Académique Documents

Professionnel Documents

Culture Documents

ENGR 3360U Winter 2014 Unit 5.2-3: Present Worth Analysis

Transféré par

sunnyopgTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ENGR 3360U Winter 2014 Unit 5.2-3: Present Worth Analysis

Transféré par

sunnyopgDroits d'auteur :

Formats disponibles

ENGR 3360U Winter 2014

Unit 5.2-3

Present Worth Analysis

Dr. J. Michael Bennett, P. Eng., PMP,

UOIT,

Version 2014-I-01

Unit 5 Present Worth Analysis

Change Record

2014-I-01 Initial Creation

Text Chapter 5

5-2

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

5.2 Equal Lives

When selecting between two alternatives

using present worth analysis:

Maximize:

5-3

Net Present Worth = Present worth benefits

Present worth of costs

NPW = PW of benefits PW of costs

The alternative with the higher NPW is

selected

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

Present Worth Approach: Mutually

Exclusive Projects

Alternatives must be of equal service, that is, evaluate all

alternatives over the same number of years.

For a single project, project is financially viable if PW 0 at

the MARR

For 2 or more alternatives, select the one

with the (numerically) larger PW value

5-4

Examples:

2014-I-01

PW1

PW2

Select

$-1500 $-500

$+2500 $-500

$-1200 $ +25

Alt 2

Alt 1

Alt 2

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

PW method for independent projects

Select all projects with PW 0 when the

MARR is used in calculating the PW values

This assumes no restriction of how much is

invested during a given time period.

If investment limit exists, which it usually does,

use the techniques of chapter 8 and 9

5-5

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

Example 5.1

A firm is trying to decide

which of 2 machines to buy.

Both have useful lives of 5

years with no salvage value.

Machine A costs $1,000 and

will save $300 annually.

Machine B costs $1,350 and

will save $300 the first year,

$350 the second, $400 the 3rd

and so on, If the interest rate

is 7%, which should be

chosen?

5-6

2014-I-01

PWA = -1000 + 300(P/A, 7%, 5)

= $230

PWB = -1000 + 300(P/A, 7%, 5)

+ 50(P/G, 7%,5) = $262.5

CHOOSE B

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

5.3 Unequal Lives

It is NOT correct to analyse alternatives

using PW with different lives.

Methods to handle this problem:

Examine the alternatives using a Least

Common Multiple of lives (LCM).

Decide on an analysis period if the LCM

method is too onerous or doesnt make sense.

5-7

(e.g., 7 and 13 years gives an LCM = 91 years)

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

LCM

E.g., 10 year project life versus a 5 year project

life

Least common multiple is 10 years

Reformulate 5 year life to 10 year life:

including the cash flows in years 0 to 5 and also in years

5 to 10

the alternatives can now be compared

6

Original 5 year project

20

0

30

1

5

32

20

10

20

0

30

1

5

32

20

10

10

20

9

32

20

10

30

5 year project now a 10 year project

5-8

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

LCM Example 5.2

An engineer needs to rent an office. Here

are her two choices.

A: First cost, - $15,000, yearly lease -3,500

Deposit return 1,000, length 6 years

B: First cost, - $18,000, yearly lease -3,100

Deposit return 2,000, length 9 years

5-9

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

PW Analysis using LCM Approach

This is a good illustration of LCM method

at i = 15% per year

Location A has nA = 6 years and B has nB = 9

o

o

o

o

LCM = 18 years; determine both PW values over 18 years

Assume two re-purchases of A at the end of years 6 and 12

Assume one re-purchase of B at end of year 9

All cash flow estimates are assumed to continue for 18 years,

including the end-of-lease return deposit

PWA = $-45,036 and PWB = $-41,384

Select location B with the (numerically) larger PW, which has

the smaller equivalent PW cost

5-10

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

PW Calculation for 18 years

PWA =-15,000 +1000(P/F,15%,6)

-15,000(P/F,15%,6) + 1,000(P/F,15%,12)

-15,000(P/F,15%,12) + 1,000(P/F,15%,18)

-3,500(P/A,15%,18)

= -$45,036

5-11

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Unit 5 Present Worth Analysis

Present Worth Analysis of Different-Life

Alternatives

For alternatives with un-equal lives the rule is:

