Académique Documents

Professionnel Documents

Culture Documents

Strategic Management CH 6

Transféré par

karim kobeissiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Strategic Management CH 6

Transféré par

karim kobeissiDroits d'auteur :

Formats disponibles

Strategic Management

Dr. Karim Kobeissi

Chapter 6: Strategy Analysis and Choice

The Nature of Strategy Analysis

and Choice

Strategy analysis and choice seek to determine alternative

courses of action that could best enable the firm to

achieve its mission and objectives. The firms present

strategies, objectives, and mission, coupled with the

external and internal audit information, provide a basis for

generating and evaluating feasible alternative strategies.

The strategy analysis and choice stage of the strategic

management process is revealed in the next slide.

A Comprehensive StrategicManagement Model

The Process of Generating and

Selecting Strategies

Strategists never consider all feasible alternatives

that could benefit the firm because there are an

infinite number of possible actions and an infinite

number of ways to implement those actions.

Therefore, a manageable set of the most

attractive alternative strategies

must be

developed through an appropriate process.

The advantages, disadvantages, trade-offs, costs,

and

benefits

determined.

of

these

strategies

should

be

The Process of Generating and Selecting

Strategies (con)

Identifying

and

evaluating

alternative

strategies should involve many of the

managers

and

employees

who

earlier

assembled the organizational vision and

mission

statements,

performed

the

external audit, and conducted the internal

audit.

The Process of Generating and Selecting

Strategies (con)

Alternative strategies proposed by participants should

be considered and discussed in a meeting or series of

meetings.

Proposed strategies should be listed in writing.

When all feasible strategies identified by participants

are given and understood, the strategies should be

ranked in order of attractiveness by all participants,

with (1) = should not be implemented, (2) = possibly

should be implemented, (3) = probably should be

implemented,

implemented.

and

(4)

definitely

should

be

The Process of Generating and

Selecting Strategies

Important strategy-formulation techniques can be

integrated into a three-stage decision making

process:

Stage 1, called the Input Stage

Stage 2, called the Matching Stage

Stage 3, called the Decision Stage

The Process of Generating and

Selecting Strategies

The Input Stage

Summarizes the basic input information

needed to formulate strategies.

It consists of the EFE Matrix, the IFE

Matrix, and the Competitive Profile Matrix

(CPM).

The Matching Stage

The matching stage of the strategy-formulation

framework consists of five techniques that can

be used in any sequence: the SWOT Matrix,

the SPACE Matrix, the BCG Matrix, the IE Matrix,

and the Grand Strategy Matrix.

It focuses upon generating feasible alternative

strategies by matching the organization internal

strengths / weaknesses and the opportunities /

threats created by its external environment.

The Matching Stage (con)

Matching

external

and

internal

critical

success factors is the key to effectively

generating feasible alternative strategies.

For example, a firm with excess working

capital (an internal strength) could take

advantage of the cell phone industrys 20

percent annual growth rate (an external

opportunity) by acquiring Cellfone, Inc., a

Matching Key External and Internal

Factors

to Formulate Alternative Strategies

The Matching Stage

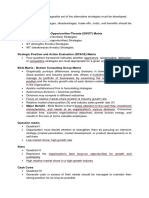

The Strengths-Weaknesses-Opportunities-Threats (SWOT) Matrix

The

Strengths-Weaknesses-Opportunities-

Threats (SWOT) Matrix is an important

matching

tool

that

helps

managers

develop four types of strategies:

1) SO (strengths-opportunities) Strategies

2) WO

Strategies

(weaknesses-opportunities)

The Matching Stage

The Strengths-Weaknesses-Opportunities-Threats (SWOT) Matrix

Strengths- Opportunities

Strategies

internal

Use

strengths

advantage

opportunities.

of

a

to

firms

take

external

Weaknesses Opportunities

Strategies Aim at improving

internal weaknesses by taking

advantage

opportunities.

of

external

The Matching Stage

The Strengths-Weaknesses-Opportunities-Threats (SWOT) Matrix

Strengths

Threat

Strategies

Use

firms

Weaknesses

Threats

Strategies

strengths

to

avoid or reduce the impact

of external threats.

