Académique Documents

Professionnel Documents

Culture Documents

VAT Report

Transféré par

Noel Christopher G. Belleza0 évaluation0% ont trouvé ce document utile (0 vote)

36 vues32 pagesasda

Copyright

© © All Rights Reserved

Formats disponibles

PPT, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentasda

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

36 vues32 pagesVAT Report

Transféré par

Noel Christopher G. Bellezaasda

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPT, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 32

Value Added Tax

NOEL CHRISTOPHER G. BELLEZA

GENERAL PRINCIPLES

NORMAL VAT TRANSACTIONS

TRANSITIONAL INPUT TAX CREDITS

PRESUMPTIVE INPUT TAX CREDITS

WITHHOLDING OF CREDITABLE VALUE-ADDED TAX

Value Added Tax

VAT stands for Value Added Tax. VAT is a type of

sales tax which is levied on consumption on the

sale of goods, services or properties, as well as

importation, in the Philippines.

To simplify, it means that a certain tax rate (0%

to 12%) is added up to the selling price of a

goods or services sold. It is also imposed on

imported goods from abroad.

Characteristics of Philippine VAT

1. It is an indirect Tax

The amount of tax may be shifted or passed on by the seller

to the buyer , transferee or lessee of goods, properties or

services

Impact of Taxation

On the seller upon whom the tax has been imposed in the

first instance

Incidence of Taxation

On the final consumer who bears the burden of the tax

Characteristics of Philippine VAT

2. It is a tax on value added of the tax payer.

It is the value added to the raw materials or to

the purchases, other than the labor component

of the goods or service, by the producer, before

its sale.

Characteristics of Philippine VAT

3. It is a transparent form of sales tax

The Law requires that the tax be shown in the VAT invoice or

receipt.

4. It is a broad-based tax on consumption of goods, properties

or services in the Philippines

There is VAT on every stage of the taxable sales of the goods, properties or services.

Characteristics of Philippine VAT

5. It is collected through the tax credit method

(sometimes referred to as the invoice method)

The input tax is shifted by the seller to the buyer is credited against the buyers output

taxes when he is in turn selling the taxable goods, properties and services.

Characteristics of Philippine VAT

6. Itdoes not cascade ( Tax on Tax) hence there is no tax

pyramiding

Cascading Tax passed on by the previous selling, which is

now a component of gross selling price/ receipts of the seller

is again subjected to Tax.

7. It adopts the tax-inclusive method

Unless otherwise stated, any price charged by a VAT

registered person shall be deemed to include the VAT

Charged.

Characteristics of Philippine VAT

8. It follows the Destination Principle / Cross Border

Doctrine

Goods and services are taxed only in the country

where these are consumed, and in connection with

the said principle, the Cross Border Doctrine

mandates that no VAT shall be imposed to form

part of the cost of goods destined for

consumption outside the territory border of the

taxing authority.

To Whom is VAT imposed/ Who are

required to be VAT Registered

Any person or entity who, in the course of his trade or business, sells,

barters, exchanges, leases goods or properties and renders services

subject to VAT, if the aggregate amount of actual gross sales or receipts

exceed One Million Nine Hundred Nineteen Thousand Five Hundred

Pesos (P1,919,500.00)

Any person, whether or not made in the course of his trade or business,

who imports goods

A person required to register as VAT taxpayer but failed to register

3 Types of VAT and Tax Rates

VAT 12%

VAT Zero Rated

VAT Exempted

VAT 12%

As a rule, gross receipts from services

rendered in the Philippines by a Value

Added Tax registered seller is subject to

12% value added tax (VAT). Such 12% value

added tax in the Philippines is passed on by

the seller to the buyer of service in the

Philippines.

Persons Liable for VAT

Any person who in the ordinary course of the trade or

business

Sells , Barters, or exchanges goods or properties ( seller or

transferor), leases goods or properties

Renders Services

Imports Goods (importer) The person who brings goods

into the Philippines, whether or not it is made in the course

of business or trade

VAT Person

Refers to any person liable for the payment

of VAT whether registered or registrable

Any person who engages in transactions

subject to VAT

Importers of goods, whether or not made in the

course of Business

VAT Registered person

VAT Person who:

Registered in accordance with the Law

or

Opted to be registered as a VAT Person

VAT- Registrable Person

Persons who are required to register for Value Added Tax

Refers to any person, who in the course of business, sells, barters of

exchanges government properties, or engages in the sale or

exchange of services, shall be liable to register for VAT if:

His gross sales or receipts for the past 12 months, other than those that are

exempt under Section 109(A) to (U) have exceeded P 1,919,500 or

There are reasonable grounds to believe that his gross sales or receipts for the

next 12 months, other than those that are exempt under Section 109(A) to (U)

will exceed 1,919,500 (NIRC, Sec 236 (G)(1)

VAT- Registrable Person

Any person who is required to register but

failed to do so. As a form of penalty, he

shall not be entitled to claim any input tax

credit, although he is liable to output tax in

his taxable sales.

