Académique Documents

Professionnel Documents

Culture Documents

Accounting Policies and Errors

Transféré par

Tia Li100%(1)100% ont trouvé ce document utile (1 vote)

157 vues32 pagesZeus Millan

Copyright

© © All Rights Reserved

Formats disponibles

PPTX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentZeus Millan

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

100%(1)100% ont trouvé ce document utile (1 vote)

157 vues32 pagesAccounting Policies and Errors

Transféré par

Tia LiZeus Millan

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PPTX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 32

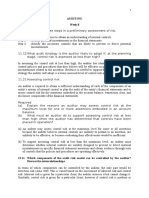

CHAPTER 41

Accounting Policies, Changes in

Estimates and Errors

Objective and Scope

PAS 8 prescribe the criteria for selecting, applying, and changing accounting

policies and the accounting and the disclosure of changes in accounting

policies, changing in accounting estimates and correction of prior period

errors. These are intended to enhance an entity’s financial statements,

relevance, reliability, and comparability.

Selecting and Applying Accounting Policies

When a PFRS specifically applies to transaction, other events or condition,

the accounting policy or policies applied to that item shall be determined by

applying the PFRS.

Philippine Financial Reporting Standards (PFRS)

- are standards and interpretations adopted by the Financial Reporting

Standards Council (FRSC). They comprise the following:

a.) Philippine Financial Reporting Standards (PFRS)

b.) Philippine Accounting Standards (PAS)

c.) Interpretations

Application and Implementation Guidance

PFRS are accompanied by guidance to assist entities in applying their

requirements. Guidance that is an integral part of the PFRS is mandatory.

Guidance that is not integral part of the PFRS does not contain requirements

for financial statements.

Accounting policies – are the specific principles, bases, conventions,

rules and practices applied by an entity in preparing and presenting

financial statements.

Materiality

It is a matter of professional judgement. Omissions or misstatements

of items are material if they could, by their size or nature, individually

or collectively, influence the economic decisions of users taken on the

basis of the financial statements.

Absence of a Standard or an

Interpretation

In the absence of a PFRS that specifically applies to a

transaction, other event or condition, management must use its judgment

in developing and applying an accounting policy that results in

information that is relevant and reliable.

In making that judgement, management shall refer to, and

consider the applicability of, the following sources in descending order.

1.) The requirements in PFRSs dealing with similar and related issues; and

2.) The definitions, recognition criteria and measurement concepts for

assets, liabilities, income and expenses in the Conceptual Framework.

In making the judgement, management may also consider

1.) The most recent pronouncement of other standard-setting bodies that use a

similar conceptual framework to develop accounting standards.

2.) Other accounting literature and accepted industry practices, to the extent

that these do not conflict with PFRSs dealing with similar and related issues and

the Framework.

Consistency of Accounting Policies

Accounting policies shall be selected and applied consistently for similar

transactions, unless a PFRs specifically requires or permits categorization of

items for which different policies may be appropriate. In such cases, an

appropriate accounting policy shall be selected and applied consistently to

each category.

Accounting Changes

There are 2 types of accounting changes accounted for under PAS 8, namely

1.) Changes in Accounting Policy; and

2.) Changes in Accounting Estimate

Changes in Accounting Policies

An entity shall change an accounting policy only if the change:

a.) is required by PFRS; or

b.) results to a more relevant and reliable information about an entity’s financial position,

performance, and cash flows.

The ff. are not changes in accounting policies:

a.) the application of an accounting policy for transaction, other events

or conditions that differ in substance from those previously occurring

b.) the application of a new accounting policy for transactions, other

events or conditions that did not occur previously or were immaterial

Accounting for changes in

accounting policies

Changes in accounting policies are accounted for

under specific transitional provisions, if any, in a PFRS.

In the absence of specific transitional provisions,

or in case of a voluntary change in accounting policy,

changes in accounting policies are accounted for by

retrospective application.

Retrospective Application – is applying a new accounting policy to

transitions, other events and conditions as if that policy had always

been applied.