PW of the alternatives must be compared over the same

number of years

Called Equal Service requirement

Approach 1 of 2 approaches

LCM -- Evaluate the alternatives over the lowest common multiple of

lives, e.g., lives of 4 and 6, use n = 12 and assume re-investment at

same cash flow estimates

Study period -- assume a planning horizon and evaluate the

alternatives over this number of years

5-12

2014-I-01

Dr. J.M. Bennett, P.Eng., PMP ENGR 3360U Eng Eco

Vous aimerez peut-être aussi

- ENGR 3360U Winter 2014 Unit 9: Other Choosing TechniquesDocument27 pagesENGR 3360U Winter 2014 Unit 9: Other Choosing TechniquessunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 6-3: Alternate Choices Using AWDocument48 pagesENGR 3360U Winter 2014 Unit 6-3: Alternate Choices Using AWsunnyopgPas encore d'évaluation

- 3360 Unit 06.2 2014-I-01Document48 pages3360 Unit 06.2 2014-I-01sunnyopgPas encore d'évaluation

- Engineering Economics 3Document60 pagesEngineering Economics 3Muktar JemalPas encore d'évaluation

- Inde232-Chapter 4Document27 pagesInde232-Chapter 4Abdullah AfefPas encore d'évaluation

- Analisa Ekonomi TeknikDocument47 pagesAnalisa Ekonomi TeknikVachri MPas encore d'évaluation

- Methods of Comparison of Alternatives and Decision Analysis: Chapter TwoDocument26 pagesMethods of Comparison of Alternatives and Decision Analysis: Chapter Tworobel popPas encore d'évaluation

- CH 2Document62 pagesCH 2robel popPas encore d'évaluation

- Engineering Economics: V-Present Worth AnalysisDocument44 pagesEngineering Economics: V-Present Worth Analysisfadhillah ivanPas encore d'évaluation

- Methods of Comparing Alternative ProposalsDocument67 pagesMethods of Comparing Alternative Proposalsrobel pop50% (2)

- Present Worth AnalysisDocument41 pagesPresent Worth AnalysisHariganesan VairavanPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 7.2: Internal Rate of Return AnalysisDocument21 pagesENGR 3360U Winter 2014 Unit 7.2: Internal Rate of Return AnalysissunnyopgPas encore d'évaluation

- Chapt 5Document48 pagesChapt 5Aatyf FaXalPas encore d'évaluation

- Annual Cost and Present WorthDocument26 pagesAnnual Cost and Present WorthSiddharthPas encore d'évaluation

- Chapter 5 - Present Worth Analysis PDFDocument34 pagesChapter 5 - Present Worth Analysis PDFSana MerajPas encore d'évaluation

- Present Worth AnalysisDocument33 pagesPresent Worth AnalysisFasih Ur RehmanPas encore d'évaluation

- Eng233ch3 141001100602 Phpapp01 PDFDocument38 pagesEng233ch3 141001100602 Phpapp01 PDFLibyaFlowerPas encore d'évaluation

- Chapter 13 - Breakeven AnalysisDocument16 pagesChapter 13 - Breakeven AnalysisBich Lien Pham100% (1)

- Lecture 9Document22 pagesLecture 9Muhammad UsmanPas encore d'évaluation

- Engineering Economy Module 6Document52 pagesEngineering Economy Module 6shaitoPas encore d'évaluation

- Task IVDocument7 pagesTask IVAdinapraja DienPas encore d'évaluation

- 05 Present Worth AnalysisDocument24 pages05 Present Worth AnalysisRio ZulmansyahPas encore d'évaluation

- Engineering Econ 2Document14 pagesEngineering Econ 2AbdullahMofarrahPas encore d'évaluation

- Equivalent Annual AnnuityDocument10 pagesEquivalent Annual Annuitymohsin_ali07428097Pas encore d'évaluation

- Energy Management & Economics: By: Lec. Ahmed ReyadhDocument20 pagesEnergy Management & Economics: By: Lec. Ahmed Reyadhاحمد محمد عريبيPas encore d'évaluation

- Chapter 6 Engineering EconomyDocument20 pagesChapter 6 Engineering EconomyArsalan AsifPas encore d'évaluation

- Week 7 PDFDocument18 pagesWeek 7 PDFKHAKSARPas encore d'évaluation

- Chapter #6Document65 pagesChapter #6Kyle JacksonPas encore d'évaluation

- 3.2. Future W - PBADocument18 pages3.2. Future W - PBAteweldePas encore d'évaluation