VAT Exempt Person

He is not liable for the imposition of Output

VAT on its sales, either because

His transactions are not taxable transactions

He is specifically exempt from VAT by specific

provisions of the CODE, by special Laws or by

international Agreements

Who are subject to Value

added tax of 12%?

Value Added Tax of 12%

As a rule, gross receipts from services rendered in the

Philippines by a Value Added Tax registered seller is subject to

12% value added tax (VAT). Such 12% value added tax in the

Philippines is passed on by the seller to the buyer of service in

the Philippines.

Persons engaged on sale of goods and properties

Persons engaged on sale of services and use or lease of

properties

Normal VAT Transactions 12%

Persons engaged on sale of goods and

properties (12%) of the gross selling

price or gross value in money of the goods

or properties sold, bartered or exchanged

Normal VAT Transactions 12%

There is an actual or deemed sale, barter or exchange of goods

or personal properties for valuable consideration;

The sale is in the course of trade or business or exercise of

profession in the Philippines;

The goods or properties are located in the Philippines and are

for use or consumption therein; and

The sale is not exempt from VAT under Section 109 of NIRC,

special law, international agreement binding upon the

government of the Philippines.

Normal VAT Transactions 12%

Persons engaged on sale of services and

use or lease of properties

Twelve percent (12%) of gross receipts

derived from the sale or exchange of

services, including the use or lease of

properties

Normal VAT Transactions 12%

The seller executes a deed of sale, barter or exchange, assignment,

transfer, or conveyance, or merely contract to sell involving real

property

The real property is located within the Philippines;

The seller or transferor is a real estate dealer

The real property is an ordinary asset held primarily for sale or for

lease in the ordinary course of business

The sale is not exempt from VAT under Section 109 of NIRC, special

law, or international agreement binding upon the government of

the Philippines

Normal VAT Transactions 12%

Persons engaged on importation of goods

Twelve percent (12%) based on the total value used by the

Bureau of Customs in determining tariff and customs duties,

plus customs duties, excise taxes, if any, and other charges,

such as tax to be paid by the importer prior to the release of

such goods from customs custody; provided, that where the

customs duties are determined on the basis of quantity or

volume of the goods, the VAT shall be based on the landed

cost plus excise taxes, if any.

Transitional Input Tax

Tax payers who become VAT Registered persons upon

exceeding the minimum turnover of 1,919,500 php in

any 12- month period or who voluntarily registers even

if they do not reach the threshold shall be entitled to a

transitional input tax on the inventory on hand as of

the effectivity of their vat registration on the following:

Goods purchased for resale in their present condition

Materials purchased for further processing

Transitional Input Tax

-Goods which have been manufactured by

the tax payer

-Goods in process for sale or

-Goods and supplies for use in the course

of the taxpayers trade or business as a VAT

Registered person

Transitional Input Tax

- 2% of the Value of the beginning

inventory on hand or

- Actual VAT paid on such goods, materials

and supplies, which ever is higher

Transitional Input Tax

The transitional input tax credit operates to benefit

newly VAT-registered persons, whether or not they

previously paid taxes in the acquisition of their

beginning inventory of goods, materials and supplies.

During that period of transition from non-VAT to VAT

status, the transitional input tax credit serves to

alleviate the impact of the VAT on the taxpayer.