Are defensive tactics directed at

reducing

internal

weakness

and avoiding external threats.

The Matching Stage

The Strengths-Weaknesses-Opportunities-Threats (SWOT) Matrix

There

are

eight

steps

involved

in

constructing a SWOT Matrix:

1. List the firms key external opportunities.

2. List the firms key external threats.

3. List the firms key internal strengths.

4. List the firms key internal weaknesses.

The Matching Stage

The Strengths-Weaknesses-Opportunities-Threats (SWOT) Matrix

5. Match internal strengths with external opportunities,

and

record

the

resultant

SO

Strategies

in

the

appropriate cell.

6.

Match

internal

weaknesses

with

external

opportunities, and record the resultant WO Strategies.

7. Match internal strengths with external threats, and

record the resultant ST Strategies.

8. Match internal weaknesses with external threats, and

record the resultant WT Strategies.

The Matching Stage

Limitations of the SWOT Matrix

Although the SWOT matrix is widely used in strategic planning,

the analysis does have some limitations.

1) SWOT does not show how to achieve a competitive

advantage, so it must not be an end in itself.

2) SWOT is a static assessment (or snapshot) in time. As

circumstances, capabilities, threats, and strategies change,

the dynamics of a competitive environment may not be

revealed in a single matrix.

3) SWOT analysis may lead the firm to overemphasize a single

internal or external factor in formulating strategies.

The Matching Stage

Boston Consulting Group Matrix

When a firms divisions compete in different

industries, a separate strategy often must be

developed for each business. The Boston

Consulting Group (BCG) Matrix and the

Internal-External (IE) Matrix are designed

specifically to enhance a multidivisional

firms efforts to formulate strategies.

The Matching Stage

Boston Consulting Group Matrix

The BCG Matrix graphically portrays differences among

divisions in terms of relative market share position

and industry growth rate. The BCG Matrix allows a

multidivisional organization to manage its portfolio of

businesses by examining the relative market share

position and the industry growth rate of each division

relative to all other divisions in the organization.

The BCG Matrix

The Matching Stage

Boston Consulting Group Matrix

Question MarksDivisions in Quadrant I have a low

relative market share position, yet they compete in

a high-growth industry. Generally these firms cash

needs are

businesses

high and their cash generation is low. These

are

called

Question

Marks

because

the

organization must decide whether to strengthen them by

pursuing an intensive strategy (market penetration, market

development, or product development) or to sell them.

The Matching Stage

Boston Consulting Group Matrix

StarsQuadrant II businesses (Stars) represent the

organizations best long-run opportunities for growth

and profitability. Divisions with a high relative market

share and a high industry growth rate should receive

substantial investment to maintain or strengthen their

dominant

positions.

Forward,

backward,

and

horizontal

integration; market penetration; market development; and

product development are appropriate strategies for these

divisions to consider.

The Matching Stage

Boston Consulting Group Matrix

Cash CowsDivisions positioned in Quadrant III

have a high relative market share position but

compete in a low-growth industry. Called Cash Cows

because they generate cash in excess of their needs,

they are often milked. Cash Cow divisions should

be managed to maintain their strong position

for as long as possible. Product development or

diversification may be attractive strategies for

strong Cash Cows. However, as a Cash Cow

The Matching Stage

Boston Consulting Group Matrix

DogsQuadrant IV divisions of the organization

have a low relative market share position and

compete

in

slow-

or

no-market-growth

industry; they are Dogs in the firms portfolio.

Because of their weak internal and external position,

these businesses are often liquidated, divested, or

The Matching Stage

Boston Consulting Group Matrix

The major benefit of the BCG Matrix is that it

draws attention to the cash flow, investment

characteristics, and needs of an organizations

various divisions. The divisions of many firms

evolve

over

time:

Dogs

become

Question

Marks, Question Marks become Stars, Stars

become Cash Cows, and Cash Cows become

Dogs in an ongoing counter clockwise motion.

Over

time,

organizations

should

strive

to

The Decision Stage

Other

than

prioritized

ranking

list,

strategies

there

is

only

to

achieve

one

the

analytical

technique that is designed to determine the relative

attractiveness

of

feasible

alternative

actions.

