Académique Documents

Professionnel Documents

Culture Documents

MPM

Transféré par

Raymond Robles Danico0 évaluation0% ont trouvé ce document utile (0 vote)

30 vues18 pagesThis document discusses public budgeting and finance. It explains that public fiscal administration involves formulating, implementing, and evaluating policies around taxation, revenue, resource allocation, budgeting, public spending, borrowing, and auditing. The goals are to allocate limited public resources appropriately to provide services to constituents while avoiding misuse of funds. Public finance uses similar tools as business finance but differs in its goals of serving the community rather than generating profit. The document traces the historical development of public finance from ancient slave societies to medieval feudalism to the beginnings of capitalism.

Description originale:

Public Fiscal Administration

Titre original

Mpm

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThis document discusses public budgeting and finance. It explains that public fiscal administration involves formulating, implementing, and evaluating policies around taxation, revenue, resource allocation, budgeting, public spending, borrowing, and auditing. The goals are to allocate limited public resources appropriately to provide services to constituents while avoiding misuse of funds. Public finance uses similar tools as business finance but differs in its goals of serving the community rather than generating profit. The document traces the historical development of public finance from ancient slave societies to medieval feudalism to the beginnings of capitalism.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

30 vues18 pagesMPM

Transféré par

Raymond Robles DanicoThis document discusses public budgeting and finance. It explains that public fiscal administration involves formulating, implementing, and evaluating policies around taxation, revenue, resource allocation, budgeting, public spending, borrowing, and auditing. The goals are to allocate limited public resources appropriately to provide services to constituents while avoiding misuse of funds. Public finance uses similar tools as business finance but differs in its goals of serving the community rather than generating profit. The document traces the historical development of public finance from ancient slave societies to medieval feudalism to the beginnings of capitalism.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 18

Master in Public Management

PUBLIC FISCAL ADMINISTRATION

WHY DO WE HAVE TO STUDY PUBLIC

BUDGETING AND FINANCE?

We must make choices about how resources are

utilized, and working through finances gives a

good start in organizing the options.

We operate in the PUBLIC TRUST and need to be

able to control the use of public resources. We are

using other peoples money and those people get

MAD when they money disappears

We need to make sure they do not run out of

money before they run out of need for the service

being provided with money

We need to make a case for the resources

appropriate to provide services to our

constituents and clients, to legislative and

executive bodies

We need to understand the case being made

by other managers

We do not want to go to jail for misuse of

resources that belong to the public or their

organization

The people in any organization who actually

understand what the organization is doing are the

people who understand the finances of the

organization

Non-profit organizations frequently have abysmal

financial management in place

Government crises, regardless of whether the

government is national, state or local, often have

budget underpinnings that could have been

avoided with better budget systems and

mechanisms for finance

It is simply fun to understand what is going on

in public organizations, and understanding

finance is the most important single step in

gaining that understanding

PUBLIC FINANCE VS. BUSINESS FINANCE

PUBLIC FINANCE BUSINESS FINANCE

Uses the same tools as business finance Increase the value of the firm to its

to allocate and control finances but owners by judicious allocation and

differ in terms of resource constraints, control of resources

ownership and objectives

Government may tax to enlarge their Operates by generating an income

resources stream from the sale of goods and

services on the market

Ownership of the government is not clear Owners and stakeholders are easily

because many stakeholders share a identified

legitimate interest in government

decisions

Value of government services is neither Businesses output can be measured by

easy to quantify or reflected in a single sales or profits

measure

PUBLIC FINANCE VS. BUSINESS FINANCE

PUBLIC FINANCE BUSINESS FINANCE

The value of government is collective, for Value received by individual through

the community as a whole purchases of business services

Generally, not for profit Profit-driven

WHAT IS PUBLIC FISCAL ADMISTRATION?

