Académique Documents

Professionnel Documents

Culture Documents

Chapter 2-The International Monetary System

Transféré par

Hay Jirenyaa100%(1)100% ont trouvé ce document utile (1 vote)

308 vues52 pagesTitre original

Chapter 2-The International Monetary System.pptx

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

308 vues52 pagesChapter 2-The International Monetary System

Transféré par

Hay JirenyaaDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 52

CHAPTER TWO

The International Monetary System:

History and Where we are Today

What is International monetary system?

Formal Definition - Structure in which foreign exchange

rates are determined, international trade and capital

flows accommodated and balance of payments

adjustments made.

In our context, International monetary system refers to

the system and rules that govern the use and exchange

of money around the world and between countries.

Each country has its own currency as money and the

international monetary system governs the rules for

valuing and exchanging these currencies.

History of Exchange Rate Regimes

Defined: The way in which a country manages its

currency and thus the arrangement by the price of

that countrys currency is determined on foreign

exchange markets.

Arrangements ranging from:

Floating Rate

Managed Rate (AKA Dirty Float)

Pegged Rate

Arrangement is determining by governments.

History of Exchange Rate Regimes

Over the past 200+ years, the world has gone

though major changes its global exchange rate

environment.

Starting with the gold standard regime of the latter

part of the 19th century to todays somewhat

mixed/flexible system we can identify there 3

distinct periods:

(1) Gold Standard: 1816 - 1914

(2) Bretton Woods: 1945 1973

(3) Mixed/flexible System: 1973 the present

Gold Standard: 1816 - 1914

During the 1800s the industrial revolution

brought about a vast increase in the production

of goods and widened the basis of world

trade.

At that time, trading countries believed that a

necessary condition to facilitate world trade

was a stable exchange rate system.

Gold Standard: 1816 - 1914

Stable exchange rates were seen as

necessary for encouraging and settling

commercial transactions across borders (both

by companies and by governments).

So by the second half of the 19th century,

most countries had adopted the gold

standard exchange rate regime.

Basics of the Gold Standard

The gold standard regime required that domestic

currencies (national money) be defined in terms of

a specific weight of gold.

For example:

The British pound was fixed at .23546% of an

ounce of pure gold (in 1816).

The U.S. dollar was fixed at 0.048379% of an

ounce of pure gold (in 1879).

Thus, the dollar pound parity (i.e., the exchange

rate) was set at $4.867

.23546/.048379 = 4.867

Basics of the Gold Standard

How it worked:

Assume the United Kingdom ran a trade deficit with the

United States.

As a result, gold would flow from the UK to the US (gold

financed trade imbalances).

Each countrys domestic money supply was tied into the

amount of gold it held, thus the U.S. money supply would

rise.

The increase money supply would increase prices in the

United States, which in turn would make U.S. goods less

attractive to the UK.

The net result was that the trade surplus of the US would

decrease and the trade deficit of the UK would decrease.

Basics of the Gold Standard

The Gold Standard also required that each country

adjust its domestic money supply in direct relation to

the amount of gold it held.

Increase in gold would increase the domestic money and

a reduction in its gold supply would reduce the money

supply.

The Advantages of the Gold

Standard

(1) Reduce risk of Exchange rate

The gold standard dramatically reduced the

risk in exchange rates because it is established

fixed exchange rates between currencies.

Any fluctuations were relatively small.

The Advantages of the Gold Standard

This made it easier for global companies to

manage costs and pricing.

International trade grew throughout the world,

although economists are not always in

agreement as to whether the gold standard was

an essential part of that trend.

The Advantages of the Gold Standard

(2) Forced countries to use strict monitory policies

The second advantage is that countries were

forced to observe strict monetary policies.

They could not just print money to combat

economic downturns.

The Advantages of the Gold Standard

One of the key features of the gold standard

was that a currency had to actually have in

reserve enough gold to convert all of its

currency being held by anyone into gold.

Thus, the volume of paper currency could not

exceed the gold reserves.

The Advantages of the Gold Standard

(3) To correct trade imbalance

For example, if a country was importing more

than it is exporting, (called a trade deficit), then

under the gold standard the country had to

pay for the imports with gold.

The Advantages of the Gold

Standard

The government of a country would have to reduce

the amount of paper currency, because there could

not be more currency in circulation than its gold

reserves.

With less money floating around, people would have

less money to spend (thus causing a decrease in

demand) and prices would also eventually

decrease.