It also means adjusting the beginning balance of each affected component

of equity for the earliest prior period presented and the other comparative

amount disclosed for each prior presented as if the new accounting policy

had always been applied.

Impracticable Application – results when the entity cannot apply a

requirement after making every reasonable effort to do so.

Voluntary Change in Accounting Policy

An entity may adopt a pronouncement of other standard-settling body in the

absence of a PFRS that specifically applies to a transaction. If the

pronouncement adopted is later on amended by the other standard-settling

body and the entity decides to adopt the amended version of the

pronouncement, the change is accounted for and disclosed as a voluntary

change in accounting policy.

Future Changes in Accounting Policies

If an entity has not applied a new standard or interpretation that has been issued

but not yet effective, the entity must disclose that fact and any and known or

reasonably estimate information relevant to assessing the possible impact that

the new pronouncement will have in the year it is applied.

Changes in reporting entity

A change that result in financial statements that, in effect, are those of a different

reporting entity.

1.) presenting consolidated or combined financial statements in place of

financial statements of individual entities.

2.) changing specific subsidiaries that make up the group of entities for which

consolidated financial statements are presented

3.) changing the entities included in combined financial statements.

Disclosures

a.) The title of the PFRS;

b.) When applicable, that the change in accounting policy is

made in accordance with its transitional provisions;

c.) The nature of the change in accounting policy;

d.) When applicable, a description of the transitional provisions;

e.) When applicable, the transitional provisions that might have

an effect on future periods;

f.) For the current period and each prior period presented, to

the extent practicable, the amount of the adjustment:

For each financial statement line item affected; and

If PAS 33 Earnings per Share applies to the entity for

basic and diluted earnings per share;

g.) The amount of the adjustment relating to periods

before those presented, to the extend practicable; and

h.) If the retrospective application required is

impracticable for a particular prior period, or for

periods before those presented, the circumstances

that led to the existence of that condition and a

description of how and from when the change in

accounting policy has been applied.

CHANGE IN ACCOUNTING

ESTIMATES

What is a Change in Accounting

Estimates?

a Change in Accounting Estimates is an

Adjustment in

• Carrying Value of an Asset;

• or a liability;

• Or the amount of Periodic consumption

of an Asset; As a result of Present

Condition

And Circumstances

What are the REASONS FOR

ESTIMATION?

When an item of financial statements

cannot be measured precisely ,it can

only be estimated because:

• Uncertainty inherent to the business

• Where judgments are involved

Where ESTIMATION ARE

REQUIRED?

• Bad debts

• Inventory Obsolescence

• Fair value of financial assets or

financial liability

• The useful lives of, or expected

pattern of consumption of the future

economic benefits embodied in,

depreciable assets

• Warranty Obligation

When Change in Accounting

Estimate is necessary?

● If changes occur in the

circumstances on which the estimate

was based

○ as a result of a new information

○ As a result of new development

○ More experience

RECOGNITION CRITERIA OF CHANGE IN

ACCOUNTING ESTIMATES

• Adjusting the carrying amounts of the

related asset, liability or equity item in

the period of change recognizes a

change in an accounting estimate

Disclosure Required for Change in

Accounting Estimate

Disclose:

the nature and amount of a change in an

accounting estimate that has an effect in the

current period or is expected to have an

effect in future periods

if the amount of the effect in future periods

is not disclosed because estimating it is

impracticable, an entity shall disclose that

fact.

ERRORS

Occur when transactions are recorded

incorrectly or when they are omitted.

Errors include the effects of:

Mathematical mistakes

Mistakes in applying accounting policies

Oversights or misinterpretation of facts

Fraud

Current Period Errors

Errors committed during the current period

Illustration:

On Jan. 10,20x2 prior to authorization of ABC Co.’s Dec. 31,

20x1 financial statements for issue, the accountant of ABC Co.

received a bill for an advertisement made in the month of

December 20x1 amounting to 400,000. This expense was not

accrued as of Dec. 31,20x1.