Transitional Input Tax

At the very beginning, the VAT-registered taxpayer is obliged to remit a significant

portion of the income it derived from its sales as output VAT. The transitional input tax

credit mitigates this initial diminution of the taxpayers income by affording the

opportunity to offset the losses incurred through the remittance of the output VAT at a

stage when the person is yet unable to credit input VAT payments. (Fort Bonifacio

Development Corp. v. Commissioner of Internal Revenue, G.R. Nos. 158885 & 170680, 2

April 2009)

Presumptive Input Tax Credits

Any person or firm engaged in the processing of

sardines, mackerel, and milk, and in manufacturing

refined sugar and cooking oil and packed noodle-

based instant meals shall be allowed a presumptive

input tax creditable against the output tax, equivalent

to 4% of the gross value in money of their purchases

ofprimary agricultural products which are used as

inputs to his production

Presumptive Input Tax Credits

It is given for those engaged in:

Processing of sardines, mackerel and milk and

In the Manufacturing of refined sugar, cooking oil and packed

noodle based instant meals

The Rate is 4% of the Gross Value in Money

They are given this 4% presumptive input tax because the

goods used in the said enumberation are VAT-Exempt

Withholding of Credible Value- Added

Tax

The government or any of its political subdivisions,

instrumentalities or agencies, including government-owned or

- controlled corporations (GOCCs) shall, before making

payment on account of each purchase of goods and services

which are subject to VAT imposed in Sections 106 and 108 of

the NIRC, deduct and withhold a final VAT at the rate of 5% of

the gross payment thereof. Provided, that the payment for

lease or use of properties to non resident owners shall be

subject to 12% withholding tax at the time of the payment.

Vous aimerez peut-être aussi

- Gimenez Jose Mari CDocument14 pagesGimenez Jose Mari CMari Calica GimenezPas encore d'évaluation

- VAT ReportDocument21 pagesVAT ReportNoel Christopher G. BellezaPas encore d'évaluation

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezPas encore d'évaluation

- Value Added TaxationDocument76 pagesValue Added Taxationxz wyPas encore d'évaluation

- Tax 2 Notes Finals 4Document36 pagesTax 2 Notes Finals 4Boom ManuelPas encore d'évaluation

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justinePas encore d'évaluation

- Taxn03b Vat IntroDocument20 pagesTaxn03b Vat IntroTrishamae legaspiPas encore d'évaluation

- Tax (Zero Rated Transactions)Document4 pagesTax (Zero Rated Transactions)QuinxPas encore d'évaluation

- Business TaxesDocument51 pagesBusiness TaxesLuna CakesPas encore d'évaluation

- A. VatDocument5 pagesA. VatKaye L. Dela CruzPas encore d'évaluation

- Vat System and OptDocument15 pagesVat System and Optlyra21Pas encore d'évaluation

- VALUE ADDED TAX and EXCISE TAXDocument18 pagesVALUE ADDED TAX and EXCISE TAXTrisha Nicole Flores0% (1)

- Comprehensive VAT TAXATION (3!31!14)Document166 pagesComprehensive VAT TAXATION (3!31!14)dereckriveraPas encore d'évaluation

- Business TaxesDocument100 pagesBusiness Taxeslynne tahilPas encore d'évaluation

- VatDocument50 pagesVatnikolaevnavalentinaPas encore d'évaluation

- Notes On VATDocument15 pagesNotes On VATErnest Benz Sabella DavilaPas encore d'évaluation

- VAT - GuidenotesDocument14 pagesVAT - GuidenotesNardz AndananPas encore d'évaluation

- Value-Added Tax PDFDocument118 pagesValue-Added Tax PDFRazel MhinPas encore d'évaluation

- Vat Tax CasesDocument24 pagesVat Tax CasesEller-JedManalacMendozaPas encore d'évaluation

- VAT Casasola NotesDocument7 pagesVAT Casasola NotesCharm AgripaPas encore d'évaluation

- VatDocument70 pagesVatPETERWILLE CHUAPas encore d'évaluation

- (G5 P1) VatDocument41 pages(G5 P1) VatFiliusdeiPas encore d'évaluation

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosPas encore d'évaluation

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroPas encore d'évaluation

- Business TaxationDocument6 pagesBusiness TaxationPATRICK JAMES BALOGBOG ROSARIOPas encore d'évaluation

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosPas encore d'évaluation

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezPas encore d'évaluation

- Mamalateo Part 1 VATDocument12 pagesMamalateo Part 1 VATPeterPas encore d'évaluation

- Business TaxDocument33 pagesBusiness TaxKiro ParafrostPas encore d'évaluation

- Tax 2 - VATDocument37 pagesTax 2 - VATShirley Marie Cada - CaraanPas encore d'évaluation

- Value Added Tax: Output Tax Less Input Tax VAT PayableDocument26 pagesValue Added Tax: Output Tax Less Input Tax VAT PayableRon RamosPas encore d'évaluation

- Accounting For Indirect TaxesDocument40 pagesAccounting For Indirect TaxesSabaa if100% (1)