The Advantages of the Gold

Standard

As a result, with cheaper goods and services to

offer, companies from the country could export

more, changing the international trade balance

gradually back to being in balance.

The Advantages of the Gold Standard

Note:

For these three primary reasons, and as a result

of the 2008 global financial crises, some

modern economists are calling for the return of

the gold standard or a similar system.

Why Gold standard collapse ?

World War I (1914) Through World War II

(1944)

World War I marks the beginning of the end of the

Gold Standard .

During the war, countries suspended the convertibility

of their currencies into gold.

After WW I, various attempts were made to restore

the classical gold standard.

1919: United States returned to a gold standard.

1925: Great Britain joined, followed by France and

Switzerland.

World War I (1914) Through World War II (1944)

These attempts proved unsuccessful.

Why: During this time, most countries were

more concerned with their national economies

than exchange rate stability.

Especially during the Great Depression (1929

1930s)

Asa result, countries abandoned their

attempts to return to an interwar gold

standard.

Britain and Japan dropped it in 1931, the U.S. in

1933.

Bretton Woods: A Pegged Regime

As World War II is coming to an end, all 44 allied countries

meet in Bretton Woods, New Hampshire for the purpose of

establishing a new international monetary system.

It was developed at the United Nations Monetary and

Financial Conference held from July 1 to July 22, 1944 .

At Bretton Woods, countries agree that fixed exchange rates

were necessary for restarting world trade and global

investment (both of which had fallen dramatically).

Bretton Woods: A Pegged Regime

The Bretton Woods Agreement was the landmark

system for monetary and Exchange rate

management established.

Under the agreement, currencies were pegged to

the price of gold, and the U.S. dollar was seen as

a reserve currency linked to the price of gold.

It was also obvious that the US dollar would

become the cornerstone of any new international

monetary system.

Bretton Woods: A Pegged Regime

Key points of the Bretton Woods were:

Pegging the U.S. dollar to gold at $35 per ounce

(with the USD the only currency convertible into

gold).

All other countries peg their currencies to the U.S.

dollar.

Their par values are set in relation to the

U.S. dollar

GBP = $2.80; JPY = 360 (1 in 1949)

Bretton Woods: A Pegged Regime

Countriesagreed to support their

exchange rates within + or 1% of these

par values.

This is done through the buying or selling of

foreign exchange when market forces

needed to be offset.

The Seeds of Bretton Woods Demise

In the 1960s, Bretton Woods begins to unravel.

President Lyndon Johnson tries to finance both his Great

Society programs at home and the American war in

Vietnam.

This produces a large US Federal budget deficit, which,

coupled with easy monetary policy, results in:

o High inflation in the United States and

o An increase in U.S. spending for cheaper imports

The Seeds of Bretton Woods Demise

As a result, the United States balance of payments

moves from a surplus into a deficit.

Dollar is seen by the market as overvalued.

Foreigners become concerned about holding

overvalued U.S. dollars at a rate of $35 an ounce.

o Markets are suggesting it should take more than

$35 to buy 1 ounce of gold.

By the mid-1960, the U.S. balance of payment (e.g.,

trade balance) started to deteriorate (a declining

surplus).

By 1971, the U.S. merchandise trade balance moved

into deficit.

The Last Years of Bretton Woods: 1970 -1973

By 1970, financial markets are reluctant to

hold the overvalued U.S. dollar.

Markets sell USD on foreign exchange markets.

o This puts downward pressure on the exchange

rate for dollars.

o And upward pressure on the exchange rate for

foreign currencies.

Central banks engage in massive intervention

in an attempt to hold their Bretton Woods par

values.

o Central banks buy U.S. dollars as they are

sold in markets.

The Last Years of Bretton Woods: 1970 -1973

As a result, foreign holdings of dollars increase

dramatically and eventually exceed U.S. gold

holdings.

By 1971, gold coverage for U.S. dollars had

dropped to 22%.

In August 1971, President Nixon suspends dollar

convertibility into gold.

o In response, more dollars are sold on foreign

exchange markets pushing the dollar lower (and

foreign currencies higher).

Smithsonian Agreements, December 1971

In December 1971, ten major counties meet in

Washington, D.C. with the aim of restoring

stability to the international monetary system.