If the books are still open:

Dec. 31, Advertising Expense 400,000

20x1 Advertising Payable 400,000

If the books are already closed:

Jan. 10, Retained Earnings 400,000

20x2 Advertising Payable 400,000

***Books still open means that closing entries have not yet been made.

***Books closed means that closing entries have already been made.

Nominal accounts cannot be used anymore.

Prior period errors

These are omissions from, and misstatements in, the

entity’s financial statements for one or more prior periods

arising from a failure to use, or misuse of reliable

information that:

Was available when FS for those periods were

authorized for issue

Could reasonably be expected to have been obtained

and taken into account in the preparation and

presentation of those FS

Correction of prior period errors

An entity must correct all material prior period errors

retrospectively in the first set of FS authorized for issue after their

discovery by:

Restating the comparative amounts for the prior period(s)

presented in which the error occurred; or

Restating the opening balances of assets, liabilities and

equity for the earliest prior period presented, if the error

occurred before the earliest prior period presented.

In other words, prior period errors are corrected by retrospective

restatement.

Retrospective statement is correcting the recognition,

measurement and disclosure of amounts of elements of financial

statements as if a prior period error had never occurred.

Illustration:

On Jan. 15, 20x3 while finalizing its 20x2 financial

statements, ABC Co. discovered that depreciation expense

recognized in 20x1 is overstated by 400,000.

Jan. 15, Accumulated Depreciation 400,000

20x3 Retained Earnings 400,000

Types of errors in accounting

1. Errors in principle – these may arise from lack of knowledge of

accounting standards or procedures, misuse of available

information, or misinterpretation of accounting standards,

whether intentional or unintentional.

Intentional misstatement of FS is sometimes reffered to as

fraudulent financial reporting.

2. Clerical errors – arise from a variety of sources which may include

some of those enumerated under PAS 8.

a) Transposition error

b) Transplacement error

c) Errors of omission

d) Errors of commission

e) Compensating errors

f) Accounting system error

g) Counterbalancing and Non-counterbalancing errors

Counterbalancing errors

- errors which, if remained uncorrected, are automatically

corrected or offset in the next accounting period. Their effect on

the FS automatically reverses in the next accounting period.

Examples:

1. Inventory

2. Purchases

3. Sales

4. Prepayments and Unearned items

5. Accruals for income and expenses

Non-counterbalancing errors

It affects the profit or loss only in the period the error was committed.

The profit and loss in subsequent periods where the error remains

uncorrected, are unaffected.

Examples:

1. Misstatement in depreciation

2. Erroneous capitalization of cost that should be expensed outright

3. Non-capitalization of capitalizable cost

Relationships between accounts

In a periodic inventory system, the following relationships can provide

guidance in determining the effects of counterbalancing errors on profit or loss.

ENDING INVENTORY: PROFIT – DIRECT RELATIONSHIP

***Direct relationship means that if ending inventory is understated, profit is

also understated. Inverse relationship means that if an account is understated,

the related account is overstated.

Ending inventory: COGS – Inverse relationship

Beginning inventory & Purchases: COGS – Direct relationship

Beginning inventory & Purchases: Profit – Inverse relationship

ASSET-RELATED ACCOUNT: PROFIT – DIRECT RELATIONSHIP

Asset-related account pertains to prepayments and accrual for income.

Example:

Error on prepaid asset – if prepaid insurance is understated, profit is

also understated.

Liability-related account: Profit – Inverse relationship

Liability-related account pertains to unearned items and accrual for

expenses.

Example:

Error on unearned income – If unearned rent is overstated, profit is

understated.

