Académique Documents

Professionnel Documents

Culture Documents

Lecture 1 - Introduction To Investment Management

Transféré par

Rica de los SantosTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lecture 1 - Introduction To Investment Management

Transféré par

Rica de los SantosDroits d'auteur :

Formats disponibles

LECTURE 1: INTRODUCTION TO

INVESTMENT MANAGEMENT

Arlene C. Gutierrez

Assistant Professor

DAME,CEM,UPLB

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

WHAT IS AN INVESTMENT?

• The current commitment of dollars

for a period of time in order to

derive future payments that will

compensate the investor for:

1. the time the funds are

committed,

2. the expected rate of inflation

3. the uncertainty of the future

payments.

“You sacrifice something of value now, expecting to benefit from

that sacrifice later.”

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

WHAT IS AN INVESTMENT?

VS

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

REAL ASSETS VS. FINANCIAL ASSETS

Real Assets • Determines the material

wealth of the society

• Includes land, buildings,

machines and

knowledge that can be

used to produce goods

and services

• Generate net income for

the economy

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

REAL ASSETS VS. FINANCIAL ASSETS

Financial Assets • Indirectly contribute to the

productive capacity of the

economy

• Claims to the income

generated by real assets

• Include stocks, fixed income

securities, derivatives and

alternative investments

• define the allocation of

income or wealth among

investors

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

THREE BROAD CLASSES OF FINANCIAL

ASSETS

Fixed

Equity

Income

Derivatives

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

FIXED INCOME SECURITIES

• an instrument that allows

governments, companies and

other types of issuers to

borrow money from investors

• Promise either a fixed stream

of income or a stream of

income that is determined

according to a specified

formula

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

FIXED INCOME SECURITIES

• Unless the borrower is

declared bankrupt, the

payments on these securities

are either fixed or determined

by formula

• For this reason, the

investment performance of

debt securities typically is

least closely tied to the

financial condition of the

issuer.

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

FIXED INCOME SECURITIES

Money Capital

Market Market

- Long term

- Short term - Ranges from very safe

- Highly marketable in terms of default risk

- Very low risk to relatively risky

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

FIXED INCOME SECURITIES

Money Capital

Market Market

Treasury Bills

Commercial Papers Bonds

Certificate of Deposits -classified according to

Banker’s Acceptance the interest rate

Eurodollar - Classified according to

Repos and reverses issuer

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

EQUITY SECURITIES

• Represent ownership share in

the corporation

• Equity holders are not

promised any particular

payment

• They receive any dividends

the firm may pay

• They have prorated ownership

in the real assets of the firm

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

EQUITY SECURITIES

• The performance of equity

investments is tied directly to

the success of the firm and its

real assets

• Equity securities tend to be

riskier than investments in

debt securities

• Two types of Equity securities:

1. Common shares

2. Preferred shares

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

DERIVATIVE INSTRUMENTS

• provide payoffs that are

determined by the prices of other

assets such as bond or stock prices

• their values derive from the prices

of other assets

• The four main types of underlying

on which derivatives are based are

equities, fixed income

securities/interest rates,

currencies and commodities

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

DERIVATIVE INSTRUMENTS

• the primary use, is to hedge risks

or transfer them to other parties

• can be used to take highly

speculative positions

• Most common derivatives are

futures, forwards, options and

swaps

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

DERIVATIVE INSTRUMENTS

• The four main types of underlying

on which derivatives are based are

equities, fixed income

securities/interest rates,

currencies and commodities

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

FINANCIAL MARKETS AND THE ECONOMY

Timing of Consumption

Separation of management and ownership

Allocation of wealth and risk

The Informational Role of Financial Markets

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

THE INVESTMENT PROCESS

INDIVIDUAL INVESTORS

• Short Term Goals

• Providing for children’s

education, saving for a

major purchase or starting a

business

• Retirement Goals

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

THE INVESTMENT PROCESS

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

INVESTMENT PORTFOLIO

• simply his collection of investment asset

• Investors make two types of decisions in constructing

their portfolios:

Asset Allocation Security Selection

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

INVESTMENT PORTFOLIO

Top Down Approach

Bottom up Approach

Department of Agribusiness Management and Entrepreneurship

CEM, UPLB

Vous aimerez peut-être aussi

- Segmentation, Targeting & PositioningDocument84 pagesSegmentation, Targeting & PositioningRica de los SantosPas encore d'évaluation

- World Market Environment - Social & CulturalDocument12 pagesWorld Market Environment - Social & CulturalRica de los SantosPas encore d'évaluation

- World Market Environment - Technological EnvironmentDocument54 pagesWorld Market Environment - Technological EnvironmentRica de los SantosPas encore d'évaluation

- The Global Trade EnvironmentDocument6 pagesThe Global Trade EnvironmentRica de los SantosPas encore d'évaluation

- Tillage Operations and EquipmentDocument8 pagesTillage Operations and EquipmentRica de los SantosPas encore d'évaluation

- Lecture 1 - Introduction To Strategic ManagementDocument22 pagesLecture 1 - Introduction To Strategic ManagementRica de los SantosPas encore d'évaluation

- Trade Theories and Economic DevelopmentDocument54 pagesTrade Theories and Economic DevelopmentRica de los SantosPas encore d'évaluation

- Psychrometry LectureDocument3 pagesPsychrometry LectureRica de los SantosPas encore d'évaluation

- Planting EquipmentDocument7 pagesPlanting EquipmentRica de los SantosPas encore d'évaluation