- 3.2. Future W - PBADocument18 pages3.2. Future W - PBAAbdulselam AbdurahmanPas encore d'évaluation

- Probability and Decision TreesDocument13 pagesProbability and Decision TreesrubbydeanPas encore d'évaluation

- ManPro-6 Present Worth Analysis 2019Document45 pagesManPro-6 Present Worth Analysis 2019Syifa Fauziah RustoniPas encore d'évaluation

- Chap 5Document8 pagesChap 5Aman Kumar SaranPas encore d'évaluation

- Present Worth AnalysisDocument39 pagesPresent Worth AnalysisOrangePas encore d'évaluation

- CE533 Chp4 PW AnalysisDocument68 pagesCE533 Chp4 PW AnalysisabegaelbautistaPas encore d'évaluation

- Case Studies in Engineering Economics For Electrical Engineering StudentsDocument6 pagesCase Studies in Engineering Economics For Electrical Engineering Studentsryan macutoPas encore d'évaluation

- Present Worth AnalysisDocument29 pagesPresent Worth AnalysisSau Yong ChienPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 16: Engineering Economic Analysis in The Public SectorDocument24 pagesENGR 3360U Winter 2014 Unit 16: Engineering Economic Analysis in The Public SectorsunnyopgPas encore d'évaluation

- Engineering Economics (MS-291) : Lecture # 14Document29 pagesEngineering Economics (MS-291) : Lecture # 14M Ali AsgharPas encore d'évaluation

- Payback Period AnalysisDocument16 pagesPayback Period AnalysisashishkapoorsrmPas encore d'évaluation

- Mutually Exclusive ProjectsDocument39 pagesMutually Exclusive ProjectsRAMRAJ CHIMOURIYAPas encore d'évaluation

- Lecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesDocument6 pagesLecture - Notes17 - Economic Comparisons of Mutually Exclusive AlternativesprofdanielPas encore d'évaluation

- Benefit Cost RatioDocument11 pagesBenefit Cost RatioSyed Raheel AdeelPas encore d'évaluation

- Idoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Document6 pagesIdoc - Pub 169018566 Engineering Economy 7th Edition Solution Manual Blank Tarquin 160312152003Tural RamazanovPas encore d'évaluation

- Eeca Unit 3Document11 pagesEeca Unit 3bharath_skumarPas encore d'évaluation

- Ch5 Present Worth AnalysisDocument17 pagesCh5 Present Worth AnalysisAshley JuddPas encore d'évaluation

- MEC210 - Lecture 06 - 241Document28 pagesMEC210 - Lecture 06 - 241Mina NasserPas encore d'évaluation

- Annual Worth AnalysisDocument12 pagesAnnual Worth AnalysisGlenn Midel Delos SantosPas encore d'évaluation

- Engineering Economy Module 6Document52 pagesEngineering Economy Module 6Bry An CañaresPas encore d'évaluation

- Evaluating Alternatives: Chethan S.GowdaDocument82 pagesEvaluating Alternatives: Chethan S.GowdaTodesa HinkosaPas encore d'évaluation

- Annual Worth Analysis - v0Document11 pagesAnnual Worth Analysis - v0Phillip WhitneyPas encore d'évaluation

- Chapter 5 - Present Worth AnalysisDocument17 pagesChapter 5 - Present Worth AnalysisMuhammad Saad Bin AkbarPas encore d'évaluation

- Present Worth AnalysisDocument29 pagesPresent Worth AnalysisKetut PujaPas encore d'évaluation

- DOE Report XinliShaDocument16 pagesDOE Report XinliShaXinli ShaPas encore d'évaluation

- Lesson 6 Application of TVM Concepts in Investment Studies and Comparison of AlternativesDocument22 pagesLesson 6 Application of TVM Concepts in Investment Studies and Comparison of Alternativesfathima camangianPas encore d'évaluation

- Bab 5Document24 pagesBab 5Felix HabarugiraPas encore d'évaluation

- 20131016210315001Document21 pages20131016210315001Saied Aly SalamahPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 4.4: Annual PaymentsDocument20 pagesENGR 3360U Winter 2014 Unit 4.4: Annual PaymentssunnyopgPas encore d'évaluation

- Chemical Process Design - Problem Set 5: 1. Question 29 of Chapter 9Document5 pagesChemical Process Design - Problem Set 5: 1. Question 29 of Chapter 9Gabriel S. Gusmão (Freddie)Pas encore d'évaluation