Vous aimerez peut-être aussi

- Harsh Electricals: Analyzing Cost in Search of ProfitDocument11 pagesHarsh Electricals: Analyzing Cost in Search of ProfitSanJana NahataPas encore d'évaluation

- Module 1 - Framework and RegulationDocument13 pagesModule 1 - Framework and RegulationLuiPas encore d'évaluation

- Valuation & Case AnalysisDocument38 pagesValuation & Case AnalysisShaheen RahmanPas encore d'évaluation

- CFAS 06 PAS 8 Accounting Policies Estimates and ErrorsDocument4 pagesCFAS 06 PAS 8 Accounting Policies Estimates and ErrorsJanine WayanPas encore d'évaluation

- AgriTech Indias Sunrise SectorDocument60 pagesAgriTech Indias Sunrise SectorKratvesh PandeyPas encore d'évaluation

- Chapter 12 - Events After The Reporting PeriodDocument10 pagesChapter 12 - Events After The Reporting PeriodMarriel Fate CullanoPas encore d'évaluation

- Swing Trading Simplified Larry D Spears PDFDocument115 pagesSwing Trading Simplified Larry D Spears PDFAmine Elghazi100% (4)

- Ra 9298Document10 pagesRa 9298Abraham Mayo MakakuaPas encore d'évaluation

- SWOT Analysis TemplatesDocument10 pagesSWOT Analysis Templatesshubham agarwalPas encore d'évaluation

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoPas encore d'évaluation

- CHAPTER 11 - Changes in Accounting Policy, Prior Period ErrorsDocument24 pagesCHAPTER 11 - Changes in Accounting Policy, Prior Period ErrorsChristian GatchalianPas encore d'évaluation

- PAS 01 Presentation of FSDocument12 pagesPAS 01 Presentation of FSRia GaylePas encore d'évaluation

- Pas 26 Accounting and Reporting by Retirement Benefit PlansDocument2 pagesPas 26 Accounting and Reporting by Retirement Benefit PlansR.A.Pas encore d'évaluation

- PSA PPT by Sir JekellDocument96 pagesPSA PPT by Sir JekellNeizel Bicol-ArcePas encore d'évaluation

- QUIZ 3 Financial Forecasting and BudgetingDocument9 pagesQUIZ 3 Financial Forecasting and BudgetingPRINCESS HONEYLET SIGESMUNDOPas encore d'évaluation

- ACC 211 Review AssignmentDocument5 pagesACC 211 Review Assignmentglrosaaa cPas encore d'évaluation

- ReportsDocument5 pagesReportsLeanne FaustinoPas encore d'évaluation

- AmazonDocument2 pagesAmazonPavan NagendraPas encore d'évaluation

- Module 3 - Events After The Reporting Period PDFDocument7 pagesModule 3 - Events After The Reporting Period PDFCaroline Bagsik100% (1)

- Specialized IndustriesDocument107 pagesSpecialized IndustriesCristine Joyce ValdezPas encore d'évaluation

- Strategic Management of AmazonDocument17 pagesStrategic Management of AmazonAyushPas encore d'évaluation

- ACCTG 013 - Module 6Document33 pagesACCTG 013 - Module 6Andrea Lyn Salonga CacayPas encore d'évaluation

- Accntg4 Non-Current Assets Held For Sale and Discontinued Operations NewDocument32 pagesAccntg4 Non-Current Assets Held For Sale and Discontinued Operations NewALYSSA MAE ABAAGPas encore d'évaluation

- Pfrs Update 2022Document21 pagesPfrs Update 2022Robert CastilloPas encore d'évaluation

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFEstiloPas encore d'évaluation

- Cpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Document4 pagesCpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Anthoni BacaniPas encore d'évaluation

- Receivable Financing Notes LoansDocument7 pagesReceivable Financing Notes Loansemman neriPas encore d'évaluation

- Afar 2 Module CH 2Document22 pagesAfar 2 Module CH 2Razmen Ramirez PintoPas encore d'évaluation

- Updates On PFRSDocument50 pagesUpdates On PFRSPrincess ElainePas encore d'évaluation

- Toa - Preboard - May 2016Document11 pagesToa - Preboard - May 2016Kenneth Bryan Tegerero Tegio100% (1)

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaPas encore d'évaluation

- Events After The Reporting Period Final 6 KiloDocument13 pagesEvents After The Reporting Period Final 6 Kilonati100% (1)