- Value Added TaxDocument9 pagesValue Added TaxĴõ ĔĺPas encore d'évaluation

- Tax 2 ReviewerDocument21 pagesTax 2 ReviewerLouis MalaybalayPas encore d'évaluation

- Business Tax - VATDocument165 pagesBusiness Tax - VATAlgen Lyn MendozaPas encore d'évaluation

- Lecture VAT With ExercisesDocument82 pagesLecture VAT With ExercisesAko C JamzPas encore d'évaluation

- Value Added TAX: Taxation Law 2 3-S Atty. Nicasio CabaineroDocument139 pagesValue Added TAX: Taxation Law 2 3-S Atty. Nicasio CabaineroAnselmo Rodiel IVPas encore d'évaluation

- Percentage Tax in The PhilippinesDocument3 pagesPercentage Tax in The PhilippinesfraziePas encore d'évaluation

- 07 Chap 15 16 Mamalateo 2019 Tax BookDocument19 pages07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayPas encore d'évaluation

- Business Tax ReviewerDocument22 pagesBusiness Tax ReviewereysiPas encore d'évaluation

- Value Added Tax Ust PDFDocument23 pagesValue Added Tax Ust PDFcalliemozartPas encore d'évaluation

- Value-Added Tax Nature of VatDocument22 pagesValue-Added Tax Nature of VatDiossaPas encore d'évaluation

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananPas encore d'évaluation

- Antonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenDocument22 pagesAntonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenJayvee FelipePas encore d'évaluation

- A NonDocument2 pagesA NonAlthea PalmaPas encore d'évaluation

- Business TaxDocument13 pagesBusiness TaxMs AJPas encore d'évaluation

- VAT ON SALES OF GOODS A 12Document48 pagesVAT ON SALES OF GOODS A 12Ivan Jester BautistaPas encore d'évaluation

- Melanie S. Samsona Business Tax Chapter 7 ExercisesDocument3 pagesMelanie S. Samsona Business Tax Chapter 7 ExercisesMelanie SamsonaPas encore d'évaluation

- VAT NotesDocument21 pagesVAT NotesiBEAYPas encore d'évaluation

- TAXATION - Value-Added TaxDocument10 pagesTAXATION - Value-Added TaxJohn Mahatma Agripa100% (2)

- VatDocument15 pagesVatEller-JedManalacMendozaPas encore d'évaluation

- Vat TaxDocument6 pagesVat TaxJunivenReyUmadhayPas encore d'évaluation

- VALUE Added TaxDocument20 pagesVALUE Added TaxMadz Rj MangorobongPas encore d'évaluation

- IM ACCO 20173 Business and Transfer Taxes Module 4 PDFDocument40 pagesIM ACCO 20173 Business and Transfer Taxes Module 4 PDFMakoy BixenmanPas encore d'évaluation

- Taxation SchemeDocument27 pagesTaxation SchemeCristina Atienza SamsamanPas encore d'évaluation

- Tax 2 On Tax LiabilitiesDocument2 pagesTax 2 On Tax LiabilitiesAlberto NicholsPas encore d'évaluation

- Module 4 VAT On Sales of Goods or Properties With Answers PDFDocument37 pagesModule 4 VAT On Sales of Goods or Properties With Answers PDFJustine JaymaPas encore d'évaluation

- Tax 2Document14 pagesTax 2Nash Ortiz LuisPas encore d'évaluation

- Very Awkward Tax: A bite-size guide to VAT for small businessD'EverandVery Awkward Tax: A bite-size guide to VAT for small businessPas encore d'évaluation

- 1040 Exam Prep Module X: Small Business Income and ExpensesD'Everand1040 Exam Prep Module X: Small Business Income and ExpensesPas encore d'évaluation

- Lagman V MDocument63 pagesLagman V MNoel Christopher G. BellezaPas encore d'évaluation

- SummonsDocument2 pagesSummonsNoel Christopher G. Belleza0% (1)

- A. Survey of US Jurisprudence On Traditional Lawyer AdvertisingDocument1 pageA. Survey of US Jurisprudence On Traditional Lawyer AdvertisingNoel Christopher G. BellezaPas encore d'évaluation

- Assignment 3 - Noel Christopher G. BellezaDocument14 pagesAssignment 3 - Noel Christopher G. BellezaNoel Christopher G. BellezaPas encore d'évaluation

