Académique Documents

Professionnel Documents

Culture Documents

Trading, Profit & Loss Acct.s

Transféré par

Sudheer Sirangula0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues14 pagesregarding trading account

Copyright

© © All Rights Reserved

Formats disponibles

PPT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentregarding trading account

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

26 vues14 pagesTrading, Profit & Loss Acct.s

Transféré par

Sudheer Sirangularegarding trading account

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 14

FINAL ACCOUNTS

Prof. Sarbesh Mishra,

NICMAR, Hyderabad.

BACK DROP

Every businessman is interested to know two facts

Whether the company has earned profit or loss

Determined by Trading, Profit & Loss Account.

What is the financial position of the firm Judged

by preparing Balance Sheet.

These two statements together are termed as Final

Accounts.

Trading and Profit & Loss

A/C

This gives a final summary of such

accounts which affect the profit or loss

position of the business.

The account is prepared in two parts

(i) Trading Account

(ii) Profit and Loss Account

TRADING ACCOUNT

Gives an overall result of trading i.e.

Purchasing and selling of goods.

It explains whether purchasing of goods

and selling them has proved to be

profitable for the business or not.

Contd.

It takes in to account cost of goods sold

and the value for which they have been

sold away.

Incase sales value is higher, there will be

a profit. Profit is termed as Gross Profit.

Equation for Preparing

Trading A/C

1. Gross Profit = Sales Cost of goods sold

2. Cost of Goods Sold = Opening Stock +

Purchases + Direct Expenses Closing Stock

3. Therefore, Gross Profit = Sales (Opening

Stock + Purchases + Direct Expenses

Closing Stock)

4. Or Gross Profit = (Sales + Closing Stock)

(Opening Stock + Purchases + Direct

Expenses)

Direct Expenses

The term direct expenses includes those

which have been incurred in purchasing the

goods, bringing them to business premises

and making them fit for sale.

Examples: Carriage, Octroi, Import Duty,

Expenses for seasoning the goods etc.

Important Point Regarding

Trading A/C

1. Stock The term stock includes goods lying

unsold on a particular date.

Opening Stock Goods lying unsold with the

businessman in the beginning of the A.Y and

is shown in the debit side of Trading A/C.

Closing Stock Goods lying unsold with the

businessman at the end of the A.Y & is

shown on the credit side of the Trading A/C.

Valuation of Closing Stock

Closing stock is valued on the basis of Cost

or market price whichever is less.

This valuation is done because of the

accounting Convention of Conservatism,

according to which expected losses are to be

taken in to account but not expected profit.

Purchases

The term Purchases includes both cash and

credit purchases of goods.

Term Goods means items purchased for

resale.

The amount of purchase will be the net

purchase made by proprietor.

Purchases will be taken in to trading account

after deducting purchase returns from gross

purchases made during the A.Y.

Sales

The term sales includes both cash and credit

sales.

Net sales = Gross sales made Sales Returns

Sale of assets like Plant & Machinery, Land &

Building, or any such assets which were

purchased for using in the business and not for

sale, should be excluded from sales to be taken

to the trading account.

Wages

The amount of wage is taken as direct

expense and is debited to the trading

account.

If the trial balance shows Wages & Salaries

then itll be charged to Trading Account & if it

is Salaries & Wages then itll be charged to

Profit & Loss Account.

Other Expenses

Customs and import duty In case the goods

have been imported from outside the

country, it is chargeable to Trading A/C.

Freight, Carriage and cartage These

charges are levied on purchase of goods.

Freight In / Cartage In / Carriage In are

taken in to debit side of Trading A/C.

Royalty Direct expense and charged to

Trading A/C.

Contd.

Gas, electricity, water, fuel etc. All

expenses are direct expenses and charged to

the Trading A/C.

Packing Materials Packing material used for

packing goods purchased bringing them to

the shop or convert them in to saleable state

are direct expenses and chargeable to

Trading Account.

Vous aimerez peut-être aussi

- Ultimate Guide To Investments For BeginnersDocument18 pagesUltimate Guide To Investments For BeginnersArkya MojumderPas encore d'évaluation

- A Revisit On The Fundamentals of AccountingDocument53 pagesA Revisit On The Fundamentals of AccountingGonzalo Jr. Ruales100% (1)

- Jacques Maritain - Man and The State-University of Chicago Press (1966)Document230 pagesJacques Maritain - Man and The State-University of Chicago Press (1966)Gabriel Viana Silveira100% (1)

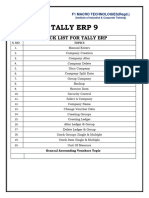

- GB Training & Placement Centre: Tally ERP 9 Certificate CourseDocument2 pagesGB Training & Placement Centre: Tally ERP 9 Certificate CourseswayamPas encore d'évaluation