Meeting concludes with the Smithsonian

Agreements, whereby:

Key countries agree to revalue their currencies

and in essence set new par values against the US

dollar (e.g., yen +17%, mark +13.5%, pound and

franc +9%)

Smithsonian Agreements, December

1971

The U.S. also agrees to raise the dollar price of

gold from $35 to $38 ounce (represents a further

devaluation of the dollar).

It was also agreed that currencies could now

fluctuate + or 2.25% around their new par

values.

The Final Collapse of the Dollar, February 1973

13 months after the Smithsonian Agreements, the dollar comes

under renewed attack for being overvalued.

In February 1973, markets sell off dollars again.

As before, central banks intervene and buy dollars.

On February, 12th, 1973 the dollar is devalued further to $42

per ounce.

But the price of gold on the London gold markets trades at $70 per

ounce.

Japan and Italy finally let their currencies float on February 13th.

France and Germany continue to manage their currencies in relation

to the dollar.

In response to mounting speculative currency flows, foreign exchange

markets are closed on March 1, 1973, and reopen on March 19,

1973.

The End of Bretton Woods

On March, 19, 1973, when foreign exchange markets

reopen, major countries announce that they are

floating their currencies:

On March 19, 1973, the list of countries floating

their currencies includes Japan, Canada, and those in

Western Europe.

The Bretton Woods fixed exchange rate system

effectively ends on this date.

Approximately 3 months later, by June 1973, the dollar

has floated down an average of 10% against the

major currencies of the world.

Exchange Rate Regimes Today

Currently, current exchange rate regimes fall along a

spectrum as represented by national government

involvement in affecting (managing) their currencys

exchange rate.

Very Little (if any) Active

Involvement Involvement

Forex Market is Government is

Determining Managing or

Exchange rate Pegging

Exchange rate

Peggers

Peggers tie their currency to one or more

currencies

A number of smaller countries tie themselves to

their leading trading partner because they

would not want to see major economic changes

caused by exchange rate changes

Peggers

Countries can tie their currencies to more than one

currency such as the SDR or a basket determined by

their trading or investment partners

Baskets are usually less risky (less variation) and

hence purchasing power would be more stable

Other Conventional Fixed Peg

Arrangements

In this category exchange rates dont fluctuate much

around a central rate (at most +/- 1% around a

central rate)

Pegged Exchange Rates within

Horizontal Bands

A similar to the previous arrangement except that

the bands are wider than +/- 1%

Crawling Pegs

The exchange rate adjusts in small increments or to

changes in various indicators (for example, inflation)

Exchange Rates Within Crawling Pegs

Similar to the previous group except that the

exchange rate fluctuates within a band of a central

rate

Managed Floating with no Preannounced

Path for the Exchange Rate

Often the central banks intervene to support this

rate

Independently Floating

Countries let the value of their currencies be

determined by the market

Most of the major currencies of the world are

in this category with the exception of those

currencies in the European Monetary Union

The central banks of these countries may

intervene occasionally (sometimes to limit

variation)

Remark:

The currencies of most countries are not floating.

Only 80/186 countries are in Managed floating

and independent floating category.

Summery of current Exchange Rate Regimes in

general?

Mixed/Flexible International Monetary System

consisting of:

Floating exchange rate regimes:

Market forces determine the relative value of a currency.

Managed (dirty float) rate regimes:

Governments managing their currencys value with regard to a

reference currency.

Market moves these currencies, but governments are managing the

process and intervening when necessary.

Pegged exchange rate regimes:

Government fixes (links) the value of its currency relative to a

reference currency.

Fewer of these regimes than in the past.

Post Bretton Woods Summary

Since March 1973, the major currencies of the

world have operated under a floating exchange

rate system.

While central banks of these major countries have

occasionally interviewed in support of their

currencies, this intervention has become less over the

years.

The US last intervened in 1998.

Post Bretton Woods Summary

In addition to the major currencies of the world,

a growing number of other developing country

currencies have also moved to a floating rate

system.

Thus: more and more, market forces are driving currency

values.

The post Bretton Woods period has resulted exchange rates

become much more volatile and , perhaps, less predictable

then they were during previous fixed exchange rate eras.

This currency volatility complicates the management of

global companies.

Note:

The currencies of most countries are not floating.

Only 80/186 countries are in the last two

categories.

European Monetary System

The European Monetary System originated in an

attempt to stabilize inflation and stop

large exchange rate fluctuations between European

countries.

The European Monetary System (EMS) is a 1979

arrangement between several European countries

which links their currencies in an attempt to stabilize

the exchange rate.