Generally refers to the FORMULATION,

IMPLEMENTATION and EVALUATION of policies

and decisions on taxation and revenue

administration; resource allocation, budgeting

and public expenditure; public borrowing and

debt management; and accounting and

auditing

Viewed as a system, it includes the

environment, structures, systems, processes

and personalities involved in fiscal

administration

FISCAL POLICY

Refers to the mix of policies on taxation,

expenditures and borrowings for the

achievement of government objectives

PUBLIC SECTOR VS. PRIVATE SECTOR

These are sectors involved in a mixed economy

Market mechanism is allowed to operate freely in

the operation of the price system

Even then, government intervention is important in

running the economy

Mixed economy therefore is a combination of a

market system tempered by government regulation

Also referred to as, capitalist

Centralized-state planning = socialist

DEVELOPMENT OF PUBLIC FINANCE

INSTITUTIONS

ANCIENT: SLAVE SOCIETIES

Development of settled agriculture and rudimentary

advances in the production of goods led to the

great slave empires of Asia

Beginnings of public finance started from the

creation of the state

ANCIENT: SLAVE SOCIETIES

EXPENDITURES Largely for defense and aggression;

narrower scope of public finance

FUNCTIONS:

-Protection of the people, territory and

sovereignty

-Preservation of internal peace, order and

security and the administration of justice

-Maintenance of state religion

-Maintenance of the monarch and

household

-Public works/construction

- Others i.e. limited goods and services,

public recreation and physical education

REVENUES -Lootings and tributes from conquered

people

-War chest

-Fines

-Direct taxes imposed on non-citiens

-Others i.e. donations or gifts

ANCIENT: SLAVE SOCIETIES

BUDGETING No distinction between the public and the

monarchs private expenditures

BORROWINGS Practically none

AUDITING -Principle of Accountability

-Maintenance and inspection of financial

records

DEVELOPMENT OF PUBLIC FINANCE

INSTITUTIONS

MEDIEVAL: FEUDALISM

Characterized by changes in the political structure

Feudalism essentially the system of economic

relationship based upon land tenure, among the

king, the lord and the vassals

Land-based

MEDIEVAL: FEUDALISM

EXPENDITURES -Public functions of central government

usually confined to national wars and

administration of the royal domain

-Feudal lords take care of the needs of

their fiefs

REVENUES -Collected taxes from serfs

-License fees from merchants and traders

who passed by the manor

-Collected gross produce taxes, inheritance

tax, marriage fees

-Tolls on rivers, bridges or roads

-Aids

BUDGETING Fiefs budget was the lords personal

budget

AUDITING No central accounting system and record

keeping

BORROWINGS Personal transaction between the monarch

as borrower and the lender ordinarily, a

wealthy trader

DEVELOPMENT OF PUBLIC FINANCE

INSTITUTIONS

BEGINNINGS OF CAPITALISM

Began from the breakdown of feudalism

Period of expansion and rationalization of national

finances

Vous aimerez peut-être aussi

- Pa 241 Introduction To Public Fiscal Administration: Dr. Luzviminda G. Manangan - Ozarraga ProfessorDocument40 pagesPa 241 Introduction To Public Fiscal Administration: Dr. Luzviminda G. Manangan - Ozarraga ProfessorMomoPas encore d'évaluation

- Public Finance & Taxations CH 1-4Document177 pagesPublic Finance & Taxations CH 1-4fentawmelaku1993Pas encore d'évaluation

- Public FinanceDocument48 pagesPublic FinanceJorge Labante100% (1)

- Pub - FinDocument21 pagesPub - Finjay diazPas encore d'évaluation

- HO #1 - Pol Sci 139Document5 pagesHO #1 - Pol Sci 139Julie Faith Aquimba BulanPas encore d'évaluation

- Public Finance: Faculty of Business & EconomicsDocument12 pagesPublic Finance: Faculty of Business & Economicsjohn3dPas encore d'évaluation

- Unit 1-Introduction To Public FinanceDocument35 pagesUnit 1-Introduction To Public Financeironman73500Pas encore d'évaluation

- Course No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Document22 pagesCourse No. AIS 2305 - Theory and Practice of Taxation - Lect Materials - Tax Theory - Jan 2012Shariful Islam JoyPas encore d'évaluation

- BM (Unit 2) NotesDocument17 pagesBM (Unit 2) NotesMohd asimPas encore d'évaluation

- Fiscal AdministrationDocument5 pagesFiscal AdministrationMercy GolipapaPas encore d'évaluation

- Social Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyDocument46 pagesSocial Security, Protection: Electricity, Water Supply, Railways, Heavy Electrical Atomic EnergyYoseph KassaPas encore d'évaluation

- Introduction To Public FinanceDocument9 pagesIntroduction To Public FinanceJ lodhi50% (2)

- Final Module Public FinanceDocument7 pagesFinal Module Public FinanceRomel Remolacio AngngasingPas encore d'évaluation