- Motion For Extension of Time To File Answer: Regional Trial CourtDocument2 pagesMotion For Extension of Time To File Answer: Regional Trial CourtNoel Christopher G. BellezaPas encore d'évaluation

- Lagman V MDocument63 pagesLagman V MNoel Christopher G. BellezaPas encore d'évaluation

- Leony LetterDocument1 pageLeony LetterNoel Christopher G. BellezaPas encore d'évaluation

- Political Law - Judicial DepartmentDocument30 pagesPolitical Law - Judicial DepartmentNoel Christopher G. Belleza100% (1)

- Assignment 2: 2016, in The Context of Jurisdiction of Special CourtsDocument1 pageAssignment 2: 2016, in The Context of Jurisdiction of Special CourtsNoel Christopher G. BellezaPas encore d'évaluation

- QuitClaim - FinalDocument5 pagesQuitClaim - FinalNoel Christopher G. BellezaPas encore d'évaluation

- Complaint Thinker BaleDocument4 pagesComplaint Thinker BaleNoel Christopher G. BellezaPas encore d'évaluation

- Stockholders VotesDocument2 pagesStockholders VotesPing KyPas encore d'évaluation

- Answer Justin Boy Luiz EditedDocument9 pagesAnswer Justin Boy Luiz EditedNoel Christopher G. BellezaPas encore d'évaluation

- Sample Employment ContractDocument3 pagesSample Employment ContractNoel Christopher G. BellezaPas encore d'évaluation

- PrinciplesDocument1 pagePrinciplesNoel Christopher G. BellezaPas encore d'évaluation

- Affidavit of Quitclaim With Indemnity UndertakingDocument2 pagesAffidavit of Quitclaim With Indemnity UndertakingNoel Christopher G. BellezaPas encore d'évaluation

- Political Law - Judicial DepartmentDocument21 pagesPolitical Law - Judicial DepartmentNoel Christopher G. BellezaPas encore d'évaluation

- Civil Law Review - QuestionnaireDocument1 pageCivil Law Review - QuestionnaireNoel Christopher G. BellezaPas encore d'évaluation

- ConstitutionDocument1 pageConstitutionNoel Christopher G. BellezaPas encore d'évaluation

- Assignment 2: 2016, in The Context of Jurisdiction of Special CourtsDocument1 pageAssignment 2: 2016, in The Context of Jurisdiction of Special CourtsNoel Christopher G. BellezaPas encore d'évaluation

- Persons Bar QuestionsDocument10 pagesPersons Bar QuestionsNoel Christopher G. BellezaPas encore d'évaluation

- Crimes Against Public MoralsDocument2 pagesCrimes Against Public MoralsNoel Christopher G. BellezaPas encore d'évaluation

- Affidavit of Quitclaim With Indemnity UndertakingDocument2 pagesAffidavit of Quitclaim With Indemnity UndertakingNoel Christopher G. BellezaPas encore d'évaluation

- Political Law Legislative DigestsDocument38 pagesPolitical Law Legislative DigestsNoel Christopher G. BellezaPas encore d'évaluation

- Consti ReviewDocument23 pagesConsti ReviewNoel Christopher G. BellezaPas encore d'évaluation

- ConstitutionDocument1 pageConstitutionNoel Christopher G. BellezaPas encore d'évaluation

- Dean Jose Mari Benjamin U. Tirol USA College of Law University of San AgustinDocument4 pagesDean Jose Mari Benjamin U. Tirol USA College of Law University of San AgustinNoel Christopher G. BellezaPas encore d'évaluation

- Consti ReviewDocument23 pagesConsti ReviewNoel Christopher G. BellezaPas encore d'évaluation

- Crimes Against Public MoralsDocument2 pagesCrimes Against Public MoralsNoel Christopher G. BellezaPas encore d'évaluation

- Crimes Against Public MoralsDocument2 pagesCrimes Against Public MoralsNoel Christopher G. BellezaPas encore d'évaluation

- Sapnote 0001023844-VIES390Document3 pagesSapnote 0001023844-VIES390LiviuPas encore d'évaluation

- Zimbabwe Investment GuideDocument20 pagesZimbabwe Investment GuideFaraiKangwendePas encore d'évaluation

- IBPS Guide - Monthly Current Affairs Capsule August - 2016Document58 pagesIBPS Guide - Monthly Current Affairs Capsule August - 2016vigneshPas encore d'évaluation

- Tax 1 DigestsDocument165 pagesTax 1 DigestsJm Palisoc100% (5)