This

technique is the Quantitative Strategic Planning Matrix

(QSPM), which uses input information from Stage 1 to

objectively evaluate the relative attractiveness of feasible

alternative strategies identified in Stage 2 and thus

provides objective basis for selecting specific strategies.

The Decision Stage

Quantitative Strategic Planning Matrix (QSPM)

There are six steps involved in the construction of a (QSPM)

matrix :

Step 1 - Make a list of the firms key external opportunities/threats and

internal strengths/weaknesses in the left column of the QSPM. This

information should be taken directly from the EFE Matrix and IFE Matrix.

A minimum of 10 external key success factors and 10 internal key

success factors should be included in the QSPM.

Step 2 - Assign weights to each key external and internal factor. These

weights are identical to those in the EFE Matrix and the IFE Matrix. The

weights are presented in a straight column just to the right of the

external and internal critical success factors.

Step 3 - Examine the Stage 2 (matching) matrices, and identify alternative

strategies that the organization should consider implementing. Record

these strategies in the top row of the QSPM.

The Decision Stage

Quantitative Strategic Planning Matrix

(QSPM)

Step 4 - Determine the Attractiveness Scores (AS) defined as

numerical values that indicate the relative attractiveness of each

strategy in a given set of alternatives. Attractiveness Scores (AS)

are determined by examining each key external or internal factor,

one at a time, and asking the question Does this factor affect the

choice of strategies being made? If the answer to this question is

yes, then the strategies should be compared relative to that key

factor. Specifically, Attractiveness Scores should be assigned to

each strategy to indicate the relative attractiveness of one

strategy over others, considering the particular factor. The range

for Attractiveness Scores is 1 = not attractive, 2 = somewhat

attractive, 3 = reasonably attractive, and 4 = highly attractive.

The Decision Stage

Quantitative Strategic Planning Matrix

(QSPM)

By attractive, we mean the extent that one strategy, compared to

others, enables the firm to either capitalize on the strength,

improve on the weakness, exploit the opportunity, or avoid the

threat. Work row by row in developing a QSPM. If the answer to

the previous question is no, indicating that the respective key

factor has no effect upon the specific choice being made, then

do not assign Attractiveness Scores to the strategies in that set.

Use a dash to indicate that the key factor does not affect the

choice being made. Note: If you assign an AS score to one

strategy, then assign AS score(s) to the other. In other words, if

one strategy receives a dash, then all others must receive a dash

in a given row.

The Decision Stage

Quantitative Strategic Planning Matrix

(QSPM)

Step 5 - Compute the Total Attractiveness Scores. Total

Attractiveness Scores (TAS) are defined as the product of

multiplying the weights (Step 2) by the Attractiveness

Scores (Step 4) in each row. The Total Attractiveness

Scores indicate the relative attractiveness of each

alternative strategy, considering only the impact of the

adjacent external or internal critical success factor. The

higher the Total Attractiveness Score, the more attractive

the strategic alternative (considering only the adjacent

critical success factor).

The Decision Stage

Quantitative Strategic Planning Matrix

(QSPM)

Step 6 - Compute the Sum Total Attractiveness Score. Add

Total Attractiveness Scores in each strategy column of the

QSPM. The Sum Total Attractiveness Scores (STAS)

reveal which strategy is most attractive in each set

of

alternatives.

Higher

scores

indicate

more

attractive strategies, considering all the relevant

external and internal factors that could affect the

strategic decisions. The magnitude of the difference

between the Sum Total Attractiveness Scores in a given

set

of

strategic

alternatives

indicates

desirability of one strategy over another.

the

relative

The Quantitative Strategic Planning Matrix

QSPM

Positive Features of the QSPM

The sets of strategies can be examined

sequentially or simultaneously.

The QSPM requires strategists to integrate

pertinent external and internal factors into

the decision process.

A QSPM can be adapted for use by small and

large for-profit and non-profit organizations

so can be applied to virtually any type of

organization.

Limitations of the QSPM

A QSPM always requires intuitive judgments and

educated

assumptions.

The

ratings

and

attractiveness scores require judgmental decisions,

even though they should be based on objective

information.