- 3360 Unit 15 2014-I-01Document20 pages3360 Unit 15 2014-I-01sunnyopgPas encore d'évaluation

- 3360 Unit 17 2014-I-01Document31 pages3360 Unit 17 2014-I-01sunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 16: Engineering Economic Analysis in The Public SectorDocument24 pagesENGR 3360U Winter 2014 Unit 16: Engineering Economic Analysis in The Public SectorsunnyopgPas encore d'évaluation

- 3360 Unit 13 2014-I-01Document34 pages3360 Unit 13 2014-I-01sunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 12: After-Tax Cash FlowDocument44 pagesENGR 3360U Winter 2014 Unit 12: After-Tax Cash FlowsunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 14: InflationDocument18 pagesENGR 3360U Winter 2014 Unit 14: InflationsunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 11: Cash Flow and DepreciationDocument40 pagesENGR 3360U Winter 2014 Unit 11: Cash Flow and DepreciationsunnyopgPas encore d'évaluation

- 3360 Unit 06.1 2014-I-01Document48 pages3360 Unit 06.1 2014-I-01sunnyopgPas encore d'évaluation

- 3360 Unit 10.5 2014-I-01Document35 pages3360 Unit 10.5 2014-I-01sunnyopgPas encore d'évaluation

- 3360 Unit 10.2 2014-I-01Document20 pages3360 Unit 10.2 2014-I-01sunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 10: Risk and UncertaintyDocument34 pagesENGR 3360U Winter 2014 Unit 10: Risk and UncertaintysunnyopgPas encore d'évaluation

- 3360 Unit 10.3 2014-I-01Document20 pages3360 Unit 10.3 2014-I-01sunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 10-4: Quantitative Assessment of RiskDocument31 pagesENGR 3360U Winter 2014 Unit 10-4: Quantitative Assessment of RisksunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 10: Risk and UncertaintyDocument34 pagesENGR 3360U Winter 2014 Unit 10: Risk and UncertaintysunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 7.2: Internal Rate of Return AnalysisDocument21 pagesENGR 3360U Winter 2014 Unit 7.2: Internal Rate of Return AnalysissunnyopgPas encore d'évaluation

- 3360 Unit 08 2014-I-01Document21 pages3360 Unit 08 2014-I-01sunnyopgPas encore d'évaluation

- 3360 Unit 07.1 2014-I-01Document26 pages3360 Unit 07.1 2014-I-01sunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 5.5: Payback Period AnalysisDocument6 pagesENGR 3360U Winter 2014 Unit 5.5: Payback Period AnalysissunnyopgPas encore d'évaluation

- 3360 Unit 06.4 2014-I-01Document14 pages3360 Unit 06.4 2014-I-01sunnyopgPas encore d'évaluation

- 3360 Unit 05.5 2014-I-01Document17 pages3360 Unit 05.5 2014-I-01sunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 4.5-6: Arithmetic and Geometric GradientsDocument18 pagesENGR 3360U Winter 2014 Unit 4.5-6: Arithmetic and Geometric GradientssunnyopgPas encore d'évaluation

- 3360 Unit 04.1 2014-I-01Document23 pages3360 Unit 04.1 2014-I-01sunnyopgPas encore d'évaluation

- 3360 Unit 05.3 2014-I-01Document25 pages3360 Unit 05.3 2014-I-01sunnyopgPas encore d'évaluation

- 3360 Unit 05.1 2014-I-01Document12 pages3360 Unit 05.1 2014-I-01sunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 4.7-8: Finding I%, N, Continuous CompoundingDocument13 pagesENGR 3360U Winter 2014 Unit 4.7-8: Finding I%, N, Continuous CompoundingsunnyopgPas encore d'évaluation

- ENGR 3360U Winter 2014 Unit 4.4: Annual PaymentsDocument20 pagesENGR 3360U Winter 2014 Unit 4.4: Annual PaymentssunnyopgPas encore d'évaluation

- Brynn Grey Financial Impact StudyDocument239 pagesBrynn Grey Financial Impact StudyScott FranzPas encore d'évaluation

- Advanced Financial Accounting Course OutlineDocument5 pagesAdvanced Financial Accounting Course OutlineEriqPas encore d'évaluation

- Vei Resume - Sarah WuDocument1 pageVei Resume - Sarah Wuapi-538868439Pas encore d'évaluation