- Anouk - Hotel New YorkDocument46 pagesAnouk - Hotel New YorkRossi Tan100% (2)

- Book Keeping MaterialsDocument64 pagesBook Keeping MaterialsAmanda Watson100% (1)

- Final Account BBADocument37 pagesFinal Account BBAgrivand100% (1)

- GST Section ListDocument7 pagesGST Section ListRahul ThapaPas encore d'évaluation

- LEED v4 Green Associate Study Guide PDFDocument209 pagesLEED v4 Green Associate Study Guide PDFSudheer Sirangula100% (2)

- Basics of Accounting - QBDocument7 pagesBasics of Accounting - QBsujanthqatarPas encore d'évaluation

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyD'EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyÉvaluation : 5 sur 5 étoiles5/5 (1)

- Tally Interview Questions PDFDocument6 pagesTally Interview Questions PDFRuqaya AhadPas encore d'évaluation

- Terence Fretheim - The Exaggerated God of JonahDocument11 pagesTerence Fretheim - The Exaggerated God of JonahChris Schelin100% (1)

- Trading and Profit Loss AccountDocument8 pagesTrading and Profit Loss AccountOrange Noida100% (1)

- Accountancy Handout RevisionDocument181 pagesAccountancy Handout RevisionSIMARPas encore d'évaluation

- Lean Six Sigma PDFDocument138 pagesLean Six Sigma PDFSudheer SirangulaPas encore d'évaluation

- Tax FinalDocument23 pagesTax FinalJitender ChaudharyPas encore d'évaluation

- Grdae 9 - Ems - Financial Literacy SummaryDocument17 pagesGrdae 9 - Ems - Financial Literacy SummarykotologracePas encore d'évaluation

- 10 Stores ManagementDocument36 pages10 Stores ManagementSudheer SirangulaPas encore d'évaluation

- Tally 036Document191 pagesTally 036anjalishah7Pas encore d'évaluation

- Resume: Saravana Kumar V 8754598732 - Career ObjectiveDocument3 pagesResume: Saravana Kumar V 8754598732 - Career ObjectiveporurPas encore d'évaluation

- Basic Accounting: I.K. Gujral Punjab Technical University JalandharDocument242 pagesBasic Accounting: I.K. Gujral Punjab Technical University Jalandharmanjotkaurpanesar1Pas encore d'évaluation

- Ap (Accounts Payable) ProcessDocument10 pagesAp (Accounts Payable) ProcessRabin DebnathPas encore d'évaluation

- Self Study - Week 1 - Journal RevisionDocument7 pagesSelf Study - Week 1 - Journal RevisionMehak Gupta100% (1)

- Tally E Book 2Document154 pagesTally E Book 2anjali44499Pas encore d'évaluation

- GST Practical Record 40-50Document48 pagesGST Practical Record 40-50Aditya raj ojhaPas encore d'évaluation

- TYBCom Sem VI Financial Accounting and Auditing Paper IX Financial AccountingDocument181 pagesTYBCom Sem VI Financial Accounting and Auditing Paper IX Financial Accountingarbazshaha121Pas encore d'évaluation

- Accounting BasicsDocument21 pagesAccounting BasicsasifparwezPas encore d'évaluation

- Personal Finance and Planning: Skill Enhancement Course (SEC)Document37 pagesPersonal Finance and Planning: Skill Enhancement Course (SEC)Babita DeviPas encore d'évaluation

- Test 2Document10 pagesTest 2himanshuPas encore d'évaluation

- Oops TutorialDocument20 pagesOops TutorialRajesh MandadapuPas encore d'évaluation

- Tally Assignment Yash ComDocument9 pagesTally Assignment Yash Comraj S.NPas encore d'évaluation

- BodhanaDocument94 pagesBodhanaVijaya BhaskarPas encore d'évaluation

- Tally Record NoteDocument74 pagesTally Record NoteBarani DharanPas encore d'évaluation

- Accountancy NCERT P2 (WWW - Ssctube.com)Document305 pagesAccountancy NCERT P2 (WWW - Ssctube.com)Priyankesh ChourasiyaPas encore d'évaluation

- General Journal: Date Description Debit CreditDocument7 pagesGeneral Journal: Date Description Debit CreditAmanuel DemekePas encore d'évaluation

- Tally - ERP9 Book With GSTDocument1 843 pagesTally - ERP9 Book With GSThatimPas encore d'évaluation

- Workshop On TALLY - 8th Jan2014Document128 pagesWorkshop On TALLY - 8th Jan2014Senthil KannanPas encore d'évaluation