A QSPM can be only as good as the prerequisite

information and matching analyses upon which it is

based.

Q S P M

f o r

R e t a i l

C o m p u t e r

S t o r e

Q S P M

f o r

R e t a i l

C o m p u t e r

S t o r e

( c o n )

Interpretation of QSPM Analysis

Results

The Sum Total Attractiveness Scores (4.36 Vs 3.27)

indicate that the computer store owner must "buy

new land and build a new, larger store.

The magnitude of the difference between the Sum

Total Attractiveness Scores gives an indication of

the relative attractiveness of a strategy over

another. This is a vital information for a company

deciding between or among strategies.

Vous aimerez peut-être aussi

- Chapter 5Document54 pagesChapter 5JulianPas encore d'évaluation

- Seatwork No.6Document3 pagesSeatwork No.6Reymond AdayaPas encore d'évaluation

- FInal Part STRAMADocument18 pagesFInal Part STRAMAHannah Kate ToledoPas encore d'évaluation

- Strategy Formulation. Strategy Analysis & Choice (8-10M)Document45 pagesStrategy Formulation. Strategy Analysis & Choice (8-10M)Muhammad FaisalPas encore d'évaluation

- Chapter ViDocument8 pagesChapter ViMustafa AhmedPas encore d'évaluation

- Strategy Analysis and Choice: Learning ObjectivesDocument6 pagesStrategy Analysis and Choice: Learning ObjectivesHak AtakPas encore d'évaluation

- WK 8Document55 pagesWK 8Muhammad AmryPas encore d'évaluation

- Lecture 6 Strategic Analysis and Choice ImportantDocument34 pagesLecture 6 Strategic Analysis and Choice ImportantSarsal6067Pas encore d'évaluation

- Chapter Five The Nature of Strategy Analysis and ChoiceDocument10 pagesChapter Five The Nature of Strategy Analysis and ChoiceBedri M AhmeduPas encore d'évaluation

- TEST CHap 8Document6 pagesTEST CHap 8LinhPas encore d'évaluation

- Topic 6Document24 pagesTopic 6AliPas encore d'évaluation

- Strategic ChoiceDocument31 pagesStrategic ChoiceRajesh TandonPas encore d'évaluation

- Chapter 4 Strategy Analysis and ChoiceDocument13 pagesChapter 4 Strategy Analysis and Choicemelvin cunananPas encore d'évaluation

- Chapter 6 Strategy Analysis and Choice Summary 17132120-002Document6 pagesChapter 6 Strategy Analysis and Choice Summary 17132120-002NOORI KhanaPas encore d'évaluation

- Strat Reviewer Chapter 6Document20 pagesStrat Reviewer Chapter 6Ross John JimenezPas encore d'évaluation

- SM Chapter 6Document13 pagesSM Chapter 6Josh PinedaPas encore d'évaluation

- SM Chapter 6Document11 pagesSM Chapter 6Habtamu AysheshimPas encore d'évaluation

- Lecture 5 - Strategy Analysis and ChoiceDocument24 pagesLecture 5 - Strategy Analysis and ChoiceAlthea Faye RabanalPas encore d'évaluation

- Strategic Management Process PDFDocument8 pagesStrategic Management Process PDFstarvindsouza22100% (1)

- Chapter 6 Strategy Analysis and ChoiceDocument9 pagesChapter 6 Strategy Analysis and ChoiceAnn CruzPas encore d'évaluation

- Strategy Generation & Selection: Chap 8Document20 pagesStrategy Generation & Selection: Chap 8MUHAMMAD ANAS BUKSHPas encore d'évaluation

- Strategic AnalysisDocument5 pagesStrategic Analysistooru oikawaPas encore d'évaluation

- Chapter 5Document69 pagesChapter 5Abdurehman AliPas encore d'évaluation

- Gray Yellow Modern Professional Business Strategy PresentationDocument86 pagesGray Yellow Modern Professional Business Strategy Presentationmonica macalePas encore d'évaluation

- 4 SummaryDocument4 pages4 Summaryhappy everydayPas encore d'évaluation

- 20085ipcc Paper7B Vol2 Cp3Document17 pages20085ipcc Paper7B Vol2 Cp3Piyush GambaniPas encore d'évaluation