- Tax Amendment Boolet Final 2020-2021-CompressedDocument40 pagesTax Amendment Boolet Final 2020-2021-CompressedCaesarKamanziPas encore d'évaluation

- TibebuDEBRE MARDocument23 pagesTibebuDEBRE MARSentayehu GebeyehuPas encore d'évaluation

- Benefits and Limitations of GSTDocument7 pagesBenefits and Limitations of GSTGovernment Ramanarayan chellaram collagePas encore d'évaluation

- Bir Form 1903 - Registration Corp (Blank)Document2 pagesBir Form 1903 - Registration Corp (Blank)Dennis Tolentino100% (3)

- Annual Report and Accounts Jan21Document234 pagesAnnual Report and Accounts Jan21Ashish KumarPas encore d'évaluation

- Faqs On Banking, Insurance and Stock Brokers CbicDocument34 pagesFaqs On Banking, Insurance and Stock Brokers CbicVenkataramana NippaniPas encore d'évaluation

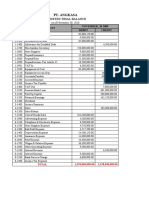

- I.D. No. Description Unit QTY Unit Cost Materials: Zeart Construction Supply CoDocument26 pagesI.D. No. Description Unit QTY Unit Cost Materials: Zeart Construction Supply CoMarie Grace A.garciaPas encore d'évaluation

- Bar Exam Qs Taxation LawDocument123 pagesBar Exam Qs Taxation LawUlyssesPas encore d'évaluation

- Kerja Kelompok PT Angkasa BDocument28 pagesKerja Kelompok PT Angkasa BElisa EndrianiiPas encore d'évaluation

- Business RFDocument7 pagesBusiness RFCloud Media SelangorPas encore d'évaluation

- Manila Memorial Park and La Funeraria Paz V DSWD and DofDocument79 pagesManila Memorial Park and La Funeraria Paz V DSWD and DofJupiterPas encore d'évaluation

- Techno-Commercial Quote For The Pool HeatingDocument5 pagesTechno-Commercial Quote For The Pool Heatingtejas varmaPas encore d'évaluation

- Uae Vat PresentationDocument64 pagesUae Vat PresentationAhammed MuzammilPas encore d'évaluation

- PercentageDocument10 pagesPercentageRiddhiman BosePas encore d'évaluation

- No Chapter Name Page No. Goods and Service Tax (75 Marks) : Indirect Taxes by CA Kedar JunnarkarDocument4 pagesNo Chapter Name Page No. Goods and Service Tax (75 Marks) : Indirect Taxes by CA Kedar JunnarkarMala M PrasannaPas encore d'évaluation

- Indirect Tax 4 Sem MbaDocument11 pagesIndirect Tax 4 Sem Mbakrushna vaidyaPas encore d'évaluation

- Tally NotesDocument33 pagesTally NotesShilpi RaiPas encore d'évaluation

- SampleDocument11 pagesSampleYanyan RivalPas encore d'évaluation

- Mushak-9.1 VAT Return On 14.JAN.2022Document8 pagesMushak-9.1 VAT Return On 14.JAN.2022Md. Abu NaserPas encore d'évaluation

- AX2012R2 CU8 ListOfHotfixsDocument174 pagesAX2012R2 CU8 ListOfHotfixsTariq RafiquePas encore d'évaluation

- IMAT MEIL10 Siricilla-Vemulawada Water Grid (O&M) Q2 2021-22 - ReportDocument96 pagesIMAT MEIL10 Siricilla-Vemulawada Water Grid (O&M) Q2 2021-22 - ReportPrashanth Reddy VallapureddyPas encore d'évaluation

- UAE Standard PPT v-1Document74 pagesUAE Standard PPT v-1SIVAKUMAR_GPas encore d'évaluation

- 4 Avril PDFDocument1 page4 Avril PDFBastien RabierPas encore d'évaluation

- Royal Mail Our Prices 25 March 2019 46305575 PDFDocument9 pagesRoyal Mail Our Prices 25 March 2019 46305575 PDFZakiur Rahman KhanPas encore d'évaluation

- Tax Guide 2022/2023: Right People. Right Size. Right SolutionsDocument60 pagesTax Guide 2022/2023: Right People. Right Size. Right Solutionstinashe mashoyoyaPas encore d'évaluation

- Tolentino Vs Secretary of FinanceDocument22 pagesTolentino Vs Secretary of FinancePatrick RamosPas encore d'évaluation