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezePas encore d'évaluation

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoPas encore d'évaluation

- PFRS For SEsDocument2 pagesPFRS For SEsRisalyn BiongPas encore d'évaluation

- Conceptual Framework and Accounting StandardsDocument34 pagesConceptual Framework and Accounting StandardsJuaymah SabaPas encore d'évaluation

- Misstatements in The Financial StatementsDocument56 pagesMisstatements in The Financial StatementsKimberly Pilapil MaragañasPas encore d'évaluation

- Learning Objective 11-1: Chapter 11 Considering The Risk of FraudDocument25 pagesLearning Objective 11-1: Chapter 11 Considering The Risk of Fraudlo0302100% (1)

- Course Syllabus-Strategic Cost MGTDocument7 pagesCourse Syllabus-Strategic Cost MGTJesel CatchonitePas encore d'évaluation

- AT Quizzer 2 - Profl Practice of AcctgDocument12 pagesAT Quizzer 2 - Profl Practice of AcctgJimmyChaoPas encore d'évaluation

- RFBT QuizzerDocument8 pagesRFBT QuizzerMara Shaira SiegaPas encore d'évaluation

- Ias 24 Related Party DisclosuresDocument3 pagesIas 24 Related Party DisclosurescaarunjiPas encore d'évaluation

- Cash and Accrual BasisDocument3 pagesCash and Accrual Basisattiva jade100% (1)

- Ap 9004-IntangiblesDocument5 pagesAp 9004-IntangiblesSirPas encore d'évaluation

- Related Party DisclosuresDocument15 pagesRelated Party DisclosuresArthur PlazaPas encore d'évaluation

- Summary Notes - Review Far - Part 3: 1 A B C D 2Document10 pagesSummary Notes - Review Far - Part 3: 1 A B C D 2Fery AnnPas encore d'évaluation

- MAS Module 6 - BudgetingDocument8 pagesMAS Module 6 - BudgetingJohn DoesPas encore d'évaluation

- Consideration of Internal Control and Test of ControlsDocument6 pagesConsideration of Internal Control and Test of ControlsJoshua AureliaPas encore d'évaluation

- MAS 2 Prelim Exam To PrintDocument3 pagesMAS 2 Prelim Exam To PrintJuly LumantasPas encore d'évaluation

- 1 Pre EngagementDocument11 pages1 Pre EngagementVito CorleonPas encore d'évaluation

- Audit of Current LiabilitiesDocument4 pagesAudit of Current LiabilitiesMark Anthony TibulePas encore d'évaluation

- Summary Accounting For InvestmentsDocument2 pagesSummary Accounting For InvestmentsJohn Rashid HebainaPas encore d'évaluation

- Philippine Accountancy Act of 2004Document6 pagesPhilippine Accountancy Act of 2004jeromyPas encore d'évaluation

- Week 8Document3 pagesWeek 8Anonymous J0pEMcy5vY100% (1)

- AFAR ProblemDocument14 pagesAFAR ProblemGil Enriquez100% (1)

- Inacc3 BalucanDocument8 pagesInacc3 BalucanLuigi Enderez BalucanPas encore d'évaluation

- Document:Syllabus COURSE: Auditing and Assurance Principles Copies Issued ToDocument10 pagesDocument:Syllabus COURSE: Auditing and Assurance Principles Copies Issued ToIm Nayeon100% (1)

- Quiz On Audit Engagement and PlanningDocument7 pagesQuiz On Audit Engagement and PlanningAdam SmithPas encore d'évaluation

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzPas encore d'évaluation

- Auditing Chapter 3Document3 pagesAuditing Chapter 3Patricia100% (1)

- Course Code and Title: Actp5 - Business Combination Lesson Number: 01 Topic: Overview of Business Combination DescriptionDocument8 pagesCourse Code and Title: Actp5 - Business Combination Lesson Number: 01 Topic: Overview of Business Combination DescriptionTryonPas encore d'évaluation