- AMFI - Investor Awareness Presentation - Jul'23Document69 pagesAMFI - Investor Awareness Presentation - Jul'23padmaniaPas encore d'évaluation

- Revit Keyboard Shortcuts Guide PDFDocument9 pagesRevit Keyboard Shortcuts Guide PDFMohit KohliPas encore d'évaluation

- Short Cut Keys in Tally 9Document10 pagesShort Cut Keys in Tally 9Partha1962Pas encore d'évaluation

- Tally - Business Accounts Question BankDocument9 pagesTally - Business Accounts Question BankBhaskar bhaskarPas encore d'évaluation

- PL SQL - Training - PpsDocument106 pagesPL SQL - Training - PpsAnuPas encore d'évaluation

- Problem 1Document3 pagesProblem 1karthikeyan01Pas encore d'évaluation

- Excise For ManufacturersDocument160 pagesExcise For ManufacturersPraveen CoolPas encore d'évaluation

- Journalise The Following TransactionsDocument1 pageJournalise The Following Transactionshamidalikhanscorpion50% (2)

- Oracle Apps Course ContentsDocument12 pagesOracle Apps Course ContentsRabindra P.SinghPas encore d'évaluation

- LLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019Document104 pagesLLB Hon. Intergrated Law Sem 1 To 8 Syllabus May 2019shah zavidPas encore d'évaluation

- Intermediate Paper 11 PDFDocument456 pagesIntermediate Paper 11 PDFjesurajajPas encore d'évaluation

- Tally Final ExamDocument4 pagesTally Final ExamsatyajitPas encore d'évaluation

- Accountancy XiiDocument122 pagesAccountancy XiiNancy Ekka100% (1)

- CA CPT Express Material 2015 16 Caultimates ComDocument112 pagesCA CPT Express Material 2015 16 Caultimates Comrishabh jain100% (1)

- Lorax Truax QuestionsDocument2 pagesLorax Truax Questionsapi-264150929Pas encore d'évaluation

- Conceptual Art and The Politics of PublicityDocument253 pagesConceptual Art and The Politics of PublicityAlan Eric Sanguinetti77% (13)

- BIOETHICSDocument4 pagesBIOETHICSSherylou Kumo SurioPas encore d'évaluation

- List of Directors - Indian CompaniesDocument209 pagesList of Directors - Indian CompaniesAditya Sharma100% (1)

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Under The Guidence OF Prof - Dr. V.R.K MurthyDocument18 pagesUnder The Guidence OF Prof - Dr. V.R.K MurthySudheer SirangulaPas encore d'évaluation

- Specpro 4Document12 pagesSpecpro 4Venice SantibañezPas encore d'évaluation

- FI Period End Closing T-Code and ProcedureDocument6 pagesFI Period End Closing T-Code and Procedurepraveen_sharma_5Pas encore d'évaluation

- 42 Implementation of Tds in Tallyerp 9Document171 pages42 Implementation of Tds in Tallyerp 9P VenkatesanPas encore d'évaluation

- Advanced Tally MCQ Original - WatermarkDocument90 pagesAdvanced Tally MCQ Original - WatermarkVinod RathodPas encore d'évaluation

- Tally - Erp 9 - Post-Dated Voucher of Accounting & Inventory Vouchers Creation, Modification, DeletionsDocument5 pagesTally - Erp 9 - Post-Dated Voucher of Accounting & Inventory Vouchers Creation, Modification, DeletionsHeemanshu ShahPas encore d'évaluation

- AccountingDocument8 pagesAccountingBasil Babym50% (2)

- FA1 General JournalDocument5 pagesFA1 General JournalamirPas encore d'évaluation

- D2K-Report6i-by Dinesh Kumar S PDFDocument98 pagesD2K-Report6i-by Dinesh Kumar S PDFallumohanPas encore d'évaluation

- 874 Taxation HandbookDocument170 pages874 Taxation HandbookYingYiga100% (1)

- Dma Module 1 Oracle SQL PL SQL IacDocument110 pagesDma Module 1 Oracle SQL PL SQL IacK T Hoq Himel100% (1)

- Key Words: Multiple Choice QuestionsDocument7 pagesKey Words: Multiple Choice QuestionsMOHAMMED AMIN SHAIKHPas encore d'évaluation

- Chapter 1Document5 pagesChapter 1palash khannaPas encore d'évaluation

- JournalDocument33 pagesJournalMitesh SethiPas encore d'évaluation

- CA Foundation Accounting Notes by Bharadwaj InstituteDocument127 pagesCA Foundation Accounting Notes by Bharadwaj Institutenasiransar26Pas encore d'évaluation