European Monetary System

This system was succeeded by the

European Economic and Monetary Union (EMU), an

institution of the European Union (EU), which

established a common currency called the euro.

Then, in June 1998, the European Central Bank was

established and, in January 1999, a unified

currency, the euro, was born and came to be used

by most EU member countries.

Criteria for Full Membership in the

European Monetary Union

Nominal inflation rates should be no more than

1.5% above the average for the three members of

the European Union with the lowest inflation rates

Long-term interest rates should be no more than 2%

above the average for the three members with the

lowest interest rates

Criteria for Full Membership in the

European Monetary Union

The fiscal deficit should be no more than 3% of the

gross domestic product

Government debt should be no more than 60% of

gross domestic debt

Euro

Is a currency issued by the European Central Bank

Its value does not depend on any other constituent

currency. This is not true for the ECU or the SDR

Initial value set at $1.16675/.

Value of Euro Oct 2000 - $.82/

Value July, 2008 - $1.60/

Value as of August, 2011- $1.44/

In Euro Zone

Cheaper transaction costs

Currency risks are reduced

More price transparency and more competition

among companies within the Euro zone.

End of Chapter Two

Vous aimerez peut-être aussi

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A KodakDocument11 pagesA KodakRajeev ShahiPas encore d'évaluation

- International Monetary SystemDocument12 pagesInternational Monetary SystemAkashVerma100% (2)

- International Monetary SystemDocument25 pagesInternational Monetary SystemMahin Mahmood33% (3)

- Chapter 6 - IbtDocument9 pagesChapter 6 - IbtALMA MORENAPas encore d'évaluation

- International Financial Management PPT Chap 1Document25 pagesInternational Financial Management PPT Chap 1serge folegwePas encore d'évaluation

- Chapter 5 - Foriegn Exchange MarketDocument67 pagesChapter 5 - Foriegn Exchange MarketHay Jirenyaa100% (1)

- Interest Rate Parity: by - Alpana Kaushal Deepak Verma Seshank Sarin Mba (Ib)Document14 pagesInterest Rate Parity: by - Alpana Kaushal Deepak Verma Seshank Sarin Mba (Ib)Deepak SharmaPas encore d'évaluation

- International MarketingDocument54 pagesInternational MarketingSimone SegattoPas encore d'évaluation

- Chapter 6 Interest Rates and Bond ValuationDocument14 pagesChapter 6 Interest Rates and Bond ValuationPatricia CorpuzPas encore d'évaluation

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaPas encore d'évaluation

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaPas encore d'évaluation

- 2 ImsDocument37 pages2 ImsZelyna RamosPas encore d'évaluation

- Business Plans Notes by Enock MarchDocument63 pagesBusiness Plans Notes by Enock MarchNyabensi EnockPas encore d'évaluation

- Theories of Foreign ExchangeDocument19 pagesTheories of Foreign Exchangerockstarchandresh0% (1)

- Unit-3 Global Economy and Regional Economic Integration-1Document29 pagesUnit-3 Global Economy and Regional Economic Integration-1Ashutosh PoudelPas encore d'évaluation

- The Is-Lm Model: ECON 2123: MacroeconomicsDocument56 pagesThe Is-Lm Model: ECON 2123: MacroeconomicskatecwsPas encore d'évaluation

- Labor Productivity and Comparative Advantage: The Ricardian ModelDocument26 pagesLabor Productivity and Comparative Advantage: The Ricardian ModelJonny FalentinoPas encore d'évaluation

- Chapter 1Document29 pagesChapter 1Amr ElkholyPas encore d'évaluation

- Pepperfry - Marketing To Manage Customer ExperienceDocument6 pagesPepperfry - Marketing To Manage Customer ExperiencePrateek GuptaPas encore d'évaluation

- Trade BarriersDocument16 pagesTrade BarriersErum MohtashimPas encore d'évaluation

- BRM - Zikmund - CHP 8 - Secondary DataDocument40 pagesBRM - Zikmund - CHP 8 - Secondary DataToobaPas encore d'évaluation

- Chapter FourDocument88 pagesChapter FourHay Jirenyaa100% (3)

- Chapter 15Document15 pagesChapter 15Malik YasirPas encore d'évaluation

- Foreign Exchange Market P P TDocument35 pagesForeign Exchange Market P P TsejalPas encore d'évaluation