- Basics of Public FinanceDocument6 pagesBasics of Public FinanceAtta Ur Rehman KhanPas encore d'évaluation

- A Hand Book of DDO'sDocument472 pagesA Hand Book of DDO'sRizwan HaiderPas encore d'évaluation

- My Written Report - FiscalDocument12 pagesMy Written Report - Fiscalfreezia xyz zinPas encore d'évaluation

- Public FinanceDocument5 pagesPublic FinanceMhai Penolio100% (1)

- Brown Aesthetic Group Project Presentation 20231206 203237 0000Document25 pagesBrown Aesthetic Group Project Presentation 20231206 203237 0000Ray RamonPas encore d'évaluation

- Afin321 FPD 4 2015 2Document27 pagesAfin321 FPD 4 2015 2Thomas nyadePas encore d'évaluation

- Best Public FinanceDocument12 pagesBest Public FinanceMinaw BelayPas encore d'évaluation

- TaxationDocument23 pagesTaxationsabit hussenPas encore d'évaluation

- Overview of TaxationDocument53 pagesOverview of TaxationSheila Marie Ann Magcalas-GaluraPas encore d'évaluation

- Lecture: Public Finance: Finance-Art and Science of Managing Financial ResourcesDocument5 pagesLecture: Public Finance: Finance-Art and Science of Managing Financial ResourcesEfren ChanPas encore d'évaluation

- Chapter One Basics of Public FinanceDocument30 pagesChapter One Basics of Public FinanceAhmedPas encore d'évaluation

- PF ScopeDocument18 pagesPF Scopeimran2233888Pas encore d'évaluation

- Meaning of Public FinanceDocument7 pagesMeaning of Public Financemahammadshaheer603Pas encore d'évaluation

- Public FinanceDocument8 pagesPublic FinanceAditi SinghPas encore d'évaluation

- Principles OF Public Finance and Taxation: Study TextDocument40 pagesPrinciples OF Public Finance and Taxation: Study TextEbong MichaelPas encore d'évaluation

- Adamawa State Polytechnic, Yola: (Department of Consultancy Services)Document30 pagesAdamawa State Polytechnic, Yola: (Department of Consultancy Services)usibrahimPas encore d'évaluation

- Chapter 1 Public Finance and TaxationDocument10 pagesChapter 1 Public Finance and TaxationMegarsa GemechuPas encore d'évaluation

- Reaction Paper Public Fiscal AdministrationDocument25 pagesReaction Paper Public Fiscal AdministrationLeigh LynPas encore d'évaluation

- Chapter 1Document29 pagesChapter 1Yusuf Hussein100% (2)

- Part Iithe Development of Public FinanceDocument6 pagesPart Iithe Development of Public FinanceJo Che RencePas encore d'évaluation

- Accounting For Government and Non-Profit Organizations BSA32E1Document40 pagesAccounting For Government and Non-Profit Organizations BSA32E1Christine Joyce Magote100% (1)

- Principles of Public Finance-PresentationDocument17 pagesPrinciples of Public Finance-Presentationnikkie100% (1)

- Chapter 1 Public ScopeDocument18 pagesChapter 1 Public ScopeyebegashetPas encore d'évaluation

- Presentation - Intro of Public Fiscal AdministrationDocument10 pagesPresentation - Intro of Public Fiscal AdministrationGroovy DulnuanPas encore d'évaluation

- Public Finance and TaxationDocument134 pagesPublic Finance and TaxationyebegashetPas encore d'évaluation

- Reading Material - Unit-1 and 2Document33 pagesReading Material - Unit-1 and 2Nokia PokiaPas encore d'évaluation

- Public FinanceDocument87 pagesPublic FinanceMichelle Rotairo100% (1)

- Lesson I - The Role and Scope of Public FinanceDocument3 pagesLesson I - The Role and Scope of Public Financemarygracepronquillo100% (10)

- Introduction To Public Finance Meaning of Public FinanceDocument4 pagesIntroduction To Public Finance Meaning of Public FinanceSakshi HaldankarPas encore d'évaluation

- Introduction of Public Fiscal AdministrationDocument5 pagesIntroduction of Public Fiscal Administrationmitzi samsonPas encore d'évaluation

