Académique Documents

Professionnel Documents

Culture Documents

Chapter 16

Transféré par

Yuxuan SongCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 16

Transféré par

Yuxuan SongDroits d'auteur :

Formats disponibles

Slide 16.

Chapter 16:

The Effects of Environmental

Uncertainty, Organizational

Strategy, and Multinationality on

Management Control Systems

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.2

Contingency/situational factors

There are no universally best control systems

that apply in every situation for all organizations

Contingency factors

Organizational factors

Technological factors

Strategic factors, etc.

MCS variables

Outcome variables

Type + tightness of controls used

Design of the budgeting system

Performance measures emphasized

Objectivity of performance evaluations

Design of reward systems, etc.

Degree of control

Dysfunctional side-effects

Control costs

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.3

Strategy typologies

Corporate diversification strategy

Refers to what businesses the firm should invest in

and how these businesses should be coordinated

Defines where to compete

Single business related/unrelated diversified

Business unit competitive strategy

Determines how to compete in each of the businesses

Low cost differentiation

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.4

Degree of Relatedness

High

Corporate diversification strategy

low

Single

Business

Firms

One line of business

Operational synergies

Related

Diversifiers

based on a common set

of core competencies

Connection between

Unrelated

Diversifiers

Number of Businesses

businesses is mainly

financial (holdings)

High

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.5

Implications for MCS design

Incentives

Budgets

Single/Related

Business

Unrelated

Diversified

Control of SBU-manager

over budget formulation

Low (?)

High

Importance attached to

meeting the budget

Low (?)

High

Bonus criteria

Bonus determination

Bonus basis

financial and

nonfinancial criteria

primarily financial criteria

primarily subjective

or discretionary (?)

primarily formula-based

SBU + corporate

primarily SBU-performance

performance

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.6

Business unit competitive strategy

Cost leadership

Differentiation

economies of scale

brand loyalty

tight cost control

superior customer

service

standard products

product features

cost minimization

standardized tasks and

production processes

product design

customization

different business unit strategies require different MCS ...

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.7

Implications on MCS design

BUDGETING

Low Cost Differentiation

Control of SBU-manager

over budget formulation

relatively low

relatively high

Budget revisions

during the year

relatively difficult

relatively easy

Tolerance towards

budget deviations

relatively low

relatively high

relatively high

relatively low

Importance attached to

meeting the budget

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.8

Implications on MCS design (continued)

Low Cost Differentiation

INCENTIVES

Bonus criteria

primarily

financial criteria

more emphasis on

nonfinancial criteria

Bonus determination

primarily

formula-based

more subjective

or discretionary (?)

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.9

Differences across countries

Factors that affect MCSs across countries

National culture

Peoples tastes, norms, values, social attitudes, religions,

personal priorities, and responses to interpersonal stimuli

Local Institutions

Government agencies, banking systems, labor unions,

financial markets, accounting rules, regulations, etc.

Local business environments

Stage of economic development, political risk, inflation,

labor availability, labor quality, labor mobility, etc.

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.10

National culture differences

National culture has a direct effect on MCS because

control problems are behavioral problems

Individualism potentially affects

Incentives based on individual vs. group performance

Propensity of engaging in myopic, self-centered behavior

Power distance potentially affects

Degree of centralization of decision-making

Degree of participation in setting performance targets

Uncertainty avoidance potentially affects

Degree of subjectivity in performance evaluations

Degree of formality of planning and budgeting processes

Masculinity potentially affects

Degree of performance-based rewards

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.11

Local institutions

Labor unions

Use of performance-based rewards

(merit-based vs. seniority-based)

Financial markets and stock market valuations

Frequency of profit measurement

Use of short-term incentives

Likelihood of myopic behavior

Threat of hostile takeovers

Use of reward schemes to get common stock

in managers and employees hands

Accounting regulations

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.12

Local business environments

Risk and uncertainty-related factors

Business risk

Military conflicts, terrorism, corporate espionage, etc.

Political risk

Adverse: forced production, prohibition of layoffs, price controls

Protective: tariff barriers, subsidies, research support, etc.

Stage of economic development

Age and size of corporations, degree of computerization, degree

of development of accounting, information, and control systems

Inflation

Financial risk (e.g., use of flexible budgeting)

Labor availability, quality, and mobility

Use of action controls, personnel controls, and long-term incentives

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Slide 16.13

Foreign currency translation

Local managers bear foreign currency translation

risk if their performance in measured in homecountry currency

Can subsidiary managers control this risk?

Authority to make cross-border investment, product

sourcing, or marketing decisions

Authority to write purchase or sales contracts in one

currency or another

Authority to make foreign exchange transactions (hedging,

swaps, arbitrage)

If not,

Evaluate manager in local currency

Treat foreign exchange losses and gains below the line

Calculate foreign exchange variance and treat it as

uncontrollable

Flex the budget to end-of-year currency rates

Merchant, Management Control Systems PowerPoints on the Web, 3rd edition, Pearson Education Limited 2012

Vous aimerez peut-être aussi

- Chapter 14Document19 pagesChapter 14Yuxuan Song100% (1)

- Chapter 17Document9 pagesChapter 17Yuxuan Song100% (1)