- International Business: by Charles W.L. HillDocument17 pagesInternational Business: by Charles W.L. HillAnoushey FatimaPas encore d'évaluation

- Ib Economics Section 3.3 The Balance of PaymentsDocument82 pagesIb Economics Section 3.3 The Balance of PaymentsTita RachmawatiPas encore d'évaluation

- Keegan gm8 PPT ch08Document28 pagesKeegan gm8 PPT ch08waleed ahmadPas encore d'évaluation

- Topic 3 - International Monetary System and Balance of PaymentsDocument53 pagesTopic 3 - International Monetary System and Balance of PaymentsM.Hatta Dosen StiepanPas encore d'évaluation

- Pricing For International MarketsDocument25 pagesPricing For International MarketsIrfan Qadir 2035029660Pas encore d'évaluation

- AIS Best Teaching MaterialDocument121 pagesAIS Best Teaching MaterialHay Jirenyaa100% (1)

- Resources and Trade: The Heckscher-Ohlin Model: Eleventh EditionDocument24 pagesResources and Trade: The Heckscher-Ohlin Model: Eleventh EditionJonny FalentinoPas encore d'évaluation

- International Monetary SystemDocument18 pagesInternational Monetary SystemUday NaiduPas encore d'évaluation

- CH 15 Marketing ChannelsDocument33 pagesCH 15 Marketing ChannelsBhanu GariaPas encore d'évaluation

- Global Marketing Planning 6Document14 pagesGlobal Marketing Planning 6Abhishek SoniPas encore d'évaluation

- FOREIGN EXCHANGE MARKET - Final ReportDocument33 pagesFOREIGN EXCHANGE MARKET - Final ReportDisha MathurPas encore d'évaluation

- Monopoly and Monopolistic CompetitionDocument31 pagesMonopoly and Monopolistic CompetitiondebojyotiPas encore d'évaluation

- Pricing For International MarketsDocument14 pagesPricing For International MarketsReyadPas encore d'évaluation

- Chapter 12 Exchange-Rate DeterminationDocument56 pagesChapter 12 Exchange-Rate DeterminationSashi VelnatiPas encore d'évaluation

- Foreign Exchange MarketDocument42 pagesForeign Exchange MarketAbhinav TiwariPas encore d'évaluation

- Chap 005Document35 pagesChap 005pPas encore d'évaluation

- CH 04 - Exchange Rate DeterminationDocument24 pagesCH 04 - Exchange Rate DeterminationadamPas encore d'évaluation

- International Business: by Charles W.L. HillDocument33 pagesInternational Business: by Charles W.L. Hilllovelyday9876100% (1)

- Instruments of International Trade PoliciesDocument11 pagesInstruments of International Trade PoliciesDinesh GannerllaPas encore d'évaluation

- Ita Reviewer PrelimDocument6 pagesIta Reviewer PrelimGian Paul JavierPas encore d'évaluation

- Entry Strategy & Strategic Alliances: C. Pioneering CostsDocument12 pagesEntry Strategy & Strategic Alliances: C. Pioneering CostsBusiness BluePas encore d'évaluation

- The International Monetary System Chapter 11Document23 pagesThe International Monetary System Chapter 11Ashi GargPas encore d'évaluation

- Trade Restrictions: Tariff and Non-Tariff BarriersDocument42 pagesTrade Restrictions: Tariff and Non-Tariff BarriersAnqaa JalPas encore d'évaluation

- The International Bond MarketDocument23 pagesThe International Bond Market2005raviPas encore d'évaluation

- Managing Transaction Exposure FinalDocument39 pagesManaging Transaction Exposure FinalJouhara San JuanPas encore d'évaluation

- Chapter 11Document24 pagesChapter 11Samina KhanPas encore d'évaluation

- International Marketing EnvironmentDocument10 pagesInternational Marketing Environmentginz2008100% (1)

- IBUS 321 Forum Q and ADocument3 pagesIBUS 321 Forum Q and Amarina belmonte100% (1)

- INB 301 - Chapter 8 - Foreign Direct InvestmentDocument16 pagesINB 301 - Chapter 8 - Foreign Direct InvestmentS.M. YAMINUR RAHMANPas encore d'évaluation

- International Marketing & Operations Definition)Document18 pagesInternational Marketing & Operations Definition)Fasika MeketePas encore d'évaluation