- Chapter Six Strategy Analysis and Choice/Strategy FormulationDocument12 pagesChapter Six Strategy Analysis and Choice/Strategy FormulationmedrekPas encore d'évaluation

- Space & QSPMDocument41 pagesSpace & QSPMRadhik Kalra50% (2)

- Strategic Anlysis and ChoiceDocument15 pagesStrategic Anlysis and ChoiceAnonymous IEF3VVwyiIPas encore d'évaluation

- Swot AnalysisDocument10 pagesSwot AnalysisPoorvi BhaskarPas encore d'évaluation

- Strategic ChoiceDocument4 pagesStrategic ChoiceRekhaSainiPas encore d'évaluation

- Strategy Analysis & ChoiceDocument69 pagesStrategy Analysis & ChoiceSemira muradPas encore d'évaluation

- Strategy Generation and SelectionDocument15 pagesStrategy Generation and SelectionAmro Ahmed Razig100% (1)

- Strategy Formulation and Strategic ChoiceDocument9 pagesStrategy Formulation and Strategic ChoiceDilip KushwahaPas encore d'évaluation

- Chapter Five: Strategy Analysis and ChoiceDocument29 pagesChapter Five: Strategy Analysis and ChoiceTa Ye GetnetPas encore d'évaluation

- 3 Aquino Ronquillo Tapia Mondia Parada Origen Guadalupe Geronimo Arcay NarizDocument53 pages3 Aquino Ronquillo Tapia Mondia Parada Origen Guadalupe Geronimo Arcay NarizrcdcavitePas encore d'évaluation

- Content:: Module 3: Strategy FormulationDocument26 pagesContent:: Module 3: Strategy Formulationrakshith bond007Pas encore d'évaluation

- BuPols LevelDocument3 pagesBuPols LevelCristina RamirezPas encore d'évaluation

- Strategic Management Chap 6Document26 pagesStrategic Management Chap 6Aman AhujaPas encore d'évaluation

- Strate GY Analysi S and Choice: Chapter # 6Document5 pagesStrate GY Analysi S and Choice: Chapter # 6Vahaj Khan Yousuf ZaiPas encore d'évaluation

- Strategy Analysis and ChoiceDocument11 pagesStrategy Analysis and ChoiceMuhammad UmaisPas encore d'évaluation

- Reviewer StratDocument14 pagesReviewer StratCzarwin William PobletePas encore d'évaluation

- Pom PlanningDocument50 pagesPom PlanningBhaumik Gandhi100% (1)

- BcgmatrixDocument16 pagesBcgmatrixRanjana TrivediPas encore d'évaluation

- Strategic ManagementDocument25 pagesStrategic ManagementCMPas encore d'évaluation

- Module 8 Strat MGTDocument21 pagesModule 8 Strat MGTAllen Gevryel Ragged A. GabrielPas encore d'évaluation

- Chapter2 (2 1 1)Document50 pagesChapter2 (2 1 1)Xander MaxPas encore d'évaluation

- Strategic FinalDocument33 pagesStrategic FinalCoffee VanillaPas encore d'évaluation

- Strategy Analysis and SelectingDocument26 pagesStrategy Analysis and SelectingNyadroh Clement MchammondsPas encore d'évaluation

- The Matching Stage and Decision StageDocument1 pageThe Matching Stage and Decision StageRichard Jr RjPas encore d'évaluation

- Strategic Management Concepts and Cases 14th Edition David Solutions ManualDocument20 pagesStrategic Management Concepts and Cases 14th Edition David Solutions Manualkiethanh0na91100% (23)

- Q1 Feasibility of Richard RummeltDocument9 pagesQ1 Feasibility of Richard RummeltSaad Ali RanaPas encore d'évaluation

- 2Document17 pages2Indira Prastika Arifianditha0% (1)

- Strategies Policies A Planning PremisesDocument19 pagesStrategies Policies A Planning PremisesAashti Zaidi0% (1)

- BCG Matrix and GE Nine Cells MatrixDocument15 pagesBCG Matrix and GE Nine Cells MatrixBinodBasnet0% (1)