- The Development of Public Finance InstitutionsDocument49 pagesThe Development of Public Finance InstitutionsPeo Batangasph100% (3)

- ReviewerDocument8 pagesReviewerApril Rose EloprePas encore d'évaluation

- Role of Public FinanceDocument13 pagesRole of Public FinanceUlaga50% (2)

- Unit-1 Public & TaxiationDocument20 pagesUnit-1 Public & TaxiationmelaPas encore d'évaluation

- Publicfinance 190121055136 PDFDocument76 pagesPublicfinance 190121055136 PDFAzhar AliPas encore d'évaluation

- LECTURE 1 Part1Document69 pagesLECTURE 1 Part1Leah FlorentinoPas encore d'évaluation

- Chapter 2 Amer SaripadaDocument50 pagesChapter 2 Amer SaripadaSian SaripadaPas encore d'évaluation

- Unit-V Public FinanceDocument76 pagesUnit-V Public FinanceDevansh DubeyPas encore d'évaluation

- Government AccountingDocument2 pagesGovernment AccountingKahayag 00Pas encore d'évaluation

- Subject-Economics Course-M.A. Semester-I & II B.A.-II Introduction To Public FinanceDocument71 pagesSubject-Economics Course-M.A. Semester-I & II B.A.-II Introduction To Public FinanceTechno GamingPas encore d'évaluation

- Public FinanceDocument41 pagesPublic FinanceMuhammad ZaidPas encore d'évaluation

- Chapter 4 - TaxationDocument34 pagesChapter 4 - TaxationGlaiza D VillenaPas encore d'évaluation

- Lecture 11 EeDocument29 pagesLecture 11 EeMuhammad SalmanPas encore d'évaluation

- Fiscal Policy and AdministrationDocument41 pagesFiscal Policy and AdministrationClint RamosPas encore d'évaluation

- Module-1 Public FinanceDocument14 pagesModule-1 Public FinancenawtamsonPas encore d'évaluation

- Ea 26: Income Taxation Introduction To TaxationDocument8 pagesEa 26: Income Taxation Introduction To TaxationFlor NasePas encore d'évaluation

- RDO No. 77 - Bacolod City, Negros OccidentalDocument361 pagesRDO No. 77 - Bacolod City, Negros OccidentalRaymond Robles Danico50% (6)

- Complaint Form For BP 22Document2 pagesComplaint Form For BP 22Raymond Robles DanicoPas encore d'évaluation

- Last - While I Was in Manila, For MeDocument1 pageLast - While I Was in Manila, For MeRaymond Robles DanicoPas encore d'évaluation

- An Evening in DecemberDocument4 pagesAn Evening in DecemberRaymond Robles DanicoPas encore d'évaluation

- Letter Fire DrillDocument1 pageLetter Fire DrillRaymond Robles Danico100% (1)

- WaiverDocument2 pagesWaiverRaymond Robles DanicoPas encore d'évaluation

- Title Composer/Arranger Item No. Pub. CompanyDocument1 pageTitle Composer/Arranger Item No. Pub. CompanyRaymond Robles DanicoPas encore d'évaluation

- Rizal Speaker PresentationDocument27 pagesRizal Speaker PresentationRaymond Robles DanicoPas encore d'évaluation

- Civil Service Commission Request For Clearance: All Fields Are RequiredDocument6 pagesCivil Service Commission Request For Clearance: All Fields Are RequiredRaymond Robles DanicoPas encore d'évaluation

- Name Serial No. Phone No. Transfer NO. Time Transfer DeptDocument2 pagesName Serial No. Phone No. Transfer NO. Time Transfer DeptRaymond Robles DanicoPas encore d'évaluation

- School-Based Legal ManagementDocument18 pagesSchool-Based Legal ManagementRaymond Robles DanicoPas encore d'évaluation

- Who Was Sendero Luminoso The Actors and Motivations Behind The Shining Path of PeruDocument123 pagesWho Was Sendero Luminoso The Actors and Motivations Behind The Shining Path of Peruanonimo120_3Pas encore d'évaluation

- History of Crime & Punishment: Hammurabi and The Laws of RetributionDocument5 pagesHistory of Crime & Punishment: Hammurabi and The Laws of RetributionJaya Mae B. MadanloPas encore d'évaluation

- OwwaDocument6 pagesOwwaJosebeth CairoPas encore d'évaluation

- Nature of Public PolicyDocument8 pagesNature of Public Policykimringine100% (1)