- Milling HandoutDocument6 pagesMilling HandoutRica de los SantosPas encore d'évaluation

- Farm Power HandoutDocument7 pagesFarm Power HandoutRica de los SantosPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Childbirth Self-Efficacy Inventory and Childbirth Attitudes Questionner Thai LanguageDocument11 pagesChildbirth Self-Efficacy Inventory and Childbirth Attitudes Questionner Thai LanguageWenny Indah Purnama Eka SariPas encore d'évaluation

- The Systems' Institute of Hindu ASTROLOGY, GURGAON (INDIA) (Registered)Document8 pagesThe Systems' Institute of Hindu ASTROLOGY, GURGAON (INDIA) (Registered)SiddharthSharmaPas encore d'évaluation

- IBM System X UPS Guide v1.4.0Document71 pagesIBM System X UPS Guide v1.4.0Phil JonesPas encore d'évaluation

- List of Saturday Opened Branches and Sub BranchesDocument12 pagesList of Saturday Opened Branches and Sub BranchesSarmad SonyalPas encore d'évaluation

- Public International Law Green Notes 2015Document34 pagesPublic International Law Green Notes 2015KrisLarr100% (1)

- 2009 Annual Report - NSCBDocument54 pages2009 Annual Report - NSCBgracegganaPas encore d'évaluation

- Progressivism Sweeps The NationDocument4 pagesProgressivism Sweeps The NationZach WedelPas encore d'évaluation

- Digital TransmissionDIGITAL TRANSMISSIONDocument2 pagesDigital TransmissionDIGITAL TRANSMISSIONEla DerarajPas encore d'évaluation

- War Thesis StatementsDocument8 pagesWar Thesis StatementsHelpPaperRochester100% (2)

- Design Thinking PDFDocument7 pagesDesign Thinking PDFFernan SantosoPas encore d'évaluation

- The Minecraft Survival Quest ChallengeDocument4 pagesThe Minecraft Survival Quest Challengeapi-269630780100% (1)

- Welcome LetterDocument2 pagesWelcome Letterapi-348364586Pas encore d'évaluation

- The New Definition and Classification of Seizures and EpilepsyDocument16 pagesThe New Definition and Classification of Seizures and EpilepsynadiafyPas encore d'évaluation

- Balezi - Annale Générale Vol 4 - 1 - 2 Fin OkDocument53 pagesBalezi - Annale Générale Vol 4 - 1 - 2 Fin OkNcangu BenjaminPas encore d'évaluation

- Case Blue Ribbon Service Electrical Specifications Wiring Schematics Gss 1308 CDocument22 pagesCase Blue Ribbon Service Electrical Specifications Wiring Schematics Gss 1308 Cjasoncastillo060901jtd100% (132)

- Jesus Died: Summary: Jesus Died We Need To Have No Doubt About That. Without Jesus' Death We Would Have NoDocument6 pagesJesus Died: Summary: Jesus Died We Need To Have No Doubt About That. Without Jesus' Death We Would Have NoFabiano.pregador123 OliveiraPas encore d'évaluation

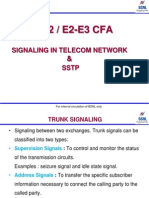

- Signalling in Telecom Network &SSTPDocument39 pagesSignalling in Telecom Network &SSTPDilan TuderPas encore d'évaluation

- Glickman - The Jewish White Slavery Trade (2000)Document152 pagesGlickman - The Jewish White Slavery Trade (2000)Alrik G. HamerPas encore d'évaluation

- Chapter One Understanding Civics and Ethics 1.1.defining Civics, Ethics and MoralityDocument7 pagesChapter One Understanding Civics and Ethics 1.1.defining Civics, Ethics and Moralitynat gatPas encore d'évaluation

- SUBSET-026-7 v230 - 060224Document62 pagesSUBSET-026-7 v230 - 060224David WoodhousePas encore d'évaluation

- HW 2Document2 pagesHW 2Dubu VayerPas encore d'évaluation

- Lewin's Change ManagementDocument5 pagesLewin's Change ManagementutsavPas encore d'évaluation

- Joshua 24 15Document1 pageJoshua 24 15api-313783690Pas encore d'évaluation

- Sodium Borate: What Is Boron?Document2 pagesSodium Borate: What Is Boron?Gary WhitePas encore d'évaluation

- Quarter 3 Week 6Document4 pagesQuarter 3 Week 6Ivy Joy San PedroPas encore d'évaluation

- Nahs Syllabus Comparative ReligionsDocument4 pagesNahs Syllabus Comparative Religionsapi-279748131Pas encore d'évaluation

- Win Tensor-UserGuide Optimization FunctionsDocument11 pagesWin Tensor-UserGuide Optimization FunctionsadetriyunitaPas encore d'évaluation

- VtDA - The Ashen Cults (Vampire Dark Ages) PDFDocument94 pagesVtDA - The Ashen Cults (Vampire Dark Ages) PDFRafãoAraujo100% (1)

- Review Questions Operational Excellence? Software WorksDocument6 pagesReview Questions Operational Excellence? Software WorksDwi RizkyPas encore d'évaluation

- Springfield College Lesson Plan Template PHED 237: The Learning and Performance of Physical ActivitiesDocument5 pagesSpringfield College Lesson Plan Template PHED 237: The Learning and Performance of Physical Activitiesapi-285421100Pas encore d'évaluation