- Chapter 15Document11 pagesChapter 15Yuxuan SongPas encore d'évaluation

- Chapter 11Document22 pagesChapter 11Yuxuan SongPas encore d'évaluation

- Chapter 13Document16 pagesChapter 13Yuxuan SongPas encore d'évaluation

- Chapter 12Document15 pagesChapter 12Yuxuan SongPas encore d'évaluation

- Chapter 10Document19 pagesChapter 10Yuxuan SongPas encore d'évaluation

- Chapter 09Document18 pagesChapter 09Yuxuan SongPas encore d'évaluation

- Chapter 06Document5 pagesChapter 06Yuxuan SongPas encore d'évaluation

- Chapter 07Document18 pagesChapter 07Yuxuan SongPas encore d'évaluation

- Chapter 08Document17 pagesChapter 08Yuxuan SongPas encore d'évaluation

- Chapter 04Document8 pagesChapter 04Yuxuan SongPas encore d'évaluation

- Chapter 05Document7 pagesChapter 05Yuxuan SongPas encore d'évaluation

- Action, Personnel, and Cultural ControlsDocument15 pagesAction, Personnel, and Cultural Controlsevaluv100% (1)

- Chapter 02Document7 pagesChapter 02Yuxuan SongPas encore d'évaluation

- Chapter 1Document9 pagesChapter 1Anonymous lp6TeWExPePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Group Sem2Document9 pagesGroup Sem2swabhiPas encore d'évaluation

- Teur CaseDocument7 pagesTeur Casewriter topPas encore d'évaluation

- M CaffeineDocument10 pagesM CaffeineKanishka KabadiPas encore d'évaluation

- Firms in Competitive MarketsDocument41 pagesFirms in Competitive MarketsNita AstutyPas encore d'évaluation

- The Hershey Company: Abdullah, Esnaira A. Pantia, Patrik Oliver E. Pasaol, Devvie Mae ADocument18 pagesThe Hershey Company: Abdullah, Esnaira A. Pantia, Patrik Oliver E. Pasaol, Devvie Mae APatrik Oliver PantiaPas encore d'évaluation

- Lazy Portfolios: Core and SatelliteDocument2 pagesLazy Portfolios: Core and Satellitesan291076Pas encore d'évaluation

- Service Leadership 19 08 2010Document9 pagesService Leadership 19 08 2010Mohamed Shahul HameedPas encore d'évaluation

- The Purchasing Process: Purchasing & Supply Chain Management, 4EDocument48 pagesThe Purchasing Process: Purchasing & Supply Chain Management, 4EMRASSASINPas encore d'évaluation

- Cisco Systems New Millennium - NewDocument2 pagesCisco Systems New Millennium - NewFrançois AlmPas encore d'évaluation

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJAN RAY CUISON VISPERASPas encore d'évaluation

- MGL Economics Chapter 2Document41 pagesMGL Economics Chapter 2jannat_sondiPas encore d'évaluation

- Decision MakingDocument97 pagesDecision MakingShohnura FayzulloevaPas encore d'évaluation

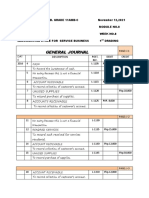

- Accounting Cycle for a Service BusinessDocument5 pagesAccounting Cycle for a Service BusinessKristel Mae PayotPas encore d'évaluation

- B ProposalDocument19 pagesB ProposalberisomorketaPas encore d'évaluation

- MGNT 3430 Homework Answers for Operations ManagementDocument4 pagesMGNT 3430 Homework Answers for Operations ManagementKeron TzulPas encore d'évaluation

- Chapter 6 (Standard Cost)Document98 pagesChapter 6 (Standard Cost)annur azalillahPas encore d'évaluation

- Sales Forecast and Pricing Strategy Impact on Battery BusinessDocument11 pagesSales Forecast and Pricing Strategy Impact on Battery BusinessMuhammad Izzudin Kurnia Adi100% (1)

- 01.intro To SCM - v11Document25 pages01.intro To SCM - v11Alexandrino dos AnjosPas encore d'évaluation

- (Corporate Finance) SUMMARY OF EXERCISES PDFDocument9 pages(Corporate Finance) SUMMARY OF EXERCISES PDFneda ajaminPas encore d'évaluation

- Peta 1&2Document3 pagesPeta 1&2Jolito FloirendoPas encore d'évaluation

- How To Define A Chart of Accounts in Oracle Apps R12: Month End ProcessDocument18 pagesHow To Define A Chart of Accounts in Oracle Apps R12: Month End ProcessCGPas encore d'évaluation

- B 11Document176 pagesB 11Nathan JonesPas encore d'évaluation

- SS 08 Quiz 1 - AnswersDocument82 pagesSS 08 Quiz 1 - AnswersVan Le Ha100% (3)

- Giridhar Case Study AshishDocument9 pagesGiridhar Case Study AshishAshish SinghPas encore d'évaluation

- 06 AmazonDocument17 pages06 AmazonmaheshpatelPas encore d'évaluation

- Round 1 Financial Stats and Stock DataDocument15 pagesRound 1 Financial Stats and Stock DataDamanpreet Singh100% (1)

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaPas encore d'évaluation

- Emerging Issues of ProcurementDocument19 pagesEmerging Issues of ProcurementUzair Ullah KhanPas encore d'évaluation

- Institute of Business Management and Research, Ips Academy, Indore Lesson PlanDocument5 pagesInstitute of Business Management and Research, Ips Academy, Indore Lesson PlanSushma IssacPas encore d'évaluation

- ACT-202 Group ProjectDocument13 pagesACT-202 Group ProjectRomi SikderPas encore d'évaluation