- 024 Villavicencio Republic v. UnimexDocument2 pages024 Villavicencio Republic v. UnimexSalve VillavicencioPas encore d'évaluation

- Code of Conduct: Simple Living Encompasses A Number of Different Voluntary Practices ToDocument3 pagesCode of Conduct: Simple Living Encompasses A Number of Different Voluntary Practices ToVai MercadoPas encore d'évaluation

- Calalang Versus Register of Deeds of Quezon CityDocument8 pagesCalalang Versus Register of Deeds of Quezon CityFarrah MalaPas encore d'évaluation

- Irving Kristol - On The Political Stupidity of The Jews (1999) - AzureDocument4 pagesIrving Kristol - On The Political Stupidity of The Jews (1999) - Azureplouise37Pas encore d'évaluation

- Machiavelli NotesDocument3 pagesMachiavelli Notessusan_sant_1Pas encore d'évaluation

- Notice: All Parties Were Duly Notified: Calendar of Cases 28 May 2019Document3 pagesNotice: All Parties Were Duly Notified: Calendar of Cases 28 May 2019Ronald Caringal CusiPas encore d'évaluation

- Accountability: BY Montano F. Salvador, DpaDocument43 pagesAccountability: BY Montano F. Salvador, DpaTristan Lindsey Kaamiño AresPas encore d'évaluation

- Juris Law Offices ProfileDocument5 pagesJuris Law Offices ProfileVikas NagwanPas encore d'évaluation

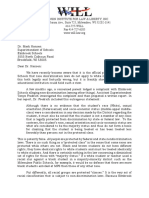

- WILL LetterDocument3 pagesWILL LetterKendall TietzPas encore d'évaluation

- CLJ 1 ModuledocxDocument54 pagesCLJ 1 ModuledocxAngel Joy CATALAN (SHS)0% (1)

- من معاني الشرعية و المشروعية و الشرعنةDocument22 pagesمن معاني الشرعية و المشروعية و الشرعنةRihab RezguiPas encore d'évaluation

- Turners Frontier Thesis ApushDocument5 pagesTurners Frontier Thesis Apushrajeedentfargo100% (2)

- Revolutionary Methods For Political Control p31Document642 pagesRevolutionary Methods For Political Control p31max_schofield100% (1)

- Justice For Children DetentionDocument106 pagesJustice For Children DetentionSalvador C. VilchesPas encore d'évaluation

- Regional Economic IntegrationDocument8 pagesRegional Economic IntegrationMary Mia CenizaPas encore d'évaluation

- DLSU Vs DLSU Employees AssocDocument2 pagesDLSU Vs DLSU Employees AssocRZ ZamoraPas encore d'évaluation

- Arrests and The Miranda RightsDocument12 pagesArrests and The Miranda RightsJohn Mark ParacadPas encore d'évaluation

- Chapter 7Document38 pagesChapter 7Shaira Mae YecpotPas encore d'évaluation

- Sagana v. Francisco20180925-5466-A9bhqcDocument7 pagesSagana v. Francisco20180925-5466-A9bhqcsensya na pogi langPas encore d'évaluation

- Aquino vs. MangaoangDocument1 pageAquino vs. MangaoangjerushabrainerdPas encore d'évaluation

- San Miguel Corp (Mandaue) Vs San Miguel 2005Document2 pagesSan Miguel Corp (Mandaue) Vs San Miguel 2005darklingPas encore d'évaluation

- Get The Huge List of More Than 500 Essay Topics and IdeasDocument2 pagesGet The Huge List of More Than 500 Essay Topics and IdeasSachin GairePas encore d'évaluation

- OFFICIAL SENSITIVE Second UK-US Trade and Investment Working Group Full ReadoutDocument64 pagesOFFICIAL SENSITIVE Second UK-US Trade and Investment Working Group Full ReadoutAnonymous snYgp7ZPas encore d'évaluation

- What Is A Constitution PrimerDocument25 pagesWhat Is A Constitution Primersaad aliPas encore d'évaluation

- MOA For OJTDocument2 pagesMOA For OJTJp Isles MagcawasPas encore d'évaluation

- Fujiki Vs Marinay 700 SCRA 69Document20 pagesFujiki Vs Marinay 700 SCRA 69RaymondPas encore d'évaluation