- Module-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionDocument6 pagesModule-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionkimsrPas encore d'évaluation

- Alternative Strategy WordDocument6 pagesAlternative Strategy WordAgathus BiastyaPas encore d'évaluation

- Marketing For Engineers CH 3Document25 pagesMarketing For Engineers CH 3karim kobeissiPas encore d'évaluation

- Marketing For Engineers CH 9Document60 pagesMarketing For Engineers CH 9karim kobeissiPas encore d'évaluation

- Marketing For Engineers CH 6Document33 pagesMarketing For Engineers CH 6karim kobeissiPas encore d'évaluation

- Marketing For Engineers CH 7Document54 pagesMarketing For Engineers CH 7karim kobeissiPas encore d'évaluation

- Marketing For Engineers CH 5Document78 pagesMarketing For Engineers CH 5karim kobeissiPas encore d'évaluation

- Marketing For Engineers CH 8Document60 pagesMarketing For Engineers CH 8karim kobeissiPas encore d'évaluation

- Engineering Economics CH 1Document18 pagesEngineering Economics CH 1karim kobeissiPas encore d'évaluation

- Engineering Economics CH 5Document23 pagesEngineering Economics CH 5karim kobeissiPas encore d'évaluation

- Marketing For Engineers CH 2Document80 pagesMarketing For Engineers CH 2karim kobeissiPas encore d'évaluation

- Engineering Economics CH 3Document57 pagesEngineering Economics CH 3karim kobeissiPas encore d'évaluation

- Engineering Economics CH 4Document42 pagesEngineering Economics CH 4karim kobeissiPas encore d'évaluation

- Strategic Management CH 9Document17 pagesStrategic Management CH 9karim kobeissiPas encore d'évaluation

- Marketing For Engineers CH 1Document46 pagesMarketing For Engineers CH 1karim kobeissiPas encore d'évaluation

- Engineering Economics CH 2Document81 pagesEngineering Economics CH 2karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 3Document25 pagesPrinciples of Marketing CH 3karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 9Document50 pagesPrinciples of Marketing CH 9karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 10Document50 pagesPrinciples of Marketing CH 10karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 5Document78 pagesPrinciples of Marketing CH 5karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 8Document61 pagesPrinciples of Marketing CH 8karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 6Document33 pagesPrinciples of Marketing CH 6karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 2Document80 pagesPrinciples of Marketing CH 2karim kobeissi100% (1)

- Principles of Marketing CH 1Document45 pagesPrinciples of Marketing CH 1karim kobeissi100% (1)

- Principles of Marketing CH 4Document60 pagesPrinciples of Marketing CH 4karim kobeissiPas encore d'évaluation

- Principles of Marketing CH 7Document54 pagesPrinciples of Marketing CH 7karim kobeissiPas encore d'évaluation

- Strategic Management CH 8Document26 pagesStrategic Management CH 8karim kobeissiPas encore d'évaluation

- Strategic Management CH 7Document31 pagesStrategic Management CH 7karim kobeissiPas encore d'évaluation

- Strategic Management CH 5Document18 pagesStrategic Management CH 5karim kobeissiPas encore d'évaluation

- Strategic Management CH 3Document26 pagesStrategic Management CH 3karim kobeissiPas encore d'évaluation

- Strategic Management CH 4Document37 pagesStrategic Management CH 4karim kobeissiPas encore d'évaluation

- Why Do South Korean Students Study HardDocument10 pagesWhy Do South Korean Students Study HardJonathan JarvisPas encore d'évaluation

- ProblemsFacedbyCounsellorsMaxim PDFDocument8 pagesProblemsFacedbyCounsellorsMaxim PDFEdward SagayarjPas encore d'évaluation

- Fundamentals of Economics and Financial MarketsDocument4 pagesFundamentals of Economics and Financial MarketsluluPas encore d'évaluation

- The Principle of FunctorialityDocument15 pagesThe Principle of Functorialitytoschmid007Pas encore d'évaluation

- Cronbach's AlphaDocument4 pagesCronbach's AlphaRobert RodriguezPas encore d'évaluation