- U.S. Capital Advisors Common Terms and Abbreviations For More Information, Please Contact Becca Followill at 713-366-0557Document1 pageU.S. Capital Advisors Common Terms and Abbreviations For More Information, Please Contact Becca Followill at 713-366-0557Familia GonzalezPas encore d'évaluation

- December 2012 With WatermarkDocument175 pagesDecember 2012 With WatermarkNageswaran GopuPas encore d'évaluation

- Consolidated Financial Statements - Intercompany Asset TransactionsDocument15 pagesConsolidated Financial Statements - Intercompany Asset TransactionsImran Abdul HamidPas encore d'évaluation

- The Guide To Worry Free Investing VectorvestDocument10 pagesThe Guide To Worry Free Investing VectorvestDdasfda DsafasdfPas encore d'évaluation

- Merrill Lynch - Assessing Cost of Capital and Performance 2015Document16 pagesMerrill Lynch - Assessing Cost of Capital and Performance 2015CommodityPas encore d'évaluation

- IrfmDocument2 pagesIrfmSuresh Kumar SainiPas encore d'évaluation

- GAW CapitalDocument6 pagesGAW Capitalchermaine_d15Pas encore d'évaluation

- Orbit 1Document2 pagesOrbit 1Pranav MishraPas encore d'évaluation

- Let MathDocument6 pagesLet MathJanin R. CosidoPas encore d'évaluation

- AE11 Man Econ Module 3-4Document51 pagesAE11 Man Econ Module 3-4Jynilou PinotePas encore d'évaluation

- You Ca Have Recently Been Assigned As Audit Senior For PDFDocument2 pagesYou Ca Have Recently Been Assigned As Audit Senior For PDFhassan taimourPas encore d'évaluation

- My Record of Group ContributionDocument16 pagesMy Record of Group ContributionMemey C.Pas encore d'évaluation

- Capability Statement 03Document1 pageCapability Statement 03macPas encore d'évaluation

- Vision January 2023 - EnglishDocument8 pagesVision January 2023 - EnglishRajat KushwahPas encore d'évaluation

- Burden of LaborDocument4 pagesBurden of Laborhamiltjw2Pas encore d'évaluation

- Redemption of Preference SharesDocument19 pagesRedemption of Preference SharesAshura ShaibPas encore d'évaluation

- Final-Term Quiz Mankeu Roki Fajri 119108077Document4 pagesFinal-Term Quiz Mankeu Roki Fajri 119108077kota lainPas encore d'évaluation

- Steps in The Accounting Process Assignment AISDocument2 pagesSteps in The Accounting Process Assignment AISKathlene BalicoPas encore d'évaluation

- CG11 - 17 Preparation of Schedule of RatesDocument4 pagesCG11 - 17 Preparation of Schedule of RatesArdamitPas encore d'évaluation

- Financial Report of Nepal Bank Limited (NBL)Document17 pagesFinancial Report of Nepal Bank Limited (NBL)Sarose ThapaPas encore d'évaluation

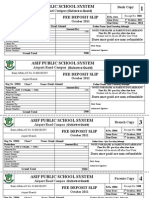

- Asif Public School System: Fee Deposit SlipDocument1 pageAsif Public School System: Fee Deposit SlipIrfan YousafPas encore d'évaluation

- Iffco-Tokio General Insurance Co. LTD: Corporate Identification Number (CIN) U74899DL2000PLC107621, IRDA Reg. No. 106Document2 pagesIffco-Tokio General Insurance Co. LTD: Corporate Identification Number (CIN) U74899DL2000PLC107621, IRDA Reg. No. 106Michael KrishnaPas encore d'évaluation

- Module 4 - Decisions Under UncertaintyDocument19 pagesModule 4 - Decisions Under UncertaintyRussell Lito LingadPas encore d'évaluation

- Detailed Program ICRMAT 2023 21.8Document13 pagesDetailed Program ICRMAT 2023 21.8Cao TuấnPas encore d'évaluation

- 1 - IjarahDocument31 pages1 - IjarahAlishba KaiserPas encore d'évaluation

- Foreign Exchange Arithmetic Worksheet (With Answers)Document4 pagesForeign Exchange Arithmetic Worksheet (With Answers)Viresh YadavPas encore d'évaluation

- The Basic Tools of FinanceDocument25 pagesThe Basic Tools of FinanceVivek KediaPas encore d'évaluation