- International Trade FeaturesDocument14 pagesInternational Trade Featurescarolsaviapeters100% (1)

- Foreign Exchange MarketDocument73 pagesForeign Exchange MarketAmit Sinha100% (1)

- Formulation of National Trade PoliciesDocument15 pagesFormulation of National Trade Policiesrafid siddiqePas encore d'évaluation

- Government Intervention in International BusinessDocument8 pagesGovernment Intervention in International Businessਹਰਸ਼ ਵਰਧਨPas encore d'évaluation

- Chapter 01 Multinational Financial Management An OverviewDocument45 pagesChapter 01 Multinational Financial Management An OverviewGunawan Adi Saputra0% (1)

- Test Bank FMDocument17 pagesTest Bank FMTan Kar BinPas encore d'évaluation

- International Product Life CycleDocument11 pagesInternational Product Life Cycleismail69690% (2)

- Market IntegrationDocument11 pagesMarket IntegrationEllie EileithyiaPas encore d'évaluation

- Lecture Class - 4 - International Parity RelationshipsDocument23 pagesLecture Class - 4 - International Parity Relationshipsapi-19974928Pas encore d'évaluation

- Conduct of Monetary Policy Goal and TargetsDocument12 pagesConduct of Monetary Policy Goal and TargetsSumra KhanPas encore d'évaluation

- Functions of Foreign Exchange MarketsDocument6 pagesFunctions of Foreign Exchange Marketstechybyte100% (1)

- Impacts of Economics System On International BusinessDocument8 pagesImpacts of Economics System On International BusinessKhalid AminPas encore d'évaluation

- International Monetary SystemDocument6 pagesInternational Monetary SystemCh WaqasPas encore d'évaluation

- International Monetary SystemDocument9 pagesInternational Monetary SystemYoginee SurwadePas encore d'évaluation

- Assignment For Evening Class StudentsDocument2 pagesAssignment For Evening Class StudentsHay JirenyaaPas encore d'évaluation

- Principle MaterialDocument35 pagesPrinciple MaterialHay JirenyaaPas encore d'évaluation

- 2016 2017 PDFDocument44 pages2016 2017 PDFHay Jirenyaa100% (1)

- Acma Assignment MaterialDocument12 pagesAcma Assignment MaterialHay Jirenyaa100% (8)

- Ahmaric Annual ReportDocument23 pagesAhmaric Annual ReportHay JirenyaaPas encore d'évaluation

- Assignment For Evening Class StudentsDocument1 pageAssignment For Evening Class StudentsHay JirenyaaPas encore d'évaluation

- Determinants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaDocument41 pagesDeterminants of Tax Revenue Efforts in Developing Countries: Abhijit Sen GuptaHay JirenyaaPas encore d'évaluation

- 2016 2017 PDFDocument44 pages2016 2017 PDFHay Jirenyaa100% (1)

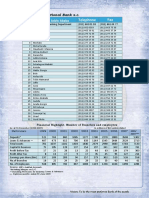

- No Telephone Fax: Branches in Addis AbabaDocument35 pagesNo Telephone Fax: Branches in Addis AbabaHay Jirenyaa100% (1)

- Chap 1 Mic IDocument37 pagesChap 1 Mic IHay JirenyaaPas encore d'évaluation

- Comm - Ica Asa510 App1ill1Document3 pagesComm - Ica Asa510 App1ill1Hay JirenyaaPas encore d'évaluation

- Accounting Information Systems: AnDocument333 pagesAccounting Information Systems: AnHay JirenyaaPas encore d'évaluation

- Chapter - 22B - Auditor's ReportsDocument12 pagesChapter - 22B - Auditor's ReportsHay JirenyaaPas encore d'évaluation

- Example of An Engagement LetterDocument3 pagesExample of An Engagement LettermaryxtelPas encore d'évaluation

- Example of An Engagement LetterDocument3 pagesExample of An Engagement LettermaryxtelPas encore d'évaluation

- E-Business Complaint PDFDocument8 pagesE-Business Complaint PDFHay JirenyaaPas encore d'évaluation

- The General Concept of Auditing in EthioDocument20 pagesThe General Concept of Auditing in Ethioh84% (19)

- Chapter 4 SlidesDocument66 pagesChapter 4 SlidesHay Jirenyaa100% (1)

- Chapter 5 SlidesDocument110 pagesChapter 5 SlidesHay JirenyaaPas encore d'évaluation

