinnPas encore d'évaluation

- LUX HoiseryDocument143 pagesLUX HoiseryJayakrishnan Marangatt100% (1)

- Financial Performance Analysis of RAIDCODocument92 pagesFinancial Performance Analysis of RAIDCOATHIRA RPas encore d'évaluation

- Chapter 8Document35 pagesChapter 8najascj100% (1)

- Fabm 2Document170 pagesFabm 2Asti GumacaPas encore d'évaluation

- VivaDocument29 pagesVivaA. ShanmugamPas encore d'évaluation

- Unit 4 - Ratio AnalysisDocument13 pagesUnit 4 - Ratio AnalysisEthan Manuel Del VallePas encore d'évaluation

- Iqmethod ValuationDocument48 pagesIqmethod ValuationAkash VaidPas encore d'évaluation

- Financial AnalysisDocument14 pagesFinancial AnalysisTusharPas encore d'évaluation

- BBC406 Fundamentals of Finance: Week 5 Analysis of Financial StatementsDocument53 pagesBBC406 Fundamentals of Finance: Week 5 Analysis of Financial StatementsZhaslan HamzinPas encore d'évaluation

- 4b - Chapter 4 Financial Management-OkDocument49 pages4b - Chapter 4 Financial Management-OkIni IchiiiPas encore d'évaluation

- Financial Analysis SeminarDocument66 pagesFinancial Analysis Seminarjp30ptt7Pas encore d'évaluation

- Financial Management: Session - 2: Financial Statement AnalysisDocument22 pagesFinancial Management: Session - 2: Financial Statement AnalysisShantanu SinhaPas encore d'évaluation

- Financial and Technical AnalysisDocument62 pagesFinancial and Technical AnalysisBhupender Singh RawatPas encore d'évaluation

- Definition and Explanation of Financial Statement Analysis:: Horizontal Analysis or Trend AnalysisDocument3 pagesDefinition and Explanation of Financial Statement Analysis:: Horizontal Analysis or Trend AnalysisrkumarkPas encore d'évaluation

- 21.understanding Retail ViabilityDocument23 pages21.understanding Retail ViabilitySai Abhishek TataPas encore d'évaluation

- Bank Performance EvaluationDocument24 pagesBank Performance EvaluationRidwan AhmedPas encore d'évaluation

- Financial Analysis Session 4 & 5Document36 pagesFinancial Analysis Session 4 & 5Sakshi SharmaPas encore d'évaluation

- FM 2Document22 pagesFM 2Kajal singhPas encore d'évaluation

- Financial Statement AnalysisDocument26 pagesFinancial Statement AnalysisRahul DewakarPas encore d'évaluation

- Financial Statement AnalysisDocument10 pagesFinancial Statement Analysisswayam anandPas encore d'évaluation

- Financial Ratios Analysis and InterpretationDocument8 pagesFinancial Ratios Analysis and InterpretationChristian Zebua75% (4)

- Business Metrics and Tools; Reference for Professionals and StudentsD'EverandBusiness Metrics and Tools; Reference for Professionals and StudentsPas encore d'évaluation

- Financial Statement Analysis: Business Strategy & Competitive AdvantageD'EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)D'EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)Pas encore d'évaluation

- NIOS Culture NotesDocument71 pagesNIOS Culture Notesmevrick_guy0% (1)

- 01.19 Safe CustodyDocument9 pages01.19 Safe Custodymevrick_guyPas encore d'évaluation

- Banking Glossary 2011Document27 pagesBanking Glossary 2011Praneeth Kumar NaganPas encore d'évaluation

- Currency Chest Operations GuideDocument10 pagesCurrency Chest Operations Guidemevrick_guyPas encore d'évaluation

- IBPS Interview PrepDocument33 pagesIBPS Interview Prepmevrick_guyPas encore d'évaluation

- Top 10 Economic Challenges for Modi GovtDocument17 pagesTop 10 Economic Challenges for Modi Govtmevrick_guyPas encore d'évaluation

- Yuva Savings Bank AccountDocument1 pageYuva Savings Bank Accountmevrick_guyPas encore d'évaluation

- A StudyDocument12 pagesA Studymevrick_guyPas encore d'évaluation

- 01 21-RBIremittanceDocument11 pages01 21-RBIremittancemevrick_guyPas encore d'évaluation

- 2nd Issue E-Gyan, October-2013Document28 pages2nd Issue E-Gyan, October-2013mevrick_guyPas encore d'évaluation

- BOD EOD ProcessesDocument25 pagesBOD EOD Processesmevrick_guy100% (1)

- 47-Corporate Salary Package - CSPDocument3 pages47-Corporate Salary Package - CSPmevrick_guyPas encore d'évaluation

- State Bank Learning Centre e-gyan Vol 1 Key HighlightsDocument13 pagesState Bank Learning Centre e-gyan Vol 1 Key Highlightsmevrick_guyPas encore d'évaluation

- 01.20 Government BusinessDocument48 pages01.20 Government Businessmevrick_guyPas encore d'évaluation

- BOD EOD ProcessesDocument25 pagesBOD EOD Processesmevrick_guy100% (1)

- Generate Multiple Demand Drafts from Deposit AccountDocument40 pagesGenerate Multiple Demand Drafts from Deposit Accountmevrick_guyPas encore d'évaluation

- 8 To 8 Functionality: Section Section DescriptionDocument7 pages8 To 8 Functionality: Section Section Descriptionmevrick_guyPas encore d'évaluation

- 01 08-BGLDocument40 pages01 08-BGLmevrick_guy100% (2)