- EXERCISES On EARNINGS PER SHAREDocument4 pagesEXERCISES On EARNINGS PER SHAREChristine AltamarinoPas encore d'évaluation

- AP.2904 - Cash and Cash Equivalents.Document7 pagesAP.2904 - Cash and Cash Equivalents.Eyes Saw0% (1)

- Multiple ChoiceDocument6 pagesMultiple Choicetough mamaPas encore d'évaluation

- IAS 8 Diana Maruf AnasDocument24 pagesIAS 8 Diana Maruf AnasLamis ShalabiPas encore d'évaluation

- Pas 8 Cfas PDFDocument6 pagesPas 8 Cfas PDFAndreaaAAaa TaglePas encore d'évaluation

- Chapter 11 Accounting Policies PDFDocument8 pagesChapter 11 Accounting Policies PDFAthena LansangPas encore d'évaluation

- PM2 - The Marketing ProcessDocument41 pagesPM2 - The Marketing ProcessRHam VariasPas encore d'évaluation

- Analysis of Monopolistically Competitive MarketDocument4 pagesAnalysis of Monopolistically Competitive MarketQueensenPas encore d'évaluation

- Preface: Ehsan Ullah SafiDocument74 pagesPreface: Ehsan Ullah Safiajaved423Pas encore d'évaluation

- ELEN03B Module 7.0Document14 pagesELEN03B Module 7.0Sayy CruzPas encore d'évaluation

- Gillette RazorDocument77 pagesGillette RazorAnjan BathiPas encore d'évaluation

- O-Level Case StudyDocument4 pagesO-Level Case StudyZarin Tasnim chowdhuryPas encore d'évaluation

- Part Ii Insight March 2018Document121 pagesPart Ii Insight March 2018Islamiat PopoolaPas encore d'évaluation

- OneChicago Fact SheetDocument1 pageOneChicago Fact SheetJosh AlexanderPas encore d'évaluation

- XI Accountancy Project WorkDocument1 pageXI Accountancy Project Workkulsum bhopalPas encore d'évaluation

- Working Capital ManagementDocument14 pagesWorking Capital ManagementSara Ghulam Muhammed SheikhaPas encore d'évaluation

- As01-Create Normal AssetDocument9 pagesAs01-Create Normal AssetAnonymous Q3J7APoPas encore d'évaluation

- Discretionary Revenues As A Measure of Earnings ManagementDocument22 pagesDiscretionary Revenues As A Measure of Earnings ManagementmaulidiahPas encore d'évaluation

- Q.1 What Was The Main Problem Kenya Airways Was Facing?Document4 pagesQ.1 What Was The Main Problem Kenya Airways Was Facing?Vedika Paliwal0% (1)

- Redeveloped Division Initiated Self-Learning Module: Department of Education - Division of PalawanDocument20 pagesRedeveloped Division Initiated Self-Learning Module: Department of Education - Division of PalawanRajer AlsadPas encore d'évaluation

- Economics (Eco 415) Assignment 3 QAMA 2 (202041)Document5 pagesEconomics (Eco 415) Assignment 3 QAMA 2 (202041)Ummu KhashiaPas encore d'évaluation

- Aircraft ValuationDocument4 pagesAircraft Valuationdjagger1Pas encore d'évaluation

- Case Study ABCDocument2 pagesCase Study ABCQuý Trần Thị NguyệtPas encore d'évaluation

- BUS 5110 Managerial Accounting - Written Assignment Unit 3Document6 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 3LaVida LocaPas encore d'évaluation

- Varun ProjectDocument14 pagesVarun ProjectRaj KumarPas encore d'évaluation

- Shiro Business 4Document35 pagesShiro Business 4jasim jaisPas encore d'évaluation

- Hoskisson and HITT Strategic Management All ChaptersDocument376 pagesHoskisson and HITT Strategic Management All ChaptersNikunj Patel100% (3)

- 13Document14 pages13JDPas encore d'évaluation

- Project Impact of Online AdvertisingDocument41 pagesProject Impact of Online AdvertisingAbhay KumarPas encore d'évaluation