- Chapter 3 SlidesDocument43 pagesChapter 3 SlidesHay JirenyaaPas encore d'évaluation

- Continuous Auditing in Internal Audit PDFDocument15 pagesContinuous Auditing in Internal Audit PDFHay Jirenyaa0% (1)

- Overview of Business ProcessesDocument68 pagesOverview of Business ProcessesHay JirenyaaPas encore d'évaluation

- Chapter 7 SlidesDocument31 pagesChapter 7 SlidesHay JirenyaaPas encore d'évaluation

- MD 2CDocument34 pagesMD 2CIbraheem KhressPas encore d'évaluation

- Role of Private Equity and Venture Capital in Indian Startup CultureDocument78 pagesRole of Private Equity and Venture Capital in Indian Startup CultureJaimin VasaniPas encore d'évaluation

- Assignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanDocument6 pagesAssignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanFAIQ KHALIDPas encore d'évaluation

- 12 Corporate Restructuring and BankruptcyDocument5 pages12 Corporate Restructuring and BankruptcyMohammad DwidarPas encore d'évaluation

- Topic 3 Assessment: Liquidation Value Per ShareDocument1 pageTopic 3 Assessment: Liquidation Value Per SharePhebe LagutaoPas encore d'évaluation

- Tuten SMM Ch10Document22 pagesTuten SMM Ch10JannatPas encore d'évaluation

- INF204K01HY3 - Reliance Smallcap FundDocument1 pageINF204K01HY3 - Reliance Smallcap FundKiran ChilukaPas encore d'évaluation

- ADF Foods Limited - Report - 17th June 2008 - DhananjayanDocument2 pagesADF Foods Limited - Report - 17th June 2008 - Dhananjayanapi-3702531Pas encore d'évaluation

- 1.international Marketing.Document14 pages1.international Marketing.Ermi Alem100% (1)

- Maalaala Mo Kaya PDFDocument1 pageMaalaala Mo Kaya PDFleonorfmartinezPas encore d'évaluation

- Answers To Concepts Review and Critical Thinking Questions 1Document7 pagesAnswers To Concepts Review and Critical Thinking Questions 1Waheed BalochPas encore d'évaluation

- CommissionDocument30 pagesCommissionVince Clifford VestalPas encore d'évaluation

- Bachelor of Business Administration (BBA) in Retailing III YearDocument8 pagesBachelor of Business Administration (BBA) in Retailing III YearMoksh WariyaPas encore d'évaluation

- Impress PMS - Feb 24 - Anand Rathi PMSDocument19 pagesImpress PMS - Feb 24 - Anand Rathi PMSshivamsundaram794Pas encore d'évaluation

- Ucp-Cf 09,11-03Document78 pagesUcp-Cf 09,11-03sumaira85Pas encore d'évaluation

- FI - Reading 44 - Fundamentals of Credit AnalysisDocument42 pagesFI - Reading 44 - Fundamentals of Credit Analysisshaili shahPas encore d'évaluation

- Cost and Economics in PricingDocument29 pagesCost and Economics in PricingMVPas encore d'évaluation

- Strategic PlanningDocument16 pagesStrategic PlanningAku PeguPas encore d'évaluation

- CH 10Document30 pagesCH 10Johnny Wong100% (1)

- IndiaMART Concall Transcript Q1FY2020 1Document17 pagesIndiaMART Concall Transcript Q1FY2020 1Harsh GandhiPas encore d'évaluation

- Set A - Problems On Relevant Decision MakingDocument6 pagesSet A - Problems On Relevant Decision MakingNitin KharePas encore d'évaluation

- Trade Management Plan 1 1Document17 pagesTrade Management Plan 1 1rushaun fearronPas encore d'évaluation

- ComprehensiveDocument9 pagesComprehensiveChristopher RogersPas encore d'évaluation

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Document7 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3011 Question 1 Answer (A It Costed $860,000 To Acquire The Machine. (B)Jaydeep KushwahaPas encore d'évaluation

- Technical Analysis - EnG EDITDocument33 pagesTechnical Analysis - EnG EDITIdham GhiffariPas encore d'évaluation

- Chapter - 4: Export PricingDocument8 pagesChapter - 4: Export PricingKeerthiraj KeerthiPas encore d'évaluation

- ToR Rental Markets in TanzaniaDocument11 pagesToR Rental Markets in TanzaniaAnonymous FnM14a0Pas encore d'évaluation