- 01.09-User System ManagementDocument12 pages01.09-User System Managementmevrick_guyPas encore d'évaluation

- 01.13 ClearingDocument38 pages01.13 Clearingmevrick_guy0% (1)

- 01.14 Maker Checker FunctionalitiesDocument19 pages01.14 Maker Checker Functionalitiesmevrick_guyPas encore d'évaluation

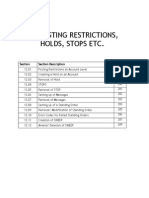

- 01.12 Posting RestrictionsDocument14 pages01.12 Posting Restrictionsmevrick_guyPas encore d'évaluation

- Transaction Processing: Cash, Cheques, TransfersDocument23 pagesTransaction Processing: Cash, Cheques, Transfersmevrick_guyPas encore d'évaluation

- 01.03-Deposit Accounts OpeningDocument38 pages01.03-Deposit Accounts Openingmevrick_guy0% (1)

- Manage cash workflow and transactionsDocument21 pagesManage cash workflow and transactionsmevrick_guyPas encore d'évaluation

- Deposit Accounts - Joint Accounts and NomineesDocument30 pagesDeposit Accounts - Joint Accounts and Nomineesmevrick_guyPas encore d'évaluation

- 01.01 IntroductionDocument16 pages01.01 Introductionmevrick_guyPas encore d'évaluation

- 01 02-CifDocument25 pages01 02-Cifmevrick_guyPas encore d'évaluation

- 00.01 PrefaceDocument1 page00.01 Prefacemevrick_guyPas encore d'évaluation

- Internship ReportDocument79 pagesInternship ReportAfroza KhanomPas encore d'évaluation

- Foriegn Exchange of Social Islami Bank LimitedDocument20 pagesForiegn Exchange of Social Islami Bank LimitedRipa AkterPas encore d'évaluation

- State Finances in Haryana - Manju DalalDocument26 pagesState Finances in Haryana - Manju Dalalvoldemort1989Pas encore d'évaluation

- Country Hill CaseDocument2 pagesCountry Hill CaseAlisha Anand [JKBS]Pas encore d'évaluation

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyPas encore d'évaluation

- NoteDocument3 pagesNotePriya GoyalPas encore d'évaluation

- BootcampX Day 6Document15 pagesBootcampX Day 6Vivek LasunaPas encore d'évaluation

- Chapter 1 - Foundations of Engineering EconomyDocument28 pagesChapter 1 - Foundations of Engineering EconomyJohn Joshua MontañezPas encore d'évaluation

- 79033bos63228 1Document98 pages79033bos63228 1pmlten2001Pas encore d'évaluation

- Asset Partner Opportunity OverviewDocument1 pageAsset Partner Opportunity OverviewkaranPas encore d'évaluation

- FINA2010 Financial Management: Lecture 2: Financial Statement AnalysisDocument68 pagesFINA2010 Financial Management: Lecture 2: Financial Statement AnalysismoonPas encore d'évaluation

- Planning Your Own Business Part 1Document50 pagesPlanning Your Own Business Part 1Marie-An CanduyaPas encore d'évaluation

- Backlog 202021 VoucherDocument1 pageBacklog 202021 VoucherYousufPas encore d'évaluation

- Pe Saudi-1Document38 pagesPe Saudi-1alamctcPas encore d'évaluation

- Study online at quizlet.com/_23q1qiDocument2 pagesStudy online at quizlet.com/_23q1qiAPRATIM BHUIYANPas encore d'évaluation

- TNEB Online Payment PDFDocument2 pagesTNEB Online Payment PDFGeetha SoundaryaPas encore d'évaluation

- IELTS speaking exam money and finance sample answersDocument22 pagesIELTS speaking exam money and finance sample answersbhawnaPas encore d'évaluation

- The IdiotsDocument44 pagesThe IdiotsChoi Young HakPas encore d'évaluation

- Stress Testing of Agrani Bank LtdDocument2 pagesStress Testing of Agrani Bank Ltdrm1912Pas encore d'évaluation

- Practice set instructionsDocument36 pagesPractice set instructionsMaureen D. FloresPas encore d'évaluation

- Banking Key TermsDocument3 pagesBanking Key Termsapi-274354851Pas encore d'évaluation

- G10489 EC Calculator Practice Problems WorksheetDocument11 pagesG10489 EC Calculator Practice Problems WorksheetiamdarshandPas encore d'évaluation

- ASSESSMENTSDocument23 pagesASSESSMENTSJoana TrinidadPas encore d'évaluation

- Weiss Cryptocurrency Ratings Provide Independent, Unbiased InsightsDocument3 pagesWeiss Cryptocurrency Ratings Provide Independent, Unbiased InsightsMarek KowalskiPas encore d'évaluation

- New Generation Banking in IndiaDocument9 pagesNew Generation Banking in IndiaGanesh TiwariPas encore d'évaluation

- The Collapse of Securitization: From Subprimes To Global Credit CrunchDocument14 pagesThe Collapse of Securitization: From Subprimes To Global Credit CrunchFernanda UltremarePas encore d'évaluation

- Generate Cashbook Public ReportDocument1 pageGenerate Cashbook Public Reportdr.rahul0210Pas encore d'évaluation

- Manajemen Keuangan Chapter 17Document27 pagesManajemen Keuangan Chapter 17zahrinaPas encore d'évaluation

- RevisionDocument8 pagesRevisionPhan Hà TrangPas encore d'évaluation

- Calculate WACC to Evaluate New ProjectsDocument52 pagesCalculate WACC to Evaluate New ProjectsksachchuPas encore d'évaluation