- Practical Research 1Document11 pagesPractical Research 1Eissa May VillanuevaPas encore d'évaluation

- Social Studies ECE - Module 8 - FinalsDocument5 pagesSocial Studies ECE - Module 8 - FinalsLea May EnteroPas encore d'évaluation

- Chapter 01 PowerPoint BBADocument26 pagesChapter 01 PowerPoint BBASimantoPreeomPas encore d'évaluation

- Retail and Distribution Management: Article InformationDocument10 pagesRetail and Distribution Management: Article InformationSalman FarooqPas encore d'évaluation

- 3roca Research Chapter 1 3Document27 pages3roca Research Chapter 1 3Jayr ReyesPas encore d'évaluation

- Compare The Aims and Objectives of Teacher Education As Given by Aggerwal and Given in The National Education Policy 2009 - AnswerDocument15 pagesCompare The Aims and Objectives of Teacher Education As Given by Aggerwal and Given in The National Education Policy 2009 - AnswerMuhammad Shahid100% (1)

- Crossing Central EuropeDocument309 pagesCrossing Central EuropeCanash CachlobPas encore d'évaluation

- Group StructureDocument2 pagesGroup Structurejade brewPas encore d'évaluation

- Design Engineering Applications of The Vexcel Ultracam Digital Aerial CameraDocument49 pagesDesign Engineering Applications of The Vexcel Ultracam Digital Aerial CameraNT SpatialPas encore d'évaluation

- Design, Fabrication and Performance Analysis of Economical, Passive Solar Dryer Integrated With Heat Storage Material For Agricultural ProductsDocument8 pagesDesign, Fabrication and Performance Analysis of Economical, Passive Solar Dryer Integrated With Heat Storage Material For Agricultural ProductsEditor IjasrePas encore d'évaluation

- Preface: Objective of The StudyDocument13 pagesPreface: Objective of The Studyashok chauhanPas encore d'évaluation

- 28 39 Bavcevic PDFDocument12 pages28 39 Bavcevic PDFJosip CvenicPas encore d'évaluation

- Clearion Software v1 Group8Document23 pagesClearion Software v1 Group8Rahul NagrajPas encore d'évaluation

- Resume - Vincenzo Pierpaolo Mancusi - ItalyDocument3 pagesResume - Vincenzo Pierpaolo Mancusi - ItalyVincenzoPierpaoloMancusiPas encore d'évaluation

- ESP & Mental Telepathy Research Documents Before I Learned My In-Depth Knowledge of U.S. Sponsored Mind Control September 10, 2007Document141 pagesESP & Mental Telepathy Research Documents Before I Learned My In-Depth Knowledge of U.S. Sponsored Mind Control September 10, 2007Stan J. CaterbonePas encore d'évaluation

- The Process of HRPDocument22 pagesThe Process of HRPdpsahooPas encore d'évaluation

- Journal of Public HealthDocument5 pagesJournal of Public HealthAhmad Muzakkir ZainaniPas encore d'évaluation

- LAB MANUAL Rebound HammerDocument4 pagesLAB MANUAL Rebound HammerDanial Asyraaf100% (3)

- Twin ThesisDocument6 pagesTwin Thesissamanthajonessavannah100% (2)

- Introducinng Social Psychology Tajfel and Fraser Introduction OnlyDocument15 pagesIntroducinng Social Psychology Tajfel and Fraser Introduction OnlyAditi GhoshPas encore d'évaluation

- Analyzing and Presenting Qualitative DataDocument4 pagesAnalyzing and Presenting Qualitative DataLeo Rivas100% (1)

- Tesla Motors Inc Semester Project1Document27 pagesTesla Motors Inc Semester Project1Hera ImranPas encore d'évaluation

- Final Community Partnership ResourceDocument7 pagesFinal Community Partnership Resourceapi-315848490Pas encore d'évaluation

- MBA - ABSK 901 Report Assignment - Salary - LimitationsDocument21 pagesMBA - ABSK 901 Report Assignment - Salary - LimitationsMarwa Mourad IbPas encore d'évaluation

- How To Write Chapter 4Document33 pagesHow To Write Chapter 4LJLCNJKZSDPas encore d'évaluation