- Retrospective Payroll Processing in Oracle PayrollDocument16 pagesRetrospective Payroll Processing in Oracle PayrollP RajendraPas encore d'évaluation

- Definition and Explanation:: Debit Side ItemsDocument17 pagesDefinition and Explanation:: Debit Side ItemsSovan NandyPas encore d'évaluation

- Final Accounts NotesDocument6 pagesFinal Accounts NotesVinay K TanguturPas encore d'évaluation

- Working Capital ManagementDocument6 pagesWorking Capital ManagementSudheer SirangulaPas encore d'évaluation

- Calculating Man Months IS101012Document1 pageCalculating Man Months IS101012Ardi RizalPas encore d'évaluation

- Working Capital ManagementDocument6 pagesWorking Capital ManagementSudheer SirangulaPas encore d'évaluation

- Valuation - MCM 625Document0 pageValuation - MCM 625Yarla ChiranjeeviPas encore d'évaluation

- HRM IiiDocument31 pagesHRM IiiSudheer SirangulaPas encore d'évaluation

- Employee Compensation-Theory, Practice & EvidenceDocument32 pagesEmployee Compensation-Theory, Practice & EvidencehaloutsoPas encore d'évaluation

- Valuation - MCM 625Document0 pageValuation - MCM 625Yarla ChiranjeeviPas encore d'évaluation

- Cement SegmentDocument18 pagesCement Segmentmanish1895Pas encore d'évaluation

- MilenaPopovaThesisWithCorrectionsAsSubmitted PDFDocument233 pagesMilenaPopovaThesisWithCorrectionsAsSubmitted PDFkakka kikkarePas encore d'évaluation

- Among The Nihungs.Document9 pagesAmong The Nihungs.Gurmeet SinghPas encore d'évaluation

- Revised Compendium FOR PERSONAL INJURY AWARDS 2018 Revised Compendium FOR PERSONAL INJURY AWARDS 2018Document52 pagesRevised Compendium FOR PERSONAL INJURY AWARDS 2018 Revised Compendium FOR PERSONAL INJURY AWARDS 2018LavernyaPas encore d'évaluation

- C.V ZeeshanDocument1 pageC.V ZeeshanZeeshan ArshadPas encore d'évaluation

- Liquidity Risk Management Framework For NBFCS: Study NotesDocument5 pagesLiquidity Risk Management Framework For NBFCS: Study NotesDipu PiscisPas encore d'évaluation

- Ermitage Academic Calendar IBP 2022-23Document1 pageErmitage Academic Calendar IBP 2022-23NADIA ELWARDIPas encore d'évaluation

- (Group 2) Cearts 1 - Philippine Popular CultureDocument3 pages(Group 2) Cearts 1 - Philippine Popular Culturerandom aestheticPas encore d'évaluation

- Grupo NovEnergia, El Referente Internacional de Energía Renovable Dirigido Por Albert Mitjà Sarvisé - Dec2012Document23 pagesGrupo NovEnergia, El Referente Internacional de Energía Renovable Dirigido Por Albert Mitjà Sarvisé - Dec2012IsabelPas encore d'évaluation

- Fungal Infections: September 2021Document270 pagesFungal Infections: September 2021NormanPas encore d'évaluation

- CM - Mapeh 8 MusicDocument5 pagesCM - Mapeh 8 MusicAmirah HannahPas encore d'évaluation

- Processes of Word Formation - 4Document18 pagesProcesses of Word Formation - 4Sarah Shahnaz IlmaPas encore d'évaluation

- Athet Pyan Shinthaw PauluDocument6 pagesAthet Pyan Shinthaw PaulupurifysoulPas encore d'évaluation

- District Memo 2021 PPST PPSSHDocument2 pagesDistrict Memo 2021 PPST PPSSHRosalie MarquezPas encore d'évaluation

- NMML Occasional Paper: The Anticolonial Ethics of Lala Har Dayal'sDocument22 pagesNMML Occasional Paper: The Anticolonial Ethics of Lala Har Dayal'sСаша ПаповићPas encore d'évaluation

- Tutorial Week 3 - WillDocument4 pagesTutorial Week 3 - WillArif HaiqalPas encore d'évaluation

- Drugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Document23 pagesDrugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Dimple Lasala ElandagPas encore d'évaluation

- Ecfl BM Report 2022 High Resolution PDFDocument231 pagesEcfl BM Report 2022 High Resolution PDFOlmo GrassiniPas encore d'évaluation

- TriboSys 3203 3204Document1 pageTriboSys 3203 3204Hayden LeePas encore d'évaluation